Price Back at Key Historical Low...High R:R SetupTaking a close look at AR/USDT on the daily timeframe. Price has completed a deep correction following its massive bull run and has now returned to a major historical support level.

This area acted as a base for the previous move and is clearly a significant pivot point. We've recently seen a sharp "stop hunt" (as labeled) underneath this support zone, which often precedes a reversal if the level holds.

Entry: Look for confirmation of a bounce/holding above the major support level (around $3.00 - $3.50).

Stop Loss: A clean daily close significantly below the support zone and the stop hunt low (e.g., below $2.50).

Potential Targets:

T1: $9.55

T2: $12.55

T3: $16

T4: $23.86

This setup offers a potentially attractive Risk/Reward ratio if the historical support proves strong once again. Trade with caution, always manage your risk, and wait for confirmation!

Good Luck!

#AR #ARUSDT #Crypto #Support #TechnicalAnalysis

ARUSDT

Will ARUSDT's Hidden Liquidity Grab Spark a Major Bullish Move?Yello, Paradisers — are you watching ARUSDT closely? Because this setup could develop into one of the cleanest short-term opportunities we’ve seen lately, but only for those who remain patient and calculated. The current structure is showing early signs of a potential bullish shift, and here’s what we’re seeing.

💎ARUSDT has displayed a proper bullish Change of Character (CHoCH) along with a Break of Structure (BOS), both occurring right after a clean sweep of seller-side liquidity. This kind of price action generally signals a potential reversal and significantly increases the probability of a short-term bullish continuation.

💎However, while the bias is clearly tilting bullish, jumping in at current price levels doesn't offer an optimal risk-to-reward setup. Entering now would only give about a 1:1 RR, which isn’t ideal for high-probability trading. The more strategic move would be to wait for a retracement back into the Fair Value Gap (FVG). If price pulls back into that zone and forms a clear bullish candlestick pattern, the probability of a strong move upward increases substantially, and the RR improves in our favor.

💎That said, the setup isn't without its invalidation. If ARUSDT breaks down and we get a candle close below the invalidation level, the entire bullish scenario becomes invalid. In that case, there’s no reason to force a trade. It’s smarter to stay patient and wait for a clearer structure to reappear.

🎖Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler. There will always be another opportunity, but only if you protect your capital and remain disciplined. Stay focused and let the setup come to you — not the other way around.

MyCryptoParadise

iFeel the success🌴

ARUSDT Forming Falling WedgeARUSDT is currently forming a strong falling wedge pattern, a bullish reversal setup that often signals the end of a downtrend and the beginning of a potential rally. The price structure shows contracting lower highs and lower lows, creating a tightening range that suggests selling pressure is fading while buyers are gradually stepping in. This consolidation phase could soon give way to a breakout, marking a possible shift in market sentiment toward the upside.

The trading volume for ARUSDT remains healthy, which supports the idea of accumulation within the wedge formation. As volume typically expands during breakout phases, traders are watching this pair closely for confirmation of an upward move. Based on the technical outlook, ARUSDT holds potential for a strong rebound, with expectations of gains ranging between 140% to 150% once the breakout is confirmed.

Investor confidence in the project continues to grow, as ARUSDT gains more attention from traders looking for high-upside opportunities in the current market cycle. The confluence of strong technical signals, consistent volume, and rising interest indicates that momentum could soon favor the bulls. A decisive close above the wedge resistance may trigger a surge toward higher price targets in the coming sessions.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

AR/USDT — Major Reversal or the Start of Breakdown?ARWEAVE (AR/USDT) is now standing on the edge of its most critical support zone between $4.4–$3.7 (highlighted in yellow).

This zone has acted as a major historical demand area since 2023 — the last stronghold where institutional accumulation often takes place.

But this time, the market has shown something different:

A deep wick below $3.7 indicates a massive liquidity grab, suggesting that the market might have flushed out weak long positions and stop orders before deciding its next major move.

---

Technical Structure & Pattern

Macro trend: Still in a structural downtrend since early 2024 (lower highs and lower lows).

Key support zone: $4.4–$3.7 remains a major reaction area that has repeatedly absorbed selling pressure.

The long wick below support suggests a potential fake breakdown or bear trap, especially if price reclaims $4.4–$6.0 in the next few candles.

Failure to hold above $3.7 would confirm a bearish continuation pattern and shift market sentiment further downward.

---

Bullish Scenario

📈 Accumulation Reversal Setup

If price successfully holds above $4.4–$3.7 and manages to close above $6.075, it could mark the beginning of a mid-term reversal.

This setup is often accompanied by strong volume spikes, bullish engulfing candles, and a new higher low formation above the support.

🎯 Upside Targets:

Target 1: $8.395 — first major resistance and reaction zone.

Target 2: $10.882 — key breakout confirmation level.

Long-term targets: $26.989 and $47.674, if the macro reversal strengthens into a new bullish cycle.

This could become the foundation of a re-accumulation phase, similar to previous cycle bottoms.

---

Bearish Scenario

📉 Final Breakdown and Capitulation Risk

If the price closes a 5D candle below $3.7 and fails to reclaim the zone, it would confirm that the yellow block has turned into a new resistance area.

This would signal a final distribution phase before potential capitulation.

🎯 Downside Targets:

Target 1: $3.0 — next psychological and structural support.

Target 2: $2.4 — historical low based on previous liquidity sweep.

A confirmed breakdown below this zone could trigger capitulation, flushing out remaining long positions before the next accumulation cycle begins.

---

Conclusion

ARWEAVE is currently at a make-or-break zone ($4.4–$3.7) that will define its medium-term direction.

If buyers defend this level, the market could form a strong base for a major reversal.

However, if the support gives way, AR might revisit $3.0–$2.4 before finding a true bottom.

This zone represents a high-stakes battle between bulls and bears —

and the next few candles will decide whether we’re witnessing the birth of a new uptrend, or the continuation of the final downtrend leg.

---

#ARWEAVE #ARUSDT #CryptoAnalysis #TechnicalAnalysis #PriceAction #SupportZone #LiquidityGrab #MarketStructure #AltcoinAnalysis #CryptoTrading #DecisionZone #SwingTrade

AR (Arweave) - Major Support Zone In PlayAR has seen a sharp pullback over the last few weeks and is now testing a key support level. This zone has previously acted as a strong base, making it a potential area for bullish reversal or bounce.

💡 Trade Idea:

🔹 Entry Zone: $5.20 – $5.40

🔹 Targets (TP):

• First target: $6.10 – $6.60

• Second target: $7.80 – $8.75

🔹 Stop Loss: Just below $5.00

🔍 Watch for bullish confirmation (volume spike, candle reversal) at support before entering. Manage your risk and scale out at key resistance levels.

AR Looks Bullish (1D)The AR symbol appears to be completing a double corrective pattern | the first part being a plapyonic diametric and the second part a flat. The green zone represents a demand area that could potentially push the price upward. Note that this type of setup is generally safer for spot trading, while futures trading would require more precise entry levels.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

AR – Testing Support, Eyeing Higher Targets

AR is currently trading around $5.630, consolidating above a key support zone near $5.240. Price action shows a downtrend line pressing from above, but buyers continue to defend the blue support area.

- Support: $5.240 – $5.000

- Bullish case: A breakout above $8.700 could open the way toward $30

⚖️ AR is at a pivotal level — holding support could fuel a strong rally, but traders should wait for confirmation above resistance before positioning aggressively.

AR (SPOT)BINANCE:ARUSDT

#AR/ USDT

Entry range (7.00- 7.50)

SL 4H close below6.67

T1 8.80

T2 11.40

T3 13.70

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

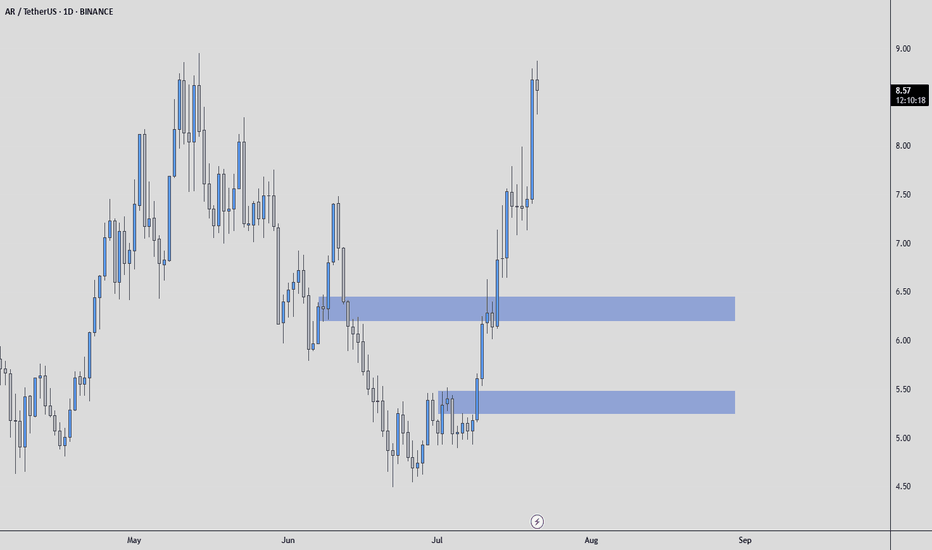

ARUSDT Mid-Term AnalysisIt made a nice rise, but I’m waiting for price in the blue boxes I’ve marked.

I won’t chase it at high prices.

If price comes to my levels, I’ll watch for:

✅ Footprint absorption

✅ CDV support

✅ Structure reclaim

If these align, I’ll consider a trade with clear risk. If not, I’m fine staying out.

Patience over chasing. The right price, or no trade.

ARUSDT Forming Descending ChannelARUSDT is showing a promising setup as it begins to break out of a clear descending channel pattern on the daily timeframe. The current chart indicates strong potential for a bullish reversal, with price action approaching key breakout levels supported by healthy trading volume. This technical formation suggests that buyers are starting to regain control after an extended correction, making ARUSDT one to watch closely for the next big move.

With a projected gain of around 90% to 100%+, the risk-to-reward ratio for ARUSDT looks highly favorable. This setup aligns well with broader market sentiment, where investors are rotating back into altcoins that show strong recovery potential. As ARUSDT pushes against the upper trendline of its channel, confirmation of a breakout could lead to a powerful rally that targets previous highs, giving traders a clear upside objective.

In addition to the technical pattern, the volume profile for ARUSDT remains supportive, indicating growing investor interest and participation. This surge in trading activity often precedes sustained moves, as more market participants add to positions once key resistance levels flip to support. The combination of strong volume and a bullish channel breakout is a classic setup for momentum traders.

Overall, ARUSDT stands out as a well-positioned crypto pair for traders looking to capture a mid-term trend reversal. Keeping an eye on breakout confirmation and subsequent retests will be key for maximizing profit potential. With momentum building, this pair could deliver significant returns in the coming weeks if market conditions stay supportive.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Arweave—Bullish Bias Confirmed (Altcoins Bull Market As Promise)Three weeks ago I told you a very strong bullish wave was approaching the altcoins market. It is here, confirmed. The rest is just too easy...

Tell me... Can you see this?

Tell me you can see this. I know you can.

Tell me you can see the end of a correction, the bearish wave.

On the 5th of June the market was supposed to move up. It started up and went up for five days. 11-June produced a major crash rather than a bullish continuation... Surprise! but the market never moves straight down, this was the final leg down; the bottom is in, we can change trend now.

Technically speaking, the 7-April bottom-low holds. We have a double-bottom situation.

The low in April led to growth. This time around we have a slightly lower low with a bullish signal coming from the last candle that closed, a reversal candle. We also have a bullish chart pattern and marketwide action; it is very early of course. I am always early because I look 24-7 at the charts.

We have first a bottom and then a double-bottom after a little more than two months. This is it. Bear volume continues to drop and has been dropping since late 2024. This means that the bearish force has been exhausted, fully exhausted. Even the latest low yesterday has lower volume than the previous lows.

This is it. The bullish bias is now fully confirmed.

We won't have to wait long. It will be clear based on price action.

Thanks a lot for your continued support.

Namaste.

#AR/USDT#AR

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 7.00, which acts as strong support from which the price can rebound.

Entry price: 7.14

First target: 7.30

Second target: 7.60

Third target: 8.00

AR Trade Setup – Watching for Market Structure ShiftAR is showing early signs of strength after defending the $5 key level a crucial support that bulls needed to hold. Now, the focus is on a potential shift in market structure around $6, which could lead to a strong upside move.

📍 Entry Zone:

Enter around $6 after confirmation (e.g., reclaim with strong volume or bullish candle close)

🎯 Take Profit Targets:

🥇 $12

🥈 $16

🥉 $22

🛑 Stop Loss:

Below $5

TradeCityPro | AR: Key Triggers in Web3 Storage Coin’s Downtrend👋 Welcome to TradeCity Pro!

In this analysis, I want to review the AR coin for you. This project is one of the Storage and Web3 platforms, and the coin of this project, with a market cap of $352 million, is ranked 124th on CoinMarketCap.

⏳ 4-Hour Time Frame

In the 4-hour time frame, as you can see, this coin is in a downtrend, and in its latest leg, after being rejected from the 7.70 top, it started to drop, and this decline continued down to the 4.78 zone.

✔️ Currently, the price has retraced to the 0.382 Fibonacci level and has created a range box between 4.78 and 5.65. A break of this box can determine the trend of this coin for the coming days or even weeks.

✨ The SMA99 indicator has so far acted well as a dynamic resistance, and within the current box, the price has already reacted to it once and is now again pulling back to this moving average.

💥 If the price is rejected from this indicator and forms a lower high than 5.65, the probability of breaking the 4.78 bottom increases significantly, and the price could move toward lower lows.

⚡️ The 4.78 support is actually a support range between 4.78 and 4.92, and to confirm a bearish move, the risky trigger is 4.92, and the main trigger is 4.78.

🔼 For a long position or spot buy, we should first wait for the SMA99 to break and for the 5.65 zone to activate. The break of this zone would be the first confirmation of a trend reversal, and the main confirmation would come after the price makes a higher low and higher high above the 5.65 zone.

🎲 The main resistance levels above this area are the 0.5, 0.618, and 0.786 Fibonacci levels. Another key resistance is the 7.70 zone.

📝 Final Thoughts

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Rebuy Setup for AR (3D)From the point where we placed the red arrow on the chart, the AR correction seems to have begun.

It now appears to be in wave C of the corrective pattern. The green zone is where the bearish wave C could potentially end.

A daily candle close below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You