XAUUSD Price Forecast: US Venezuela Tensions Test $4,500Market Overview

- Gold (XAU/USD) opened the week with strong upside momentum, briefly pushing above the $4,400 handle during the early European session. However, that initial advance stalled relatively quickly. The primary driver behind the early strength was not technical in nature, but rather a renewed surge in geopolitical risk. Developments in Latin America, particularly the U.S.-led military action in Venezuela and the arrest of President Nicolás Maduro, have significantly increased global risk sensitivity. Additional rhetoric suggesting that Colombia and Mexico could face similar pressure has further unsettled markets.

- Beyond Latin America, unresolved conflicts in Ukraine, persistent instability involving Iran, and ongoing tensions in Gaza continue to reinforce a fragile global backdrop. In this environment, capital preservation has become a priority. Investors are rotating into traditional safe-haven assets, and gold remains one of the primary beneficiaries of this risk-off positioning.

Strong U.S. Dollar Fails to Suppress Gold Demand

- Despite the broader risk-off tone supporting the U.S. dollar, gold has proven resilient. Normally, a stronger dollar would act as a headwind for bullion, but current market conditions suggest that safe-haven demand is strong enough to offset currency pressure. This divergence highlights how elevated geopolitical uncertainty is currently overriding conventional correlations.

- Looking ahead, U.S. macroeconomic data will be a key driver. Inflation-related releases throughout the week, followed by Friday’s U.S. employment report, are critical inputs for Federal Reserve expectations. Any signs of labor market softening could reinforce expectations for additional rate cuts, which would further support gold by reducing real yield pressure.

Short-Term Forecast

In the near term, gold is likely to remain range-bound as the market digests both geopolitical headlines and upcoming economic data. A consolidation range between $4,410 and $4,450 appears reasonable over the next few sessions. As long as safe-haven demand remains intact, upside pressure persists, and a clean break above the $4,500 level cannot be ruled out.

Technical Structure and Key Levels

- From a technical standpoint, gold is currently trading near $4,421 after rebounding from the recent sharp pullback off the $4,550 high. Price has successfully reclaimed the $4,412 Fibonacci retracement level, and short-term EMA closes above this zone suggest improving near-term structure. Importantly, the broader uptrend that has been in place since December remains intact.

- Imediate resistance is located near $4,445, aligning with the 61.8% Fibonacci retracement, followed by a higher resistance zone around $4,498. Recent price action has produced a sequence of higher lows, signaling renewed dip-buying interest and improving market confidence.

- Momentum indicators support this view. The RSI has recovered toward the 50 level, indicating stabilization and early momentum recovery rather than overextension. From a tactical trading perspective, pullbacks toward the $4,410 area remain attractive, with upside targets toward $4,500, while a protective stop below $4,340 helps manage downside risk if the recovery fails.

Analysis

GOLD intraday trading setup 📉 XAUUSD – Sell Setup (Intraday / Short-Term)

Current Price: ~4450

Sell Zone: 4450 – 4460

Targets:

🎯 TP1: 4415

🎯 TP2: 4385

🎯 TP3: 4350

Stop Loss: 4480

---

🔍 Reasons for Sell

Gold has seen an extended bullish rally, increasing chances of profit-taking.

Price is reacting near a liquidity zone, which often attracts institutional sellers.

A stronger USD (DXY) or a rise in US bond yields could add bearish pressure on gold.

---

🧠 Bias

Short-term bearish correction expected unless price reclaims and holds above the sell zone.

---

🤝 Support & Engagement

If you find this analysis helpful,

please support with a 👍 Like and 💬 Comment — it really motivates me to keep sharing quality ideas.

Wishing everyone safe trades and disciplined risk management 📊✨

EUR/USD 30- MINUTES LONG CHART SETUPEUR/USD 30-minute chart analysis based Market Structure (30-M)

After a strong bearish move, price formed a liquidity sweep / fake breakdown below support.

Sharp bullish impulsive recovery → shows buyers stepping in aggressively.

Current structure is shifting from LH–LL → potential HH–HL (bullish correction phase).

Key Levels

Support Zone

1.1700 – 1.1703

Previous breakdown area + demand reaction

Validation level for bullish bias

Entry Zone (Intraday Buy)

1.1722 – 1.1726

Price is retesting previous resistance turned support

Resistance / Supply

1.1750 – 1.1756

Strong rejection area from the left

Marked as target area

Trade Plan (Bullish Setup)

Bias: Bullish continuation (pullback buy)

Entry:

Buy around 1.1722 – 1.1726 after bullish candle confirmation

Stop Loss:

Below 1.1700 – 1.1702 (structure invalidation)

Take Profit Targets:

TP1: 1.1738

TP2: 1.1750

TP3: 1.1755 – 1.1760

Confirmation Checklist

✔ Bullish engulfing / strong rejection wick at entry

✔ Higher low on 5M–15M

✔ No strong bearish rejection before resistance

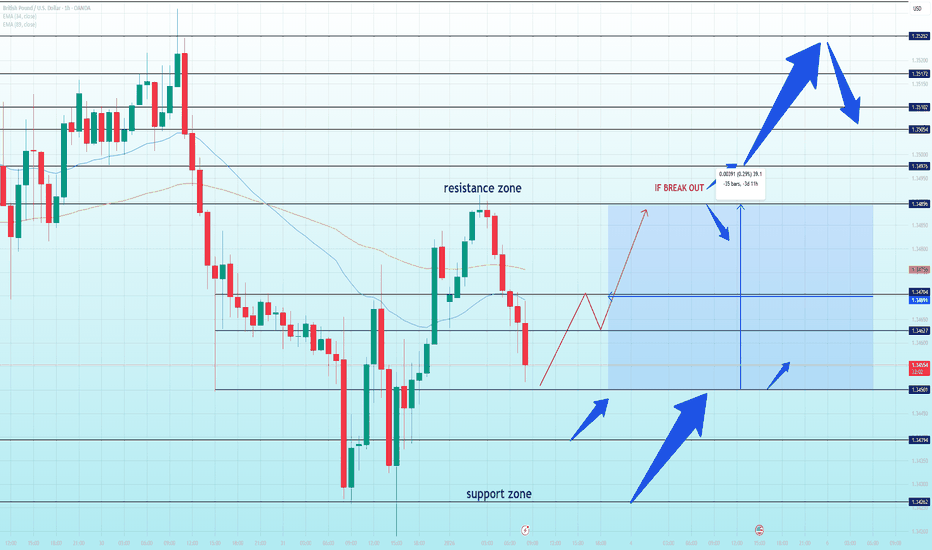

GBP/USD at a Decision Point: Breakout Potential or Another RangeGBP/USD is currently trading inside a clearly defined range structure, with price compressing between a well-respected support zone around 1.3450 and a resistance zone near 1.3490–1.3500. Recent price action shows a sharp recovery from the lower boundary, but upside momentum has stalled again as price re-enters the prior resistance area. This behavior suggests the market is not trending, but rotating liquidity within the range.

From a technical perspective, the rejection from the resistance zone is technically clean. Price failed to hold above the short-term equilibrium and slipped back below the mid-range, indicating that buyers lack conviction at higher levels. The moving averages are flattening and overlapping, reinforcing the idea of balance rather than trend. Until a decisive break occurs, upside moves should be treated as corrective, not impulsive.

The bullish scenario only becomes valid if GBP/USD can break and hold above the 1.3490–1.3500 resistance zone, followed by acceptance above that level. In that case, upside expansion could open toward 1.3510 → 1.3525, where higher-timeframe supply is located. Without that confirmation, any push higher remains vulnerable to rejection.

On the bearish / range-continuation scenario, failure to reclaim resistance keeps price rotating back toward the 1.3450 support zone. A clean breakdown below this support would expose deeper downside toward 1.3430 and below, extending the range rather than reversing the broader structure.

From a macro standpoint, GBP remains sensitive to the USD side of the equation. Persistent USD resilience—supported by relatively restrictive financial conditions and cautious Fed messaging—continues to cap upside in GBP/USD. At the same time, the Bank of England’s stance remains restrictive but growth concerns limit aggressive GBP inflows. This macro backdrop favors choppy, range-bound price action, not clean directional trends.

Summary:

GBP/USD is in a neutral-to-range environment. The market is waiting for confirmation. A sustained break above resistance is required to unlock upside continuation; otherwise, the higher-probability outcome remains range rotation back toward support. Patience and confirmation are key at this level.

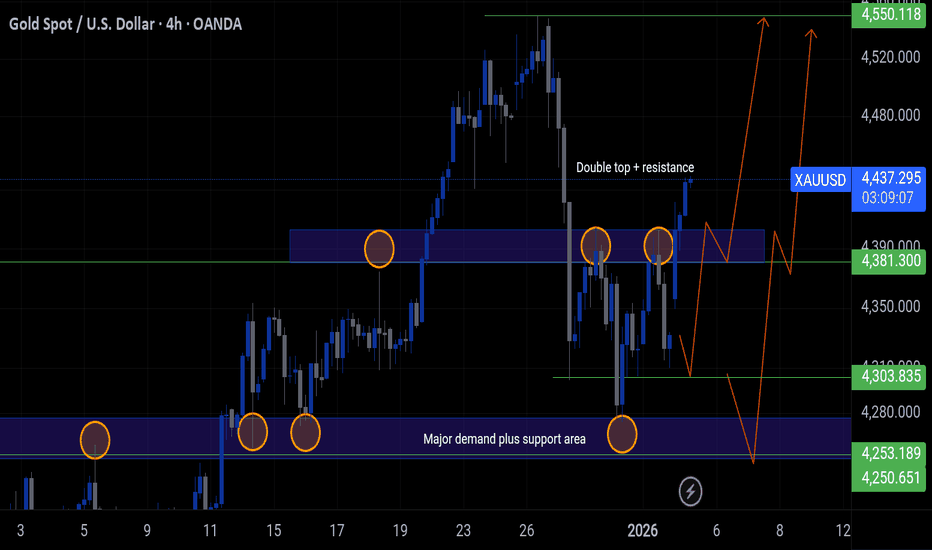

Gold at a Tipping PointHello Traders,

Gold is currently trading within a short-term recovery structure after forming a clear swing low and establishing a rising support trendline. Price has respected this ascending support well, producing higher lows and signaling that buyers are gradually regaining control following the prior impulsive sell-off.

At the moment, price is pressing into a clearly defined resistance zone. This area previously acted as supply and now represents a critical decision point for the market. The recent bullish push into this zone suggests growing momentum, but continuation is not confirmed until acceptance above resistance is seen.

If price breaks above this resistance and holds, the structure opens the door for upside continuation toward the next higher liquidity levels. In this scenario, the preferred execution is not chasing the initial breakout, but waiting for a pullback that successfully retests the broken resistance as support. This confirms acceptance and provides a cleaner risk-to-reward framework.

Alternatively, failure to hold above the resistance could result in a corrective rotation. A rejection here would likely send price back toward the rising support trendline. As long as this support remains intact, such a move would still be considered a healthy pullback within an emerging bullish structure rather than a reversal.

The bullish outlook is invalidated if price decisively breaks below the ascending support and accepts beneath the recent swing low. That would signal a structural failure and shift the market back into a bearish or neutral regime.

At this stage, Gold is at a decision zone rather than an execution zone. Patience is required. Let price confirm whether it accepts above resistance or rotates back toward support before committing to directional bias.

Share your perspective below.

Bitcoin Is Not Escaping Yet — This Is H2 Accumulation Hello everyone,

On the H2 timeframe, the key focus right now is not an immediate breakout, but the fact that Bitcoin remains locked inside a broad accumulation range, where price continues to rotate between clearly defined support and resistance.

Structurally, BTC has spent an extended period compressing inside the 86,200–90,500 range. Multiple upside attempts toward the upper resistance zone have been rejected, while every pullback into the lower support zone has been absorbed. This repeated rotation confirms balance, not trend, and signals that liquidity is still being built.

From a technical perspective, price is currently holding above the EMA34–EMA89 cluster, which has acted as dynamic support during the recent recovery. The latest dip was defended cleanly and followed by a push higher, forming a support-and-retest structure around the 88,200–88,400 area. This behavior shows that buyers are active, but not yet aggressive enough to force acceptance above resistance.

Importantly, there is no structural breakout at this stage. Highs remain capped below the range top, and price action continues to print overlapping swings, typical of accumulation rather than continuation. The projected path on the chart reflects this well: a shallow pullback to retest support, followed by another attempt higher toward resistance.

Resistance zone: ~90,400–90,600 — range high and breakout trigger.

Mid-range support / retest: ~88,200–88,400 — current decision area.

Major support: ~86,200–86,500 — accumulation floor.

Invalidation: Acceptance back below the EMA cluster would weaken the constructive setup.

Only a clean breakout and sustained acceptance above the resistance zone would confirm that accumulation has completed and open the door for upside expansion. Until then, Bitcoin is not trending — it is absorbing liquidity and preparing, where patience and level discipline remain critical.

Wishing you all effective and disciplined trading.

EURUSD Is Not Reversing — This Is a Pullback Into H1 SupportHello everyone,

On the H1 timeframe, the key focus right now is not the recent bearish candles, but how EURUSD is reacting after rejecting from a descending resistance and pulling back into a well-defined support zone.

Structurally, the market remains capped by a descending resistance trendline, with price consistently forming lower highs beneath it. The most recent push higher stalled precisely at the EMA cluster and the resistance zone, where sellers stepped in aggressively. This rejection confirms that upside attempts are still being sold and that bullish momentum has not yet regained control.

Following that rejection, EURUSD is now rotating lower toward the 1.1720–1.1730 support zone, which has already acted as a strong reaction base in previous sessions. This area is technically important: it marks prior demand and has previously absorbed selling pressure before producing sharp rebounds. The current move lower appears orderly and corrective, rather than an impulsive breakdown.

From a price action perspective, there is no confirmed trend reversal at this stage. The decline into support fits well with a pullback within a broader corrective structure, not a fresh bearish expansion. As long as price holds above the support zone, downside follow-through remains limited.

The projected path on the chart reflects this logic:

A test or sweep of the 1.1720 support zone to check demand

A technical rebound back toward the mid-range

Potential continuation higher toward the descending resistance if buyers regain strength

Only a clean breakdown and acceptance below the support zone would invalidate this pullback scenario and open the door for deeper downside. Conversely, a reclaim above the EMA cluster and descending trendline would be the first signal that bearish pressure is fading and that a larger recovery toward resistance is possible.

Until confirmation appears, EURUSD is not trending aggressively in either direction. It is rebalancing after rejection, and patience around key levels remains critical.

Wishing you all effective and disciplined trading.

Fundamental Market Analysis for January 5, 2025 EURUSDEUR/USD on Monday, January 5, is holding near 1.16800–1.17000. The US dollar is strengthening at the start of the first full week of 2026 as investors refocus on fresh US macro data and reduce risk appetite. Sentiment is also influenced by heightened geopolitical uncertainty: when headlines escalate, demand for defensive assets typically supports the dollar.

The key focus today is US manufacturing activity data and its impact on expectations for the Federal Reserve’s policy rate in 2026. If the figures prove resilient, it becomes harder for the market to price in rapid rate cuts, giving the dollar an additional tailwind. Another volatility driver is anticipation of a decision on the next Fed Chair candidate, which increases sensitivity to comments and shifts in forecasts.

In the euro area, there are fewer immediate catalysts. The ECB aims to keep inflation near target, while the recovery remains uneven. With the US agenda dominating and investors staying cautious, the euro may remain under pressure—especially if incoming US data confirms solid demand and employment conditions.

Trading recommendation: SELL 1.16850, SL 1.17150, TP 1.15950

LTC/USDT 1D Chart 🔎 Market Structure

The market is in a downtrend (a series of lower highs and lower lows).

The price is moving within a descending channel (black lines).

The recent move is a rebound from the lower demand zones, but the trend has not yet been broken.

📉 Trend & Price Action

The main downtrend line has not been broken – the price has reached it and is reacting.

The current move looks like a pullback/upward correction, not a trend reversal.

No clear higher high → the structure remains bearish.

🟢 Key Levels

Resistance (sell zones)

86.84 USDT – local resistance (currently being tested)

95.83 USDT – strong structural resistance

103.54 USDT – previous downside base

110.66 USDT – very strong resistance (key to trend reversal)

Support (buy zones)

78.67 USDT – local support

72.25 USDT – strong demand zone

63.14 USDT – critical support (channel bottom)

📊 Indicators

Stochastic RSI

Currently in the overbought zone (>80)

Historically, on this chart, → often ends in a correction

Signal: watch out for shorts / profit-taking

CHOP Index

High → market was in consolidation

Recent CHOP breakout down → possible impulse but not yet confirmed by volume

🧠 Scenarios

🔴 Baseline scenario (more likely)

Rejection at 86–88 USDT

Return to around 78.67 → 72.25

Continuation of the downtrend

🟢 Alternative scenario (bullish, conditional)

Daily close above 95.83

Then a breakout of 103.54

Only 110.66 = a real trend change to up

🎯 Final conclusion

This is a correction in a downtrend, not a trend reversal.

Shorts are logical under resistance

Longs are only short-term/scalp

Swing longs only after a breakout of 103–110

The Euro’s Bullish Blueprint: Identifying the Breakout TriggerHello everyone,

On the H1 timeframe, the key focus right now is not the minor fluctuations around the EMA 50, but how EURUSD is positioning itself within a tight consolidation range between a proven support base and a looming resistance ceiling.

Structurally, the market has transitioned from a sharp impulsive drop into a steady recovery phase, characterized by the formation of higher lows. Price is currently grappling with the EMA 50 and the lower boundary of the 1.1750–1.1760 resistance zone. This area represents a significant hurdle; a successful breach here would signal that the corrective phase is over and that buyers have successfully reclaimed the mid-term momentum.

Following the recent bounce from the 1.1710–1.1720 support zone, EURUSD is showing signs of accumulation. This support area is technically critical as it represents a "demand pocket" where buyers have previously intervened to halt deeper declines. The current price action suggests that the market is gathering liquidity for a potential push higher, rather than preparing for a breakdown.

From a price action perspective, we are seeing a "squeeze" against the resistance. As long as the higher-low structure remains intact, the bias leans toward an upside resolution. The move appears to be a preparation for a trend continuation toward the higher targets identified on the chart, provided the resistance zone is flipped into support.

The projected path on the chart reflects this logic:

- A decisive break above the 1.1760 Resistance Zone to reach Target 1.

- A technical pullback to retest the breached zone, confirming it as new support.

- A secondary rally toward Target 2 (1.1779) and eventually Target 3 (1.1807).

Only a clean breakdown and acceptance below the 1.1710 support zone would invalidate this recovery scenario and shift the focus back to the bearish lows. Conversely, a daily close above the current resistance zone would be the definitive signal that a larger bullish cycle has commenced.

Until the breakout is confirmed, EURUSD remains in a "wait-and see" compression. Patience around these key levels is essential to avoid being caught in a fake-out.

Wishing you all effective and disciplined trading.

Market Analysis & Reaffirmation of Trading PlanMarket Analysis & Reaffirmation of Trading Plan

- Today's market is moving exactly as planned yesterday. After a consolidation phase and absorption of liquidity around the 4.38x – 4.40x range, the price has clearly broken out, confirming the return of large capital flows. The market structure on the H4 timeframe has shifted to a higher high – higher low, indicating that the uptrend has been established and is being maintained.

- The price holding above the breakout zone not only reinforces the trend but also proves that following the structure was the correct choice. The current corrections are merely technical, serving to create more liquidity for the market to continue expanding its range.

Message to the community:

- The market is not random. When you correctly read the structure, identify the correct price zone, and patiently wait for confirmation, the advantage will automatically be on your side.

- A correct plan doesn't need fanfare The results are the clearest evidence of a leader's position.

TODAY'S LIMITED STRATEGY JAN 6

Intraday trading: Increase

📌 SET UP 1. Timming Sell Zone

XAUUSD SELL ZONE: 4517 - 4520

💰 Take Profit(TP): 4514 - 4509

❎ Stoploss(SL): 4524

Note capital management to ensure account safety

📌 SET UP 2. Timming Buy Zone

XAUUSD BUY ZONE: 4394 - 4397

💰 Take Profit(TP): 4400 - 4405

❎ Stoploss(SL): 4390

Note capital management to ensure account safety

Gold Bulls Eye the Horizon: Old ATH is the Next DestinationXAUUSD H1 – Market Analysis

1. Current Market Structure

Gold continues to exhibit a powerful bullish structure on the H1 timeframe.

The price action is characterized by a series of aggressive impulsive moves followed by shallow consolidations, maintaining the higher high – higher low sequence.

Currently, the market is holding steady above a freshly established support base, indicating that the uptrend is healthy and not overextended.

2. Key Zones & Market Positioning

Main Support Zone: 4430 – 4437

-> This is the primary demand area where buyers successfully absorbed selling pressure.

Current Trading Range: 4437 – 4499

Resistance / Target Zones:

Resistance Zone: 4499 – 4510 (The final hurdle before the open sky).

Target 2: ~4499.

Target 3: ~4524.

Final Target: 4549 (Old ATH).

The bullish roadmap remains intact as long as the 4430 support level is defended.

3. Liquidity & Price Behavior

The upward slope of the EMAs provides a clear trend filter, acting as dynamic support for every minor dip.

Long lower wicks at the 4437 level confirm that sell-side liquidity is being aggressively harvested by institutional buyers.

Price is currently tightening its range, a classic sign of energy accumulation before a breakout attempt toward the upper resistance levels.

4. Today’s Market Scenario

🔼 Primary Scenario – Bullish Continuation

Expected flow: Price continues to consolidate above the 4437 zone to build momentum.

A decisive breach of the 4499 – 4510 resistance will likely lead to a rapid expansion toward Target 3 (4524) and the ultimate retest of the Old ATH at 4549.

🔽 Invalidation Scenario

A breakdown and sustained close below 4430 would invalidate the immediate bullish thesis, potentially leading to a deeper corrective phase toward 4408.

5. Trading Perspective

Bias: Strongly Bullish – Buy the pullback.

Strategy: Focus on long entries near the 4430 – 4437 support zone.

Avoid chasing the price as it approaches the 4500 psychological level; instead, wait for price action confirmation (rejection of the dip) to enter with a superior risk/reward ratio.

Summary

Gold is in a clear "Buy the Dip" regime.

The 4430 – 4437 zone is the foundation for the next leg up.

As long as this floor holds, the path of least resistance is toward 4549.

Roadmap: Consolidation → Support Hold → Expansion to ATH.

BTC $94.5K Fatigue: Decoding the $92.3K Line in the SandBitcoin (BTC/USD) Technical Breakdown

Bitcoin recently completed a steep impulsive move, encountering significant selling pressure at the Resistance Zone ($94,400 – $94,600). The appearance of long upper wicks (rejection candles) at this level confirms that profit-taking is underway, pushing price back to test internal liquidity.

The pair is currently trading near the blue EMA, which serves as immediate dynamic support. However, the short-term bias remains tilted toward a deeper "healthy pullback" to re-accumulate buy orders. The Support Zone around $92,300 is the critical "pivot area" where institutional demand is expected to resurface.

Key technical scenarios:

- Base-case scenario: Following the projected path on the chart, BTC is likely to continue its retracement toward the $92,300 support. A bullish reversal signature (such as a pin bar or engulfing pattern) at this level would confirm a Higher Low (HL) and set the stage for a recovery test of $93,300 and beyond.

- Bullish continuation: Should the bulls defend the $92,900 level and decisively reclaim $93,500, the correction may end prematurely, opening the door for an immediate retest of the $94,500 supply zone.

- Bearish risk: A decisive close below the $92,000 psychological level would invalidate the immediate bullish structure. This would expose BTC to a deeper correction toward $91,000 or the $90,000 liquidity pool.

Macro Drivers Impacting Bitcoin

As of January 2026, Bitcoin's price action is heavily influenced by institutional flows and global macro shifts:

- ETF Inflows & Institutional Floor: The maturity of Spot ETFs has created a persistent "floor" for price. Current volatility is likely driven by early-year portfolio rebalancing by major asset managers.

- Monetary Policy & Fed Outlook: Market participants are closely monitoring Fed signals. Expectations of quantitative easing or rate pauses in Q2 2026 continue to support the long-term "debasement trade" narrative, favoring BTC.

- Geopolitical Risk Premium: Ongoing tensions in key global regions (Middle East/Eastern Europe) reinforce Bitcoin’s status as "Digital Gold." Safe-haven flows tend to limit the downside during macro uncertainty.

- Risk-On vs. Risk-Off Sentiment: The Fear & Greed Index remains in "Greed" territory. While the trend is bullish, this high sentiment often precedes "liquidity sweeps" where over-leveraged long positions are flushed out at key support levels.

Summary

Technically, Bitcoin is undergoing a textbook correction after hitting a major resistance ceiling. This phase is essential for market health, allowing for the rotation of capital and the removal of weak-handed leverage.

The $92,300 support is the line in the sand. As long as price holds above this zone, the broader bullish trend remains intact. Traders should remain disciplined, waiting for confirmed price rejection at support rather than chasing the move mid-range.

Fundamental Market Analysis for January 6, 2025 GBPUSDGBP/USD remains near 1.35 after a strong rise at the end of last year, but the dynamics increasingly depend on sentiment around the US dollar. Following a volatility spike driven by foreign-policy headlines, the market is returning to macroeconomic assessment, while the dollar is trying to hold ground amid demand for liquidity.

For the pound, the key drivers are expectations for the Bank of England’s rate path and the state of the UK economy. Signs of slowing growth and cautious consumer behavior raise the likelihood of further policy easing if inflation continues to cool and the labor market weakens. This limits the sustainability of sterling gains even during short periods of dollar softness.

In the US, labor-market and price reports are important this week: strong figures could restore support for the dollar via higher yields and a repricing of rate expectations. In this environment, GBP/USD looks vulnerable to a pullback, especially if participants reduce risk exposure.

Trading recommendation: SELL 1.35600, SL 1.36000, TP 1.34400

Gold is currently experiencing strong growth.1️⃣ Trendline

Short-term trend: bullish pullback within a larger bearish trend.

Price has broken the descending trendline → confirming a short-term structural shift.

However, price is still below a major supply zone → no medium–long-term reversal yet.

2️⃣ Support

4,400 – 4,402

Key support zone

Confluence of: demand zone + Fibonacci 0.5–0.618 + EMA

→ Area for technical buy reactions / holding buy positions.

Below 4,400: short-term bullish structure is invalidated.

3️⃣ Resistance

4,515 – 4,517

Strong resistance zone

Confluence of: Fibonacci 1.618 + previous supply zone

→ Prioritize sell reactions, avoid FOMO buying.

4️⃣ Fibonacci

Current rebound has reached:

1.0 → trendline break

Next target: 1.618 (4,515)

Only a clean breakout above 1.618 would open the door for a higher bullish scenario.

📌 Trade Setup

BUY GOLD: 4402 – 4400

Stop Loss: 4390

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4515 – 4517

Stop Loss: 4527

Take Profit: 100 – 300 – 500 pips

H4 US Dollar Index (DXY) – Technical AnalysisThe US Dollar Index (DXY) is trading near 98.70 on the 4H chart, and it’s looking like it’s going to continue its recovery within that rising channel from the low at 97.75. Price has managed to take back the 50% Fib level at 98.24 and is now testing the resistance at 98.74 – which just so happens to be where a prior support level used to be.

The 200-EMA at 99.00 is a big deal as far as upside goes, while the supports sit at 98.12 and 97.9. RSI is sitting at 58, which is a pretty good sign. The trade idea is to pick up a few dollars on the dip near 98.30 and aim for 99.20, but set a stop loss below 97.95.

What's new in gold prices this week? 01/05/20261️⃣ Trendline

Short-term: Bearish. Price remains below the descending trendline → selling pressure is still dominant.

Structure: Weak technical pullback, forming a lower high → no clear reversal signal yet.

2️⃣ Resistance

4,445 – 4,447: Strong resistance, confluence of Fibonacci 0.618 + trendline touch → ideal sell zone if confirmation appears.

3️⃣ Support

4,396 – 4,394: Near-term support + previous breakout zone + lower trendline touch.

4,333 – 4,331: Major support + GAP area + lower trendline touch.

4️⃣ Scenarios

Priority: Look for SELL setups at resistance, trading with the trend.

BUY: Only reactive buys at strong support levels, no FOMO.

Trade Plan

BUY GOLD: 4333 – 4331

Stop Loss: 4321

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4445 – 4447

Stop Loss: 4457

Take Profit: 100 – 300 – 500 pips

Weekly outlook: XAUUSD, #SP500, #BRENT | 09 January 2026XAUUSD: BUY 4415.50, SL 4380.00, TP 4522.00

Gold starts the week near 4415.50 per ounce: thin trading at the beginning of the year has amplified reactions to news from Venezuela and broader geopolitical tension, lifting demand for safe-haven assets. Support also comes from expectations of lower US interest rates in 2026 and continued buying by central banks.

For the week of January 5–9, the focus is on US data on business activity and the labor market, with the key event being Friday’s jobs report. Weaker figures could strengthen interest in gold, while strong numbers may boost the dollar and cool the market temporarily.

Trading recommendation: BUY 4415.50, SL 4380.00, TP 4522.00

#SP500: BUY 6858, SL 6778, TP 7098

The #SP500 is holding around 6858 at the start of the first full week of 2026: investors are weighing geopolitics and oil, but the main guide remains expectations for US interest rates. After a strong finish to 2025, the market enters the week with a cautious tone.

The week of January 5–9 is packed with US statistics, with Friday’s employment report as the highlight. Moderate data would support equities through hopes of lower borrowing costs, while a surprise rise in inflation expectations and yields could increase pressure on the stock market.

Trading recommendation: BUY 6858, SL 6778, TP 7098

#BRENT: SELL 60.43, SL 62.10, TP 55.40

#BRENT is trading near 60.43 per barrel: news around Venezuela has added sharp swings, but the market sees no major supply disruptions for now. OPEC+ is keeping current output settings, and talk of potential supply growth ahead is capping prices.

For the week of January 5–9, the spotlight is on demand signals via US statistics and updates from China, as well as the regular US inventory figures. If demand stays soft and the dollar strengthens, oil risks sliding; however, tighter sanctions or logistical disruptions could quickly restore support.

Trading recommendation: SELL 60.43, SL 62.10, TP 55.40

Can the Venezuela Crisis Spark the Next Rally?Gold (XAUUSD) Price Outlook: Can the Venezuela Crisis Spark the Next Rally?

1. Market Context: Margin Hike Drives Forced Selling, Not Structural Weakness

Gold closed last week with a sharp downside move, but the decline was driven primarily by a technical and mechanical factor rather than a deterioration in fundamentals. The increase in futures margin requirements forced leveraged traders to liquidate positions, triggering a cascade of sell orders. This type of margin-driven selloff typically exaggerates price moves and does not, by itself, signal a change in the broader trend. Despite the magnitude of the drop, the long-term bullish structure remains intact.

2. Trader Behavior Shift: From Momentum Chasing to Selective Positioning

For several months, traders aggressively chased upside momentum, consistently lifting offers as price moved higher. The margin hike has altered that behavior. With higher capital requirements, participants are now more selective, focusing on value zones and confirmation rather than momentum alone. Until upside momentum re-emerges, gold is likely to trade with more caution and tactical positioning rather than impulsive trend extension.

3. Weekly Close Snapshot: Sharp Loss, Trend Still Preserved

XAUUSD settled last week at $4,332.06, down $201.14 (-4.44%). While the weekly decline was significant, it did not violate the core structure of the uptrend. From a professional trading perspective, this type of correction is consistent with position rebalancing rather than trend failure, especially after an extended rally.

4. Primary Technical Structure: Defining Bullish and Bearish Boundaries

From a technical standpoint, the main trend remains bullish. A sustained break above $4,550 would confirm trend continuation and signal renewed upside expansion. Conversely, the trend would only shift decisively bearish if price breaks below $3,886 on a weekly closing basis. Until one of these levels is resolved, gold remains structurally bullish within a corrective phase.

5. Key Decision Zone: $4,218–$4,139 Sets the Near-Term Tone

The most critical area in the current structure lies between $4,218 and $4,139, a key retracement zone. Price reaction here will determine the next directional move. Strong buying interest on the first test would suggest the formation of a secondary higher low, reinforcing bullish continuation toward the record high near $4,550. Failure to hold $4,139, however, would signal weakness and increase the probability of a deeper corrective leg toward $3,886.

6. Long-Term Value Area: Where Institutional Buyers May Step In

For longer-term positioning, the weekly chart highlights a high-confluence support cluster between $3,545 and $3,472. This zone aligns with the 50% retracement of the rally from the November 2024 low at $2,537, as well as the 52-week moving average near $3,472. As long as this moving average holds, the broader market regime remains firmly in “buy-the-dip” mode rather than a trend reversal environment.

7. Geopolitical Catalyst: Venezuela Crisis Adds Risk Premium

Fundamentally, gold has received a fresh tailwind from rising geopolitical uncertainty. Developments in Venezuela escalated after the U.S. launched a military strike and detained President Nicolás Maduro on criminal charges. President Donald Trump’s statement that the U.S. would oversee Venezuela during a transition period has added further uncertainty. Any escalation or instability tied to this situation has the potential to reintroduce a geopolitical risk premium into gold prices.

8. Macro Focus: U.S. Jobs Data and Fed Policy Expectations

Attention now turns to the upcoming December U.S. jobs report, which will be closely monitored by both traders and policymakers. Federal Reserve officials have emphasized that labor market conditions will play a key role in shaping the rate-cut path into 2026. Recent policy minutes revealed internal divisions, with labor data and inflation as the primary points of disagreement. A weaker employment print could strengthen expectations for additional rate cuts, indirectly supporting gold.

9. Week Ahead Outlook: Volatility Before Clarity

In the near term, gold is likely to experience heightened volatility as markets react to developments in Venezuela. Bias may remain cautiously to the upside as long as geopolitical uncertainty persists. However, the more decisive macro-driven move may not materialize until after the jobs data is fully absorbed. For now, gold sits at a critical junction—supported by long-term structure, constrained by near-term resistance, and highly sensitive to geopolitical and macroeconomic headlines.

Gold Turns at Key Support — Break or Fake Into Resistance?Gold on the H1 timeframe has completed a clean rebound from the major support zone, confirming that buyers are actively defending this area. The sharp rejection from the lows suggests the recent sell-off was corrective rather than the start of a sustained bearish trend.

Price is now recovering above the short-term structure and pushing back toward the key resistance zone around 4,425–4,450. This area is critical, as it previously acted as a strong supply region and aligns with prior breakdown levels. The current move should be treated as a reaction leg, not a confirmed continuation yet.

Two clear scenarios are in play.

Scenario 1: Price holds above the recent pullback level, consolidates, and breaks cleanly through resistance. This would open the path toward higher levels and a potential retest of the upper range and ATH zone.

Scenario 2: Price stalls or rejects at resistance, forming a lower high, which would signal ongoing range behavior and a possible rotation back toward mid-range or support.

In summary, Gold has turned bullish from support , but confirmation depends on acceptance above resistance. Until a clean breakout occurs, the market remains reactive and range-controlled, with resistance being the key decision point.

Can Bitcoin Hold This Level?Hello Traders,

On the H1 timeframe, Bitcoin is currently trading back into a clearly defined resistance zone after recovering from the prior sell-off. The recent price action shows a series of higher lows, indicating short-term bullish pressure rebuilding as price rotates upward toward supply.

This resistance zone is a key decision area. Historically, this level has acted as a distribution zone, and price reaction here will determine whether the move develops into a sustained continuation or another corrective rotation.

If price manages to break above the resistance and hold with acceptance, the structure opens the path toward higher targets, as marked on the chart. In this scenario, continuation would likely unfold in stages, with upside extensions toward Target 1, then Target 2, and potentially Target 3, assuming structure remains intact.

However, failure to accept above resistance would likely trigger a pullback. A rejection from this zone could rotate price back toward the mid-range support levels. As long as price holds above the broader support zone, such a move would still be considered a corrective pullback within a developing recovery, not a full bearish reversal.

The bullish continuation scenario is invalidated if price decisively breaks below the marked support zone and shows acceptance below it. That would signal a structural failure and reopen the downside.

At this point, Bitcoin is not at a high-conviction entry area but at a decision zone. Patience and confirmation are required. Let the market show whether it accepts above resistance or rotates back toward support before committing to directional bias.

Share your view below.

USDJPY — Multi-Timeframe Short Bias (1M, 1Week,D / 4H)After a choppy bullish move, price is now reacting to a fresh 4H supply zone, where selling pressure is beginning to show. This area aligns well with higher-timeframe resistance and presents a potential downside opportunity.

From a daily and 4H perspective, market structure shows signs of weakening momentum as price struggles to continue higher. The setup highlighted on the chart offers a 1:2 risk-to-reward, targeting the downside if supply holds.

Zooming out to the monthly timeframe, price is currently trading into a fresh higher-timeframe supply zone. As we move into January, momentum appears to be slowing, I suggesting distribution at these levels.

This technical view is further supported by fundamentals:

Recent COT data shows increasing strength in the Japanese Yen

The U.S. Dollar is weakening as price reacts to higher-timeframe resistance

If supply continues to hold, price could rotate lower toward the 149.960 zone.

This is my current bias on USDJPY.

As always, waiting for confirmation is key.

Happy trading 📊