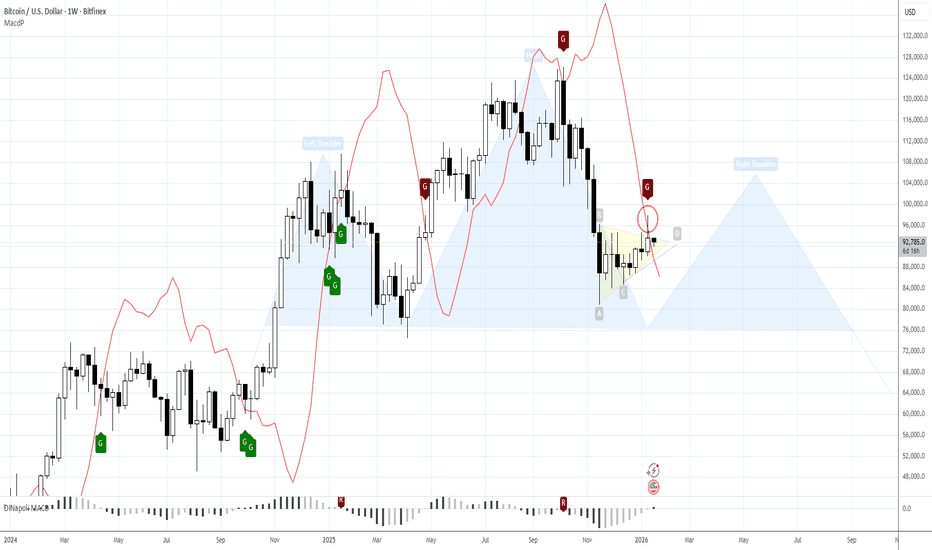

BTC WEEKLY BEARISH GRABBER IS SETMorning folks,

Today a short update, as last time we explained our position in details. So, the clarity has come, we've got our bearish grabber on weekly chart. This pattern suggests drop back to 76-80$ K lows within a few weeks.

Now we consider no longs. From fundamental point of view, appearing of this pattern is quite logical now. Geopolitical tensions are raising and demand for high risk assets is dropping. BTC is one of the most risky assets with questionable potential return. So, it is not a surprise that it is under pressure. Clarity Act has not passed the Senate and postponed...

So, right now we rather watch for chances to sell, at least until this pattern holds.

Btc-e

Bitcoin Keeps Printing Higher Highs — Trend Continuation On the H1 timeframe, Bitcoin is maintaining a textbook bullish market structure, clearly defined by a consistent sequence of higher highs (HH) and higher lows (HL). After reclaiming and holding above the key moving averages, price transitioned into a strong impulsive phase, with each pullback remaining shallow and corrective rather than aggressive. The most recent retracement respected the prior higher-low zone and the rising MA, confirming that buyers are still firmly in control and that selling pressure remains limited to profit-taking, not distribution.

From a structural perspective, the current pullback is forming a healthy higher low, which is a critical condition for trend continuation. Momentum has already re-engaged after the pullback, signaling that demand is stepping in earlier rather than waiting for deeper discounts. This behavior typically appears in strong trending markets, where price does not allow extended corrections. As long as Bitcoin holds above the recent HL area and above the moving averages, the bullish structure remains fully intact.

Looking ahead, the market roadmap remains straightforward: continuation toward the next upside liquidity zone. A sustained push above the recent HH opens the path toward the 98,700 region, with a further extension toward the psychological 99,500–100,000 zone if momentum accelerates. Any short-term dips into the higher-low region should be viewed as continuation opportunities, not weakness. The bullish scenario would only be invalidated if price breaks decisively below the last higher low, which would signal a deeper corrective phase. Until then, Bitcoin is not topping — it is trending, reloading, and preparing for the next expansion leg.

ETHEREUM - Bullish market behavior pattern. Confirmation?BINANCE:ETHUSDT is forming a consolidation in the $3300 zone in a “descending wedge” pattern, which is a relatively bullish market behavior model.

The market is reacting to the improvement in the fundamental background, inflows of funds are increasing, and buyers are showing interest. Local trends are beginning to change for the better. After the rally, Bitcoin is trying to consolidate above 94-95K, and if it succeeds, we will have a green signal.

Ethereum is consolidating and fighting for the 3300 zone after implementing a U-formation pattern. Overall, there are signs of bulls in the market, and if buyers keep the price above 3300, the market will have an opportunity for growth.

The price is forming a descending wedge against the backdrop of a local bull market. A close above 3315 will be a confirming signal for growth.

Resistance levels: 3315, 3383, 3450

Support levels: 3300, 3281

The price has consolidated above 3300 and above 3315, as well as broken the resistance of the descending wedge. If the bulls keep the price above these key areas, another bull run may form...

Best regards, R. Linda!

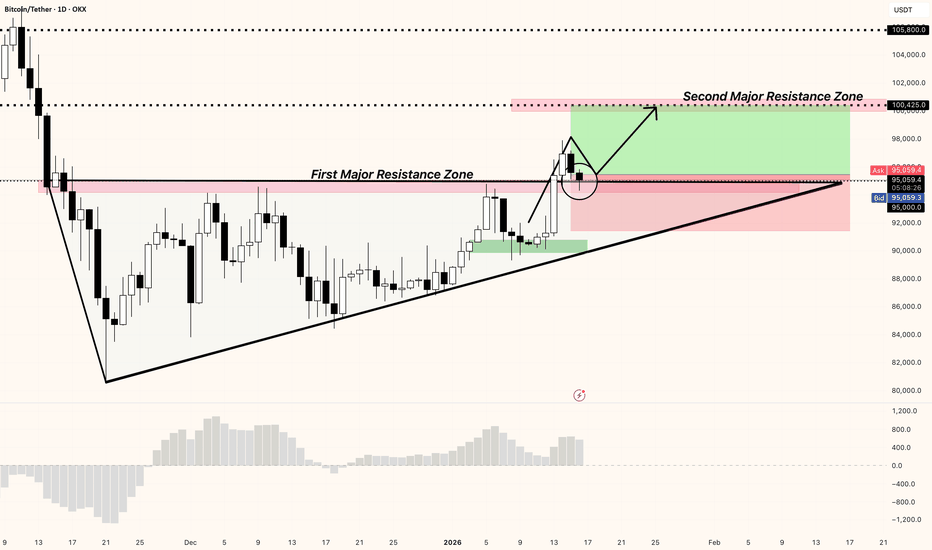

Could we see a bullish reversal from here?Bitcoin (BTC/USD) is reacting off the pivot, and a bounce could lead the price to rise to the 1st resistance.

Pivot: 92,972.95

1st Support: 84,280.72

1st Resistance: 106,899.10

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

$BTC - Possible Second Test into 95-96kBINANCE:BTCUSDT | 2h

Price got capped and stalled under 96k and broke down into 92k (local demand zone).

I think if we can hold 92-90k, we might get a secondary upthrust back into 95–96k

If you’re short, I’d consider de-risking or just closing it out here — especially if we end up holding this current low / the 90k zone.

BRIEFING Week #3 : ETH and OilHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

BTC Bearish cycleAs I see it BTC we are going into a long term retracement below the 50% of the previous bullish range.

The price target is at OTE level (Optimal Target Entry)around 45.000$ .

BTC revolve in cycles ,bearish and bullish and it often ,almost always repeat the same price delivery at the same time.

The bearish cycle :

-365 day

The bullish cycle :

-around 1060 days

But how do I calculate?

Placing a Fib projection from the lower low to the higher high of the BEARISH range, once the leg(range) is broken(the higher have been taken , we can approximate our target as you can see in the image are pretty precise.

To find the bearish target ,always below 50% of the Bullish (explanation on image).

I do so expect to go into a big buy by this year October .

This is a fully technical and only analysis ,but long term calculations do not lie.

Let me know in the comments what you think about it.

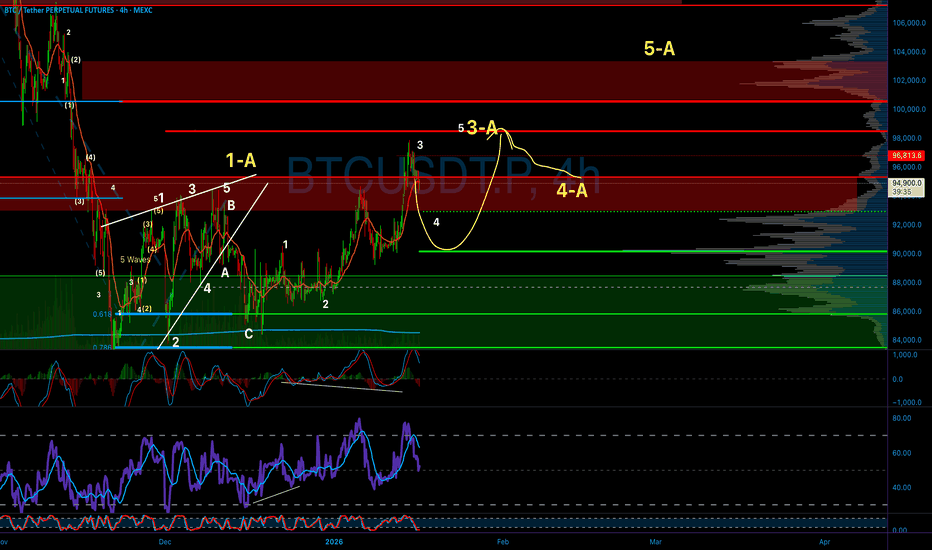

BTCUSD - Bullish Swing Setup Toward $100kA) Market Context

BTC remains in a strong higher-timeframe uptrend after reclaiming and holding above the 94.9k breakout zone. The broader environment continues to favor risk assets, supported by ETF demand, a constructive regulatory narrative (CLARITY Act), and dovish-leaning US macro data.

While short-term pullbacks are possible after the recent impulse, the path of least resistance on a swing basis still points higher, with $100k acting as the primary psychological and liquidity target.

⸻

B) Structure Overview

HTF Structure (Daily–4H)

• Trend: Bullish continuation with higher highs and higher lows since the ~80k base.

• Breakout: Clean HTF breakout above 94.9k, previously the top of an ascending triangle.

• Key zones:

• Support: 95.0k–95.5k (breakout base / demand zone)

• Invalidation: 94.0k–94.3k (loss of last major higher low)

• Resistance: 99k–100k (psychological level, options interest)

HTF Bias: Bullish continuation unless 94k is lost on a closing basis.

⸻

C) Liquidity, Derivatives & Positioning (High-Level)

• Liquidity landscape:

• Bid interest expected around 95k (breakout retest zone)

• Large liquidity and option interest clustered near 100k

• Funding: Mildly positive, not euphoric

• Open Interest: Elevated but not extreme, suggesting room for further trend participation

• Positioning takeaway: Market is long-biased but not overheated, allowing for continuation if momentum holds

⸻

D) Swing Trade Setup – Long Toward $100k

Direction: LONG (Swing)

Entry plan:

• Conservative: 95,000 – 95,500

Ideal pullback into the breakout base and HTF demand.

• Alternative (no pullback scenario):

Small starter position around ~96.5k, with a planned add-on near 95k if price retraces.

Stop-loss zone:

• 94,000 – 94,300

Below the breakout structure and last meaningful higher low

→ invalidates the current bullish leg.

Target zones:

• T1: 99,000 – 100,000

Primary objective, psychological level

(~1:2+ R:R from 95.5k)

• T2 (only if momentum is exceptionally strong): 102k – 105k

Extension zone / potential blow-off move

Expected holding period:

• 5–15 days, or until the Fed meeting on Jan 29, whichever comes first.

⸻

E) Key Risks

• ETF flows stall or flip to net outflows (similar to early-January behavior)

• CLARITY Act headlines turn negative due to political resistance

• Macro deterioration: Data points toward a harder landing

(e.g. very weak jobs data triggering risk-off across equities)

⸻

F) Trade Logic Summary

Macro alignment

• CPI/PPI soft to neutral; retail sales weaker

• Market expectations drifting toward earlier rate cuts

• No fresh hawkish shock → supportive backdrop for BTC

Structure & liquidity

• HTF breakout above 94.9k from ascending triangle favors continuation toward 100k

• Recent LTF consolidation below 97–98k resembles a bull-flag rather than distribution

Derivatives & positioning

• Funding positive but far from blow-off levels

• Previous short liquidations reset positioning and created room for new shorts, which can fuel a squeeze higher

Order-book logic (inferred)

• Strong bids likely near 95k (breakout retest)

• Offer clusters expected between 98k–100k, aligning with liquidity and options data

On-chain / flows

• ETFs and institutions continue accumulating

(AUM ~$123B, 2026 inflows >$1B), reinforcing structural demand

Overall takeaway:

From a risk-reward perspective, swing longs offer a better profile than chasing shorts as long as 95k holds. Intraday dip-buys remain aligned with the broader bullish swing thesis.

⸻

G) Invalidation Rules

Price-based

• Swing long invalidation:

Daily or decisive intraday close below 94,000

→ suggests a failed breakout above 94.9k.

Time-based

• Reassess the swing around / after the Jan 29 Fed meeting, or once T1/T2 is reached.

Macro-based

• Strongly hawkish Fed or FOMC commentary

• Sudden risk-off move with equities down 2–3%+ in a single session

• Negative surprise related to the CLARITY Act

Order-book-based

• If a 95k retest occurs with aggressive market selling and minimal bounce, treat it as weak demand, not a dip-buy opportunity.

$BNB 1W: Bullish update going into the week of Jan 19BNB update.

BNB is starting to lean bullish again on the weekly, and the structure here looks constructive rather than exhausted. After the sharp impulse higher and the fast pullback from the highs, price has stabilized and is now reclaiming the ~$900–950 region, which is an important pivot zone on this chart.

What stands out is how well BNB respected higher timeframe support. The pullback never threatened the $660–670 level, which was former resistance and is now clearly acting as strong support. That’s classic trend behavior and suggests the larger uptrend remains intact.

The recent move higher looks like the market is forming a higher low and rotating back up rather than rolling over. This type of consolidation after a strong expansion often resolves higher once sellers are absorbed, especially when price reclaims prior value instead of stalling below it.

As long as BNB holds above the $900 area on a weekly closing basis, the bullish bias remains valid. Acceptance above this zone increases the odds of continuation toward the prior highs and potentially a new leg higher later in the cycle.

If price were to lose $900 and especially $660, that would shift the narrative back to deeper consolidation. Until then, this looks like strength after a reset, not distribution. Overall, BNB is acting like a leader again, and the path of least resistance is starting to tilt back to the upside.

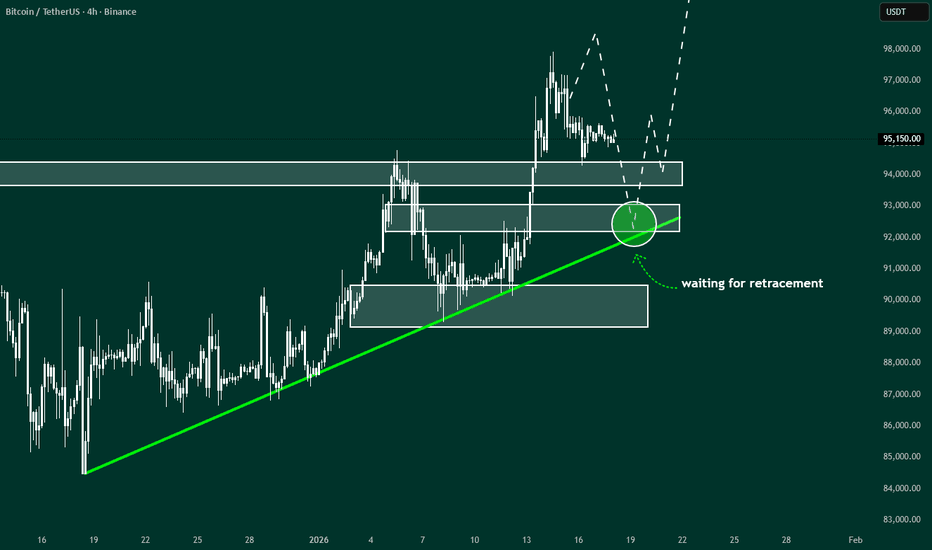

Bitcoin: This Level Offers Optimal Scenario For 100K Objective.Bitcoin is poised to break higher from the current price area BUT it is worth noting these other high probability support areas. The 92K to 93K offers the most attractive level because of the alignment of the trend line and a previous key support (order block). While a swing trade long opportunity may confirm sooner, this scenario is the lower risk, higher probability scenario worth waiting for. In fact, I just shared an Ethereum trade setup that has a very similar configuration relative to the 3K level.

This chart is show the 4 hour time frame, ideal for shorter time horizon swing trades which can have a duration of a couple of hours up to a few days or even a week. Risk can be specifically defined by the key support levels like 90K and 92K. The ideal situation is to WAIT for price tot confirm before putting on a position. You can see the expected outcome on this chart which can reasonably test the 100K level upon the next leg higher.

Some key considerations as to why this scenario is more likely over the next week or two. Technical argument still favors a broader BULLISH trend. There was some questioning when 88K was briefly compromised, but price spent VERY little time below that key Wave 1/4 over lap which is something I have been pointing out for months. The current broader wave count favors the possibility Bitcoin is in a bullish wave 5 of the broader 5th which in simple language means the 126K high is within reason to be tested over the first quarter. This is NOT an absolute conclusion, it is what the current price structure implies.

Fundamentals must drive the move IF it is going to move. Major items on the horizon are the CLARITY ACT going into effect, more favorable actions by the Fed (QE), a new Yesman (I mean Chairman of the FED), etc. Always maintain an open mind because IF any bearish catalysts surprise the market, it will change the current structure which should automatically prompt an adjustment in expectations on your part. Until that argument comes along though, this market is pointing HIGHER.

Charts can't tell us much about the future, bond yields and LAWMAKERS can.

By the way these are my new charts. I am going to be featuring a variety of time frames, perspectives, etc in this new format. You will notice the candles no longer have a color. This is to help you focus on the actual price structure rather than become confused by "red" or "green" which can plant seeds of unjustified bias. Let me know how you like it in the comment and by giving this article a boost!

Thank you for considering my analysis and perspective.

BITCOIN is about to take off (4H)Bitcoin has formed a clear bullish Change of Character (CHoCH) on the chart, signaling a potential shift in market structure from bearish or ranging conditions into a bullish phase. This structural change suggests that buyers are gaining control and that the market sentiment is gradually turning positive.

At the moment, price is trading around key higher-timeframe levels, where we have observed significant trading activity and time spent in this zone. This type of price behavior indicates strong acceptance of value in this area, which often acts as a solid base for continuation moves.

One of the most important observations is the liquidity pool located above the recent highs. This liquidity has already been swept, yet the price failed to drop afterward. This is a critical sign of strength. If the primary intention of the move had been only to grab liquidity, we would typically expect a sharp rejection or bearish follow-through. Instead, price has held its structure, suggesting that smart money is positioning for higher targets, not distribution.

For execution, two buy entry zones have been clearly marked on the chart. We are not chasing the price. Instead, we will patiently wait for pullbacks into these zones and enter long positions using a DCA (Dollar-Cost Averaging) strategy. This approach allows better risk management and reduces the impact of short-term volatility.

Target : 95127$ _ 106000$

When price reaches Target 1, it is recommended to secure partial profits. After that, the stop loss should be moved to break-even, allowing the trade to continue risk-free while aiming for higher targets.

As always, proper risk management is essential. A strong daily close below the key structure levels would weaken this bullish scenario and require a reassessment of the setup.

Overall, as long as Bitcoin holds above these key levels and maintains its bullish structure, the path of least resistance remains to the upside.

If you would like us to analyze a coin or altcoin for you, first like this post, then comment the name of your altcoin below.

Stock Market Forecast | BTC TSLA NVDA AAPL AMZN META MSFT0:00 Intro & Overview

0:22 Sector Data & Sentiment

2:42 Dark Pools (RSP & MAG7)

6:44 S&P 500 (SPY)

9:21 Nasdaq 100 (QQQ)

11:37 Bitcoin (BTC)

15:04 Tesla (TSLA)

18:17 Meta (META)

22:03 Amazon (AMZN)

23:25 Microsoft (MSFT)

26:54 Google (GOOGL)

31:16 Apple (AAPL)

34:58 Nvidia (NVDA)

37:26 Outro

Stock Market Forecast | BTC TSLA NVDA AAPL AMZN META MSFT

SP:SPX AMEX:SPY CME_MINI:ES1! CME_MINI:NQ1!

BTCUSD FREE SIGNAL|LONG|

✅BTCUSD Strong bullish displacement from the demand zone confirms ICT market structure shift. Price respected mitigation on the pullback, showing acceptance above the key level. With sell-side liquidity already cleared, continuation toward buy-side targets remains the higher-probability path.

—————————

Entry: 95,186$

Stop Loss: 94,242$

Take Profit: 96,624$

Time Frame: 6H

—————————

LONG🚀

✅Like and subscribe to never miss a new idea!✅

ETH — Price Slice. Capital Sector. 3475.39 BPC 6.2© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 17.01.2026

🏷 3475.39 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 6.2

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

$BTC 1W: Zoomed out update, Bullish Bitcoin update.

BTC continues to look bullish on the weekly, and this move higher is happening in the right part of the structure. After the sharp pullback from the highs, price has reclaimed the mid-range and is now holding above the ~92–93k area, which previously acted as resistance. That reclaim is an important signal that buyers are still in control on higher timeframes.

Structurally, this looks like a higher low forming within a broader uptrend rather than the start of a larger correction. The selloff was aggressive, but it failed to break key support near 73k, and the response since then has been constructive. Momentum has shifted back to the upside, and price is no longer trapped below prior value.

The 95k region is now acting as a pivot. Holding above it keeps BTC in a strong position to challenge the upper range near 108k. A clean reclaim and acceptance above 108k would likely open the door to the next leg higher and continuation of the macro trend.

As long as BTC remains above the low 90s on a weekly closing basis, the bullish thesis stays intact. Pullbacks should be viewed as consolidation within an uptrend rather than signs of failure, unless price starts losing reclaimed levels with momentum.

Overall, BTC looks healthy here. This is strength returning after a reset, not late-stage blow-off behavior. Trend remains up, and the market is acting like it wants higher prices with time.

BTC/USDT Chart Update. BTC/USDT Chart Update

Overall bullish structure remains intact

25 MA (Moving Average)

Price is holding strongly above the 25 MA

25 MA is acting as a dynamic support zone

94,000 – 94,300 → major demand + MA support

As long as this zone holds, any pullback is considered healthy

99,700 – 100,000 → immediate resistance

A confirmed breakout can open the path toward 102K – 104K

Ichimoku Cloud is providing support, confirming trend strength

A 4H close below the 25 MA may signal short-term weakness

In that case, the price could retest the 90,200 area

The trend is still bullish. Dips may be viewed as buying opportunities as long as the price holds above the 25 MA.

Market involves risk — use proper risk management.

BITCOIN Free Signal! Buy!

Hello,Traders!

BITCOIN Price has tapped into a well-defined horizontal demand, where sell-side liquidity has been cleared and displacement higher followed. Current consolidation suggests absorption of remaining supply, favoring continuation toward buy-side imbalance above.

--------------------

Stop Loss: 93,846$

Take Profit: 97,304$

Entry: 95,248$

Time Frame: 4H

--------------------

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BITCOIN CAN FAKE THIS OUT NOW!!!!!!!(be careful)Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

$ZEC 1D Update: Into the chop here ZEC update.

ZEC is firmly in the doldrums right now. Price is all over the place with no clear directional control, and the chart is telling a story of chop rather than trend.

After the sharp breakdown and the fast bounce that followed, ZEC has failed to reclaim the prior uptrend structure and is now stuck rotating in the middle of the range. Rallies are getting sold, dips are getting bought, but neither side is showing conviction. That’s classic consolidation behavior after a high-volatility move.

The $400–430 area is acting as a noisy pivot zone where price keeps flipping back and forth. This is not a level to expect clean follow-through. Above here, there’s still heavy overhead supply from the prior breakdown. Below, buyers continue to defend in anticipation of another bounce, which is why price isn’t collapsing either.

The only higher timeframe level that really matters remains $300–310. As long as that zone holds, this chop can be interpreted as digestion rather than full trend failure. But until price either decisively reclaims the mid-$400s or flushes closer to $300, ZEC is likely to remain frustrating and directionless.

This is a low-quality environment for momentum trades. Patience is key here. ZEC tends to resolve these dull, messy ranges with expansion, but right now it’s firmly in chop mode, and the chart is reflecting that clearly.

SUPER Trade Setup – Watching the RetestWe’re tracking SUPER closely as it approaches a major technical juncture. The price is pressing up against the daily descending resistance line, along with a key overhead resistance zone. We're not looking to chase the initial breakout. Instead, we want to see a clean break, followed by a constructive retest and hold above former resistance.

🔁 Trade Plan:

The entry trigger comes on a successful retest of the $0.23 level, turning it into support. That’s our confirmation for a long spot position. If the level holds on the pullback, it could open the door for the next leg up.

🎯 Targets & Risk Management:

Take Profit Zones: $0.28–$0.36 and $0.47–$0.55

Stop Loss: Just below $0.2050