AUDUSD — FRGNT WEEKLY CHART FORECAST Q1 | W3 | Y26📅 Q1 | W3 | Y26

📊 AUDUSD — FRGNT WEEKLY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

Audusdanalysis

AUDUSD: Big Rejection From W -FVG! Time To Sell?Welcome back to the Weekly Forex Forecast for the week of Jan 12 - 16th.

In this video, we will analyze the following FX market: AUDUSD

AUDUSD had a big rejection from the W -FVG, leaving a huge wick behind. If the market continues to trade below the 50% of that wick, which is inside a Quarterly -OB, we can start to look for sell setups on the LTFs.

A Daily close below 0.6684 would be confirmation to me to begin looking for sell setups in this market.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Buy AUDUSD nowAUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY AUDUSD now

Market Analysis: AUD/USD Pulls Back, Caution Creeps InMarket Analysis: AUD/USD Pulls Back, Caution Creeps In

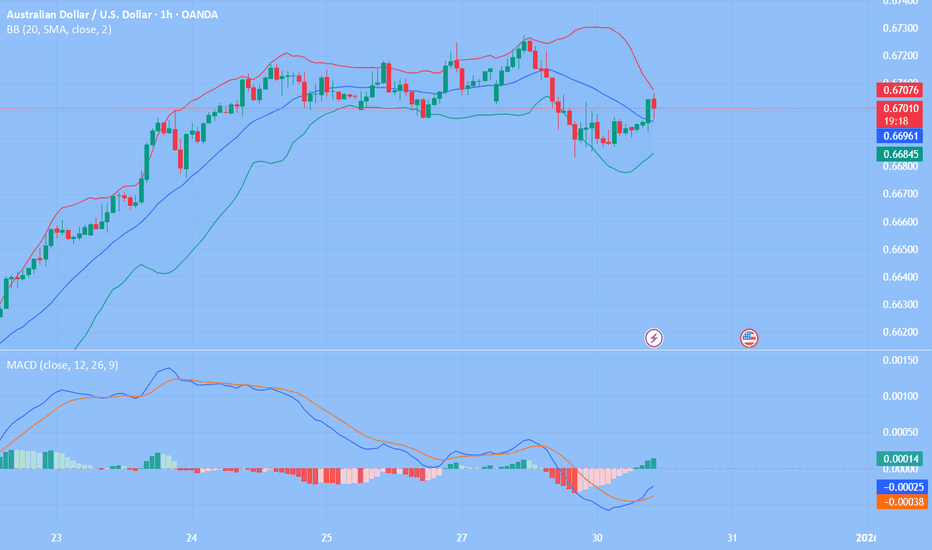

AUD/USD failed to stay in a positive zone and declined below 0.6700.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar started a fresh decline from well above 0.6740 against the US Dollar.

- There is an expanding triangle forming with resistance at 0.6705 on the hourly chart of AUD/USD.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD, the pair struggled to clear 0.6765. The Aussie Dollar started a fresh decline below 0.6750 against the US Dollar.

The pair even settled below 0.6720 and the 50-hour simple moving average. There was a clear move below 0.6680. A low was formed at 0.6663, and the pair is now consolidating losses. There was a minor recovery wave above the 23.6% Fib retracement level of the downward move from the 0.6766 swing high to the 0.6663 low.

On the upside, immediate resistance is near an expanding triangle at 0.6705. The next major hurdle for the bulls could be near 0.6725 and the 61.8% Fib retracement.

The main selling point could be 0.6740, above which the price could rise toward 0.6765. Any more gains might send the pair toward 0.6800. A close above 0.6800 could start another steady increase in the near term. In the stated case, the next key resistance on the AUD/USD chart could be 0.6840.

On the downside, initial support is near 0.6675. The next area of interest might be 0.6665. If there is a downside break below 0.6665, the pair could extend its decline. The next target for the bears might be 0.6620. Any more losses might send the pair toward 0.6600.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Week of 1/11/26: AUDUSD AnalysisPrice has pushed to the extreme swing structure of the 4h and daily chart. 1h structure is bearish, so we are not exactly bullish yet until 1h switches bullish. We're going to wait until price makes its move to the upside or downside for a market structure shift.

Major News:

Tues - CPI

Wed - PPI

AUD/USD Is Under Bearish PressureAUD/USD Is Under Bearish Pressure

As indicated by the AUD/USD chart, the Australian dollar has fallen below the 0.6680 level today, with the decline from Wednesday’s high (A) exceeding 1.1%.

Key bearish drivers include:

→ Declining inflation expectations. Data released on Wednesday showed a sharp slowdown in Australian inflation to 3.4%. This has removed the likelihood of a February rate hike by the Reserve Bank of Australia, which had previously maintained a hawkish stance.

→ Uncertainty surrounding China. The economy of Australia’s main trading partner is failing to deliver the expected strong growth, with today’s PMI data coming in mixed. This raises doubts about Chinese demand for Australian commodities and weighs on the AUD, which is often viewed as a proxy for the Chinese economy.

→ NFP-related risk aversion. Ahead of today’s US labour market report, investors are shifting into risk-reduction mode and increasing demand for so-called safe-haven US dollars amid concerns over potential negative surprises.

Technical Analysis of AUD/USD

On 26 December, we drew an ascending channel, which remained in place at the start of 2026. However, the following developments should be noted:

→ the current downward move represents a bearish breakout below the lower boundary of the channel;

→ the bullish impulse that began on 5 January (marked by the arrow) has been fully neutralised.

These signals point to a meaningful shift in market sentiment, clearly reflected in price action. Should bulls attempt to bring AUD/USD back within the ascending channel, resistance might emerge near 0.6720, where the sharp sell-off began on 8 January, highlighting the dominance of sellers.

The release of high-impact news could fuel further downside momentum, opening the way for the continuation of the descending trajectory (highlighted in red).

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AUDUSD(20260108)Today's AnalysisMarket News:

U.S. Energy Secretary Chris Wright stated that the Trump administration plans to take over Venezuela's future oil sales and use the proceeds to rebuild the country's economy.

"If we control where the oil flows and the cash flow generated from those sales, we will have tremendous leverage," Wright said Wednesday at the Goldman Sachs Energy, Clean Technology, and Utilities conference in Miami. "We need that leverage and control over oil sales to drive the necessary changes in Venezuela." Wright anticipates that Venezuela's daily crude oil production could increase by hundreds of thousands of barrels in the short to medium term. The U.S. government plans to deposit the proceeds into government accounts to benefit the Venezuelan people.

Technical Analysis:

Today's Buy/Sell Threshold:

0.6733

Support and Resistance Levels:

0.6783

0.6764

0.6752

0.6714

0.6703

0.6684

Trading Strategy:

If the price breaks above 0.6733, consider buying with a first target price of 0.6752.

If the price breaks below 0.6714, consider selling with a first target price of 0.6703.

AUDUSD📊 OANDA:AUDUSD Technical Analysis (4H Timeframe)

The overall trend for AUD/USD is strongly bullish, as evidenced by the consistent formation of higher highs and higher lows 📈. The price is currently trading comfortably above the EMA 200 (black line), which shows a clear upward slope, confirming long-term buyer control. The EMA 50 (red line) is also trending upwards and providing immediate dynamic support, highlighting robust bullish momentum. Looking at the candle bodies, we see significant strength in the recent impulsive moves. Currently, the price is testing a major resistance zone near 0.67550 USD. A clean break and hold above this grey box would confirm the continuation of the trend toward the next structural targets 🚀.

🔑 Key Levels to Watch:

Primary Resistance Target: 0.68190 USD (Top Grey Box) 🚩

Immediate Resistance: 0.67550 USD (Current Grey Box) 💡

Dynamic Support 1: 0.66850 USD (EMA 50 / Broken Resistance) 🎯

Dynamic Support 2: 0.66330 USD (EMA 200 / Grey Box) ⚡

Structural Support: 0.66000 USD & 0.65700 USD (Dashed Lines) 🛡️

Major Demand Zone: 0.64270 USD (Origin Grey Box) 🏗️

AUDUSD — FRGNT DAILY CHART FORECAST Q1 | D7 | W1 | Y26

📅 Q1 | D7 | W1 | Y26

📊 AUDUSD — FRGNT DAILY CHART FORECAST

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:AUDUSD

Time to BUY AUDUSD... AUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY AUDUSD now - buy AUDUSD now.

Week of 1/14/26: AUDUSDThis week price is continuing to correct in the 4h where we have finally reached a daily POI level where the 4h could finish correcting. We will follow the 1h trend where internal structure is bullish at the moment. If 1h internal structure breaks 1h external structure bullish, it will further make our case of bullish price action to an eventual new 4h high. If it breaks bearish, then we can expect the 4h to continue in the correction phase.

Major News:

Mon - PMI

Tues - CPI

Wed - ADP NFP, PMI, JOLTS

Thu - Unemployment

Fri - Hourly Earnings, NFP, Unemployment Rate, UoM

AUDCAD Building Strength for an Upside Channel BreakoutAUDCAD – 4H Ascending Channel Continuation

Market Structure:

Price is moving inside a well-defined ascending channel. Higher lows are holding above the lower channel support, while price remains capped below the upper channel resistance, indicating controlled bullish structure within a rising range.

Price Action:

Recent price action shows rejection from the lower half of the channel followed by consolidation near the channel midline. The structure suggests a continuation attempt toward the upper boundary after holding support.

Trade Bias:

Bullish

Entry Zone:

0.9170 – 0.9190

Stop Loss:

0.9090

Take Profit Levels:

Level 1: 0.9240

Level 2: 0.9280

Level 3: 0.9320

Invalidation:

A 4H close below the lower channel support around 0.9090 invalidates the bullish setup.

AUD/USD Strengthening After Corrective Phase!🔥 AUD/USD "THE AUSSIE" | Multi-Layer Swing/Day Trade Setup 💰

📊 MARKET OVERVIEW

Pair: AUD/USD (Australian Dollar vs US Dollar)

Strategy: Bullish Re-Accumulation Zone

Style: Thief Layer Entry Method (Multiple Limit Orders)

Risk Level: Medium-High | Trade at Your Own Risk ⚠️

🎯 TRADE PLAN BREAKDOWN

📍 ENTRY STRATEGY - "Thief Layering Method"

Using multiple limit orders to build position strength:

Layer 1: 0.66500

Layer 2: 0.66600

Layer 3: 0.66700

Layer 4: 0.66800

Layer 5: 0.66900

💡 Flexibility: You can add more layers OR enter at ANY price level based on your risk appetite

🛑 STOP LOSS: 0.66400

⚠️ Thief's Note: Dear Ladies & Gentlemen (Thief OG's) - This is MY stop loss level. You are NOT obligated to use it. Set your own SL based on YOUR risk tolerance. Your money, your rules!

🎯 TAKE PROFIT TARGET: 0.67600

📌 Key Resistance Zone: High-tension electric wall acting as strong resistance + overbought conditions + potential bull trap area = ESCAPE WITH PROFITS HERE!

⚠️ Thief's Note: Dear Ladies & Gentlemen (Thief OG's) - This is MY take profit target. You are NOT required to follow it. Take profits when YOU feel comfortable. Your money, your decision!

💹 CORRELATED PAIRS TO WATCH

🔗 Direct USD Exposure:

EUR/USD - Inverse correlation to AUD/USD (when EUR/USD rises, often AUD/USD follows)

DXY (US Dollar Index) - Strong inverse correlation (DXY down = AUD/USD up)

USD/JPY - Risk sentiment indicator (USD/JPY up = risk-on = AUD/USD potential strength)

🔗 Commodity Correlation:

Gold (XAU/USD) - Positive correlation (both are risk-sensitive)

Copper Futures - Strong positive correlation (AUD is commodity currency)

Iron Ore Prices - Critical for Australian exports

🔗 Asia-Pacific Pairs:

NZD/USD - High positive correlation (both Oceanic currencies)

AUD/JPY - Pure risk sentiment gauge

AUD/NZD - Relative strength between Australia/New Zealand economies

📊 Key Correlation Logic:

AUD = Commodity currency + Risk-on asset. When global risk appetite increases + commodity prices rise + China economy strengthens = AUD typically strengthens against USD.

📰 FUNDAMENTAL & ECONOMIC FACTORS

🇦🇺 AUSTRALIAN FACTORS (AUD Strength Drivers):

✅ Recent Economic Data:

RBA (Reserve Bank of Australia) maintaining hawkish stance on inflation

Australian employment data showing resilience

Iron ore and coal export prices supporting AUD

China's economic stimulus measures benefiting Australian exports

✅ Upcoming Events to Watch:

Australian CPI (Consumer Price Index) data

RBA Interest Rate Decision & Statement

Australian Employment Change & Unemployment Rate

China's economic indicators (PMI, GDP, trade data)

Commodity price movements (iron ore, coal, LNG)

🇺🇸 US DOLLAR FACTORS (USD Weakness Drivers):

⚠️ Recent Economic Data:

Federal Reserve dovish pivot expectations

US inflation cooling off

Potential Fed rate cuts on horizon

Weakening US economic indicators

⚠️ Upcoming Events to Watch:

FOMC Meeting Minutes & Fed Chair speeches

US Non-Farm Payrolls (NFP)

US CPI & Core CPI data

US GDP figures

Fed Interest Rate Decision

⚡ CRITICAL NEWS CATALYSTS:

US Dollar weakness from dovish Fed = AUD/USD bullish

China stimulus announcements = AUD strength (Australia's largest trading partner)

Commodity price rallies = AUD support

Risk-on market sentiment = AUD outperformance

RBA maintaining higher rates longer than Fed = interest rate differential favoring AUD

🎓 WHY THIS SETUP WORKS

✨ Technical + Fundamental Alignment:

Re-accumulation zone suggests smart money building positions

Multi-layer entry reduces risk of poor single entry

Target at resistance zone for realistic profit taking

Fundamental support from China-Australia trade dynamics

Potential USD weakness cycle beginning

⚡ Risk Management Built-In:

Layer entries = better average price

Clear stop loss zone (though YOU decide your own)

Defined resistance target for exits

Correlation monitoring for confirmation

🎯 Your Money = Your Rules = Your Responsibility

Trade safely, manage risk wisely, and always remember: The market gives and the market takes.

🔔 Like this idea? Smash that 👍 button!

💬 Comment your thoughts below!

🚀 Follow for more premium setups!

#AUDUSD #Forex #SwingTrading #DayTrading #TheAussie #ForexSignals #TradingView #ThiefStrategy #LayerEntry #ForexTrading #CurrencyTrading #TechnicalAnalysis #FundamentalAnalysis

AUDUSD(20251230)Today's AnalysisMarket News:

Last week, Trump posted a lengthy statement on social media, which he called the "Trump Rule." He stated that the Federal Reserve, led by his soon-to-be-nominated new chairman, should lower interest rates to help keep the stock market and economy thriving, even at the risk of stimulating inflation. Trump posted, "I expect my new Fed chair to lower interest rates when the markets are doing well, not to destroy them without reason."

Technical Analysis:

Today's Buy/Sell Threshold:

0.6700

Support and Resistance Levels:

0.6744

0.6727

0.6717

0.6683

0.6672

0.6656

Trading Strategy:

If the price breaks above 0.6700, consider buying, with a first target price of 0.6717.

If the price breaks below 0.6683, consider selling, with a first target price of 0.6656.

AUDUSD SELL | Idea Trading AnalysisAUDUSD is moving on Resistance zone..

The chart is above the support level, which has already become a reversal point twice.

We expect a decline in the channel after testing the current level.

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity AUDUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

Time to BUY AUDUSD now it's going upAUDUSD was in a recent downtrend for the last few weeks and struggled to stay bullish, but recently it has just broken a strong resistance trend line which it tested several times and failed to break through. AUDUSD is very likely to hit the next major resistance zone which is market as the "TAKE PROFIT" LEVEL. There are many clear signs of new bullish movements. BUY AUDUSD now - buy AUDUSD now it's going up

Market Analysis: AUD/USD StrengthensMarket Analysis: AUD/USD Strengthens

AUD/USD started a fresh increase above 0.6700.

Important Takeaways for AUD/USD Analysis Today

- The Aussie Dollar started an increase above 0.6650 against the US Dollar.

- There is a short-term bullish trend line forming with support at 0.6695 on the hourly chart of AUD/USD.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD, the pair started a fresh increase from 0.6600. The Aussie Dollar was able to clear 0.6650 to move into a positive zone against the US Dollar.

There was a close above 0.6580 and the 50-hour simple moving average. Finally, the pair tested 0.6725. A high was formed near 0.6724 and the pair recently started a short-term downside correction. There was a minor decline below 0.6700.

On the downside, initial support is near a short-term bullish trend line at 0.6695 and the 50-hour simple moving average. The next area of interest could be 0.6665 and the 50% Fib retracement level of the upward move from the 0.6604 swing low to the 0.6724 high.

If there is a downside break below 0.6665, the pair could extend its decline toward the 0.6650 zone. Any more losses might signal a move toward 0.6635 and the 76.4% Fib retracement.

On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6725. The first major hurdle for the bulls might be 0.6750. An upside break above 0.6750 might send the pair further higher. The next stop is near 0.6800. Any more gains could clear the path for a move toward 0.6850.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

AUDUSD Selling Trading IdeaHello Traders

In This Chart AUDUSD HOURLY Forex Forecast By FOREX PLANET

today AUDUSD analysis 👆

🟢This Chart includes_ (AUDUSD market update)

🟢What is The Next Opportunity on AUDUSD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Chart

AUD/USD Rises to a Yearly HighAUD/USD Rises to a Yearly High

As the AUD/USD chart indicates, the pair updated its yearly highs today, reaching levels above 0.6710. Since the beginning of December, it has risen by approximately 2.45%.

Key bullish drivers include:

→ Central bank policy divergence. While the Federal Reserve is cutting interest rates, the Reserve Bank of Australia is seriously discussing the possibility of rate hikes in 2026 (as reflected in the minutes of the latest RBA meeting).

→ Record-high gold prices. As the Australian dollar is a commodity currency, it shows a strong correlation with prices of key export commodities.

Technical analysis of the AUD/USD chart

In December, price action continued to form an ascending channel. In this context:

→ the price found support near the lower boundary between 18 and 22 December;

→ the median line regained its role as support (as indicated by the arrow).

However, bulls have a serious reason for concern.

After breaking above the September high near the 0.6707 level, a Double Top pattern appears to be forming. From a Smart Money Concept perspective, this setup may be interpreted as a bearish liquidity sweep.

Given the above, we can assume that the median line may still act as support. Nevertheless, if bears manage to seize control, the AUD/USD exchange rate could decline towards the lower boundary of the channel and attempt a downside breakout.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.