ALT

$ONDO ABC Correction in Wave 2?LSE:ONDO wave (c) of 2 appears to be underway after the failure to reach a new local high. However there is strong support just below of the daily pivot and 200EMA.

Failure to hold this level brings up the High Volume Node support and golden pocket at $0.79. RSI has room to fall and the alt-coin golden pocket, Fibonacci 0.786 sits at the S1 daily pivot.

Analysis is invalidated above wave B.

Safe trading

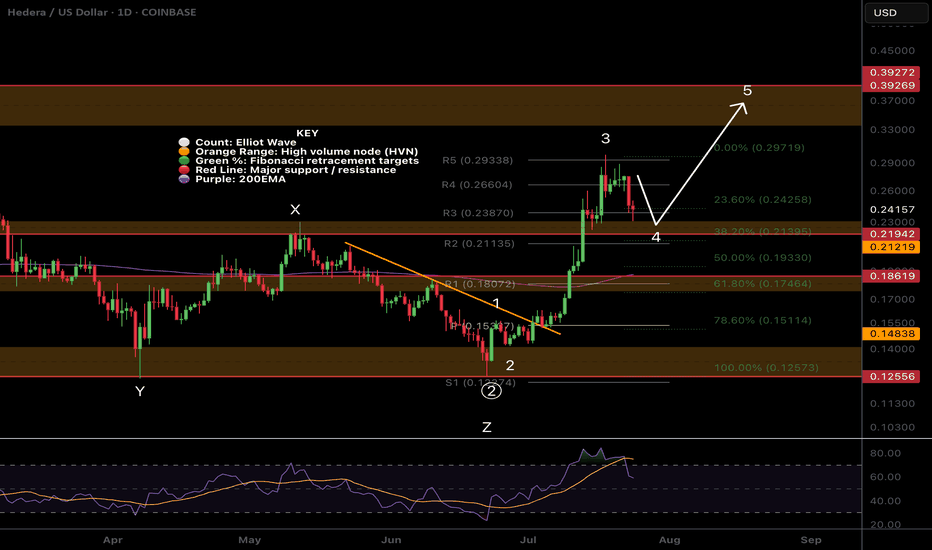

A Local look at the $HBAR retracementWave (c) appears to be underway with a target of the golden pocket and major support High Volume Node at $0.175.

There may resistance at the daily 200EMA along the way but it just seems to floating between supply and demand zones right now.

Daily RSI has room to fall.

Safe trading

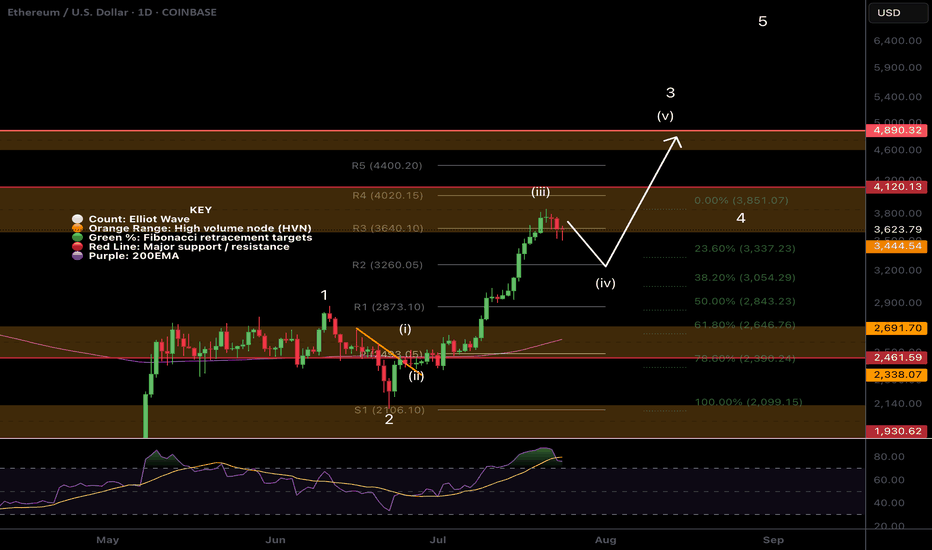

$ETH Topping Without All Time High?Has the most anticipated all time high of the year been cancelled? The crowd does not get what it wants! Everyone from CNBC to my grandmas goldfish have been bullish on ETH for the past few months so what a fitting psychological mess it would be if we significantly pulled back here!

Firstly it may just be a temporary set back to the High Volume Node support at $3900 before a move to all time high. Even then I am expecting a deeper pullback to set us up for all time high in Q4. Losing this support bring up the ascending daily 200EMA right at the Fibonacci golden pocket, which you can see is the wave 3 high!

The next target, which is my next buy level, is the larger degree Fibonacci golden pocket, major support High Volume Node and wave 4 bottom at $2100. This would be a capitulation area for many!

RSI has printed confirmed bearish divergence with plenty of room to fall.

Safe trading

$HBAR Printing an ABC in wave 4?Wave C of an ABC correction in wave 4 appears to be underway in CRYPTOCAP:HBAR

This would see price have a quick drop below the daily pivot testing the major support High Volume Node and rising daily 200EMA as support before continuing up in wave 5. This is also the .382-.5 Fibonacci retracement a typical area for wave 4 to end per Elliot wave rules. Lots of confluence in this area.

RSI is still making its way down from overbought. Investor psychology is still irrationally bullish giving opportunity for professional traders to make some volatility bucks.

Analysis is invalidated if price breaks $0.273 upgrading the count to wave 4 completing at the current wave (a) bottom.

Safe trading

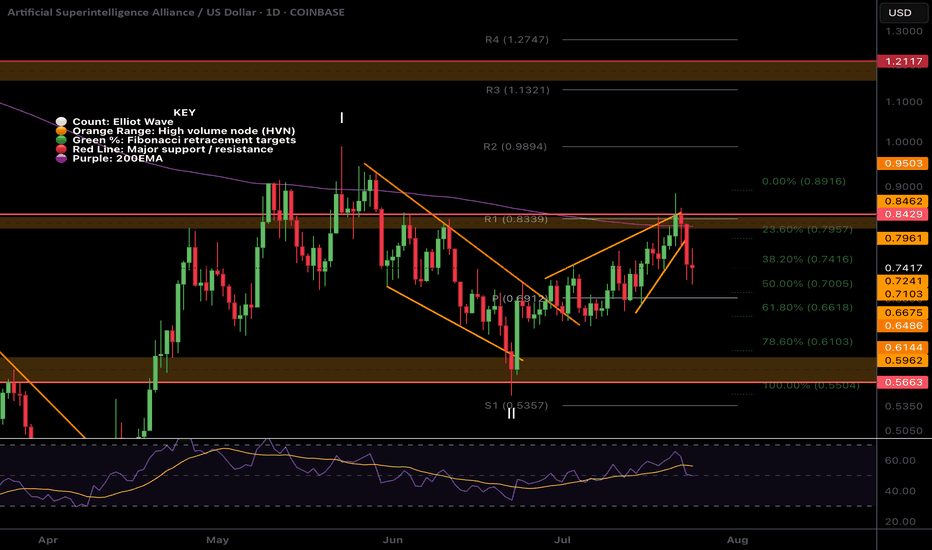

$FET Elliot Wave Updated, Triangle forming?NYSE:FET appears to be printing a triangle in a larger degree wave B of an ABC counter-bear trend correction.

Wave (D) is expected to finish at the descending resistance, poking above the daily 200EMA, while wave (e) is often shallow so expected to end at the daily pivot point. The target is $1.6 at he triangle pattern depth and major High Volume Node resistance.

An ABC corrective wave does not mean that the macro count is invalidated and may form part of larger ending diagonal series of ABCs to achieve my high degree wave 5 targets above all time high. I will update the weekly chart to reflect this shortly.

Safe trading

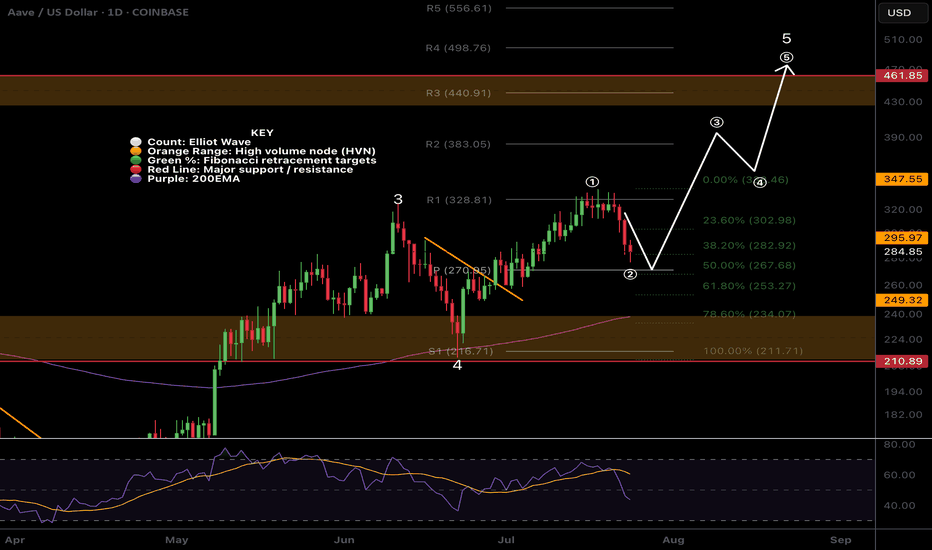

$AAVE Continues to follow the path!CRYPTOCAP:AAVE was immediately reject from the swing high as expected, per the percentage band take profit rules.

Daily RSI has plenty of room to grow to reach the all time High Volume Node resistance which is the next target at $430.

Based on the depth of wave (2) after touching the daily 200EMA as support, wave 3 is still underway to complete the larger degree wave 5 with a poke above all high, the highest probability terminal target per Elliot wave rules.

Safe trading

For those interested in trading signals / diary & trade management / trading parameters etc... Signals updated for 15/08/25

✅ LSE:ONDO DEMA Percentage Band rule added

✅ CRYPTOCAP:BTC hit take profit #2 for 2.59RR

✅ CRYPTOCAP:AAVE (DEMA) HIt take profit 1 for 1.45RR

✅ CRYPTOCAP:ADA moved 10% after signal activation but still not hit take profit 1

✅ NASDAQ:AAPL (Apple) very close to take profit #1

✅ BTC added to completed trade signals along side Take profit 2 for google, 700, HBAR and a few stop (INJ, SOL, BTDR) and invalidations for META, SHIBINU, WLD)

Safe trading

$SUI Short term bearish move coming?CRYPTOCAP:SUI is currently testing the daily pivot as support which must hold to keep the bullish count alive.

I have 2 Elliot Wave counts, short term bullish and bearish that I am patiently waiting to see unfold. Long term is still bullish.

The white count suggests that we have printed a micro wave (1) and are completing a wave (2) now at the daily pivot just above the daily 200EMA where price should move powerfully in a wave (3) of 3 upwards.

Alternatively, the red count, wave B of a larger corrective could also be complete at the recent swing high and losing the pivot and daily 20EMA would confirm this. Wave C has an initial target of the triple support 0.618 Fibonacci retracement, daily 200EMA and major support High Volume Node at $3 to complete wave 2 and a secondary target of the alt-coin golden pocket 0.786 Fibonacci retracement and S1 daily pivot at $2.7

The bearish analysis is my preferred count due to the amount of confluence, including the fact we are entering mid August and this move would also push daily RSI back into oversold.

This would set up new long signals so look out for those in the Substack Trading Signals

Safe trading

$SOL Short term Bearish Outlook ?CRYPTOCAP:SOL Solana is currently testing the daily pivot as support which must hold to keep the bullish count alive.

I have 2 Elliot Wave counts, short term bullish and bearish that I am patiently waiting to see unfold. Long term is still bullish.

The white count suggests that we have printed a wave (1) and are completing a wave (2) now at the daily pivot just above the daily 200EMA where price should move powerfully in a wave 3 upwards.

Alternatively, the red count, wave B of a larger corrective could also be complete at the recent swing high and losing the pivot and daily 20EMA would confirm this. Wave C has a target of the triple support alt-coin golden pocket 0.786 Fibonacci retracement, S1 daily pivot and major support High Volume Node at $142 to complete wave 2.

The bearish analysis is my preferred count due to the amount of confluence, including the fact we are entering mid August and this move would also push daily RSI back into oversold.

This would set up new long signals! The asset is in limbo atm, not very impulsive as you would expect for wave 3.

Safe trading

$RENDER bearish triangle or motif wave?I have 2 local Elliot Wave counts for CRYPTOCAP:RENDER the bearish triangle yet to complete wave D which would result in a final thrust down before a new macro uptrend and a (1) (2) with wave (3) started.

The overlapping and slow price action does not suggest RENDER is in a wave as it is not moving impulsively.

Many alts have failed to move from the bottom while others have shined like ETH and XRP etc..

Either this is the new normal behaviour for 'alt season' or we are not actually in alt-season yet with a big move lower around the corner!

Safe trading

LinqAI Main Trend. Dragon. Breakout Zone. 10 08 2025Logarithm. Time frame 3 days.

AI project. Quite fresh. Listing 04 2024 and long distribution in the channel (target of the Dragon's "head", in case of implementation).

Currently traded:

Top exchanges - 0

Medium liquid - 3 (this is good)

Low liquidity junk and DEX - 6 (completely ignored).

LinqAI Twitter - 33 thousand subscribers and bots, which is not enough.

Unlocks every month on the 26th 1.4% of the issue. And so on until 02/26/2029. In my opinion, the project is unlikely to survive until this year. These unlocks do not affect the price, a very small %. The price is affected by the general direction of the market. That's it...

The Legend of the Project. LinqAI is at the forefront of combining innovative technologies with practical business solutions. Our expertise lies in creating universal AI that can be adapted to any business environment, be it traditional sectors or the emerging Web3 space. This AI is specifically designed to automate routine tasks traditionally performed by people. In doing so, we aim to improve the quality of life of employees, giving them more time to solve complex and creative problems. This not only improves the balance between work and personal life, but also significantly increases the overall efficiency of the business. Our approach is not only about integrating AI into work processes; we aim to rethink the work of companies in an increasingly digital world, ensure their readiness for the future, and at the same time value human capital.

🟣Local. Time frame 1 day. Just "as the book says" everything is done at the moment.

$ETH All Time High Soon?CRYPTOCAP:ETH wave 3 is still underway and its the only news you've been hearing about for 2 weeks! The hype is real making the potential top of this move much closer as institutions will be selling into the FOMO soon. There is no better way to trap newbies than a poke above all time high before a savage retracement!

Retracement targets are the daily pivot and rising 200EMA at $3337 the .382 Fibonacci retracement from the wave 2 bottom, just above the weekly pivot point. Daily RSI has huge bearish divergence.

Secondary retracement targets are the weekly 200EMA and S1 weekly pivot sitting at $2250 which could present an incredible buying opportunity before the real alt season!

Analysis is invalidated below $2122

New long signals are building in the DEMA PBR and Price Action strategies so keep an eye out on the Trade Signals Substack as we have made very good profits lately in these markets!

Safe trading

XRP - The Unpopular Analysis!XRP printed a macro triangle from 2021-2024. Triangles are an Elliot wave pattern resulting in a terminal thrust up in a motif wave before price returns to the bottom of the triangle at $0.28! Now this seems extremely unlikely given whats going on fundamentally but I don't make the rules so don't shoot the messenger!

The motif wave appears to have completed wave 4 bull flag at the $1.6 swing low and wave 5 is underway (which can overextend). Elliot wave count would suggest we are near a major top after one more push up to new highs. More realistic price targets for a deep retracement would be $1.6 again which the ascending weekly 200EMA would catch up to for confluence.

Interested to hear from the other Elliot wave specialists on this count!

Analysis is invalidated below $1.6

New long signals are building in the DEMA PBR and Price Action strategies so keep an eye out on the Trade Signals Substack as we have made very good profits lately in these markets!

Safe trading

AltLayer 3,000% Late 2025 Target · Bottom ConfirmedThis is a perfect chart. You can see the same drawings made by the candles compared to other altcoins we've been visiting. For example, the main low happened 7-April 2025, four months ago. So AltLayer hit bottom and has been consolidating slowly moving up.

Notice higher lows. Notice how after more than two months in June when the market tried to move lower the session ended as an inverted hammer, with high volume. The hammer as a candlestick pattern is a reversal signal. It is only a valid signal when it comes at the end of a trend. Here we have the major low in April after a major downtrend. These signals confirms the low is in and the trend will soon change.

It is true, because we already have confirmation. ALTUSDT has been challenging resistance with long upper wicks, support remains unchallenged. As this trend continues, bullish momentum will grow and a massive bullish wave will occur. AltLayer has a huge 3,000% potential for growth in the coming months. Can be a bit less but it can also end up being much more.

Namaste.

AITECH Main trend Channel Wedge. Reversal zones. AI. 30 07 2025Logarithm. Time frame 1 week. Main trend. Huge pumps for hype. The price is driven up on dexes, and profits are realized on centralized medium and low liquid exchanges. Important. Twitter (X) of the project has 560 thousand subscribers. That is, at the right time there will be a flow of positive news for subscribers who are former holders, or potential buyers (there are most of them, they buy only very expensive ones) and pumping as before, but by a smaller percentage.

And while in the ascending channel, the decline phase forms a descending wedge in the secondary trend. A triangular formation has formed in the local trend. The logic of the reversal zones is shown with arrows.

What is it. From the marketplace:

Solidus AI Tech is building one of Europe's first Web3-based AI infrastructures, powered by a state-of-the-art, green HPC data center. The $AITECH token powers an ecosystem of products that combine AI utilities, scalable computing, and Web3 tools, empowering developers, enterprises, and institutions to easily build, deploy, and scale AI solutions.

With the support of major partners including NVIDIA, IBM, Fetch.ai, Tron, BNBChain, Binance Wallet, Trustwallet, and many more, Solidus AI Tech is becoming one of the most advanced and adaptable Web3 AI token projects, positioning itself among industry leaders.

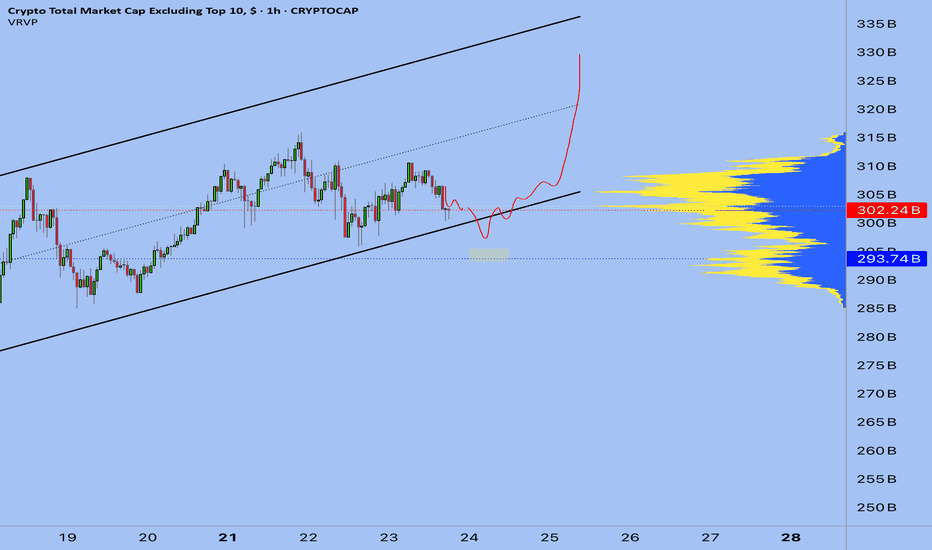

6/ Altseason: Live - Is this really the Altseason?12day Result I know this is the exact question you're asking yourselves as you look at your portfolios. "What altseason? Everything is flat."

Maybe I was wrong two weeks ago when I said it had already started. But, as they say, the result speaks for itself.

12 days ago, as part of the Altseason Live challenge, I started with $10k . Today, the account is at $35k .

Let's break down what's really happening, and why your feeling of having missed out is an illusion.

You are absolutely right in your observations. If we look at most coins, we'll see that they are still at the very bottom. They haven't even begun their main move yet.

Below are random strong projects of the industry

Here is the visual proof. This isn't a "dumping" market. This is a market that is accumulating energy. And that's the best possible news for anyone who thinks they've missed out. The main, most powerful wave of growth that will lift all these coins hasn't even started.

My result wasn't achieved through general market hype, but through surgical, precise trades. I used my coin-picking strategy (which I wrote about in Post 2/ Altseason: Live - My Coin-Picking Strategy) -focusing on projects that play by their own rules. I continue to do deep research and enter every position with surgical precision.

Why August Will Be Incredible. The Calm Before the Storm.

What we are seeing now is the classic calm before the storm. Most market participants don't understand what's happening and are in a state of confusion. But if you look closely, you can see that many projects have already completed their accumulation phase. An immense amount of power is building up under the hood of the market.

I believe that August will be the month when this energy is unleashed. It will be the month that kicks off the explosive, broad movement that everyone is waiting for. And that is exactly why now is the most crucial time. It's not a time for FOMO, but for level-headed preparation.

So, knowing all this, what do we do next?

First, we don't panic. We understand that the main train is still at the station.

We keep hunting for strength. My strategy of finding strong projects remains unchanged.

We use every correction as a gift. Any 15-25% dip on a promising asset is an opportunity, not a catastrophe.

We prepare for August. The next month could be the defining one for this entire cycle.

My result proves that opportunities always exist, even in a "sleeping" market. And for complete transparency, all proof of my trades is broadcasted on streaming platforms. The real fun, the altseason we are all waiting for, is still ahead. Stay focused.

Best regards EXCAVO

PENGU. Main trend. Trend reversal zone. 04 07 2025Logarithm. Main trend. Fresh cryptocurrency, which is being driven into hype.

Locally now. Price at the median of the bowl.

Buyer volume dominates. Most likely, there will be a large pump in case of a breakout.

The chart is somewhat reminiscent of the Bitcoin chart, the reversal zones of this secondary trend, after the first local wave of growth. The first local, significant target is shown.

There is a possibility of a helicopter, that is, to collect stops in both directions, and thereby dump passengers before a potential pump.

Such cryptocurrencies (low liquidity, monopoly over the price due to the concentration of cryptocurrency in “one hand”) at a good time "the hamster is not scared", will be pumped up conditionally, like Shiba Inu (SHIB), driving the hype (raising the price over and over again, and coming up with positive news) and 0.5 million Twitter subscribers (X). Medium-term — long-term level zones are shown on the chart.

5/Altseason Live Psychology:My Core Principle,Learned Over Years

This experience is built on analyzing every previous altseason. And here is the main takeaway: altseasons are always short, but incredibly rapid. In this chaos, most people, driven by emotion, make the same mistakes:

- They open too many trades.

-They close a position on the first small move, hoping to "re-enter" another project that's "about to explode."

-They shift capital from a growing asset to one that hasn't moved yet. And it still doesn't move.

The problem is the mindset. You don't invest in what's falling or bet on "dark horses." You invest in what is already growing.

This might sound new to some, but the most important principle in trading, and in life, is to REINFORCE STRENGTH.

This is an attention market. And attention is captured by the speed and power of growth. Everyone is looking at what's pumping. That's where the money flows. Your job is to be in that flow, not to try and catch a falling knife.

And one more thing, the most critical rule for the next two months. I AM BEGGING YOU, DO NOT OPEN SHORT POSITIONS. Any 15-25% correction on a strong project is not a reason to short; it is your buying opportunity. Measure from the peak, and you will see these entry points. The strongest projects will correct even less. This system works.

Of course, this doesn't mean blindly buying everything that's green. You need to understand the narratives. But if your project is old and showing weakness while others are flying, maybe it's time to switch to a leader. As a subscriber wrote in the comments of my last post: in the previous cycle, SUI did a 10x, while APTOS did a 4x. This clearly shows where the market's attention was focused, and consequently, where the results were.

Best regards EXCAVO

$HBAR Wave 4 finishing soon?CRYPTOCAP:HBAR Hedera appears to have completed wave 4 with the test of the High Volume Node support at the 0.382 Fibonacci retracement.

Wave 5 has an expected target of the High Volume Node resistance at $0.4 before a larger retracement in wave 2 aligning with my summer pump august / September dump view.

Analysis is invalidated below $0.1933 at the 0.5 Fib retracement and will be updated to a wave 2 instead of 4.

Safe trading

$FET local ending Diagonal and wave 2 near completion?NYSE:FET was rejected for the 4th time at the daily 200EMA! Each time the probability of a breakout increases.

I have adjusted the High Volume Nodes for accuracy.

Locally Fetch appears to have completed a motif wave up with an ending diagonal for wave 5. Wave 2 is expected to find support at the daily pivot and .618 Fibonacci retracement before attempting a breakout of the daily 200EMA once more.

A move below wave II will invalidate this analysis.

Safe trading

$ETH Hit Our Targets and was rejectedCRYPTOCAP:ETH hit our signal take profit target at $3820 and was rejected at the High Volume Node EQ to the penny.

That appears to have completed wave 3 of this motif wave. Wave 4 has an expected target of the R2 daily pivot and 0.236-0.382 Fibonacci retracement, $3260 before continuing to the upside in wave 5 with a target of the all time high.

This aligns with my views of a significant pullback at the end of August and September which is typical after a summer rally.

No divergences yet in daily RSI.

Safe trading

$AAVE Daily Hidden Bullish divergence?CRYPTOCAP:AAVE and alts begin their retracement Wednesday but is this a long term top or just local? Im betting we have a higher to go this summer..

Hidden daily bullish divergence is printing on RSI at the daily pivot and 0.5 Fibonacci retracement which should all act as strong support provided BTC doesn't dump.

The 'alt-coin golden pocket' Fibonacci retracement 0.786 sits at the descending daily 200EMA and High Volume Node support offering a secondary target for reversal and continued upside.

Losing this and closing below would flip me bearish until a new bullish signal emerges.

Safe trading.

4/ Altseason: Live -The Final game is in September. My plan Altszn Live #4: My <50% Win Rate, the Psychology of Missed Profits, and the Endgame in September. Start with 10k

Let's be brutally honest. Running a public trading experiment comes with immense psychological pressure. This isn't a game. It's real money, real nerves, and a real reputation on the line. The last 9 days have been tough; I hit a losing streak, and I want to show it to you, not hide it. Because trading isn't a non-stop party of green numbers. It's a marathon where your own psychology is both your greatest enemy and your greatest ally.

Section 1: Working on Myself. My System vs. Crowd Psychology

To be profitable in the long run, you have to be honest about your strengths and weaknesses. My weakness? My trade win rate is less than 50%. Yes, more than half of my positions do not close in profit.

My strength? I've developed one rule that allows me to stay profitable despite this win rate. This isn't some pretty quote; it's a hard-won system: "Hold your profitable positions for as long as possible, and close your losing positions as quickly as possible."

Now, look at the market. Most people do the exact opposite. They "marry" their losing positions for years, while a 20-30% profit is an irresistible temptation they must lock in immediately.

This leads to the pain of missed opportunities (FOMO). I went through this myself with $RSR. I was waiting to buy at 0.081. The price touched 0.083 and then flew to 10 cents without me. That feeling of the market leaving without you while you wait for the perfect correction is familiar to everyone. It's that burnout that causes you to make mistakes. But I've learned my lesson: there will be no deep corrections this season.

Section 2: Altseason in Full Swing. Where is the Money Flowing, and Where is the "Final Station"?

Altseason is already here. This isn't a guess; it's a fact. Billions of dollars in USDT and other stablecoins are pouring into the market right now. Bitcoin is at its highs. Ethereum is moving up aggressively, just as I've said in my previous posts. But the biggest potential isn't in them right now.

Money moves in waves in the market. You need to understand this to avoid getting on at the "final station":

1. First, Tier-1: Capital flows into BTC and ETH. (This phase is almost over).

2. Then, Tier-2: The flow shifts to large-cap projects (LINK, UNI, SOL, etc.). (Happening now).

3. Next, Tier-3 & Tier-4: Money moves into smaller, riskier altcoins. (Our main target).

4. The Finale - Memecoins: Euphoria, insane percentages, media headlines. When your grandmother asks you about Dogecoin — that's the "final station." It's time to get off the ship.

And we have a date. September 2025. For me, this is the deadline, after which I'm moving into stablecoins and waiting for major shifts in the global economy.

Section 3: My Hunt for "Green Flags" and the XETR:HEI Trade

How do you find that Tier-3 project in this chaos that could deliver massive returns? I look for "green flags." The main one is a rebranding. New tokenomics, a new chart, a new concept. It's a startup with a history.

It was precisely this principle that led me to XETR:HEI (formerly AMEX:LIT ). A small capitalization, a strong narrative, and a complete reset of old holders. The probability of such a project taking off is extremely high.

I'm managing this trade, from entry to exit, in real-time within my private channel. These aren't just signals; it's a demonstration of the system in action.

Conclusion & Call to Action

This public experiment is my personal challenge. I have one shot and only two months to show a result. I'm sharing everything: the wins and the losses. All proof of my trades is available on streaming platforms.

In the first post about Altseason, I invited you to join this journey, and the response was incredible. It brought many strong and mindful people into our community. Let's continue.

If you want to follow my trades in real-time, and ride this final wave of the altseason with me, write "Altseason " in the comments or in pm

And I have a question for you. Share your thoughts, your pain points, your projects. What's on your radar? And one more thing: would you want me to open a separate public account with $1000 and trade it in parallel for transparency? Let's discuss. I'm open to any suggestions.

Best regards EXCAVO