BTC Update — Rising Risk of a Pullback Toward 85KBTC Update — Rising Risk of a Pullback Toward 85K

Last update with Data proven trend.

Bitcoin is currently trading inside a strong resistance / supply zone around 93–94K, where price is starting to show signs of exhaustion after a sharp impulsive move up.

What the Chart Is Showing

📉 Rejection risk at resistance: Price is pushing into a heavy supply zone with limited follow-through.

🧱 Weak continuation structure: Momentum is slowing, and upside progress is becoming inefficient.

🔄 Distribution signals: The current range suggests potential distribution rather than accumulation.

Bearish Scenario (High Probability)

If BTC fails to hold above the 92–93K zone, a deeper correction becomes likely.

The projected move points toward the 85K area, which aligns with:

Previous demand

Liquidity resting below recent lows

A clean reset level for structure

Key Levels to Watch

93–94K: Major resistance / invalidation zone for shorts

92K: Short-term support — loss of this level increases downside momentum

85K: Primary downside target and potential bounce zone

Summary

At this stage, BTC has a high probability of rolling over from resistance.

Unless price reclaims and holds above 94K with strong volume, the path of least resistance points down toward the 85K zone.

📌 Caution is advised — this looks more like a pullback phase than a breakout continuation.

B-market

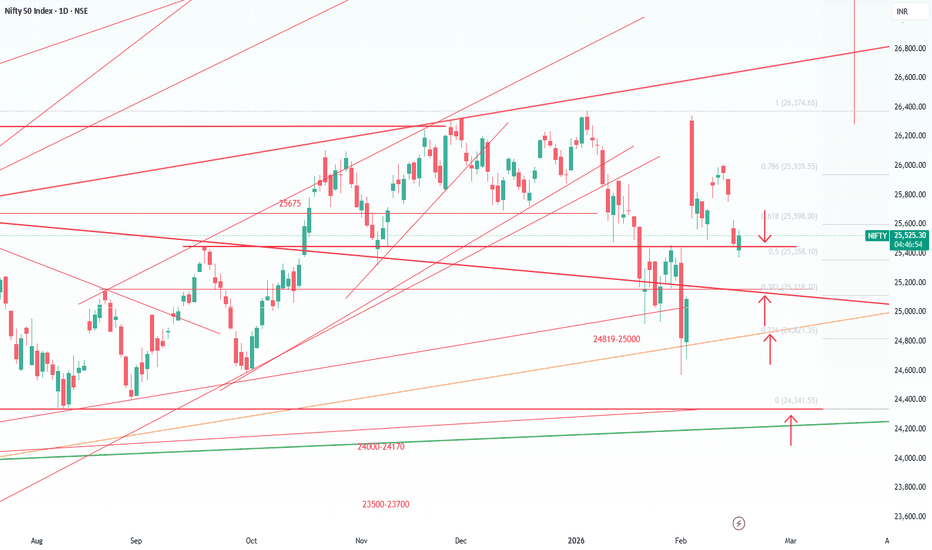

Nifty Short, Medium, Long Term Analysis_16-Feb to 20-Feb-26Nifty 25471 (Last week 25693)

Nifty dipped to 25444 last week after touching high of 26008 and closed at 25471. Following the announcement of the trade deal with the US, the market bounced back sharply on Monday, rising to 26,337. Thereafter, it consolidated and find bottom near 25450.

This nifty drop is mainly contributed from IT sector stocks. IT index is at 2021 levels. IT Stocks can be accumulated slowly in mulitple parcels as further drop is expected.

RSI 46%, MACD crossed the signal but after that dipped but still above the signal, Stochastic 56% Indicators denote neutral movement.

Profit booking happened near to 26000 last week. Broader range bound movement expected upto 26372 (all time high)/26400 to bottom 24200.

Decisive break above 26372/26400 will pave way for nifty to 27000.

As still global tension prevails, high volatility expected, use this opportunity to buy slowly. Since the short term suppport is broken, there is no need in any urgency to buy the stocks.

As far as India is concerned, economy is moderate.

The Nifty 500 stocks have shown a mix of performance in Q3 FY25-26. Many stocks have performed well, while others have lagged.

Q3 results are moderate as public sector banks like union bank, punjab sind, Federal & IOB posted good results. Reliance with moderate 1% up, hdfc bank posted 12% up, ICICI bank -3%, IDBI Bank is flat, Yes Bank is up but sales and EBIT are negative, South indian bank 9%, Infosys 11%, wipro -7% and Tech Mah 33%, Polycab 36%, HDB Fin Services 36% , HDFC Life -1% and ICICI Pru Life 12% and ICICI AMC 45% up and budget for 2026-27 to be proposed on Ist Feb 2026. Persistent system, Waaree Energies , CPCL , BPCL, SBFC Fin, Ultratech Cem, mcx, laurus lab, KVB gave very good results this week. SBI posted 24% growth last week.

Gold have dropped more than 15 % in last two trading session but slightly recovered, silver fell near to 50%.

As i am emphasizing for more than 3 months now, that the situation is highly Volatile, SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years ( Medium to Long term) will workout.

Considering the global situation, diversify the portfolio with Debt and liquid fund ( approx 20-30% portfolio) and 10-20% in Gold & Silver for Year 2026, this funds ( especially liquid funds will create funds availability for further buying opportunity incase of market dips like a Systematic transfer plan.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,HPCL, BPCL, IOCL, Carysil, MAS Financial Services and BSE . Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

New stocks proposed for watchout for 29-Dec-25 to 02-Jan-26 is Indian Bank and NBCC, buy on dip as market in volatile situation. Both stocks reduced further and in buyable range.

New Stocks ( to watchout For Jan Ist Week 2026) are ITC & Lupin.

For 18-Jan-26, after Q3 Results HDFC AMC ( already provided in the call above), Poly cab, union bank, Tech Mah, Infosys are some of the picks for Watchlist.

New Stocks to watchout for 01-Feb-26 are Capri Global, persistent systems, narayana hrudayala, nalco, Dixon & CG Power ( Semiconductor Push).

All the above stocks can be considered slowly ( as multiple parcels) in case of stock price has fallen.

Nifty Short Term Supports :

24819 (Trend Line as shown)

25000

25200 ( 25154 Aug 2025 high)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25450 ( 25442 is the Aug 2025 high)

25500 ( 25441 Sep 18th 2025 High )

Short Term Resistance ( Many from 25000-26320)

1.26329 ( All time High)

25670 (Jun 2025 High)

Medium Term Support:

There are multiple supports are from 24000-25000.

1. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

2. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

2. 26500

3. 26700 ( Finonacci 1.618 as shown in graph)

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

NAS100 (4H) — Wait for flow confirmationNAS100 is still in a heavy 4H selloff — so I’m not interested in forcing a long right now.

Framework:

• Price is approaching a lower reaction area (potential demand / liquidity zone).

• The plan is wait first, then read momentum.

What I want to see on ARVEX Flow Oscillator:

• Exhaustion: downside flow stops expanding and starts to flatten in the lower region.

• Shift: oscillator begins to curl up and the histogram fades (less downside pressure).

• Confirmation: a reclaim toward/above the midline would support a stabilization thesis.

If flow keeps accelerating lower: no long attempts — stay patient and reassess at the next zone.

Educational / analytical use only. Not financial advice.

$SPY & $SPX — Market-Moving Headlines Friday Feb 13, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Friday Feb 13, 2026

🌍 Market-Moving Themes

📊 CPI Follow-Through

January CPI in focus as markets test whether the disinflation trend is stable

📉 Core Inflation Sensitivity

Core readings remain the key driver for rate expectations and yield volatility

💵 Real Rates vs Risk Assets

Bond market reaction likely determines equity breadth into the weekend

🧠 Positioning Into Weekend

After a volatile week, traders manage exposure ahead of Friday close

📊 Key U.S. Economic Data Friday Feb 13 ET

8:30 AM

Consumer Price Index Jan: 0.3%

CPI year over year: 2.5%

Core CPI Jan: 0.3%

Core CPI year over year: 2.5%

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #CPI #Inflation #Macro #Fed #Rates #Markets #Stocks #Options

GOLD 12/02 – H1 ROUTE MAP | FALSE BREAK ABOVE 5100?Gold broke above 5100 but failed to maintain structure. Positive US labor data boosted USD recovery. Price returns to the balance zone of 5000–5100 ahead of tonight's news and tomorrow's CPI.

MACRO CONTEXT

Yesterday's news (NFP & Income):

NFP 130K > forecast 66K

Hourly income increased 0.4% > 0.3%

→ USD supported, gold under pressure.

Tonight (Unemployment Claims – 8:30pm):

Forecast 222K

→ If lower than forecast → USD strengthens further, gold likely to lose 5000.

Tomorrow (CPI):

Core CPI m/m forecast 0.3%

CPI y/y forecast 2.5%

➡️ The market is waiting for CPI to confirm the medium-term direction. Currently, all movements are just positioning before major news.

TECHNICAL STRUCTURE H1

Price breaks 5100 but fails to create a sustained BOS. The 5080–5100 area becomes short-term resistance. The lower H1 FVG is still holding. The uptrend line from the 44xx bottom remains unbroken.

➡️ This is a rejection state after breakout – returning to the balance zone.

ROUTE MAP – KEY PRICE AREAS

UPPER AREA

5080 – 5100

H1 Resistance

Distribution area after news

➡️ If it holds above 5100 after tonight's news → opens up a rally to 5200–5250.

BALANCE ZONE

5000 – 5030

Trapped price area

High liquidity concentration

➡️ Losing 5000 → high probability of liquidity sweep below.

LOWER AREA

4950 – 4980

H1 FVG

Nearest support area

4800 – 4850

Major H4 Support

If CPI is strong → this area might be retested.

HOW LUCASGRAY IS MONITORING NOW

Tonight's news might create a spike but tomorrow's CPI will determine the structure. Breaking 5100 is not enough to call it a continuation. Losing 5000 confirms short-term selling pressure returns.

We:

Clearly separate scalp based on news reaction.

Only swing when structure acceptance occurs after CPI.

Current bias: NEUTRAL – prioritize observing reactions at 5000 and 5100 before CPI news.

— LucasGrayTrading

$SPY & $SPX — Market-Moving Headlines Thursday Feb 12, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Thursday Feb 12, 2026

🌍 Market-Moving Themes

📈 Rates Still the Driver

Hot labor data keeps yields in focus as markets re-price the path for cuts

🛒 Consumer Pressure Check

Recent KO and PEP weakness keeps inflation sensitivity front and center

🏠 Housing Reality Test

Existing home sales becomes a clean read on affordability and rate impact

🧠 Enterprise AI Buildout

Networking and infrastructure demand stays in focus after latest AI order signals

🏛️ Fed Messaging Watch

Late-day remarks from Fed Governor Stephen Miran adds headline risk into the close

📊 Key U.S. Economic Data Thursday Feb 12 ET

8:30 AM

Initial jobless claims Feb 7: 225,000

10:00 AM

Existing home sales Jan: 4.15 million

7:05 PM

Fed governor Stephen Miran speaks

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #JoblessClaims #Housing #Macro #Fed #Rates #Markets #Stocks

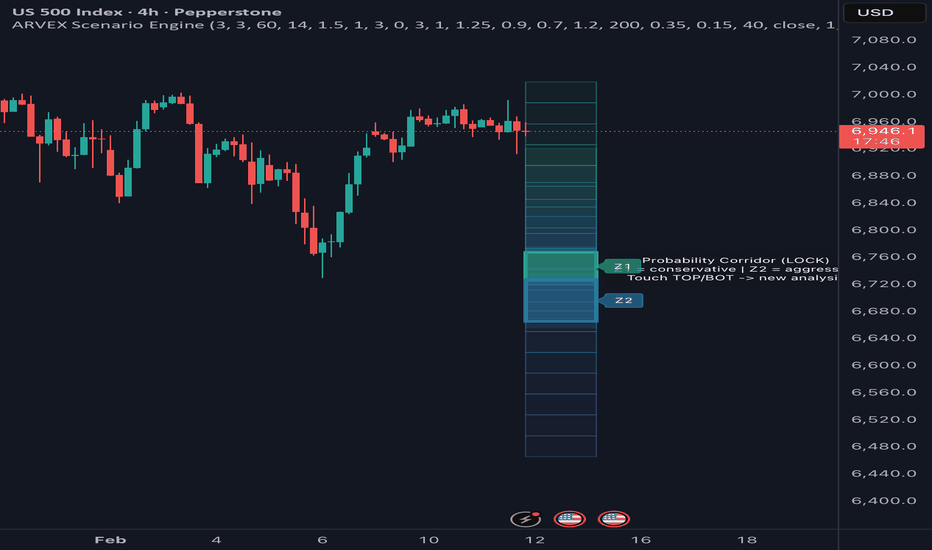

US500 Probability Corridor → Bearish Scenario Building | ARVEX SUS500 is currently trading inside a structured probability corridor following a lower-high formation, suggesting weakening bullish momentum on the 4H timeframe.

The ARVEX Scenario Engine has locked a bearish directional bias, projecting two downside target zones derived from recent swing behavior and volatility conditions.

Z1 represents the conservative path — the area where price is statistically more likely to react first.

Z2 reflects an extended volatility path if downside momentum accelerates.

As long as price remains inside the corridor and fails to reclaim higher structure, the current framework favors continued downside exploration.

A confirmed breakout beyond the corridor would invalidate this scenario and trigger a new structural analysis.

This publication is intended for market context and analytical purposes only — not financial advice.

$BTC 1W: Zoomed out update, down we go Bitcoin continues to weaken on the weekly timeframe after decisively losing the 72.9k support, with price now trading in the mid-60s and firmly below the rising trendline that had supported the broader uptrend. The rejection from the 92.6k region marked a clear lower high, and the impulsive breakdown that followed shifts momentum firmly in favor of sellers in the near term. Structurally, this opens the door for a grind lower toward the major macro support around 52.8k, which represents the prior cycle higher low and the most important level on the chart. From a market structure perspective, it would not be surprising to see BTC chop and bleed lower into that 52k region, allowing time-based correction and sentiment reset before any meaningful reversal attempt. While this does not invalidate the broader bull market unless 52k is lost on a weekly closing basis, the current trend favors rallies being sold until strong acceptance back above 72.9k occurs. For now, the path of least resistance remains slightly lower, with 52k acting as the key demand zone that could determine whether this is a deeper bull-market retracement or the start of something structurally heavier.

$SPY & $SPX — Market-Moving Headlines Wednesday Feb 11, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Wednesday Feb 11, 2026

🌍 Market-Moving Themes

💼 Delayed Jobs Data Lands

January employment report finally drops after shutdown delays, reopening rate and growth debate in one print

🛒 Consumer Stress Signals

Recent KO and PEP misses keep focus on wage growth vs spending power as inflation sensitivity rises

☁️ Enterprise Cloud Resilience

Selective strength in cloud software highlights divergence between consumer-facing and enterprise demand

🤖 AI Cost Scrutiny Persists

Capex intensity across Big Tech remains a market overhang as investors weigh spending vs monetization

🏛️ Fiscal Optics in Focus

Monthly federal budget update adds context to deficit trajectory amid slowing growth signals

📊 Key U.S. Economic Data & Fed Events — Wednesday Feb 11 ET

8:30 AM

U.S. employment report Jan: 55,000

U.S. unemployment rate Jan: 4.4%

U.S. hourly wages Jan: 0.3%

Hourly wages YoY: 3.7%

10:10 AM

Kansas City Fed President Jeff Schmid speaks

2:00 PM

Monthly U.S. federal budget: -$89.0B

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #JobsReport #LaborMarket #Macro #Fed #Markets #Stocks

$SPY & $SPX — Market-Moving Headlines Tuesday Feb 10, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Tuesday Feb 10, 2026

🌍 Market-Moving Themes

🧠 Capex Winners vs Losers

Meta spending fears weigh on platforms while Nvidia and infrastructure names absorb AI investment flows

🛍️ Consumer Stress Signals

Pepsi revenue miss raises concern that pricing power is breaking across staples and retail

🛒 E-Commerce Speculation

Shopify volatility builds ahead of earnings following Amazon’s cloud and retail strength

₿ Crypto Confidence Damage

Bitcoin remains rangebound as regulatory scrutiny freezes institutional participation

📊 Data Compression Risk

Markets remain cautious ahead of Wednesday’s delayed labor data release

📊 Key U.S. Economic Data & Fed Events — Tuesday Feb 10 ET

6:00 AM

NFIB optimism index Jan: 99.5

8:30 AM

Employment cost index Q4: 0.8%

Import price index Dec delayed: 0.0%

U.S. retail sales Dec delayed: 0.4%

Retail sales ex autos Dec: 0.3%

10:00 AM

Business inventories Nov delayed: 0.2%

12:00 PM

Cleveland Fed President Beth Hammack speaks

1:00 PM

Dallas Fed President Lorie Logan speaks

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #RetailSales #AI #Macro #Markets #Stocks #Earnings

#GOLD , Lets Play it 📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #GOLD

⚠️ Risk Environment: High

📈 Technical Overview:

After Many months , i added GOLD on Watchlist of PUBLIC channel ... but i don't wanna it be like a TRAP so mostly will just Watch it ... and if it be 100% good will take it .

—

#EURUSD IS STILL VALID

—-

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

$SPY & $SPX — Market-Moving Headlines Week of Feb 9–13, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Week of Feb 9–13, 2026

🌍 Market-Moving Themes

🧠 AI Capex Anxiety Returns

Meta spending leak revives fears that AI margins will lag spending, reopening the hardware vs platform divide

⚙️ Pick-and-Shovel AI Trade

Rising AI budgets continue to funnel into chipmakers and infrastructure suppliers rather than end platforms

📉 Crypto Trust Shock

Weekend Bitcoin exchange glitch damages confidence and raises volatility risk across crypto-linked equities

📊 Data Delay Volatility

Delayed labor data creates a compressed macro week with multiple releases colliding midweek

🛍️ Consumer Stress Test

Retail sales, confidence, and CPI converge to define whether spending is holding up or cracking

📊 Key U.S. Economic Data & Events Feb 9–13 ET

Monday Feb 9

10:50 AM Atlanta Fed President Raphael Bostic speaks

1:30 PM Fed Governor Christopher Waller speaks

2:30 PM Fed Governor Stephen Miran speaks

5:00 PM Fed Governor Stephen Miran podcast interview

Tuesday Feb 10

6:00 AM NFIB optimism index Jan: 99.5

8:30 AM Employment cost index Q4: 0.8%

8:30 AM Import price index Dec delayed: -0.1%

8:30 AM U.S. retail sales Dec delayed: 0.5%

8:30 AM Retail sales ex autos Dec: 0.3%

10:00 AM Business inventories Nov delayed: 0.2%

12:00 PM Cleveland Fed President Beth Hammack speaks

1:00 PM Dallas Fed President Lorie Logan speaks

Wednesday Feb 11

8:30 AM U.S. employment report Jan: 55,000

8:30 AM U.S. unemployment rate Jan: 4.4%

8:30 AM U.S. hourly wages Jan: 0.3%

8:30 AM Hourly wages YoY: 3.7%

10:10 AM Kansas City Fed President Jeff Schmid speaks

2:00 PM Monthly U.S. federal budget: -50.0B

Thursday Feb 12

8:30 AM Initial jobless claims Feb 7: 222,000

10:00 AM Existing home sales Jan: 4.15M

7:05 PM Fed Governor Stephen Miran speaks

Friday Feb 13 — CPI DAY

8:30 AM Consumer price index Jan: 0.3%

8:30 AM CPI YoY: 2.5%

8:30 AM Core CPI Jan: 0.3%

8:30 AM Core CPI YoY: 2.5%

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #CPI #Jobs #RetailSales #AI #Fed #Macro #Markets #Stocks #Options

Nifty Short medium Long term 9-Feb to 13-Feb-26Nifty 25693 (last week 24820 )

Nifty dipped to 24,691 on the first day of the week. Following the announcement of the trade deal with the US, the market bounced back sharply on Monday, rising to 26,337. Thereafter, it consolidated and eventually settled at 25,693.

Though Budget was a disappointment, there was a support in nifty near to 24740.

Since the GST was reduced in Oct 2025 and also the Income Tax slab reduction last year, there was no much changes in Direct and Indirect Taxes in the budget.

Trade deal framework was released with reduction in tax to 18% for export of apparel, leather, chemicals & marine products.

Tea, Coffee, Spices, Few auto parts & machinery, Diamonds are taxed at 0%.

Simillary US gains from industrial goods, Alchohol, Cars over 3000 Cc, Bikes above 800CC with zero tax.India managed to impose same tariff for sensistive agri products.

RSI 54%, MACD crossed the signal, Stochastic 64% all indicators denote upward rally in the coming week.

However, Broader range bound movement will be upto 26372 (all time high)/26400 to 24500.

Decisive break above 26372/26400 will pave way for nifty to 27000.

As still global tension prevails, high volatility expected, use this opportunity to buy slowly. Since the short term suppport is broken, there is no need in any urgency to buy the stocks.

As far as India is concerned, economy is moderate.

The Nifty 500 stocks have shown a mix of performance in Q3 FY25-26. Some stocks have performed well, while others have lagged.

Q3 results are moderate as public sector banks like union bank, punjab sind, Federal & IOB posted good results. Reliance with moderate 1% up, hdfc bank posted 12% up, ICICI bank -3%, IDBI Bank is flat, Yes Bank is up but sales and EBIT are negative, South indian bank 9%, Infosys 11%, wipro -7% and Tech Mah 33%, Polycab 36%, HDB Fin Services 36% , HDFC Life -1% and ICICI Pru Life 12% and ICICI AMC 45% up and budget for 2026-27 to be proposed on Ist Feb 2026. Persistent system, Waaree Energies , CPCL , BPCL, SBFC Fin, Ultratech Cem, mcx, laurus lab, KVB gave very good results this week. SBI posted 24% growth last week,

On Budget Day, Muthoot Fin, Gold related stocks like Muthoot , Thangamayil, MAnappuram, Titan have fallen, Nalco, Hindalco have fallen by 10% in last two sessions.

Also Public Sector banks are reduced,

Gold have dropped more than 15 % in last two trading session but slightly recovered, silver fell near to 50%.

As i am emphasizing for more than 3 months now, that the situation is highly Volatile, SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years ( Medium to Long term) will workout.

Considering the global situation, diversify the portfolio with Debt and liquid fund ( approx 20-30% portfolio) and 10-20% in Gold & Silver for Year 2026, this funds ( especially liquid funds will create funds availability for further buying opportunity incase of market dips like a Systematic transfer plan.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,HPCL, BPCL, IOCL, Carysil, MAS Financial Services and BSE . Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

New stocks proposed for watchout for 29-Dec-25 to 02-Jan-26 is Indian Bank and NBCC, buy on dip as market in volatile situation. Both stocks reduced further and in buyable range.

New Stocks ( to watchout For Jan Ist Week 2026) are ITC & Lupin.

For 18-Jan-26, after Q3 Results HDFC AMC ( already provided in the call above), Poly cab, union bank, Tech Mah, Infosys are some of the picks for Watchlist.

New Stocks to watchout for 01-Feb-26 are Capri Global, persistent systems, narayana hrudayala, nalco, Dixon & CG Power ( Semiconductor Push).

All the above stocks can be considered slowly ( as multiple parcels) in case of stock price has fallen.

Nifty Short Term Supports :

24819 (Trend Line as shown)

25000

25200 ( 25154 Aug 2025 high)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25450 ( 25442 is the Aug 2025 high)

25500 ( 25441 Sep 18th 2025 High )

Short Term Resistance ( Many from 25000-26320)

1.26329 ( All time High)

25670 (Jun 2025 High)

Medium Term Support:

1. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

2. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

3. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

2. 26500

3. 26700 ( Finonacci 1.618 as shown in graph)

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

1000SHIB Forming a Falling Wedge Structure1000SHIB is currently trading within a falling wedge pattern on the higher timeframe, defined by a series of lower highs and lower lows that are gradually converging. This structure reflects decreasing downside momentum, even though price remains under overall bearish pressure.

Price is now positioned close to the lower boundary of the falling wedge, an area that often acts as a short-term reaction zone. From here, the market may attempt to cover recent downside wicks or perform a brief liquidity sweep below support, which would still be consistent with the structure of the pattern.

As long as price continues to compress within the wedge, the focus remains on how it reacts around the lower trendline. A sustained defense of this area increases the probability of a mean reversion move toward the upper wedge resistance, while a clean breakdown and acceptance below the structure would invalidate the pattern and extend the broader downtrend.

At this stage, the market is still in a compression and decision-making phase, with confirmation only coming after a clear breakout from the wedge boundaries.

Easy Buy on Netflix - Breakout of Ascending Channel !Netflix is currently down almost 50% from its all time high in Nov 2021.

Currently traded in an ascending channel since Oct 2022 and briefly broke out above with strong volume to close at 357.42 as of market close.

Now we look for some profit taking and pullback to retest the top of the channel

Buy zone is:

336 - 357

Take profit:

393

Now we have the 50 EMA crossing the 200 EMA, with the 100 EMA close behind. A cross of 100 EMA will signal stronger bullish momentum on Netflix stock, giving us more room for upside.

$SPY & $SPX — Market-Moving Headlines Friday Feb 6, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Friday Feb 6, 2026

🌍 Market-Moving Themes

☁️ Cloud Confidence Restored

AMZN earnings reverse the AI capex panic as AWS profit growth proves spending is paying off

🚗 Legacy Auto Breakdown

Ford EV losses confirm widening gap between legacy automakers and Tesla as price wars intensify

📱 Ad Tech Surprise

SNAP earnings signal renewed advertiser demand and Gen Z engagement after years of stagnation

📊 Jobs Day Volatility

Non-Farm Payrolls set the tone for rates expectations, risk appetite, and end-of-week positioning

🛡️ Gold as Shock Absorber

Gold remains bid as hedge against both recession fear and inflation surprise from jobs data

📊 Key U.S. Economic Data Friday Feb 6 ET

8:30 AM

U.S. employment report Jan: 55,000

U.S. unemployment rate Jan: 4.4%

U.S. hourly wages Jan: 0.3%

Hourly wages YoY: 3.6%

10:00 AM

Consumer sentiment prelim Feb: 55.0

12:00 PM

Fed Vice Chair Philip Jefferson speaks

3:00 PM

Consumer credit Dec: $8.0B

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #JobsReport #NFP #AMZN #AI #Cloud #Macro #Markets #Stocks #Options

DMART – STWP Equity Snapshot📊 DMART – STWP Equity Snapshot

Ticker: NSE: DMART

Sector: Retail / Consumer

CMP: 3,934.9 ▲ (+2.89%)

Learning Rating: ⭐⭐⭐⭐☆ (Strength Emerging After Demand Response)

Chart Pattern Observed: Range Base → Early Expansion Attempt

Candlestick Pattern Observed: Strong Bullish Range Expansion Candle

📊 Technical Snapshot

DMART has staged a decisive rebound from a previously defended demand zone, printing a wide-range bullish candle supported by expanding participation. The move reflects active buyer presence after a prolonged balancing phase, suggesting that the market is transitioning from contraction toward expansion.

Price is now approaching the upper boundary of the recent value area, where prior supply reactions have historically emerged. Acceptance above this region would indicate value migration higher, while failure to sustain could lead to temporary rebalancing within the range.

From a CPR perspective, the structure is shifting upward with a projected wide CPR — typically associated with trending environments rather than sideways behaviour. This alignment subtly strengthens the probability of directional continuation, provided participation remains supportive.

Overall structure signals improving momentum, but extension risk must be respected after a sharp single-session expansion.

📊 Volume Analysis

🔹 Current Volume: ~867K

🔹 20-Period Average: ~540K

⚖️ Participation has expanded meaningfully above average, indicating institutional interest rather than purely retail activity.

💡 Interpretation:

Breakouts backed by volume expansion tend to carry better structural reliability than low-participation moves. Sustained volume will be the key validator of whether this is accumulation continuation or merely a short-term price spike.

🔑 Key Levels – Daily Timeframe

Support Areas: 3856 | 3778 | 3732

Resistance Areas: 3981 | 4027 | 4105

These are zones where price has paused or reacted earlier.

What’s Catching Our Eye: Strong demand-led expansion emerging from a defended base.

What to Watch For: Sustained acceptance above the near-term value zone.

Failure Zone: Loss of structure below the immediate support cluster.

Risks to Watch: Post-expansion cooling or short-term profit rotation.

What to Expect Next: Potential continuation attempt with intermittent consolidation.

📌 Price Reference Framework – Educational View

🔹 Intraday Reference (Short-Term Observation)

Observation Zone: 3,949

Risk Invalidation Area: Below 3,741

Upside Reference Zones: 4,198-4,365

Used only to observe near-term price behaviour.

🔹 Swing Reference (Positional | Multi-Session Observation)

Observation Zone: 3,935-3949

Risk Invalidation Area: Below 3,638

Upside Reference Zones: 4,572 → 5,039 (structure projection)

Relevant only if price sustains above the evolving value region.

STWP View

Momentum: Strengthening

Trend: Attempting Upward Transition

Risk: Elevated After Expansion

Volume: Supportive

🧠 Learning Note

Strong candles attract attention — strong structure sustains trends. Always evaluate participation and acceptance before forming directional bias.

⚠️ Disclaimer

This post is shared purely for educational and informational purposes and does not constitute investment advice or a recommendation. Please consult a SEBI-registered financial advisor before making any trading or investment decisions. Market participation involves risk.

💬 Did this help you understand the chart better?

🔼 Boost | ✍️ Comment | 🔁 Share with a learner

👉 Follow STWP for structure-based market education

🚀 Stay Calm. Stay Clean. Trade With Patience.

Why Market ChangesMarkets change because participation changes. Price is not driven by patterns. It is driven by order flow, liquidity conditions, and shifting incentives across timeframes. When those inputs change, the behaviour of the chart changes with them. The same strategy can look flawless for weeks and then feel unusable, not because the market became random, but because the environment that supported the edge is no longer present.

One driver is liquidity. Crypto liquidity is not stable. Depth increases during overlap sessions and dries up during dead zones. When liquidity is thick, moves are cleaner, levels respect more often, and retests tend to hold. When liquidity thins, spreads widen, stops get tagged more frequently, and structure becomes less reliable on lower timeframes. Many traders call this manipulation. It is often just a liquidity problem.

Another driver is volatility regime. Volatility expands when uncertainty rises, new information enters, or leverage builds and gets forced out. Volatility compresses when participation slows and the market waits for fuel. Strategies that rely on tight invalidation distance struggle during expansion because candle ranges widen and execution becomes less precise. Strategies that rely on momentum struggle during compression because price rotates without follow-through. A strategy does not stop working. It becomes mismatched with the regime.

Market phase also matters. Trends, ranges, and transitions behave differently because the market is doing different work. Trends move between liquidity pools with momentum. Ranges build inventory and sweep both sides repeatedly. Transitions are messy because control is shifting and both sides are active. Traders lose most money in transitions because they apply trend logic to a market that is no longer trending.

Timeframe alignment is another source of change. A clean intraday trend can exist inside a higher timeframe range. A strong lower timeframe breakout can occur while the higher timeframe is still completing a liquidity objective in the opposite direction. When timeframes are aligned, trades feel easy. When timeframes conflict, trades feel like constant stop hunts.

Finally, participants adapt. When one side becomes crowded, the market seeks the liquidity created by that crowd. Retail tends to chase clean breakouts and obvious levels. Larger participants use those obvious levels to fill positions. As positioning shifts, the market shifts with it. Price changes behaviour because the incentives behind price change.

The practical takeaway is simple: your job is not to predict direction. Your job is to diagnose environment before you execute. Liquidity conditions, volatility regime, market phase, and timeframe alignment should decide whether you trade aggressively, trade selectively, or stay flat. Consistency comes from adapting exposure to conditions, not forcing the same behaviour onto every chart.

BTC Outlook / Breakdown and Retest SetupBitcoin saw an impulsive breakdown after failing to hold the prior consolidation range. Once acceptance was established below the mid-range, downside momentum expanded quickly, leaving price stretched relative to recent structure.

The yellow and green levels above represent prior support and value areas where price previously spent time consolidating. These zones are now likely candidates for a retest from below, should relief or short-covering occur.

From a structural perspective, a move back into those levels would not invalidate the current bearish leg. Instead, it would be consistent with a breakdown and retest scenario, where former support acts as resistance.

As long as price remains below those zones, the broader bias stays to the downside. Any upside reaction into that area should be evaluated on acceptance and follow-through, not assumed strength.

For now, momentum favors continuation, while the yellow and green zones define the most important areas to watch for a potential reaction or rejection.

$SPY & $SPX — Market-Moving Headlines Thursday Feb 5, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Thursday Feb 5, 2026

🌍 Market-Moving Themes

🧠 AI Cost Reckoning

Big Tech spending fears intensify after GOOGL capex shock and AMD collapse, forcing markets to question AI profitability timelines

🏭 Hardware vs Software Divide

Capex-heavy AI buildouts favor chip and infrastructure suppliers while pressure mounts on software margins

💊 Healthcare Rotation Accelerates

LLY strength highlights capital rotation out of volatile Tech into durable growth healthcare

⚖️ Macro Crosscurrents

Weak ADP payrolls clash with strong services data, keeping recession and no-landing narratives in conflict

🛡️ Defensive Repositioning

Gold stabilizes as investors hedge against Tech volatility and labor market uncertainty

📊 Key U.S. Economic Data Thursday Feb 5 ET

8:30 AM

Initial jobless claims Jan 31: 212,000

delayed release due to shutdown

10:50 AM

Atlanta Fed President Raphael Bostic speaks

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #AI #GOOGL #AMD #Macro #Jobs #Gold #Healthcare #Markets #Stocks #Options

Learning from the losses.Hello, in this series i am going over all my losing trades and study each case to become a better trader! Feel free to join me.

GU: CSFR - poor (candle:size:flow:ratio)

GU: impatience,

USDCHF: Fib less than 50, CSFR poor

GBPCHF: narrow focus, long in short market, calling the bottom

EURUSD: CSFR poor, no engulfing, 61.8 disrespected - last fib in bullish trend.

$SPY & $SPX — Market-Moving Headlines Wednesday Feb 4, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Wednesday Feb 4, 2026

🌍 Market-Moving Themes

🧠 AI Reversal Setup

AMD earnings confirm AI chip demand is accelerating, resetting sentiment for NVDA AVGO MU and the broader semi complex

📉 Tech Shakeout Exhaustion

Tuesday’s Nasdaq selloff looks like a leverage flush ahead of real earnings confirmation rather than a trend break

💰 Inflation Hedge Resilience

Gold and Silver rebound sharply, signaling investors are not abandoning inflation protection despite recent liquidation

👷 Labor Market Stability

Steady job openings and ADP data reinforce the no-landing narrative heading into Friday’s payrolls

🏦 Fed Noise Returns

Lisa Cook remarks late in the day could reintroduce rate volatility after markets ignored recent Fed warnings

📊 Key U.S. Economic Data Wednesday Feb 4 ET

8:15 AM

ADP employment Jan: 45,000

9:45 AM

S&P final U.S. services PMI Jan: 52.5

10:00 AM

ISM services Jan: 53.5%

6:30 PM

Fed Governor Lisa Cook speaks

⚠️ For informational purposes only. Not financial advice.

📌 #SPY #SPX #AMD #NVDA #AI #ISM #ADP #Macro #Earnings #Stocks #Options