The Euro’s Bullish Blueprint: Identifying the Breakout TriggerHello everyone,

On the H1 timeframe, the key focus right now is not the minor fluctuations around the EMA 50, but how EURUSD is positioning itself within a tight consolidation range between a proven support base and a looming resistance ceiling.

Structurally, the market has transitioned from a sharp impulsive drop into a steady recovery phase, characterized by the formation of higher lows. Price is currently grappling with the EMA 50 and the lower boundary of the 1.1750–1.1760 resistance zone. This area represents a significant hurdle; a successful breach here would signal that the corrective phase is over and that buyers have successfully reclaimed the mid-term momentum.

Following the recent bounce from the 1.1710–1.1720 support zone, EURUSD is showing signs of accumulation. This support area is technically critical as it represents a "demand pocket" where buyers have previously intervened to halt deeper declines. The current price action suggests that the market is gathering liquidity for a potential push higher, rather than preparing for a breakdown.

From a price action perspective, we are seeing a "squeeze" against the resistance. As long as the higher-low structure remains intact, the bias leans toward an upside resolution. The move appears to be a preparation for a trend continuation toward the higher targets identified on the chart, provided the resistance zone is flipped into support.

The projected path on the chart reflects this logic:

- A decisive break above the 1.1760 Resistance Zone to reach Target 1.

- A technical pullback to retest the breached zone, confirming it as new support.

- A secondary rally toward Target 2 (1.1779) and eventually Target 3 (1.1807).

Only a clean breakdown and acceptance below the 1.1710 support zone would invalidate this recovery scenario and shift the focus back to the bearish lows. Conversely, a daily close above the current resistance zone would be the definitive signal that a larger bullish cycle has commenced.

Until the breakout is confirmed, EURUSD remains in a "wait-and see" compression. Patience around these key levels is essential to avoid being caught in a fake-out.

Wishing you all effective and disciplined trading.

Analysis

At Trendline Resistance — Pullback Before the Next Leg?BITSTAMP:BTCUSD is pressing into the descending trendline resistance after a strong impulsive rally. Momentum remains constructive, but price is now at a reaction area, where profit-taking and pullbacks are likely. The broader structure still favors continuation as long as higher lows are maintained.

The EMA cluster is rising and aligning with a strong demand zone, supporting a dip-buying framework rather than immediate reversal.

Resistance: 93,200 – 93,800 (trendline)

Support: 89,200 – 89,800 (strong demand)

EMA support: ~90,600

➡️ Primary: rejection at trendline → pullback into 89.2k–89.8k → higher low → continuation higher.

⚠️ Risk: clean breakout and acceptance above trendline opens extension toward new highs without a deep pullback.

BTC $94.5K Fatigue: Decoding the $92.3K Line in the SandBitcoin (BTC/USD) Technical Breakdown

Bitcoin recently completed a steep impulsive move, encountering significant selling pressure at the Resistance Zone ($94,400 – $94,600). The appearance of long upper wicks (rejection candles) at this level confirms that profit-taking is underway, pushing price back to test internal liquidity.

The pair is currently trading near the blue EMA, which serves as immediate dynamic support. However, the short-term bias remains tilted toward a deeper "healthy pullback" to re-accumulate buy orders. The Support Zone around $92,300 is the critical "pivot area" where institutional demand is expected to resurface.

Key technical scenarios:

- Base-case scenario: Following the projected path on the chart, BTC is likely to continue its retracement toward the $92,300 support. A bullish reversal signature (such as a pin bar or engulfing pattern) at this level would confirm a Higher Low (HL) and set the stage for a recovery test of $93,300 and beyond.

- Bullish continuation: Should the bulls defend the $92,900 level and decisively reclaim $93,500, the correction may end prematurely, opening the door for an immediate retest of the $94,500 supply zone.

- Bearish risk: A decisive close below the $92,000 psychological level would invalidate the immediate bullish structure. This would expose BTC to a deeper correction toward $91,000 or the $90,000 liquidity pool.

Macro Drivers Impacting Bitcoin

As of January 2026, Bitcoin's price action is heavily influenced by institutional flows and global macro shifts:

- ETF Inflows & Institutional Floor: The maturity of Spot ETFs has created a persistent "floor" for price. Current volatility is likely driven by early-year portfolio rebalancing by major asset managers.

- Monetary Policy & Fed Outlook: Market participants are closely monitoring Fed signals. Expectations of quantitative easing or rate pauses in Q2 2026 continue to support the long-term "debasement trade" narrative, favoring BTC.

- Geopolitical Risk Premium: Ongoing tensions in key global regions (Middle East/Eastern Europe) reinforce Bitcoin’s status as "Digital Gold." Safe-haven flows tend to limit the downside during macro uncertainty.

- Risk-On vs. Risk-Off Sentiment: The Fear & Greed Index remains in "Greed" territory. While the trend is bullish, this high sentiment often precedes "liquidity sweeps" where over-leveraged long positions are flushed out at key support levels.

Summary

Technically, Bitcoin is undergoing a textbook correction after hitting a major resistance ceiling. This phase is essential for market health, allowing for the rotation of capital and the removal of weak-handed leverage.

The $92,300 support is the line in the sand. As long as price holds above this zone, the broader bullish trend remains intact. Traders should remain disciplined, waiting for confirmed price rejection at support rather than chasing the move mid-range.

Gold Bulls Eye the Horizon: Old ATH is the Next DestinationXAUUSD H1 – Market Analysis

1. Current Market Structure

Gold continues to exhibit a powerful bullish structure on the H1 timeframe.

The price action is characterized by a series of aggressive impulsive moves followed by shallow consolidations, maintaining the higher high – higher low sequence.

Currently, the market is holding steady above a freshly established support base, indicating that the uptrend is healthy and not overextended.

2. Key Zones & Market Positioning

Main Support Zone: 4430 – 4437

-> This is the primary demand area where buyers successfully absorbed selling pressure.

Current Trading Range: 4437 – 4499

Resistance / Target Zones:

Resistance Zone: 4499 – 4510 (The final hurdle before the open sky).

Target 2: ~4499.

Target 3: ~4524.

Final Target: 4549 (Old ATH).

The bullish roadmap remains intact as long as the 4430 support level is defended.

3. Liquidity & Price Behavior

The upward slope of the EMAs provides a clear trend filter, acting as dynamic support for every minor dip.

Long lower wicks at the 4437 level confirm that sell-side liquidity is being aggressively harvested by institutional buyers.

Price is currently tightening its range, a classic sign of energy accumulation before a breakout attempt toward the upper resistance levels.

4. Today’s Market Scenario

🔼 Primary Scenario – Bullish Continuation

Expected flow: Price continues to consolidate above the 4437 zone to build momentum.

A decisive breach of the 4499 – 4510 resistance will likely lead to a rapid expansion toward Target 3 (4524) and the ultimate retest of the Old ATH at 4549.

🔽 Invalidation Scenario

A breakdown and sustained close below 4430 would invalidate the immediate bullish thesis, potentially leading to a deeper corrective phase toward 4408.

5. Trading Perspective

Bias: Strongly Bullish – Buy the pullback.

Strategy: Focus on long entries near the 4430 – 4437 support zone.

Avoid chasing the price as it approaches the 4500 psychological level; instead, wait for price action confirmation (rejection of the dip) to enter with a superior risk/reward ratio.

Summary

Gold is in a clear "Buy the Dip" regime.

The 4430 – 4437 zone is the foundation for the next leg up.

As long as this floor holds, the path of least resistance is toward 4549.

Roadmap: Consolidation → Support Hold → Expansion to ATH.

GBPAUD (Pending SELL)GA is known to be volatile and move fast I can see this trade idea play out in the near future, If price does break above my zone it will most like go to 2.04300 next but for now its all sells until zones get invalidated... If price liquidates 1.99600 before hitting my pending short I would not look for the short at my current price anymore I would wait because that's the price I am currently targeting.

USD/JPY(20260107)Today's AnalysisMarket News:

① Venezuela and the United States are negotiating on oil exports to the US.

② In the early years of Maduro's rule, Venezuela shipped $5.2 billion worth of gold to Switzerland.

③ Shipping data shows that in the past five days, Venezuela's main oil terminals have not shipped crude oil for export to any destination other than Chevron in the United States.

Technical Analysis:

Today's Buy/Sell Threshold:

156.52

Support and Resistance Levels:

157.15

156.91

156.76

156.28

156.13

155.89

Trading Strategy:

If the price breaks above 156.76, consider buying, with a first target price of 156.91.

If the price breaks below 156.52, consider selling, with a first target price of 156.28.

LTC/USDT 1D Chart 🔎 Market Structure

The market is in a downtrend (a series of lower highs and lower lows).

The price is moving within a descending channel (black lines).

The recent move is a rebound from the lower demand zones, but the trend has not yet been broken.

📉 Trend & Price Action

The main downtrend line has not been broken – the price has reached it and is reacting.

The current move looks like a pullback/upward correction, not a trend reversal.

No clear higher high → the structure remains bearish.

🟢 Key Levels

Resistance (sell zones)

86.84 USDT – local resistance (currently being tested)

95.83 USDT – strong structural resistance

103.54 USDT – previous downside base

110.66 USDT – very strong resistance (key to trend reversal)

Support (buy zones)

78.67 USDT – local support

72.25 USDT – strong demand zone

63.14 USDT – critical support (channel bottom)

📊 Indicators

Stochastic RSI

Currently in the overbought zone (>80)

Historically, on this chart, → often ends in a correction

Signal: watch out for shorts / profit-taking

CHOP Index

High → market was in consolidation

Recent CHOP breakout down → possible impulse but not yet confirmed by volume

🧠 Scenarios

🔴 Baseline scenario (more likely)

Rejection at 86–88 USDT

Return to around 78.67 → 72.25

Continuation of the downtrend

🟢 Alternative scenario (bullish, conditional)

Daily close above 95.83

Then a breakout of 103.54

Only 110.66 = a real trend change to up

🎯 Final conclusion

This is a correction in a downtrend, not a trend reversal.

Shorts are logical under resistance

Longs are only short-term/scalp

Swing longs only after a breakout of 103–110

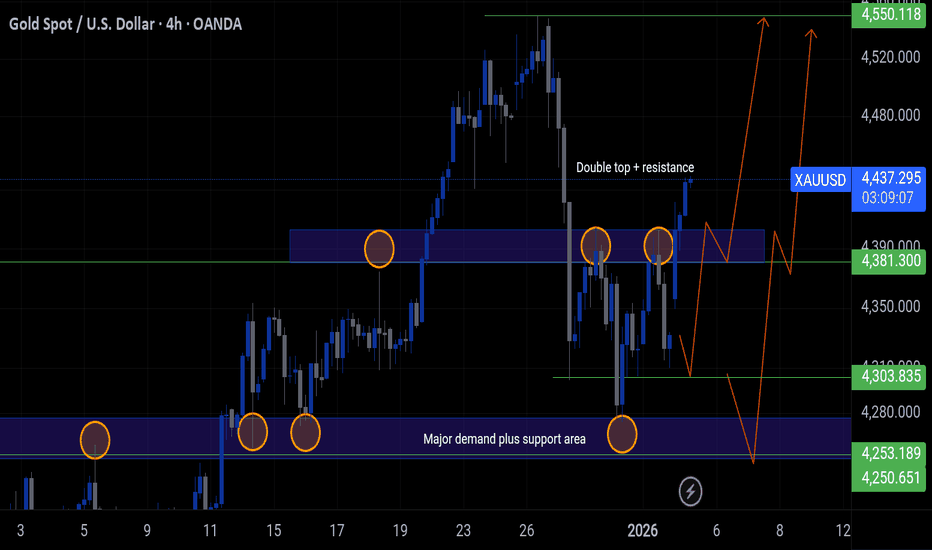

xauusd 2026-2027As of January 2026, the XAU/USD (Gold/USD) pair is coming off an extraordinary performance in 2025, where it saw gains of over 60%, the highest since 1979.The consensus among major financial institutions like J.P. Morgan, UBS, and Goldman Sachs is that the bullish momentum will carry through 2026, though the pace may become more volatile as it reaches new psychological milestones.

📊 Market Price Forecasts

Most analysts have significantly revised their targets upward following the record-breaking surge in late 2025.

Institution2026 Target (Year-End)Primary Outlook

J.P. Morgan $5,055 /ozBullish; driven by investor diversification.

Goldman Sachs $4,900 /ozBullish; structural demand from central banks.

UBS $5,000 /ozBullish; lower real yields and policy uncertainty.

Bank of America $5,000 /ozBullish; safe-haven demand remains high.

🔍 Fundamental Analysis

The 2026 outlook is anchored by several structural shifts in the global economy:1. De-dollarization & Central Bank DemandCentral banks—particularly in Poland, Kazakhstan, Brazil, and China—are no longer just "opportunistic" buyers; they are strategic diversifiers. While 2026 demand might not hit the 1,000-tonne-per-year peak of the previous three years, it is expected to remain high (averaging 750+ tonnes), providing a solid price floor.2. Monetary Policy & Real YieldsAs the Federal Reserve's easing cycle matures in 2026, real yields are expected to drift lower. Historically, gold thrives in the 4–6 months following initial rate cuts. Investors are increasingly viewing gold not just as a hedge against inflation, but as a hedge against rising global debt levels.3. Geopolitical Risk PremiumOngoing tensions in the Middle East and Eastern Europe, combined with new trade uncertainties (tariffs and domestic policy shifts in the U.S.), continue to drive "flight-to-safety" flows into XAU/USD.

📈 Technical Analysis

(XAU/USD)As of early January 2026, gold is trading near $4,400.The Bullish Channel: The weekly chart shows Gold moving within a well-defined ascending channel. A sustained break above $4,655 would confirm a move toward the $5,000 psychological barrier.Key Support Levels: If a correction occurs, the first major support sits near $4,255. A deeper correction could see a test of the $4,150 – $4,175 zone, which represents a strong "buy the dip" area for long-term investors.Momentum Indicators: The RSI is currently in overbought territory on higher timeframes. While this suggests strength, it also signals the potential for a "blow-out" phase or a sharp, healthy distribution (correction) before the next leg up.⚠️ Key Risks to the Bullish CaseWhile the trend is upward, traders should watch for:Strong Economic Rebound: If the U.S. achieves 6–7% growth with low inflation, the need for a safe haven diminishes.Policy Reversal: A "higher for longer" stance on interest rates by major central banks would increase the opportunity cost of holding non-yielding gold.Liquidity Squeeze: Sharp corrections in the equity markets can sometimes lead to temporary gold sell-offs as investors cover margin calls

Gold’s Disciplined Climb: Is the $4,541 Target the NextXAUUSD / H1 — Market Update

Gold is maintaining a highly disciplined bullish posture, advancing within a well-defined ascending parallel channel. The market structure is characterized by a textbook series of Higher Highs and Higher Lows (noted by the orange reaction circles), signaling sustained buying pressure and strong trend health. Currently, price is navigating the upper half of the channel, eyeing a major liquidity pool sitting at the horizontal resistance level.

The technical alignment is strongly supportive of the upside. Both the EMA 34 (Blue) and EMA 89 (Yellow) are sloping upward with healthy separation, acting as dynamic support zones. The current price action suggests a brief period of consolidation or a minor "buy-the-dip" opportunity as the market prepares for the next impulsive leg toward the psychological and technical targets above.

Key Levels

Resistance: 4,520 (Channel Top) – 4,541 (Major Horizontal Ceiling)

Support: 4,445 – 4,455 (Channel Lower Boundary / Demand Zone)

EMA Support: ~4,428 (EMA 34)

Trading Scenarios

➡️ Primary: A shallow pullback toward the 4,445 – 4,455 zone (intercepting the lower trendline) → validation of a Higher Low → continuation higher toward the 4,541 liquidity target.

⚠️ Risk: A decisive hourly close below 4,428 (EMA 34) would signal a temporary shift in momentum, likely leading to a deeper correction toward the EMA 89 (~4,400) before any further upside attempts.

Market Analysis & Reaffirmation of Trading PlanMarket Analysis & Reaffirmation of Trading Plan

- Today's market is moving exactly as planned yesterday. After a consolidation phase and absorption of liquidity around the 4.38x – 4.40x range, the price has clearly broken out, confirming the return of large capital flows. The market structure on the H4 timeframe has shifted to a higher high – higher low, indicating that the uptrend has been established and is being maintained.

- The price holding above the breakout zone not only reinforces the trend but also proves that following the structure was the correct choice. The current corrections are merely technical, serving to create more liquidity for the market to continue expanding its range.

Message to the community:

- The market is not random. When you correctly read the structure, identify the correct price zone, and patiently wait for confirmation, the advantage will automatically be on your side.

- A correct plan doesn't need fanfare The results are the clearest evidence of a leader's position.

TODAY'S LIMITED STRATEGY JAN 6

Intraday trading: Increase

📌 SET UP 1. Timming Sell Zone

XAUUSD SELL ZONE: 4517 - 4520

💰 Take Profit(TP): 4514 - 4509

❎ Stoploss(SL): 4524

Note capital management to ensure account safety

📌 SET UP 2. Timming Buy Zone

XAUUSD BUY ZONE: 4394 - 4397

💰 Take Profit(TP): 4400 - 4405

❎ Stoploss(SL): 4390

Note capital management to ensure account safety

EURUSD Strong Bearish Continuation ScenarioQuick Summary

EURUSD continues to decline with strong momentum and is expected to extend the move toward 1.16610. There is currently no technical reason supporting a bullish reversal since all upside levels are already mitigated. However, if price rallies first toward the equal highs at 1.17633, that area would also present a valid sell opportunity.

Full Analysis

EURUSD remains under clear bearish pressure and continues to move lower with strong momentum. The current price action does not show any meaningful signs of exhaustion or accumulation that would justify a bullish scenario at this moment. All nearby upside levels have already been mitigated, removing the incentive for the market to push higher in the short term.

Given this context, the most likely path for price is a continuation of the decline toward the 1.16610 level. This level represents the next logical downside objective where liquidity may be resting and where the market could pause or reassess direction.

That said, an alternative scenario must also be considered. If price unexpectedly retraces higher before continuing its drop and reaches the equal highs at 1.17633, this area would act as a strong sell zone. Equal highs often attract liquidity, and a reaction from this level would offer another high probability opportunity to align with the prevailing bearish bias.

BTCUSDT Long: Uptrend Continues Toward 94,500 ResistanceHello traders! Here’s a clear technical breakdown of BTCUSDT (4H) based on the current chart structure. BTCUSDT initially traded within a well-defined descending channel, reflecting sustained bearish pressure during that phase. This move ended with a clear pivot point, followed by a strong breakout from the descending channel, signaling a shift in market control from sellers to buyers. After this breakout, price transitioned into a broad range, where BTC consolidated for an extended period, showing balance between supply and demand with multiple internal reactions.

Currently, BTC is approaching a key Supply Zone around the 94,500 level, where previous selling pressure is expected to re-emerge. This area aligns with the upper boundary of the ascending channel, increasing the likelihood of a reaction. Below current price, the Demand Zone near 86,800 remains a critical support level, marking the prior breakout area and the base of the bullish structure.

My scenario: as long as BTCUSDT holds above the Demand Zone and stays within the ascending channel, the bullish bias remains intact. I expect price to test the 94,500 Supply Zone, where a reaction or short-term pullback may occur. A clean breakout and acceptance above supply would signal further upside continuation. However, a strong rejection from supply followed by a breakdown below channel support would suggest a deeper corrective move. For now, structure favors buyers while price remains within the ascending channel. Manage your risk!

BTCUSDT: Sellers Defend 91,800 as Bullish Momentum WeakensHello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT spent a significant period trading inside a well-defined range, where price oscillated between clear support and resistance levels, showing indecision and balanced participation from both buyers and sellers. Multiple breakout attempts from this range failed, confirming the strength of the boundaries and the lack of sustained momentum during that phase. Eventually, price broke out of the range to the upside and transitioned into a clean ascending channel, signaling a short-term bullish shift. This move was supported by higher highs and higher lows, reflecting increasing buyer control. However, as price approached the major Resistance Zone around 91,800, bullish momentum started to fade. The market printed reactions and hesitation near this resistance, indicating strong selling interest at higher levels.

Currently, the upper boundary of the ascending channel is being tested, and price is currently struggling to hold above the 90,000 Support Zone, which previously acted as a key breakout and demand area. The recent price action suggests that the upside move is losing strength and may be corrective rather than impulsive.

My Scenario & Strategy

My primary scenario: as long as BTCUSDT remains below the 91,800 Resistance Zone and fails to reclaim the upper part of the ascending channel, the bias favors a short-term bearish correction. A rejection from resistance increases the probability of a pullback toward the 90,000 Support Zone, which is the first key downside target. If this support fails to hold, further downside continuation toward lower range levels becomes possible.

However, a strong bullish breakout and acceptance above 91,800 would invalidate the short bias and open the door for renewed upside continuation within or above the channel. For now, price is at a critical decision area, with sellers defending resistance and buyers attempting to hold structure. Caution and proper risk management are essential in this zone.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

XAUUSD Price Forecast: US Venezuela Tensions Test $4,500Market Overview

- Gold (XAU/USD) opened the week with strong upside momentum, briefly pushing above the $4,400 handle during the early European session. However, that initial advance stalled relatively quickly. The primary driver behind the early strength was not technical in nature, but rather a renewed surge in geopolitical risk. Developments in Latin America, particularly the U.S.-led military action in Venezuela and the arrest of President Nicolás Maduro, have significantly increased global risk sensitivity. Additional rhetoric suggesting that Colombia and Mexico could face similar pressure has further unsettled markets.

- Beyond Latin America, unresolved conflicts in Ukraine, persistent instability involving Iran, and ongoing tensions in Gaza continue to reinforce a fragile global backdrop. In this environment, capital preservation has become a priority. Investors are rotating into traditional safe-haven assets, and gold remains one of the primary beneficiaries of this risk-off positioning.

Strong U.S. Dollar Fails to Suppress Gold Demand

- Despite the broader risk-off tone supporting the U.S. dollar, gold has proven resilient. Normally, a stronger dollar would act as a headwind for bullion, but current market conditions suggest that safe-haven demand is strong enough to offset currency pressure. This divergence highlights how elevated geopolitical uncertainty is currently overriding conventional correlations.

- Looking ahead, U.S. macroeconomic data will be a key driver. Inflation-related releases throughout the week, followed by Friday’s U.S. employment report, are critical inputs for Federal Reserve expectations. Any signs of labor market softening could reinforce expectations for additional rate cuts, which would further support gold by reducing real yield pressure.

Short-Term Forecast

In the near term, gold is likely to remain range-bound as the market digests both geopolitical headlines and upcoming economic data. A consolidation range between $4,410 and $4,450 appears reasonable over the next few sessions. As long as safe-haven demand remains intact, upside pressure persists, and a clean break above the $4,500 level cannot be ruled out.

Technical Structure and Key Levels

- From a technical standpoint, gold is currently trading near $4,421 after rebounding from the recent sharp pullback off the $4,550 high. Price has successfully reclaimed the $4,412 Fibonacci retracement level, and short-term EMA closes above this zone suggest improving near-term structure. Importantly, the broader uptrend that has been in place since December remains intact.

- Imediate resistance is located near $4,445, aligning with the 61.8% Fibonacci retracement, followed by a higher resistance zone around $4,498. Recent price action has produced a sequence of higher lows, signaling renewed dip-buying interest and improving market confidence.

- Momentum indicators support this view. The RSI has recovered toward the 50 level, indicating stabilization and early momentum recovery rather than overextension. From a tactical trading perspective, pullbacks toward the $4,410 area remain attractive, with upside targets toward $4,500, while a protective stop below $4,340 helps manage downside risk if the recovery fails.

Fundamental Market Analysis for January 6, 2025 GBPUSDGBP/USD remains near 1.35 after a strong rise at the end of last year, but the dynamics increasingly depend on sentiment around the US dollar. Following a volatility spike driven by foreign-policy headlines, the market is returning to macroeconomic assessment, while the dollar is trying to hold ground amid demand for liquidity.

For the pound, the key drivers are expectations for the Bank of England’s rate path and the state of the UK economy. Signs of slowing growth and cautious consumer behavior raise the likelihood of further policy easing if inflation continues to cool and the labor market weakens. This limits the sustainability of sterling gains even during short periods of dollar softness.

In the US, labor-market and price reports are important this week: strong figures could restore support for the dollar via higher yields and a repricing of rate expectations. In this environment, GBP/USD looks vulnerable to a pullback, especially if participants reduce risk exposure.

Trading recommendation: SELL 1.35600, SL 1.36000, TP 1.34400

GOLD intraday trading setup 📉 XAUUSD – Sell Setup (Intraday / Short-Term)

Current Price: ~4450

Sell Zone: 4450 – 4460

Targets:

🎯 TP1: 4415

🎯 TP2: 4385

🎯 TP3: 4350

Stop Loss: 4480

---

🔍 Reasons for Sell

Gold has seen an extended bullish rally, increasing chances of profit-taking.

Price is reacting near a liquidity zone, which often attracts institutional sellers.

A stronger USD (DXY) or a rise in US bond yields could add bearish pressure on gold.

---

🧠 Bias

Short-term bearish correction expected unless price reclaims and holds above the sell zone.

---

🤝 Support & Engagement

If you find this analysis helpful,

please support with a 👍 Like and 💬 Comment — it really motivates me to keep sharing quality ideas.

Wishing everyone safe trades and disciplined risk management 📊✨

Gold is currently experiencing strong growth.1️⃣ Trendline

Short-term trend: bullish pullback within a larger bearish trend.

Price has broken the descending trendline → confirming a short-term structural shift.

However, price is still below a major supply zone → no medium–long-term reversal yet.

2️⃣ Support

4,400 – 4,402

Key support zone

Confluence of: demand zone + Fibonacci 0.5–0.618 + EMA

→ Area for technical buy reactions / holding buy positions.

Below 4,400: short-term bullish structure is invalidated.

3️⃣ Resistance

4,515 – 4,517

Strong resistance zone

Confluence of: Fibonacci 1.618 + previous supply zone

→ Prioritize sell reactions, avoid FOMO buying.

4️⃣ Fibonacci

Current rebound has reached:

1.0 → trendline break

Next target: 1.618 (4,515)

Only a clean breakout above 1.618 would open the door for a higher bullish scenario.

📌 Trade Setup

BUY GOLD: 4402 – 4400

Stop Loss: 4390

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4515 – 4517

Stop Loss: 4527

Take Profit: 100 – 300 – 500 pips

Gold’s Next Move Depends on PMIOn the H1 timeframe, the key focus is the clean reclaim and hold above the 4,390–4,405 support zone, which is now acting as the market’s “base” after the recent swing low. Price has already pushed back above the EMA34/EMA89 cluster, and the fact that candles are stabilizing above this green band suggests the move is recovery + acceptance, not a random bounce.

Technically, the structure is constructive as long as gold holds this reclaimed support. The chart shows a clear step-by-step pathway: a controlled pullback into support, followed by continuation into the marked targets. The first real test remains the 4,430–4,460 supply area (Resistance zone). If price accepts above that zone (not just a wick), upside targets become well-defined and mechanically consistent with prior swing levels.

Support zone (must hold): 4,390–4,405

This is the pivot. A successful retest here keeps the bullish continuation scenario valid.

Resistance zone /decision area: ~4,430–4,460

This is where breakouts often fail first. Acceptance above is required for continuation.

Targets:

Target 1: 4,459.703

Target 2: 4,499.067

Target 3: 4,524.117

Old ATH region: ~4,549.465

How the structure reads

- The market is currently in a recovery leg with price holding above a reclaimed support shelf.

- As long as pullbacks remain corrective and buyers defend 4,390–4,405, the path of least resistance stays up toward Target 1, then a retest, then continuation toward Target 2 / Target 3.

PMI is one of the cleanest short-term drivers for USD + yields, which directly impacts gold.

- The US ISM Manufacturing PMI printed 48.2 (below 50 = contraction), reinforcing “growth cooling” and typically supporting gold through softer yields / softer USD when markets price easier policy expectations.

- The S&P Global US Manufacturing PMI has also been signaling expansion but with recent moderation (December data described as slower improvement / lower reading vs prior month depending on release), which keeps markets sensitive to “surprise risk” in the next PMI prints.

- Europe remains in contraction (Eurozone manufacturing PMI 48.8), which can add a risk-off undertone at times another background tailwind for gold if USD strength does not dominate.

Practical implication for this chart:

Weaker-than-expected PMI → higher probability gold holds 4,390–4,405 and breaks into Target 1 /Target 2.

Stronger-than-expected PMI → higher probability of a rejection from the resistance zone and a deeper retest of the support band before continuation.

What's new in gold prices this week? 01/05/20261️⃣ Trendline

Short-term: Bearish. Price remains below the descending trendline → selling pressure is still dominant.

Structure: Weak technical pullback, forming a lower high → no clear reversal signal yet.

2️⃣ Resistance

4,445 – 4,447: Strong resistance, confluence of Fibonacci 0.618 + trendline touch → ideal sell zone if confirmation appears.

3️⃣ Support

4,396 – 4,394: Near-term support + previous breakout zone + lower trendline touch.

4,333 – 4,331: Major support + GAP area + lower trendline touch.

4️⃣ Scenarios

Priority: Look for SELL setups at resistance, trading with the trend.

BUY: Only reactive buys at strong support levels, no FOMO.

Trade Plan

BUY GOLD: 4333 – 4331

Stop Loss: 4321

Take Profit: 100 – 300 – 500 pips

SELL GOLD: 4445 – 4447

Stop Loss: 4457

Take Profit: 100 – 300 – 500 pips

Weekly outlook: XAUUSD, #SP500, #BRENT | 09 January 2026XAUUSD: BUY 4415.50, SL 4380.00, TP 4522.00

Gold starts the week near 4415.50 per ounce: thin trading at the beginning of the year has amplified reactions to news from Venezuela and broader geopolitical tension, lifting demand for safe-haven assets. Support also comes from expectations of lower US interest rates in 2026 and continued buying by central banks.

For the week of January 5–9, the focus is on US data on business activity and the labor market, with the key event being Friday’s jobs report. Weaker figures could strengthen interest in gold, while strong numbers may boost the dollar and cool the market temporarily.

Trading recommendation: BUY 4415.50, SL 4380.00, TP 4522.00

#SP500: BUY 6858, SL 6778, TP 7098

The #SP500 is holding around 6858 at the start of the first full week of 2026: investors are weighing geopolitics and oil, but the main guide remains expectations for US interest rates. After a strong finish to 2025, the market enters the week with a cautious tone.

The week of January 5–9 is packed with US statistics, with Friday’s employment report as the highlight. Moderate data would support equities through hopes of lower borrowing costs, while a surprise rise in inflation expectations and yields could increase pressure on the stock market.

Trading recommendation: BUY 6858, SL 6778, TP 7098

#BRENT: SELL 60.43, SL 62.10, TP 55.40

#BRENT is trading near 60.43 per barrel: news around Venezuela has added sharp swings, but the market sees no major supply disruptions for now. OPEC+ is keeping current output settings, and talk of potential supply growth ahead is capping prices.

For the week of January 5–9, the spotlight is on demand signals via US statistics and updates from China, as well as the regular US inventory figures. If demand stays soft and the dollar strengthens, oil risks sliding; however, tighter sanctions or logistical disruptions could quickly restore support.

Trading recommendation: SELL 60.43, SL 62.10, TP 55.40

EURUSD Short: Supply Holds Strong - Market Eyes 1.1680 DemandHello traders! Here’s a clear technical breakdown of EURUSD (3H) based on the current chart structure. EURUSD is trading within a broader bullish structure, supported by a well-defined ascending trend line that has guided price higher from the previous pivot low. Earlier, the market spent time consolidating inside a range, indicating accumulation before the upside expansion. A strong impulsive breakout from this range confirmed buyer control and triggered a bullish continuation move. As price advanced, EURUSD reached a key Supply Zone around 1.1750–1.1760, where selling pressure became visible. Multiple attempts to push above this area resulted in fake breakouts, clearly signaling buyer exhaustion and the presence of strong sellers at higher levels. The chart highlights several failed breakouts and rejections from the supply line, reinforcing this zone as a critical resistance.

Currently, after the rejection from the upper highs near the pivot point, price broke below the short-term structure and is now trading below the supply line, suggesting a loss of bullish momentum. The recent bounce appears corrective rather than impulsive, indicating that the market may be preparing for a deeper pullback rather than immediate continuation higher. Below current price, the Demand Zone around 1.1680 stands out as the next major downside target. This level previously acted as support and aligns with a key horizontal demand area where buyers may attempt to step back in. A move toward this zone would represent a healthy correction within the broader structure.

My scenario: as long as EURUSD remains below the 1.1750 Supply Zone and continues to respect the descending supply line, the short-term bias favors sellers. I expect downside continuation toward the 1.1680 Demand Zone. A strong bullish reaction from demand could lead to consolidation or a corrective bounce, but a clean breakdown below 1.1680 would signal a deeper bearish correction. For now, price is at a key decision area, with sellers in control below supply and demand acting as the main downside objective. Manage your risk!