USD/JPY would be consolidating until BoJ meeting this Friday・USD/JPY market fundamental

The Japanese Yen has weakened following reports of Prime Minister Takaichi's snap election. Market is anticipating that her administration will implement expansionary fiscal policies.

Japanese Financial Minister Katayama has been warning against the rapid movement of the Yen several times last week.

Market is now focusing on BoJ meeting scheduled for Friday. If the BoJ signals a faster pace of rate hikes, the current support level could be broken and potentially reversing the trend.

・Technical Analysis

USD/JPY market is expected to consolidate within the range of 157.000 to 160.000 ahead of the Friday's BoJ meeting.

Analysis

EURUSD at a Make-or-Break Demand Zone — Bounce Setup bearish impulsive move from the prior supply zone near 1.1660–1.1670. The sell-off was aggressive, breaking structure cleanly and confirming that sellers remain in control on the H1 timeframe. However, after reaching demand, price has shifted into short-term consolidation, signaling hesitation rather than immediate continuation.

From a structure and trend perspective, the market is still bearish overall. Price remains below the descending trendline and below the EMA, both of which are acting as dynamic resistance. Any bullish movement from the current demand zone should be treated as a corrective pullback, not a trend reversal, unless price can reclaim the trendline and hold above it with strong momentum.

Scenario-wise, there are two clear paths. If buyers manage to defend the demand zone and push price upward, the most likely upside reaction would be a pullback toward the trendline and EMA confluence, where sellers are expected to re-enter from a premium area. Failure at that level would reinforce the bearish continuation narrative. On the other hand, if the demand zone fails to hold, a clean breakdown below 1.1590 would likely trigger another bearish expansion, opening the door toward lower liquidity levels around 1.1560 and below.

➡️ Market bias: Bearish, corrective bounce possible

➡️ Key focus: Reaction at demand zone vs. trendline rejection

➡️ Invalidation: Strong acceptance above trendline and EMA

This is a classic sell the rally environment, with demand acting as a temporary pause rather than a confirmed reversal zone.

Ethereum Is Completing a Classic Head & Shoulders1. Current Market Structure

Ethereum has transitioned from a strong bullish impulse into a clear distribution structure on the H1 timeframe. After the vertical rally from the 3,100 area, price formed a well defined Head & Shoulders pattern, signaling exhaustion rather than continuation. The left shoulder and right shoulder are symmetrical, while the head marks the final aggressive push that failed to attract sustained demand. Since then, price has shifted into lower highs and overlapping candles, confirming loss of bullish control.

This is no longer an impulsive uptrend it is a corrective-to-distributive phase.

2. Key Zones & Market Positioning

Major Supply / Head Zone: 3,390 – 3,420 → Strong rejection, distribution confirmed

Neckline / Key Support: ~3,280 – 3,265 → Structural decision level

Intermediate Demand: ~3,220

Final Downside Liquidity Target: 3,080 – 3,100

Price is currently hovering just above the neckline, which is typical behavior before a decisive breakdown in classical H&S structures.

3. EMA & Momentum Context

The EMA 98 is still rising and located below price, which explains the temporary pauses and bounces. However, price is now trading below prior momentum highs, and EMA support is flattening. This often occurs before deeper pullbacks as late buyers get trapped above the neckline.

Momentum is clearly weakening bullish candles are corrective, not impulsive.

4. Liquidity & Pattern Psychology

The Head & Shoulders structure reflects a distribution of long positions:

- Early buyers took profit near the head

- Late buyers entered near the right shoulder

- Liquidity now rests below the neckline

Once the neckline breaks and acceptance occurs, price typically accelerates quickly as stop-loss liquidity is released.

5. Market Scenarios

🔽 Primary Scenario – Bearish Continuation (High Probability)

Clean break and close below 3,265

Retest of neckline fails

Expansion toward 3,220 → 3,080

This move would be a healthy correction within the broader uptrend, not a macro reversal.

🔼 Invalidation Scenario

Strong reclaim and acceptance above 3,360

Break of right-shoulder structure

This would neutralize the H&S pattern and reopen bullish continuation — currently unlikely without volume.

6. Trading Perspective

Bias: Bearish (short-term)

Avoid longs near the neckline

Shorts favored on rejection or confirmed breakdown

Best long opportunities appear after liquidity is swept lower

Summary

Ethereum is no longer in expansion it is distributing.

The Head & Shoulders pattern is mature, momentum is fading, and liquidity is clearly building below the neckline. As long as price remains capped below the right shoulder, the roadmap remains straightforward:

Distribution → Neckline Break → Liquidity Expansion Downward

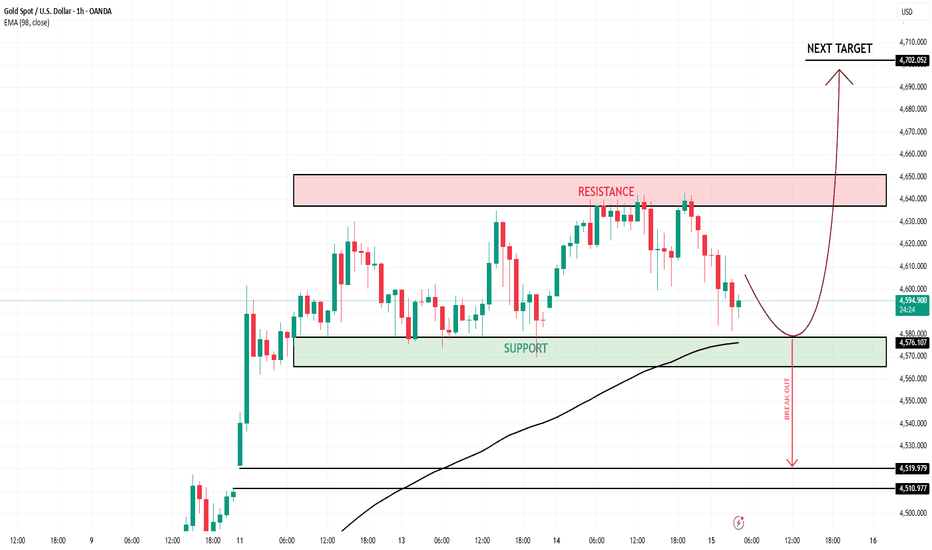

Gold Is Compressing at Range Highs 1. Current Market Structure

Gold is maintaining a neutral-to-bullish structure on the H1 timeframe. After a strong bullish expansion earlier, price has transitioned into a well-defined horizontal range, oscillating between support and resistance. Importantly, this is not a distribution pattern — price is holding above the rising EMA 98 and continues to print higher reaction lows, signaling controlled consolidation within an uptrend, not weakness.

2. Key Zones & Market Positioning

Resistance Zone: 4,640 – 4,650 → Multiple rejections, but no strong bearish follow-through

Support Zone: 4,570 – 4,585 → Strong demand area aligned with EMA 98 (~4,589)

Breakdown Invalidation Level:

Below 4,570 → opens downside toward 4,520 – 4,510

Upside Target (Break & Hold): 4,700 – 4,710 (next expansion target)

As long as price remains above the support zone, the bullish structure stays intact.

3. Liquidity & Price Behavior

Price is clearly absorbing liquidity inside the range. Repeated tests of resistance without aggressive sell-offs suggest sellers are being absorbed rather than in control. On the downside, every dip into the support zone is met with quick buy reactions, reinforcing the idea of re-accumulation, not distribution.

This type of tight rotation typically precedes range expansion, not reversal.

4. Short-Term Market Scenarios

🔼 Primary Scenario – Bullish Breakout (Higher Probability)

Price holds above 4,580–4,590

Continued compression below resistance

Break and acceptance above 4,650

Expansion toward 4,700 – 4,710

🔽 Invalidation Scenario – Range Failure

Strong H1 close below 4,570

Loss of EMA 98 support

Opens downside toward 4,520 – 4,510

This would indicate deeper corrective behavior, not immediate trend reversal.

5. Trading Perspective

Bias: Buy dips near support, avoid shorting inside the range

Best approach: Wait for confirmation either support reaction or clean breakout

Market is loading orders, not distributing at highs

Summary

Gold is not topping.

It is compressing, absorbing liquidity, and preparing for its next directional move.

As long as the support zone holds, the roadmap remains clear:

Range → Accumulation → Breakout → Expansion toward 4,700+.

Gold Is Quietly Building Pressure — Accumulation On the 45-minute timeframe, Gold is firmly locked inside a well-defined range, with price repeatedly rotating between support around 4,580–4,570 and resistance near 4,630–4,640. This is not random price action it is structured, controlled, and intentional, characteristic of an accumulation environment rather than distribution.

Price behavior shows multiple clean reactions at both extremes of the range. Each dip into support is met with responsive buying, while rallies into resistance are consistently capped. Importantly, these reactions are becoming tighter and more compressed, indicating that liquidity is being absorbed on both sides. The market is effectively building energy, not trending.

From a moving-average perspective, price is hovering around the mean, with the EMA acting as a magnet rather than directional support or resistance. This reinforces the idea that Gold is in balance, where neither buyers nor sellers have full control yet. Momentum has flattened, volatility has contracted, and impulsive follow-through is absent — all classic signs of accumulation.

What stands out is that sellers have failed to break below the established support zone, despite multiple tests. This suggests sell-side weakness rather than buyer exhaustion. As long as price continues to hold above 4,570, the broader bullish structure remains intact.

The projected path highlights a bullish resolution scenario: continued absorption inside the accumulation zone, followed by a decisive breakout above 4,640, opening the door toward the 4,690–4,700 resistance band. However, until that breakout is confirmed with strong acceptance, Gold remains a reaction-based market, not a chase.

➡️ Market state: Range / accumulation

➡️ Key resistance: 4,630–4,640

➡️ Key support: 4,580–4,570

➡️ Bias: Neutral → Bullish on confirmed breakout

For now, patience is key. Gold is not trending it is preparing.

Gold at a Critical Decision Zone — Distribution Risk After Wave Gold on the H4 timeframe is showing signs of structural exhaustion after a strong impulsive advance. Price has completed a full bullish sequence into the 4,700–4,725 resistance zone, where upside momentum has clearly stalled. The failure to sustain above this region suggests buyers are losing control at premium prices.

From a price action perspective, the market has transitioned from expansion into sideways-to-distribution behavior. The rejection from the highs and subsequent pullback toward 4,560–4,580 indicates that this level is now acting as a key pivot. While price is still trading above the rising EMA structure, momentum has slowed significantly, and candles are becoming overlapping — a classic warning sign after a mature rally.

The projected path highlights a corrective phase rather than immediate continuation. A rebound toward 4,650–4,680 may occur as a corrective bounce, but unless Gold can reclaim and hold above 4,700, rallies are likely to be sold into. A confirmed break below 4,560 would signal a bearish continuation, opening downside targets toward 4,410 and potentially deeper liquidity below.

➡️ Market state: Post-rally distribution

➡️ Bias: Bearish below 4,700

➡️ Key resistance: 4,700–4,725

➡️ Key support: 4,560 → 4,410

➡️ Bullish invalidation: Strong acceptance above 4,725

At this stage, Gold is no longer in clean trend mode — it is correcting a completed move, and risk is shifting from trend-following longs to defensive or short-biased positioning until structure resets.

EURUSD Liquidity sweep Before ReversalQuick Summary

I initially planned to sell EURUSD after the strong move following market open, However the timing is not ideal due to equal highs forming at the current top

Price may break these highs to collect more liquidity

A final reaction from the bearish trend could then push price lower to fill the liquidity void created by the strong rally.

Full Analysis

After the market opened EURUSD pushed higher aggressively which initially made selling appear attractive

However current price behavior suggests that entering sell positions now may be premature

Equal highs have formed at the current top

These structures often attract price as the market seeks additional buy side liquidity

Because of this there is a strong possibility that EURUSD breaks above these highs before showing any real weakness

If that liquidity is taken we may then see a final reaction from the bearish trend

Such a move could trigger a downside push aimed at filling the liquidity void that was created during the strong bullish rally

For now patience is required

Waiting for liquidity to be collected and for clear reversal behavior to appear will provide a higher probability opportunity than selling too early

EURUSD Bearish Continuation From Channel StructureQuick Summary

EURUSD is expected to continue its bearish trend after A clear descending price channel has formed which supports further downside, Before continue lower price may sweep liquidity at 1.16271

After that a rejection from the orderblock at 1.16303 could offer a sell opportunity.

Full Analysis

EURUSD remains in a clear bearish structure and the formation of a descending price channel adds further confirmation to the downside bias.

This type of structure typically supports continuation rather than reversal

Before resuming the drop price is likely to perform a liquidity sweep around the 1.16271 level

This move would allow the market to collect resting orders before continuing lower

Following that sweep price may react from the nearby orderblock at 1.16303

This zone represents a potential area to look for sell setups in line with the dominant down trend

If price shows a clear rejection from this orderblock it would support opening sell positions.

The expectation remains for continuation lower as long as price respects the descending channel and bearish orderflow remains intact

XAUUSD Short: Rejection from Major Supply, Eyes On $4,520 DemandHello traders! Here’s a clear technical breakdown of XAUUSD (4H) based on the chart structure shown in the screenshot. XAUUSD previously traded within a consolidation range, where price moved sideways after a corrective phase, reflecting temporary balance between buyers and sellers. This range acted as an accumulation area before the next directional move. Following this consolidation, gold initiated a strong bullish breakout, shifting market control decisively to buyers. After the breakout, price developed a well-defined ascending channel, characterized by consistent higher highs and higher lows. This structure confirms a sustained bullish trend, with each pullback remaining corrective and contained within the channel. During the advance, XAUUSD experienced a sharp corrective drop from a local pivot high, briefly breaking internal structure. However, this move was quickly absorbed by buyers near a clear pivot point, from which price aggressively reversed and resumed the bullish trend, reinforcing demand strength.

Currently, XAUUSD is trading near a major Supply Zone around 4,620–4,630, where price has repeatedly shown signs of exhaustion. After a strong bullish impulse and formation of a well-defined ascending channel, buying momentum has started to weaken near the upper boundary of the structure. Multiple attempts to sustain price above the supply area have failed, indicating strong seller presence and lack of acceptance at higher levels. The most recent price action shows a rejection from the supply zone, followed by a pullback below the local resistance line. This behavior suggests that the bullish move is losing strength and that the market is transitioning into a corrective phase. Additionally, the break of the short-term internal structure increases the probability of a deeper retracement rather than immediate continuation higher.

My primary scenario favors a short setup while price trades below and continues to reject the 4,620–4,630 Supply Zone. A confirmed rejection or bearish reaction from this area may trigger a move lower toward the 4,520 Demand Zone (TP1), which aligns with previous breakout structure and acts as the first key downside objective. If selling momentum strengthens and price breaks below 4,520 with acceptance, this would open the door for a deeper correction toward lower support levels within the broader structure. However, a clean breakout and strong acceptance above 4,630 would invalidate the short bias and signal bullish continuation. Until that happens, the market structure favors a corrective move to the downside from supply. Manage your risk!

BTCUSDT Long: Buyers in Control Above 94K, Next Stop 98.5KHello traders! Here’s a clear technical breakdown of BTCUSDT (3H) based on the current chart structure shown in the screenshot. BTCUSDT previously traded inside a well-defined descending channel, reflecting strong bearish pressure and consistent lower highs and lower lows. This bearish phase ended near a clear pivot point, where selling momentum weakened and buyers stepped in aggressively. From this pivot, price initiated a recovery move and successfully broke out of the descending channel, signaling a shift in short-term market control. Following the breakout, BTC transitioned into a broad consolidation range, where price moved sideways for an extended period. This range represented a balance between buyers and sellers, with multiple internal reactions confirming accumulation and uncertainty before the next directional move. Eventually, BTC broke out from the upper boundary of the range, confirming renewed bullish interest. After the range breakout, price formed a well-structured ascending channel, characterized by higher highs and higher lows. This structure confirms a bullish corrective-to-impulsive transition, with buyers maintaining control. Within this channel, BTC recently broke above a key Demand / Support Zone around 94,000, which previously acted as resistance and is now acting as support.

Currently, BTCUSDT is approaching a major Supply Zone around 98,000–98,500, where selling pressure has previously appeared. This zone aligns with the upper boundary of the ascending channel, increasing the probability of a reaction or short-term pullback. The most recent price action shows hesitation near this area, suggesting that sellers are beginning to defend higher levels.

My scenario: as long as BTCUSDT remains above the 94,000 Demand Zone and continues to respect the ascending channel structure, the bullish bias remains intact. I expect buyers to defend pullbacks toward demand and attempt another push into the 98,000–98,500 Supply Zone (TP1). A clean breakout and acceptance above this supply would confirm bullish continuation and open the door for further upside. However, a strong rejection from the supply zone followed by a breakdown below the ascending channel and 94,000 support would signal weakness and increase the probability of a deeper corrective move back toward the prior range highs. For now, price is at a key decision area near supply. Manage your risk!

BTCUSDT: Pullback To 93K Support Before Return of Bullish TrendHello everyone, here is my breakdown of the current BTCUSDT setup.

BTCUSDT previously transitioned from a strong bearish impulse into a recovery phase, where price formed a well-defined upward channel, signaling a corrective bullish structure. Within this channel, Bitcoin produced higher highs and higher lows, confirming temporary buyer control after the sell-off. During this phase, price also formed a consolidation range, reflecting a pause and balance between buyers and sellers before the next move. As price advanced, BTCUSDT approached a major Resistance Zone around 95,500–96,000, where selling pressure became evident. Multiple tests of this area failed to produce acceptance above resistance, and a clear rejection / test occurred at the top of the channel. This behavior indicates supply dominance at higher levels. Following the rejection, price broke below the upper channel structure and pulled back toward the Support Zone near 93,000, which previously acted as both demand and a breakout level.

Currently, BTCUSDT is trading below the resistance zone and showing signs of weakness after the failed breakout attempt. The recent breakout below minor support suggests a potential continuation to the downside, while the broader structure remains vulnerable as long as price stays capped below resistance.

My Scenario & Strategy

My primary scenario remains bearish while BTCUSDT trades below the 95,500–96,000 Resistance Zone and continues to show rejection from the upper channel. Any pullbacks toward resistance that show weakness or rejection may offer short opportunities, with downside continuation toward the 93,000 Support Zone as the first objective. A decisive breakdown below support would open the door for a deeper corrective move.

However, a strong breakout and acceptance above resistance would invalidate the short bias and signal a shift back toward bullish continuation. I believe there will be a correction to around 93K, and then a resumption of the bullish scenario.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

EURUSD: Sellers Take Control Below Key Resistance, Eyes 1.1600Hello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD previously traded within a well-defined upward channel, confirming a bullish recovery phase after forming a strong base from the prior decline. Buyers maintained control by producing higher highs and higher lows, eventually pushing price toward a key Resistance Zone around 1.1690–1.1700. At this resistance area, price transitioned into a broad range, signaling a balance between buyers and sellers. Multiple attempts to hold above resistance failed, indicating growing selling pressure at the highs. Eventually, EURUSD broke down from the range, confirming a loss of bullish momentum and a shift in short-term market control.

Currently, EURUSD is trading within the descending channel and moving toward a key Support Zone around 1.1600, which previously acted as a demand area and a structural reaction level. This zone represents the next important area where buyers may attempt to slow or pause the decline.

My Scenario & Strategy

My primary scenario remains bearish as long as EURUSD stays below the 1.1690–1.1700 Resistance Zone and continues to respect the downward channel. Any pullbacks into resistance that show rejection can be viewed as potential short opportunities, with downside continuation toward the 1.1600 Support Zone as the first target.

However, a clean breakout and acceptance above resistance would invalidate the short bias and suggest a possible shift back toward consolidation or bullish recovery. Until that happens, market structure favors sellers, and rallies are considered corrective within the broader bearish context.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

XAUUSD Holds Bullish Structure Above Support - Eyes on $4,680Hello traders! Here’s my technical outlook on Gold (XAUUSD, 3H) based on the current chart structure. Gold is trading within a well-defined bullish trend after reclaiming key levels and establishing a sequence of higher highs and higher lows. Earlier on the chart, price formed a consolidation range, signaling accumulation before continuation. This range was later broken to the upside, confirming renewed buyer control and continuation of the broader bullish structure. Following the breakout, price moved higher but then entered a corrective phase, pulling back toward the rising trend line and the Support Level around the 4,510 area. This pullback appears corrective rather than impulsive, with buyers stepping in to defend the trend. Price respected the support line multiple times, forming fake breakouts to the downside before reversing higher, which further confirms underlying buying strength. Currently, XAUUSD has broken above the descending resistance line and is consolidating above it, signaling a successful breakout and potential continuation. Price is now trading above the Buyer Zone and approaching the Seller Zone / Resistance Level around 4,640. This area represents a key reaction zone where selling pressure may appear. My scenario: as long as Gold holds above the Support Level and continues to respect the rising trend line, the bullish structure remains intact. A clean breakout and acceptance above the 4,640 Resistance Level would confirm continuation toward the next upside target 4,680 (TP1). However, rejection from resistance could lead to a short-term consolidation or corrective pullback toward support before the next attempt higher. For now, the bias remains bullish, and price is positioned for a potential continuation move. Please share this idea with your friends and click Boost 🚀

The gold came down as we expected previouslyWe are going to look for a buy in gold as it came down to a cheap level and we are waiting for the price to retest to our febonachi level and 1h OB so that we put a long position in gold. I hope you guys are learning and enjoying from the experienced trader thanks.

EURUSD Short: Sellers Take Control Below 1.1680Hello traders! Here’s a clear technical breakdown of EURUSD (2H) based on the current chart structure. EURUSD previously traded within a well-defined ascending channel, confirming a strong bullish phase with consistent higher highs and higher lows. During this advance, price formed a consolidation range, which eventually resolved to the upside with a breakout, reinforcing bullish momentum. However, as price approached the key Supply Zone around 1.1680–1.1700, buying pressure started to weaken. Several attempts to hold above this area resulted in fake breakouts, signaling strong seller presence and exhaustion at the highs. Following the rejection from supply, EURUSD formed a clear rounding top near the pivot high, marking a structural transition. Price then broke below the range support and the ascending channel, confirming a short-term shift from bullish to bearish control. This breakdown led to the formation of a descending channel, where price is now producing lower highs and lower lows. Recent pullbacks into the channel resistance and supply area have failed, further confirming that the upside moves are corrective rather than impulsive.

Currently, EURUSD is trading below the 1.1680 Supply Zone and is moving toward the Demand Zone around 1.1600, which represents a key support level and the next potential reaction area. This zone aligns with previous structure and may attract buyers for a temporary pause or bounce.

My scenario: as long as EURUSD remains below the 1.1680 Supply Zone and respects the descending channel, the bearish bias remains valid. I expect sellers to maintain control and push price toward the 1.1600 Demand Zone (TP1). A clean breakdown and acceptance below 1.1600 would open the door for a deeper bearish continuation. However, a strong bullish breakout and acceptance back above 1.1680 would invalidate the short scenario and suggest a potential shift back toward consolidation or recovery. For now, market structure favors sellers. Manage your risk!

EURUSD Lower Highs Signal Continuation Toward 1.1590Hello traders! Here’s my technical outlook on EURUSD (2H) based on the current chart structure. EURUSD is currently trading within a broader bearish structure after failing to sustain bullish momentum near recent highs. Earlier on the chart, price formed a clear consolidation range, where the market paused before a breakout to the upside. However, this breakout lacked follow-through and eventually marked a local turning point, after which selling pressure began to increase. Following the rejection from the highs, EURUSD started to form lower highs and lower lows, confirming a shift in short-term market control. Price then broke below the key Seller Zone around 1.1680, which previously acted as support, flipping it into resistance. This breakdown signaled a bearish market structure shift and initiated a sustained move lower. Subsequent pullbacks into this Seller Zone were corrective and met with renewed selling interest, reinforcing its role as a resistance level. Currently, price is trading below the descending trend line, which continues to cap upside attempts. Recent corrective moves have failed to reclaim the trend line or the Seller Zone, suggesting that sellers remain in control. Below current price, the Buyer Zone / Support Level around 1.1590–1.1600 stands out as the next key area of interest, aligning with prior demand and a potential reaction zone. My scenario: as long as EURUSD remains below the 1.1680 Resistance Level and continues to respect the descending trend line, the bearish structure remains intact. I expect price to continue lower toward the 1.1600 Support Level (TP1). A clean break and acceptance below this support could open the door for further downside, while a strong bullish reclaim above resistance would invalidate the bearish scenario and signal a potential trend reversal. For now, the bias remains bearish while price trades below resistance. Please share this idea with your friends and click Boost 🚀

20260116 - BTCUSD on a crossroadFollowing a significant plunge from the record high, BINANCE:BTCUSDT significantly plunged to 80,600 before recovering. The recovery was pretty slow before eventually accelerating in the last 3 weeks. The price has hit the Weekly Bearish FVG at 96,043-98,944 but still remain below the area, suggesting the current long-term downtrend remain intact.

If BINANCE:BTCUSDT fails to close above the bearish FVG, I think it may accelerate the downtrend toward the previous Sellside Liquidity at 80,600 before further falling to about 74,508.

On the contrary, if BINANCE:BTCUSDT closes above 107,500, the high of the candlestick with the bearish FVG, the trend may reverse and start a new uptrend, aiming for the record high.

In the meantime, the psychological resistance at 100,000 remains dominant in blocking the recovery.

EURUSD Possible Corrective UpsideQuick Summary

EURUSD saw a strong bearish move yesterday, This move left a clear liquidity void behind

Price may attempt to move higher to fill this imbalance. A move toward 1.16525 is possible

Long entries require a clear choch confirmation

Full Analysis

After the strong bearish move that occurred on EURUSD yesterday price left behind a significant liquidity void with clear upside objectives

Despite the current bearish pressure there is still a possibility that price attempts a corrective move higher

The descending trend is still present but there are early signs that it could be challenged

This idea is not confirmed yet and should be treated with caution

However at least, price may attempt to move higher to rebalance the liquidity void created by the impulsive selloff

The level around 1.16525 stands out as a reasonable upside objective for this corrective move

This area represents where price may seek balance before deciding on the next directional move

Any long position should not be taken blindly

A clear choch is required to confirm bullish intention and justify trading against the current internal bearish structure

Until that confirmation appears the move higher should be viewed as a potential correction rather than a confirmed trend reversal

Range Control After Impulse — ETH Is Being Prepared, Not RejectCOINBASE:ETHUSD has completed a strong impulsive breakout and is now consolidating in a controlled range on the H1 timeframe. Price remains above the EMA cluster, confirming that the recent move was a bullish shift, not a false breakout. Price is currently rotating between 3,380–3,410 resistance and 3,260–3,280 support. Rejections at the top and consistent buyer reactions at support indicate range acceptance and post-impulse consolidation, not distribution. Sellers have failed to produce a lower low, keeping the bullish structure intact. The EMA cluster is rising and aligned with the lower range, reinforcing the view that pullbacks are corrective. As long as price holds above the EMAs, bearish continuation lacks confirmation.

Primary scenario: continued range compression followed by a clean breakout above 3,410, opening the path toward 3,450+.

Alternative scenario: acceptance below 3,260 would signal a deeper correction, though still within a broader bullish context.

Summary: ETH is pausing after strength. This is consolidation, not weakness patience is required while the market prepares for its next expansion.

“Lower Highs Keep the Pressure On — EURUSD Still Trapped EURUSD remains firmly locked in a descending structure on the H1 timeframe. The chart clearly shows a sequence of lower highs, each one precisely capped by the same descending trendline. Every bullish attempt into this trendline has been sold aggressively, confirming that sellers continue to control market structure. The highlighted swing points are critical: they demonstrate repeated trendline rejections, a classic sign that this is not a random pullback, but a well respected bearish structure.

Price is currently compressing between:

- Descending trendline (dynamic resistance)

- Horizontal support base around 1.1620

This compression reflects indecision, but within a bearish context. Importantly, bullish candles into the trendline lack follow through, while bearish impulses break structure faster a subtle but crucial sign of seller dominance.

Primary Scenarios

🔴 Scenario 1 — High-Probability (Trend Continuation):

If price fails again at the descending trendline and loses the 1.1620 support, EURUSD is likely to enter a markdown phase, targeting the liquidity pool near 1.1590 – 1.1585.

This scenario aligns perfectly with the prevailing downtrend logic: sell rallies, not chase breakouts.

🟢 Scenario 2 — Countertrend Break (Lower Probability):

A clean break and acceptance above the descending trendline, followed by a retest, could trigger a short-term bullish correction toward 1.1660 – 1.1680. However, unless structure shifts decisively, this move would still be considered corrective, not a trend reversal.

Volume & Market Behavior Insight

Volume expansion appears mainly on bearish impulses, while pullbacks show weaker participation reinforcing the idea that smart money is still positioned on the sell side. This is typical behavior during a controlled downtrend, where liquidity is harvested above trendline touches.

Conclusion

As long as EURUSD trades below the descending trendline, the market bias remains bearish. The structure favors continuation lower, not aggressive longs. Patience here is key the market is offering information, not entries yet.

Liquidity Grab Before the Next Expansion?Gold on the H1 timeframe is currently trading in a well-defined equilibrium between higher-timeframe demand and overhead supply, and the chart reflects a classic professional accumulation–distribution dynamic rather than random price movement. After the strong impulsive rally that established the current range, price has repeatedly failed to gain acceptance above the upper resistance zone, signaling that sell-side liquidity and profit-taking remain active at premium levels. Each attempt into resistance has been met with rejection, but notably, those rejections have not produced structural breakdowns, which is a critical clue about underlying strength.

On the downside, price is rotating back toward a clearly defined support zone, which aligns closely with prior consolidation, value re-acceptance, and the rising EMA 98 a dynamic level often defended in healthy bullish trends. This overlap between horizontal support and dynamic trend support significantly increases the probability that this area acts as a liquidity absorption zone, rather than a true breakdown point. The projected curved move reflects a typical scenario where price dips into support to sweep weak longs and trigger sell stops, allowing larger players to re-enter long positions at discounted prices.

Importantly, the broader structure remains bullish as long as price holds above the lower support and does not establish acceptance below it. A clean breakdown would open the path toward the deeper liquidity pool near the lower range, but at this stage, such a move would be considered a corrective extension, not a trend reversal. The market has not yet shown the characteristics of distribution that precede sustained downside, such as lower highs on expansion or aggressive momentum selling through support.

If buyers successfully defend the support zone and reclaim the mid-range, the upside scenario becomes dominant again. In that case, a renewed push through resistance would likely be impulsive rather than corrective, targeting the next upside objective near the 4,700 region, where liquidity from prior highs is resting. This aligns with the classic range-expansion model: compress → sweep liquidity → expand.

In summary, Gold is currently in a decision phase, but the weight of evidence still favors a bullish continuation after a controlled pullback. Patience is key here the highest-probability opportunity emerges not at resistance, but at support, where risk can be defined tightly and momentum can be reloaded for the next leg higher.