Immunome (IMNM) — ADC-Led Precision Oncology UpsideCompany Overview

NASDAQ:IMNM Clinical-stage biotech focused on targeted cancer therapies, especially antibody–drug conjugates (ADCs) and precision oncology.

Lead Asset — Varegacestat (desmoid tumors)

Phase 3 RINGSIDE: 84% reduction in risk of progression; 56% response rate → compelling best-in-class profile.

Regulatory path: NDA planned Q2 2026, setting up the company’s first commercial launch and a major inflection point.

Pipeline Momentum (2026–2027 catalysts)

IM-1021 (ROR1 ADC): early Phase 1 data in 2026.

IM-3050 (FAP radioligand): entering Phase 1.

Multiple preclinical ADCs → INDs, broadening optionality across hard-to-treat tumors.

Why It Matters

Differentiated targets + next-gen payloads → partnerability and durable competitive moat.

Multi-asset pipeline = layered catalyst stack through 2026–2027.

Investment View

Bullish above: $21–$22

Upside target: $40–$42 — driven by NDA/launch setup and ADCs + radioligand pipeline execution.

Biotechstocks

Gilead Sciences — Durable HIV Cash Engine, Expanding OncologyMarket Overview

Gilead NASDAQ:GILD is a leading biopharma with a durable HIV franchise and a scaling oncology portfolio. Biktarvy (U.S. exclusivity to 2036) underpins predictable cash flows to fund growth in oncology and inflammation.

Key Catalysts

HIV Leadership: Biktarvy’s longevity funds pipeline; lenacapavir (long-acting prevention) adds medium-term upside.

Oncology Momentum: Trodelvy growth across breast/bladder; pipeline enhanced by assets like Repare’s Polθ inhibitor.

Visibility: Multiple Phase 3 readouts through 2026 support multi-year revenue/EPS clarity.

Investment Outlook

Bullish above: $105–$108

Target: $150–$155 — supported by HIV cash durability, oncology expansion, and late-stage catalysts.

#GILD #Biopharma #Oncology #HIV #Lenacapavir #Trodelvy

Ride the Wave to $33Biotech's can offer explosive gains

And disastrous collapses.

#WVE is a great example of that.

And a great illustration how powerful head and shoulders tops and bottoms are.

I have to apologise I was looking at this company yesterday as having a nice setup.

but unfortunately neglected to share the idea... (the company is exploding during premarket trade)

But I believe dips should be viewed as opportunities as this stocks clearly wants to go higher.

GeneDx Holdings (WGS) — Scaling AI-Driven Genomic DiagnosticsCompany Overview

GeneDx NASDAQ:WGS is a genomics leader in pediatric & rare disease diagnostics, leveraging whole exome/genome sequencing and AI analytics—a direct play on the $20B+ precision medicine market.

Data & Platform Edge

GeneDx Infinity™: 1M+ exomes/genomes analyzed—one of the largest global repositories, enabling faster, more accurate diagnostic yield and clinical insights.

FDA Breakthrough Designations: ExomeDx™ and GenomeDx™ recognized—supports reimbursement, hospital integration, and market access expansion.

Execution & Financial Momentum

Q3’25 revenue $116.7M (+52% YoY); sequencing volumes +33%.

FY’25 guide raised to $400–$415M; 5th straight quarter of adjusted profitability—evidence of a scalable model and accelerating neonatal/pediatric adoption.

Why It Wins

Proprietary data flywheel (scale → accuracy → adoption).

AI-first pipeline for variant interpretation and turnaround times.

Structural tailwinds from newborn screening, rare disease coverage, and payer alignment.

Investment Outlook

Bullish above: $143–$144

Upside target: $280–$285, driven by volume growth, Breakthrough-enabled access, and operating leverage.

📌 WGS — turning genomic scale into clinical precision and durable growth.

TSHA: substantial upside potentialPrice as been showing constructive four weeks of sideways consolidation following the early October gap-up move.

I continue to see substantial upside potential as long as price respects the 10-week MA on the macro view and the 21-day EMA in the more immediate perspective.

Daily chart:

Weekly chart:

Previously:

On bullish structure (Oct 2):

Chart:

www.tradingview.com

NTLA: reached key resistance zonePrice has followed through strongly from the mid-term support outlined in the September update, moving directly into the target mid-term resistance zone.

As long as the price remains below 30, I expect a near-term pullback below the 21dEMA to complete the first leg of decline.

If, however, the price breaks out above the October highs, it would open the door for further extensions toward the 31–34 resistance zone in the short term.

Chart:

Previously:

On bullish trend structure and support zone (Sep 26):

Chart:

www.tradingview.com

On resistance zone and pullback potential (Oct 8 and Oct 13):

Chart:

See weekly review:

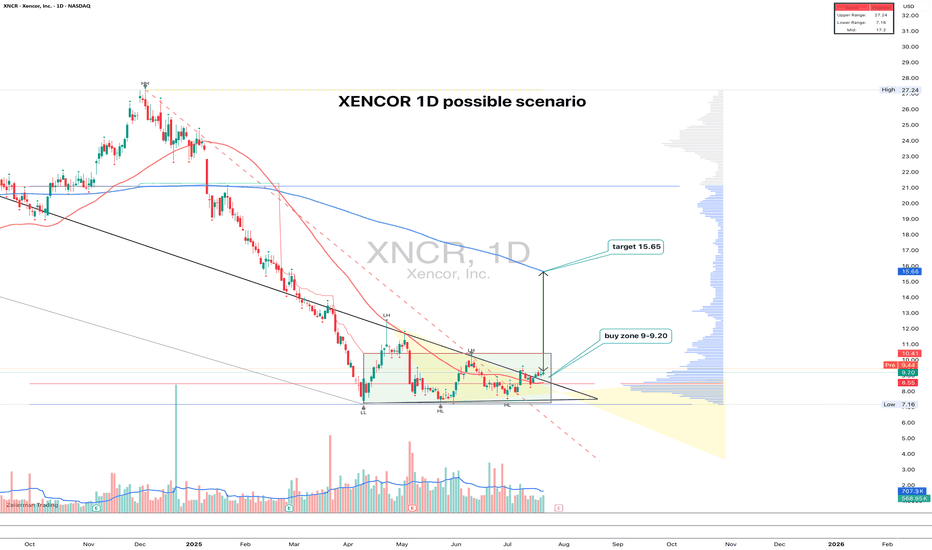

XNCR 1D time to growth?XNCR: the uptrend hasn't started yet - but someone's quietly accumulating

XNCR spent nearly 4 months building a base and finally broke out of consolidation with a clear upward move. The pattern looks like a range with a narrowing triangle at the bottom — the breakout came with rising volume. Entry makes sense in the 9.00–9.20 zone on a retest. Volume profile and Fib levels confirm the importance of this area, plus there’s a clean support shelf at 9.00. The target is 15.65, which aligns with the height of the structure. The 200-day MA is still above price, but a push beyond 11.00 could open the door to acceleration.

Fundamentally, Xencor is a biotech company focused on monoclonal antibodies. After a tough 2023–2024 and cost reductions, the market is beginning to price in signs of recovery. Key partnerships remain intact, the pipeline is alive, and recent data for XmAb7195 was well received at industry events. Valuation remains low, and biotech ETF flows are slowly picking up.

Still a relatively low-volume name, but the structure is clean, the setup is readable, and fundamentals are turning. With a tight stop below 8.50, the risk-reward looks solid.

MNMD – MindMed | Bullish Setup in Psychedelic Biotech SectorMind Medicine Inc. NASDAQ:MNMD is emerging as a key player in the psychedelic-inspired therapeutics space, developing next-gen treatments for mental health and neurological disorders such as anxiety and addiction.

🔬 Clinical Highlights

Lead candidate MM120 (a refined LSD formulation) is in three pivotal Phase 3 trials targeting GAD (Generalized Anxiety Disorder) and MDD (Major Depressive Disorder).

Strong Phase 2b efficacy data backs the current trial progress.

Cash runway through 2027 supports continued development without immediate capital pressure.

⚖️ Regulatory & Social Momentum

Growing bipartisan political support—notably from U.S. lawmakers pushing for veteran access to psychedelic therapy.

Institutional backing and changing public perception could accelerate regulatory approval and market entry.

🧩 Strategic Execution

New leadership: Brandi Roberts (CFO) and Matt Wiley (CCO) add commercial expertise.

Equity grants and talent acquisition efforts signal serious intent to scale operations for potential commercialization.

📈 Technical View

Bullish bias above $9.50–$10.00

Target range: $14.00–$15.00

MNMD is aligning technical setup with strong fundamental and macro tailwinds. This makes it a name to watch closely in the psychedelic biotech space.

QURE – Gene Therapy Play Gaining MomentumuniQure N.V. NASDAQ:QURE is a leading gene therapy biotech targeting rare diseases like Huntington’s and hemophilia.

🔹 Bullish setup forming above $14.50–$15.00

🔹 Price Target: $28.00–$29.00

📈 Catalyst: FDA alignment on its Huntington’s program (AMT-130) clears the path for a BLA submission in Q1 2026, significantly derisking the development.

✅ Early data from AMT-130 is promising, tracking well with clinical and biomarker endpoints — potential first-mover in disease-modifying therapies for Huntington’s.

🧠 Expanding platform: AMT-260 (epilepsy) delivered a 92% seizure reduction in initial patient, showcasing pipeline breadth across CNS disorders.

🧬 QURE offers exposure to the fast-growing gene therapy space with high long-term upside potential if clinical momentum continues.

#QURE #GeneTherapy #BiotechStocks #FDA #BreakoutSetup #LongSetup #RareDiseases #HuntingtonsDisease #Epilepsy #SmallCapStocks #GrowthStocks #Healthcare #BiotechInvesting #TechnicalAnalysis #StockWatchlist #Bullish

OPKO Health | OPK | Long at $1.12OPKO Health finally closed the price gap on the daily chart between $1.11 and $1.12. There are no more price gaps below the current price (bullish). In the past year, insiders (primarily the CEO), have purchased over $4.7 million of shares at an average price of $1.55. Historically, this stock is very cyclical, and I believe we are near the bottom before the next cycle up. I have no idea when this will occur (may trade sideways for a while or dip below $1 in the near-term), but the insider purchases tell me they are preparing for a move. Average analyst price targets are between $2.75 and $3.99 right now, depending on the source. Book value = $1.66. As with any biopharmaceutical and diagnostics company, NASDAQ:OPK is purely speculative at this stage - yet raking in over $600 million in annual revenue.

My personal buy for NASDAQ:OPK was triggered at $1.12 and I hope to see more insider buying at this level.

Targets into 2028:

$1.40 (+22.8%)

$1.66 (+45.6%)

Squeeze for any reason = $5.00 (+338.6%)

ABCL — Bullish Breakout with Upside PotentialAbCellera Biologics Inc. (ABCL) has recently confirmed a breakout above a long-term descending trendline, followed by a successful retest of both the trendline and previous local highs. This technical development increases the probability of a sustained upward move.

The first target stands around $5.70, with a potential medium-term extension toward $13.20, offering attractive risk-to-reward parameters.

The company operates in the biotechnology and healthcare innovation sector — one of the most promising and rapidly advancing industries. While such stocks often face increased volatility due to news-driven events, the potential for high returns makes them compelling for both swing traders and long-term investors.

Kiniksa (KNSA) – Rare Disease Revenue & Pipeline Momentum Company Overview:

Kiniksa NASDAQ:KNSA is establishing itself as a high-growth biopharma player, with a sharp focus on autoimmune and inflammatory diseases. The company’s strategy is paying off through commercial execution and a robust, de-risked pipeline.

Key Catalysts:

🏆 Arcalyst Commercial Success

Core driver in recurrent pericarditis treatment

Delivering double-digit YoY revenue growth

Expanding potential in broader inflammatory indications

🧬 Deep Clinical Pipeline

KPL-404 (anti-CD40): Targets autoimmune diseases like lupus and rheumatoid arthritis

Mavrilimumab: Late-stage potential in rare inflammatory conditions

Orphan Drug & Breakthrough Therapy designations → accelerated approvals + exclusivity

📊 Strong Earnings Momentum

Recent beat on both revenue and EPS

Reinforces credibility in commercial & clinical execution

May attract institutional investors and technical breakout traders

Investment Outlook:

✅ Bullish Above: $23.00–$24.00

🎯 Target Price: $38.00–$40.00

📈 Thesis Drivers: Proven revenue engine (Arcalyst), high-potential pipeline, regulatory tailwinds, and institutional attention

🔬 Kiniksa is not just a clinical-stage story—it's a commercial growth engine with rare disease upside. #KNSA #BiotechStocks #RareDisease

Is Gene Editing's Investment Promise Within Reach?CRISPR Therapeutics stands at the vanguard of the gene editing revolution, transitioning into a commercial-stage biopharmaceutical entity following the landmark approval of CASGEVY. This first-of-its-kind gene editing treatment targets sickle cell disease and beta-thalassemia, validating the transformative potential of CRISPR-Cas9 technology and signaling the dawn of a new medical era. CASGEVY's market entry provides critical proof of concept, paving the way for broader gene editing applications in treating genetic disorders.

Despite this scientific triumph, CASGEVY's commercial launch faces immediate hurdles, primarily its high cost and complex administration, contributing to slow initial sales. While development partner Vertex Pharmaceuticals reports the revenue, CRISPR receives a profit share. The company currently operates at a loss, with operating expenses significantly exceeding revenue, primarily from grants. However, a robust cash reserve provides financial stability as CRISPR pursues an ambitious pipeline targeting widespread diseases like cancer, diabetes, and cardiovascular conditions, alongside its commercial efforts with CASGEVY.

The intellectual property landscape remains dynamic, marked by ongoing patent disputes over the foundational CRISPR-Cas9 technology, which could influence future licensing and competition. Simultaneously, CRISPR Therapeutics contributes to advancements in personalized medicine and delivery systems. A notable achievement includes the rapid development and delivery of a personalized mRNA-based CRISPR therapy for a rare metabolic disorder using lipid nanoparticles, demonstrating a potential model for swift, patient-specific treatments and highlighting the crucial role of advanced delivery technologies in expanding gene editing's therapeutic reach.

For investors, CRISPR Therapeutics presents a high-risk, high-reward opportunity. The stock has experienced volatility, reflecting current unprofitability and market conditions. Yet, strong institutional ownership and optimistic analyst ratings underscore confidence in the long-term potential. The company's deep pipeline and foundational technology position it for significant future growth if clinical programs succeed and commercial adoption of its therapies expands, suggesting that for those with a long-term perspective, the promise of gene editing may indeed be within reach.

Post-Report Sell-Off Seen as UnwarrantedSupporting Arguments

The market's reaction to the Q1 report was excessively negative

The stock possesses fundamental upside potential driven by a high revenue growth rate

The technical analysis indicates a probable rebound

Investment Thesis

GeneDx (WGS) specializes in delivering precise medical diagnostic results, leveraging exome and genomic testing to accurately diagnose genetic disorders. The company exclusively generates its revenue within the United States.

The recent GeneDx report significantly exceeded market expectations, yet the market's reaction was starkly negative. In our assessment, this presents a promising acquisition opportunity for WGS. Revenue for the first quarter of 2025 surpassed consensus estimates by 9.6%, also resulting in a substantial positive EPS surprise. The company has revised its full-year 2025 revenue guidance upwards by a median of $12.5 million, now projecting between $360 million and $375 million. This adjustment accounts for an anticipated $3 million to $5 million in revenue from the prospective acquisition of Fabric Genomics. The net increase in the guidance aligns closely with the value realized from the first-quarter surprise.

The only potentially contentious aspect of the report is the recorded 0.5% q/q decline in testing volumes within the largest revenue-generating segment, exome and genome sequencing. This trend has not been observed in this segment before. However, a seasonal dip in Q1 testing volumes is typical within the laboratory industry. This decline is primarily driven by a reduced number of working days in the first quarter and heightened diagnostic demand in Q4, as patients seek to maximize their insurance benefits before year-end. Historically, the low base effect coupled with GeneDx's robust sequential growth has counterbalanced unfavorable seasonal trends in Q1. Additionally, in the latest quarter, management cited the California wildfires as a possible negative influence on testing volumes. Consequently, we believe this testing dynamic does not warrant the marked downtrend seen in the price of WGS, especially given the upgraded guidance and the expansion of the product portfolio, both of which are poised to drive revenue growth over the next three years.

WGS stock is fundamentally undervalued. The GeneDx peer group has maintained a trading average of a 6.8 EV/Sales multiple over the past three years. We regard this figure as an appropriate target for GeneDx. Presently, the 2026 EV/Sales multiple stands at 5.6. We believe that sustained robust revenue growth over the next three years provides ample opportunity for valuation appreciation from the existing levels. Utilizing comparative valuation metrics, we project a target price for WGS shares at $87 over the next two months, accompanied by a "Buy" recommendation.

To mitigate risks, we advise establishing a stop-loss at $58. From a technical standpoint, a robust short-term support zone is identified within the range extending from $60 to the 200-day moving average.

ADMA Biologics, Inc. (ADMA) – Plasma Power with Policy TailwindsCompany Snapshot:

ADMA Biologics NASDAQ:ADMA is carving out a dominant position in plasma-derived immunotherapies, with a 100% U.S.-based supply chain that delivers both regulatory resilience and logistical strength in a vital healthcare segment.

Key Catalysts:

Strategic Domestic Advantage 🇺🇸

Fully U.S.-based manufacturing and supply chain

Aligns with national healthcare policy and reduces global exposure risk

Elite Healthcare Partnerships 🏥

Works with Mayo Clinic & Cleveland Clinic

Validates product quality and ensures recurring revenue streams

Strong Insider Conviction 📈

CEO Adam Grossman purchased $1.2M in stock

Insiders own 12%, showing long-term commitment

Plasma Therapy Demand on the Rise 🚨

Growing market for immune deficiency and infectious disease treatments

Reliable production scale + strategic partnerships = compounding value

Investment Outlook:

✅ Bullish Above: $19.00–$20.00

🚀 Target Range: $29.00–$30.00

🔑 Thesis: Fully domestic moat + institutional partnerships + insider alignment = high-conviction growth biotech

📢 ADMA: A rare mid-cap with stability, growth, and a policy-aligned advantage.

#BiotechStocks #PlasmaTherapy #Immunology #ADMA #InsiderBuying #HealthcareMoat

Breaking: Vision Marine Technologies (VMAR) Set For 1700% SurgeVision Marine Technologies Inc. (NASDAQ: VMAR) is set poised to capitalied on a patterned from on the 12 hour price chart pattern called the U-shaped cup shape which is a bullish pattern depending on the trend and shape of the cup.

With the Relative Strength Index (RSI) at 29, NASDAQ:VMAR is looking poised to capitalized on this dip that is forming a U-shaped cup pattern looking forward to delivering a 1700% surge.

As of the time of writing, the stock closed Monday's session up by 9.07% showing an increased in the influx of buyers.

About VMAR

Vision Marine Technologies Inc. designs, develops, manufactures, rents, and sells electric boats in Canada, the United States, and internationally. The company offers e-motion electric powertrain technology; e-motion electric outboard powertrain system; electric boats; and maintenance, repair, and customer support services, as well as manufactures customized boats.

Financial Performance

In 2024, VMAR's revenue was 3.79 million, a decrease of -32.86% compared to the previous year's 5.65 million. Losses were -14.06 million, -32.65% less than in 2023.

Analyst Forecast

According to Lucas Ward from Ascendiant Capital, the rating for VMAR stock is "Strong Buy" and the 12-month stock price forecast is $270.0 with a whopping +5,057.10% returns

OKYO Pharma Limited (NASDAQ: OKYO) Set for 70% SurgeNASDAQ:OKYO could be on the cusp of a significant breakout. We believe NASDAQ: NASDAQ:OKYO could be a boomer trade with a potential 70% surge in sight, offering a compelling short-term opportunity while also holding long-term promise as a transformative player in the biotech and ophthalmology space.

Technical Overview

OKYO Pharma Limited (NASDAQ: OKYO) shares are down 7.33% in Monday's market trading. The stock’s Relative Strength Index (RSI) stands at 47, which, despite the recent decline, suggests that bullish momentum is building. The RSI is neither overbought nor oversold, indicating a healthy consolidation phase before a potential upward move.

For OKYO Pharma Limited (NASDAQ: OKYO) shares, the immediate support lies in the $0.926 pivot level not so far from the current price will serve as a springboard towards greater highs with eyes set on 70% gain as confirmed by the chart pattern.

Similarly, a breakout above the $1.55 resistant level could pave the way for the anticipated 70% surge on the horizon without testing the support point aforementioned above.

About OKYO Pharma Limited (NASDAQ: OKYO)

OKYO Pharma Limited (NASDAQ: NASDAQ:OKYO ) is a United Kingdom-based clinical-stage biopharmaceutical company, founded in 2007, that focuses on developing innovative therapeutics for inflammatory eye diseases and ocular pain. The company went public on May 17, 2022, and operates within the healthcare sector, specializing in ocular health advancements. OKYO is led by CEO Gary S. Jacob and a dedicated team, working to address unmet needs in ophthalmology.

Hoth Therapeutics (NASDAQ: HOTH) Could Be the Next 100% RunnerHoth Therapeutics, Inc. (NASDAQ: HOTH) shares are down slightly by 1.83% in Thursday’s trading session, but the technical outlook suggests a major breakout could be on the horizon. A fully formed falling wedge pattern has developed on the chart, and liquidity has been swept to the downside. The stock attempted to break out of this wedge in early March 2025, but the move was faded due to broader market consolidation, influenced by recent uncertainties surrounding Trump’s tax policy. However, the current setup indicates that a breakout remains imminent, with a potential 100% surge in sight.

The 12-hour chart shows that the Relative Strength Index (RSI) currently sits at 50.66, positioning the stock in a neutral zone. This is a strong indicator that NASDAQ: HOTH could gain traction as buyers begin to accumulate, capitalizing on its stability. The stock’s ability to maintain strength at this level suggests that momentum could shift rapidly if bullish pressure increases.

Key Fibonacci retracement levels are also aligning with this bullish setup. The 65% and 61.8% Fibonacci zones are acting as the primary breakout points, which correspond to the $1.40–$1.50 price range. If NASDAQ: HOTH successfully breaks through these levels, a strong upward move could follow, validating the 100% surge potential. This setup is further reinforced by increasing trading volume and early signs of buyer interest, which could trigger the anticipated breakout.

With volume ticking up and key resistance levels within reach, Hoth Therapeutics, Inc. (NASDAQ: HOTH) shares are shaping up for a move that could catch many off guard. Historically, setups like this don’t stay quiet for long—once momentum kicks in, those on the sidelines may find themselves chasing the action.

About Hoth Therapeutics, Inc. (NASDAQ: HOTH)

Founded in 2017, Hoth Therapeutics, Inc. (NASDAQ: HOTH). is a clinical-stage biopharmaceutical company dedicated to developing innovative therapies for unmet medical needs. Headquartered in New York, the company focuses on advancing treatments across multiple therapeutic areas, including dermatology, oncology, neurology, and immunology.

Important Dates

The next estimated earnings date is Thursday, March 27, 2025, after market close.

Analysts Ratings

Hoth Therapeutics (NASDAQ: HOTH) has garnered strong support from analysts, with a 12-month average price target of $4.75, representing a potential upside of 339.81% from the current price of $1.08. Analysts have given HOTH a "Strong Buy" rating, signaling confidence in the stock's growth potential.

With institutional interest rising and Hoth targeting multi-billion-dollar healthcare markets, this stock offers an opportunity for both immediate momentum and long-term growth.

Don’t overlook Hoth Therapeutics (NASDAQ: HOTH)—a major breakout could be on the horizon.

$TGTX Stock Set For Breakout Amidst Symmetrical Triangle PatternTG Therapeutics, Inc. (NASDAQ: NASDAQ:TGTX ) a biopharmaceutical company, that focuses on the acquisition, development, and commercialization of novel treatments for B-cell mediated diseases in the United States and internationally is set for a breakout amidst a bullish symmetrical triangle pattern.

Analyst Forecast

According to 6 analysts, the average rating for TGTX stock is "Strong Buy." The 12-month stock price forecast is $40.67, which is an increase of 35.16% from the latest price.

Important Dates

The next confirmed earnings date is Monday, March 3, 2025, before market open.

On How the bullish symmetrical plays out is largely incumbent on the earnings report slated for today Monday March 3, 2025 before the bell.

$CRSP: A BioTech to add to the watchlist! 95% UpsideNASDAQ:CRSP

Not a High Five Setup...yet

-H5 Indicator is GREEN

-Filling Volume Profile GAP and setting up at a new Volume Profile Shelf

-Need Wr% to push up above -20 and form Williams Consolidation Box

-Need to breakout of Symmetrical Triangle at $56ish

If we get that it will be a H5 Trade and look for targets:

🎯$73 🎯$91 📏$110 ⏳Before mid-2026

NFA

$VKTX is about to FEAST! Don't miss out on this BioTech trade. 🚀 Here it is: Your Free Saturday Setup! 🚀

Just as promised, here is a detailed video analysis on NASDAQ:VKTX Viking Therapeutics! 🧬 This trade meets all the criteria of my "High Five Setup" trading strategy, backed by solid technical analysis. Also, it has the potential to return over 100% on your capital deployed.

With more probabilities on our side, the likelihood of success is through the roof! 📈💥

Check it out, and let’s ride this wave together! 🌊

Stay tuned for more insights! 🔔

NFA

#Trading #StockMarket #Biotech #Investing #HighFiveSetup

Gilead Sciences (GILD): Will Support Hold or Will We See a Drop?We've neglected Gilead Sciences for a while, but it's time for an update. Unfortunately, our entry looking back wasn't ideal, as the stock has fallen below the 61.8% retracement level. It found support just below the 78.6% level, which marks the bottom of our range. This level was precisely touched, and we saw a relatively good movement upward from there.

However, the outlook remains uncertain. We hope that the stock does not fall below this range bottom, as it would prompt us to consider cutting it. Our first take-profit target is at the range high around $86.5, but reaching this level will take time as Gilead Sciences is currently underperforming.

Unlike most other stocks, Gilead Sciences operates in the research sector, not the tech sector. This means it follows a different cycle and is influenced by different capital flows. It tends to perform well when tech stocks do poorly. If tech stocks remain bullish, Gilead Science might continue to struggle. However, if there's a shift, Gilead Science could reverse and potentially reach up to $123, though this is quite far off.

We are holding our position for now, hoping not to cut if the stock falls out of the range. If it does, we will take necessary action.