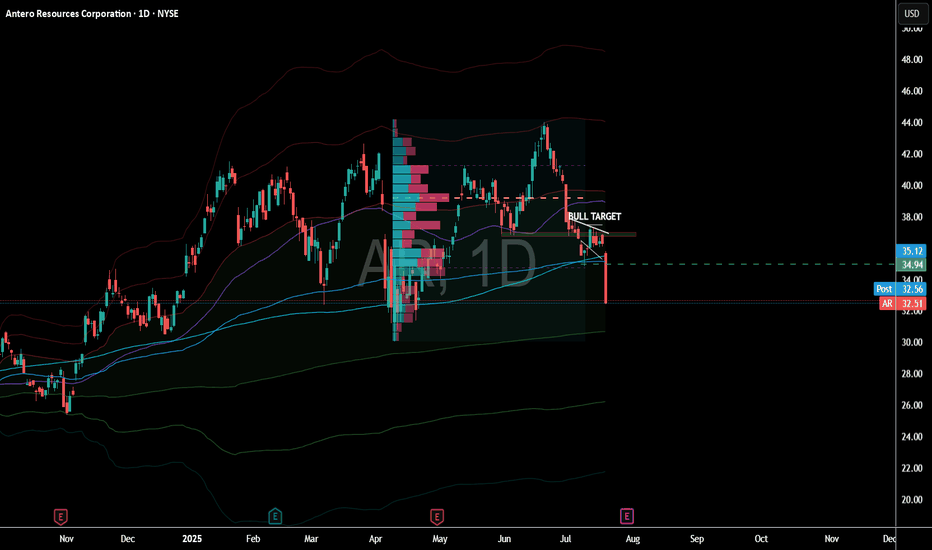

AR Looks Bullish (1D)The AR symbol appears to be completing a double corrective pattern | the first part being a plapyonic diametric and the second part a flat. The green zone represents a demand area that could potentially push the price upward. Note that this type of setup is generally safer for spot trading, while futures trading would require more precise entry levels.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Ar

Natural Gas - Epic Trade SetupNatural Gas is potentially setting up a blow off top move into its Thursday inventory report.

This chart pattern rally is looking very similar to what we saw last Thursday when Nat gas had a 6.6% range decline from the high pivot it made off of inventories.

If we get a blow off top move on Thursday through the 200 Week MA I will look to fade that move.

This will be a live trading scalp idea...not financial advice.

Right now the swing trading trend is still bullish and looking strong.

Dip buyers are still in a favorable position for this commodity.

Natural Gas: Buy The Rumor Sell The NewsNatural gas spiked higher in the morning session on a strong inventory report.

Natural Gas inventories came in at 53B vs 66B est.

This report is showing a greater demand likely due to the colder temps.

In the afternoon Natural Gas reversed from the highs and sold off.

Ending the day with a Daily topping tail.

Technically the chart pattern in still strong. The 200 MA should be observed as bulls will want to defend that price level.

The Chart is still showing $4.00 target unless we see a failed breakout.

We netted a lovely day trade short today on the live stream.

Natural Gas Triggers Bullish PatternNatural gas triggered and confirmed a daily chart breakout.

A technical inverse head and shoulders pattern can be observed.

Natural GAs is rallying on colder temperature forecast in the US.

Colder temps often yield more consumption.

Inventories are set to take place on Thursday...the daily 200MA should be watched closely.

AR – Testing Support, Eyeing Higher Targets

AR is currently trading around $5.630, consolidating above a key support zone near $5.240. Price action shows a downtrend line pressing from above, but buyers continue to defend the blue support area.

- Support: $5.240 – $5.000

- Bullish case: A breakout above $8.700 could open the way toward $30

⚖️ AR is at a pivotal level — holding support could fuel a strong rally, but traders should wait for confirmation above resistance before positioning aggressively.

Natural Gas Bearish News TodayNatural Gas crumbled off the inventory report this morning.

Natural gas inventories came in at 90B vs 80B consensus.

This larger than expected build shows a weaker demand for Nat Gas during this seasonal period.

Key things to consider:

1. EU moves to accelerate ban on Russian LNG.

2. New Israel–Egypt pipeline coming online

3. China continues to import from Arctic LNG‑2 despite sanctions

4. Japan’s JERA in talks to buy U.S. shale gas assets

5. Gas storage in Germany & winter supply concerns

6. Western Canada storage nearly full; supply glut

7. Canadian production at record levels, but prices very low

Natural Gas Inventories Today: What You Need To KnowNatural gas is currently holding the 50 Moving average.

Inventories come out tomorrow and could make or break this trend.

I'm keeping it simple and looking for shorts below the 50 MA and longs above.

Nat Gas inventories estimate is 69B build.

Right now the EMA weekly 113 is a tough resistance level.

Consolidation would be best in this commodity to help support the next leg higher.

Natural Gas Surging into Key Moving AverageNatural gas has tagged near term resistance.

We have trimmed and locked in profits on many of the equity trades and the boil trade that we were long.

The entire commodity complex minus oil has been very strong.

Inventory report is tomorrow at 10:30am.

Let see if Nat gas can continue its bullish ascent.

Dont forget to trim profits along the way.

NATURAL GAS: Stunning breakout!Natural Gas has had a wonderful move off the lows.

Breaking out of a falling wedge pattern on inventories.

Inventory report supports higher price. 27B exp build vs 18B actual.

If you have been following our analysis you would have ought to have know to start accumulating into the key weekly gap fill zone.

We have been pounding the table on resource stocks showing relative strength compared to the underlying commodity.

Our members have received several alerts via: AMEX:BOIL , NYSE:EQT NYSE:AR NYSE:RRC and others. We have netted some wonderful profits and it looks like Nat Gas should climb higher after some near term consolidation.

I would like to see Nat gas retest the major volume shelf (POC). That level should be monitored closely.

Natural Gas Equities Showing Relative StrengthNatural Gas was briefly red today but saw a bit of a bullish recovery.

Price action came very close to filling the weekly downside gap but just missed it.

Inventories are set to be released tomorrow at 10:30am

Interestingly, Nat Gas stocks like NYSE:AR & NYSE:EQT showed great relative strength in the market today.

Is this signaling a pop in Nat Gas price tomorrow?

We are long NYSE:AR calls from yesterday.

AR (SPOT)BINANCE:ARUSDT

#AR/ USDT

Entry range (7.00- 7.50)

SL 4H close below6.67

T1 8.80

T2 11.40

T3 13.70

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Natural Gas Bullish Recovery?Nat gas has recovered key technical levels with a strong rally today.

Looking at the daily chart we got a close above the 7 MA staging a potential 3 bar surge setup.

Nat gas looks to be targeting 3.18 in the near term...

Inventory report tomorrow: 10B forecast for inventories.

A potential arbitrage opportunity setting up for EQT, upside calls for next week.

Natural Gas Bullish Reversal...Are the Lows in?U.S. natural gas inventories increased by 48 billion cubic feet last week to 3,123 Bcf, increasing the surplus over the five-year average.

Consensus / forecast was 37Billion Cubic feet.

Despite a much higher build than expected Nat gas saw positive price action.

This appears to simply be a dead cat bounce before we go lower.

A death cross on the daily chart has occurred. This signal often results in a small bounce before going lower.

Natural Gas Crisis: Profits were made!Nat Gas plunged to a 1-week low Monday on the outlook for cooler US temperatures.

A report came out that Nat gas has heat peak demand which is scaring investors.

Nat GAs equities got demolished which could indicate that this breakdown is real.

We got rejected off the daily 50 MA & Knifed through the 200 Daily MA.

Some clear technical breakdowns are now in affect.

We banked on EQT put options that ran over 400%. This trade was called out free on our channel. You tube Short.

Natural Gas - The Epic Reversal? Natural gas had an astonishing move to the upside. Closing up over 5% today.

This volatility can make all tarders head spin if youre not used to it.

Why did Nat gas pop today?

Partly from being oversold and into really good technical support, Natural gas inventories were released today at 10:30am.

The inventories showed a smaller build than the market expected which implies stronger demand. 56B consensus vs 53B actual.

This could potentially be the start to a new bullish trend.

Names like EQT & AR hit some major support today. Some call options on these names have been accumulated.

NATURAL GAS - Who can Predict this wild beast?Natural gas got demolished today, down over 8%.

The one headline we saw hitting the tape that is having some partial influence:

"Vessel Arrives at LNG Canada to Load First Cargo, Strengthening Global Supply Outlook – LNG Recap"

Today, we did hedge our core long UNG position with a short dated $56 put on EQT.

We are already green on that trade and looking for $56 level to come into play.

Natural gas volatility sure trades in a world of its own which is why it is key to size accordingly.

Arweave—Bullish Bias Confirmed (Altcoins Bull Market As Promise)Three weeks ago I told you a very strong bullish wave was approaching the altcoins market. It is here, confirmed. The rest is just too easy...

Tell me... Can you see this?

Tell me you can see this. I know you can.

Tell me you can see the end of a correction, the bearish wave.

On the 5th of June the market was supposed to move up. It started up and went up for five days. 11-June produced a major crash rather than a bullish continuation... Surprise! but the market never moves straight down, this was the final leg down; the bottom is in, we can change trend now.

Technically speaking, the 7-April bottom-low holds. We have a double-bottom situation.

The low in April led to growth. This time around we have a slightly lower low with a bullish signal coming from the last candle that closed, a reversal candle. We also have a bullish chart pattern and marketwide action; it is very early of course. I am always early because I look 24-7 at the charts.

We have first a bottom and then a double-bottom after a little more than two months. This is it. Bear volume continues to drop and has been dropping since late 2024. This means that the bearish force has been exhausted, fully exhausted. Even the latest low yesterday has lower volume than the previous lows.

This is it. The bullish bias is now fully confirmed.

We won't have to wait long. It will be clear based on price action.

Thanks a lot for your continued support.

Namaste.

Navigating a Pullback in Natural GasNatural gas prices have been on a wild ride lately, with a recent pullback raising questions about the future of this energy source. This video provides insights into navigating this market volatility, offering actionable strategies for live trading in the midst of uncertainty.

Current weather forecasts for the U.S. show neither extreme heat nor cold—limiting heating or cooling demand. This typical spring-to-summer lull supports low prices .

Although rig counts in the U.S. are falling—the latest count shows an 8‑week decline—production remains ample. Storage levels remain healthy, and oversupply worries persist .

Natural gas rallied earlier today but faced resistance at the $4/mmBtu mark—a major psychological barrier. After hitting that ceiling, prices gave back gains, a typical sign of "rally exhaustion"

Natural Gas Explodes - Bullish Option ContractsTechnical Breakout Observed! Huge upside potential!

Inverse Head & Shoulders breakout on daily chart.

Weekly Bullish Cross 7/20 MA.

- Increased Demand: After a sluggish 2024, demand for natural gas is rebounding—especially for electricity generation in North America and Asia. This is tightening the market and pushing prices up.

- LNG Export Boom: New liquefied natural gas (LNG) export terminals, like the one coming online in British Columbia, are expanding shipping capacity. That’s opening up more international markets and driving up prices domestically.

- Geopolitical Tensions: Broader energy markets are reacting to instability in the Middle East, particularly between Iran and Israel. While this directly impacts oil, it also creates uncertainty across all energy commodities, including natural gas.

- Inventory and Supply Adjustments: After oversupply in 2024, producers are now recalibrating. But with inventories still low in some regions, prices are sensitive to even small disruptions

Natural Gas - Soaring Upside - Option Plays!Technical Breakout Observed! Huge upside potential

- Increased Demand: After a sluggish 2024, demand for natural gas is rebounding—especially for electricity generation in North America and Asia. This is tightening the market and pushing prices up.

- LNG Export Boom: New liquefied natural gas (LNG) export terminals, like the one coming online in British Columbia, are expanding shipping capacity. That’s opening up more international markets and driving up prices domestically.

- Geopolitical Tensions: Broader energy markets are reacting to instability in the Middle East, particularly between Iran and Israel. While this directly impacts oil, it also creates uncertainty across all energy commodities, including natural gas.

- Inventory and Supply Adjustments: After oversupply in 2024, producers are now recalibrating. But with inventories still low in some regions, prices are sensitive to even small disruptions

A BULLISH SNAPCHAT ANALYSIS SNAPCHAT has a neat chart setup long term. Here is a bullish look. I use a metric called NJT which analyzes total user hours available.

From a technical standpoint, there are gaps up to $70, and it could soar much higher. Think longer term investment, with short term jump potential.

Here is my summarized view with a little help from Grok (X).

"Overview of Snap Inc.'s Assets and Valuation

Snap Inc., the parent company of Snapchat, is a publicly traded technology company listed on the NYSE under the ticker SNAP. Founded in 2011 by Evan Spiegel, Bobby Murphy, and Reggie Brown, it focuses on multimedia messaging, augmented reality (AR), and related products. Below, I outline Snap Inc.'s key assets, estimate their valuation based on available data, and apply the NJT (Net Joint Time) metric to contextualize its user engagement in the competitive landscape of 2025-2026. The NJT metric, defined as monthly active users (MAUs) × average time spent per user per month, is used to assess user hours, with the global pool estimated at 285.6 billion user hours per month (9.52 billion hours/day × 30 days).

Key Assets of Snap Inc.

Snap Inc. owns several products and services, with Snapchat being the flagship. Here’s a breakdown of its primary assets as of June 2025:

Snapchat (Core Multimedia Messaging App)

Description: Snapchat is a visual messaging app allowing users to send ephemeral photos and videos, with features like Stories, Snap Map, Discover, and AR Lenses. It generates most of Snap’s revenue through advertising, particularly AR ads and Snap Ads.

User Metrics: Approximately 900 million MAUs and 453 million daily active users (DAUs) as of Q4 2024, with users spending an estimated 30 minutes daily (15 hours/month).

NJT Calculation:

MAUs: 900 million

Average time spent: 15 hours/month

NJT = 900 million × 15 = 13.5 billion user hours/month

Valuation Estimate: Snapchat accounts for ~98% of Snap’s revenue ($5.26 billion of $5.36 billion in 2024). Assuming the company’s current market cap of $14.18 billion (June 2025) is primarily driven by Snapchat, we allocate ~98% of the market cap to this asset:

Value: $13.9 billion

Spectacles (AR Smart Glasses)

Description: Wearable sunglasses that capture Snaps and integrate with Snapchat, featuring GPS-powered AR lenses and hand-tracking capabilities. Launched in 2016, Spectacles have not gained widespread popularity but remain part of Snap’s AR vision.

User Metrics: Limited user data; estimated <1 million users with minimal time spent (assumed 1 hour/month for valuation purposes).

NJT Calculation:

MAUs: ~1 million (conservative estimate)

Average time spent: 1 hour/month

NJT = 1 million × 1 = 1 million user hours/month

Valuation Estimate: Spectacles contribute ~2% of revenue ($100 million in 2024). Using the same revenue-to-market-cap ratio as Snapchat, we estimate:

Value: $0.28 billion ($280 million)

Bitmoji (Personalized Avatar Platform)

Description: Acquired in 2016 for ~$64 million, Bitmoji allows users to create personalized avatars integrated into Snapchat and other platforms. It enhances user engagement but is not a direct revenue driver.

User Metrics: Assumed to align with Snapchat’s user base (900 million MAUs) but with lower engagement (estimated 2 hours/month).

NJT Calculation:

MAUs: 900 million

Average time spent: 2 hours/month

NJT = 900 million × 2 = 1.8 billion user hours/month

Valuation Estimate: As a feature enhancing Snapchat’s ecosystem, we estimate its value based on acquisition cost adjusted for inflation and integration (5% annual growth since 2016):

Value: ~$100 million

Snap Camera (Desktop Application)

Description: Launched in 2018, Snap Camera allows users to apply Snapchat filters during video calls on platforms like Zoom. It has niche usage, primarily for streaming and virtual meetings.

User Metrics: Limited data; estimated 10 million MAUs with 1 hour/month usage.

NJT Calculation:

MAUs: 10 million

Average time spent: 1 hour/month

NJT = 10 million × 1 = 10 million user hours/month

Valuation Estimate: Minimal direct revenue; valued as a brand enhancer at ~1% of Snapchat’s value:

Value: $140 million

Zenly (Location-Sharing App, Discontinued)

Description: Acquired in 2017 for an undisclosed amount (estimated $200-$300 million), Zenly was shut down in 2023, but its location-sharing features were integrated into Snap Map.

User Metrics: No independent users post-shutdown; value absorbed into Snapchat.

NJT Calculation: Not applicable (integrated into Snapchat’s NJT).

Valuation Estimate: Residual value in Snap Map enhancements, estimated at acquisition cost:

Value: ~$250 million

Other Assets (Content Partnerships, Snapchat+, R&D)

Description: Includes partnerships with NBCUniversal, Disney, and others for Snapchat Originals, the Snapchat+ subscription service (7 million subscribers in March 2024), and ongoing AR R&D. Snapchat-Az These contribute to revenue and engagement but are not separately quantified.

User Metrics: Snapchat+ has ~7 million users; other assets are part of Snapchat’s ecosystem.

NJT Calculation: Included in Snapchat’s NJT (13.5 billion hours/month).

Valuation Estimate: Snapchat+ and content partnerships generate ~$100 million annually (estimated); R&D is a cost center. Valued at ~2% of market cap:

Value: $280 million

Total NJT and Market Cap Projection

Total NJT:

Snapchat: 13.5 billion hours/month

Bitmoji: 1.8 billion hours/month

Snap Camera: 10 million hours/month

Spectacles: 1 million hours/month

Total: ~15.311 billion hours/month

Market Share: 15.311 ÷ 285.6 ≈ 5.36% of the global pool (285.6 billion hours/month).

Current Market Cap (June 2025): $14.18 billion

Projected Market Cap Using NJT: Assuming the total market cap of 45 companies (~$10 trillion) is distributed proportionally to NJT shares (as in prior conversations), Snap’s 5.36% share yields:

Projected Market Cap: $536 billion

Comparison: Significantly higher than the current $14.18 billion, suggesting Snap is undervalued based on user engagement.

Breakdown of Valuation by Asset

Asset

NJT (Billion Hours/Month)

Estimated Value ($B)

% of Total Value

Snapchat

13.5

13.9

98.0%

Spectacles

0.001

0.28

2.0%

Bitmoji

1.8

0.10

0.7%

Snap Camera

0.01

0.14

1.0%

Zenly (integrated)

-

0.25

1.8%

Other (Snapchat+, R&D)

-

0.28

2.0%

Total

15.311

14.18

100%

Key Insights

Snapchat Dominance: Snapchat accounts for 98% of Snap’s value and 88% of its NJT, driven by its 900 million MAUs and strong engagement among younger users.

Undervaluation: The projected market cap of $536 billion (based on NJT share) is significantly higher than the current $14.18 billion, suggesting Snap’s user engagement is not fully reflected in its stock price, possibly due to ongoing losses ($1.4 billion in 2022).

AR and Innovation: Investments in AR (Spectacles, Lenses) and Snapchat+ position Snap for growth in 2025-2026, particularly as AR advertising and immersive experiences gain traction.

Challenges: Competition from TikTok and Instagram Reels, privacy changes (e.g., Apple’s iOS updates), and macroeconomic swings in ad spending could limit growth.

Conclusion

Snap Inc.’s primary asset, Snapchat, drives its value and user engagement, with a projected market cap of $536 billion based on NJT, far exceeding its current $14.18 billion. This suggests significant undervaluation, driven by its strong user base and AR innovations, despite profitability challenges. Spectacles, Bitmoji, and other assets play smaller roles but enhance Snap’s ecosystem, positioning it as a top contender for 2025-2026.

Key Citations

Snap Inc. - Wikipedia

Who Owns Snapchat? - Famoid

Snapchat Revenue and Usage Statistics (2025) - Business of Apps

Snap (SNAP) - Market Capitalization - CompaniesMarketCap

Snapchat - Wikipedia

SNAP Intrinsic Valuation and Fundamental Analysis - Alpha Spread

Snap Inc. Announces Fourth Quarter and Full Year 2024 Financial Results - Snap Inc."

- GROK

Do You Smell That...Natural Gas Burning!Recent Trends: The Energy Information Administration (EIA) reported the seventh consecutive weekly gain in inventories since late April, indicating a steady buildup ahead of summer demand.

Regional Highlights:

East: 340 Bcf

Midwest: 396 Bcf

Mountain: 166 Bcf

Pacific: 199 Bcf

South Central: 658 Bcf

Next inventory report is June 12 2025

June 5 - 122B Build

May 29 - 101B build

May 22 - 120B Build

These last builds have come in higher than consensus andd price is still holding.

A weekly Bullish cross of the 7 / 20 MA is about to occur. This indicates high provability of higher prices on the next few months if this can hold above the key MA's.