Bitcointrading

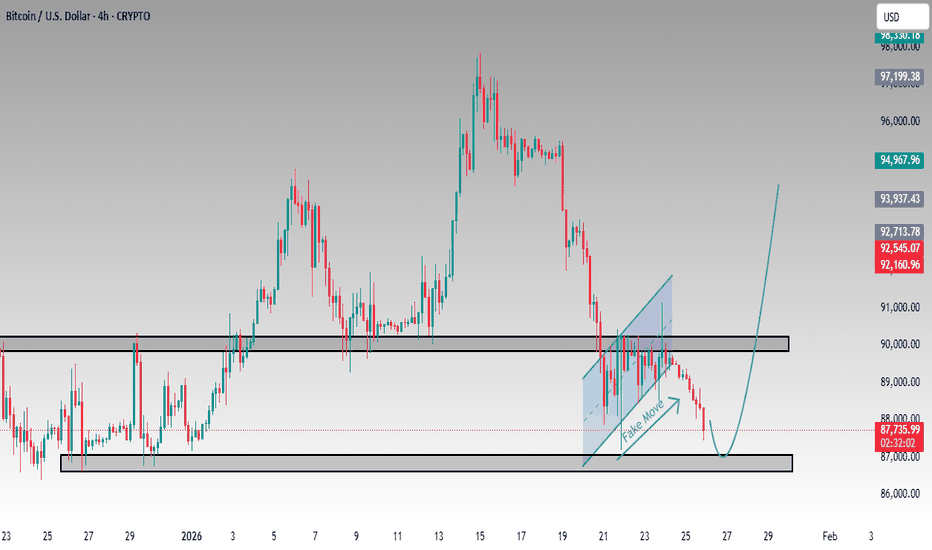

BTC/USD BUY SIGNAL – Support + Fake out Reversal Setup On the 4h Bitcoin chart, price has wicked down sharply into the major support zone around 87,000 – 87,866, forming what appears to be a classic fake move / liquidity grab below the channel bottom (blue shaded area + dashed trendline). This is often a bullish trap before reversal. Key Bullish Points: Strong horizontal support defended multiple times (gray box ~87k–91k)

Clear down-channel fake out / sweep of lows

Rejection candle + bounce already forming from the lows

Higher timeframe structure still bullish overall

Entry: Buy around current levels ~87,866 or on dips back to 87,000–87,500

Stop Loss: Below the wick low ~86,800–87,000 (tight risk)

Targets: TP1: 90,000 – 91,000 (channel top retest)

TP2: 92,500 – 93,000

TP3: 95,000+ (previous highs)

High-probability reversal setup if price closes back above the channel bottom. Watch volume and 4h candle close for confirmation. This is not financial advice. Crypto is highly volatile. Use proper risk management and trade at your own risk.

#Bitcoin #BTCUSD #BTC #BuyBitcoin #BitcoinDip #CryptoTrading #Fakeout #LiquidityGrab #BullishReversal #TradingSignal #Crypto #TechnicalAnalysis #Investor #TradeSmart #BitcoinBull

Bitcoin Price AnalysisBitcoin is declining within a descending channel that I charted just over a day ago. The price action is following the projected path as anticipated.

Key Levels to Watch:

Primary Target Zone: $80,700 - $79,000

This is where I’m expecting the next potential bounce. Specifically, I’m watching for a sweep of the lows around $79,500 as a likely scenario.

Alternative Scenarios:

If we fail to find support in the $80,700-$79,000 range, the technical picture deteriorates significantly, with $55,000 becoming a realistic downside target.

There’s also the possibility of a shorter-term bounce occurring at the current local lows around $84,600-$84,800, though this seems less probable given the lack of buying pressure we’re seeing at these levels.

Timeline:

We have considerable time for this price action to develop and resolve, so there’s no immediate rush to判断 the final direction.

Base Case:

My primary expectation remains a move down to sweep the $80,000 level, with $79,500 as the most likely area where we see a meaningful reaction.

Bullish Divergence appearing on shorter tf.BTC Analysis

CMP 87846.93 (24-12-2025)

Bullish Divergence appearing on shorter tf.

The price may bounce towards 91000 - 91500.

However, monthly closing above 87000 may bring

some more positivity.

Immediate Resistance is around 91000 - 91500 &

then aorund 97700.

However, if 80000 is broken this time, we may

witness more selling pressure.

BTC Is Not Weak — It’s Just Quiet Before the Next Big WaveIf I look at BTCUSDT right now through the lens of someone who has lived through multiple market cycles, what I see is a market that is calm rather than weak.

Recent news hasn’t delivered a major catalyst, and that is actually a positive sign. There is no new macro pressure, no unexpected bad news, and capital is still staying within Bitcoin. In that context, the market naturally chooses accumulation over panic selling.

On the chart, BTC is far from losing control . Price remains above the Ichimoku cloud, and the medium-term bullish structure is still intact. The 88,000 USD zone is acting as a psychological buffer — a level where sellers are losing momentum and buyers are starting to wait patiently.

The current volatility should be seen as a short-term position clean-up, not a reversal signal . The market is digesting the previous rally, quietly rebuilding energy for the next move.

As long as BTC continues to hold this price base, the probability of a retest toward the 94,000 USD zone remains high. This is the kind of market that does not reward impatience, but favors traders who understand that sustainable uptrends always need a pause in between.

bitcoin daily bullish outlook Like i said earlier, i have a bullish bias on bitcoin. All you have to do is zoom out.

My next buy zone is around 86k. I am going to long bitcoin from 85-86k all the way back to 103-104k, where the next daily liquidity and supply zone is located

Wait for price to form sort of a reverse head and shoulder pattern and buy from the break out.

Why Does Bitcoin Often Top When Everyone Is Bullish?In the Bitcoin market, there is a familiar paradox:

The more people believe price will keep going up, the closer the market often is to a top.

This isn’t superstition or coincidence.

It’s the result of capital flow, crowd psychology, and how markets truly work.

1. When Everyone Is Bullish, New Buyers Are Running Out

Price can only continue to rise if there are new buyers willing to pay higher prices.

But when:

- Positive news is everywhere

- Social media is full of higher price targets

- “Buy the dip” becomes automatic

→ Most of the available capital is already in the market.

At this stage:

- Those who wanted to buy → already bought

- Those who haven’t → either lack capital or are unwilling to chase price

Demand weakens, while supply quietly starts to appear.

2. Smart Money Doesn’t Buy When Optimism Is Extreme

Large institutions don’t accumulate Bitcoin when:

- News is overwhelmingly positive

- Retail traders are FOMOing

- Price is far from its accumulation zone

Instead, they tend to:

- Buy during doubt

- Dustribute during certainty

When the crowd turns aggressively bullish, it often signals:

Smart money is reducing exposure, not adding to it.

3. Extreme Bullishness Creates Psychological Imbalance

Near market tops, you often see:

- No bearish scenarios considered

- Anyone questioning the trend labeled as “FUD”

- Stop losses ignored in the name of “conviction”

This is a psychological imbalance:

- Expectations are stretched

- Risk is underestimated

At this point, the market doesn’t need bad news.

A lack of new buyers is enough to trigger a correction.

4. Tops Form Quietly, Not in Panic

Many believe a top must come with a violent crash.

In reality:

- Tops often form through choppy price action and slowing momentum

- Volume fades

- Breakouts repeatedly fail

This is when:

Confidence remains high, but underlying strength is already weakening.

5. The Key Lesson for Traders

- Tops don’t form when the market is fearful

- They form when risk is ignored and confidence becomes one-sided

Understanding this helps you:

- Avoid FOMO when everyone is bullish

- Stay cautious when “everyone is right”

- Realize that market psychology matters as much as technical analysis

Final Thoughts

Bitcoin doesn’t top because too many people are bullish.

It tops because when everyone is bullish, the market runs out of fuel.

In trading:

The crowd is usually right in the middle of a trend — and wrong at turning points.

Keeping a calm, rational mindset while others are euphoric

is the true edge of a mature trader.

BTC Stuck in Range | Liquidity Grabs Ongoing — Patience RequiredBTC is trading below the major resistance zones marked on the chart.

As long as price fails to reclaim and hold above these upper levels, I will not turn bullish.

The structure suggests BTC is stuck in a broad range, where price is repeatedly grabbing liquidity.

During this phase, alts will also continue to grab liquidity on both sides, creating fake breakouts and stop hunts.

This is not the phase to be aggressive — this is the phase to survive.

If we manage risk properly and protect the portfolio here, the next phase will offer much cleaner and higher-probability opportunities.

Why Does BTC Often Move Strongly During the U.S. Session?Not by coincidence — but because real money enters the market

If you’ve traded BTC long enough, you’ve probably noticed a familiar pattern:

Asian session: slow price action, compression, sideways

European session: increased volatility, trap-building

U.S. session: BTC makes the real move

So the question is:

👉 Why does BTC usually show its strongest volatility during the U.S. session?

1. The Largest Capital Flows Enter During the U.S. Session

The U.S. session is when:

U.S. banks

Hedge funds

Prop desks

Institutional traders

U.S.-based crypto whales

👉 Start trading aggressively

This is not retail money.

This is institutional capital, trading large size — not scalping a few dozen dollars.

When big money enters → the market must move.

2. The U.S. Session Is When News Gets “Activated”

Most major news that impacts BTC happens during the U.S. session:

CPI, PPI, FOMC

Fed interest rate decisions

DXY and U.S. Treasury yields

U.S. stock market open

👉 All occur during the U.S. session.

BTC doesn’t exist in isolation.

It reacts strongly to:

Risk-on / Risk-off sentiment

USD strength or weakness

Capital flowing into or out of risk assets

3. Highest Liquidity → Structure Breaks More Easily

The U.S. session has:

The highest daily volume

The deepest liquidity

More stable spreads

➡️ This makes it the ideal time to break ranges,

take out highs and lows from the Asian and European sessions.

💡 Many:

True breakouts

Large stop hunts

Strong expansions

👉 Happen at the start or middle of the U.S. session.

4. Europe–U.S. Overlap: BTC’s “Golden Hour”

During the Europe–U.S. overlap:

European traders are still active

U.S. traders are just entering

📌 Liquidity + liquidity = explosive volatility

If BTC has:

Been compressed all day

Accumulated for a long time

Gathered enough liquidity

👉 The U.S. session is often when that energy is released.

5. Retail Traders Get Trapped the Most During the U.S. Session

One hard truth:

Retail traders often FOMO on large candles

Enter when volatility is at its peak

Place stop losses where everyone can see

👉 And that’s also when:

Whales sweep stops

The market shakes violently before moving in the real direction

💡 The U.S. session is not just when BTC moves,

but also when those without a plan get eliminated the fastest.

SOLUSDT: When Capital Pulls Out, Price Never LiesLooking at SOLUSDT through the lens of a trader who has lived through multiple market cycles, it’s clear that the market has decisively shifted its stance.

After the previous rally, SOL lost its bullish momentum as a sharp sell-off broke through the entire underlying support structure. This is no longer a normal pullback, but a clear signal that large capital has exited, making room for active selling pressure. The broader risk-off sentiment across the crypto market merely acted as a catalyst—the core issue is that buyers no longer have the strength to defend higher price levels.

On the H4 chart, price behavior is very telling. SOL broke the ascending trendline, rallied for a retest, and was aggressively rejected around the 133–134 zone, a textbook setup for a developing downtrend. The highlighted areas on the chart make it obvious: each bounce is simply an opportunity for sellers to distribute more, with no signs of absorption or accumulation. Lower highs followed by increasingly pressured lows—the market’s message is loud and clear.

The key level to watch now lies around 122–123. This is not a random target, but a zone where SOL previously built strong accumulation. Given the current downside momentum, a liquidity sweep into this area is increasingly likely, unless a powerful, broad-based reversal across the crypto market emerges—something that has yet to materialize.

Bitcoin Faces Risk-Off: Short-Term Pullback Ahead?In the current environment, BTCUSDT is under short-term corrective pressure as overall market sentiment shifts toward a risk-off stance. Ongoing economic and geopolitical concerns have prompted capital to temporarily move away from risk assets, and Bitcoin is no exception. This explains the price weakness seen over the past 24 hours.

On the other hand, capital inflows into spot Bitcoin ETFs remain positive, providing an important layer of support for the market. This factor has helped prevent aggressive selling, suggesting that the current move is more of a technical pullback than a broad-based sell-off following the previous rally.

In the short term, the higher-probability scenario is for BTCUSDT to move sideways to slightly lower, unless market sentiment clearly shifts back to risk-on. If price manages to hold key support levels, a technical rebound remains possible; however, a clean break below support could open the door to deeper short-term downside.

BTCUSDT – Daily Market Structure UpdatePrice is currently trading within a well-defined daily support zone following the recent bearish impulse. The sharp reaction into this area suggests sell-side momentum is weakening, and the market is now entering a period of balance rather than continuation to the downside.

I expect Bitcoin to consolidate within this daily range over the coming days as price digests the prior move and liquidity accumulates. This sideways behavior is constructive and often forms the base for the next expansion phase.

Provided this zone continues to hold, the higher-timeframe structure remains intact. A clean breakout and daily close above the consolidation high would signal renewed bullish intent and increase the probability of a push toward higher resistance levels. Until then, patience is warranted as the market develops its next clear setup.

BITCOIN: Huge Bear-Flag-Formation, Confirmation Incoming!Hello There,

welcome to my new analysis about Bitcoin from a more local timeframe perspective. Recently the price of Bitcoin has been forming a crucial formational structure that will be highly determining for the future outcome. Therefore, I spotted all the important levels and indications to consider in this pivotal determination. Also, this whole setup is corresponding to the bearish Wyckoff distribution I have spotted previously.

As it is seen in the chart, Bitcoin is trading within this massive descending channel formation. In this channel there is a strong resistance formed by the upper boundary of the channel. The fact that Bitcoin already bounced several times to the downside from there makes it a resistance zone, which should not be underestimated in any case. As Bitcoin is approaching this zone again, a pullback from there is highly likely.

There are also further indicators and formations that make the range between $100,000 and $105,000 a major resistance zone. The fact that there is also horizontal resistance from where Bitcoin bounced several times to the downside already in the past makes this an additional resistance. Also, the 100-EMA crossed already below the 50-EMA. This bearish crossover is, in most cases, a sure sign that the trend moves forward to the downside.

Considering all of these crucial levels and indications, we can watch now that Bitcoin is building this pivotal resistance cluster from where a pullback to the downside is highly likely. Several resistance factors come together within this resistance cluster: the upper resistance boundary of the descending channel, the horizontal resistance, and the EMA resistance. All of these levels confirm the bearishness of the cluster.

For the whole bear flag formation, this now means that the formation will be confirmed once the breakout below the lower boundary of the formation happens. As it is marked within my chart, this will provide the final bearish bear flag setup from where Bitcoin is going to continue to the downside. The main target zones of this formation are marked in my chart. Once they are reached, further considerations need to be made.

With this being said, it is great to consider the important trades upcoming.

We will watch out for the main market evolutions.

Thank you very much for watching!

Bullish Bitcoin Market Observation Entry Zone (for study): Around 94,000 – 94,967.96 (current demand zone with strong higher low formation and multiple retests showing buyer control).

Hypothetical Target Levels (for analysis): 97,199.38 (next major supply/resistance zone + measured extension from the recent impulse leg).

Risk Zone / Invalid Level (example): Below 93,500 (critical invalidation if price breaks and closes beneath the demand block base). The 15-minute chart displays a clear bullish continuation structure with price respecting the demand area around 93,500–94,967 after a sharp upward impulse. Momentum remains upward-biased, supported by higher lows and repeated buyer absorption at the gray zone, indicating strong defense against selling pressure. A sustained hold above 94,000 could set the stage for continuation toward the unfinished business near 97,200. This is an educational observation, not a trading call.

BTCUSD – The Uptrend Is Being ReinforcedAs the market waits for key macroeconomic data, BTCUSD is telling a clear and constructive technical story: price is building a solid base for a sustainable uptrend, rather than reacting in a chaotic way to short-term news.

Looking at the chart, Bitcoin continues to maintain a structure of higher lows, closely respecting a long-term ascending trendline. Each corrective move has stalled precisely within demand zones, confirming that active buying interest remains present. Most importantly, price is now holding firmly above the Ichimoku Kumo — a strong signal that the bullish trend is being accepted by the market, not merely forming a temporary technical rebound.

The 89,400 USD zone is acting as a key support level. Repeated positive reactions from this area clearly highlight it as a defensive zone for buyers. In a constructive scenario, as long as BTCUSD continues to hold above this support and absorb short-term volatility, the next upside objective points toward 94,900 – 95,000 USD, aligning with the upper supply zone and previous reaction highs.

When combined with the news backdrop, as long as CPI data does not come in excessively “hot” , Bitcoin has a solid foundation to extend its current bullish momentum. Technical structure remains supportive, while overall market sentiment is gradually stabilizing — a combination that favors continuation rather than reversal.

Bitcoin 4 hour shows us potential Squeeze incoming-

The desxcending line is the 17.618 Fib circle....the 17th of this Cycle and is nased o January 2023.

The Horizontal line is the 4.618 Fib extension, again, based in January 2023

The Apxe of this "Triangle" is Mid week next weel and as I always remind you, PA ALWAYS REACTS BEFORE THE APEX>

This is a Zoomed out 4 hour

This shows how PA has been around this Horizontal Fib line for a while now....

We need to remain above it.....

If we loose it, the Mid 80K area is a likely Target....

Crucial days again

Bitcoin “Cools Off” as Macro Risks Loom Over the MarketBTCUSDT is now facing a clearer short-term correction risk, as both news flow and technical factors fail to support the bulls.

From a market sentiment perspective, Bitcoin remains under pressure during the Asian session as risk appetite continues to shrink. Rising geopolitical tensions across Asia and Latin America are pushing investors toward a more defensive stance, reducing exposure to high-volatility assets such as crypto. At the same time, markets are waiting for the U.S. Non-Farm Payrolls (NFP) data, reinforcing a “wait-and-see” mindset and leaving buying interest cautious and indecisive.

On the technical side, BTCUSDT has failed to sustain its early-year rebound and is starting to weaken as it approaches the upper resistance zone around 94,300. Recent rebounds appear to be mainly technical, rather than driven by a genuine return of strong capital inflows. Repeated rejections at higher levels signal that profit-taking pressure remains dominant. Meanwhile, 89,400 stands as the nearest support, and a break below this level could open the door to a deeper pullback toward 87,300, a previous consolidation area.

Overall, BTCUSDT is in a sensitive phase : the short-term bearish bias remains favored as macro risks have yet to ease and bullish momentum is still insufficient to trigger a reversal. The current pullback can be seen as a “necessary cleansing phase”, allowing the market to reset before Bitcoin can potentially establish a clearer trend in the next stage.

#Bitcoin Sunday Update: $BTC is holding the 1W 99 EMA#Bitcoin Sunday Update:

CRYPTOCAP:BTC is holding the 1W 99 EMA very strongly. That is why I repeatedly warned that a short term pump toward the 1W 50 EMA was likely. This strength is signaling a potential continuation to the upside, which is exactly what I have been waiting for over the past two months.

After Bitcoin hit my sub 90k target, I clearly stated that a move toward the 1W 50 EMA in the 98k to 100k region, or even slightly above, was still possible before any major downside continuation.

At this stage, the market appears to be attempting that move. For this reason, I am placing multiple short orders at 98k and 100k.

I am keeping my existing shorts from the 118k region fully open, while current short orders are only preparation if price moves higher. My overall bias remains bearish, with downside targets below 72k in the coming months.

This view is supported by Federal Reserve liquidity actions, including a $106 billion overnight repo injection on New Year’s Day, raising serious questions about underlying stress. At the same time, insider selling remains aggressive, increasing the risk of a 2008 style market event.

These are extreme conditions. While many ignore these signals, the market remains highly vulnerable. I stay bullish only on gold and silver and strongly bearish on stocks and Bitcoin. If BTC reaches the 98k to 100k zone, I will add significantly to short positions.

#btc #btcusd

Bitcoin BTC price analysis#Bitcoin remains in a compression phase between key structural levels.

A failed attempt to break the descending trendline resulted in a bearish 12H pin bar, increasing the probability of a short-term move toward $84,500.

Key OKX:BTCUSDT levels:

• Resistance: $91,000 → $94,000–95,000

• Support: $84,000–84,500

• Major downside target if support fails: $75,000–77,000

On the monthly timeframe, a sweep into the $75–77K zone in early January aligns with historical market behavior observed in early 2025-type structures.

Bullish continuation requires a clean break and acceptance above $91K, followed by short liquidation fuel above $94K.

Question for traders:

Will CRYPTOCAP:BTC resolve this range to the downside first, or can buyers reclaim control before year-end?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud

Bitcoin (BTC/USDT) – Monthly OutlookThe new 12-month candle has just opened with Bitcoin holding firmly above prior macro structure. Price is consolidating just below the previous All-Time High, showing acceptance at premium levels rather than rejection.

Monthly market structure remains bullish, with higher highs and strong candle bodies signaling continued demand. The lack of deep pullbacks suggests sellers are being absorbed, increasing the probability of a clean ATH breakout and continuation into price discovery.

As long as price holds above the yearly opening range, the bias remains bullish.

Bias: Bullish

Expectation: ATH break

Invalidation: Monthly close back below prior structure

Here is How BITCOINs Historical Cycle Could Pursue.Hello There,

recently I spotted an important constellation within the cycle of Bitcoin, which caught my attention and is extremely crucial for the forthcoming of future price actions. While Bitcoin, in the short term, is still extremely bearish with many bears and whales dumping into the market, the middle-to-long-term perspective should be considered from a different angle. In this case Bitcoin could be about to pursue an extremely important cycle, which was already the origin of a massive peak expansion, boosting Bitcoin into massively high spheres.

Currently, Bitcoin could just be in the middle of this massively underlying cycle trend, which could repeat itself in a different shape to turn out with a fundamental reversal and increase of volatile price outbreaks. Such dynamics are always interesting to watch for traders when considering placing a trade in a breakout pattern and simultaneous setup for a high profit. This whole cycle mainly consists of 5 elements, of which 2 have already been completed in the current constellation.

You can watch all the important levels of cycle progress in my chart. What is highly important and a necessary factor for the current cycle to hold and continue as well is that when bearish volume increases in the short term within the next times, Bitcoin has the ability to continue seeking support within the range. If this does not happen and Bitcoin does not show the ability to hold the $45,000 to $50,000 range, then the potential for a downtrend continuation increases.

If this scenario happens, there are two possibilities. Either Bitcoin expands the current uptrend channel to lower levels in which it seeks support within the lower accumulation channel line marked in green, or a black swan event such as corona or a massive financial market crash like the one seen in 2008 could dismiss this whole cycle. Such possibilities would only increase if the bearish price action really accelerates to a point where there are no potentials for reversal.

Generally speaking, it will be highly important how Bitcoin reacts to the lower accumulation channel line of this gigantic uptrend channel. If there will be a stabilization and substantial bounce, the possibility of the repetition of the cycle almost increases above any bearish scenario. Also, the 9- and 21-MA are crucial signals here. If this cross down happens again, there is a likelihood that Bitcoin will continue with a cross up also. In any case, the upcoming short-term bearish trend dynamics are highly deterministic for any further price actions and cycle considerations.

Thank you very much for watching.