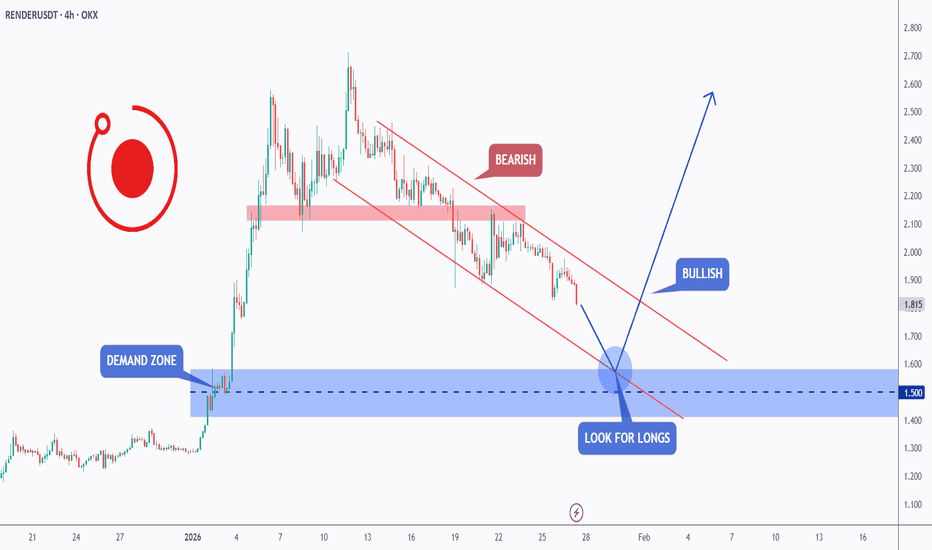

RENDER - Decision Zone ApproachingRENDER is slowly grinding lower and approaching a clear demand zone, an area where buyers have previously stepped in aggressively.

As long as price is holding inside this blue demand zone, the plan is simple:

👉 look for longs, patiently, with confirmation...

That said, context matters.

For the bulls to fully take control again, one thing is still missing:

a clean break above the red falling channel. Until that happens, any upside remains corrective rather than impulsive.

In short:

Demand zone = opportunity.

Channel break = confirmation.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Altcoin

ETH - The Last Standing Low!ETH is now sitting right around the lower bound of its range, and this isn’t just any support.

This level marks the last standing low from the weekly timeframe, a zone that has already proven it matters.

As long as this weekly low holds, ETH still has a real chance to rotate higher and work its way back toward the upper bound of the range. This is where strong markets usually make a decision:

either defend structure… or break it.

For now, I’m not guessing bottoms. I’m simply respecting the level.

Hold this zone, and upside scenarios stay valid. Lose it, and the picture changes entirely.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

[LOI] - SUI - SUI

Keypoints :

Purpose : Sui is a high-performance Layer 1 blockchain platform that enables real ownership of digital assets, data, and permissions through an object-centric model and the Move programming language, facilitating scalable, secure, and user-friendly decentralized applications across DeFi, gaming, AI, and institutional finance.

Problem Solved : It addresses blockchain's core limitations like scalability bottlenecks, high transaction fees, slow finality, and developer complexity by offering horizontal scaling, sub-second transactions, low costs, and modular tools that simplify building without compromising security or decentralization.

Bullish Case for Demand : Research suggests Sui's demand could rise significantly in 2026 due to its evolving ecosystem, with features like gas-free stablecoin transfers, protocol-level privacy, and integrations boosting adoption; strong on-chain metrics (e.g., $800M+ daily DEX volume), institutional inflows, and potential price breakouts (up to 168% gains) highlight growth potential amid broader crypto recovery, though volatility remains a factor.

Partnerships : Key collaborations include UNDP for sustainable development pilots, Bhutan’s DHI InnoTech for offline blockchain tech, LINQ for crypto-fiat in Nigeria, BitGo for WBTC integration, ZenLedger for tax tools, Nansen for analytics, and gaming firms like Epic Games Store for titles such as Super-B and XOCIETY; investor ties with Franklin Templeton, Google Cloud, and Binance Labs further strengthen its position.

Current Market Cap : Approximately $5.45 billion as of January 27, 2026, with a circulating supply of about 3.79 billion SUI out of a 10 billion total supply, priced around $1.44 USD; this valuation reflects growing TVL and adoption but exposes it to market swings.

Recent Announcements: In early 2026, Sui resolved a mainnet stall swiftly, launched DeepBook Margin for advanced trading, introduced Hydropower Fellowship for Web3 founders, announced evolutions to a unified S2 developer platform with USDsui stablecoin and fee-free transfers, and highlighted 2025 reviews showcasing global events, payments, Bitcoin integrations, and institutional adoption.

Notes on how I personally use my charts/NFA:

Each level L1-L3 and TP1-TP3 (Or S1-S3) has a deployment percentage. The idea is to flag these levels so I can buy 11% at L1 , 28% at L2 and if L3 deploy 61% of assigned dry powder. The same in reverse goes for TP. TP1: 61%, TP2:28% and TP3:11%. If chart pivots between TP's, in-between or in Between Sell levels these percentages are still respected. I like to use the trading range to accumulate by using this tactic.

Just my personal way of using this. This is not intended or made to constitute any financial advice.

This is not intended or made to constitute any financial advice.

NOT INVESTMENT ADVICE

I am not a financial advisor.

The Content in this TradingView Idea is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained within this idea constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this idea post is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the idea/post constitutes professional and/or financial advice, nor does any information on the idea/post constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the idea/post before making any decisions based on such information.

Sir. Galahad - QUANT

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by.

TRB Holding Falling Wedge SupportTRB is trading inside a clearly defined falling wedge on the daily timeframe. Price is currently positioned near the lower boundary of the wedge, which has acted as support multiple times in the past. This area is important, as falling wedges often show slowing downside momentum near their base.

As long as price holds above this lower trendline, the structure remains constructive and allows for a potential rotation back toward the upper resistance of the wedge. A strong bounce from this zone would be an early sign of buyers stepping in, while a confirmed breakout above the upper trendline would signal a larger trend shift.

If price loses the lower wedge support decisively, the bullish structure would weaken and could open room for further downside toward the next demand zone. For now, TRB is sitting at a key support area where direction is likely to be decided.

AVA Falling Wedge at Demand | Reversal Setup FormingAVA is forming a clear falling wedge pattern on the 1D timeframe, with price compressing toward the lower boundary of the structure. The current pullback has reached a key demand zone around 0.30–0.28, aligning with the 0.618–0.786 Fibonacci retracement.

Falling wedges are typically bullish reversal structures. As long as this demand zone holds, price can rotate higher and attempt a breakout above wedge resistance. A confirmed breakout would open upside toward 0.33, followed by 0.38.

A clean loss of the demand zone would invalidate the setup and expose downside toward 0.23.

This is a critical reaction area.

Dash Signals Bullish Recovery After Deep CorrectionWe discussed Dash back on December 16, 2025, when we highlighted strong support within the wedge pattern, marking wave C of an ABC corrective structure. That area acted as a key technical floor, increasing the probability of a bullish reaction.

As we can see today, price is recovering strongly from that support, and the advance appears to be unfolding as wave (3) of a new five-wave bullish cycle within wave A/1. This type of impulsive price action typically reflects strengthening momentum and growing bullish participation. As a result, further upside is favored toward the 100 area and potentially higher levels.

That said, while the broader structure remains constructive, traders should remain mindful of a possible wave (4) pullback, which would be a normal corrective pause before another continuation higher into wave (5). As long as key support levels hold, the overall outlook remains bullish.

OKB - The 100 Level TestThis one is pretty straightforward.

OKB is still trading inside a clear range, and price is now pushing into the lower bound of that range, right around the $100 round number.

That area matters. It has acted as support before, and it’s doing so again....

As long as:

• the lower range support holds

• and $100 remains intact

➡️ I’ll be looking for long setups , targeting a move back toward the upper bound of the range.

If $100 fails, the idea is invalid.

If it holds, the range trade remains in play.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

XRP - Decision Time at Support!XRP is currently retesting a strong support zone, and this is where things usually get interesting.

After the sharp impulse higher, price slipped into a falling wedge, which is a typical corrective structure rather than pure weakness.

For now, sellers still have short-term control, but they are losing momentum as we grind into support.

The key for the bulls is simple 🔑

👉 A clean break above the falling wedge.

That breakout would signal that the correction is done and that buyers are ready to step back in, opening the door for a bullish continuation from this base.

📈 Bulls take over above the wedge.

📉 Failure to break keeps XRP corrective.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

ETH – Correction in play, patience matters hereETH did exactly what we were expecting.

Price got rejected from the upper bound of the wedge, and that rejection triggered the correction phase.

Now the focus shifts lower.

As long as ETH holds the lower bound of the wedge, which also aligns nicely with the demand zone, the overall bullish structure remains intact.

I’ll be patiently waiting for trend-following long setups from support, once the market shows clear rejection.

Let the setup come to you...

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

XRP, 200EMA rejection, local uptrend intactCRYPTOCAP:XRP

🎯Price printed a bullish engulfing 3 white knight candle pattern, reclaiming the daily pivot now being tested as support. The daily 200EMA served as resistance as price was swiftly rejected. Overcoming this is the goal for the bulls.

📈 Daily RSI negated bearish divergence, RSI is resting quickly, a good sign for the bulls.

👉 Analysis is invalidated below the swing low $1.8, keeping the downtrend alive.

Safe trading

SUI, volatile, but local uptrend intactCRYPTOCAP:SUI

🎯Price printed a 3 white knight bullish engulfing pattern, reclaiming the daily pivot, now being tested as support. Wave 2 of a new uptrend appears to be underway. Wave 3 has a first target of the daily 200EMA, followed by $3.1

📈 After negating the bearish divergence, daily RSI has unconfirmed hidden bullish divergence forming.

👉 Analysis is invalidated below $1.31, keeping the downtrend alive

Safe trading

SOL, uptrend intactCRYPTOCAP:SOL

🎯Price caught a bid moving bullishly above the daily pivot, now being tested as support. Wave 2 of a new motif wave appears to be underway with an inital target of the daily 200EMA.

📈 Daily RSI is back to the EQ, restting quickly. A good sign for bullish continuation.

👉 Analysis is invalidated below wave C, $110

Safe trading

ONDO, rekt, fresh low...LSE:ONDO

🎯Price printed a 3 white knight bullish engulfing pattern, jumping above the daily pivot before being rejected hard to fresh lows, keeping the downtrend intact. The 0.786 Fibonacci retracement has been penetrated as price loses the High Volume Node support. S1 pivot is the next target, $0.3.

📈 Daily RSI is showing unconfirmed bullish divergence.

👉 Analysis is invalidated above $0.5 swing high.

Safe trading

HBAR, Bears in control, strong rejectionCRYPTOCAP:HBAR

🎯Price caught a strong bid on bullish divergence, but was rejected just as hard. Price is below the daily pivot and 200EMA, which is bearish, showing the downtrend is intact. The next downside target is the S1 pivot at $0.0893.

📈 Hidden bearish divergence played out at a High Volume Node. Bullish divergence is now forming, but unconfirmed.

👉Analysis is invalidated below the swing low, keeping wave 2 alive. We are very close to this level.

Safe trading

ETH, trying to breakout, multiple attempts 200EMA and R1 pivotCRYPTOCAP:ETH

🎯Wave 1 appears to have completed a leading diagonal. Wave 2 appears complete with the recent higher low, but we need to break above wave 1 for confirmation. Price was rejected at the daily 200EMA and R! pivot, but is attempting to break through again. Overcoming this will be very bullish, especially as we are above the daily pivot.

📈 Daily RSI is printed hidden bearish divergence, followed by another bearish divergence. A move above wave (1) is essential to negate this, or prices could head to new local lows.

👉 Analysis is invalidated below wave (2)

Safe trading

DOGE, testing daily pivot as support, not much changed in a weekCRYPTOCAP:DOGE

🎯 Price printed a bullish engulfing 3 white knight candle pattern. It is above the daily pivot, yet testing as support. A critical level to hold. DOGE is still below the daily 200EMA. Overcoming this will be very bullish. The Elliot wave count remains tricky, so I will await more confirmation.

📈 Daily RSI printed bullish divergence, then negated the bearish divergence. The RSI shot up too hard and fast, which often results in a reversal. The reversal took place and tested the daily pivot as suggested last week.

👉 Analysis is invalidated below the swing low, keeping the downtrend alive

Safe trading

AAVE Hidden bearish divergence on the daily playing outEURONEXT:AAVE

🎯 The path from last week’s analysis is being followed, so far. Price printed a bullish engulfing candle breaking above the daily pivot, but was ultimately rejected at the R1 pivot, now testing the daily pivot and High Volume Node as support. The downtrend is intact. The first target for continued upside is the daily 200EMA and High Volume Node resistance at $210. Overcoming the daily 200EMA will add confluence to a major bottom being in. Wave (C) of triangle wave (D) appears to be underway.

📈 Daily RSI printed hidden bearish divergence which is playing out.

👉 Analysis is invalidated if we drop below $148, keeping wave (B) alive.

Safe trading

Bitcoin (BTC) – 4-Hour Timeframe Tradertilki AnalysisGood morning my friends,

I have prepared a Bitcoin analysis for you on the 4-hour timeframe.

My friends, Bitcoin is currently moving in an HH-HL structure. Never forget: markets always move rhythmically in waves. Every rise has a correction, and every drop has a rebound. This rhythmic wave never breaks.

Since we are in an HH-HL structure, if Bitcoin reaches the levels of 90,847.0 - 89,361.0 on the 4-hour timeframe, I will open a buy position.

My targets:

1st Target: 92,500

2nd Target: 95,000

3rd Target: 102,000

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏

Thank you to all my friends who support me with their likes.❤️

APR - Ascending Support Holding | Break Above Range Can Trigger APR on the 4H timeframe is forming a rising base after a sharp selloff, with price respecting an ascending trendline from the December low. Higher lows are developing while price consolidates below the key horizontal resistance at 0.157–0.160.

The pullback is holding within the 0.618–0.786 retracement zone (0.128–0.122), which aligns with the rising trend support, strengthening this area as a demand region. As long as price holds above the trendline, the structure remains constructive.

A clean break and acceptance above 0.157 can open the path toward the higher resistance near 0.288. Failure to hold the ascending support would invalidate the setup and expose downside toward 0.091.

COSMOS / USDT – Daily OutlookDaily structure shows a bullish Market Structure Shift (MSS), confirming a short-term trend change.

Price is currently trading above key structure, however:

The 50% retracement (~2.30) marks the optimal discount zone

Multiple unfilled FVGs remain below current price, increasing pullback probability

Key considerations:

- Long continuation is favored after retracement

- Lower timeframe confirmation remains required

- Aggressive entries above current price carry elevated risk

Bias remains bullish, but patience is required.

If this analysis added value or offered a new perspective, consider leaving a like 👍

Feel free to share your view in the comments — constructive discussion helps everyone improve.

MrC

POL - Cooling Off Before the Next Move?POL is currently in a clear correction phase after a strong impulsive move higher.

This pullback is happening inside the red correction channel, which is healthy and expected after such momentum. The overall structure remains constructive, but timing matters.

For now, patience is key 👇

I’ll be looking for trend-following long setups only after POL breaks above the correction channel marked in red.

That breakout would signal that buyers are stepping back in and that the next impulse leg may be ready to unfold.

Until then, we wait!

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

ETH - is it time for a correction?ETH is starting to look over-bought.

Price is currently hovering around a strong intersection between the orange supply zone and the upper red trendlines. This is not just any resistance, it’s a zone where momentum has historically cooled off.

As long as this area holds, a bearish correction is expected, with price likely rotating back toward the lower blue trendlines, where buyers previously stepped in.

This doesn’t change the bigger picture... it’s simply a reset within structure.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Ethereum (ETHUSD) – 4-Hour Timeframe Tradertilki AnalysisMy friends, greetings,

I have prepared an Ethereum-ETHUSD analysis for you.

My friends, if ETHUSD manages to close a candle above the levels of ( 3027.3-2964.1 ) on the 4-hour timeframe, I will open a buy position.

My target will be the 3,450 level.

My friends, I share these analyses thanks to each like I receive from you. Your likes increase my motivation and encourage me to support you in this way.🙏✨

Thank you to all my friends who support me with their likes.❤️