Algorand

Algorand ALGO USDT Upcoming TAKE PROFIT POINTSHi Traders, Investors and Speculators of Charts📈📉

New Year 2026 loading....🥂🥳

Algorand is a decentralized network built to solve the Blockchain Trilemma of achieving speed, security, and decentralization simultaneously.

Algorand is designed to be a payments-focused network with rapid transactions and a strong focus on achieving near-instant finality which aims to be processing over 1,000 transactions per second (TPS) and achieving transaction finality in less than five seconds.

As a public smart contract blockchain that relies on staking, Algorand is also capable of hosting decentralized application (dApp) development and providing scalability. Rising gas fees on Ethereum have led many dApp developers and decentralized finance (DeFi) traders to look for alternative blockchain solutions. Algorand is capable of managing the high-throughput requirements of widespread global usage and a variety of use cases.

Technical Chart Analysis:

Algorand is still "in prison", but holding the 50d Moving Averages is the first step towards a new bullish cycle. Look at all of this upside potential!

Technical indicator Analysis:

If ALGO can get back ABOVE the 50d moving averages (0,18), that is when we can expect to see some serious bullish/parabolic price action.

You don't have to wait until then to trade algo. In the daily timeframe, there are some great setups for those who have a bit of patience, with low buy and high sells from 15% - 30% over a few weeks (in both shorts and longs).

Tis market is still moving, even though it doesn't neccesarily seem like it from a macro outlook.

#ALGO/USDT - this will go up#ALGO

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.1764, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.1784

First target: 0.1811

Second target: 0.1840

Third target: 0.1870

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

ALGO/USDT –Between Capitulation or Massive Reversal Zone?ALGO is now trading at one of the most decisive zones in recent years, a major historical support area between 0.17–0.135 — a battle zone between buyers and sellers since 2020.

Each time the price tapped this area, the market reacted with a strong reversal, signaling heavy accumulation by smart money. However, this time, selling pressure appears stronger, creating tension between a potential massive reversal or a final breakdown before a new redistribution phase.

The weekly structure continues to print consistent lower highs since 2021, confirming that the macro trend remains bearish. Yet, the recent price rejection around 0.135–0.17 and the presence of a liquidity sweep below that zone suggest that many retail stop-losses have been taken — possibly setting the stage for a mean reversion rally.

---

🟢 Bullish Scenario: “The Bottom Reclaim”

Confirmation only occurs if weekly close > 0.235 with strong volume.

A breakout above this level would signal a structural reclaim and open the path for a rally toward 0.285 – 0.49 as the primary targets.

If momentum strengthens, further expansion toward 0.78 – 1.54 remains possible (the former 2021–2022 distribution area).

Aggressive traders may consider accumulation within 0.17–0.135, with a tight stop below 0.12, aiming for a minimum 1:3 risk-reward ratio.

💡 Additional bullish narrative:

If the crypto market rotates capital from major layer-1 assets into mid-cap plays, ALGO could become one of the “revival candidates,” backed by strong liquidity and a recognizable brand.

---

🔴 Bearish Scenario: “Break the Floor”

If weekly close < 0.135, it would confirm a breakdown of multi-year structural support.

The next logical downside target lies around 0.082, the historical low and the last visible demand zone before uncharted territory.

Such a breakdown usually triggers a capitulation event, where short-term volume spikes due to panic selling.

In an extreme case, ALGO could establish a new structural range below 0.10 before attempting a long recovery.

💡 Additional bearish narrative:

If macro pressure persists (e.g., BTC retraces or USDT dominance rises), ALGO might experience a “final flush” before forming a structural bottoming pattern.

---

📊 Key Structure & Technical Patterns

Primary pattern: Long-term Accumulation Range with repeated liquidity sweeps below support.

Macro trend: still bearish, though momentum is weakening — visible through declining volatility and volume contraction.

Potential reversal trigger: a strong bullish engulfing candle from within the yellow box.

Volume divergence: watch for rising volume around 0.15–0.17 — it often signals silent accumulation by smart money.

---

🧭 Conclusion

ALGO is standing at a critical multi-year decision zone — it could either mark the beginning of a multi-year reversal or the final breakdown toward new lows.

Traders should focus on weekly reactions around 0.17–0.135 and wait for confirmed weekly closes before taking positions.

There is no “best” position yet — only patience and discipline will define the outcome at such a pivotal stage.

---

#ALGO #ALGOUSDT #Algorand #CryptoAnalysis #PriceAction #MarketStructure #SwingTrading #TechnicalAnalysis #CryptoBreakout #TradingViewCommunity

ALGO Setup: Watching $0.15 for Potential Long OpportunityWe're eyeing ALGO/USD for a potential retest of the $0.15 support zone, which could act as a springboard for a bullish reversal on higher timeframes. This zone has historically provided strong demand, and another touch could offer a high-probability entry — though patience is key as we wait for confirmation.

📈 Long Spot Trade Idea:

Entry Zone: $0.15 – $0.16

Targets:

TP1: $0.225 – $0.26

TP2: $0.28 – $0.33

Stop Loss: Below $0.13

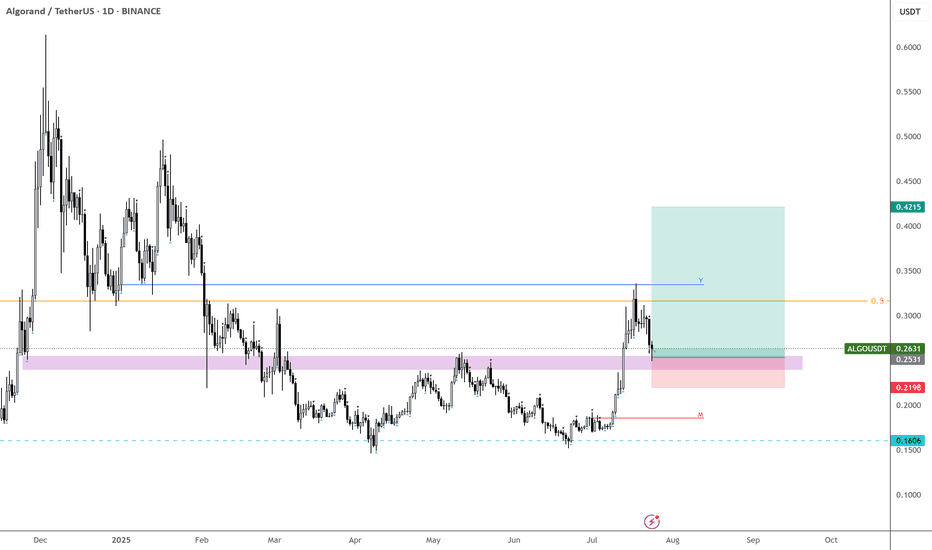

ALGO – Reversal from the Final Support ZoneLike most altcoins, Algorand also ended Friday’s crash by touching its final support zone, then strongly reversed.

After dropping to 0.10, the coin rebounded sharply and reclaimed the next key level at 0.15.

Currently trading around 0.20, ALGO is showing early signs of stabilization. If the overall crypto recovery continues, this setup could develop into a solid bullish signal.

The confirmation comes with a break above 0.2250, which would mark the end of the correction that started in December last year — opening the way toward the 0.40 zone.

Let’s see if the market confirms it. 🚀

ALGO/USDT - Swing Setup | Low-Risk Long Targeting +273%🚀 Trade Setup Details:

🕯 #ALGO/USDT 🔼 Buy | Long 🔼

⌛️ TimeFrame: 1D

--------------------

🛡 Risk Management (Example):

🛡 Based on $10,000 Balance

🛡 Loss-Limit: 1% (Conservative)

🛡 The Signal Margin: $409.84

--------------------

☄️ En1: 0.2258 (Amount: $40.98)

☄️ En2: 0.2056 (Amount: $143.44)

☄️ En3: 0.1924 (Amount: $184.43)

☄️ En4: 0.1799 (Amount: $40.98)

--------------------

☄️ If All Entries Are Activated, Then:

☄️ Average.En: 0.1992 ($409.84)

--------------------

☑️ TP1: 0.2835 (+42.32%) (RR:1.73)

☑️ TP2: 0.336 (+68.67%) (RR:2.81)

☑️ TP3: 0.4171 (+109.39%) (RR:4.48)

☑️ TP4: 0.549 (+175.6%) (RR:7.2)

☑️ TP5: 0.7437 (+273.34%) (RR:11.2)

☑️ TP6: Open 🔝

--------------------

❌ SL: 0.1506 (-24.4%) (-$100)

--------------------

💯 Maximum.Lev: 2X

⌛️ Trading Type: Swing Trading

‼️ Signal Risk: 🙂 Low-Risk! 🙂

--------------------

🔗 www.tradingview.com

❤️ Your Like & Comments are valuable to us ❤️

ALGO/USDT Double-Entry Precision Signal with 80% profitHere’s a strategic setup for #ALGOUSDT designed to lock in gains and eliminate downside risk through a two-tiered entry.

- Entry 1: 0.2020

- Entry 2: 0.1627 (purely to reduce overall trade risk; not a profit-seeking leg)

- TP1: 0.2670 (take 50% off the table)

- TP2: 0.1627

---

After TP1 is hit and you’ve secured half your position, shift your stop to breakeven on the remaining size. You can free-risk by moving your stop in the platform or setting a manual alert once 0.2670 is reached. This ensures the rest of the trade carries zero risk while letting profits run.

---

Note: the second entry point isn’t aimed at generating additional profit—it serves solely to widen your safety net and lower the average cost of your position. Trade smart, manage risk, and let the market work in your favor.

BINANCE:ALGOUSDT.P

Four Coins for the Longer Run – My PlanWhen it comes to crypto, I’m definitely not the “buy & hold to the moon 🚀” type of trader. I prefer realistic targets, good entries, and a clear plan.

That being said, there are a few coins where I’m willing to have more patience, aiming for a 3x or more return.

For the first three (ADA, ALGO, XDC), the ETF story could play a big role in the coming year. FET is a different case, but one I still like. Let’s go one by one.

ADAUSD

- After the ATH above 3 in 2021, ADA collapsed more than 90%, bottoming in 2023 near 0.23.

- That bottom marked the start of a long accumulation phase, followed by an upside breakout in Nov 2023.

- Each correction since then has formed higher lows (0.3 → 0.5), showing strength.

- July’s rise looks constructive, and last week price also broke the falling trendline.

📌 Plan:

Accumulate around 0.9 and below, with DCA reserve if we see 0.65–0.67 zone.

Target: 2.3 in the first phase. Above that, I’ll reassess for a possible run toward ATH.

ALGO

- ALGO’s drop was even harsher, losing more than 90% from its peak.

- Found bottom near 0.1, and despite the spike late last year, it’s mostly still sideways accumulation.

For me, this is exactly the kind of base-building I like to see before a real run.

📌 Plan:

Buy near 0.2, keep reserves for a DCA if it drops again to 0.1.

Target: at least 0.7, then I’ll evaluate if market conditions favor holding further.

XDC

- XDC is more speculative, but also more explosive.

- The structure shows that a 3x to 5x move isn’t unrealistic once momentum picks up.

- With potential ETF headlines in play, it could be a nice upside surprise.

📌 Plan:

First buy zone around 0.07, with DCA reserves at 0.045.

Target: 0.15 in the first stage.

FET – Not About ETFs, But Strong Potential

- Different case here – no ETF talks, but I like the project.

- Already holding from around 0.4.

- If price dips to 0.55, I’ll add more.

📌 Target: 2.0 USD.

Final Thoughts

I’m not aiming for x100 fairy tales. My strategy is simple:

- Enter at accumulation levels

- Use DCA wisely

- Take profits at realistic targets

Algorand Trading Volume Signals Potential 20% Gain To 0.33Hello✌️

Let’s analyze Algorand’s price action both technically and fundamentally 📈.

🔍Fundamental analysis:

Algorand has updates coming new wallet, quantum-proof security, and enterprise tools.

Big moves like 100M USDC minted and partnerships with FIFA & TravelX show real-world use.

If the roadmap works out, demand might rise, but ALGO’s still far from its all-time high. 📈🚀

📊Technical analysis:

BINANCE:ALGOUSDT shows solid trading volume with a nearby daily support level. If this zone holds, a potential 20% upside could be expected, aiming for $0.33. Monitor the price closely and manage risk accordingly. 📈🛡️

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

ALGO – Finally Getting the Retrace

Back at EURONEXT:ALGO —missed the lows, but finally seeing the retrace I’ve been waiting for.

Should’ve entered alongside CRYPTOCAP:HBAR , but this is the next best spot.

If this level doesn’t hold, we’re likely heading back below 20c, and many alts could retrace their entire impulse moves.

Starting to bid here—let’s see if it holds. BINANCE:ALGOUSDT

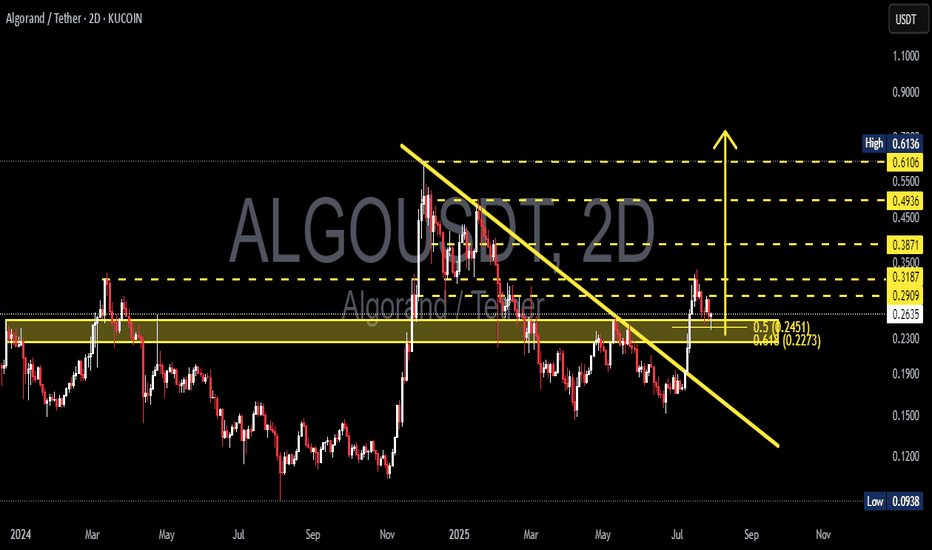

ALGOUSDT Break Downtrend – Reversal in Progress or Just a Retest📊 Technical Analysis Overview:

The Algorand (ALGO) / Tether (USDT) pair has shown a notable technical development by successfully breaking above a medium-term descending trendline that has acted as resistance since early 2025.

---

🔍 Pattern & Structure:

A clean breakout above the descending trendline (yellow sloped line) indicates a potential shift in trend from bearish to bullish.

Price is currently undergoing a retest of the breakout zone, aligning with the Fibonacci retracement levels 0.5 ($0.2451) and 0.618 ($0.2273).

The yellow horizontal zone ($0.25–$0.29) has been a significant support/resistance flip zone, showing strong historical reaction throughout 2024 and early 2025.

A higher high and higher low structure is starting to form — an early signal of a potential bullish reversal.

---

📈 Bullish Scenario:

If the price holds the support zone between $0.2451 and $0.2273, we could see a continuation of the upward move toward the following resistance levels:

$0.2909 (current minor resistance)

$0.3187

$0.3500

$0.3871

Mid-term targets: $0.4936 and $0.6106

A daily or 2D candle close above $0.3187 with strong volume would confirm a bullish continuation.

---

📉 Bearish Scenario:

On the other hand, failure to hold above the $0.2451–$0.2273 support zone could lead to a renewed bearish move with potential targets at:

$0.1900 (weekly historical support)

$0.1500

Extreme support: $0.0938 (2024 cycle low)

A break below $0.2273 would invalidate the breakout and may signal a bull trap.

---

📌 Summary:

ALGO is at a key inflection point. The current pullback could be a healthy correction after a breakout or a failed retest. Watch for price action and volume reaction near $0.2451–$0.2273 to confirm the next move.

#ALGO #Algorand #ALGOUSDT #CryptoAnalysis #TechnicalAnalysis #Breakout #BullishReversal #Fibonacci #SupportResistance #Altcoins #CryptoSetup #PriceAction

ALGOUSDT Forming Bullish Flag ALGOUSDT is currently trading inside a well-defined bullish Flag pattern on the 4-hour chart, a structure known for its bullish breakout potential. The price recently tested a significant demand zone, which previously acted as a base for a strong upward move earlier in July.

Key Points:

Bullish Flag Structure: Price is compressing within converging trendlines, forming lower highs and lower lows a classic bullish flag pattern.

Support Zone: The $0.24 – $0.255 area has acted as a strong demand zone, providing reliable support.

Bounce Potential: A bullish reaction from the lower flag boundary and demand zone could lead to a move toward the upper trendline and potentially trigger a breakout.

200 EMA Support: The 200 EMA is currently providing dynamic support, reinforcing the bullish setup.

Breakout Confirmation: A breakout above the flag resistance with strong volume could initiate a rally toward the $0.30 – $0.40 zone.

Cheers

Hexa

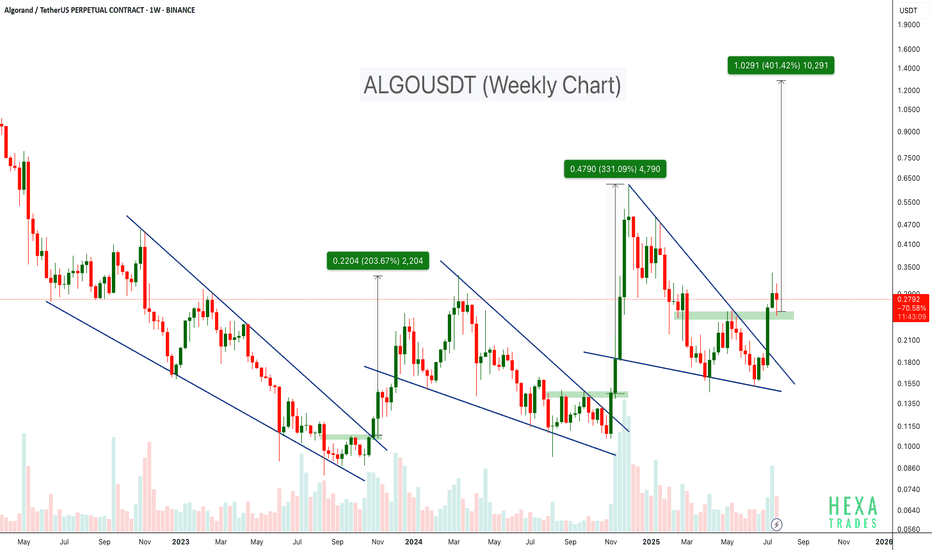

ALGO Breaks Out of Falling Wedge – 400% Target Ahead?BINANCE:ALGOUSDT has consistently followed a bullish pattern on the weekly timeframe. Each major rally has been preceded by a falling wedge breakout, as shown by the three highlighted instances on the chart.

- First breakout: ~200%+ move

- Second breakout: ~300%+ move

- Current breakout projection: Potential target up to +400%

The price has just broken above the wedge and is currently retesting the breakout zone. If history repeats itself, ALGO may be poised for a strong upside move from its current levels.

Cheers

Hexa🧘♀️

COINBASE:ALGOUSD EURONEXT:ALGO