GEK TERNA Group: Powerful H1 2025 PerformancGEK TERNA Group: Powerful H1 2025 Performance Driven by Concessions and Construction

Athens, September 10, 2025 – GEK TERNA Group posted a commanding first-half performance in 2025, powered by record-breaking earnings, robust activity across all segments, and a major boost in profitability. The numbers confirm the company’s strategic focus on infrastructure, concessions, and energy is delivering strong, sustainable results.

Revenue surged 44% year-over-year to €1.96 billion, while adjusted EBITDA jumped 84% to €317 million, reflecting a better mix of high-margin projects. Adjusted net profits rose 24% to €68 million, or €0.68 per share, from €55 million and €0.56 per share a year ago.

The Group’s pre-tax earnings reached €87 million, up 50% from the same period in 2024, driven by increased profitability in both its core concessions and construction activities. EBITDA margin rose to 16%, compared to 12% in H1 2024.

Concessions Take the Lead

The concession segment was the engine of growth, accounting for 53% of the Group’s total EBITDA. Revenues from concessions more than doubled, while adjusted EBITDA in the segment jumped 114%, reaching €167 million. This growth was driven by higher vehicle traffic across all toll roads and the inclusion of the Attiki Odos concession, which alone contributed €89 million in EBITDA during the period.

Traffic volume increased 4.6% on Attiki Odos, 7.5% on Nea and Central Odos (thanks to new segments being opened), and 3.5% on Olympia Odos. These assets now form the foundation of GEK TERNA’s recurring revenue streams, offering long-term cash flow visibility.

Additional projects, including the Egnatia Odos, the Kasteli Airport, and several water and waste management concessions, are expected to further enhance earnings starting in the coming periods.

Construction Segment Scales Up

Construction revenues increased 41% to €813 million, while segment EBITDA rose 49% to €89 million. The uptick reflects an acceleration in project execution and the launch of several new developments.

As of June 30, 2025, the Group’s signed construction backlog hit a record €6.3 billion, up from €4.1 billion at year-end 2024. Notably, around half of this backlog comes from GEK TERNA’s own investment projects, which the company characterizes as lower-risk and higher-quality assets. The pipeline is expected to grow even further as the Group awaits final contract signatures on several awarded tenders.

Energy: Steady Profitability Amid Market Volatility

In energy and natural gas, GEK TERNA maintained positive momentum despite ongoing market pressures. Demand for electricity in Greece rose just 0.6% during the first half, but wholesale prices climbed 37% year-over-year, largely due to higher natural gas prices earlier in the year.

In the power supply segment, HERON Energy preserved market share, despite a slight dip in volumes driven by reduced industrial sales. On the production side, the HERON plant generated 0.7 TWh, a marginal decrease due to planned maintenance.

Meanwhile, the new combined cycle gas plant in Komotini entered trial operation, while the HERON I plant in Crete—developed for Public Power Corporation (PPC)—came online. The completion of the Crete project contributed positively to segment earnings.

Strategic Deal with Motor Oil Reshapes Energy Division

A key development in the Group’s energy strategy is the newly announced joint venture with Motor Oil, under which both companies will merge their respective energy businesses into a new 50/50 enterprise. This move creates a vertically integrated energy platform with strong production assets and a sizable customer base.

The transaction, pending regulatory and shareholder approvals, is expected to close in early 2026. GEK TERNA will receive €128 million in cash upon completion of the deal. The combined entity is positioned to accelerate growth and lead Greece’s energy transition with a highly competitive footprint.

Strengthened Financial Position

GEK TERNA continues to improve its financial resilience. Adjusted net debt at the parent company level fell to €117 million, down from €153 million at the end of 2024. Group-level adjusted net debt also declined, from €3.26 billion to €3.12 billion.

The Group closed the half-year with €1.46 billion in total cash, including €748 million at the parent company level. The reduction in cash reserves reflects the full repayment of a €120 million bond (KOD 2018) earlier in the year, reinforcing the Group’s commitment to disciplined capital management.

Looking Ahead

GEK TERNA’s performance in the first half of 2025 paints a picture of a diversified, cash-generating group firing on all cylinders. With its concession portfolio now driving the majority of earnings, a deep and expanding construction pipeline, and a strong position in the energy transition through its Motor Oil joint venture, the Group is well-positioned for continued growth.

The second half of the year is expected to bring further progress across all fronts—especially as more concession projects become operational and energy sector synergies begin to materialize. The numbers tell the story: GEK TERNA is not just growing—it’s building a platform for long-term, sustainable value.

Athex

OTE: Stock Breathes Again After Romania Exit OTE: Stock Breathes Again After Romania Exit – Strong Support from AXIA – Bullish Rebound from Key Support Zone (TECHNICAL ANALYSIS)

KONSTANTINOS GKOUGKAKIS – July 30, 2025, 07:31

Romania is over, shareholder returns are next. OTE’s strategic exit from the loss-making Romanian mobile market (Telekom Romania Mobile) gives the Group renewed momentum. AXIA Ventures sees clear positive impact on liquidity and OTE’s investment profile.

A Move the Market Was Waiting For

The green light from Romanian authorities for the sale of Telekom Romania Mobile (TKRM) didn’t come as a surprise—but the market reaction revealed how eagerly it was anticipated. For years, OTE was trapped in a challenging investment in Romania. Now, the Group breathes easier, freeing itself from a burden that dragged down cash flows, operations, and stock dynamics.

What AXIA Says – Capital Relief, Liquidity and Shareholder Rewards

AXIA Ventures is clear and direct: the deal will have a positive effect on free cash flow and capital returns to shareholders. AXIA estimates an immediate cash flow benefit of €10 million for 2025, with €20–30 million annually thereafter. At the same time, they foresee a €40–50 million increase in shareholder capital returns, translating to at least a 10% boost in total yield to shareholders for 2025.

Cash Flows Without TKRM – OTE Gets Breathing Room

TKRM was expected to have a negative €70 million cash flow impact in 2025—a figure already baked into OTE’s guidance of €460 million free cash flow, of which €451 million (or 98%) is planned for distribution:

€298 million in dividends

€153 million in share buybacks

With the Romania exit, OTE gains a fresh window for special capital returns beyond what’s already planned. Management has confirmed that any additional net cash benefit from the transaction will be returned to shareholders, reinforcing market confidence.

A Costly Chapter Closes – The Numbers Speak

TKRM came at a high price. In 2024 alone, the subsidiary posted €143 million in losses, adding to a decade-long total exceeding €440 million. Equity was wiped out, and the operation was sustained only by Group funding. While the sale doesn’t command a high price tag, it helps avoid hundreds of millions in future losses and unlocks a tax credit of over €100 million, according to AXIA.

The total estimated benefit stands at €560 million—or €1.39 per share.

Stability and Strategic Clarity

OTE stock needed a catalyst like this. Despite solid fundamentals and international momentum, the uncertainty around TKRM was a drag. Now, the picture is clear:

Strategic cleanup is complete

Focus shifts fully to profitability and Greece

The investment story becomes positive, predictable, and scalable

No surprise that AXIA maintains a “buy” rating with a €19.5 price target. Similarly, NBG Securities sees a 29% upside (targeting €19.8), calling OTE an “ideal pick for defensive portfolios.”

A Two-Step Deal – Vodafone and Digi Split the Assets

The Romanian deal involves two separate transactions:

Digi Communications will acquire TKRM’s prepaid mobile customers, spectrum licenses, and part of the base station infrastructure.

Vodafone Romania will acquire the rest of TKRM’s equity, excluding 7 shares owned by Radiocomunicații.

Final closing is pending approval from ANCOM (Romanian telecom regulator) and is expected within Q3 2025.

The Bigger Picture: OTE on a New Trajectory

The Romania exit is part of a wider strategic transformation. OTE is betting on technological leadership, leveraging the global Telekom brand, and targeted capital returns.

COSMOTE leads with 70% 5G SA coverage and 99% total population reach.

Investments in FTTH, FWA, AI-RAN, and MagentaONE build an integrated digital services ecosystem.

Srini Gopalan’s “un-carrier mindset” strategy signals OTE is no longer playing defense—it's attacking with tech and international scale.

Why Now? Why This Way?

Simple answer: it had to happen. The Romanian mobile venture had failed. Exiting now—while tough at first—paves the way for better capital allocation, higher returns, and strategic clarity.

The market got the message. AXIA confirmed it. And the stock finally took the breather it needed to restart its climb.

OTE Technical Analysis – July 30, 2025

Short-Term Picture: Bullish Reaction from Strong Support Zone

OTE stock shows clear signs of recovery after a period of pressure. Accumulation around €15.00–15.20 created a solid support base, confirmed by Buy signals and strong green volume spikes.

The current price sits at €15.83, posting a +0.44% daily gain, and approaches the critical 0.5 Fibonacci retracement level at €16.12—a key intermediate resistance between the low of €15.02 and the high of €17.89.

Fibonacci Retracement Levels

0.382 at €15.79: already breached (bullish sign)

0.5 at €16.12: immediate resistance

0.618 at €16.45: strong resistance level; a break here could lead to retesting €17.00–17.80

A clean breakout above €16.12 would be a bullish confirmation, targeting €16.80–17.20.

MACD – Momentum Strengthening

The MACD is turning bullish:

MACD Line: -0.0188, rising toward

Signal Line: -0.0884

Histogram: +0.0696, indicating momentum buildup

A bullish crossover is expected soon, reinforcing the positive bias.

RSI – No Overbought Signals, Room to Rise

The RSI is at 59.91, not yet in overbought territory, suggesting room for further gains before any pullback. The RSI-based moving average sits at 45.53, confirming upward momentum.

Exponential Moving Averages (EMA)

EMA 20: €15.50

EMA 50: €15.72

EMA 100: €15.97

EMA 200: €15.93

Price is currently above all major EMAs, reinforcing the bullish scenario. A possible Golden Cross could materialize on the 4-hour chart. Staying above EMA 100 (€15.97) will be key.

Volume – Breakout Confirmed by Strong Demand

Volume surged significantly during the breakout above €15.60, validating buyer interest. Green bars dominate the latest sessions, showing a shift in sentiment and confirming demand.

Momentum with Structure, But Watch Key Zones

OTE’s stock has entered a positive momentum phase, with several technical indicators (MACD, RSI, Fibonacci) pointing to potential continuation. Recent news about the TKRM sale adds fuel.

Still, the €16.12–16.45 zone is critical. A clean breakout on strong volume could lead to a full recovery of June’s losses and pave the way for new 2025 highs.

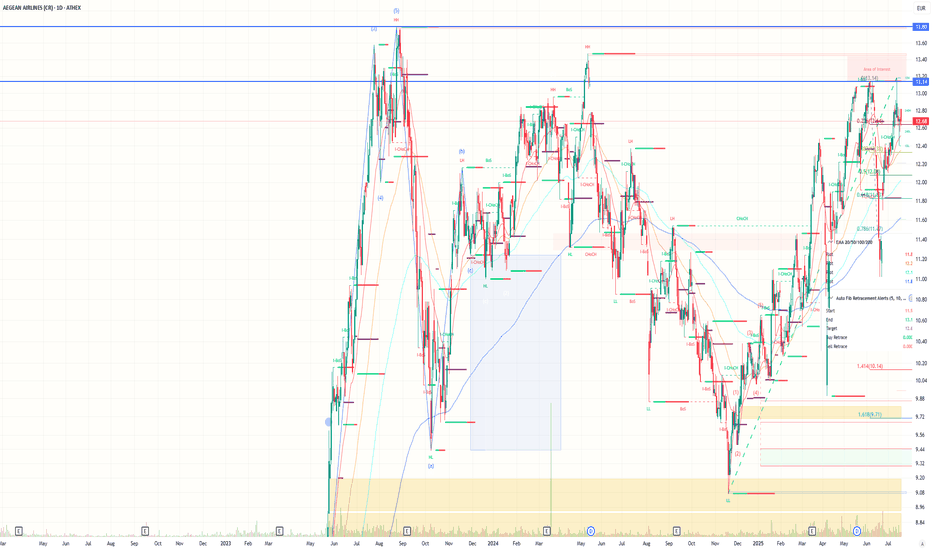

Aegean: The cheapest airline in Europe?Aegean is flying high, but the stock remains grounded at -71.5% – The market values it at just 28.5% of its real worth: The cheapest airline in Europe?

Aegean: Time for the Market to Wake Up

We’ve said a lot about Aegean. About its stock going nowhere, about how it's been ignored by the market, about how it just refuses to move. Sure, some of that skepticism is understandable—geopolitical risk, a volatile global landscape, travel disruptions. But at some point, we need to look at the numbers.

Because this isn’t just another airline stock. Aegean is sitting on assets worth over €4 billion. And its current market cap? Just €1.14 billion.

Do the math: that's a 71.5% discount — the stock is trading at only 28.5% of what the company is worth on paper.

If that’s not undervalued, what is?

60 Aircraft, €4 Billion in Investment

This isn’t hype — it's hard investment. Aegean has committed to 60 Airbus A320/321neo aircraft by 2031, with a total fleet investment reaching $4 billion. The two newest additions, the A321neo XLRs, have a flight range of over 10 hours. That opens the door to long-haul destinations far beyond Europe — like India, the Maldives, Nairobi, and more.

In fact, direct flights to India are already scheduled to start in March 2026, ahead of the original plan. This isn’t about just growing the fleet — it’s a shift in scale, reach, and ambition.

Meanwhile, Aegean has already received 36 of the 60 aircraft. The buildout is real. And it’s happening now.

An Airline Investing in Itself

Aegean isn't just growing in the air — it’s building on the ground. It has launched maintenance and training facilities, is servicing third-party aircraft, and is investing heavily in talent and education.

From 1,878 employees in 2013 to nearly 4,000 today. Dozens of scholarships. A full ecosystem of aviation infrastructure is taking shape — one that positions Aegean not just as an airline, but as a regional aviation hub.

How is all of that still being missed on the board?

The Market Is Rallying – Aegean Is Not

While the Athens Stock Exchange hits 15-year highs, and large caps are breaking records, Aegean’s stock is standing still.

It’s one of the few big names that hasn’t made a move — and that makes it a prime candidate for a snap revaluation.

All it needs is a spark — a catalyst. A major deal. A re-rating. A surprise quarter. Something to jolt the market awake. And when that happens, it won’t be slow or gradual. It’ll be violent and vertical.

Geopolitics? Sure. But Everyone’s Facing It

Yes, global tensions are high. Wars, inflation, airspace closures, unpredictability. But every airline is in the same storm. What matters is how you build resilience. And Aegean has done that.

It emerged from the COVID crisis leaner, stronger, more focused. While others pulled back, Aegean doubled down. That’s not weakness — that’s conviction.

Why the Discount Still Exists

The short answer: the market hasn't connected the dots.

The new fleet hasn’t been fully priced in.

The strategic expansion hasn’t registered.

The infrastructure buildout hasn’t translated into market value.

Investors are still judging it on short-term P&Ls — not on what it’s quietly turning into.

Time for That to Change

It’s time for the market to take another look. To see the €4 billion in assets not as a future maybe — but as a real foundation for growth. To recognize the international pivot. To price in the hidden strength.

Aegean has the fundamentals. It has the vision. It has the operational edge.

What it doesn’t have — yet — is the recognition on the board.

But that’s coming. And when it comes, the move won’t be subtle.

Aegean is undervalued. Not just theoretically, but blatantly — with a 71.5% discount staring everyone in the face. The business is solid. The growth is real. The investments are in motion.

The market will catch up. The only question is: will you be in before it does?

The Risky Strategy of Vassilakis: Aegean’s Profit Decline The Bold but Risky Strategy of Vassilakis: Aegean’s Profit Decline and the Volotea Acquisition

Aegean's nine-month financial results for 2024 confirmed a worrisome trend that had begun to surface on the stock market, revealing a significant deterioration in the company's financials. The 3% drop in revenue and a 23% decline in post-tax profits compared to the same period last year underscore the financial pressure facing the company.

This downward trend is also reflected in Aegean’s stock, which has plummeted by 26.22% over the past six months, showing losses of 13.14% since the start of the year. These developments intensify investor pessimism, with the stock nearing its 52-week low.

Despite these challenges, Aegean made a bold yet potentially risky move by acquiring a 13% stake in Volotea, one of Europe’s top low-cost carriers. This €100 million investment could be seen as Aegean’s attempt to strengthen its position in the European market and increase its international presence. However, given the current negative financial state, the investment appears risky, particularly considering the challenges the company is already facing.

Mr. Vassilakis, Aegean's chairman, continues to pursue investments despite the company’s financial difficulties, a strategy that could lead to further risks. Aegean is facing a decline in efficiency and a serious drop in key financial metrics. Especially concerning is the EBITDA, which dropped by 10%, indicating reduced operational profitability and raising doubts about the long-term viability of this strategy.

The decision to allocate such a large capital amount for an acquisition amid falling profits leaves room for questioning the appropriateness of this move in the current economic climate.

Looking ahead to the year’s end, prospects appear bleak, as the company’s financial trajectory suggests potentially greater losses. The negative growth rate in critical indicators suggests that challenges will persist, casting doubt on the profitability of the Volotea acquisition at this stage.

This acquisition could only be successful if Aegean manages to reverse its negative course and capitalize on its investment in Volotea, but current signs leave little room for optimism. The combination of financial challenges and high acquisition costs may confront Aegean's management with tough decisions.

Key financial results for Aegean for Q3 and the nine months of 2024:

Third Quarter 2024 compared to 2023:

Revenue: €630.8 million (down 3% from €653.6 million in 2023)

EBITDA: €182.3 million (down 20% from €227.9 million in 2023)

Earnings before interest and taxes: €136.1 million (down 27% from €186.2 million in 2023)

Earnings before taxes: €138.8 million (down 18% from €168.8 million in 2023)

Net profit after taxes: €108.3 million (down 19% from €133.6 million in 2023)

Nine Months 2024 compared to 2023:

Revenue: €1,379.9 million (up 4% from €1,331.7 million in 2023)

EBITDA: €329.9 million (down 10% from €367.4 million in 2023)

Earnings before interest and taxes: €199.5 million (down 21% from €253.7 million in 2023)

Earnings before taxes: €170.4 million (down 22% from €217.5 million in 2023)

Net profit after taxes: €132.0 million (down 23% from €170.7 million in 2023)