BTC : (Reversal 67K After Lows) Btcusd Buy @ 67323.41

TP1 : 67532.01

TP2 : 67729.05

TP3 : 67924.17

TP4 : 68238.67

SL : 66120.03

It maybe look like a permanent drop however we shall revisit the (67K) region due to the price and when we return we shall (break across 67K) as we are only clearing the lows the return stronger with the bulls and their momentum

Beyond Technical Analysis

The value of the Option Open Interest Heatmap in futures tradingThe Option Open Interest Heatmap provided by CME is a free tool often underestimated by traders. Yet it offers a clear reading of the structural forces that influence the behaviour of the underlying, whether in FX, indices, commodities, or rates.

Unlike a traditional view focused on price action and volume, the options heatmap immediately shows where open positions are concentrated at each strike and each expiry. It gives shape and depth to the influence of options on the dynamics of the underlying contract.

For a trader who deals exclusively in the underlying but wants to understand what truly drives accelerations, slowdowns, or reversals, this tool is an important source of information.

Option Open Interest: a risk map rather than a directional signal

Option open interest measures the total number of outstanding contracts, broken down by strike and maturity. It is not a directional indicator in the usual sense but a map of risk, hedging activity, and speculative bets that institutional players are taking at various price levels.

A simple list of numbers would not capture these interactions. The heatmap, however, provides an immediate view of position density. The most heavily loaded areas stand out and reveal where market forces are concentrated.

For a trader, this representation acts as an atlas of zones likely to influence the path of the underlying, often more deeply and mechanically than simple technical support and resistance.

Why options OI directly shapes the behaviour of the underlying

The value for a futures trader does not stem from any intention to trade options, but from the need to understand the behaviours induced by these positions. When a strike accumulates a large volume of puts or calls, it often becomes a natural magnet for the underlying. As expiry approaches, the hedging adjustments that dealers must carry out push prices toward that zone: this is the pinning phenomenon.

Conversely, if price breaks through a particularly dense cluster, the reaction can be much more explosive. Moving past a strike loaded with options abruptly changes dealers’ risk structure, triggering mechanical buying or selling flows on the underlying contract. The trader who does not follow the heatmap can be unsettled by these sharp moves. The one who does immediately understands that these moves are structural adjustments often invisible on a simple price chart.

Since many market movements originate from these clusters, the heatmap also makes it possible to compare risk distribution across expiries, revealing areas of immediate tension in near-term maturities or more strategic stakes in longer maturities.

A practical tool for futures traders: working zones, scenarios, and gamma structure

For a futures trader, the heatmap leads to concrete decisions. It helps identify zones where institutions have strong incentives, and therefore the levels where the market tends to stall, or on the contrary, zones where it is likely to accelerate.

It improves scenario evaluation: gradual stabilisation around a heavily loaded strike, a targeted test of a cluster-defined level, or tensions arising in an area where near-spot options generate negative gamma.

Gamma influence is central here. When near-spot options contain a large share of open interest, dealer positioning partly shapes the market environment. A dealer who is long gamma (buyer of options) tends to stabilise prices and reduce volatility. A dealer who is short gamma, by contrast, amplifies moves in both directions to meet hedging needs.

The heatmap therefore becomes indispensable for identifying zones where these constraints may alter the dynamics of the underlying, and for distinguishing purely technical moves from structural ones.

Final Thoughts: an essential and complementary structural dimension

The Option Open Interest Heatmap is not meant to replace a trader’s classic analytical tools, but it enriches analysis by highlighting forces that are invisible on a simple price chart. It helps anticipate slowdown zones, inflection points, pinning risks, or accelerations triggered by the unwinding of an options cluster. Altogether, these elements allow the trader to approach the market with a more complete understanding of the forces at play.

By integrating this map of options positioning into the analytical process, the trader gains a much clearer view of probable scenarios and significantly strengthens decision-making. Understanding the influence of options on the underlying is not marginal: it is often a decisive factor in reading the market correctly and improving trading quality.

---

When charting futures, the data provided could be delayed. Traders working with the ticker symbols discussed in this idea may prefer to use CME Group real-time data plan on TradingView: tradingview.com/cme/ .

This consideration is particularly important for shorter-term traders, whereas it may be less critical for those focused on longer-term trading strategies.

General Disclaimer:

The trade ideas presented herein are solely for illustrative purposes forming a part of a case study intended to demonstrate key principles in risk management within the context of the specific market scenarios discussed. These ideas are not to be interpreted as investment recommendations or financial advice. They do not endorse or promote any specific trading strategies, financial products, or services. The information provided is based on data believed to be reliable; however, its accuracy or completeness cannot be guaranteed. Trading in financial markets involves risks, including the potential loss of principal. Each individual should conduct their own research and consult with professional financial advisors before making any investment decisions. The author or publisher of this content bears no responsibility for any actions taken based on the information provided or for any resultant financial or other losses.

Major Market Crash Warning! Not if, It's when?⚠️ High Probability of a Major Market Crash in 2026 — It’s Not “If”, It’s “When”

Global markets are currently priced for a soft landing that history rarely delivers. Beneath the surface, multiple structural risks are converging — risks that have historically preceded major market drawdowns, recessions, and volatility expansions.

This isn’t greed or fear — it’s risk math and leverage dynamics.

📉 Where Markets Sit Right Now

S&P 500 (SPX500): ~ 6,950 (still extended above long-term value)

Nasdaq 100 (NDX): ~ 25,000 (strong tech bias, highly leveraged)

Bitcoin (BTC): Weak structure after failed rallies

These levels are high compared to historic norms, and technical support zones have already been breached in many risk assets.

📊 Projected Drawdown Scenarios (Macro + Technical Alignment)

Based on leverage unwind risk and prior market breakdowns:

S&P 500 (SPX500): ⬇️ 30–60% drawdown

Targets: 4,300 → 3,800 → 3,200–2,800

Nasdaq 100 (NDX): ⬇️ 40–60% drawdown

Targets: 15,300 → 13,000 → 11,000–10,500

Bitcoin (BTC): ⬇️ $40,000–$50,000

Major liquidity zones expected near $50k and below

These are not random — they align with known value nodes, historical liquidity zones, and deleverage pressure points.

📌 Key Technical Levels to Watch

🔴 S&P 500 (SPX500)

Resistance: 7,400–7,500

Breaking down: below 6,500

Acceleration: below 6,200

Crash magnets:

4,300

3,800

~2,800

Breakdown below 6,500 would trigger major systematic selling.

🔴 Nasdaq 100 (NDX)

Resistance: 26,800–27,200

Breakdown: below 24,500

Acceleration: below 22,000

Crash magnets:

15,300

13,000

11,000–10,500

Tech leads both up and down — leverage risk is highest here.

🔴 Bitcoin (BTC)

Resistance: 70k–73k

Breakdown: below 60k

Acceleration: below 55k

Crash magnets:

$50k

$45k

$40k

BTC remains risk-on, not safe haven, especially during systemic risk.

💣 The Real Risk — Carry Trades & Leverage Unwind

Over the past decade, markets have been supported by:

Cheap funding

Carry trades (FX-based, rates-based)

Derivatives leverage

Systematic strategies like CTAs and risk parity

These only work if:

Volatility stays suppressed

Liquidity remains abundant

Once one of those breaks — which it has — the unwind becomes mechanical, not discretionary.

🧠 The Fed Is Trapped — Every Path Hurts Markets

🔻 If the Fed cuts rates:

Signals economic stress

Undermines bond confidence

Can worsen currency volatility

Raises real inflation risk

🔺 If rates stay high:

Debt servicing costs soar

Credit conditions tighten

Defaults increase

Equity valuations compress

Either outcome increases risk assets’ downside.

💳 Debt at Record Levels = Fragile Structure

Governments, corporations, and consumers are highly leveraged.

High debt + high rates = fragility, not resurgence.

That’s why risk assets get hit on the way down, not the way up.

⏳ Why De-Risking Before April Matters

April tends to coincide with:

Liquidity regime shifts

Earnings reality replacing optimism

Volatility normalization

Macro data catching up with price

Once a drawdown starts, prices rarely stop cleanly — they overshoot liquidity clusters before forming a base.

🛡️ Capital Preservation Strategy

This is not about perfect timing — it’s about protecting capital.

Consider:

Reducing leverage

Raising cash

Hedging key exposures

Shorting rallies inside a downtrend

Avoiding emotional “hope trades”

You can always re-enter once direction becomes clearer.

🧭 Final Takeaway

CAPE extremes currently sitting at 40.8 second highest in the last 150 years! High leverage, tight liquidity, and structural macro risks are not bullish.

This setup mirrors prior pre-crash environments — 1929, 2000, 2008 — not coincidences, but patterns.

📌 This is not a matter of if, but when.

📌 This is not a prediction — it’s a risk framework.

Protect capital first.

Opportunity comes after the unwind.

The 3 Biggest Mistakes New Crypto Traders Make & How AI FixesThe 90% Rule

There is a brutal statistic in crypto: 90% of traders lose 90% of their money in the first 90 days.

Why? Is the market rigged? Are they stupid? No.

They simply fall into the same three psychological traps that have destroyed portfolios for decades.

I used to be one of them. I blew my first two accounts making these exact mistakes. But recently, I started using Fortune AI signals to "check" my decisions, and the difference has been night and day.

Here are the 3 mistakes killing your gains—and how AI solves them.

Mistake #1: Revenge Trading (The "Get It Back" Trap)

The Scenario: You take a loss. Maybe you lost $50. You feel angry. You think, "I need to make that $50 back NOW." So you immediately enter a new trade with bigger leverage and zero setup.

The Result: You lose $200.

How AI Fixes It:

An AI bot doesn't have an ego. It doesn't care if it lost the last trade. It doesn't feel "angry."

If the market conditions aren't perfect, Fortune AI stays silent. It forces you to wait for a high-probability setup, preventing you from spiraling into a loss streak.

Rule: AI waits for math, not revenge.

Mistake #2: The "Hopium" Hold (Refusing to Cut Losses)

The Scenario: You buy a coin at $1.00. It drops to $0.90. You say, "It'll come back." It drops to $0.80. You say, "I'm a long-term investor now." It drops to $0.50. You are liquidated.

The Result: A small, manageable loss becomes a portfolio-ending disaster.

How AI Fixes It:

Fortune AI signals always come with a predefined Stop Loss (SL) level.

The Signal: BUY at $1.00. SL at $0.95.

The Execution: If the price hits $0.95, the signal says EXIT. No questions asked.

By strictly following the AI's risk parameters, you take small "paper cuts" instead of fatal wounds.

Mistake #3: Over-Trading (The Boredom Killer)

The Scenario: The market is boring. Bitcoin hasn't moved in 4 hours. You want "action," so you start scalping 1-minute candles on a random altcoin just to feel something.

The Result: You get chopped up by fees and volatility.

How AI Fixes It:

Humans get bored; algorithms don't.

Fortune AI can scan 50+ charts simultaneously, 24/7, without getting tired or bored. It filters out the "noise" and only alerts you when a genuine opportunity appears. If there is no trade, there is no signal. It saves you from yourself.

The Solution: Outsource Your Discipline

You don't need to be a robot to trade successfully—you just need to listen to one.

By using an AI signal tool like Fortune AI, you essentially hire a professional risk manager to watch over your shoulder. You still press the buttons, but you stop making the emotional errors that wreck 90% of traders.

Stop trading with your heart. Start trading with data.

The Right Bitcoin ChannelHello TV Community,

I am back with this and more insightful charts coming soon.

This chart was first published back in 2020 (linked below) and this is an update to BTC's trajectory over the past few years.

This chart demonstrates that BTC's price action has been steadily following the mid 50% of my "right" channel (see idea linked below to understand what I mean by "right channel"). The last time BTC's price broke out of the mid 50% range was back in December 2017's high.

The most up to date volume profile indicates that the majority of the trading volume was pre-2017. The MACD indicator is a great example of BTC's highly volatillity since the Dec 2017 high.

If BTC's price breaks into the bottom 25% of the channel, I would expect a touch of the lower end of this channel. If the price bounces off the lower end of the mid 50% of this channel, we can expect higher highs in the not too distant future.

'Til next time.

__________________________________

I let my charts do the talkin'.

TECK GOING FOR MARKUP?This is an Atypical Trading Range Schematic #2

With possbile Copper Theme in play, im thinking to exploit this stock for some profit

It is possible that the Bar 11/2/26, An Upthrust

-I would consider to add if any probable Springboard in future

Position intiated as attached yesterday

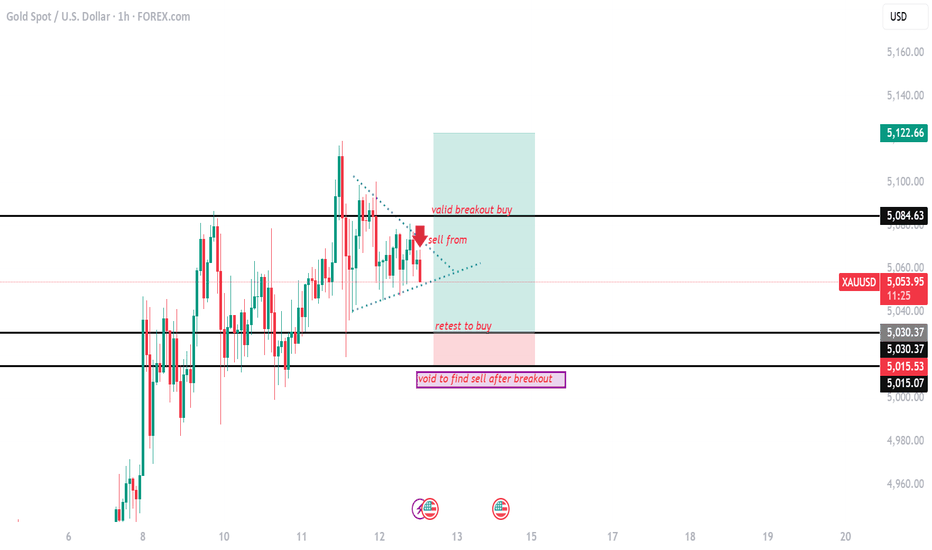

G O L D : (Buy Stop 5082+)Gold Buy Stop - (Xausd) looking to be buying this is due to its trend and price structure as usual we follow the trend and look at the structure ,combine that with our daily direction this helps us discover the sentiment of the market for the day

Potential New Price : 5118.269

Live Trade

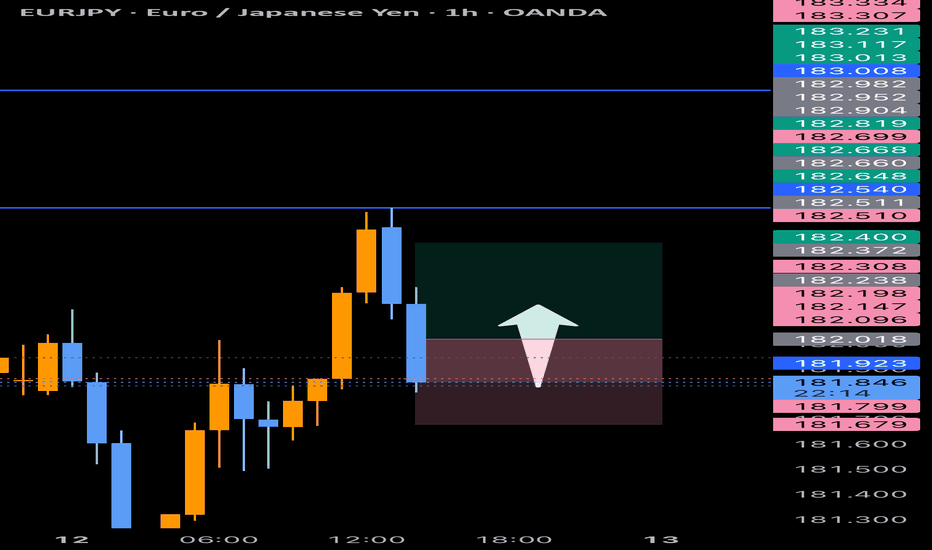

This is my live trade documented, I wanted to see higher prices on Eur/Usd, I executed and entered the trade and explained what I wanted to see in hindsight. I cut half of my position at the high and trailed my stop loss to profit which was eventually tagged.

Ideation behind the trade

- Bullish directional bias

- News event at 1:30 PM Eastern Standard Time

- Manipulation Lower

AMPG Orderflow (Daily)

No Bullish mBOS/CHoCH yet (@$3.29)

FVG from 13/11/2026 - 17/11/2026 fully mitigated .

Testing bullish gap up from 13/11/2026 - 14/11/2026 (gap fill @$2.66)

Sellside liquidity under $2.76. Buyside Liquidity over $3.16 & $3.29.

Weak short term Substructure Swing High @$3.16 if Fractal Swing Low @$2.70 does not get taken out.

Looking for Absorption candles & trapped shorts (i.e Daily close above Bearish Imbalance/s).

gold on retest below 5030#XAUUSD base on D1 similar candle, we expect opposite move first on price before actual move. Price needs to retest below 5030 for continuation on buy.

5030 2 times breakout buy, target 5080,5122, SL 5015.

Above 5074 can expect drop till 5030 but valid breakout above 5084 on M15 tf will continue buy.

If breakout below 5007 then we look for sell.

AMPG Orderflow (W)Testing Line in the sand/corkscrew:

1) Retesting Absorption Weekly candle from 10/02/2026 - 17/02/2026.

Trapped shorts breakeven liquidation from bearish imbalance @$2.70-2.67 stabilising price.

Weekly inside bar close above $2.70 would provide a Minor Swing Low for a possible final liquidation into Bullish Imbalance @2.63.

2) Diminishing negative delta could provide confirmation in regards to a Test of No Supply under $2.70.

3) Looking for weekly absorption candle closing about bearish imbalance/s.

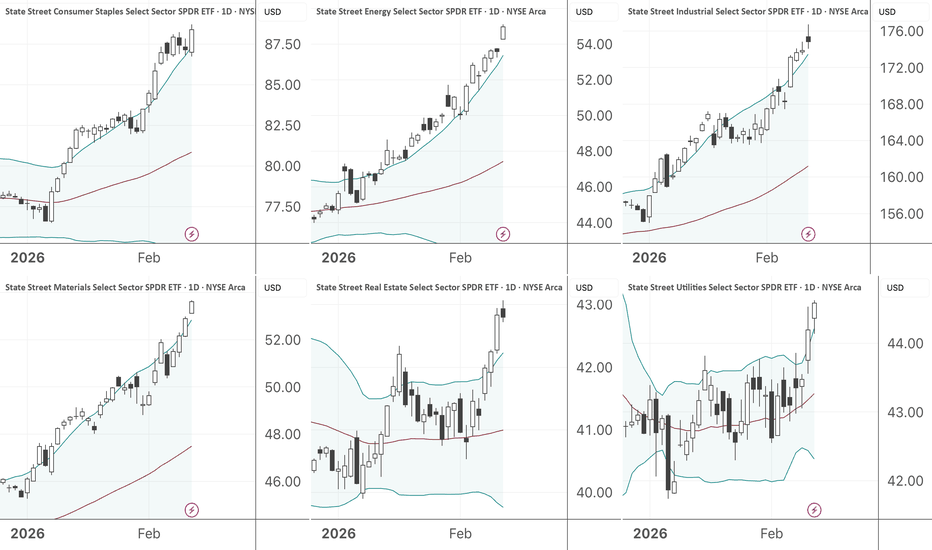

Why S&P 500 Sectors Have My Attention NowFor the first time in 35 years, more than half of the S&P 500 sectors are extremely overbought... while the index itself is struggling to maintain neutral territory. 🤯

Using a 50-period Bollinger Band (standard deviation framework around a 50 MA), we can define “extremely overbought” as price trading outside the upper band.

Right now, the following sectors are outside their upper Bollinger Bands:

Consumer Staples AMEX:XLP

Energy AMEX:XLE

Industrials AMEX:XLI

Materials AMEX:XLB

Real Estate AMEX:XLRE

Utilities AMEX:XLU

That’s more than half of the major S&P sectors extended beyond their statistical mean at the same time... while at the same time the index as a whole struggles to maintain neutral territory.

This hasn’t occurred in 35 years.

Important: This Is Not Automatically Bearish

An overbought condition is not a sell signal. Markets can stay irrational longer than most trader accounts can stay solvent . In strong momentum environments, riding the upper band can actually signal persistent institutional accumulation.

However… When this many sectors are simultaneously stretched, two things become true:

The probability of sector-level pullbacks increases.

The S&P 500 becomes vulnerable if those pullbacks happen together.

The index doesn’t need panic selling to decline — it just needs enough sectors mean-reverting at the same time.

The Bigger Context Matters

Here’s where it gets more interesting.

While these sectors are extremely extended, the S&P 500 itself is struggling to make meaningful upside progress. Momentum (MACD) has been making lower highs for over 260 days while price has made higher highs.

That kind of bearish divergence suggests:

Internals are weakening

Upside participation is narrowing

Progress is slowing

The S&P 500 is telling you it's “ tired. ”

Now, there’s an old saying on Wall Street: Never short a boring market.

I agree.

To be clear...

I’m not forecasting a crash.

I’m not forecasting a trend reversal.

But I do believe we’re in a period where:

Bullish trades require tighter risk management

Expectations for explosive upside should be tempered

Mean reversion is more likely than momentum expansion

Here’s what you need to keep an eye on:

If overbought sectors begin rolling over one by one

If the S&P fails to hold neutral territory

If MACD divergence continues while price stalls

A coordinated sector pullback could create the kind of controlled retracement we often see heading into late Q1.

The Takeaway

Be cautious with your bullish trades. Manage your account risk. Be relentless with your use of stops.

I'm curious to hear your thoughts:

Do you view widespread overbought readings as exhaustion or strength?

Are you tightening up your trades here?

How will seasonality and the presidential election cycle add pressure to the market?

Share your comments below!

ONDO: poised for a bounce? key levels and targets to watchONDO. Still watching this RWA kid bleed and wondering when it finally wakes up? According to market chatter, the project keeps pushing tokenized Treasuries and new integrations, but price has been in a long cooldown after the hype spike. Now we’re sitting right on a big 4H demand block around 0.24 where sellers started to dry up.

On the 4H chart I see a steady downtrend, but the last legs are more sideways than vertical and RSI is making higher lows while price chops in a tight range – classic early bullish divergence. Volume profile shows a fat node and point of control near 0.27–0.28, so any bounce has a clear magnet above. With funding calm and fresh RWA headlines, I’m leaning toward a relief long rather than another straight dump.

My base plan: as long as the green support zone around 0.24 holds, I like a move first into 0.27–0.28 and, if buyers press, into the next supply near 0.30–0.32 ✅. If we get a clean 4H close below 0.24, that kills the idea for me and opens room toward 0.22 and even 0.21, where I’d rather wait for the next setup ⚠️. I might be wrong, but I’m slowly scaling in with tight risk just under that support.

MICROSOFT (MSFT) Market update, Weekly Insight.Fundamental Analysis:

As of today, Microsoft shares are valued are at 404.37, the company market cap stands at 3.09T, with a P/E ratio of 25.30 and dividend yield of 84.1%. an announcement was made on Wednesday that top security leader Charlie Bell will take on a new role, and that Hayete Gallot will return to the company to run security after a stint at Google. this could be a robust growth to the company, as we look forward to the outcome of this change.

Technical Analysis:

This weekly chart clearly shows a significant buying moment in respect of the structure, the overall market view displays uptrend formation, as price is almost at the weekly trendline demand zone.

42-43% of analysts recommend a strong buy, also 55% recommend buy. for the meantime, we keep a close eye on the market and see how it plays out.

Thanks for reading.

Can Cloudflare Become the Nervous System of the AI Internet?Cloudflare has evolved far beyond its origins as a content delivery network to emerge as a unified "connectivity cloud" that sits at the critical intersection of security, performance, and programmable compute. The company's fourth-quarter 2025 results reveal a remarkable 34% year-over-year revenue surge to $614.5 million, driven by its strategic positioning in what CEO Matthew Prince calls the "Agentic AI" era. With Cloudflare now handling 60% of all internet traffic via APIs and 31% of traffic originating from bots, the company has built infrastructure specifically designed for autonomous AI agents that execute complex tasks across the web. Its Workers platform enables developers to run code at the network edge, physically closer to users, dramatically reducing latency for real-time AI interactions. Recent acquisitions of Astro, Human Native, and Replicate demonstrate a comprehensive strategy to own the entire AI lifecycle, from high-performance web development to AI model deployment and ethical data monetization.

The financial trajectory reinforces Cloudflare's competitive moat in an increasingly AI-centric economy. Management projects fiscal 2026 revenue of $2.79 billion, representing 29% growth, while institutional ownership has reached 82%, a vote of confidence in the company's long-term vision. Free cash flow more than doubled in the recent period, providing ammunition for continued strategic acquisitions without excessive leverage. Cloudflare's economic model disrupts traditional cloud providers through unmetered DDoS protection and zero-egress-fee storage via R2, creating a "virtuous flywheel" where increased traffic enhances machine learning models, which in turn attracts more customers. In a market where global IT spending is forecast to exceed $6 trillion in 2026, with cybersecurity spending up 12.5% and GenAI model spending surging 80.8,% Cloudflare addresses both priorities simultaneously through its integrated platform that 85% of tech leaders are using to consolidate redundant tools and eliminate "shadow IT."

Beyond growth metrics, Cloudflare has established critical technological and geopolitical advantages that will define its competitive position for the next decade. The company leads the industry in post-quantum cryptography adoption, with 52% of TLS traffic already quantum-secure using NIST-approved ML-KEM standards protecting against future "harvest now, decrypt later" attacks before competitors have even begun migration. Its Data Localization suite addresses the urgent need for digital sovereignty, allowing organizations to comply with regulations like GDPR while maintaining global scale. With 291 patents and a 98.6% USPTO grant rate, Cloudflare's intellectual property portfolio focuses heavily on AI networking and edge security. The company's "Firewall for AI" provides granular control over AI interactions, blocking prompt injections and preventing data leaks—critical capabilities as 93% of employees input sensitive information into unauthorized AI tools. As the internet fragments into regional silos and quantum computing threatens existing encryption standards, Cloudflare has positioned itself as the essential infrastructure layer for organizations navigating the "Technical Glass Ceiling" that separates modern enterprises from those trapped by legacy systems.

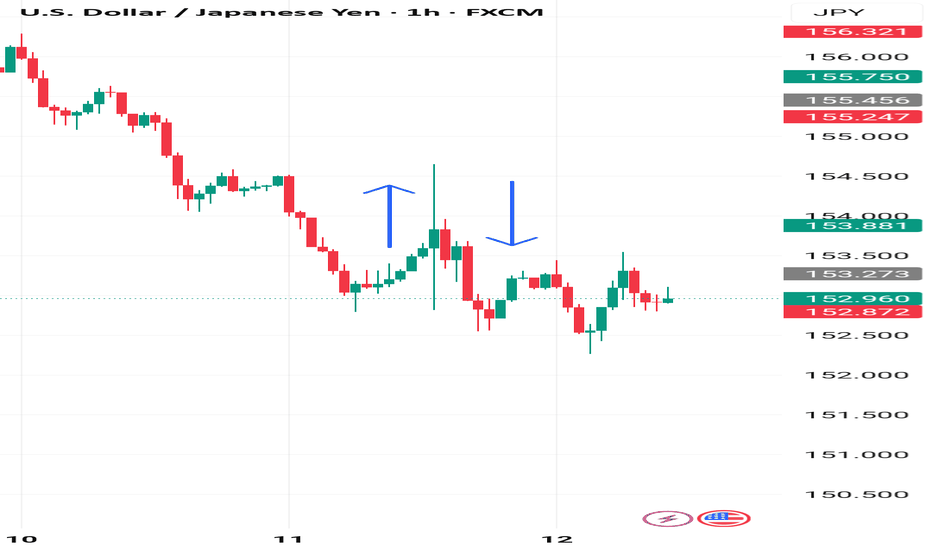

Post NFP thoughts:When I saw the the NFP data, before looking a chart, I thought USD long, possibly Vs JPY, I also thought the across the board positive numbers would be good for the overall risk environment.

Indeed, that was the initial reaction. But it was very short lived, USD selling returned very quicky. Maybe it was the revisions, maybe it was JPY liquidity as USD JPY continues to unwind post election, in what appears to be 'buy the rumour' (last week) 'sell the fact' (this week).

Maybe it's the market signalling an underlying desire to sell the USD, as the saying goes, if an instrument doesn't strengthen on good news, it doesn't bode well.

For now, until USD JPY shows signs of a meaningful push up, I'll continue to view the dollar as the preferred short option. But I'll wait and see the reaction to today's US session and, (or) tomorrow's US CPI data.

Don't be down hearted if you did get caught out with a USD long yesterday. For me, it was a logical thought process. NFP reactions are notoriously choppy at the best of times.

*Side note, Friday's European session GBP data is worth keeping an eye on for a potential short term trade in either direction, if there is an opportunity, I would close the trade before the release of the US CPI data .

GBPCHF SHORTS @ 1.04856 - BELIEVE IN WHAT YOU SEEContinuation of previous bearish bias.

I had initially exited too early and trade went on without me and I didn't want to FOMO back in on the wrong price.

Second point of entry missed TWICE??!!! @ 1.055996, once on Sunday around Asia open and another yesterday after an aggressive pullback.

Pull the trigger no matter what, lesson learned...again.

Entry: 1.04856

SL: 1.51845

TP1: 1.040530

TP2: 1.036189

We go again,

C'est la vie

USOIL BUY ZONE !!Oil prices edged up on Thursday morning as investors worried about escalating tensions between the U.S. and Iran, and fears that any attacks on Tehran or shipping could lead to supply disruptions.

Key Scenarios

✅ Bullish Case 🚀 → Demand Zone 64.40

🎯 Target 1: 65.05

🎯 Target 2: 65.82