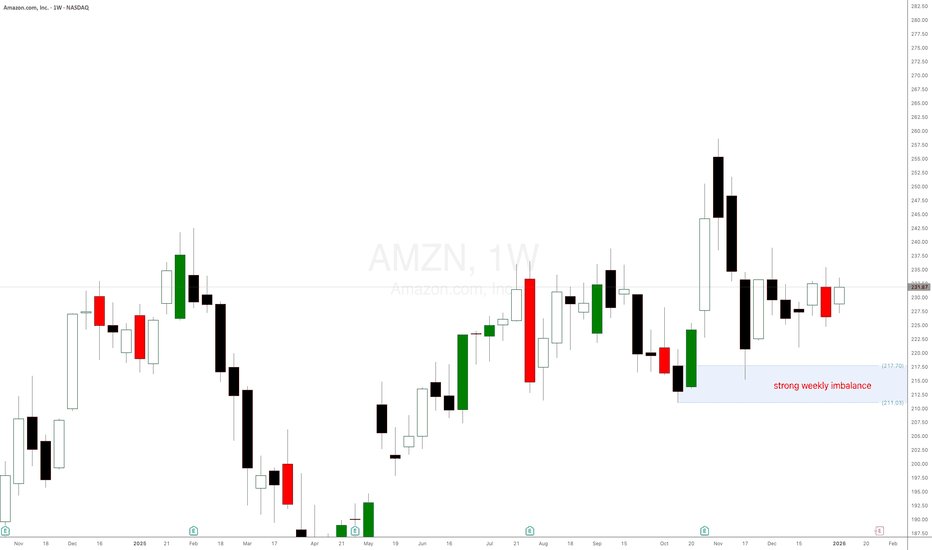

Breaking: Amazon.com, Inc. ($AMZN) Shares Are TankingShares of Amazon.com, Inc. (NASDAQ: NASDAQ:AMZN ) are nosediving amidst market bloodbath in both crypto and stock market world.

Shares of Amazon ( NASDAQ:AMZN ) closed Thursday's session down 4.42% extending lose to Friday's premarket currently down 7.78% approaching $100+ levels. Shares of Amazon have an RSI of 35 highlighting that NASDAQ:AMZN is oversold.

If selling pressure persists, NASDAQ:AMZN could see the $160 support.

In recent news, the company's hefty capital expenditure plans deepened investor worries over Big Tech's spending spree on artificial intelligence.

Massive AI spending by companies - estimated to be more than $600 billion this year - have raised doubts among investors over the prospects of immediate returns from the huge capital outlays.

Despite the bearish thesis on NASDAQ:AMZN , according to 45 analysts, the average rating for AMZN stock is "Strong Buy." The 12-month stock price target is $286.8, which is an increase of 28.79% from the latest price.

About AMZN

Amazon.com, Inc. engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services (AWS).

Amznsetup

AMZN Bullish SMA Pullback | Institutional Swing Setup🚀 AMZN: The AI Cloud King's Pullback Play! | Swing Trade Setup 💰

🎯 Instrument: Amazon.com Inc. (NASDAQ: AMZN)

⏱️ Timeframe: Multi-Day Swing Trade (3-7 days)

📊 Strategy Type: Bullish Mean Reversion + Technical Confluence

🔥 Confidence Level: Institutional Grade 📋

📌 THE SETUP (Current Price: $241.44)

Amazon is consolidating near critical support zones after a 60% rally from 52-week lows ($161.38 → $258.60). With earnings on Feb 5, 2026 and keynote expansion into AI data centers, this presents a textbook swing trade opportunity. 🤖

🎯 BULLISH THESIS

✅ Technical Confluence:

Simple Moving Average (SMA 50/200) providing dynamic support

Price bouncing off $228-$232 support zone (psychological + institutional levels)

Rounding bottom pattern forming (classic bullish reversal indicator)

✅ Fundamental Tailwinds:

AWS Growth Acceleration: Amazon Web Services driving 30%+ YoY revenue growth, commanding 17% of total revenue

AI Data Center Demand: Strategic copper deal with Rio Tinto signals massive capex into AI infrastructure (70% of cash flow allocated)

Retail Dominance: E-commerce segment (74% of revenue) shows 12.24% quarterly growth

Margin Expansion: EBITDA at $141.68B with 19.15% margin—highest in 3 years ⚡

Analyst Consensus: 63 out of 67 analysts rate BUY | Average target: $295.21 (+23% upside)

💎 ENTRY STRATEGY (Smart Laddering)

Use multiple limit buy orders to scale in smoothly (25% position per layer):

🎯 Layer 1: $239.50 - Confirmation of support

🎯 Layer 2: $236.00 - Intermediate zone

🎯 Layer 3: $232.00 - Key psychological level

🎯 Layer 4: $228.00 - Ultimate accumulation zone

Pro Tip: Adjust ±$2-3 based on daily price action. Stay flexible! 📍

🎯 PROFIT TARGET

Primary Target: $260.00 🏆

Secondary Target: $270.00 (Psychological resistance + prior resistance band)

Tertiary Target: $280.00 (Monthly resistance + analyst consensus)

Rationale:

Breaks above 52-week high of $258.60

Aligns with institutional resistance clusters

Captures pre-earnings momentum

Provides 7-17% unrealized gains ✨

🛑 RISK MANAGEMENT (Critical!)

Stop Loss: $227.00

Placement Reasoning: Below the $228-$232 support zone, closing a daily candle here signals bearish invalidation. Protects against surprise earnings miss or macro headwinds.

Risk-Reward Ratio: 1:3.2 (Excellent! 🎲)

Position Sizing: Never risk more than 1-2% of total portfolio on this single trade

📈 RELATED PAIRS TO MONITOR (Correlation Watch) 🔗

🔴 NASDAQ:MSFT (+0.89) – AI competitor strength | Watch $450 breakout

🔴 NASDAQ:NVDA (+0.85) – Chip demand barometer | AWS data center proxy

🔴 NASDAQ:META (+0.82) – Big Tech sentiment | CapEx cycle correlation

🔴 NASDAQ:QQQ (+0.91) – Tech sector ETF | Leading indicator (must hold support)

🔵 TVC:DXY (-0.67) – US Dollar | Stronger $ = headwind for exports

🔵 TVC:VIX (-0.73) – Market volatility | Avoid entry if VIX > 18

⚡ Entry Rule: Wait for NASDAQ:QQQ support confirmation + TVC:VIX below 18 before scaling in! 📊

🌍 MACROECONOMIC & FUNDAMENTAL FACTORS (Feb 2026 Preview)

🔴 HEADWINDS:

FTC Antitrust Scrutiny: Regulators targeting Amazon's marketplace practices (watch for policy shifts)

Layoff Execution Risk: 30,000 job cuts (16K announced Jan 2026) could disrupt operational efficiency short-term

UPS Relationship Breakup: UPS cutting Amazon logistics services = inventory delays possible

Fresh/Go Store Closures: Grocery pivot failing signals capex inefficiency narrative ⚠️

🟢 TAILWINDS:

Earnings on Feb 5: Market historically rewards AWS guidance beats (watch for capex/AI commentary!)

AI Investment Cycle: Amazon's copper deal proves long-term AI data center commitment—signals confidence 🚀

Cloud Market Growth: Gartner projects 20%+ IaaS growth through 2026

International Expansion: Germany, UK, Japan segments showing 8%+ growth

Prime Video Monetization: Ad-tier rollout driving revenue diversification ✨

⏰ Calendar Alerts:

Feb 5, 2026: AMZN Q4 Earnings (Critical!)

Feb 10-15: Analyst callout periods (watch for price gaps)

Mid-Feb: Potential macro Fed commentary on rates (impacts growth stocks)

💼 TRADE EXECUTION CHECKLIST

✅ Pre-Entry:

Wait for daily close above $241 (confirmation)

Check NASDAQ:QQQ support (must be intact)

Verify TVC:VIX < 18 (low volatility environment)

Place all four limit orders simultaneously

✅ During Trade:

Scale in gradually (don't FOMO all at once!)

Adjust stops to breakeven once 25% profit reached

Move stops up by $2 after each 5% gain

Monitor pre-earnings catalysts daily

✅ Exit Plan:

Trail stop at $255 once $260 zone approaches

Take 50% profits at $260 (lock in gains!)

Let remaining 50% ride to $270-$280

Close all positions by Feb 4 (earnings risk!)

⚡ THE FUNNY, PROFESSIONAL TRUTH 😄

Look, the market doesn't care about your feelings or your "fool-proof strategy." What it does care about:

Supply/Demand imbalances (Your limit orders create that!)

Risk-to-Reward ratios (3.2:1 = Institutional quality!)

Catalyst timing (Earnings Feb 5 = This is your window!)

Position sizing discipline (1-2% risk = Sleep-at-night money!)

This isn't about getting rich quick—it's about compounding consistent 5-8% swing trades into generational wealth. Amazon at $241 with $260 targeting is math. The rest is emotional control. 💪

Your engagement directly helps me dedicate more time to institutional-grade swing trade analysis. Much appreciated! 🙏

Happy Trading! May your exits be as smooth as your entries. 📊✨

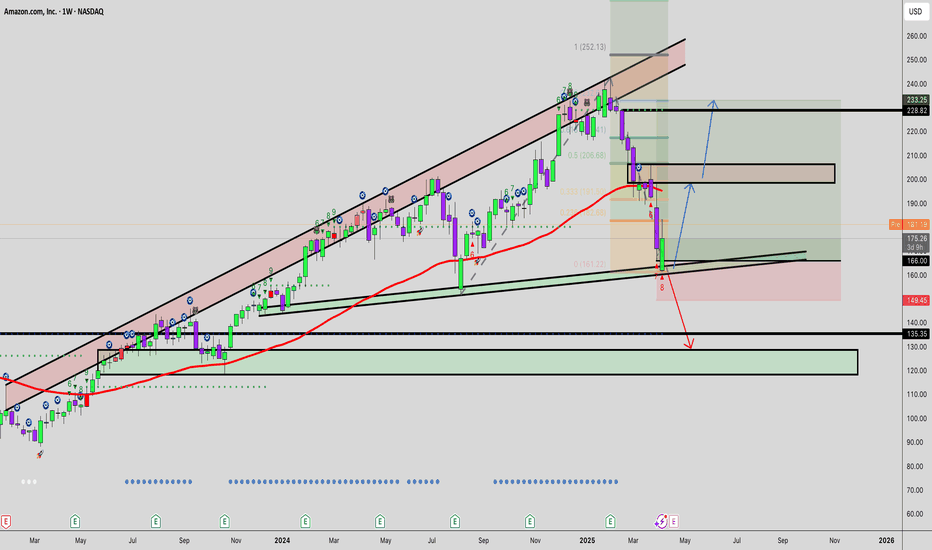

Amazon - A quite boring new all time high!🎈Amazon ( NASDAQ:AMZN ) is simply heading for new highs:

🔎Analysis summary:

For the past couple of months, Amazon has overall just been consolidating. But in the meantime, we witnessed a major bullish break and retest and an expected rally of +50%. Following this quite slow behavior, Amazon will also slowly create new highs.

📝Levels to watch:

$250

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

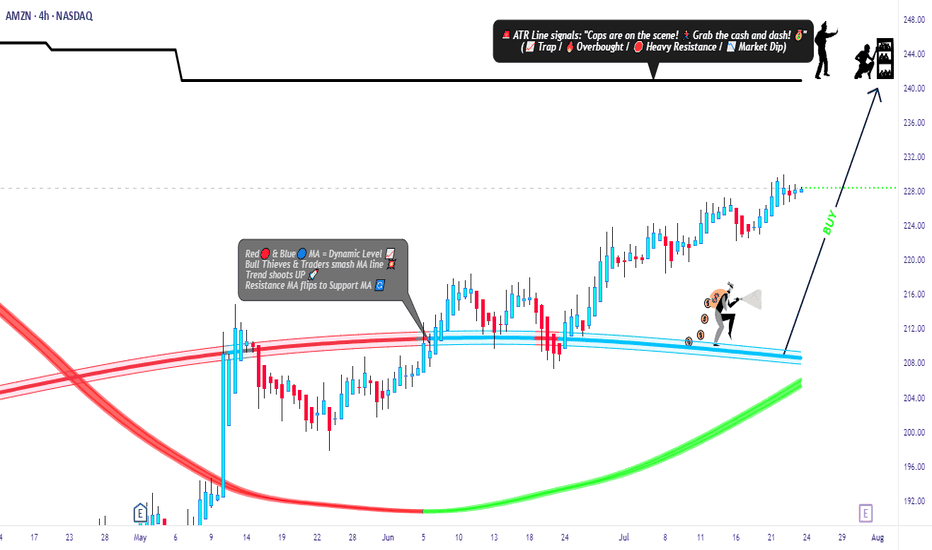

Amazon’s Hidden Pullback Opportunity – Smart Risk, Smart Entry🎯 AMZN: The "Thief's Playbook" — Stealing Profits Like a Wall Street Ninja

📊 Asset Overview

AMAZON.COM INC (NASDAQ: AMZN) — The E-Commerce Titan & Cloud King 👑

Strategy Type: Swing/Day Trade — Bullish Pullback Setup

Confirmation Tool: ATR (Average True Range) ✅

🎭 The "Thief Strategy" Explained

Listen up, Thief OG's! 🦹♂️ This ain't your grandma's single-entry trade. We're using layered limit orders — think of it like setting multiple traps to catch money at different price levels. Professional? Yes. Legal? Absolutely. Stylish? You bet! 😎

🔥 Entry Zones — The Multi-Layer Trap

The Thief's Ladder Entry Method:

You've got options, trader! Pick your poison:

Option 1: Aggressive Single Entry

Jump in at current market price (~$220-$225 zone)

Option 2: The Layered "Thief" Method 🎯

Set multiple buy limit orders to scale in:

Layer 1: $220

Layer 2: $218

Layer 3: $216

Layer 4: $214

Why layer? Because markets don't move in straight lines, baby! This lets you average down if price dips while maintaining a solid risk profile. Add more layers based on your risk appetite! 🍰

🛑 Stop Loss — Protecting Your Loot

Thief's Emergency Exit: $210 🚨

⚠️ IMPORTANT DISCLAIMER:

Dear Ladies & Gentlemen (my fellow Thief OG's), I'm NOT telling you to blindly follow my stop loss. This is MY risk management. YOU manage YOUR money. Trade at your own risk — this is entertainment with charts, not financial advice! 🎲

🎯 Target Zone — Where We Cash Out

⚡ High-Voltage Trap Alert — Resistance Wall Ahead! ⚡

Target Price: $235 🎯💵

Why this target?

💡 This zone shows classic signs of:

Strong resistance from previous price action 🧱

Overbought conditions brewing (RSI warming up) 📈

Liquidity build-up (big money sitting here) 💰

Potential "bull trap" zone → smart money escapes here! 🪤

My advice? When price hits $235, secure your profits! Don't get greedy.

⚠️ ANOTHER DISCLAIMER:

Dear Thief OG's, this is MY target based on MY analysis. You do YOU. Take profits when YOU feel comfortable. Your money, your rules, your risk! 💪

🔗 Related Assets to Watch

Keep an eye on these correlated movers — they can give you early signals for AMZN's direction:

📦 E-Commerce & Tech Giants:

NASDAQ:TSLA (Tesla) — Tech sentiment leader; when tech rallies, AMZN often follows 🚗⚡

NASDAQ:MSFT (Microsoft) — Cloud competitor (Azure vs AWS); inverse correlation sometimes kicks in ☁️

NASDAQ:GOOGL (Alphabet) — Ad spending indicator; strong Google ads = strong consumer spending = bullish for AMZN 🔍

NYSE:WMT (Walmart) — Retail competitor; if WMT struggles, AMZN often benefits 🛒

📊 Market Indices:

NASDAQ:QQQ (Nasdaq 100 ETF) — AMZN is heavily weighted here; QQQ direction = AMZN direction 📉📈

AMEX:SPY (S&P 500 ETF) — Overall market health check; risk-on = AMZN rallies 🇺🇸

💵 Market Sentiment Indicators:

TVC:VIX (Volatility Index) — Low VIX = calm markets = bullish for growth stocks like AMZN 😌

TVC:DXY (US Dollar Index) — Weak dollar = bullish for mega-cap tech stocks 💵📉

The Correlation Play: If you see NASDAQ:QQQ breaking higher + TVC:VIX dropping + tech stocks rallying → high probability AMZN follows the party! 🎉

🧠 Key Technical Points

✅ ATR Confirmation: Volatility is in the "sweet spot" — not too choppy, not too sleepy

✅ Pullback Structure: Classic bullish retracement setting up

✅ Risk-Reward: Solid 2:1+ ratio with layered entries

✅ Volume Profile: Watching for confirmation on breakout

⚠️ Legal Disclaimer — Read This Twice! 📢

THIS IS THE "THIEF STYLE" TRADING STRATEGY — JUST FOR FUN & EDUCATIONAL ENTERTAINMENT! 🎭

I am NOT a financial advisor. This is NOT financial advice. This is a trading idea based on technical analysis, shared for educational and entertainment purposes only.

❌ Do NOT risk money you can't afford to lose

❌ Do NOT trade based solely on this idea

❌ Do your own research (DYOR)

❌ Past performance ≠ future results

✅ Trade responsibly and manage your risk

You are 100% responsible for your own trading decisions. I'm just a chart nerd sharing ideas with the community! 🤓📊

💬 Final Thoughts from Your Friendly Neighborhood Chart Thief

Markets are a game of patience, discipline, and calculated risks. The "Thief Strategy" is about being strategic, not reckless. Set your traps, manage your risk, and let the market come to you! 🕸️💰

Stay sharp, stay profitable, and remember: the best trades are the ones you plan, not the ones you chase! 🏃♂️💨

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#AMZN #Amazon #StockMarket #SwingTrading #DayTrading #TechnicalAnalysis #BullishSetup #LayeredEntry #ThiefStrategy #TradingIdeas #ATR #ResistanceZone #TakeProfit #RiskManagement #NASDAQ #TechStocks #PullbackTrading #PriceAction #SupportAndResistance #TradeSmart

Trade safe, trade smart, and let's get this bread! 🍞💸

Amazon Stock Heist: Thieves Targeting 247 Escape Point🔐💰 AMAZON HEIST PLAN – STOCK MARKET ROBBERY STYLE 🚀📈

👋 Hey Thief OG’s, Money Grabbers & Market Shadows!

Today’s mission is inside the vault of Amazon.com Inc. (AMZN) – and we’re planning a Bullish Heist.

🎯 ENTRY – Layering the Break-In 💎

The vault doors are always open for the thief gang!

Place multiple Buy Limit Orders (layer entries) at 🏦:

230.00 / 227.00 / 225.00 / 222.00

You can add more layers to your heist plan based on your own risk appetite.

Thief strategy = stack the entries, wait for the pullback, strike big.

🛑 STOP LOSS – Thief Escape Route 🚔

This is the official Thief SL: @219.00.

But remember OG’s – adjust your SL based on your own strategy & bag size.

We don’t all run with the same loot.

🎯 TARGET – Police Barricade 🚨

Before the sirens ring, our escape bag is ready at @247.00.

That’s where we dump the loot and vanish into the shadows. 🏃💨💼

🕵️♂️ THIEF STYLE STRATEGY

✅ Layering entry method (multiple buy limits = thief stacking plan).

✅ Risk management = key to survival.

✅ Exit before the market police catches you.

💥 Remember OG’s: This is not financial advice – this is a robbery simulation in the stock market.

Support the gang 👉 Smash the Boost Button 💥 so our heist team gets stronger!

🤑💼💰 Every day, every chart, every loot = Thief Trader Style.

Stay sharp. Stay hidden. Stay profitable.

AMZN $240 Weekly Call — Tactical Play for Quick Gains

🚀 **AMZN Weekly Options Alert — \$240 Call Could Double in 4 Days!**

**Directional View:** **Strong-to-Moderate Bullish** 💹

**Confidence:** 75%

**Trade Setup:**

* **Instrument:** AMZN

* **Strategy:** BUY CALL (single-leg)

* **Strike:** \$240

* **Expiry:** 2025-09-12 (4 DTE)

* **Entry Price:** \$0.68 (ask at open)

* **Size:** 1 contract

**Targets & Risk:**

* **Profit Target:** \$1.36 (100% gain)

* **Partial Profit:** \$1.02 (50% gain)

* **Stop Loss:** \$0.34 (50% of premium)

* **Exit Rule:** Close everything by Thursday 15:30 ET to avoid gamma/theta risk

**Why This Trade?**

✅ Weekly RSI rising (71.5) + expanding weekly volume (1.3x) → bullish momentum

✅ Strong call skew (C/P 1.99) → institutional positioning

✅ Low VIX (\~15.2) → cheaper premiums, directional edge

✅ Strike \$240 slightly OTM with **high liquidity** (OI 24,202)

**Key Risks:**

⚠️ Falling daily RSI (59.9) → short-term consolidation possible

⚠️ 4-DTE weekly → high gamma/theta; strict stop mandatory

⚠️ Unexpected news or sector moves could spike IV or widen spreads

⚠️ High OI may create pinning behavior near \$240

**Quick Takeaway:**

* Tactical **short-term bullish weekly trade**

* Exploits **momentum + options flow + liquidity**

* Strict **risk management**: stop at 50% and exit by Thursday

* Partial profits at 50%, full target at 100% gain

---

📊 **TRADE DETAILS (JSON)**

```json

{

"instrument": "AMZN",

"direction": "call",

"strike": 240.0,

"expiry": "2025-09-12",

"confidence": 0.75,

"profit_target": 1.36,

"stop_loss": 0.34,

"size": 1,

"entry_price": 0.68,

"entry_timing": "open",

"signal_publish_time": "2025-09-08 10:11:13 UTC-04:00"

}

```

AMZN Options Flow Explodes! $230 Call Trade Idea”

# 🚀 AMZN Weekly Options Trade Idea (2025-09-03)

### 📊 Market Recap

* **Daily RSI**: 47.9 ⬇️ (bearish tilt)

* **Weekly RSI**: 57.1 ⬇️ (losing momentum)

* **Volume**: 0.9x 📉 (weak vs prior week)

* **Options Flow**: 💎 Strongly bullish (C/P = 3.30)

* **VIX**: ✅ Favorable (16–17)

👉 **Models Split:**

* 🐻 DeepSeek → \$225 PUT idea (bearish).

* 🐂 Grok + Llama → \$230 CALL (moderate bullish).

* ⚖️ Gemini + Claude → **NO TRADE** (risk > reward).

---

### ✅ Consensus Trade Setup (Flow-Weighted Lean)

```json

{

"instrument": "AMZN",

"direction": "call",

"strike": 230.0,

"expiry": "2025-09-05",

"entry_price": 0.43,

"profit_target": 0.86,

"stop_loss": 0.26,

"size": 1,

"confidence": 0.62,

"entry_timing": "open"

}

```

---

### 🎯 Trade Plan

* 📌 **Strike**: \$230 CALL (Sep 5)

* 💵 **Entry**: 0.43 (ask @ open)

* 🎯 **Target**: 0.86 (+100%)

* 🛑 **Stop**: 0.26 (–40%)

* ⏰ **Max Hold**: Exit by Thu EOD (avoid Fri gamma risk)

* ⚖️ **Size**: 1 contract (small, <2% equity)

* 📈 **Confidence**: 62% (flow-driven edge, weak technicals)

---

⚠️ **Risks**

* Daily + weekly RSI trending down = 🐻 momentum risk

* Weak institutional volume confirmation 📉

* Heavy call flow could be **retail noise / covered calls** 😬

* 2 DTE → **theta burn + gamma whip risk** ⚡

---

AMZN Swing Trade Setup | $235C Targeting 100%+ This Week# 🔥 AMZN Weekly Options Setup (Aug 29 Expiry) 🚀📈

📊 **Consensus from Multi-Model Analysis**

* ✅ Daily RSI rising (Bullish)

* ⚖️ Weekly RSI falling (Neutral)

* 🏦 Institutional Flow: **Strong Call Skew (C/P 3.61)**

* 📉 Volume: Contracting (risk flag)

* 📉 VIX: Low → Favors Call Buying

---

## 📌 Trade Setup

🎯 **Instrument**: AMZN Weekly Call

💵 **Strike**: \$235

📅 **Expiry**: 2025-08-29

💰 **Entry**: \$0.82 (open)

🛑 **Stop Loss**: \$0.41 (-50%)

🎯 **Target 1**: \$1.07 (+30%)

🎯 **Target 2**: \$1.64 (+100%)

📏 **Size**: 1 Contract (risk ≤3%)

⏰ **Hold Window**: Mon → Thu (Exit before Friday Gamma)

📈 **Confidence**: 66%

---

## 🚨 Key Risks

⚠️ Low weekly volume = weak follow-through risk

⚠️ Theta burn accelerates after Wed → exit by Thu

⚠️ VIX spike (>18) = invalidate setup

---

## 🧾 Quick Trade Card

* **Bias**: Moderate Weekly Bullish

* **Edge**: Institutional call flow + Daily RSI momentum

* **Caveat**: Weak weekly volume, fading RSI

---

### 🚀 Viral Hashtags

\#AMZN #OptionsTrading #SwingTrade #UnusualOptionsActivity #StocksToWatch #TradingSetup

AMZN Losing Momentum? Put Flow on the Table

# 🛒 AMZN Weekly Options Setup (8/18 – 8/22)

📉 **Consensus: Neutral → Cautious Bearish**

* 🔻 RSI trending down (daily + weekly)

* 📉 Weak volume = no strong institutional conviction

* ⚖️ 4/5 AI models → **NO TRADE**

* 🐻 Only **DeepSeek** calls for puts → bearish divergence

---

## 🎯 Trade Setup (Aggressive Play)

* **Instrument**: AMZN

* **Direction**: PUT (SHORT)

* **Strike**: \$225.00

* **Expiry**: 2025-08-22

* **Entry**: \$0.82

* **Profit Target**: \$0.98 (scalp style)

* **Stop Loss**: \$0.50

* **Confidence**: 65% (only because DeepSeek flagged momentum divergence)

* **Timing**: Enter at open → monitor closely (don’t baghold into Friday ⚠️).

---

## 📈 Breakeven @ Expiry

👉 \$224.18 (Strike – Premium)

AMZN must **close < \$224.18 by 8/22** to finish ITM.

But plan = **exit early on IV / momentum pop**, not expiry hold.

---

## 🧠 Key Risks

* Theta burn 🔥 (short expiry puts bleed fast)

* Market news swings (AMZN often reacts to macro headlines)

* Lack of volume → potential for chop instead of follow-through

---

# ⚡ AMZN 225P WEEKLY PLAY ⚡

🎯 In: \$0.82 → Out: \$0.98

🛑 Stop: \$0.50

📅 Exp: 8/22

📈 Bias: Weak, but playing the downside momentum divergence 📉

Amazon Market Robbery Blueprint – Swing/Scalp Long Setup🟨💣 “AMZN Market Heist Blueprint – Bullish Robbery in Progress 🚨💼💸” 💣🟨

By Thief Trader – Rob the Market with Precision

🌍 Hello World! Hi, Hola, Ola, Bonjour, Hallo, Marhaba!

🤑💰 Calling all Money Makers & Market Robbers – get ready to execute the next bullish heist on AMAZON.COM, INC (NASDAQ: AMZN), powered by our signature Thief Trading Style™ – where technical precision meets psychological warfare.

🔥 Plan Summary:

Based on our fundamental & technical intel, we’re eyeing a long entry into AMZN. The target? 💥The High-Risk ATR Police Barricade Zone – a zone flooded with liquidity, overbought conditions, fakeouts, and bear traps. It's where most traders get caught – but we walk in with a blueprint.

🟩 Entry Zone – “The Vault Is Wide Open!” 💼📈

🕰 Entry timeframe: 15min / 30min (preferably after confirmation or rejection wick)

💵 Buy Limit Orders: Place multiple layered entries (DCA-style) near recent swing lows/highs. Wait for breakout confirmation; no blind orders before breakout!

Thief Note: This isn’t spray-and-pray – this is sniper-mode. Scope, place, execute.🎯

🛑 Stop Loss – “SL is the Escape Route!”

📍 SL below recent 4H candle wick swing low (around 219.00 – adjust based on your risk/margin size).

Important: Only place SL after breakout; not before. Risk per order must match your lot strategy.

🎯 Target – “Grab the Bag or Escape Before the Alarms!”

💸 Target Zone: 240.00

🧠 Smart robbers know when to bail early – use a trailing SL to lock gains. Exit before reversal or heavy volume shift.

👀 Scalper Alert – “Only One Way – LONG!”

If you’re a quick thief with a fat bag, hit-and-run with a Long scalp. If you’re running lean, swing with the crew. Watch the PA and news timing. Trailing SL = insurance policy.

📊 Why Bullish? Here’s the Background:

🔍 Macro Drivers

💼 COT Report

🌍 Geo-political Influences

🧠 Sentiment Score

📈 Index Correlation

🔮 Intermarket Signals

💹 Institutional Positioning

All lights flashing green for short-to-midterm bullishness, but keep checking real-time updates.

⚠️ Risk Alert – News Triggers Can Blow Your Cover 🚨

🗞 Avoid trading near major news releases – they cause volatility spikes.

🧲 Always protect gains with trailing stops and don’t over-leverage your ammo.

💖 Support the Robbery – Hit BOOST 🔥

Smash that 💥BOOST💥 button if you ride with the Thief Trading Crew!

Let’s build this into the #1 robbery squad on TradingView.

Make money. Protect profits. Trade like a bandit – with a plan. 💼📈🏆

🔔 Stay Tuned for the Next Robbery Mission 🔔

Another heist plan dropping soon. Until then, rob smart, rob safe, and rob rich.

– Thief Trader™ | Rob The Market. Not Your Wallet.

AMZN AMZN Bullish Setup --Don’t Miss Out🚀 AMZN Weekly Call Play — Riding the Bullish Flow**

Amazon (AMZN) shows strong institutional bullish flow with a **Call/Put ratio of 2.09**, backed by favorable RSI trends and low volatility conditions. While volume is weaker than last week, momentum and options flow point toward upside potential into next week.

**🛠 Trade Setup:**

* **Instrument:** AMZN

* **Direction:** CALL (LONG)

* **Strike:** \$230.00

* **Expiry:** 2025-08-15

* **Entry Price:** \$0.63

* **Profit Target:** \$1.26 (100% gain)

* **Stop Loss:** \$0.38

* **Size:** 1 contract

* **Entry Timing:** Market open

* **Confidence:** 65%

**📊 Key Factors:**

* Call/Put ratio: **2.09** — strong bullish options flow

* Daily RSI: 49.0, Weekly RSI: 58.3 — uptrend confirmation

* Low VIX (\~15.88) — supportive for directional plays

* Potential resistance at \$226–\$230

**⚠ Risks:**

* Weak weekly volume (0.8x prior week) may reduce conviction

* Broader market weakness could cap gains

---

**#AMZN #OptionsTrading #CallOptions #WeeklyOptions #BullishSetup #TechnicalAnalysis #TradingView #OptionsFlow #LowVIX #SwingTrade #MarketMomentum**

AMZN Earnings Play — July 30 (AMC)

## 🚀 AMZN Earnings Play — July 30 (AMC)

**💵 High Conviction Call Trade | 85% Confidence**

📈 **Amazon (AMZN)** — Cloud + Consumer Power Combo

🧠 Setup driven by earnings momentum, bullish flow, and macro strength.

---

### 🔍 FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +8.6% TTM

✅ **Margins**: Profit 10.1%, Op 11.8%, Gross 49.2%

🎯 **EPS Beat Streak**: 8/8 with avg. surprise of +34.7%

🔮 **Consensus Target**: \$252.03 (+9.4% upside)

📌 AWS + AI + Cost control = 🔥 upside setup

🟢 **Score: 9/10**

---

### 📊 OPTIONS FLOW SIGNAL

💰 **High OI**: \$232.50, \$240, \$247.50 calls

📈 **Call/Put Ratio**: Bullish Skew

🛡️ **Put Hedging** ≠ Bearishness

📉 Expected Move: \~5%

⚖️ **Gamma Bias**: Bullish above \$240

🟢 **Score: 8/10**

---

### 📉 TECHNICAL SETUP

📍 Price: \$231.01

📈 20D MA: \$226.21 (Support)

📉 RSI: 66.71 (momentum building)

🔒 Resistance: \$242.52 (watch for breakout)

🟢 **Score: 8/10**

---

### 🌐 MACRO TAILWINDS

🧠 AI & Cloud Momentum 🚀

💹 Consumer spending rebound

🔧 Regulatory risk mitigated via diversification

🟢 **Score: 8/10**

---

## 🎯 TRADE IDEA

🟩 **AMZN 08/01 \$247.50 Call**

💸 Entry: \$0.86

🎯 Target: \$2.58 (200%)

🛑 Stop: \$0.43 (50% loss)

⏰ Entry: **July 30 — Pre-close**

📏 Max Risk: \$86

💰 Max Reward: \$258

🧠 IV Crush Defense: Exit 2H post-ER

---

## ⚡️ WHY THIS WORKS

✅ 8-straight beat streak

✅ Fundamentals + Technicals = aligned

✅ Flow + Macro confirm direction

📈 Setup = asymmetrical upside

---

🎯 Tag your earnings sniper crew

📈 #AMZN #EarningsTrade #OptionsFlow #AmazonStock #CloudAI #OptionsStrategy #EarningsPlays #TradingView #SwingTrade #CallOptions #VolatilityTrade #EarningsMomentum

Shoulders to the Sky: Amazon’s Breakout Journey BeginsOverview

Name: Amazon.com, Inc

Ticker Symbol: AMZN

Exchange: NASDAQ

Founded: 1994

Headquarters: Seattle, Washington, USA

CEO: Andy Jassy (as of 2025)

Sector: Consumer Discretionary / E-commerce & Cloud Computing

About

Amazon is a global e-commerce and cloud services powerhouse. It dominates online retail while also operating AWS (Amazon Web Services), one of the world’s leading cloud computing platforms. Other segments include advertising, logistics, streaming, AI hardware (Alexa), and physical retail.

Fundamentals

Earnings: Amazon has consistently beaten revenue expectations with strong growth in AWS and advertising segments.Revenue: Q1 2025 revenue topped $154.8B, up 13% YoY, with solid margins.Outlook: Management has raised guidance for Q2 citing AI integration in AWS and retail efficiency gains.

Technicals

Inverted Head and Shoulders Pattern confirmed on the daily chart — a strong bullish reversal signal.

Price has broken above the neckline (~$213–$215) with volume confirmation.

Golden Cross forming on short-term MAs — bullish signal.

RSI is around 64, suggesting momentum remains but is nearing overbought.

MACD is bullish with widening divergence — supports potential continuation.

📌 Support Zones: $202, $199

📈 Resistance / Target Zones: $217 (short-term), $235 (TP), $242 (extension)

💡 My Take

AMZN is showing bullish continuation out of a textbook inverted head and shoulders — typically a strong reversal setup after a downtrend. We’ve seen the neckline break with follow-through, and volume patterns support the move.

While the RSI shows slight overbought conditions, this could lead to a short consolidation before another leg up toward $235–$242. With macro tailwinds from cloud and advertising sectors, AMZN is positioned well for a strong Q3 rally.

Position

Type: AMZN 235 Call

Expiry: July 11, 2025

Quantity: 7

Average Cost Basis: $1.00

Last Price: $0.69

Purchase Date: June 12, 2025

Total % Gain/Loss: –30%

Despite current drawdown, I remain optimistic about AMZN's momentum. The technical setup is strong, and short-term weakness is likely just healthy consolidation. I'm holding through July with my eyes on the $235 target.

AMZN Trade PlanLooking to buy AMZN at market price, with additional entries at 187 and 179 for better positioning.

🎯 Profit Target: 210 - 215

Stay disciplined, manage risk, and let the trade develop! 📈📊

⚠️ Disclaimer: This is not financial advice. Always do your own research and trade responsibly! 💡

Amazon’s Stock Stuck in a Downhill Slope or Ready to Escape ?Amazon's stock price movement on a 4-hour timeframe, presenting a descending channel pattern. This pattern is often associated with bearish sentiment, as it reflects a market structure characterized by lower highs and lower lows, signaling a consistent effort by sellers to dominate price action.

Currently, the price is trading near the upper boundary of the channel, which acts as a dynamic resistance level. Historically, such resistance zones within descending channels tend to attract selling pressure, reinforcing the bearish outlook. If the price fails to break above this resistance and shows rejection signs (e.g., long wicks or bearish candlesticks), it could confirm a continuation of the downtrend, targeting the lower boundary of the channel as the next support level.

It is crucial to monitor this resistance area closely, as a breakout above the channel could shift the sentiment from bearish to bullish. For such a breakout to be credible, it must be accompanied by strong volume and decisive candlestick patterns, such as a bullish engulfing or a breakout gap. In that scenario, the price could invalidate the descending channel and initiate a reversal, targeting higher resistance levels.

Additionally, the broader market context and fundamental factors should be considered. If the stock is supported by positive catalysts or market sentiment, it could strengthen the likelihood of a breakout. Conversely, weak sentiment or negative news could intensify the bearish momentum, leading to further downside.

The chart currently reflects a bearish bias due to the descending channel structure. However, the key to determining the next move lies in the price action and volume near the upper resistance line, which will decide whether the pattern continues or reverses.

AMZN: Are We Heading to $247 or Taking a Quick Dip First? Hey Mindbloome Family, here’s my take on Amazon (AMZN) right now:

1️⃣ If we break above $233, I think we’ll see a strong move up to $246–$247.

2️⃣ If we don’t break just yet, we could see a pullback to one of these levels first:

$225

$221

$215

From there, I’m still looking for a bounce back up to $246.

3️⃣ If we break below $215, that’s when we’ll need to pause and reassess the plan.

Wellness Tip: Don’t underestimate a good night’s sleep. Trading with a clear, rested mind makes all the difference—you’ll see the charts more clearly and make better decisions.

What’s your take—do we break through to $247, or are we dipping first? Let me know! If you want to chat more or dive deeper into this setup, check out my profile or send me a DM.

KRIS/MINDBLOOME EXCHANGE

TRADE WHAT YOU SEE

BEZOS AND EX-BEZOS ARE GIVING YOU A EARLY GIFT ON AMAZON!BEZOS AND EX-BEZOS ARE GIVING YOU A EARLY GIFT ON AMAZON! NASDAQ:AMZN

- HIGHFIVESETUP still intact

- Creating Support on Wr%

- Retesting Ascending triangle and CupnHandle breakout

- Measure move on both is to $300+

- Cheap on a DFCF model

Have you been buying more Amazon?

NFA

$AMZN IS ABOUT TO EXPLODE! BUY NOW OR FOMO LATERNASDAQ:AMZN

💥 NASDAQ:AMZN IS ABOUT TO EXPLODE! 💥

I first called out NASDAQ:AMZN on October 21st as it was setting up for a huge move and CupnHandle breakout. Here's 3 reasons to not miss this investing or trading opportunity. Price targets at the end.

1.) HIGH FIVE SETUP (Check the numbers below and you will see. 1-Breaking out of cupnhandle & symmetrical triangle pattern. 2-Volume profile gap from a volume shelf. 3-Uptrending MACD. 4-Higher Highs on RSI. 5-Uptrending Stoch. (trend).

2.) #Amazon margins and FCF are growing rapidly and will continue this uptrend heading into the holiday season with a RESILIENT AMERICAN CONSUMER.

3.) It's a BUY according to the fundamentals especially when valuing this company according to it's Discounted Cash Flow (DCF).

Intrinsic Value: $250

🎯PT1: $231 (Symmetrical triangle measured move)

🎯PT2: $310 (Multi-year CupnHandle Measure Move)

Are you a shareholder? or Are you trading this name?

I'm done for the day! Going to be with my wife on her birthday and go trick or treating with my boys. Thanks for all the support, much love!

LIKE l FOLLOW l SHARE

HAPPY HALLOWEEN!

#Earnings

NFA

Amazon’s Next BIG Move: Can It Bounce to $207 from Key Support?If Amazon holds strong at $194.31, it could be setting up for a run to $207.30. This level is both a potential target and a great take-profit zone if the bounce holds. Let’s break down what to watch for as this setup unfolds!"

Trade Setup Details:

Support Level at $194.31

Right now, $194.31 is acting as a solid foundation. If Amazon finds buyer interest here, it could kick off a new upward move.

Target Zone: $207.30

If the support holds, $207.30 is the next target. This level is likely to see some selling pressure, making it an ideal area for profit-taking on a successful bounce.

Beginner Tip

Keep an eye on how Amazon reacts around $194.31. Look for strong buying signals (like a bullish candle) before entering, and consider setting your take-profit level around $207.30 to capture gains if the bounce holds.

Happy Trading

Kris/ Mindbloome Trading

Mindbloome Exchange

AMZN 50%+ UPSIDE!!! CUP N HANDLE PATTERN! BREAKDOWN BELOW:NASDAQ:AMZN #Earnings #BlackFriday

I PRESENT TO YOU: 🎁

🔜 THE NEXT 3T MKT CAP COMPANY

Behold the beautiful CUP 🍵& Handle 👌#chartpatterns #trading #tradingstrategy #Stock

This tea is going to taste delicious when we finally break over $201.20. NASDAQ:AMZN has been a laggard and it's time for them to play a little catch up! 🧧

Not much explaining needed with this one...Cup n Handle breakout means we are going to the measured move destination of...🥁🥁🥁....$310.69 ‼️‼️‼️

CATALYST: 😼

✔️Continued AWS growth and dominance!

✔️Stellar holiday quarter (best quarter of ea. year)

✔️MONEY PRINTER (ATH Free Cash Flows (FCF)

✔️Better margins and #3 player in Ad space!

NASDAQ:AMZN is a 17% in my LT portfolio. Also, I have several options plays on this name. Gonna be a fun ride! 🎢

Like and follow for more great charting and stock talk!

Not financial advice 🖖 NASDAQ:QQQ AMEX:SPY AMEX:IWM NASDAQ:BIVI