GOLD - Correction from 4945 before continuing growthFX:XAUUSD continues to recover, but at the same time faces strong interim resistance at 4945. What to expect next?

Gold is recovering after a sharp correction, taking advantage of the weakening dollar amid the US government shutdown: The delay in important data (employment report) is creating uncertainty about Fed policy, putting pressure on the dollar. However, de-escalation with Iran and the deal with India have improved sentiment but limited demand for gold as a safe haven.

The recovery looks like a technical correction on temporary dollar weakness rather than a trend reversal. Further dynamics depend on the development of the shutdown situation and the tone of the Fed.

Technically, gold may form a pullback before rising, or close within the range of 4950-4750 to accumulate potential before further movement.

Resistance levels: 4884, 4944, 5100

Support levels: 4812, 4755, 4696

The first test of resistance at 4944 ended in a false breakout. During the European session, the market may enter a correction phase and test the zone of interest (ascending support line) at 4812-4755 before continuing to rise. The local bullish trend and the relatively weak dollar may support gold's growth.

Best regards, R. Linda!

AB-CD

GOLD - Correction within the local downtrend FX:XAUUSD stabilizes after correction, returning above $4750 after testing the $4400 area earlier in the week. However, the overall trend remains under pressure.

Key factors: DXY remains strong, limiting gold's growth. Tensions between the US and Iran have eased slightly, reducing demand for gold as a safe-haven asset. The appointment of Kevin Warsh, who is considered a proponent of tighter fiscal policy, has supported the dollar.

The market is awaiting the release of the US ISM Manufacturing PMI, which will set the tone ahead of employment data. This data will adjust expectations for future Fed rate cuts.

Despite a short-term recovery, gold remains in a downward correction amid a strong dollar and reduced geopolitical risks. The latest economic data from the US will determine the dynamics.

Resistance levels: 4470 - 4475, 4885

Support levels: 4696, 4583, 4432

Technically, I expect a retest of the nearest resistance; the market may react with a pullback/decline to support.

Best regards, R. Linda!

BITCOIN - Correction to 81K - 82K before the fallBINANCE:BTCUSDT.P is forming a correction after a decline. The market is testing 79,200 (the consolidation boundary), which could trigger a breakout and momentum for a retest of the liquidity zone.

The fundamental background remains weak, there is still no support for the market in this direction, and the crypto winter phase may continue for some time. Statistically, after a sharp fall or a strong trend, the market should move into a sideways range/flat, where accumulation for a trend reversal may form.

Bitcoin is in local consolidation after strong sell-offs. The market is storming 79,200 and, as part of the correction, may break through resistance and head towards the zone of interest 81,000-82,000 before falling.

The cryptocurrency market, like Bitcoin, is in a downtrend. The coin tested support at 75K, but the area of interest (74,500) was not reached. Accordingly, due to the relevance of the liquidity zone, the market may form a short squeeze and return to the target.

Resistance levels: 79,200, 81K, 82,000

Support levels: 77,850, 74,500

I expect two movements from the market. As part of the current correction, Bitcoin may form a breakout of 79200 and an impulse to 81-82K, but bears are likely to keep the market in this zone and provoke a further decline to 77900 - 74500.

Best regards, R. Linda!

USDJPY - Is the correction complete? Return to range...FX:USDJPY returns to an upward trend amid the growth of the dollar and the weakening of the Japanese yen. Focus on 154.5 - 155.0

Against the backdrop of the dollar's growth, the Japanese yen continues to lose value, which generally provokes the growth of the currency pair. If the bulls keep the price above 154.5 - 155.0, we can expect growth to 156.0 - 157.8.

A long squeeze and retest of the 153.0-152.5 zone is forming a reversal pattern as the impact of the Bank of Japan's interventions wears off. The price has returned to the range...

Resistance levels: 156.18, 157.78

Support levels: 155.0, 154.5, 154. 0

The price has returned to the range of 154.5 - 157.78, and technically, a retest of support and a battle between market participants for the key zone are possible. If the bulls keep the price within the range, the market may form growth within the trend.

Best regards, R. Linda!

GOLD - The market may move towards consolidation...FX:XAUUSD is testing 4686, but by the end of Friday's session, traders are buying back the drop to 4800. The market may enter a consolidation phase until the fundamental situation stabilizes.

The reasons for the decline may include a change in the Fed's rhetoric due to the nomination of a new head of the regulator, Kevin Warsh, who is likely to adopt a more hawkish monetary policy. In addition, the growth of the dollar was also driven by hot inflation data. Traders reacted quite aggressively to the situation and moved to aggressively lock in profits.

In the new trading week, we are awaiting PMI, JOLTS, and ISM PMI data, as well as perhaps the most important economic index, NFP.

Technically, it is too early to talk about a clear market direction, as the situation has not yet stabilized. Accordingly, at the moment, I expect that the market may move towards consolidation after such a sharp decline. The approximate boundaries within which the price may stop are 4650 - 4950 (5000).

Support levels: 4800, 4686, 4643

Resistance levels: 4944, 4990, 5000

The Asian market may test resistance, but if bears keep the market below 5000, gold may form a correction to 4800 - 4686 due to the floating fundamental background.

Best regards, R. Linda!

HYPEUSDT - Dump after pumpBINANCE:HYPEUSDT.P ended its rally in the 35.0 zone, smoothly changing the market phase from pump to dump. The cryptocurrency market is weak, but after a sharp decline, there may be a local correction

Bitcoin fell again to 81K during the Asian session. A strong rebound or uptrend should not be expected at this time. There is no fundamental support for the crypto market. Any attempts at growth may be perceived as a hunt for liquidity before the fall.

Within the framework of the downward trend and the weak state of cryptocurrencies, HYPEUSDT formed a pump phase and tested the local resistance zone of 35.0. The market was unable to reach the liquidity zone of 36.4. Before continuing its decline, against the backdrop of a general market correction, the coin may test 31.38 - 32.90

Resistance levels: 31.38, 32.9

Support levels: 29.98, 28.4, 25.84

If the market rebounds after the fall, the coin may test the resistance zone of 31.38 - 32.9. Another short squeeze and a close below 29.98 could trigger a continuation of the dump down to the interim bottom...

Best regards, R. Linda!

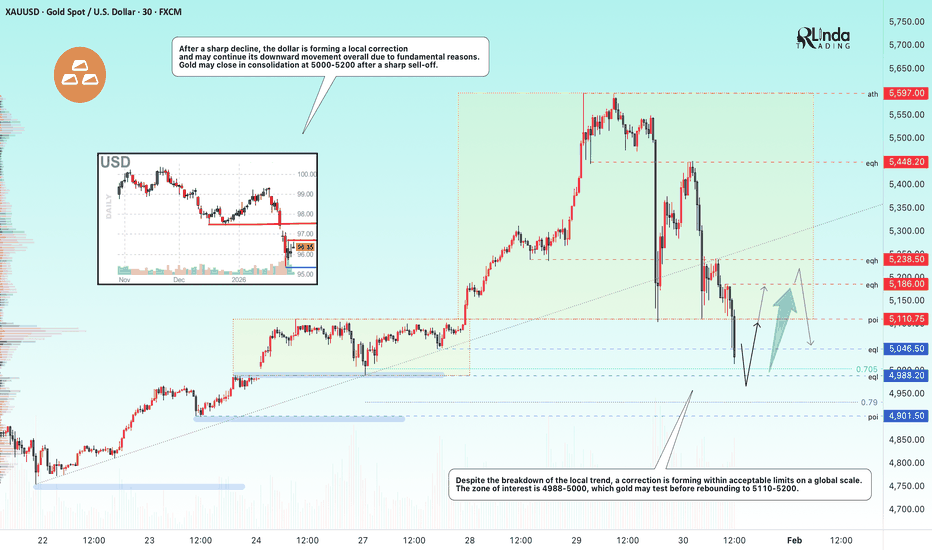

GOLD - Correction or trend reversal? Interest in 5000...FX:XAUUSD is correcting, heading towards the $5000 liquidity and interest zone after record growth and the formation of an ATH of 5597. The reason is the temporary strengthening of the dollar against the backdrop of the US budget deal and profit-taking.

Key pressure factors

The dollar strengthened on optimism over the Senate deal to fund the US government. Trump's statements: he ruled out military intervention in Iran (reducing geopolitical hedging), but maintained threats of tariffs against Canada and Cuba.

However, risks of the Fed losing its independence (possible replacement of Powell), prospects for rate cuts. Geopolitical tensions (Trump's threats on tariffs, the situation with Iran) support demand for safe havens.

The correction in gold looks natural after its parabolic rise. Long-term drivers (geopolitics, pressure on the Fed) remain, so the decline may attract buyers. Further dynamics depend on the tone of the new Fed chair and inflation data.

Resistance levels: 5110, 5186, 5238

Support levels: 5046, 4988, 4901

Despite the breakdown of the local trend, a correction is forming within acceptable limits on a global scale. The zone of interest is 4988-5000, which gold may test before rebounding to 5110-5200. Gold may close in consolidation at 5000-5250 after a strong liquidation. It is important to monitor the market's reaction to key levels!

Best regards, R. Linda!

EURUSD - The correction may be over. Bullish trend FX:EURUSD is forming a correction within an uptrend and testing the support of the local uptrend channel and the 1.1900 zone.

The weak dollar is providing tremendous support for the euro. The currency pair is testing important support within the uptrend. There is a possibility of the correction ending and growth...

The currency pair is in a correction phase, with an emphasis on local downward resistance (triangle boundary). A breakout of the boundary could trigger growth due to the end of the correction.

Panic zone - support at 1.1898. (A breakout of this support could break the bullish structure)

Resistance levels: 1.1970, 1.2025, 1.2082

Support levels: 1.900, 1.1898

Ahead lies the resistance of the triangle; a breakout of this boundary will confirm the end of the correction, and if the bulls keep the price above 1.197, the market will be able to move into an active growth phase. Before that, a retest of 1.1907 - 1.1920 is possible.

Best regards, R. Linda!

SOLUSDT - Bears increased pressure after retesting resistance BINANCE:SOLUSDT bounces off trend resistance and updates its local minimum to 122.4. A bearish phase is developing in the market, and a small correction is possible before the fall.

The daily timeframe indicates a crypto winter, a downtrend, and weak buying power due to capital outflows and a weak fundamental background.

Bitcoin is testing 90K and has once again been rejected by the resistance zone. Liquidation and a fall to the intermediate support zone have formed. Altcoins reacted aggressively to this impulse.

Resistance levels: 126.6, 130.5

Support levels: 123.0

SOLANA has two key levels: 123.0, closing below which could trigger a sell-off and a drop to 116.7. And resistance at 126.6, which acts as a zone of interest. It is possible that altcoins may test resistance in search of liquidity.

Best regards, R. Linda!

GOLD - Correction after the rally. Focus on support!FX:XAUUSD , after hitting a new all-time high of 5597, is entering a correction phase due to profit-taking triggered by local news. Overall, the structure is bullish, and the market will be able to return to growth after the pullback.

Fundamental situation

Trump's threats against Iran and Tehran's response. The active conflict between Russia and Ukraine generally supports interest in hedge assets.

Fed : Rates remain unchanged, investigation against Powell and pressure on the Fed undermine confidence in the regulator's independence. The market still expects two Fed rate cuts in 2026.

Near-term indicators: US jobless claims data (today). Any further weakening of the dollar or escalation of geopolitical tensions will resume gold's growth.

Gold's correction is a natural pause after a sharp rise. The combination of geopolitical risks, pressure on the Fed, and a weak dollar supports the uptrend. Pullbacks to $5475 - 5391 can be seen as a buying opportunity.

Resistance levels: 5515, 5595, 5597

Support levels: 5475, 5453, 5391

After strong growth, the market may form a correction of 50-70% relative to the momentum formed within the trading session. All attention is on the support zones: 5475, 5453, 5391. A long squeeze will provide an opportunity for growth.

Sincerely, R. Linda!

GOLD - Correction ahead of the Fed meeting. What next?FX:XAUUSD hit a new high of 5311 and entered a correction phase (profit-taking) ahead of the Fed's interest rate meeting...

Fundamental situation

Tensions between the US and NATO over plans for Greenland. Trump's threats to impose 100% tariffs on goods from Canada. Fruitless negotiations between Russia and Ukraine

Fed:

Expectations that rates will remain unchanged at the January 31 meeting. Powell's tone and the appointment of a new Fed chair (announcement possible today) could increase volatility. However, the market is pricing in two Fed rate cuts in 2026, despite a possible pause in the near term.

US consumer confidence index fell to an 11.5-year low (84.5), supporting demand for gold

Resistance levels: 5285, 5310, 5350

Support levels: 5250, 5230, 5190

Gold maintains its upward momentum thanks to geopolitical risks and expectations of a soft Fed policy. However, news volatility could trigger a correction before the growth continues. Focus on key (marked) support levels.

Best regards, R. Linda!

GBPUSD - The hunt for liquidity before the trend continues FX:GBPUSD entered a local correction phase amid a pullback in the dollar after a strong rally. The main trend is bearish, and growth after the correction may continue.

A correction has been forming since the opening of the session. The dollar is recovering slightly, while the pound is correcting towards the daily level of 1.377 and the Fibonacci area of 0.5-0.6. If the bulls hold back the correction, the market may return to the trend.

The main/medium-term trend is bullish. The correction and false breakout of support may shift the imbalance of forces towards buyers, which could trigger growth from strong levels.

Resistance levels: 1.3831, 1.38688

Support levels: 1.377, 1.3748

A false breakdown of support and the upward trend line could trigger growth within the main trend

Best regards, R. Linda!

GOLD - The market bought the dip. ATH retest. 5150?FX:XAUUSD , after an aggressive rally, faced a correction (profit-taking) near 5100. However, the market is quickly buying back the decline and is once again storming the ATH with the aim of continuing its growth.

Fundamental situation

- Trump continues to escalate relations with Canada (new tariffs) and maintains tensions with the EU...

- Russia-Ukraine negotiations in Abu Dhabi ended without result, which maintains geopolitical risks.

- The Fed meeting (decision on January 31) will be the main event of the week. Rates are expected to remain unchanged, but Powell's tone could cause volatility. However, the market expects two Fed rate cuts in 2026.

Technically, the market has the potential to continue its movement due to fundamental support.

Resistance levels: 5100, 5111, 5125, 5150

Support levels: 5075, 5055

In the current situation, it is logical to consider two scenarios:

- steady growth without pullbacks and a storming of resistance could lead to a breakout of 5100 and an upward momentum. Local target 5125-5150

- retest of the liquidity zone (long-squeeze) 5075 - 5055 before continuing growth

Best regards, R. Linda!

USDJPY - Interventions strengthen the JPY (price decline)FX:USDJPY is in a negative rally phase, passing through the entire trading range, breaking through the daily timeframe support at 154.450 and closing below the level, hinting at a possible continuation of the decline.

The dollar is falling, the yen is strengthening. The Bank of Japan intervened, which contributed to the strengthening of the national currency. The current movement may continue...

The currency pair breaks through the fairly important support level of 154.500 (154.45) as part of the rally and closes below the level. Consolidation is forming on the local timeframe, which may be aimed at a further decline. A short squeeze in the 154.45 zone could trigger a decline to 153 - 151.8

Resistance levels: 154.45, 155.65

Support levels: 152.96, 151.85

A breakdown from the local consolidation could trigger a continuation of the decline, as could a retest of the nearest resistance (liquidity hunt).

The market still has the potential to continue falling to 151.85 and to the intermediate bottom of 149.5.

Best regards, R. Linda!

BITCOIN - Consolidation below 90K. Weak marketBINANCE:BTCUSDT failed to break through the 90K area, and the market is forming a cascade of resistance, indicating the dominant position of sellers in the current circumstances.

The market still looks quite weak, and any attempts at growth are a hunt for liquidity. Global and local trends are bearish, with sales dominating (outflow of funds).

There is no fundamental support, the transfer of assets to crypto exchanges and the outflow of funds from ETF funds continues, which in general indicates weak market sentiment during the crypto winter. The current cycle is downward, and there is a possibility of a retest of the 80,000-75,000 zone.

Technically, Bitcoin is facing strong resistance at 89K and, unable to continue its growth, is rebounding and heading downwards. A short squeeze may form before the fall.

Resistance levels: 88,950, 89,590, 90,350

Support levels: 86970, 86100

If the bears keep the price below 89000, the market may fall to an intermediate bottom of 86000, however, closing below 86K could signal a further decline to 80K.

Best regards, R. Linda!

GOLD - Waiting for a pullback to enter a long position...FX:XAUUSD continued its record growth for the sixth consecutive day, reaching $5,110. The driving forces behind this are geopolitical uncertainty, expectations of a softening of Fed policy, active purchases by central banks, and an outflow from the dollar...

Fundamental drivers

Geopolitics: Russia-Ukraine, Trump's threats of 100% tariffs on Canada, and the risks of further escalation with the EU...

The dollar fell to its lowest level since September 2025 due to interventions by the Bank of Japan and expectations of interest rate cuts. At the same time, central banks in many countries continue to show high interest in the metal.

The Fed's interest rate meeting is coming up (January 31 - February 1). The tone of the regulator is important; there are doubts about further rate cuts, and if this is confirmed, the market may enter a correction...

Resistance levels: 5110, 5150

Support levels: 5080, 5055, 5031

Technically, it is quite risky to open long trades from the current price position (in the 5090 zone). I recommend waiting for a correction to the specified support zones to find more profitable and safer entry points!

Best regards,

GOLD - Test $5000... Will the rally continue?FX:XAUUSD closes Friday's session with a new record and consolidation after the rally. Focus on 4988 - 4968. The session closed quite favorably for continued growth, everything depends on Asian traders...

Fundamentals:

The tense situation between Trump and the EU over Greenland and tariffs is still present. The Bank of Japan intervened (which strengthened the yen), triggering a fall in the dollar, which in turn is affecting the price of gold. Overall, the market remains aggressively bullish.

New session:

- Fed meeting (January 31) – focus on Powell's tone. Softening rhetoric on inflation could weaken the dollar and support gold.

- Selection of a new Fed chair (announcement possible by the end of January) – candidates Waller or Warsh are perceived as more “dovish,” which could put pressure on the dollar.

- Geopolitics – any escalation with Iran will trigger a new influx into gold

Resistance levels: 4988, 5000, 5024

Support levels: 4967, 4958, 4945

Gold maintains its upward momentum, driven by a weak dollar and geopolitical risks. Any correction is likely to be limited.

Asian traders may buy up all the supply. A breakout and close above 4988 could trigger a continuation of the rally to 5025-5050. However, it is possible that the market may test support at 4958-4945 before rallying...

Best regards, R. Linda!

LTCUSDT - Hunting for liquidity before the fallBINANCE:LTCUSDT is consolidating below 70.0 before a possible continuation of the decline. The global trend is downward, liquidity is low...

After a sharp decline, the coin entered a consolidation phase, during which a cascade of support is observed, which may falsely indicate the presence of a buyer. The goal of such a maneuver may be to capture liquidity at 69.70 before falling to 65.0

Within the context of a downtrend and low liquidity, MM may form a retest of the 69.3-69.7 zone (liquidity area) to continue consolidation and further decline to 67-65.

Resistance levels: 69.30, 69.70

Support levels: 67.0, 65.3

A retest of the resistance and liquidity zone and the absence of bullish momentum may form a false breakout of the upper boundary of consolidation, which in turn may provoke a continuation of the decline towards both local targets and the global bottom...

Best regards, R. Linda!

BTCUSDT - The battle for 90K may end in a decline BINANCE:BTCUSDT , against the backdrop of Trump's speech and various comments, caused a shake-up within the range of 87,800-90,300, but the price is consolidating below key resistance within the current downtrend...

The downtrend may continue if Bitcoin consolidates below 90K. There is a chance of this happening as there is still no fundamental support for the market. Everyone is talking about the "CLARITY Act" on cryptocurrencies, but there is no date for its signing, and there are rumors that the process may be postponed until late winter or mid-spring, leaving the market without a bullish driver.

The market is experiencing a phase of struggle for the 90K resistance zone. Bears are stubbornly resisting, forming a false breakout and consolidation below resistance. The structure could be broken if there is an impulsive breakout of the 90,500 zone and the bulls are able to keep the price above this zone, but the bears have formed a fairly strong resistance zone.

Resistance levels: 90,400, 91,400

Support levels: 87800, 85000

I do not rule out another attempt to retest the 90350 zone, but if the bears keep the price below 90K, the market will have no chance for growth. In this case, a pullback to 89K - 88K can be considered.

Best regards, R. Linda!

GOLD - Correction to 4900. Is there a chance it will reach 5000?FX:XAUUSD continues to update historical highs. New 4967, bears appeared (profit-taking). The market has moved into correction, but the overall fundamental (geopolitical) background is still complex...

Expectations of further easing of Fed policy remain the main factor supporting gold.

Trump's reversal on Greenland temporarily improved sentiment, but did not stop the flow into defensive assets.

Economy : GDP for the third quarter has been revised upward to 4.4%. Core PCE (inflation) rose to 2.8% y/y. Jobless claims (200,000) were better than expected.

Despite strong indicators, the dollar is weakening amid the general trend of de-dollarization .

Today, preliminary PMI (business activity) data for key regions will be released.

The figures may affect global sentiment, but are unlikely to change the main upward trend for gold.

Resistance levels: 4935, 4967, 5000

Support levels: 4900, 4888, 4870

The current correction is a distribution of the formed consolidation 4935 - 4967. In the context of the current movement, the market may test the key support area (liquidity zone) 4900 - 4888. I do not rule out a deep long squeeze (to 4870) before renewed interest in growth. In the current cycle, there is a possibility of a retest of 5000!

Best regards, R. Linda!

GBPUSD - Readiness for a breakthrough and rally FX:GBPUSD breaks through the resistance conglomerate and enters a long zone. Consolidation is forming (due to bullish activity), and we have a chance for a local rally...

The long squeeze of the key support zone at 1.3400 forms distribution and growth towards the intermediate resistance at 1.3486. The trend is bullish, there is support in the market (weak dollar).

The currency pair breaks through resistance with an impulsive movement, after which the bulls try to keep the price above 1.3486. A breakout of the local base will give a chance for continued growth to 1.3562 - 1.3671

Resistance levels: 1.3486, 1.3507, 1.3562

Support levels: 1.3486, 1.3456

Consolidation above 1.3486 - 1.3500 will be a strong signal of readiness to continue growth within the bullish trend

Best regards, R. Linda!

EURUSD - Retest of support at 1.170 on a bullish trendFX:EURUSD is in a bullish trend phase and is forming a correction to retest the key psychological support level. Bulls may influence the situation...

The dollar has fallen sharply due to economic problems, which has triggered a rise in the euro, which is trying to stay above 1.170.

After rallying and updating the interim high to 1.1768, the currency pair entered a correction phase and is testing 1.170, an important technical and psychological support level.

Support levels: 1.1700, 1.1672, 1.1685

Resistance levels: 1.1763, 1.1804

A false breakdown and the bulls holding the price above 1.170 could form a reversal pattern and give a chance for growth within the local bullish trend

Best regards, R. Linda!

GOLD - Pullback before growth after Asian momentum FX:XAUUSD is correcting after hitting a historic high ($4,900), due to the de-escalation of tensions between the US and the EU. Profit-taking is observed, but the trend remains bullish...

Fundamental background:

- Trump has cooled down: tariffs are temporarily suspended, as is the forceful seizure of Greenland. Negotiations are likely to continue. The market reacted quite aggressively to yesterday's “swings” led by Trump.

Today, data on PCE inflation and US GDP for the third quarter will be released, which may provide new momentum.

Further dynamics will depend on inflation data: weak indicators may renew interest in defensive assets, while strong ones may increase pressure.

Resistance levels: 4838, 4850, 4880

Support levels: 4813, 4800, 4777

Technically, after the Asian momentum, gold may form a correction of 50% of the total movement. I consider the 4813-4800 area (liquidity area) to be a zone of interest. And as zones of interest at the top, I consider the 4850 area — the liquidity pool.

Best regards, R. Linda!