Gold Holding Support - Path Toward 5,150 OpensHello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure. Gold previously traded within a steady bullish structure, moving inside a clearly defined ascending channel where price respected both the dynamic support and resistance boundaries. This phase showed consistent buyer control, with higher highs and higher lows confirming sustained upward momentum. Eventually, price broke above the channel resistance, accelerating into a strong impulsive rally that pushed the market into the Seller Zone near 5,150, where aggressive selling pressure emerged. Following this spike, gold experienced a sharp bearish reaction and quickly retraced lower, marking a temporary structural shift. However, the decline found strong support near the 4,980 Buyer Zone, which aligns with the horizontal support level and the developing rising trend line from the recent lows. This reaction confirmed that buyers remain active at demand and that the broader bullish structure has not been invalidated. Currently, XAUUSD is consolidating above the Buyer Zone while respecting the rising support line from below. Price action shows compression just under the Seller Zone and resistance level, suggesting the market is stabilizing after the volatility and preparing for the next move. The recent breakout from the consolidation hints at renewed bullish pressure, while the overall structure still favors continuation as long as support holds. My primary scenario favors bullish continuation, as long as XAUUSD remains above the 4,980 Buyer Zone and continues to respect the rising support line. If buyers maintain control, price could gradually push higher toward the 5,150 Seller Zone (TP1), which serves as the main upside target and the key area where sellers may attempt another reaction. A clean breakout and acceptance above this level would confirm trend continuation and open the door for further upside expansion. However, a decisive rejection from resistance or a breakdown below the Buyer Zone and rising support would weaken the bullish scenario and signal a deeper corrective phase. For now, market structure favors buyers, with demand holding firm and price compressing beneath resistance — a classic setup for a potential continuation move. Please share this idea with your friends and click Boost 🚀

Analysis

EURUSD Short: Bearish Triangle Building Below SupplyHello traders! Here’s my technical outlook on EURUSD (1H) based on the current chart structure. EURUSD was previously trading within a well-defined descending channel, where price respected both the dynamic resistance and support boundaries while forming consistent lower highs and lower lows. This structure confirmed steady bearish pressure and controlled downside continuation rather than impulsive panic selling. Eventually, price broke below the lower boundary of the channel, confirming continuation of the bearish leg and reinforcing seller dominance. After this breakdown, the market entered a consolidation phase, forming a horizontal range where price moved sideways as buyers attempted to absorb supply while sellers paused after the impulsive drop. Later, EURUSD broke out of this range to the upside, initiating a recovery move that pushed price back toward the major Supply Zone near 1.1890. However, the bullish impulse failed to sustain acceptance above this area. Price formed another consolidation just beneath supply, while a descending supply trend line emerged, showing that sellers remain active at higher levels.

Currently, EURUSD is compressing between the descending supply line from above and a rising demand line from below. This tightening structure signals volatility contraction and suggests that a directional breakout is approaching. Importantly, price continues to trade below the key Supply Zone, indicating that recent bullish attempts may still be corrective in nature rather than the start of a new trend.

My primary scenario favors bearish continuation as long as EURUSD remains below the 1.1890 Supply Zone and continues to respect the descending supply line. The current compression structure appears more consistent with distribution rather than accumulation, suggesting that sellers may regain control once price breaks lower from the pattern. If bearish momentum resumes, the next logical downside target lies near the 1.1830 Demand Zone (TP1), which aligns with previous breakout levels and a key area where buyers previously stepped in. This zone represents the most probable location for price to seek liquidity and potentially stabilize. However, a strong breakout and sustained acceptance above the supply line and resistance zone would invalidate the bearish scenario and suggest a broader recovery or range expansion to the upside. For now, structure favors sellers, with rallies viewed as corrective unless resistance is reclaimed. Manage your risk!

BTCUSDT: Range Compression Signals Incoming Move To $72,300Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT previously traded inside a clearly defined range near the highs, where price moved sideways while forming equal highs and lows. This structure reflected temporary balance between buyers and sellers rather than immediate continuation. Eventually, price broke down from this range and entered a well-structured downward channel, confirming increasing bearish pressure and a shift in short-term control toward sellers. Following this reaction, BTC broke out of the descending channel, signaling a potential momentum shift. After the breakout, price entered a new consolidation range above support, suggesting that the market is transitioning from impulsive selling into accumulation. This range is now developing above the rising triangle support line, showing that buyers are gradually gaining strength while volatility compresses.

Currently, BTCUSDT is trading near the upper boundary of this range and just below the Resistance Zone around 72,300. Price compression between rising support and horizontal resistance often precedes a directional expansion, and the recent higher lows indicate that buyers are slowly taking control.

My Scenario & Strategy

My primary scenario favors a bullish continuation as long as BTCUSDT holds above the 69,300 Support Zone and continues to respect the rising triangle support line. The current consolidation appears to be accumulation rather than distribution, suggesting that buyers may be preparing for another push higher. If BTC manages to break above the range high and gain acceptance above the 72,300 Resistance Zone, this would confirm bullish continuation and open the path toward higher liquidity areas. A successful breakout could trigger a momentum expansion as trapped shorts unwind and breakout buyers step in.

However, if price fails to hold above support and breaks back below the triangle structure, this would weaken the bullish case and shift focus back toward range lows or deeper downside continuation. For now, structure and price behavior suggest that buyers are attempting to regain control, with support holding firm and resistance being gradually tested.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

NZD/JPY - Trendline Break – Bulls Taking Control? (16.02.2026)📊 Description ✅ Setup OANDA:NZDJPY

NZDJPY has been in a clear downtrend, respecting a descending trendline with multiple rejections (A–C). Now price is reacting from a key demand/support zone and attempting a trendline breakout.

Confluences:

✔ Descending trendline breakout attempt

✔ Demand/support zone reaction

✔ Ichimoku cloud support

✔ Volume profile interest at lows

✔ Structure forming higher lows

This suggests potential shift from bearish to bullish momentum.

🧱 Support & Resistance

🔻 Support Zone: 91.90 – 92.15

🔺 1st Resistance: ~93.18

🔺 2nd Resistance: ~93.58

These are key reaction levels to watch.

⚠️ Disclaimer

This analysis is for educational purposes only.

Not financial advice. Always use proper risk management.

#NZDJPY #ForexTrading #PriceAction #SupportAndResistance #TrendlineBreak #ForexAnalysis #TradingViewIdeas #SmartMoney #FXTrading

🙌 Call to Support If this idea helps you:

👉 Hit Like ❤️

👉 Share your bias in comments 💬

👉 Follow for more FX setups 📈

Happy trading & stay disciplined! 🚀

EURUSD Holding Demand, Preparing for a Move Toward 1.1930Hello traders! Here’s my technical outlook on EURUSD (3H) based on the current chart structure. EURUSD previously transitioned from a bearish environment into a clear bullish recovery after breaking out of a descending channel. This breakout marked a shift in market control, as buyers stepped in aggressively and drove price higher with strong impulsive momentum. Following this move, price established a rising trend line, confirming a new bullish structure with higher highs and higher lows. The impulsive advance eventually led price into a Seller Zone around the 1.1930 area, where bullish momentum slowed and a corrective phase began. This correction was healthy in nature, as it did not immediately break the broader bullish structure but instead signaled temporary profit-taking. After the correction, EURUSD pulled back toward the Buyer Zone near 1.1850, which aligns with a key support level and the rising trend line. Price briefly broke below this area, creating a fake breakout, but quickly reclaimed the level — a strong sign of buyer absorption and demand acceptance. This false breakdown trapped late sellers and reinforced the validity of the support zone. From there, price moved into a consolidation range, indicating balance between buyers and sellers while the market builds energy for the next directional move. Currently, EURUSD is holding above the Buyer Zone and respecting the ascending trend line, which keeps the bullish structure intact. Price action remains constructive, with higher lows forming above support and no decisive acceptance below demand. The market is now pressing higher toward the descending resistance line and the 1.1930 Resistance Level, which represents the next major upside objective and a potential reaction zone. My scenario: as long as EURUSD holds above the 1.1850 Buyer Zone and continues to respect the rising trend line, the bullish bias remains valid. A sustained push higher could lead to a retest of the 1.1930 resistance level (TP1), where sellers may attempt to slow price. A clean breakout and acceptance above this resistance would confirm further bullish continuation. However, a decisive breakdown and acceptance below the Buyer Zone and trend line would invalidate the bullish scenario and signal a deeper corrective phase. For now, market structure and price behavior continue to favor buyers. Please share this idea with your friends and click Boost 🚀

XAUUSD Long: Rebounds From Support - Buyers Target 5,100Hello traders! Here’s my technical outlook on XAUUSD (2H) based on the current chart structure. Gold was previously trading inside a well-defined ascending channel, where price respected both the rising support and resistance boundaries, forming a steady sequence of higher highs and higher lows. This structure reflected controlled bullish momentum rather than impulsive expansion. The move culminated near a clear pivot high, where bullish pressure weakened and sellers stepped in aggressively. Following this pivot, price broke decisively below the ascending channel, confirming a structural shift and signaling that the prior bullish trend had exhausted. The breakdown was strong and impulsive, driving price sharply lower and reclaiming previously defended levels. This move established a new bearish leg and pushed gold toward a major pivot low, where buyers finally reacted and triggered a recovery phase.

Currently, after the rebound, price formed a rising demand structure supported by a clear ascending demand line. This recovery has been more corrective than impulsive, with price gradually climbing back toward the horizontal Supply Zone near 5,100. Recently, gold has been consolidating inside a defined range just beneath this supply area while holding above the Demand Zone around 4,900. This behavior suggests a temporary balance between buyers defending support and sellers protecting resistance.

My primary scenario favors bullish continuation as long as XAUUSD holds above the Demand Zone and continues respecting the rising demand line. A sustained hold above demand increases the probability of an upside move toward the 5,100 Supply Zone (TP1), which represents the first major resistance and a logical area for seller reaction. A confirmed breakout and acceptance above this supply level would signal a broader bullish continuation and potential expansion toward higher highs. On the other hand, a decisive breakdown below the Demand Zone and loss of the rising demand structure would invalidate the bullish recovery scenario and suggest a deeper corrective move. Until such confirmation appears, the current structure reflects consolidation with a mild bullish bias from support. Manage your risk!

XAUUSD: Bullish Structure Holds - Buyers Target 5,110 ResistanceHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD is trading within a broader bullish environment after a strong impulsive advance earlier in the structure. This initial rally was supported by a clearly defined upward channel, confirming strong buyer control and sustained demand. Following this impulsive leg, price reached a major Resistance Zone, where bullish momentum stalled and aggressive selling pressure entered the market. This resulted in a sharp corrective move to the downside, breaking the short-term bullish channel and triggering a deep pullback. Despite the intensity of the drop, sellers failed to fully reverse the broader trend, as price eventually found strong support at a lower demand area, where buying interest re-emerged decisively.

Currently, from this support, gold rebounded strongly, reclaiming key structure levels and forming a series of higher lows. The recovery phase transitioned into consolidation, with price moving sideways inside a clearly defined range just above the Support Zone. This range signals equilibrium between buyers and sellers, suggesting absorption rather than distribution. A breakout from this range to the upside confirmed renewed buyer strength and reinforced the bullish bias. Importantly, price continues to respect a rising triangle support line, indicating that demand is stepping in at progressively higher levels.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the Support Zone around 5,000 and continues to respect the ascending support line. The current consolidation above support appears corrective rather than distributive, favoring continuation. A sustained move higher could drive price toward the key Resistance Zone near 5,110 (TP1), where sellers may attempt to react again.

However, a decisive breakdown below the support zone and loss of the rising structure would weaken the bullish case and open the door for a deeper corrective phase. Until that happens, market structure, trend behavior, and demand dynamics continue to favor buyers.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

EUR/USD - Triangle Breakout | Sellers in Control📊 Technical Overview TICKMILL:EURUSD

EUR/USD formed a clear symmetrical triangle pattern on the M30 timeframe, showing consolidation after a strong impulsive move.

✅Price rejected precisely from a higher-timeframe bearish order block, confirming strong supply in that zone.

✅The recent break below the triangle structure signals a potential continuation to the downside. Momentum is now favoring sellers as price trades below the structure.

✅If bearish pressure continues, the next target sits around the 1.1800 psychological level, followed by the lower marked key demand zone.

🎯 Key Levels to Watch

• Bearish Order Block (major resistance)

• 1.1800 Psychological Level

• Lower Key Support Zone

A sustained move below 1.1800 could accelerate downside momentum.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only.

EURUSD: Bearish Pressure Building Inside TriangleHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD was previously trading within a clearly defined downward channel, where price respected both the resistance and support boundaries while forming consistent lower highs and lower lows. This structure confirmed sustained bearish pressure and controlled selling rather than impulsive panic moves. The market eventually broke out of this channel to the upside, signaling a potential shift in short-term momentum. Following the breakout, price rallied strongly and pushed into the major Resistance Zone near 1.1890. However, the bullish move failed to sustain acceptance above this area, forming a fake breakout near the triangle resistance line. This rejection suggests that sellers remain active at higher levels. After the rejection, price pulled back and entered a consolidation range inside a contracting triangle structure. This phase reflects temporary balance between buyers and sellers, with volatility compression as price approaches the apex of the pattern.

Currently, EURUSD is trading below the Resistance Zone while respecting the triangle boundaries, indicating that the recent recovery may be corrective rather than a full trend reversal. Overall, the broader structure now shows weakening bullish momentum inside resistance, increasing the probability of a downside rotation toward support.

My Scenario & Strategy

My primary scenario favors a short setup as long as EURUSD remains below the 1.1890 Resistance Zone and continues to respect the triangle resistance line. The recent consolidation appears to be distribution rather than accumulation, suggesting that sellers may regain control once price breaks lower from the structure. If bearish momentum resumes, the next logical downside target lies near the 1.1800 Support Zone, which aligns with previous breakout levels and a strong demand reaction area (TP1). This level represents a natural zone for price to seek liquidity and potentially stabilize.

However, if EURUSD manages to break decisively above the triangle resistance and reclaim the 1.1890 level with strong acceptance, this would weaken the bearish scenario and suggest a broader bullish continuation or range expansion. For now, structure favors sellers, with rallies viewed as corrective moves unless resistance is reclaimed.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

XAUUSD: Range Holding Strong - Upside Expansion PossibleHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD previously experienced a strong bearish impulse, breaking decisively below a key support area and triggering an acceleration to the downside. This sell-off marked a clear loss of bullish control and led to a deep corrective phase. After forming a local bottom, price began to recover and transitioned into a consolidation phase, signaling a slowdown in selling pressure. During this recovery, Gold started forming higher lows while respecting a rising triangle support line, indicating that buyers were gradually stepping back into the market. As price continued to stabilize, XAUUSD broke above the descending triangle resistance line, confirming a short-term structural shift in favor of buyers. Following this breakout, price entered a well-defined range above the support zone, showing acceptance above demand rather than an immediate rejection. Multiple breakout and retest behaviors around the support area suggest that buyers are actively defending this level. The market is now compressing within this range, reflecting absorption of supply and preparation for a potential directional move.

Currently, XAUUSD is trading above the key support zone around 5,040–5,060, while holding structure above the rising triangle support line. Price action remains constructive, with recent pullbacks appearing corrective rather than impulsive. This behavior suggests that bearish attempts are being absorbed, and buyers maintain short-term control as long as price stays above support.

My Scenario & Strategy

My primary scenario favors a bullish continuation, provided XAUUSD continues to hold above the 5,040 support zone and respects the ascending triangle support line. Consolidation above demand indicates accumulation rather than distribution. A confirmed breakout and acceptance above the current range would open the path toward the 5,180 resistance zone (TP1), which aligns with a major resistance and previous supply area. This level is expected to attract selling pressure, making it a key upside objective.

However, a decisive breakdown and acceptance below the support zone and triangle support line would invalidate the bullish scenario and signal a return of bearish pressure, potentially leading to a deeper corrective move. Until that happens, market structure and price behavior continue to favor buyers.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

Hype testing resistanceIn my previous idea on Hype I was looking at 3 probabilities. Now I am waiting to see if the resistance is broken or not. Even if this is the case I would still wait for a test of the broken level and a flip into support. We also got a 900 ema on top of the resistance so thats an important area. The are 2 prices on wich net longs showed interest recently , one is 30 and the other one is 31.5. This shows that theres a chance we break the resistance. If not then we go low and im interested only in shorts, at least to the lower levels pointed out in previous post.

BTCUSDT Long: Higher Lows Forming Above Key DemandHello traders! Here’s my technical outlook on BTCUSDT (4H) based on the current chart structure. Bitcoin was previously trading within a clearly defined descending channel, where price consistently respected both the upper resistance and lower support boundaries. This structure was characterized by a sequence of lower highs and lower lows, confirming sustained bearish control and a controlled downside movement rather than panic-driven selling. Sellers remained dominant throughout this phase, using every pullback toward the channel resistance to add pressure. Eventually, price broke down below the lower boundary of the descending channel, confirming continuation of the bearish leg and reinforcing seller dominance. This breakdown led to a sharp impulsive move to the downside, culminating in a pivot point, where aggressive selling was finally met by strong buyer reaction. This area marked the first significant demand response, resulting in a sharp rebound and signaling short-term exhaustion from sellers.

Currently, following this rebound, BTC entered a consolidation phase, forming a horizontal range between a clearly defined Demand Zone near 68,000 and a Supply Zone around 71,700–71,800. During this phase, price moved sideways as buyers attempted to build a base while sellers defended overhead resistance. The market then began forming a rising demand trend line, showing gradually improving buyer strength and higher lows, while supply above continued to cap price advances. At the moment, BTC is trading between rising demand from below and strong supply from above, creating a compression structure that often precedes a directional move. As long as price remains below the Supply Zone, the current upside move can still be viewed as corrective within a broader bearish context, rather than a confirmed trend reversal.

My primary scenario favors long continuation on pullbacks into the rising demand line or the 68,800–69,000 support area, provided price shows bullish reaction (strong candles, rejection wicks, or structure holding). A sustained move higher would target the 71,700–71,800 Supply Zone (TP1), where partial profit-taking is reasonable due to expected seller reaction. A clean breakout and acceptance above the 71,800 supply would confirm a trend shift and open the door for further upside continuation toward higher resistance levels. Manage your risk!

ID – 1H Descending Channel With Short Term AccumulationOn the 1H timeframe, ID is clearly trading inside a well defined descending channel, respecting lower highs and lower lows. The macro intraday trend remains bearish as long as price stays inside that channel.

🔍 Current Structure

Recently, price formed a short term ascending mini range / rising structure near the lower half of the channel. This suggests local accumulation after a strong sell off.

We are currently sitting around the 0.0515 – 0.0530 area, which is acting as an intraday pivot zone.

📌 Key Levels

• 0.0515 → Local support / flip Level

• 0.0445 – 0.0460 → Major channel support & liquidity area

• 0.0652 → Resistance Level

• 0.0926 → Higher timeframe major resistance

🧠 Possible Scenarios

🟢 Bullish Case

If price holds above 0.0515 and breaks the descending channel resistance, we can expect continuation toward 0.065 first, and potentially expansion toward 0.09 zone.

🔴 Bearish Case

If the current structure fails and 0.051 breaks with momentum, market could sweep liquidity around 0.0445 before any meaningful bounce.

For now, short term structure is improving, but confirmation only comes with a clean channel breakout.

DOGE 1D TFI am bearish on Doge. I dont think any support will hold until we reach 0.063 first. That area for me represents the real value. From there we might see a bounce, or even a small fall a bit under 0.06. At the moment there is a small area, 0.094 in wich we might see a pump , but I dont think buyers will take over control and push price above the resistance. In case we do fall to 0.063, there is another level of resistance in wich I will be interested in shorting as showed in TA. Will see how this goes.

Bitcoin Rejects Resistance, Eyes Support Test Around $65KHello traders! Here’s my technical outlook on BTCUSDT (1H) based on the current chart structure. Bitcoin previously traded within a well-defined descending channel, where price respected both the resistance and support boundaries, confirming controlled bearish pressure rather than impulsive selling. This channel structure guided the market lower with consistent lower highs and lower lows, reflecting steady seller dominance. The decline eventually culminated in a sharp sell-off that swept liquidity and formed a clear turning point, where price reacted strongly from the Buyer Zone. This reaction marked the first sign of demand stepping in and weakening the bearish momentum. Following this reversal, BTC staged a strong impulsive recovery and broke back above the Buyer Zone, signaling a temporary structural shift and attracting renewed bullish interest. After this move, price entered a consolidation phase, forming a clean range where buyers and sellers temporarily found equilibrium. This ranging structure acted as a redistribution zone before the market rotated lower again. The rejection from the upper boundary of the range aligned with the descending resistance line, confirming that sellers were still active within the broader channel context. Currently, BTC is trading below the Seller Zone and remains inside the descending structure, with price recently breaking down from resistance and rotating toward the channel support. This move suggests that the recent bounce was corrective rather than the start of a sustained bullish reversal. Price action shows controlled downside continuation, with the market now approaching the Buyer Zone around 65,000, which also aligns with the lower boundary of the descending channel and a key support area. My primary scenario favors a continuation toward the support region, as long as BTC remains below the Seller Zone and continues respecting the descending resistance line. A clean reaction from the 65,000 Buyer Zone (TP1) could trigger another bounce, as this level represents a confluence of structural support and potential liquidity. On the other hand, a decisive breakdown and acceptance below this Buyer Zone would confirm bearish continuation and open the path toward deeper downside expansion. Until buyers reclaim the Seller Zone and break the descending structure, the broader short-term bias remains cautiously bearish. Please share this idea with your friends and click Boost 🚀

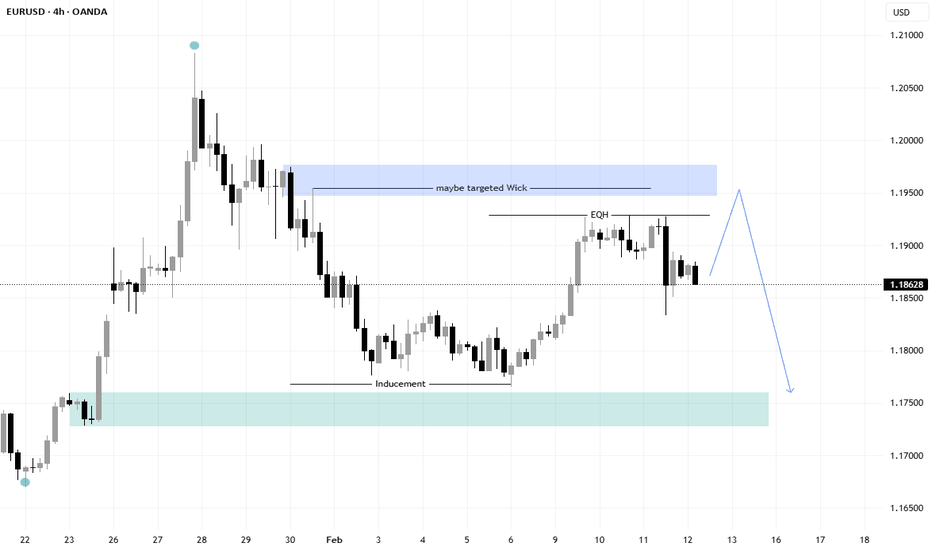

EURUSD NFP Reaction Confirms Supply StrengthQuick Summary

The strong 90+ pip drop after NFP confirms the strength of the supply zone and Price has not fully reached the main supply area yet

Current movement may represent liquidity engineering and a sweep above Equal Highs is likely before bearish continuation

Selling before liquidity is taken may be premature

Full Analysis

The sharp 90+ pip bearish reaction following the NFP release reinforces the idea that the supply zone above remains significant and respected by the market. Strong fundamental catalysts often reveal where real institutional orders are positioned, and this reaction suggests active sellers are present.

However, price has not yet fully tapped into the primary supply level. This raises the probability that the current structure is part of a broader liquidity-building phase rather than the start of an immediate sustained decline.

The recent price behavior indicate potential accumulation of liquidity. Equal Highs sitting above current price act as a clear liquidity magnet. From a market structure perspective, it would be logical for price to push higher, sweep those resting buy stops, and only then initiate the true bearish continuation.

For that reason, initiating short positions before a liquidity sweep above the Equal Highs may be premature. A cleaner scenario would involve:

1 - Liquidity sweep above EQH

2 - Clear rejection or bearish displacement

3 - Lower timeframe CHOCH confirming shift in control

EURUSD Awaiting Liquidity Sweep above1.19570Quick Summary

Price is currently moving in a slow sideways range and still Waiting for a break of the candle wick at 1.19570 because Liquidity pool rests below this level

A minor push upward may follow to sweep retail liquidity

Bearish continuation is expected toward an unmitigated zone

Full Analysis

The market is currently trading within a very slow and tight consolidation phase, suggesting a temporary equilibrium between buyers and sellers rather than directional intent. At this stage, patience remains essential as the next meaningful move will likely be driven by liquidity objectives rather than pure momentum.

The key level being monitored is the candle wick at 1.19570. A break above this point could act as the initial trigger for a downside move, especially considering the presence of a liquidity pool resting beneath it. Taking this liquidity may provide the fuel required for the next phase of price delivery.

Following this liquidity grab, price may stage a minor upward retracement. This move would likely aim to sweep the wick highs once again, as they represent potential resting liquidity from retail traders who placed stop losses above recent highs.

After completing this double-sided liquidity sweep, the probability increases for bearish continuation toward the unmitigated zone left behind previously. Once price reaches that area, the reaction will determine whether it acts as support or if bearish momentum remains strong enough to drive the market even lower.

MVX: knife catching or caution? key levels to monitor nowMVX. Who’s trying to catch this knife and who’s just watching with popcorn? While majors steal the spotlight, smaller perp tokens like MVX are getting aggressively de‑leveraged, and this one just did a full waterfall into historical demand.

On the 4H chart we’re sitting right on that 1.8–2.0 demand zone, RSI is buried under 20 and starting to curl, and the last leg down came with a clear volume spike that smells like capitulation. With price trading well below the main volume cluster above, I’m leaning toward a short‑term relief long rather than chasing further downside here ✅

My base case: a bounce toward 2.3 first, then 2.7–2.9 if buyers really wake up. For me the trigger is a 4H close back above 2.0 with a higher low, with invalidation under 1.8; below that, door opens to 1.5 and I step aside. I might be wrong, but ignoring these oversold bounces is how you miss the “easy” trades – I’m flat for now and stalking that confirmation.

CAKE: ready for a bounce? key levels to watch in the coming daysCAKE. Tired of watching this one bleed out? After months of DeFi fatigue and constant sell pressure, CAKE finally tagged a big demand zone around 1.25 where buyers stepped in hard. Recent headlines about protocol updates and ongoing token burns keep it on the radar again, according to market chatter.

On the 4H chart, price bounced cleanly off that green support block and is carving higher lows while grinding above the local volume node near 1.30. RSI has flipped from oversold to above 50, momentum is up, and there's a clear low-volume pocket up toward 1.45-1.50 that price often loves to fill. I might be wrong, but the structure looks like the start of a relief leg, not just a random candle.

My base case: as long as CAKE holds above 1.32-1.30, I expect continuation to 1.45 first and then 1.50+ ✅ I’m watching for a pullback into 1.33-1.34 to join the move, with invalidation below 1.29. If we get a 4H close back under the green zone near 1.28, bulls are cooked and a sweep toward 1.20-1.15 opens up ⚠️ For now I stay patient and let price come to my levels.

BTCUSDT: Bullish Scenario While Above 66.3K SupportHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT was previously trading inside a well-defined descending channel, where price consistently respected the falling resistance and support boundaries. This structure was characterized by a sequence of lower highs and lower lows, confirming sustained bearish pressure and controlled downside continuation rather than panic selling. Each corrective bounce into channel resistance was rejected, reinforcing seller dominance throughout the move lower. As price approached the Support Zone around 66,300, selling momentum began to weaken. Bitcoin briefly broke below this support, creating a fake breakdown and triggering sell-side liquidity. However, this move was quickly reclaimed, followed by a strong bullish impulse back above the support zone. This behavior signaled seller exhaustion and marked a potential short-term structural shift.

Currently, after the reclaim, BTCUSDT transitioned into a range structure between roughly 66,300 support and 69,900 resistance. This consolidation reflects temporary balance between buyers and sellers, with price holding above reclaimed demand while failing to break through resistance. Importantly, price is also respecting a rising triangle support line, indicating gradual bullish pressure building from below.

My Scenario & Strategy

My primary scenario favors bullish continuation, as long as BTCUSDT holds above the 66,300 Support Zone and continues to respect the rising triangle support line. The fake breakdown followed by strong acceptance above support suggests that the prior move down was a liquidity sweep rather than the start of a new bearish leg. Structurally, this range appears more like accumulation than distribution. The next key upside objective is the 69,900 Resistance Zone (TP1), which aligns with previous resistance and the upper boundary of the current range. A clean breakout and acceptance above this level would confirm bullish continuation and open the door for further upside expansion.

However, if price fails to hold above the support zone and breaks decisively below both the range low and the triangle support line, the bullish scenario would be invalidated, potentially leading to renewed downside continuation. Until such a breakdown occurs, pullbacks toward support are viewed as corrective rather than bearish reversal signals.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

Fundamental Market Analysis for February 16, 2026 EURUSDThe euro against the dollar is starting the week without a clear impulse, and the key driver is a reassessment of rate expectations in the United States. The market is factoring in both the recent labor-market data and personnel news around the future leadership of the Federal Reserve, which helps keep demand for the dollar steady and increases the pair’s sensitivity to any surprises in US releases.

In the Eurozone, the situation is calmer: the European Central Bank is holding a pause, while inflation is clearly below 2%, so investors are not rushing to price in higher euro yields. Improved risk sentiment across the region supports the currency, but without acceleration in growth and price pressures, it is harder for the euro to strengthen sustainably against the dollar.

For today, the base scenario is moderate pressure on EURUSD as demand for the dollar returns on the back of US headlines and data. In that logic, selling from current levels looks preferable, with a protective stop and a target in the area of lower prices.

Trading recommendation: SELL 1.18750, SL 1.19000, TP 1.18000

BONK: ready for a bounce? key levels and targets for todayBONK. Tired of watching this meme coin bleed and finally ready for a real bounce? After a long grind down, BONK just woke up with a sharp spike on the back of fresh interest in Solana memecoins, and according to the market chatter that rotation is not over yet. Price punched out of the base and volume picked up right where buyers previously disappeared - that’s usually not random.

On the 4H chart we’ve got a clear trend change: higher low, breakout, then a pullback into the first demand zone and high-volume node on the profile. RSI cooled from extreme overbought into the 60s, so the FOMO froth is getting rinsed out without killing the structure. I’m leaning to the long side, looking for a continuation push into the next red supply clusters above.

My base plan: as long as price holds the local support area around the recent breakout zone, I’m expecting a move toward the upper resistance block where the last heavy sell zone sits ✅. If that support fails and we close 4H candles back inside the old range, the setup flips and opens room for a slide back to the lower accumulation area. I might be wrong, but for now I’m stalking entries on dips, not chasing green candles.

IP: catching a knife or waiting for bounce? key levels aheadIP

Catching this knife or letting it bounce first? While majors are chilling after the latest volatility spike, small caps like IP are quietly building bases - according to market chatter, leverage in alts has been flushed and fresh spot buyers are creeping back in. On 4H we’ve got a long bleed, capitulation wick and now a flat shelf right on a strong demand zone around 1.10.

On the 4H chart price hugs that green support with declining sell volume, and the volume profile shows a fat liquidity zone sitting higher around 1.35-1.50. RSI has recovered from oversold and is grinding under 50 - classic early accumulation vibe rather than full trend reversal. I’m leaning long, looking for a mean-reversion pop into the first supply block once price finally punches through this micro range.

My base case ✅ bounce toward 1.35 then possibly 1.50 if momentum heats up and we see a clean 4H close above the local highs of this range. Aggressive traders can stalk longs in this demand area, conservative ones might wait for a breakout and retest from above. If 1.10 gives way with volume, the idea flips and we can easily slide to new lows - I might be wrong, but below that level I’d step aside and let the knife fall without me.