AUD/JPY Price Outlook – Trade Setup📊 Technical Structure

OANDA:AUDJPY AUD/JPY remains in a short-term bullish structure after staging a strong impulsive rally from the lower range. Price is currently pulling back toward the 107.85–108.05 support zone, which aligns with the prior breakout area.

The broader structure suggests continuation higher as long as the pair holds above support. The projected path indicates a potential dip for liquidity before buyers attempt another push toward the 108.65–108.85 resistance zone.

🎯 Trade Setup (Bullish Bias)

Entry Zone: 108.05 – 107.85

Stop Loss: 107.80

Take Profit 1: 108.65

Take Profit 2: 108.85

Risk–Reward Ratio: Approx. 1 : 3.01

📌 Invalidation:

A sustained break and close below 107.80 would invalidate the bullish setup and signal weakening upside momentum.

🌐 Macro Background

AUD/JPY is supported by persistent weakness in the Japanese Yen amid fiscal uncertainty and political developments in Japan. Discussions around potential tax pauses and election-related spending have pressured the currency.

Meanwhile, the Australian Dollar remains relatively resilient, benefiting from stable risk sentiment. Although intervention concerns from Japanese authorities may slow the rally, the near-term macro environment still favours upside continuation.

🔑 Key Technical Levels

Resistance Zone: 108.65 – 108.85

Support Zone: 107.85 – 108.05

Bullish Invalidation: Below 107.80

📌 Trade Summary

AUD/JPY is undergoing a healthy pullback after a strong bullish impulse. As long as price holds above the support zone, the bias favours a buy-on-dips strategy, targeting a continuation toward the upper resistance band.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

Audjpyforecast

AUD/JPY Price Outlook – Trade Setup📊 Technical Structure

OANDA:AUDJPY AUD/JPY pulled back after the recent rally and is now consolidating around the 105.70–105.93 support zone. This area overlaps with prior demand and a key technical base, where downside momentum has started to slow.

From a structural perspective, the current move appears to be a corrective pullback within an ongoing bullish trend, rather than a trend reversal. As long as price holds above the support zone, the broader price action favours a continuation higher toward the upper resistance area.

🎯 Trade Setup (Bullish Bias)

Entry Zone: 105.70 – 105.93

Stop Loss: 105.61

Take Profit 1: 106.62

Take Profit 2: 106.84

Risk–Reward Ratio: Approx. 1 : 2.36

📌 Invalidation

A sustained break and close below 105.61 would invalidate the bullish setup and suggest a deeper corrective move.

🌐 Macro Background

On the macro front, the Japanese Yen continues to face pressure despite repeated verbal warnings from Japanese officials regarding potential intervention. So far, these comments have failed to translate into concrete action, keeping the JPY structurally vulnerable.

Meanwhile, the Australian Dollar remains supported by expectations that the Reserve Bank of Australia maintains a relatively hawkish stance, especially compared with Japan’s still-accommodative policy environment. This ongoing policy divergence continues to underpin AUD/JPY, favouring buy-on-dips strategies rather than aggressive selling.

🔑 Key Technical Levels

Resistance Zone: 106.68 – 106.84

Support Zone: 105.70 – 105.93

Bullish Invalidation: Below 105.61

📌 Trade Summary

AUD/JPY is undergoing a healthy pullback within a broader bullish structure. As long as price holds above the 105.70 support zone, the technical bias favours a rebound toward the upper resistance band. The overall setup supports a buy-on-dips approach, rather than a bearish trend reversal.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

AUD/JPY Price Outlook – Trade Setup📊 Technical Structure

FOREXCOM:AUDJPY AUD/JPY is currently consolidating near recent highs after a strong impulsive rally. Price has pulled back into the 105.18–105.37 support zone, where buying interest has emerged and downside momentum has clearly slowed.

The broader market structure remains bullish. As long as price holds above the support zone, AUD/JPY is likely to form a higher low and resume its upward move. The projected path suggests a brief consolidation or shallow retracement, followed by a continuation toward the 105.75–105.93 resistance zone, rather than a deeper corrective breakdown.

🎯 Trade Setup (Bullish Bias)

Entry Zone: 105.15 – 105.37

Stop Loss: 105.15

Take Profit 1: 105.75

Take Profit 2: 105.93

Risk–Reward Ratio: Approx. 1 : 2.6

📌 Invalidation:

A sustained break and close below 105.15 would invalidate the bullish setup and signal a deeper correction risk.

🌐 Macro Background

The macro backdrop continues to favor AUD/JPY on a relative basis. Persistent uncertainty surrounding the Bank of Japan’s policy normalization keeps the Japanese Yen structurally weak, while expectations of a relatively hawkish Reserve Bank of Australia continue to support the Australian Dollar.

In the near term, markets remain sensitive to global risk sentiment and upcoming U.S. macro data. However, as long as risk appetite does not deteriorate sharply, yield differentials and policy divergence should continue to underpin AUD/JPY, favoring buy-on-dips opportunities near key technical support.

🔑 Key Technical Levels

Resistance Zone: 105.75 – 105.93

Support Zone: 105.15 – 105.37

Bullish Invalidation: Below 105.15

📌 Trade Summary

AUD/JPY is holding above a critical support zone following a corrective pullback from recent highs. As long as price remains supported above 105.15, the bias favours a buy-on-dips approach, targeting a continuation toward the upper resistance band near 105.90.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Financial markets involve significant risk; proper risk and position management are essential.

AUDJPY is setting up..... Patient is keyIn this AUDJPY analysis, I outline the current price structure, key levels of interest, and possible scenarios the market may deliver next. This breakdown is focused on clean price action and smart risk management rather than predictions.

#audjpy #forexanalysis #forextrading #technicalanalysis #priceaction #fxtrader #marketanalysis #chartanalysis #daytrading #forexmarket

AUDJPY: +400 Pips Possible Buying Opportunity! Dear Traders,

AUDJPY is likely to continue the bullish price momentum up until 104, currently price has reversed from a critical point. You may consider buying at this moment with a proper risk management. Please use strict management while trading and use this analysis for educational purposes only.

Please like and comment for more!

Team Setupsfx_❤️🏆

AUD/JPY Price Outlook – Trade Setup📊 Technical Structure

OANDA:AUDJPY AUD/JPY has rebounded toward 101.20 after defending the 100.40–100.70 support zone, keeping the medium-term uptrend structure intact. Price continues to trade above a rising trendline and the 100-day EMA, while momentum (RSI) remains in bullish territory.

The chart shows a clear range within an ascending structure:

Support zone: 100.40 – 100.70

Resistance zone / target area: 102.07 – 102.39

As long as the cross holds above 100.40, dips into support are likely to attract buyers, with upside potential back toward the 102.00+ resistance band. A decisive 4H close below 100.40 would invalidate the bullish scenario and expose the 99.80 area.

🎯 Trade Setup

Idea: Buy dips into support, targeting a move back into the 102.00 resistance zone.

Entry: 100.70 – 100.40

Stop Loss: 100.10 (below support and recent swing low)

Take Profit 1: 102.07

Take Profit 2: 102.39

Risk–Reward Ratio: ≈ 1 : 2.81

Bias stays constructively bullish while price holds above 100.40–100.70 on a closing basis. A 4H close below this zone would warn that the bullish structure is breaking down.

🌐 Macro Background

According to FXStreet, AUD/JPY has attracted buyers near 101.20 in early European trading as the Japanese Yen weakens on fiscal concerns and uncertainty over the Bank of Japan’s (BoJ) tightening path. Mixed signals from Tokyo keep JPY under pressure, supporting the cross.

BoJ & Japan:

Markets remain unsure how quickly the BoJ will move away from ultra-loose policy.

Japan’s Finance Minister Satsuki Katayama reiterated that FX intervention is possible if JPY moves become “excessively volatile and speculative,” which could cap AUD/JPY on sharp spikes higher.

Australia:

Traders are watching October CPI data due Wednesday for clues on the RBA’s rate path.

A firmer CPI print could reinforce expectations that the RBA will keep policy relatively tight, lending support to AUD.

Overall, BoJ uncertainty and relatively firmer Australian yields favour AUD/JPY on dips, but the risk of verbal or actual FX intervention argues for scaling out profits near resistance rather than chasing the move.

🔑 Key Technical Levels

Resistance zone: 102.07 – 102.39

Interim resistance: 101.70–101.90

Support zone: 100.40 – 100.70

Invalidation level (bulls): 100.40 (4H close below)

📌 Trade Summary

AUD/JPY remains in a gradually bullish structure above the 100-handle, with buyers defending the 100.40–100.70 support band. As long as this floor holds, the setup favours buying dips toward support and targeting 102.07–102.39 where prior supply and intervention risk may re-emerge. Traders should stay alert to Japanese officials’ comments and the upcoming Australian CPI release, which could amplify short-term volatility.

⚠️ Disclaimer

This analysis is for reference only and does not constitute trading advice. Trading involves significant risk, and proper risk management is essential.

AUD/JPY – H4 - Rising Wedge Breakdown | Key Zones Targeted📝 Description:

The AUD/JPY pair is showing a clear Rising Wedge formation on the 4H timeframe, with three clean touches on the trendline—indicating weakening bullish momentum. Price has now broken below the lower trendline, suggesting increased probability of bearish continuation toward the next key zones. FX:AUDJPY

This setup highlights:

Rising Wedge pattern

Trendline break

Retest opportunity

Key support zones at 99.00 and 97.80

AUD fundamentals: driven by commodity demand, RBA policy, and risk sentiment

JPY fundamentals: influenced by BOJ stance, yields, and safe-haven flows

This analysis is ideal for traders monitoring price action, forex patterns, and high-probability setups on AUD/JPY.

Keep an eye on upcoming economic releases from RBA, BOJ, and US data, as they can influence risk sentiment and impact this pair heavily.

✅ Support this analysis with a

LIKE 👍 | COMMENT 💬 | FOLLOW 🔔

It helps a lot & keeps the ideas coming!

⚠️ Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Forex trading involves high risk. Trade only with capital you can afford to lose and always do your own research.

AUDJPY Overextended: Watching for a Corrective Pullback 📈 Taking a closer look at AUD/JPY, we can see that price is in a strong bullish trend, but currently overextended and trading into a major external range high — an area rich in liquidity 🏦. The market appears to be absorbing buy-side liquidity, signaling that a corrective phase may be approaching.

From a structural standpoint, I’m monitoring two overlapping concepts — a potential Three-Drive pattern 🌀 and a Five-Wave structure that may lead into an ABC correction. Both suggest that price could be preparing for a deeper retracement before the next bullish leg resumes.

At this stage, I’m not interested in buying at a premium 💸. Instead, I’ll wait for price to pull back, ideally into a discount zone, and then look for bullish structure confirmation to rejoin the trend. Patience here is key — let the market come to you. 🧘♂️

💬 Disclaimer: This analysis is for educational purposes only and not financial advice. Always trade responsibly and manage risk effectively.

AUDJPY.....IS GOING FOR A RIDE? I THINK SOHey Amazing People!

My T.A. of AJ is pretty simplistic, we have seen a rejection to the downside and what seems to be a double bottom in the making on the 1H time frame! Showing me that we could see a heavy push to the upside, also taking out a key R-Zone! Meaning that there is a TON of avaiable room to run up and orders that need to be eaten up! So I believe if we have a break of the current high we can see a rally to Price points such as

97.580 or even

97.660-97.728!

I am worried about AUS news reaction on tuesday but we can only wait and see but either way the currency strength are rather equal so it sould just continue with trend.

This is just my thoughts and logging but tell me what you think? I trade with binary options so I let price tell me which way to go so if it follows this im going to sell high and buy low! If price gives me a push to the downside well dang haha looks like we looking for sell ops!! ;P

but let me know your thoughts or if you feel like this could be correct as well!

AUDJPY Daily Forecast -Q3 | W40 | D30 | Y25|📅 Q3 | W40 | D30 | Y25|

📊 AUDJPY Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:AUDJPY

AUDJPY Daily Forecast -Q3 | W39 | D24 | Y25| 📅 Q3 | W39 | D24 | Y25|

📊 AUDJPY Daily Forecast

🔍 Analysis Approach:

I’m applying Smart Money Concepts, focusing on:

Identifying Points of Interest on the Higher Time Frames (HTFs) 🕰️

Using those POIs to define a clear trading range 📐

Refining those zones on Lower Time Frames (LTFs) 🔎

Waiting for a Break of Structure (BoS) for confirmation ✅

This method allows me to stay precise, disciplined, and aligned with the market narrative, rather than chasing price.

💡 My Motto:

"Capital management, discipline, and consistency in your trading edge."

A positive risk-to-reward ratio, paired with a high win rate, is the backbone of any solid trading plan 📈🔐

⚠️ Losses?

They’re part of the mathematical game of trading 🎲

They don’t define you — they’re necessary, they happen, and we move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Stay sharp, stay consistent, and protect your capital

— FRNGT 🚀

FX:AUDJPY

AUDJPY Momentum Weakens, Sellers Eye Deeper PullbackAUDJPY has lost steam after a strong recovery rally, with sellers now pressing back below trendline support. The recent rejection near 98.40 signals exhaustion, and the pair looks set for a corrective leg lower toward key support zones. Unless buyers reclaim higher ground quickly, the near-term risk is skewed to the downside.

Current Bias

Bearish – price action shows a breakdown from recent upward momentum, with downside targets opening below 97.10.

Key Fundamental Drivers

RBA Policy: Australia’s central bank remains cautious with no immediate tightening bias, limiting AUD support.

BOJ Policy: Still ultra-loose but rising JGB yields and quiet speculation about adjustments give JPY some underlying support.

Commodities: Weakness in iron ore and concerns around Chinese growth cap AUD upside.

Macro Context

Interest Rates: RBA is holding rates steady, while markets anticipate the Fed and ECB easing earlier than BOJ. Yield differentials still favor AUDJPY upside, but recent data has weakened AUD’s momentum.

Economic Growth: Australia’s growth is slowing; Japan is stable but not accelerating, making yield spreads the main driver.

Geopolitics: Trade tensions and tariff-related uncertainty push investors toward JPY during risk-off episodes, undermining AUD.

Primary Risk to the Trend

A rebound in Chinese demand or a risk-on rally in equities could boost AUD and derail the bearish setup.

Most Critical Upcoming News/Event

Australian retail sales and CPI updates

Japanese inflation data

China PMIs for growth signals impacting AUD

Leader/Lagger Dynamics

AUDJPY is a lagger compared to USDJPY and EURJPY, which tend to set the tone for yen pairs. It is also influenced by AUDUSD moves, making it sensitive to Chinese and commodity-linked headlines.

Key Levels

Support Levels: 97.10, 96.29

Resistance Levels: 97.90, 98.40

Stop Loss (SL): 98.72 (above recent highs)

Take Profit (TP): 97.10 (first target), 96.29 (secondary target)

Summary: Bias and Watchpoints

AUDJPY is turning bearish after losing momentum at 98.40, with sellers eyeing 97.10 and 96.29 as key downside targets. A stop above 98.72 helps protect against sharp rebounds, while risk sentiment and China data remain the main watchpoints. The pair is more of a lagger, following broader yen moves and AUD commodity flows, so traders should watch USDJPY and AUDUSD closely for signals.

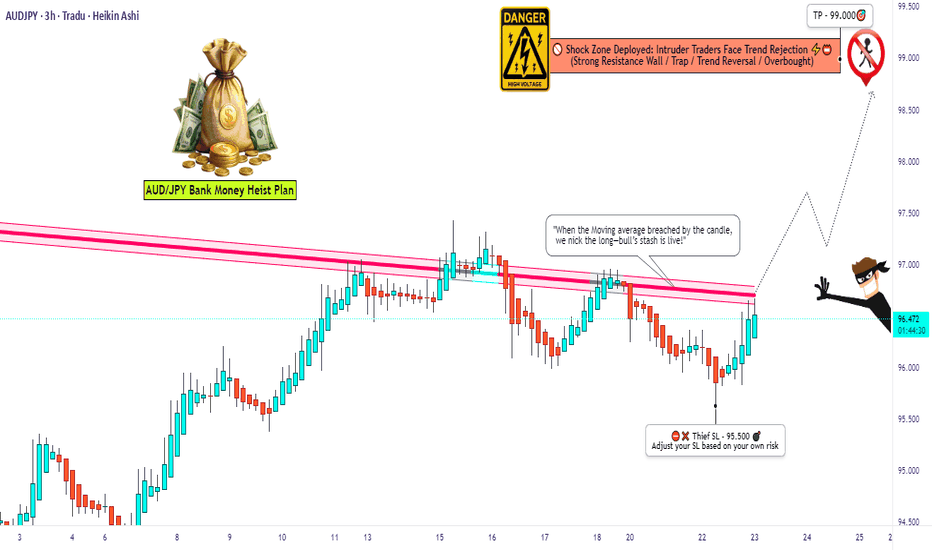

Is This Your Entry for the AUD/JPY Bull Run?🔓💸 AUD/JPY "Aussie vs Yen" Forex Bank Heist 💸🔓

🎯 Plan: Bullish Robbery | Targeting 97.500 | Stop Loss: 95.000

💰 Multi-Layer Limit Entry | Precision Heist | No Mercy

🚨🧠 Attention Thieves, Looters & Forex Mercenaries! 🧠🚨

The AUD/JPY vault is cracked, and the Thief Trader blueprint is live! We're executing a multi-layer LIMIT ENTRY HEIST – stacking orders like stolen cash in a briefcase. 💼💷💣

👀 We ain't chasing price – we're setting a TRAP with layers. Every dip? A planned robbery opportunity.

💥 ENTRY: The Thief's Layered Ambush 💥

"Aussie Bull" on a bank job – we loot using precise limit orders!

Thief Layer Entry Zones: 95.500 | 95.800 | 96.000 | 96.100

Pro Thief Move: You can increase your limit layers based on your own capital. More layers, more loot!

🛑 STOP LOSS: This is Thief SL @95.000 🔐

Dear Ladies & Gentleman (Thief OG's), this is the panic room. Adjust your SL based on your own strategy & risk. Let the amateurs get shaken out, we hold firm or reload.

🎯 TARGET: Escape Before The Cops Arrive! 💸

The police barricade is set @98.000. Kindly escape with the stolen money before that! OUR target is a clean getaway @97.500.

🧠 Scalpers? Take partials on the way up. Swingers? Let the layers ride. Investors? You're the mastermind behind the heist. ☕💵

Use a trailing SL to protect your stolen profits as the market moves.

🕵️♂️ THIEF TRADER PROTOCOL:

📊 This heist is backed by technicals, liquidity grabs, and pure audacity.

🗞️ Remember: High-impact news = volatility = adjust your layers accordingly.

⚠️ MONEY HEIST RULES:

✅ Avoid placing new layers during news events 📉

✅ Use risk-adjusted sizing on each limit order

✅ Patience is key – a layered heist requires discipline, not desperation

❤️🔥 Hit that 💥 BOOST BUTTON 💥 if you're riding with the Thief Squad!

Support the robbery. Respect the style. Make money like a true Market Outlaw.

🔔 Follow for the next HEIST PLAN. Big bags only. 💼💰🚀

“The market is a bank, not a casino. Act accordingly.” – Thief Trader

🤑📈🐂 #AUDJPY #ForexHeist #ThiefTrader #LayeredEntry #LimitOrders #SwingTrading #ForexTrading #RobTheMarket #DayTrading #BankTheProfit

Cracking the Aussie-Yen Vault: Bullish Heist Setup in Progress🔓💸 AUD/JPY "Aussie vs Yen" Forex Bank Heist 💸🔓

🎯 Plan: Bullish Robbery | Targeting 97.300 | Stop Loss: 95.000

💰 Layered Entries | Precision Robbery | No Mercy

🚨🧠 Attention Robbers, Looters & Forex Mercenaries! 🧠🚨

The AUD/JPY vault is open, and Thief Trader is back with a multi-layer LIMIT ENTRY STRATEGY – stacking orders like cash in a briefcase. 💼💷💣

👀 We ain’t sniping one entry – we’re building an army of LIMITS. Every dip? A robbery opportunity.

💥 ENTRY: Any Price is a Good Price 💥

"Aussie Bull" on steroids – grab the loot on any pullback!

Set buy limits across key dips in liquidity pockets, swing zones, or even psychological levels.

Thief-style: Entries aren’t missed, they’re planned.

🛑 STOP LOSS: 95.000 🔐

Locked tight at the institutional panic zone – let them get triggered, we reload with confidence.

Built for multiple orders – size wisely, survive the fakeouts.

🎯 TARGET: 97.300 💸

Targeting the upper vault room, stacked with JPY weakness.

Ride the bullish getaway car all the way to the Tokyo vault rooftop.

🧠 Scalpers? Ride the trend. Swingers? Load your clip. Investors? Sit back and sip that profit. ☕💵

Use trailing SL to protect the bag as price moves in your favor.

🕵️♂️ THIEF TRADER SECRETS:

📊 Backed by technicals, macro juice, and liquidity-sniffing analysis.

🗞️ Don’t forget: News releases = volatility = sniper mode ON.

⚠️ MONEY HEIST PROTOCOL:

✅ Avoid entries during high-impact news 📉

✅ Use risk-adjusted sizing on your orders

✅ Be patient – layering needs discipline, not desperation

❤️🔥 Hit that 💥 BOOST BUTTON 💥 if you're with the Thief Squad!

Support the robbery. Respect the style. Make money like a true Market Outlaw.

🔔 Follow for the next HEIST PLAN. Big bags only. 💼💰🚀

“Markets don’t move randomly – they move for the ones who rob it correctly.” – Thief Trader

🤑📈🐂 #AUDJPY #ForexHeist #ThiefTrader #BankTheMarket #LayeredEntries #ForexTrading #RobTheMarket

Aussie vs Yen: Setup for a Clean Long Robbery💣AUD/JPY Forex Heist: Aussie vs Yen 🔥Master Robbery Plan Unfolded!

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers, Bandits & Chart Pirates 🤑💰💸✈️

It's time to reload your gear and lock in the blueprint. Based on our 🔥Thief Trader Technical + Fundamental Intelligence🔥, we’re all set to ambush the AUD/JPY "Aussie vs Yen" battlefield. This ain’t no casual walk—it’s a full-scale market operation targeting the High Voltage Reversal Trap Zone⚡. The pressure is real: Overbought, Tricky Consolidation, and Bears camping at resistance. Your job? Steal profits before they smell the breakout! 🏆💪💵

🎯 Entry Point — "Let the Heist Begin"

🗝 Entry Level: Wait for the Breakout @ 94.500. When price shatters the Moving Average ceiling—that's your greenlight!

🚀 Execution Choices:

Place Buy Stop above the breakout point

Or, use Buy Limit Orders near recent swing highs/lows on the 15/30-min chart using Layering/DCA tactics (that’s how the real thieves sneak in 🕶️).

🔔 Set an alert to stay sharp—don’t miss the vault crackin’ open!

🛑 Stop Loss — “Cover Your Escape”

🎯 SL Level: Just under the recent swing low on the 3H timeframe (around 95.500)

🚫 Never place the SL before the breakout confirms! Let the move prove itself first.

🧠 SL sizing depends on your capital, lot size, and number of entries stacked. You control the risk, not the other way around!

🎯 Target — "Cash Out or Vanish"

💎 First Take-Profit: 99.000

🚪Optional Escape: Secure the bag early if momentum fades. Better leave rich than be late!

👀 For Scalpers & Swing Robbers Alike

🔍 Scalpers: Only ride the Long wave.

💼 Big pockets? Hit straight entry.

👟 Small capital? Tag in with swing trades and trail that SL like a pro.

🎣 Use a Trailing SL to lock profits as price sprints toward resistance.

📰 The Bigger Picture: Why AUD/JPY?

The pair is pumped by:

📈 Macro Economics

📊 Quant Analysis

📰 COT Reports

📉 Intermarket Correlations

🧠 Sentiment Heatmaps

🔥 Future Price Dynamics

Don’t pull the trigger blind. Read the battlefield before charging in.

⚠️ Thief’s Caution Zone: News Traps Ahead

🛎 News = chaos.

📌 Avoid entering fresh trades during major data drops.

🔐 Use Trailing SLs to protect ongoing plays.

📉 Let the market dance, but you control the music.

💥Hit the Boost Button!💥

If this heist plan pumps your portfolio, smash that boost. That’s how we fund more blueprints, fuel the Thief Gang’s vault, and keep the robbery cycle alive.

🤑💵 Together, let’s rob this market clean—Thief Style.

New plan drops soon. Stay locked. Stay sharp. Stay profitable.

🧠💰🏴☠️

— Thief Trader Out 🐱👤🔓🚀

AUDJPY - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

AUDJPY – Waiting for the Long SetupThe price is currently in a corrective move,

and as always, we’ve already marked our key level.

📍 We’re patiently waiting for price to reach our support zone.

If a valid buy signal appears, we’ll take the long position

according to our trading plan.

❌ What if the level breaks?

No worries.

We don’t predict — we follow the market.

We’ll wait for a clean pullback and enter short if confirmed.

🎯 Our job isn’t to predict where price will go,

our job is to manage risk and stay aligned with the market.

Price can do anything —

we’re ready for every scenario.