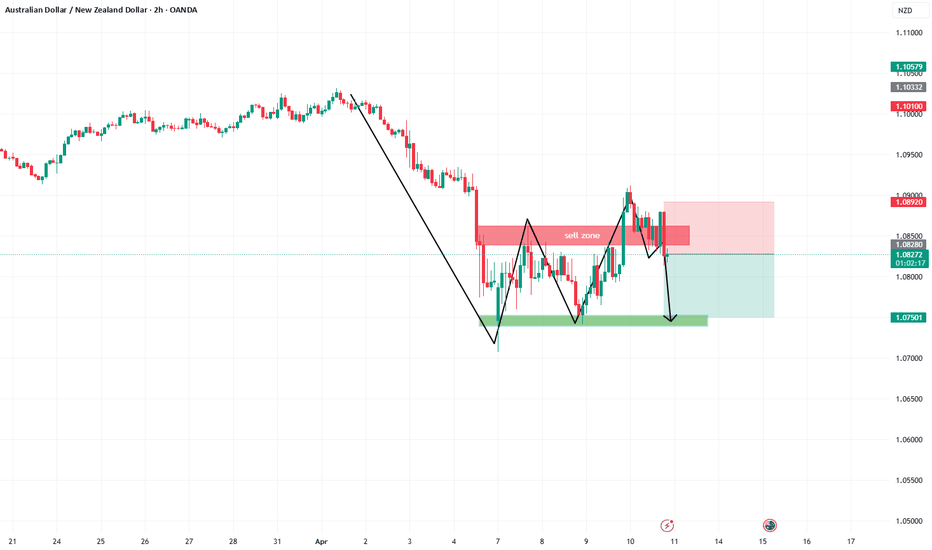

Audnzdshort

AUD/NZD - A QUICK SELL SET UP - 30-01-2026AUD/NZD - G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

AUD/NZD - still kinda on the "move" and continue DOWN...

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

AUDNZD Rally Losing Steam – Watch This Reversal Zone!As we’ve seen, AUDNZD ( OANDA:AUDNZD ) recently began an upward move after forming a Falling Wedge Pattern , and it’s been in an Ascending Channel for about the past 16 days.

Currently, AUDNZD is moving into a Heavy Resistance zone(1.1662 NZD-1.1340 NZD) and a Potential Reversal Zone(PRZ) .

From an Elliott Wave perspective, it seems like AUDNZD is completing the microwave 5 of the main wave 3 . Once it breaks below the lower line of the ascending channel, we can somewhat confirm the end of the main wave 3.

Additionally, we can see a Negative Regular Divergence(RD-) forming between two consecutive peaks.

I expect that in the coming hours, AUDNZD might decline at least to the Support zone(1.1480 NZD-1.1444 NZD) . If it breaks that Support zone, we could see it dropping toward around 1.1353 NZD(Second Target) .

Stop Loss(SL): 1.16403 NZD

Please respect each other's ideas and express them politely if you agree or disagree.

Australian Dollar/New Zealand Dollar Analyze (AUDNZD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

AUDNZD - EXTENDS RALLY AMID HAWKISH RBA TONESymbol - AUDNZD

AUDNZD continues to hold its upward momentum, supported by fundamental divergence between the two economies. The Australian dollar remains strong and has been outperforming the New Zealand dollar since the RBNZ implemented an aggressive 50 basis-point rate cut, while the RBA has stayed on hold due to persistent inflation concerns.

Today’s move is largely driven by the Reserve Bank of Australia’s hawkish tone, which has further strengthened the AUD. The pair has been trending higher without any notable pullbacks or corrections, and several technical indicators now suggest potential exhaustion in the ongoing uptrend.

A possible reversal setup could form if price action begins to show rejection patterns near key resistance zones, offering short-term trading opportunities.

Resistance levels: 1.1485, 1.1500

Support levels: 1.1427, 1.1378

However, keep in mind that if the RBA issues any additional hawkish statements or policy measures, it could further boost AUD strength - potentially driving AUDNZD higher before any meaningful correction takes place.

AUDNZD - the squeeze will soon end.We have witnessed how this pair has been in a squeeze to the downside for over 2 weeks. The highs have been consistently lower while the bottom (yellow) zone around 1.130 has been firmly holding price above it. This will change soon as price breaks below this zone.

We can trade the break out (below) or wait for a retest; depends on our own trading style and preference. Either way, hopefully this will be a good trade with positive risk/reward.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk so carefully managing your capital and risk is important. If you like my idea, please give a “boost” and follow me to get even more.

AUDNZD: Triple Confluence Sell –Monthly, Weekly & MACD All AlignPrice has been locked in a long-term range between 1.14 and 1.02 since 2013, with several spikes above and below this zone—but every time, price has ultimately closed back inside the range.

On the Monthly chart, we can see that price broke through the 1.11 resistance in September, which opened the door for a 300-pip rally up toward the major range top at 1.14.

Since reaching this key level, the Weekly candles have shown clear signs of exhaustion — three consecutive topping-tail candles, followed by a spinning-top last week, suggesting momentum is stalling.

Zooming into the 2-Day chart, as explained in the video, we now have a MACD bearish crossover forming right at resistance — a strong confluence with the monthly level and the weekly rejection candles.

This combination makes for a high-probability sell setup.

My Trading Plan

Looking for one final pop toward 1.14 (or slightly below) to initiate shorts.

First target: 1.115 — the previous resistance turned support, which also aligns with the 50% FIB retracement of the current leg up.

If 1.115 breaks: next levels to watch are 1.105, then 1.06, which marks the bottom of the long-term range.

📉 Summary:

All major timeframes are aligning — monthly resistance, weekly exhaustion, and a 2-day MACD crossover.

If we see a rejection near 1.14, this could develop into a powerful swing short back into the middle and potentially the bottom of the multi-year range.

Stop loss will be well above 1.15 and will be based on what price I get in.

Let me know what you think below

AUDNZD Technical + Fundamental Align for DownsideToday I want to analyze a short position on the AUDNZD ( OANDA:AUDNZD ) pair, first, let's look at it from a fundamental analysis perspective .

Fundamental View on AUDNZD

Key reasons to short AUDNZD:

Australian weakness:

Recent data show weakening consumer sentiment and declining building approvals. The RBA seems hesitant to hike further, putting pressure on the Aussie.

New Zealand resilience:

The RBNZ maintains a relatively hawkish stance. Inflation is still a concern, and the central bank is committed to keeping rates high, supporting NZD strength.

Monetary policy divergence:

The divergence between RBA’s dovish stance and RBNZ’s hawkish approach supports further downside in AUDNZD.

----------------------

Now let's take a look at AUDNZD from a technical analysis perspective on the 4-hour timeframe .

AUDNZD is currently trading in a Heavy Resistance zone(1.0963 NZD-1.0870 NZD) near the upper line of the Range Channel , Potential Reversal Zone(PRZ) and Yearly Pivot Point .

In terms of Elliott Wave theory , AUDNZD appears to be completing microwave B of microwave Y of the main wave 4 .

I expect AUDNZD to drop to at least 1.0904 NZD(First Target) based on the above explanation .

Second Target: 1.0886 NZD

Note: Stop Loss(SL): 1.0963 NZD

Please respect each other's ideas and express them politely if you agree or disagree.

Australian Dollar/New Zealand Dollar Analyze (AUDNZD), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

AUDNZD possible short, patience required The daily candle has not yet closed but we could have an inside bar setup later today.

Price is below the 200dma and the price action today seems indicative of a bearish breakout that could happen tomorrow.

I am not advising jumping the gun, instead wait and see how it all plays out.

This is not a trade recommendation; it’s merely my own analysis. Trading carries a high level of risk, carefully manage your capital and risk. If you like my idea, please give a “boost” and follow me to get even more.

It’s not whether you are right or wrong, but how much money you make when you are right and how much you lose when you are wrong – George Soros

AUDNZD - Expecting Retraces Before Prior Continuation LowerM15 - Strong bearish momentum

Lower lows on the moving averages of the MACD indicator.

Expecting retraces and further continuation lower until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDNZD Rejected – CPI & RBA Dovish Bias Pressures AussieKey Resistance Zone: 1.0780 – 1.0800

The pair tested this area twice and failed to break above, forming a clear double-top pattern. This is a bearish signal suggesting buyers are exhausted.

Price Action:

A strong bearish rejection candle followed the second resistance test, aligning with historical resistance and structure. The pair is now showing signs of reversal.

Support Levels to Watch:

🥅 Target 1: 1.0707 – Previous consolidation zone

🥅 Target 2: 1.0677 – Key swing low

📉 Stop Loss: Above 1.0800

Pattern: Rising wedge structure breaking down, signaling downside continuation.

🔍 Fundamental Analysis

🇦🇺 Australia (AUD) – Weakness Potential

RBA’s Dovish Leaning:

RBA Assistant Governor Kent emphasized external FX market risks and cautious positioning on monetary tightening, which dampens rate hike expectations【source: RBA speech】.

Key Data Incoming:

April 30: Quarterly CPI data

Forecasts suggest core inflation might ease, reducing pressure on the RBA to act. If CPI undershoots, it could trigger AUD selling.

AUD also faces pressure from global growth fears and risk-off sentiment.

🇳🇿 New Zealand (NZD) – Relative Strength

While the RBNZ has already started easing, the NZD has shown resilience amid improving trade balance and stable economic performance.

NZ Business Confidence is also due, which could influence near-term NZD moves, but broader positioning supports the Kiwi.

🧠 Sentiment Overview

The risk-reward favors shorts here:

Clear technical rejection

Bearish macro backdrop for AUD

Relative NZD strength

CPI data will be the key catalyst, and positioning ahead of it looks justified given current chart structure.

📝 Conclusion:

AUDNZD looks primed for a downside correction after repeated rejections at a major resistance zone. With dovish RBA commentary and potential soft inflation data ahead, short setups are favored with targets at 1.0707 and 1.0677.

AUDUSD SHORT FORECAST Q2 W17 D22 Y25AUDUSD SHORT FORECAST Q2 W17 D22 Y25

SUMMARY

- Weekly 50 exponential moving average

- Daily high rejection

Requirements

- 15' Break of structure short! Non negotiable.

- 15' order block creation to short from once price action pulls back.

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUD/NZD Triangle Breakout (15.04.2025)The AUD/NZD Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Triangle Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 1.0666

2nd Support – 1.0617

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

SHORT ON AUD/NZDAUD/NZD has given a perfect setup for a sell.

I has bearish divergence as well as a rising channel/wedge into a Major Supply Area from the Higher TF.

We have also change structure from Up to Down on the Lower Timeframe.

I will be selling AUD/NZD to the pervious swing low / demand area for about 100 pips. OANDA:AUDNZD

We’re bullish on AUDUSDTechnical Analysis

AUDUSD lies below 50 - period SMA (0.6324, declining) and 100 - day SMA (0.6512, falling), indicating a downward trend yet short - term upside potential. January 2025 RSI bullish divergence shows weakening downward momentum. Break above 0.6340 could push it to 0.6400; otherwise, it may range 0.6131 - 0.6302.

Economic Fundamentals

Australia: Its economic growth, inflation and export prices affect the Aussie. Growth aids appreciation; inflation undermines it. Higher resource prices boost the currency.

US: Strong US data strengthens the dollar, weakening AUD/USD; weak data has the opposite effect.

Market & Geopolitical Factors

High risk appetite benefits the Aussie; low appetite favors the dollar. Geopolitical tensions prompt a flight to the dollar, hurting the Aussie.

💎💎💎 AUDUSD 💎💎💎

🎁 Buy@0.62500 - 0.62800

🎁 TP 0.63500 - 0.64000

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates