ABCL: When biotechnology not only curesABCL: When biotechnology not only cures, but also makes your wallet happy!

Hello, fellow investors and those who just like to tickle your nerves on the stock exchange!

Today we have on our agenda (and on the chart) - the stock AbCellera Biologics Inc. (ABCL), which seems to have decided to prove th

AbCellera Biologics Inc.

4.92USDR

−0.19−3.72%

At close at Jul 28, 23:57 GMT

USD

No trades

Next report date

August 7

Report period

Q2 2025

EPS estimate

−0.13 USD

Revenue estimate

6.07 M USD

−0.57 USD

−162.86 M USD

28.83 M USD

223.95 M

About AbCellera Biologics Inc.

Sector

Industry

CEO

Carl Lars G. Hansen

Website

Headquarters

Vancouver

Founded

2012

FIGI

BBG00LLW2MF2

AbCellera Biologics, Inc. engages in the development of therapeutic antibodies. It offers antibody discovery platform that searches, decodes and analyzes natural immune systems to find antibodies that can be developed to prevent and treat disease. The company was founded by Carl Lars G. Hensen, Kathleen Lisaingo, Kevin Heyries, Véronique Lecault and Daniel Da Costa on November 8, 2012 and is headquartered in Vancouver, Canada.

−1,080.00%

−910.00%

−740.00%

−570.00%

−400.00%

Q1 '24

Q2 '24

Q3 '24

Q4 '24

Q1 '25

−60.00 M

−40.00 M

−20.00 M

0.00

20.00 M

Revenue

Net income

Net margin %

Revenue

COGS

Gross profit

Op expenses

Op income

Non-Op income/ expenses

Taxes & Other

Net income

−63.00 M

−42.00 M

−21.00 M

0.00

21.00 M

Revenue

COGS

Gross profit

Expenses & adjustments

Net income

−48.00 M

−32.00 M

−16.00 M

0.00

16.00 M

Q1 '24

Q2 '24

Q3 '24

Q4 '24

Q1 '25

−70.00 M

0.00

70.00 M

140.00 M

210.00 M

Debt

Free cash flow

Cash & equivalents

No news here

Looks like there's nothing to report right now

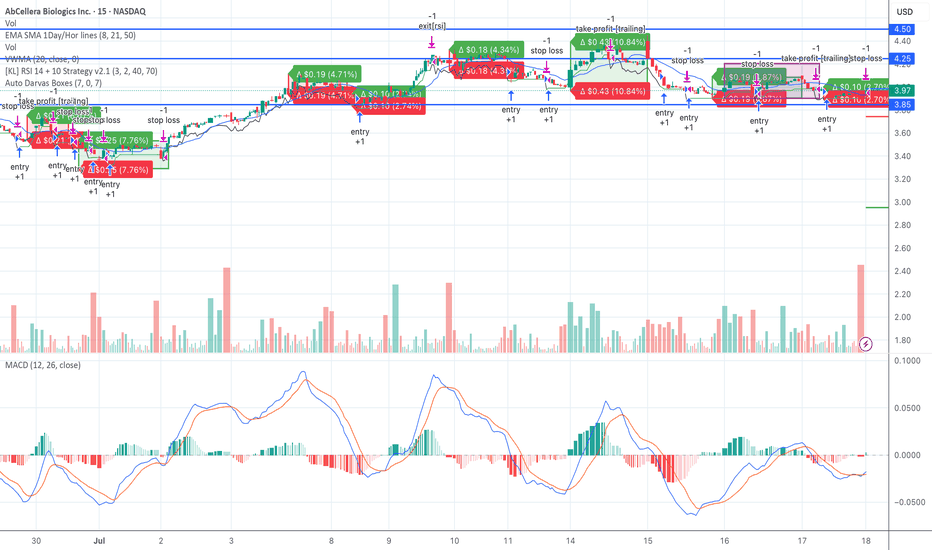

$ABCL – Loaded Base Pattern FormingEntry: $3.90

Stop: $3.50

Target: $4.50–5.00

Status: Active swing, scaling in at Darvas box lows

System: Seed System v2.1 | EMA stack | VWMA confluence | RSI/Volume triggers

NASDAQ:ABCL is riding a tight compression zone just above VWMA with layered Darvas box support. Multiple Seed System entries

NLong

ABCL OTE ESCENARIOSIf the stock brake the weak high US$ 4.00 could be a rally to the next historic resistance US$ 6.03. If not the bullback can go to US$ 2.00. I am confortable at FIBO 61.9 at 2.90 as an OTE. Comments...

NLong

ABCL at Inflection Point — Breakout or Breakdown?ABCL — Watching for Bounce or Breakdown at Support

Symmetrical triangle breakdown on the 15m sent price back to the 0.786 retracement near $3.91. This zone now acts as a key inflection point.

📈 Bullish Scenario:

If buyers step in here, a reclaim above $4.00 could trigger a breakout toward $4.10

NLong

ABCL — Bullish Breakout with Upside PotentialAbCellera Biologics Inc. (ABCL) has recently confirmed a breakout above a long-term descending trendline, followed by a successful retest of both the trendline and previous local highs. This technical development increases the probability of a sustained upward move.

The first target stands around $

NLong

Short ABCLThis company is a train wreck financially. Why there is hype right now is beyond my understanding. How someone can look at this chart and buy is wild. Rule # 1, dont fight the trend. I believe this will rip a little bit longer, than the nothing burger will arrive.

NShort

ABCL- Big Move PendingFrom a technical perspective, the last time we saw a golden cross, was in early 2023, that is nearly 2 years ago.

Nice upside potential pending

NLong

ABCL - +40% upside with 1:3 RRSet-up nicely after a squeeze for a breakout and a mean reversion to the fibonacci retracement areas.

My target is 0.50 which is $4.24

However, based on analyst ratings the stock could do 400% in the next 12 months.

NLong

$ABCL - bull flag in the making?A potential bull flag formation in the making for $ABCL. Volume drying up in the flag part of the channel. Would love to see this breakout above $6.

NLong

$ABCL get ready for liftoff NASDAQ:ABCL could blow through the light volume gap and return back to the high 6s, low 7s. With AI hype coming back, this might a good time to add to or start a position.

NLong

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ABCL is 4.92 USD — it has decreased by −3.72% in the past 24 hours. Watch AbCellera Biologics Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange AbCellera Biologics Inc. stocks are traded under the ticker ABCL.

ABCL stock has risen by 2.98% compared to the previous week, the month change is a 33.38% rise, over the last year AbCellera Biologics Inc. has showed a 53.27% increase.

We've gathered analysts' opinions on AbCellera Biologics Inc. future price: according to them, ABCL price has a max estimate of 17.00 USD and a min estimate of 5.00 USD. Watch ABCL chart and read a more detailed AbCellera Biologics Inc. stock forecast: see what analysts think of AbCellera Biologics Inc. and suggest that you do with its stocks.

ABCL reached its all-time high on Dec 11, 2020 with the price of 71.91 USD, and its all-time low was 1.89 USD and was reached on Apr 7, 2025. View more price dynamics on ABCL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ABCL stock is 6.04% volatile and has beta coefficient of 1.45. Track AbCellera Biologics Inc. stock price on the chart and check out the list of the most volatile stocks — is AbCellera Biologics Inc. there?

Today AbCellera Biologics Inc. has the market capitalization of 1.53 B, it has decreased by −2.74% over the last week.

Yes, you can track AbCellera Biologics Inc. financials in yearly and quarterly reports right on TradingView.

AbCellera Biologics Inc. is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

ABCL earnings for the last quarter are −0.15 USD per share, whereas the estimation was −0.14 USD resulting in a −10.19% surprise. The estimated earnings for the next quarter are −0.13 USD per share. See more details about AbCellera Biologics Inc. earnings.

AbCellera Biologics Inc. revenue for the last quarter amounts to 4.24 M USD, despite the estimated figure of 7.24 M USD. In the next quarter, revenue is expected to reach 6.07 M USD.

ABCL net income for the last quarter is −45.62 M USD, while the quarter before that showed −34.21 M USD of net income which accounts for −33.36% change. Track more AbCellera Biologics Inc. financial stats to get the full picture.

No, ABCL doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 29, 2025, the company has 596 employees. See our rating of the largest employees — is AbCellera Biologics Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AbCellera Biologics Inc. EBITDA is −225.69 M USD, and current EBITDA margin is −755.27%. See more stats in AbCellera Biologics Inc. financial statements.

Like other stocks, ABCL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AbCellera Biologics Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AbCellera Biologics Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AbCellera Biologics Inc. stock shows the buy signal. See more of AbCellera Biologics Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.