Bank of Montreal Earnings Beat & U.S. Turnaround Gains TractionBank of Montreal (NYSE: NYSE:BMO ) reported a strong fourth quarter, supported by improving credit performance in its U.S. division and disciplined execution on its long-term growth strategy. Profit rose to $2.3 billion, helped by a sharp decline in provisions for bad loans as the bank continues to repair last year’s weakened U.S. loan book. Provisions for impaired loans in the U.S. business fell to $209M, down from $446M a year earlier, showing meaningful progress in stabilizing asset quality.

Chief risk officer Piyush Agrawal noted that watchlist formations continue to decline, positioning the bank for lower impaired balances over time. Alongside the credit improvement, BMO has hired more than 100 commercial bankers and private advisers in the United States to expand its loan pipeline. The bank also sold 138 underperforming U.S. branches while planning to open 150 new locations in higher-growth regions over the next five years.

These moves follow BMO’s US$16.3B Bank of the West acquisition, which significantly increased its U.S. footprint. The turnaround is starting to show: U.S. operations earned $807M, up from $281M last year. Capital markets also surged, contributing $521M, more than double last year’s $251M.

Adjusted EPS rose to $3.28, ahead of estimates, and revenue reached $9.34B, up from $8.96B. The bank raised its quarterly dividend to $1.67 per share, reflecting confidence in its medium-term goal of lifting ROE to 15%.

TECHNICALS

The weekly chart shows NYSE:BMO trading just above a key breakout zone around $123–$125, which previously acted as multi-year resistance. Holding above this level keeps momentum bullish and opens a path toward $131–$135 highs. Support sits at $110, with deeper structure support near $85 if macro conditions weaken. MA trend remains positive.

BMO

Bank of Montreal (TSE:BMO) Pre-Earnings: Here’s What to ExpectBank of Montreal ( NYSE:BMO ) shares gained in trading as investors await the Canadian bank's Q2 earnings results on May 29. Analysts are expecting earnings per share to come in at C$2.77 on revenue of C$8.054 billion, a decline from the C$2.93 per share seen in the year-ago period. The bank has not had a good track record lately when it comes to beating estimates, with only beating EPS forecasts two times during the past eight quarters.

Bank of Montreal ( NYSE:BMO ) has a Strong Buy consensus rating on NYSE:BMO stock based on eight Buys, one Hold, and zero Sells assigned in the past three months. The average NYSE:BMO price target of C$135.61 per share implies 3.66% upside potential. Other equities research analysts have issued research reports about the company, with Jefferies Financial Group starting coverage on February 22nd, StockNews.com raising Bank of Montreal ( NYSE:BMO ) from a "sell" rating to a "hold" rating, and Barclays taking coverage on March 20th.

Bank of Montreal ( NYSE:BMO ) has a market cap of $69.63 billion, a P/E ratio of 18.22, a price-to-earnings-growth ratio of 2.37, and a beta of 1.13. The bank reported $1.90 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.24 by ($0.34). Hedge funds and other institutional investors own 45.82% of the company's stock.

Technical Outlook

Bank of Montreal ( NYSE:BMO ) stock closed Friday's trading session up 0.97% trading with a Relative Strength Index (RSI) of 59.22 which is poised for further growth. The daily price chart shows a strong retracement to the support zone of $93.33.

BMO Bank of Montreal Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BMO Bank of Montreal prior to the earnings report this week,

I would consider purchasing the 85usd strike price Calls with

an expiration date of 2024-1-19,

for a premium of approximately $3.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

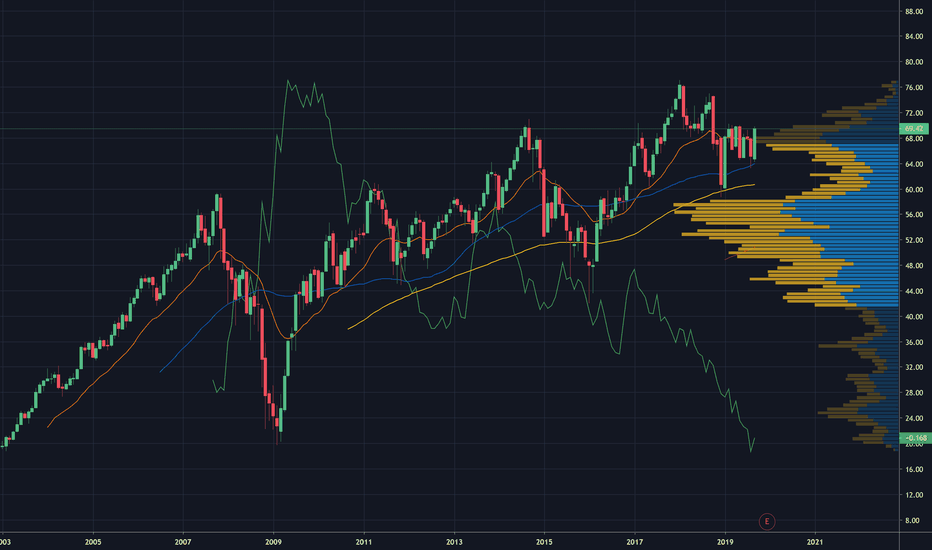

BMO: Broke Through and Confirmed Supply at a Demand LineBMO has broken down a previous Demand Line and Confirmed it as a present Supply Line. I am now looking for BMO to break below the 200-week Simple Moving average; upon doing that, there will be nothing left for BMO to hold on to and should take it down to about $43.

BMO - Ascending Triangle BMO has formed a very large Ascending Triangle

Price has broken out of this ascending Triangle and is looking to continue this bullish action, this is shown with the bars pattern in white

Ascending Triangles most of the time break out bullishly, especially one of this magnitude

STOCKS IM BUYING THIS WEEKI think last week's pullback in equity markets was a good thing. The market got overheated and it gave us a reminder that stocks don't always rise. Memories and patience are short in the finance industry especially with some recent trends (blockchain) skewing people's perception that building wealth gets built overnight. Not the case, in the past 50 years of the SP500's history, it has NEVER had a stretch of over a year without a 5% correction or more. So relax, this is not doomsday, it is the ebbs and flows of Mr. Market playing his tricks.

Here is the list of stocks I'm buying or adding a position too.

- Icahn Enterprises (see earlier post)

- Scott's Miracle Grow (post coming this week)

- Bank of Nova Scotia

- Bank of Montreal

- Citigroup

- Home Capital Group (post coming next week)

- Canadian Imperial Bank of Commerce

- Valeant Pharmaceuticals

- Equifax

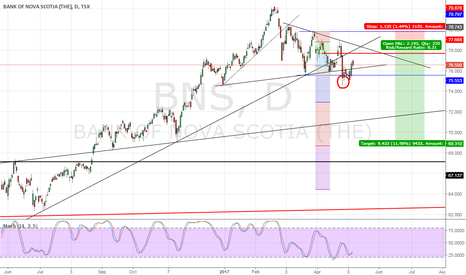

BNS, BMO, CM are banks I own in a fund and will simply be buying more of the fund (FIE.TO), but BNS and BMO are the two banks I would buy, if you go back one year and look at the worst performing Canadian bank, it's a pretty safe bet that the next year will be better. As well: www.theglobeandmail.com

I apply this same rationale to Citigroup , one of the less fortunate American banks from last year.

EFX was a stock I bought down around $90 when it sold off following a security breach announcement. I think the firm, fundamentally, is strong and will continue to regain ground. VRX is also one of those contrarian stock picks, after some allegations a couple of years ago for fraud and insider trading, I think they've found their bottom. They've also started to pay off debt which is never a bad thing for a recovering company.

I'm in the process of putting a valuation on HCG and SMG and will make a post in the coming week, this will be a buy and hold value-pick. I'm liking what I'm seeing so far.

BMO (Long) - Pullback & Upward Trend ContinuationNYSE:BMO

21MAY16:

- POSITION: Long

- PRICE: $63.02

- TARGET PRICE: $67

- STOP LOSS: $61.80

- TARGET ENTRY:

- Looking for entry on Monday on upward price movement.

- Appears to be a pullback on a strong upward trend.

- Aggressive stop loss to be pursued.