QQQ: Tariff ReactionNASDAQ:QQQ As China strikes back with a 34% tariff on U.S. goods starting April 10, the global trade landscape could see some serious turbulence. This follows Trump's tariff moves, and the market's already feeling it: QQQ’s daily chart shows capitulation volume on the table, suggesting a potential bounce— IF tariffs ease.

But until these trade tensions subside, it's likely to be a rocky ride. Tariffs push prices up, inflation lingers, and the Fed finds itself boxed in. The outcome? A market crash, recession, and stagflation—yet, there's still hope for a bounce, depending on how these factors play out.

Manage the levels with us at ChartsCoach.

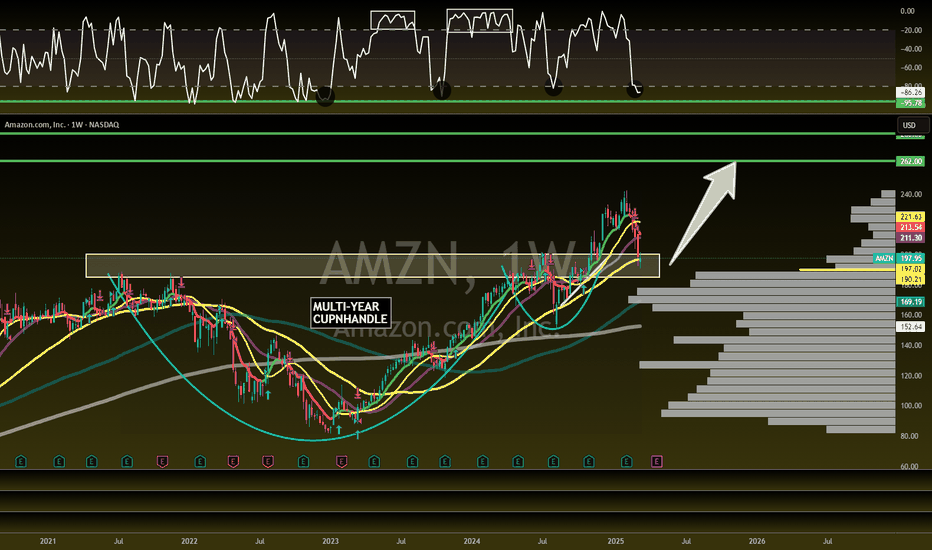

AMZN

Amazon (NASDAQ: $AMZN) Drops 8% as Trump Tariffs Shake Markets. Amazon (NASDAQ: NASDAQ:AMZN ) is facing huge downward pressure following President Donald Trump's announcement of sweeping tariffs. The stock dropped 9.26% in early trading, reaching $176.92 as of 11:01 AM EDT.

These tariffs impact over 100 countries, including China, a key supplier for third-party merchants on Amazon’s platform. Rising import costs could push prices higher, affecting consumer spending and Amazon’s profit margins.

Looking at the broader market, it is also struggling from the tariffs. The Magnificent Seven stocks, including Apple, Nvidia, Meta, Tesla, Alphabet, Microsoft, and Amazon, have all seen huge drops.

Amazon’s 8% drop is among the largest, further highlighting its vulnerability to trade disruptions. If these tariffs persist, they could reignite inflation, weigh on economic growth and further impact stock prices. Amazon has faced major market shifts in the past. In 2022, its stock lost over 50% of its value within a few quarters.

The question now is, can the current decline lead to similar losses?

With Amazon trading at $242 in February, some fear it could drop below $120 if the economic outlook worsens.

Adding to concerns, geopolitical risks remain high. The ongoing war in Ukraine, coupled with uncertainty over future U.S policies, creates a volatile environment for stocks. Amazon’s reliance on global supply chains and consumer spending makes it highly sensitive to market shocks.

Technical Analysis

Looking at Amazon technically, there has been a downtrend since early February when it reached an all-time high and a 52-week high of $242. This peak came shortly after the presidential inauguration, but since then, the market conditions have not been favorable. The introduction of new tariffs has fueled bearish momentum, pushing Amazon lower toward key support levels.

Currently, the stock is testing a double support level, an ascending trendline and a horizontal support around $180. If buyers step in at this level, a rebound could occur, targeting the previous $252 all-time high. However, given the economic uncertainty, there is a strong chance the stock may break below this current support.

If the weekly candle closes strongly below the $180 level, the next critical point where the stock might find support is around $144. This area has historically provided strong buying interest and it may serve as a potential bottom if the decline continues.

Looking at momentum indicators, the weekly RSI currently sits at 33, indicating strong bearish momentum. Despite the reading approaching the oversold reading, macroeconomic data shows the downtrend remains dominant and further losses could be ahead.

What's the Outlook? Can Amazon Recover Soon?

The coming weeks will be crucial for Amazon’s stock. With earnings expected between April 28th and May 2nd, market sentiment may shift based on revenue growth and profit margins. However, ongoing trade uncertainties and rising costs remain key risks.

For now, monitor price action around the current market price of $180. A strong bullish move could confirm a short-term recovery. On the other side, a break below this double support level may signal a further drop towards $144 support level.

AMZN breaks bear trendAmazon stock has gapped higher along with several other tech firms as investors rushed back into riskier assets following reports that Trump's upcoming tariffs will be more targeted than initially thought.

AMZN broke its bearish trend line after finding good support lats week at $190 key support level. If the gap now gets filled, then dip buyers might emerge near Friday's closing levels of around $195-$196. This area is now going to be significant.

Anyway, the short-term bias has flipped back to being bullish in light of today's breakout. As long as the stock now remains above the trend line, any short-term dips could be bought.

By Fawad Razaqzada, market analyst with FOREX.com

AMAZON SWING LONG FROM SUPPORT|LONG|

✅AMAZON fell again to retest the support of 190.79$

But it is a strong key level

So I think that there is a high chance

That we will see a bullish rebound and a move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AMZN Trade PlanLooking to buy AMZN at market price, with additional entries at 187 and 179 for better positioning.

🎯 Profit Target: 210 - 215

Stay disciplined, manage risk, and let the trade develop! 📈📊

⚠️ Disclaimer: This is not financial advice. Always do your own research and trade responsibly! 💡

AMZN butterfly & $192.The stock trend of Amazon (AMZN) in 2024 showed significant upward movement, with the price reaching a peak of $230 and a low of $145 during the year, driven by strong market performance and investor confidence.

However, In 2025 based on technical analysis, the formation of a Butterfly harmonic pattern suggests a highly probable correction toward the $190 level .

This pattern, often appearing after an extended bullish trend, indicates a potential reversal. Given the current market dynamics, the likelihood of such a drop is considerable.

Investors should closely monitor key support levels and prepare for possible downside risks while making informed decisions.

SEYED.

AMAZON Is it worth buying now?Amazon (AMZN) broke below its 1W MA50 (blue trend-line) last week for the first time since the week of August 05 2024 and opened this week below it. As you can see, the stock has been trading within a 2-year Channel Up and today's candle is as close to a technical Higher Low (bottom) as it can get.

The previous Higher Low was in fact that Aug 05 2024 candle, which despite breaking below the 1W MA50, managed to post a strong intra-week recovery and close above the it. Technically that was the 'Max pain' situation on every 1W bottom candle in those 2 years.

Every Bullish Leg that followed was around +65.24%, so that gives us an end-of-year technical Target of $300.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

AMAZON at important support. Positive days coming?AMZN looking at good support. We can see positive days if it works.

Many cryptocurrency dominance charts, as well as Nasdaq and other stock charts too, showing the same pattern. Is the reversal starting? Check my other analysis too.

We’ll see.

This is not investment advice. Please do your own research.

Wishing you best.

-YusufDeli

Amazon - Catch The Parabolic Rally Now!Amazon ( NASDAQ:AMZN ) will start the parabolic rally:

Click chart above to see the detailed analysis👆🏻

Just a couple of months ago, we finally saw the expected all time high breakout on Amazon. Following the overall governing rising channel pattern, I simply do expect the acceleration of the current rally, the creation of a parabolic rally, but maybe we will see a bullish retest first.

Levels to watch: $180, $400

Keep your long term vision,

Philip (BasicTrading)

AMAZON: Oversold on 1D. Massive buy opportunity.Amazon is oversold on its 1D technical outlook (RSI = 27.320, MACD = -7.090, ADX = 63.698) and this is best displayed on the 1W timeframe where the price hit this week its 1W MA50 for the first time in 7 months. The decline since the January top is technically the bearish wave of Amazon's 2 year Channel Up. The previous HL was priced on the 0.5 Fibonacci level and the one before on the 0.382. We are now just over the 0.5 Fib again, while the 1W RSI is about to hit its LL trendline. All those form massive support levels for the stock, which translate into the best buy opportunity since the early August 2024 bottom. We are expecting a similar +59.62 bullish wave to begin. The trade is long, TP = 300.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Amazon Stock Trapped in a Bearish ChannelOver the past two weeks, Amazon's stock has declined by more than 13% , forming a new bearish channel. Selling pressure has intensified as concerns about potential tariffs begin to affect investor confidence in Amazon's multinational operations. The possible onset of a new trade war could seriously impact some of Amazon’s business model, which relies on importing products from other countries into the United States. This could eventually reduce demand and continue to reinforce the bearish bias in stock movements.

Bearish Channel

Since late February, shortly after the earnings report, Amazon's stock has entered a clear short-term bearish channel, reaching a low of $197 per share. Currently, a minor bullish correction is emerging, approaching the upper boundary of the bearish channel. However, as long as bullish momentum fails to break this upper level, it is likely that the channel will remain the dominant formation, maintaining downward pressure on the stock.

ADX Indicator

The ADX line continues to rise above the neutral level of 20, reaching levels not seen since December 2024. This reflects the momentum of current price movements and the increase in volatility affecting the stock. If the ADX line remains elevated, volatility could either support or challenge the current trend, depending on market dynamics.

MACD Indicator

Lower lows in price movements and higher lows in the MACD histogram have formed a divergence between the indicator and price movements. This imbalance of forces could signal the continuation of short-term bullish corrections.

Key Levels:

$230: Major resistance. This level corresponds to the highest price zone recorded in December 2024. If the stock returns to this level, it could reactivate a previously forgotten uptrend.

$216: Current key resistance. This level aligns with the upper boundary of the bearish channel and the 100-period simple moving average. Sustained buying pressure above this level could put the bearish channel at risk.

$197: Near-term support. This level corresponds to November 2024 lows. If the stock breaks below this support, it could lead to new lows on the chart, reinforcing the ongoing downtrend.

By Julian Pineda, CFA – Market Analyst

AMZN to snap back

Hi

I am very encouraged by my PLTR trade idea to test 116, 121 in my previous post. They certainly do respect the Fib Extension levels.

This time, I am applying Fib Retracement to AMZN, which I think will bounce back to 0.28 (222) , 0.38 (226) and even 0.5 (229) , from it current levels of 216.

Secondly if you observe the daily charts, everytime RSI dips below 30, it's a buying opportunity.

(Do note: there are a couple of times when RSI double dipped to present a buying opportunity.)

All the best!!!!