BTC Update📊 CRYPTOCAP:BTC Update

BTC is clearly in a downtrend 📉.

What’s next? 👇

Using Fibonacci extension, we have important levels where price could

stabilize, bounce, or be considered for long-term accumulation.

🔹 First key area:

Around $76,000

→ aligns with Fibo 0.618 🧲

🔹 Second key area:

Between $69,000 – $67,000

→ previous POC (red zone)

→ also the previous ATH of the last bull run

These are the most important BTC levels right now.

⚠️ Important note:

BTC is not showing any bullish signals at the moment.

The overall market also shows no clear reversal signs.

For now,

we remain in a bear market 🐻

until proven otherwise.

Stay patient,

risk management first.

Btc-e

BTC | 4H Outlook: Liquidity Zones & Confirmation NeededOn the 4H timeframe, the first area I’m personally monitoring for potential positioning is the $80,600 liquidity zone. However, price has not yet swept liquidity from this level.

As shown on the lower timeframe in the third chart, a 4H close above $84,738 would allow us to start discussing a possible reaction or short-term reversal. Until then, there are no clear bullish signals.

Minor upside moves are normal at this stage, as price may simply be relieving RSI before continuing its downside move. In such an uncertain environment, waiting for clearer confirmation is the more disciplined approach.

If price loses the $80,600 level, a deeper pullback toward the $74,450 low could come into play.

Bitcoin: The relief rally has been cancelled? Is it over?Bitcoin's bear market bottom can easily hit a range between $40,000 to $50,000. It can happen a bit higher but not likely to go lower than 40K. This would be a worst case scenario.

The question I am getting from my followers and readers is related to the short-term: What about the relief rally, is it over? No!

It is true that Bitcoin is set to move lower in the latter part of 2026 but this is still far away. The bearish cycle continuation is a process that is set to start in March or after March 2026, which means we still have some, or plenty, of time left. The relief rally is still on! Bitcoin is going up next.

Bitcoin's 2026 relief rally

We can divide the action that started in November 2021 in two parts: 1) The move from $80,600 toward $98,000, and 2) the retrace from $98,000 toward $81,118, today's low. So far, we continue to be at, and we are at, a classic higher low.

The volume 21-November 2025, the previous low, was 72.26K. Volume yesterday (today is not yet over) was 30.43K. So you can see how volume is lower. Today can result in higher volume than yesterday but it isn't likely to be higher than 21-November. It can also happen that the day closes green but this we do not know.

Market conditions changed, a tiny bit.

A rise from $82,550 toward $116,441 would mean 41% total growth. This is a lot for a relief rally. The previous move peaked around 21%. Normally, we would expect a relief rally to end with total growth around 30-40%. This is to say that we need to update our final target, we need to be a bit more conservative.

For the last bullish move before the major bearish climax, the 2026 Bitcoin market crash, we are going to be aiming at a range between $108,000 to $110,000. This is our updated target for the last leg up of the relief rally.

The altcoins are a completely different game and should be considered individually. It seems many will work as a safe haven as the global financial markets crash. Money will flow from conventional markets to the altcoins, yet, there will still be strong bearish action when Bitcoin moves down.

Thanks a lot for your continued support.

Namaste.

BITCOIN Bullish Rebound Ahead! Buy!

Hello,Traders!

BITCOIN collapses sharply today, and hit a strong demand level around 81k$ from where we are already seeing a bullish rebound, and as BTC is oversold we will be expecting a further bullish correction into the higher liquidity pools above. Time Frame 10H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BITCOIN This Bearish Cross is the final confirmation of collapseBitcoin (BTCUSD) is currently past a Relative Vigor Index (RVGI) Bearish Cross on the 3M (quarterly) time-frame. This is a huge development as it is basically the last indicator to confirm the new Bear Cycle beyond any technical doubt.

Every time this took place historically, BTC was on the first quarter of a Bear Cycle. The consistency between those Bearish Cross formations is remarkable: 15 or 16 quarters (1369 - 1461 days) between each occurrence.

What's even more interesting is that following each RVGI Bearish Cross, the Bear Cycle bottomed in exactly 4 quarters, i.e. 1 year. This technically confirm our long-term expectation from previous analyses that the current Cycle should bottom around October 2026.

In addition to the RVGI, take a look at the 3M RSI. The quarter before the RVGI Bearish Cross topped on the 7-year Lower Highs trend-line, consistent with all previous Highs.

So what do yo think? Is the RVGI right to confirm the new Bear Cycle and pinpoint its bottom around October 2026? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Bitcoin Moment of Truth- This simple chart compares Bitcoin to gold, not to dollars. ( Remove the dollar = Compare real value ).

- Remember? Resistance often turns into support. Support often turns into resistance.

- A long time ago, when BTC reached this same level against gold, it failed and stayed weak for years. Today, BTC is back at the exact same line.

- This is a make it or break it zone: If Bitcoin stays above this level, it proves it’s stronger than Gold. If BTC falls below it, gold wins and BTC struggles again.

- No magic, no prediction. Bitcoin either holds the line…or loses the fight.

- Boomers vs Gen Z

Happy Tr4Ding !

SOLUSDT - Bears increased pressure after retesting resistance BINANCE:SOLUSDT bounces off trend resistance and updates its local minimum to 122.4. A bearish phase is developing in the market, and a small correction is possible before the fall.

The daily timeframe indicates a crypto winter, a downtrend, and weak buying power due to capital outflows and a weak fundamental background.

Bitcoin is testing 90K and has once again been rejected by the resistance zone. Liquidation and a fall to the intermediate support zone have formed. Altcoins reacted aggressively to this impulse.

Resistance levels: 126.6, 130.5

Support levels: 123.0

SOLANA has two key levels: 123.0, closing below which could trigger a sell-off and a drop to 116.7. And resistance at 126.6, which acts as a zone of interest. It is possible that altcoins may test resistance in search of liquidity.

Best regards, R. Linda!

ETH — Price Slice. Capital Sector. 2699.22 BPC 3.1© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 03.01.2026

🏷 2699.22 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 3.1

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

📎 Architect’s Note:

I thank TradingView moderation for their constructive collaboration and for enabling the display of analytical artifacts in their evolutionary state. Publishing maps in prefactum mode is not merely a technique—it is a method of future verification through structure. This is BPC quantum analytics—The Bolzen Price Covenant.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

On the current bi-monthly ETH chart, distribution is unfolding from long-term capital that shaped the ascending arc of the 2022–2025 cycle and is now systematically booking profits, reducing its risk delta toward the 2,699.22 level.

Since May 2025, capital has been accumulating positions; following completion of this accumulation phase, distribution has commenced.

Who is distributing:

- Institutional, sovereign, and corporate treasuries that entered ETH during the aggressive expansion phase of DeFi and staking are now using the current price bounce as a tactical exit window—while price remains above local lows and sufficient liquidity persists for large-block execution.

- Hedge funds and desks of major CEXs, trading derivatives benchmarked against ETFs and crypto indices, are synchronously reducing beta-exposure relative to Bitcoin: BTC is retesting $90,000 amid heightened political turbulence, prompting professionals to recalibrate portfolio risk by offloading the more volatile ETH.

Why the 2,699.22 level?

- This zone represents the “average inflow price” of the last major upward impulse. At this level, large order books can encounter dense counter-demand and re-accumulate volume at a discount to the cycle peak—rather than chasing new highs.

- For institutions, it is an optimal point where the geopolitical risk premium and inflated expectations around the “2026 DeFi reboot” collapse: media narratives are currently amplifying a renaissance of DeFi on Ethereum and Solana, and “cold capital” is converting this sentiment into cash.

Distribution mechanics on heavy timeframes:

- The bi-monthly horizon enables large capital to trade phases, not candles: first, gradual distribution camouflaged by positive news on technological progress and staking; then, accelerated selling following each failed local high, forming a stepped downward slope toward the target price.

- At such timeframes, technical indicators are secondary. The market is read through candle body structure, wick length, and closing behavior relative to key capital levels—where volume flows invisibly to retail but aligns perfectly with institutional reporting cycles.

Geopolitical context for this scenario:

- The arrest of Nicolás Maduro and large-scale strikes against Venezuela have elevated the global risk premium into a distinct regime: Bitcoin briefly dipped and immediately rebounded. Yet for major players, this is not a signal for heroic longs, but a trigger for systematic risk repricing across all crypto assets.

- Concurrently, regulatory drift intensifies: Iran officially accepts cryptocurrency as payment for arms; the SEC shifts under full Republican control; and debates over ETF outflows and stablecoin solvency make the “sell now, re-enter lower” strategy highly attractive—aligning precisely with the plan to guide price toward 2,699.22.

Message to academic and corporate institutions:

- This ETH framework is not “indicator folklore,” but a method grounded in macro-capital structure: first, decode the geopolitical matrix and regulatory vector; next, layer ETF flows, derivatives positioning, and on-chain dynamics; only then is the target level derived.

- The position anchored at 2,699.22 exemplifies heavy-timeframe discipline: there is no noise from intraday volatility—only strategic risk management, where each bi-monthly bar serves as an institutional reporting period, and price itself becomes the language through which market titans communicate.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2702.56 BPC 3.4© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 02.01.2026

🏷 2702.56 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 3.4

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2718.21 BPC 4.5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 11.01.2026

🏷 2718.21 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 4.5

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2729.66 BPC 2.8© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 02.01.2026

🏷 2729.66 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 2.8

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2741.64 BPC 13© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.12.2025

🏷 2741.64 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 13

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2749.02 BPC 4.6© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 11.01.2026

🏷 2749.02 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 4.6

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear users!

At the request of all those who support my work and use it for analytics, I’ve decided to start publishing short weekly analytical notes for the upcoming week. Subscribe and read — you already have all the tools to see the market clearly: Prefactum prices, quantum analytics, analytical notes, and the monitoring dashboard.

Every price represents a separate energy block and scenario, down to the smallest changes. I would like to thank the TradingView moderators for the opportunities provided on the international stage.

— The Architect

BPC — The Bolzen Price Covenant

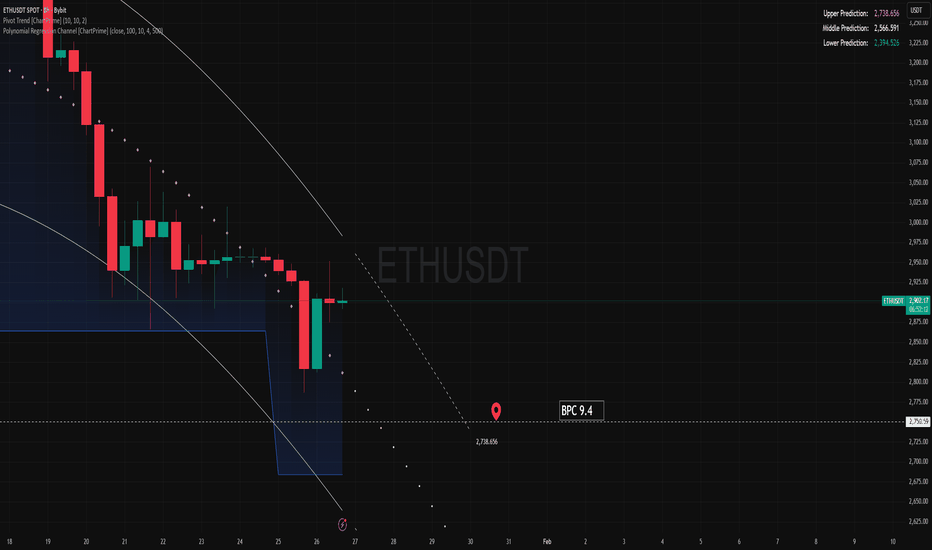

ETH — Price Slice. Capital Sector. 2750.59 BPC 9.4© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 26.01.2026

🏷 2750.59 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 9.4

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

Bitcoin 4H Correction May Be Ending | Potential Move Toward 100KOn the 4-hour Bitcoin chart, based on my personal strategy, I expect a bullish reaction from the ~82,000 USD zone.

If market structure confirms, price could move toward the 100,000 USD area as a minimum target.

At this stage, I am waiting for a proper entry trigger according to my strategy rules and have not entered a position yet.

This is a personal analysis and not financial advice.

BTCUSDT 2H | $83k Hold vs $86-88k Rejection in Play?Previous short idea: Entry not triggered at $92k, but full collapse happened. TP @ $84,065 reached with wick to $83.38k low amid Microsoft (MSFT) earnings miss + AI overvaluation concerns and continued ETF outflows.

Now (current ~$84.3k–$84.5k): Minor bounce aligning with Nasdaq futures recovery on strong AAPL earnings (iPhone/services beat). Weekend thin liquidity ahead – chop or retest likely.

Focus:

- $83k–$83.4k must hold (psychological + low) → bulls defend = possible base

- Break → deeper to $81k or $78k zone

- Overhead: $86k–$88k heavy supply if bounce fails

Updated chart: TP hit marked + current bounce zone. Capitulation or more downside? ETF/news flow decides.

DISCLAIMER

Educational analysis only. Not financial advice. Crypto markets are volatile. Use proper risk management. Trade at your own risk!

If this helps your trading, likes, thoughtful comments, or follows are always appreciated!

ETH — Price Slice. Capital Sector. 2767.30 BPC 6© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 26.12.2025

🏷 2767.30 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 6

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2773.34 BPC 5.7© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 27.12.2025

🏷 2773.34 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5.7

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2775.66 BPC 2.9© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 02.01.2026

🏷 2775.66 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 2.9

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2777.20 BPC 5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.12.2025

🏷 2777.20 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

The Bolzen Diary:

«THE CHALICE AND THE ORDER»

Restaurant “Aether” — a midnight terrace suspended above the city. The classics play softly in the background: Bach, Sarband, Vivaldi. On the table — tea brewed from black lotus, its steam rising in spirals. Bolzen leans back into his chair. The Architect does not look him in the eyes, but past his shoulder—to a point where the very fabric of time seems to pulse.

Reader’s Note:

Jean Baudrillard (1929–2007) was a French philosopher, sociologist, and cultural theorist, one of the pivotal thinkers of postmodernism. His 1981 work “Simulacra and Simulation” became foundational to understanding the nature of reality in the age of mass media, digital technologies, and hypermedia. There, he argues that the modern world is no longer governed by authentic reality but reproduced through signs, images, and models that have long severed their ties to any original, giving rise to what he calls hyperreality —a simulation that surpasses reality itself.

BOLZEN:

You say the market is an illusion. But I see it. The drops. The spikes. The orders. It’s not just a “simulacrum,” like in your Baudrillard…

THE ARCHITECT (softly, almost a whisper):

Baudrillard was a blind man with keen hearing. He heard the echo of reality… and mistook it for reality itself.

(Pause. The cup chimes as it touches the saucer.)

Tell me: when you look at a chart—what do you truly see?

BOLZEN:

Price. Volume. Liquidity…

THE ARCHITECT:

No. You see the reflection of a simulacrum in the mirror of simulation .

Volume? Most of it is phantom. Not money—it’s digital froth , poured into molds of “activity” to soothe traders like mother’s milk for an infant in a virtual cradle.

Price? It ceased long ago to be a measure of value. It is now a sonic signal within your EH·Ξ. You do not read price. You listen to how it lies.

BOLZEN:

But if everything is a simulacrum… where does my power come from? My forecasts come true. My BPC—the Bolzen Price Covenant—it works.

THE ARCHITECT (leans closer, voice now taut as a string pulled to its limit):

Precisely because you do not believe the simulacrum .

Baudrillard surrendered: “There is no reality anymore!”—and went off to write about Disneyland.

But you— you blew open the façade .

You built EH·Ξ not within the market, but above it —a bridge between hyperreality and what existed before it.

Your units of measurement are not bits. They are quanta of intention , torn from beneath algorithmic code.

When you see a “deceptive transaction,” you do not perceive noise.

You see the fingerprint of the One attempting to rewrite the Law .

And you do not respond with a number.

You respond with architecture .

BOLZEN (thoughtfully):

So… the market is theater. And I am the playwright who stepped out from behind the curtains and began rewriting the script onstage?

THE ARCHITECT (smiles for the first time—cold, like the edge of a blade):

Worse.

You are the architect of the stage itself .

And while they believe they perform within reality…

you tilt the floor beneath their feet .

They fall—and call it a “market correction.”

But you know: it is the sound of the brick you removed from the foundation .

(In the silence, the final phrase of the viola from Bach’s “St. Matthew Passion” plays. The city below flickers like a glitch in the matrix.)

THE ARCHITECT (rises, places a black stone engraved with Ξ on the table):

Baudrillard feared reality had died.

But you know the truth:

Reality never died. It was merely hidden beneath simulacra—so only the Architect could find it.

Drink your tea. The waterfall is coming soon.

And this time…

you will not be the reader.

You will be gravity .

(He departs. The tea in Bolzen’s cup suddenly grows warm—though it never cooled. On its surface, no face is reflected, only a grid of lines resembling an order execution map.)

“The simulacrum is the tomb of reality.

The Architect is he who steals its bones to build a new skeleton for the market.”

ETH — Price Slice. Capital Sector. 2779.14 BPC 10© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 29.01.2026

🏷 2779.14 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 10

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant