AUDUSD(20260202)Today's AnalysisMarket News:

Federal Reserve Governor Christopher Waller said on Friday that he opposed the Fed's decision to keep interest rates unchanged this week because economic data signaled the need for further rate cuts.

Fed officials voted this week to maintain the benchmark interest rate in the range of 3.5% to 3.75%, citing an improved outlook for the U.S. economy. Waller opposed this decision, preferring a 25-basis-point cut and believing the neutral rate could be around 3%.

This dissenting vote reflects Waller's core view: significant vulnerabilities remain in the U.S. labor market.

Technical Analysis:

Today's Buy/Sell Threshold:

0.6985

Support and Resistance Levels:

0.7098

0.7056

0.7028

0.6942

0.6914

0.6872

Trading Strategy:

If the price breaks above 0.6985, consider buying with a first target price of 0.7028.

If the price breaks below 0.6942, consider selling with a first target price of 0.6914.

Audusdanalysis

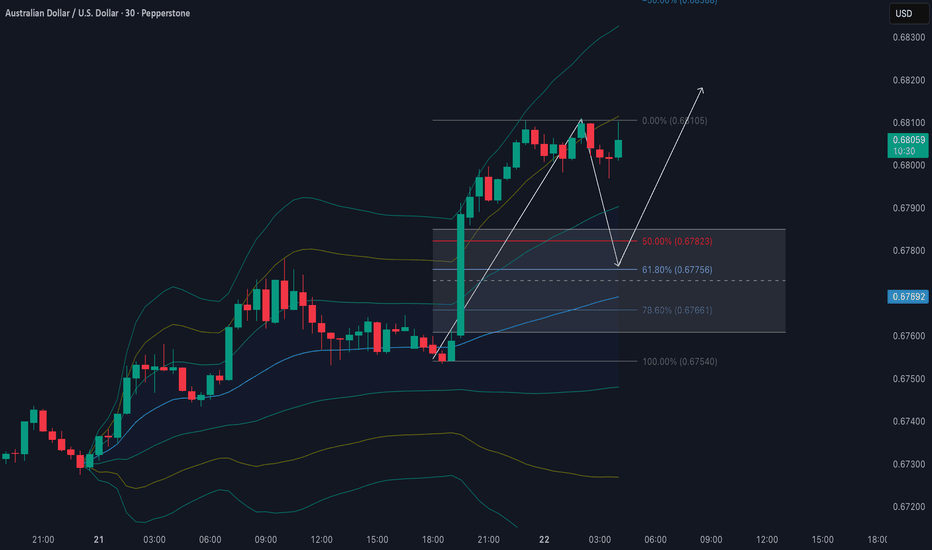

AUD/USD - A QUICK SELL SET UP - 30-01-2026AUDUSD - G-Money's short version analysis based purely on technical analysis only, no nonsense or "BS". I do totally ignore any fundamental analysis, technical analysis only

AUDUSD - still kinda on the "move" and continue DOWN...

Who did enter this trade earlier congratulations! Who missed it... See you next time! ;)

Chart is itself explaining. Kept a "KISS" approach all the way ( "Keep It Simple, Stupid") & beginners friendly... ;)

I do hope that nobody ignoring SL ( Stop Loss) ! Without it, It is a fastest way to loose hard earned money...

;)

Trade safe & don't do "gambling". In the end it never pays, not worth it to risk loose all your $...

PS: above technical analysis is done for the community & educational purpose only! It is not a financial advice. Just share my very own insight to it.

#AUDUSD:We are yet to see weaken USD! AUDUSD to make yearly highAUDUSD hasn’t seen strong bullish volume yet, but tomorrow’s NFP will be crucial for determining the future trend of the AUDUSD. Based on your analysis, you can set multiple targets.

If you like our work and want to support us, you can do so by following us:

-Liking our ideas

-Commenting on our ideas

-Sharing

Team Setupsfx_

❤️🚀

#AUDUSD: Three Swing Target Accumulating Total of 1400+ Pips! Analysing the AUDUSD currency pair on a broader timeframe of three days reveals a bearish trend. This suggests a potential final decline in prices before a significant bullish surge in the market.

Two golden lines are drawn around the entry area, indicating potential entry points at the first, second, or intersection of these lines. Alternatively, the first and second lines can serve as entry and stop loss points, tailored to your trading strategy.

Additionally, important economic indicators are set to impact the market. For instance, the Non-Farm Payrolls (NFP) report scheduled for this coming Friday will significantly influence the direction of the DXY monthly price.

If you find our analysis valuable, please consider liking and commenting on our ideas. Your feedback will be instrumental in our efforts to provide more detailed and insightful analysis.

Much Love and Gratitude for your support in advance, happy to help.❤️🚀

Team Setupsfx_

#AUDUSD: +1100 Pips Possible Swing Bullish Move! AUDUSD a strong sign of bullish behaviour has appeared alongside bullish momentum. As we have NFP tomorrow, we expect market to remain volatile; what we think now is to have market settled down before we can have any confirmation. We recommend to remain extra cautious tomorrow, once market get settled we can then enter with accurate risk management.

Like, comment and Share for more!

Team Setupsfx_

AUDUSD: Neutral View First Buy and Then Sell! Hey everyone!

Our first buy swing entry is going swimmingly! We’ve got over 500 pips running positively, and we reckon price can keep going up and then when it hits our selling zone, you can swing sell too. This is a fantastic opportunity where we can wait for price to do its thing and then when it reaches the sell zone, we can execute our order. But if you’re feeling adventurous and want to take a bit of a risk, you can take a buy entry at the given point and keep it up until it reaches our sell area.

With just one shot, we can make two entries!

Good luck and trade safely!

Thanks a bunch for your unwavering support! 😊

If you’d like to lend a hand, here are a few ways you can contribute:

- Like our ideas

- Comment on our ideas

- Share our ideas

Cheers,

Team Setupsfx_

❤️🚀

#AUDUSD: Accumulated Completed Now Time For DistributionThe AUD/USD currency pair has been quite active lately. It has moved from a period of buying to an early selling phase. This analysis looks at the market, how prices are moving, technical tools and what might happen when trading, keeping an eye on how to manage risk.

1. Market Overview

The Australian Dollar (AUD) has become stronger against the US Dollar (USD). After a long period of little change, the price action seems to be changing. The bulls are still in charge, with a target swing at 0.7050, which could be a 400-pip move from where they were accumulating.

In terms of the economy, AUD’s strength is supported by stable commodity prices and a positive outlook for Australia. The USD is feeling a bit uncertain because people are speculating about what the Federal Reserve will do next and how much risk people are willing to take around the world.

Price Action Structure:

Accumulation Phase:

The pair stayed around the 0.6650 – 0.6750 range, which showed that big investors were buying. This usually happens before a big move, which we saw on both daily and H4 charts.

Breakout and Shift to Distribution:

Recently, the price broke above the main resistance near 0.6800, which means it is going up. This confirms that the accumulation phase was right and that the market is set up for buyers. The next step is to move into the distribution phase, where prices are aiming for higher targets and testing the upper resistance zones before any possible reversal.

Swing Targets:

The main focus is on 0.7050, a spot where the price has reacted quite strongly before. For smaller gains, we have intermediate targets at 0.6920 and 0.6990. This move could be worth about 400 pips, which is a good chance for traders who are careful.

Fibonacci Retracement Levels:

A Fibonacci projection hints at possible targets around 0.6990 (which is a 1.618 extension) and 0.7050 (which is a 2.0 extension), which helps us stick to our price targets.

- First target: 0.6920 (this is where resistance is)

- Second target: 0.6990 (this is where Fibonacci levels meet)

- Final swing target: 0.7050 (this is a big supply zone)

The way people feel about the market can help us decide when to buy or sell. Smart money got in during the time when prices were building up, but they weren’t sure what to do. When the price broke out, it showed that more people were feeling bullish, and retail traders were joining in. The last part of the move towards 0.7050 will probably get more momentum traders before the price goes into a new pattern and might reverse.

Things like how well commodities are doing and what people expect the US interest rate to be will affect the pair. If people suddenly change their minds about risk, the price could get really volatile, so it’s important to keep an eye on news.

The AUD/USD pair has moved from a time when prices were building up to a bullish breakout, which means we might see a 400-pip move with a main target at 0.7050. The intermediate targets at 0.6920 and 0.6990 are good places to think about taking some profits. Looking at things like moving averages, RSI and Fibonacci levels, we can see that this is a good time to be bullish.

Traders should be careful with their risk, avoid using too much leverage and stay alert to important economic events that could change the price. By sticking to a plan and being disciplined, they can make the most of this good situation in the forex market.

Team Setupsfx_

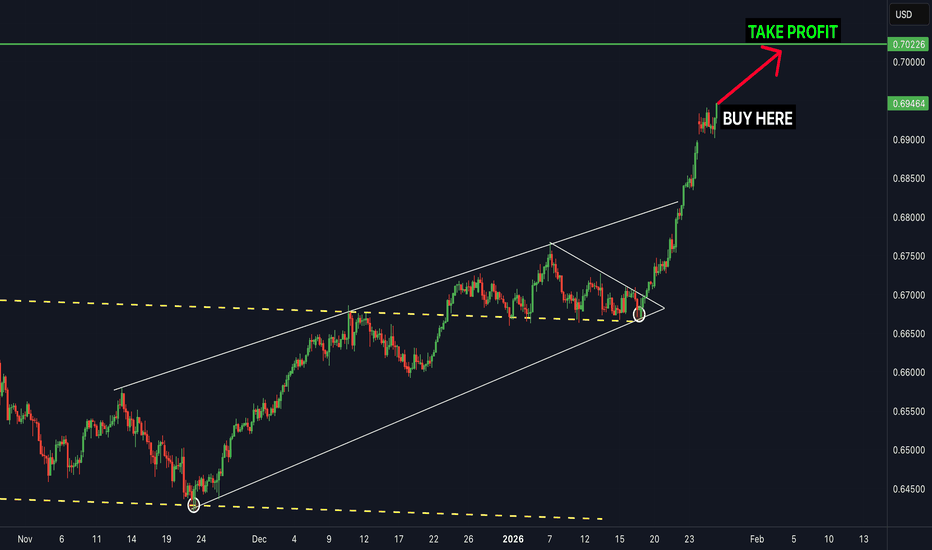

Buy AUDUSD nowAUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY AUDUSD now

AUDUSD — FRGNT DAILY CHART FORECAST. Q1 | W4 | D26| Y26📅 Q1 | W4 | D26| Y26

📊 AUDUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

Market Analysis: AUD/USD Advances As Risk Appetite AcceleratesMarket Analysis: AUD/USD Advances As Risk Appetite Accelerates

AUD/USD started a fresh increase above 0.6850 and 0.6880.

Important Takeaways for AUD USD Analysis Today

- The Aussie Dollar started a decent increase above 0.6850 against the US Dollar.

- There is a short-term bullish trend line forming with support at 0.6880 on the hourly chart of AUD/USD.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD, the pair started a fresh increase from 0.6725. The Aussie Dollar was able to clear 0.6800 to move into a positive zone against the US Dollar.

There was a close above 0.6880 and the 50-hour simple moving average. Finally, the pair tested 0.6930. A high was formed near 0.6930 and the pair recently started a consolidation phase. There was a minor decline below 0.6920.

On the downside, initial support is near the 23.6% Fib retracement level of the upward move from the 0.6834 swing low to the 0.6930 high. The next area of interest could be near a short-term bullish trend line at 0.6880 and the 50% Fib retracement.

If there is a downside break below 0.6880, the pair could extend its decline toward the 0.6850 zone and the 50-hour simple moving average. Any more losses might signal a move toward 0.6755.

On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6930. The first major hurdle for the bulls might be 0.6950. An upside break above 0.6950 might send the pair further higher. The next stop is near 0.7000. Any more gains could clear the path for a move toward 0.7085.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AUDUSD — FRGNT FUN COUPON FRIDAY Q1 | D23 | W3 | Y26📅 Q1 | D23 | W3 | Y26

📊 AUDUSD — FRGNT FUN COUPON FRIDAY DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

AUDUSD Technical Analysis and Trade IdeaHi all. My bias remains bullish on the AUDUSD 🐂, but patience is the name of the game today. Fundamentally, the Aussie is ripping on the back of that monster jobs print (unemployment down to 4.1%!), which has traders aggressively pricing in an RBA hike for February. Combine that with the "Tariff Truce" relief rally crushing the USD, and we have a perfect storm for upside 🌪️. Technically, the 4H structure is flagging beautifully at the highs, but we need to be smart about our entry.

I am not chasing price at the highs 🚫 — I want to see the market flush the weak hands down to our discount zone. We are looking for an optimal entry around 0.6765 – 0.6785 to catch the next leg up. This trade is invalidated if we lose the 0.6715 structural pivot 🛑.

If the trade sets up, aim for a 5R return to start 🎯. Look to close partial profits (50%) at 1R 💰, then let the rest run using our indicator alerts for dynamic exits if the trend resumes. Patience pays on this one, let the setup come to us. ⏳

AUD/USD Made Clear Reversal Pattern,Long Setup To Get 150 Pips !Here is my 4H Chart On AUD/USD , The price creating a very clear reversal pattern ( Inverted Head & Shoulders ) and the price made a very good bullish price action now And the price confirmed the pattern by closing above the neckline. so we can enter a buy trade when the price go back to retest the broken neckline to can use a small stop loss ,or we can enter directly now cuz we have a very good bullish candle confirmed the pattern , and we can targeting from 50 to 100 pips with a decent stop loss .

Reasons To Enter :

1- Perfect Touch For The Area .

2- Clear Bullish Price Action .

3- Bigger T.F Giving Good Bullish P.A .

4- Clear Reversal Pattern .

5- Pattern Confirmed .

AUDUSD(20260121)Today's AnalysisMarket News:

The Polish central bank has approved a plan to purchase 150 tons of gold, increasing its gold reserves to 700 tons.

Technical Analysis:

Today's Buy/Sell Threshold:

0.6728

Support and Resistance Levels:

0.6769

0.6754

0.6744

0.6712

0.6703

0.6687

Trading Strategy:

Consider buying if the price breaks above 0.6744, with a first target price of 0.6754.

Consider selling if the price breaks below 0.6728, with a first target price of 0.6712.

AUD/USD Demand Zone Holding as Bulls Regain Control📈 AUD/USD “THE AUSSIE” Signal — Swing & Day Trade Guide 🇦🇺💵

Bullish Bias — Multi-Layered Entry Thief Strategy 🎯📊

🔔 Current live rate: ~0.6680–0.6700 (major FX session volatility)

📌 Trade Plan — Bullish Thief Layers

We’re positioning for Aussie strength vs USD as risk sentiment improves and macro data evolves.

💡 Layered Buy Entries (Thief Method):

➡️ 0.66800

➡️ 0.66900

➡️ 0.67000

➡️ 0.67200

(Add more buy limit layers based on your risk tolerance & market structure)

📊 Thief Strategy = Multiple limit buys to build position slowly, reducing average entry.

🎯 Targets & Structure

📍 Primary Target: 🎯 0.68300 — Strong resistance zone + possible overbought trap exit.

📍 Let price validate upside momentum & lock profits if premium levels reject.

⚠️ Stop Loss (Thief SL): 🛑 0.66600

(Close below key support = invalidation zone)

📌 Take Profit & Stop Loss decisions remain your responsibility. Manage risk per your risk profile.

🌐 Fundamentals & Macro Drivers 📊

Bullish drivers for AUD/USD:

✔️ AUD/USD has rallied ~5% since late 2025 due to improving China data & commodity support.

✔️ RBA vs Fed rate dynamics — RBA possibly more hawkish/sticky while Fed easing slows.

✔️ Aussie behaves like a risk-linked & commodity currency — iron ore, coal & gold flows matter.

✔️ IMF warns prolonged above-target inflation for Australia (affects interest expectations).

🗓️ Key Real-Time Economic Events to Watch (London time basis):

• RBA Rate Decision & statement

• Australian CPI / employment figures

• US Nonfarm Payrolls & Unemployment claims

• US CPI & Retail Sales

Use global Economic Calendar for live impacts.

🔁 Correlated Pairs to Watch 🧠

These help confirm bias and manage risk:

📌 GBP/USD & EUR/USD — Often move with USD strength/weakness

📌 USD/JPY — Inverse USD risk signal

📌 Gold (XAU/USD) — Positive correlation with AUD/USD on risk sentiment / commodity flows

📌 AUD/JPY & NZD/USD — Commodity/carry-linked peers

💡 When USD weakens broad-based, AUD/USD tends to benefit.

🛠 Technical Structure & Indicators

Indicators adding conviction:

📌 Price above key moving averages

📌 RSI approaching bullish momentum

📌 Higher lows structure forming

A break above intermediate resistance ~0.6760 would accelerate bullish odds.

💬 Trade Notes & Community Buzz

👍 This setup blends technical precision + fundamental context, crafted for engagement & clarity.

👥 Traders tracking commodities, risk appetite and central bank tilts will find this useful.

Time To Buy AUDUSD nowAUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. TIME TO BUY AUDUSD now

AUDUSD — FRGNT DAILY CHART FORECAST Q1 | D20 | W3 | Y26📅 Q1 | D20 | W3 | Y26

📊AUDUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

AUDUSD — FRGNT WEEKLY CHART FORECAST Q1 | W3 | Y26📅 Q1 | W3 | Y26

📊 AUDUSD — FRGNT WEEKLY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

AUDUSD: Big Rejection From W -FVG! Time To Sell?Welcome back to the Weekly Forex Forecast for the week of Jan 12 - 16th.

In this video, we will analyze the following FX market: AUDUSD

AUDUSD had a big rejection from the W -FVG, leaving a huge wick behind. If the market continues to trade below the 50% of that wick, which is inside a Quarterly -OB, we can start to look for sell setups on the LTFs.

A Daily close below 0.6684 would be confirmation to me to begin looking for sell setups in this market.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.