BTC Is Not Weak — It’s Just Quiet Before the Next Big WaveIf I look at BTCUSDT right now through the lens of someone who has lived through multiple market cycles, what I see is a market that is calm rather than weak.

Recent news hasn’t delivered a major catalyst, and that is actually a positive sign. There is no new macro pressure, no unexpected bad news, and capital is still staying within Bitcoin. In that context, the market naturally chooses accumulation over panic selling.

On the chart, BTC is far from losing control . Price remains above the Ichimoku cloud, and the medium-term bullish structure is still intact. The 88,000 USD zone is acting as a psychological buffer — a level where sellers are losing momentum and buyers are starting to wait patiently.

The current volatility should be seen as a short-term position clean-up, not a reversal signal . The market is digesting the previous rally, quietly rebuilding energy for the next move.

As long as BTC continues to hold this price base, the probability of a retest toward the 94,000 USD zone remains high. This is the kind of market that does not reward impatience, but favors traders who understand that sustainable uptrends always need a pause in between.

Bitcoin (Cryptocurrency)

Don’t Panic With SOL – The Market Is Offering an OpportunitySOLUSDT currently looks like a deep correction within a broader uptrend, rather than a trend reversal. Recent news has mainly created short-term psychological pressure across the crypto market, while Solana’s fundamentals remain solid: institutional capital has not exited aggressively, staking levels stay high, and the ecosystem continues to show healthy activity.

On the chart, the recent drop came from a strong rejection at the descending trendline and the upper edge of the Ichimoku cloud. The key point, however, is that after the breakdown, price did not continue to collapse. Instead, it quickly formed a clear consolidation zone around 125 USDT — a sign that selling pressure is fading and buyers are starting to absorb supply.

The 125 area now acts as a critical support zone. As long as price holds above this level, I favor a scenario where SOL continues short-term fluctuations to build a base, followed by a recovery toward the 132–136 zone.

Overall, SOLUSDT is still following the textbook structure of a healthy uptrend: a sharp drop, base formation, consolidation, and recovery. For me, this is a phase that requires patience, because the market tends to reward those who wait for proper structure — not those who rush in.

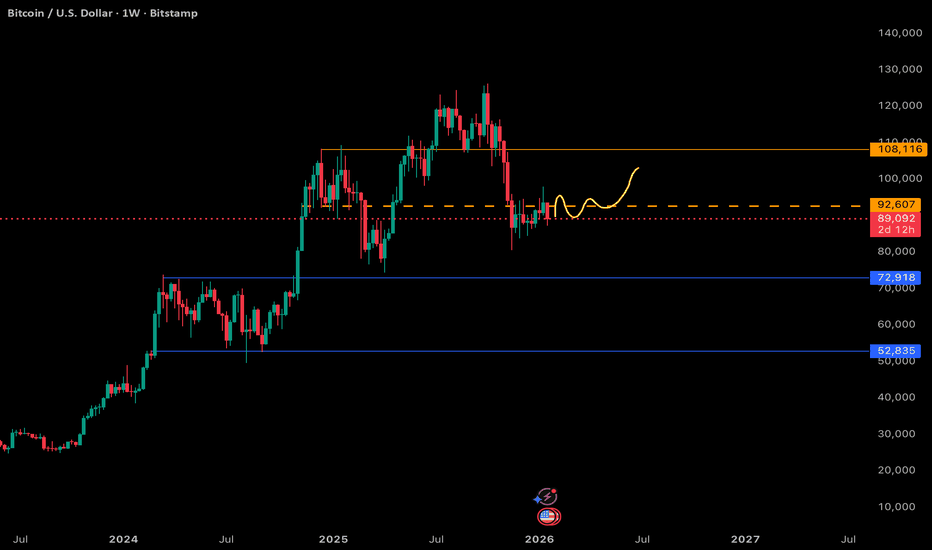

Down to 60kAs I said, Bitcoin pulled back to 93k.

93k support did NOT hold. Green path is invalidated and out of the question at this point.

Slight support around 87k (100 sma), but I would not expect that support to hold either as it was where this bear flag started forming back in November. This is especially clear to us because Bitcoin topped 1st, led equities lower. Equities were stubborn for a bit, but have now given out indicating more selling pressure is coming for Bitcoin. There is no good reason to expect less than -30% downside risk here.

Next major support will be at the 200 sma around 60k.

We will bounce there. No doubt.

The question is whether that bounce will hold and take us to new highs (yellow path), OR whether it flips over and crypto enters the worst crypto winter ever seen before (red path).

Bitcoin Elliott Wave Outlook: $200k Next! Bitcoin (BTCUSD) – Weekly Outlook

Bitcoin is currently correcting the impulsive advance in a wave 4 structure.

The correction is unfolding as a W-X-Y, which is a common form of complex consolidation following a strong wave 3.

* Wave W has already completed

* Wave X acted as the connector

* Price is now in the process of completing the final Y leg of wave 4

At this stage, we are not interested in predicting the exact bottom. Instead, the focus is on allowing wave Y to fully mature and give us structure.

Once wave Y completes:

* We will draw the entry trendline across wave Y

* A clean break of that trendline will be our confirmation that wave 4 has ended

* That break signals the start of wave 5, where momentum should expand again

From an Elliott Wave perspective, wave 5 extensions following a wave-3 expansion of this magnitude make new highs not only possible, but realistic.

Based on the higher-timeframe structure, $200,000 becomes a logical and achievable objective for the next impulsive leg.

Plan

* Allow wave Y to complete

* Draw the trendline across wave Y

* Enter Bitcoin on the break of that trendline

* Targets align with a full wave 5 extension to new highs

This keeps us reactive, not predictive - letting price confirm before committing capital.

Goodluck and as always, trade safe!

Bitcoin Breaks Key Support – Bear Flag Signals Next DropYesterday, Bitcoin( BINANCE:BTCUSDT ) successfully broke through the support zone ($90,590-$89,320) and the 50_SMA(Daily) and support line.

From a classical technical analysis perspective, it seems that Bitcoin has formed a bearish flag pattern, suggesting a continuation of its downward trend.

From an Elliott Wave standpoint, it appears that Bitcoin has completed its wave 4 after a pullback to the support cluster, and we should now anticipate the next downward wave.

I expect that Bitcoin will begin to decline in the coming hours, potentially dropping at least to the Cumulative Long Liquidation Leverage($87,240-$86,190), and if the support zone ($86,420-$83,830) is broken, we can expect even more downward movement.

I’d love to hear your thoughts on Bitcoin. Do you think the downward trend will persist, and how far do you expect it to drop?

Stop Loss(SL): $90,743

CME gap: $93,060-$92,940

Cumulative Short Liquidation Leverage: $92,620-$91,040

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), 1-hour time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

BITCOIN BULLS ARE GETTING READY TO SMACK BEARS!!!!Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

$BTC 1W Update: Don't get shaken out, anon Market update – BTC higher-timeframe context

Yes, there was a sharp dump and, as usual, sentiment flipped to panic quickly. But stepping back to the weekly chart, this move was largely noise within structure, not a trend change.

Price is still chopping in the middle of the broader range. We flushed liquidity below local support, triggered stops, and immediately stabilized back into the prior value area. That’s classic range behavior, not breakdown behavior.

Key points from the chart:

• No weekly range low has been lost

• No high-timeframe support has been decisively broken

• Volatility expanded, but structure remains intact

• This looks more like redistribution and positioning than capitulation

In other words, the market did what ranges do: shake out weak hands in the middle before resolving later.

Until price accepts below the range lows or reclaims range highs, expect continued chop. Getting emotional in the middle is how traders get shaken out of good positioning.

Zoom out, respect the range, and let price confirm before assuming something bigger is happening.

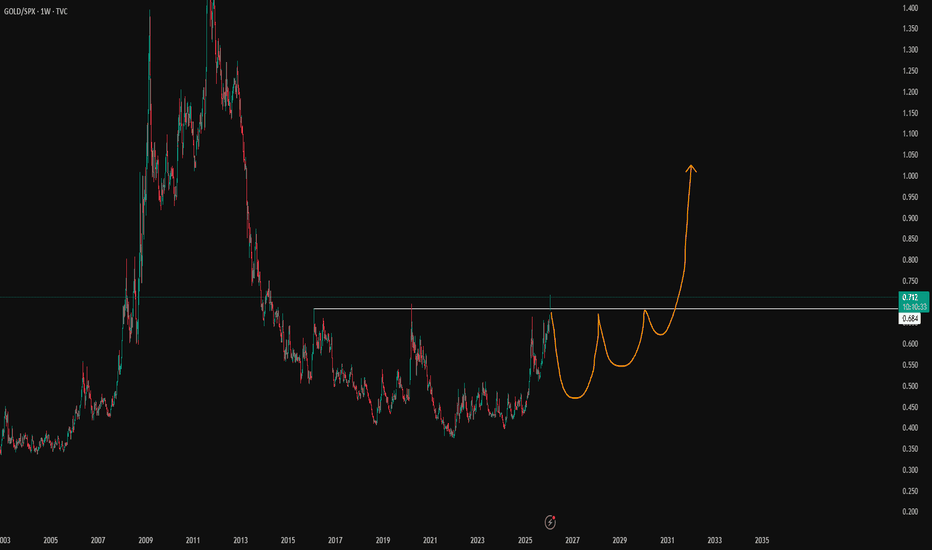

The Gold/SPX Breakout Narrative Is a TrapSaw the GOLD / SP:SPX chart with people calling a breakout.

Not buying it.

Until this W candle actually confirms, there is no breakout.

For me, this is the top in gold or at least very close. We’re talking days, not weeks.

The real trap?

People trying to time the perfect short on $XAU.

That won’t work either.

Gold won’t just roll over and die. It’ll chop, frustrate, and punish anyone trying to front-run the move. Longs get tired. Shorts get squeezed. Everyone loses patience.

And while that’s happening, something bigger is unfolding.

The rotation from GOLD into CRYPTOCAP:BTC and risk assets is already in motion.

It’s one of those transitions that’ll be studied in history books.

No indicators. No opinions. Nothing can stop it.

AVAX Testing Key Support – Long Spot OpportunityAVAX is currently testing a significant support zone around the $12.00 – $12.75 range. This area has held historically, and price is showing signs of stabilization, potentially offering a good risk-to-reward setup for a spot long entry.

🎯 Entry Zone: $12.00 – $12.75

✅ Take Profit Targets:

• TP1: $15.00 – $17.00

• TP2: $18.50 – $21.00

🛑 Stop Loss: Just below $11.40 (to protect against breakdown of support)

This setup favors patient accumulation at support with clear upside targets and controlled downside. As always, watch for confirmation signals like volume spikes or bullish structure before entering.

BTCUSDT Short: Lower Highs, Supply Rejection & Demand in FocusHello traders! Here’s a clear technical breakdown of BTCUSDT (2H) based on the current chart structure. Bitcoin previously traded within a broader bullish recovery phase, supported by a rising trend line that guided price higher from the lows. During this advance, BTC formed a consolidation range, reflecting accumulation before continuation. This range eventually broke to the upside, confirming buyer control and pushing price toward a major Supply Zone around 91,400. At this level, price reacted sharply, forming a clear pivot high and signaling strong seller presence. Following the rejection, BTC entered a corrective phase, trading within a short-term range near the highs before breaking down. After the breakdown, price lost the ascending demand line and confirmed a structural shift to the downside. Subsequent pullbacks failed to reclaim the broken structure, and former support acted as resistance, reinforcing bearish pressure. The move lower accelerated, bringing price back toward the broader Demand Zone near 88,600–88,700, which aligns with the long-term rising trend line and a key historical reaction area.

Currently, BTCUSDT is trading near this demand zone after a strong bearish impulse. This area is critical, as buyers may attempt to slow the decline or form a short-term base. However, until price shows a clear bullish reaction and regains broken structure, the downside risk remains.

My scenario: as long as BTCUSDT stays below the 91,400 supply zone and fails to reclaim the broken demand line, the bearish bias remains valid. I expect price to test and potentially react from the 88,700 demand area (TP1). A clean break and acceptance below this zone would open the door for a deeper correction. Conversely, a strong bullish reaction from demand followed by a reclaim of key resistance would weaken the bearish outlook and suggest a potential recovery. Manage your risk!

USDJPY FLYINGUSDJPY is maintaining a strong bullish continuation after a clean break and hold above the prior supply turned support zone, confirming bullish market structure with higher highs and higher lows on the daily timeframe. The recent consolidation acted as a healthy pause before continuation, absorbing supply and building liquidity for the next upside expansion, which aligns with the impulsive breakout now in play. Fundamentally, the pair remains supported by the persistent policy divergence between the Federal Reserve and the Bank of Japan, where US yields stay elevated and risk sentiment continues to favor the dollar, while the yen remains structurally weak despite periodic intervention concerns. As long as price holds above the key demand zone and trend support, bullish momentum, breakout continuation, liquidity sweep, and trend-following strategies remain favored, targeting higher resistance levels with the trend firmly in control for profit-focused execution.

QuyetP | Bearish signal on Bitcoin - 1DBITSTAMP:BTCUSD Daily chart just broke Weekly minor structure to the downside.

This chart looks very bearish despite that USD is weak.

I was watching the market for last 2 months and it was just consolidation.

Im looking for sell at lower timeframe now.

Target is 75-78k$.

I plan to open some small positions first then add-in more when the market in trending.

Coinranger| BTCUSDT. Flat at 90500 - 87550?🔥News

🔹The WEF continues. Preliminary US manufacturing and services PMI data will issue at 17:45 (UTC+3) - no sharp movements expected.

🔥BTC

🔹Staying within yesterday's levels:

1️⃣ The levels above are the same: 91800 and 92855.

2️⃣ Below, 87550 remains actual.

The situation remains unclear. A pullback is still possible - we're currently seeing a triangle forming in the second wave. Potential flat ranges are 90500 - 87550.

---------------

Share your thoughts in the comments!

Bitcoin (BTC/USD) Update: Multiple Scenarios Still in PlayI am providing an update on my Bitcoin analysis as the cryptocurrency navigates a critical phase in its price development. Bitcoin is currently trading at 89,412 USD, and the technical scenarios I previously outlined remain relevant as the market continues to choose its path forward.

Current Market Position:

Since my last analysis, Bitcoin has experienced notable volatility and is currently in a consolidation phase. The price has pulled back from higher levels and is now testing important support zones. This price action is healthy and typical of Bitcoin's cyclical nature, where periods of rapid appreciation are followed by consolidation or correction phases.

The market is at a decision point where the next major move will likely determine the trajectory for the coming months. The technical levels I identified in my previous analysis continue to serve as key reference points for understanding potential future price action.

Scenario One: Direct Path Higher

The first scenario involves Bitcoin finding support at current levels and resuming its upward trajectory. In this path, the cryptocurrency would work its way through the resistance zones around 98,124 and potentially extend toward 111,119. This scenario assumes that current support levels hold firm and that buying interest emerges at these prices.

This more conservative scenario would represent a measured advance where Bitcoin respects key resistance levels and builds a solid foundation at each stage. The consolidation at current levels would serve as an accumulation phase before the next leg higher. If this scenario unfolds, traders can expect a gradual climb with intermittent pullbacks to retest support before continuing upward.

Scenario Two: Deeper Correction Before Major Rally

The second scenario, illustrated with dashed lines on the chart, presents a more volatile path. This alternative suggests that Bitcoin could experience a deeper correction toward the 53,312 level, marked as point C on the chart. Such a move would represent a significant retracement that tests major support structures and likely shakes out leveraged positions and weak holders.

However, this scenario is not bearish in the long-term context. Following this deeper correction, the projection shows a powerful recovery rally that could ultimately reach much higher levels, potentially toward the 150,000+ area indicated by the upward arrow. This path would create a classic shakeout pattern where the market tests resolve before embarking on the next major bull phase.

Key Technical Levels:

Several critical zones have been identified on the chart that will determine which scenario unfolds. The resistance areas around 98,124 and 111,119 represent supply zones from previous price action where sellers have historically emerged. Breaking above these levels with conviction would confirm strength and support the first scenario.

On the support side, the current price area around 89,000 is important for maintaining the bullish structure of the first scenario. Below that, the order blocks marked on the chart represent institutional interest zones. The most significant support in the second scenario sits at 53,312, which aligns with major historical levels and would represent a substantial discount from current prices.

The "BUY LEVEL for ever!!" notation on the left side of the chart highlights a long-term accumulation zone that has historically provided excellent entry points for patient investors. This area represents a floor where strong hands have consistently stepped in to purchase Bitcoin.

What Could Trigger Each Scenario:

Multiple factors could influence which path Bitcoin takes. Macroeconomic conditions, particularly interest rate policies from major central banks, significantly impact risk asset valuations including Bitcoin. Regulatory developments, either positive or negative, can create volatility and influence medium-term direction.

Market sentiment and leverage levels also play crucial roles. High leverage in the system increases the probability of the second scenario, as cascading liquidations can drive sharp moves. Conversely, strong institutional buying interest and positive news flow could support the first scenario's more gradual appreciation.

Fundamental Considerations:

Bitcoin's long-term value proposition remains intact regardless of short-term price fluctuations. The fixed supply of 21 million coins, increasing institutional adoption, and growing recognition as a store of value and inflation hedge provide fundamental support. The halving cycles continue to reduce new supply entering the market, creating favorable supply-demand dynamics over time.

Additionally, Bitcoin's role in the global financial system continues to evolve. More institutions are incorporating Bitcoin into their treasury strategies, and infrastructure supporting Bitcoin adoption continues to expand. These fundamental developments support higher valuations over extended time horizons.

Risk Management Approach:

Given the uncertainty between these two scenarios, proper risk management becomes paramount. Traders and investors should consider their time horizons and risk tolerance when positioning. For long-term holders, both scenarios ultimately point toward higher prices, making the timing of entry less critical than maintaining exposure.

For more active traders, identifying key invalidation levels for each scenario can help manage risk. A decisive break below major support would favor the second scenario, while sustained strength above resistance zones would confirm the first path.

Market Psychology:

Understanding market psychology helps contextualize these scenarios. Bitcoin markets are known for maximum pain trades where price moves in the direction that causes the most discomfort to the largest number of participants. The deeper correction in scenario two would certainly qualify as such a move, flushing out recent buyers and creating fear before the eventual recovery.

Conversely, a steady grind higher in scenario one would frustrate bears waiting for lower entry points. Both paths are psychologically challenging in different ways, which is typical of cryptocurrency markets.

Conclusion:

This updated analysis reaffirms that Bitcoin remains at a critical juncture with multiple viable paths forward. The technical framework provides clear levels to monitor, while fundamental factors support long-term appreciation regardless of near-term volatility. Patience, discipline, and adherence to a well-defined trading plan will be essential as this phase develops.

Whether Bitcoin takes the more direct path higher or experiences a deeper correction before rallying, the long-term outlook remains constructive for those with appropriate time horizons and risk management. The key is to remain flexible, monitor the identified levels closely, and adjust positioning as the market reveals its chosen path.

This analysis represents my personal technical assessment and interpretation of potential scenarios based on chart patterns and market structure. It does not constitute financial advice. Cryptocurrency investments carry substantial risk, and you should never invest more than you can afford to lose. Always conduct your own research and consider consulting with a financial advisor.

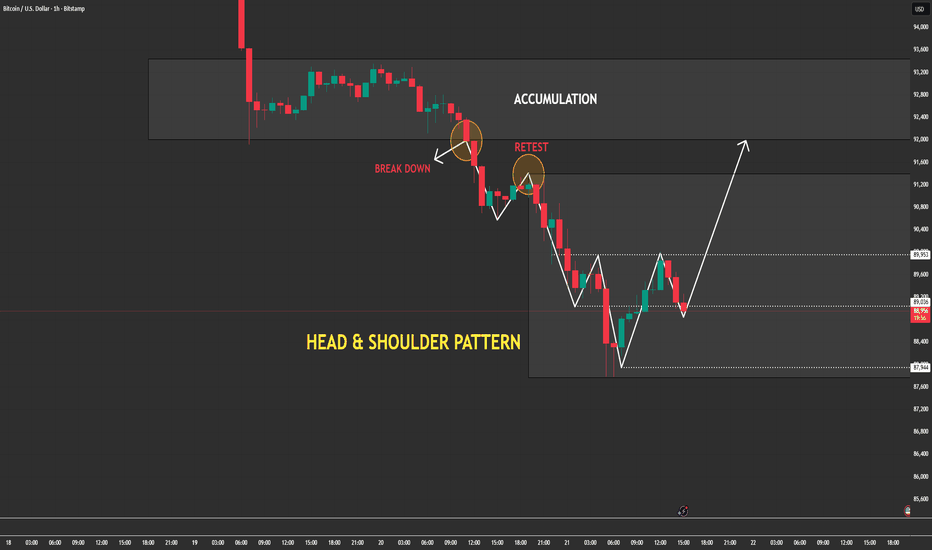

Bitcoin’s Head & Shoulders Has Played Out - Market Is ResettingOn the BTC H1 chart, the market has already completed a clean Head & Shoulders distribution, followed by a decisive breakdown and textbook retest, confirming bearish control in the prior structure. The impulsive sell-off after the retest flushed liquidity aggressively, signaling that weak longs were fully cleared. However, the key shift now is context: price is no longer trending impulsively lower. Instead, BTC has transitioned into a post-distribution accumulation range, marked by compressed, overlapping candles and diminishing downside momentum. This behavior suggests bearish momentum exhaustion, not trend continuation.

The current structure shows price stabilizing after the sell-off, with higher lows forming inside the range — a classic rebalancing phase where smart money absorbs liquidity rather than pushing price immediately. As long as BTC holds above the recent swing low, the probability favors a range expansion to the upside, with the first objective being a move back toward the upper boundary of the accumulation zone. That move would represent a corrective recovery, not a full trend reversal yet.

The Head & Shoulders has already done its job. What follows is not immediate downside continuation, but structural digestion. Bitcoin is rebuilding a base. A confirmed breakout and acceptance above the range would open the door for a controlled bullish leg until then, this remains a range-first, patience-required environment, not a chase market.

Detaching Emotions from Wins & LossesWelcome back everyone to another educational article, it makes me happy to see these posts are benefiting a lot of you! Make sure to share them!

Today we will look into one of the leading but overlooked skills in the trading environment:

“Detaching Emotions, from wins & losses”

Just this skill alone, separates consistent and disciplined traders, from emotional traders.

Emotions in Trading: ( What are they, really? )

In Trading, emotions are the psychological responses, as well as mindset shifts that take place, during different stages of the trading process.

These stages include:

- Winning

- Losing

- Consolidation

- Learning

- Earning

The emotions that are commonly experienced among traders are:

- Fear

- Greed

- Anger

- Frustration

- Impatience

- Revenge Trading

- Overconfidence (Ego)

Emotions are natural right.

The problem though, is not having emotions, but it is allowing them to control the decisions during a probability based environment

The Effects of winning and losing:

What a win in Trading really is:

A win in trading is not just about being able to make that $100.

A win includes:

- Following your trading system

- Respecting your risk management

- Accepting a stoploss without emotions

- Staying out of the market, even when there is no setup showing

- Journaling and assessing previous trades

- Backtesting and refining your system (edge)

These actions can and will lead to long-term profitability.

Money is just one outcome, but discipline is the real win.

What a loss really is:

A loss is more than just losing money.

Losses occur when traders:

- Break their trading rules

- Give into fear or greed (I made a post regarding Fear vs Greed)

- Overtrading

- Revenge trading (usually because they might lose 3x trades in a row)

- Ignore risk management

- Chase the market emotionally

A financial loss can still remain as a psychological win, if the system rules were followed.

A profitable trade can still remain as a psychological loss, if discipline was broken.

Traders Emotional Responses to Wins x Losses

When a trader experiences a win:

When a trader makes money, the brain releases dopamine.

A dopamine hit can:

- Increase confidence

- Increase risk-taking

- Encourage overtrading

- Lead to greed if unmanaged

This is why wins are often more dangerous than losses.

Positive wins vs negative wins

A positive win:

- Making money while following the plan

- Hitting a target and stopping for the day

A negative win:

- Hitting stop loss

- Accepting it

- Closing the platform

- Being done for the day

It may feel frustrating, but discipline is strengthened.

That frustration is growth.

When a Trader faces a loss

There is no such thing as a “ positive loss ” when rules are broken.

Losses caused by emotional decisions reinforce bad habits and increase weak discipline.

These losses:

- Trigger revenge trading

- Create anger

- Damage confidence

- Snowball into larger drawdowns

This is why emotional losses are far more expensive than financial ones.

Recommended steps to detach emotion from wins & losses

Accepting wins

When you hit your target:

- Log off for the day

- Do not chanse more

- Do not increase risk

- Do not let greed take control

If you targeted, $500 and you scored $612, that is a win. Not a reason to continue on.

Greed starts after the win. Not before it.

Accepting losses

When you lose:

- Stop trading

- log the trade

- Review it honestly

- Walk away

Losses are tuition, they are not punishment.

“Log, Learn, Earn Repeat”

This is a process I like to use and follow. It focuses on keeping emotions of the equation.

1) Log the trade honestly.

2) Learn from the execution, not the outcome & results

3) Earn by applying lessons over time.

4) Repeat the process consistently in your system

Wins and losses become data, not emotional events

My Final thoughts:

You do not level up as a trader by winning more trades.

You level up by reacting the same way to wins and losses.

You also level up with experience. You can not “ Pay to win ” to get skills.

Emotions fade when:

- Risk is controlled

- Rules are followed

- Process is trusted

Detach emotions from outcomes, and consistency will follow.

I hope this article is and will be beneficial to you all.

Thank you for reading.

BTC Panic: Why This Flush Out Is a MONSTER Trade OpportunityWe are revisiting our BTC Bitcoin "Monster Trade" strategy following the recent volatility spikes triggered by Donald Trump’s tariff rhetoric at the World Economic Forum. While the market panicked, we saw a significant liquidity flush.

💰 The "Monster Trade" Strategy In this video, I break down exactly how we are capitalizing on any deep retrace and more importantly, this current pullback. We are executing a systematic position-building strategy.

The main thing with this is we MUST lock in 50% profit on existing positions before opening new ones. This allows us to ride the entire trend while banking realized gains along the journey.

Because we have already banked profits, this deep retracement isn't a threat or a risk.

🚀 The Macro View Looking at the Higher Time Frame (HTF), the technicals suggest the corrective trend is exhausting and potentially reversing. This structural shift indicates we are staring at a potentially once-in-a-lifetime opportunity to load the boat before the next parabolic Bitcoin rally.

Watch now to see the exact price levels I'm watching! 👇

BITCOIN / GOLD ratio's mind-blowing revelation.Bitcoin (BTCUSD) remains under heavy pressure since its October 2025 All Time High (ATH) but the BTC/GOLD ratio reveals that the real selling pressure in terms of the precious yellow metal has been boiling up for some time before that date.

In fact the ratio's last High was in August 2025, which technically was a Lower High as the true Top for BTC/GOLD's Cycle was in December 2024. Mind-blowing revelation indeed and that undoubtedly draws similarities with the previous Cycle, which also had a Double Top in 2021.

The key indicator here is the 1M RSI of the ratio. It has a Lower Lows trend-line, which has priced all Cycle bottoms since 2015. More recently (since January 2019) there is a diverging Lower Lows trend-line (dashed) also. The tight zone within those two trend-lines may be holding the key for this Cycle's bottom.

This shows that the bottom may be closer than we may expect but the last Bear Cycle showed a slowing down behavior once it approached the RSI Lower Lows and turned sideways before it finally made contact with it 6 months later. For the real BTC/GOLD price action though, the downtrend didn't slow down as much, first breaking violently below the 1M MA50 (blue trend-line) and finding bottom 6 months later as mentioned just above the 1M MA100 (green trend-line).

If we have a decreasing rate on the MA bottoms, we can expect the current Cycle to bottom below the 1M MA100 this time, closer to the 1M MA150 (red trend-line).

So closer than it looks or not in terms of bottom, the Bear Cycle is entering its 2nd and final Phase.

So what do you think about the BTC/GOLD approach? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Is Bitcoin about to crash? Read in full...Bitcoin is very slow lately and the same price range has been holding for months, no change truly. Normally, even while we recognize all of the signals and keep a bullish bias, it is still normal to wonder if Bitcoin will continue growing.

The active price range is the same since late November. Bitcoin has been moving between $84,000 to $92,000.

Now, think of this. Do you remember after the higher low 18-December how sellers couldn't produce a price below $86,000?

Regardless of all the fluctuations and the sideways range, the lowest possible was $86,400, never below, and this development is still true today.

The lowest Bitcoin has gone was $87,277, yesterday, and you can see how easily this is the final low. Last month it was $86,400, 24-Dec, this month it is ~$87,000.

We have a trading range but still, there is a clear and undeniable bullish bias. The most recent move is a higher high that peaked at a perfect level based on Fibonacci retracement; all the action is composed of higher highs and higher lows.

So, we have a bullish consolidation period, we can even say an uptrend if we consider only the short-term. This will lead to a higher high next.

The last target at $98,000 matches the 0.382 Fib. retracement level (inverted correction) on this chart. The next target is 0.618 which sits around $108,800... And that's all I have to say.

While the doubt is in the air, it is not in the chart. Trust the chart and all will be good.

The truth is that the next move has already being revealed. Bitcoin is going higher, at this point you can open LONG with any amount of leverage below 20X.

Any trading below $90,000 is a very strong buy opportunity right now. Do whatever you have to do to make the most out of this situation. It will soon be gone.

As soon as the relief rally is over Bitcoin will start to crash for months.

I've been mentioning Ethereum decoupling from Bitcoin but I don't really think so. I do believe Ether will produce massive growth before a major correction shows up, but when Bitcoin crashes everything crashes. Don't wait for the hype, greed and euphoria to take action. Now it is the time to go LONG.

Bitcoin is perfect right now, all the altcoins as well. The market is going up, but we have some reckoning to do after this bullish wave.

It is always the same; up and down, up and down, up and down... We can profit from both the bearish and bullish cycles.

Thank you for reading.

Namaste.

Bitcoin’s Next Big Move: Relief Rally or Extended C Toward 50k?Hello everyone.

BTCUSD on the weekly chart, I read the advance from the 2023 lows as a completed 1–5 impulse. After the top, price action clearly transitioned into an A-B-C corrective structure.

Price is currently trading around 89,091, below 0.236 (91,330), suggesting that upside attempts have not yet gained structural acceptance and the market remains in correction mode.

My primary roadmap:

A appears completed with an initial defense.

The rebound that follows can be interpreted as B, typically a relief move rather than trend continuation.

The key risk is that if B remains weak, the structure may shift into an extended C wave, leading to a deeper rebalancing phase.

Key weekly zones:

91,330 (0.236): First threshold. Reclaiming it supports a developing B rebound.

98,008 (0.382): Major test for rebound strength.

103,405 – 108,801 (0.50 – 0.618): A high-probability exhaustion/supply zone for B. As long as price stays below this band, upside is treated as corrective.

Downside risk:

Weekly acceptance below 80,537 confirms the transition into C.

If C extends, the 50,000 area emerges as a meaningful medium-to-long-term balance / target zone on the weekly timeframe.

Bottom line: The dominant weekly structure remains an ABC correction. Upside is possible within B, but a weak B increases the risk of an extended C toward the 50k region.