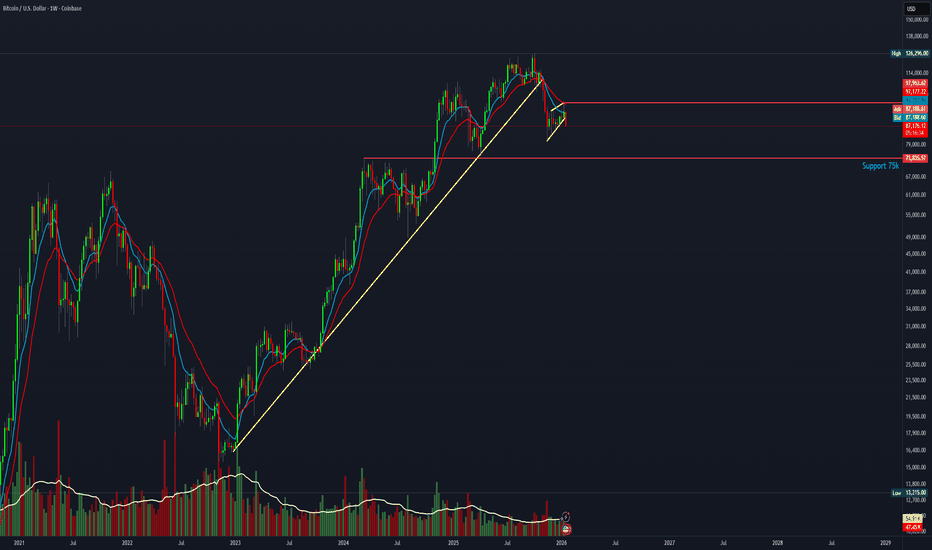

BTCUSDT - The battle for 90K may end in a decline BINANCE:BTCUSDT , against the backdrop of Trump's speech and various comments, caused a shake-up within the range of 87,800-90,300, but the price is consolidating below key resistance within the current downtrend...

The downtrend may continue if Bitcoin consolidates below 90K. There is a chance of this happening as there is still no fundamental support for the market. Everyone is talking about the "CLARITY Act" on cryptocurrencies, but there is no date for its signing, and there are rumors that the process may be postponed until late winter or mid-spring, leaving the market without a bullish driver.

The market is experiencing a phase of struggle for the 90K resistance zone. Bears are stubbornly resisting, forming a false breakout and consolidation below resistance. The structure could be broken if there is an impulsive breakout of the 90,500 zone and the bulls are able to keep the price above this zone, but the bears have formed a fairly strong resistance zone.

Resistance levels: 90,400, 91,400

Support levels: 87800, 85000

I do not rule out another attempt to retest the 90350 zone, but if the bears keep the price below 90K, the market will have no chance for growth. In this case, a pullback to 89K - 88K can be considered.

Best regards, R. Linda!

Btc-e

BTC: There is an H1 pattern, but daily volume is against buyingHi traders and investors!

The seller defended the weekly level at 90,128. We can see three buyer candle wicks there that failed to break and hold above this level. After that, yesterday a seller candle formed on the daily timeframe with solid volume. More details are covered in the previous review.

On the hourly timeframe, a false breakout pattern of the lower boundary of the range has formed. However, considering long positions here is extremely risky.

The reason is that the daily seller candle formed on increased volume, with the main volume accumulated in the upper part of the candle. Buying against such a signal carries a high level of risk.

Given the overall context, the priority scenario is to look for short setups, targeting the daily seller target at 83,822.

This analysis is based on the Initiative Analysis (IA) method.

Next Volatility Period: Around February 7th

Hello, fellow traders!

Follow us to get the latest information quickly.

Have a great day!

-------------------------------------

I believe BTC is currently at a critical crossroads, where it's either going to continue its uptrend or turn into a downtrend.

(BTCUSDT 1M Chart)

Therefore, support near the M-Signal indicator on the 1M chart is crucial.

Looking at this month's candlestick chart, the StochRSI 20 indicator appears to have formed a new point, rising from 37,155.0 to 87,550.43.

Therefore, caution is advised, as a decline below 87,550.43 could lead to a decline toward the next support and resistance level, near 73,499.86.

Even if the M-Signal indicator on the 1M chart rises above the OBV High indicator at 97,954.51, an uptrend is expected only if it rises above this level.

-

(1W chart)

The key is whether the price can rise along the rising trend line (1).

Furthermore, to maintain the price above the M-Signal indicator on the 1M chart, it is crucial to see if the price can rise above the 91013.65 level, which is the StochRSI 50 indicator point, to find support.

-

(1D chart)

The next volatility period is expected to begin around February 7th.

However, since the volatility period shown on the 1W chart is in April, the main volatility period is expected to occur in April.

As the next volatility period passes, the key point to watch is whether the price continues to rise along the rising trend line (1).

Therefore, the price must remain above 89524.74 at the very least.

Currently, the M-Signal on the 1W chart > M-Signal on the 1D chart > M-Signal on the 1M chart, so a complete reversal has not yet occurred.

Therefore, if support is found near the M-Signal indicator on the 1M chart this time, it is expected to move upwards above the M-Signal indicator on the 1W chart.

Considering these points,

1. Key areas to protect: Left Fibonacci ratio 2.618 (87814.27) ~ Left Fibonacci ratio 3.14 (93570.28)

To protect the first key area, support is needed around the 84739.74 ~ 87944.84 area.

To turn to an uptrend and continue the uptrend, the M-Signal indicator on the 1W chart must rise above this level. Based on the current position, this is expected to occur only if the price rises above 95330.17.

-

(15m chart)

For the Heikin-Ashi candlestick to turn bullish, it needs to rise near 92631.0. It's rising.

Based on the chart movement, I believe a rise above 92631.0 will signal a reversal.

Since the M-Signal indicator on the 1D chart is passing near 92631.0, we believe the price must ultimately rise above the M-Signal indicator to maintain its upward momentum.

My basic trading strategy is to buy in the DOM(-60) ~ HA-Low range and sell in the HA-High ~ DOM(60) range.

However, if the price rises from the HA-High to DOM(60) range, it could exhibit a step-like upward trend. If the price falls from the DOM(-60) to HA-Low range, it could exhibit a step-like downward trend.

Therefore, it's recommended to trade using a split trading method.

Looking at the current 15m chart, the DOM(-60) and HA-Low indicators were generated and then rose, but only slightly, generating the DOM(60) indicator.

Therefore, to sustain the upward trend, the DOM(60) indicator must break above the level.

Once you've identified a key point or range, you need to determine whether a break above that point or range can sustain the upward trend.

For this purpose, we use the StochRSI, TC, and OBV indicators.

The StochRSI, TC, and OBV indicators should all be showing upward trends.

If possible, the StochRSI indicator should not have entered an overbought zone. The TC indicator should remain at 0.

The OBV indicator should remain above the High Line.

If the above conditions hold when the DOM (60) indicator breaks above, an attempt to rise above 92631.0 is expected.

If not, a decline towards the HA-Low indicator is likely.

--------------------------------------------------

The final destination is likely to be near the 69K to 73499.86 range, as mentioned at the start of the decline.

However, as always, there is a possibility of a smaller decline and a subsequent rise. Therefore, we need to closely monitor the upward trend, especially when the price rises above the left Fibonacci 2.618 (87814.27) to left Fibonacci 3.14 (93570.28) range and sustains.

Every investor wants to buy at a lower price. However, caution is required, as buying when the price is in a downward trend can be extremely burdensome.

Currently, the price is near the HA-Low indicator on the 1D chart, so if the price falls, it is likely to experience a step-down trend.

This step-down trend ultimately signals a reversal to the upside, so aggressive buying is acceptable. However, investment allocation should be adjusted, as additional buying will be necessary when the HA-Low indicator is met again.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

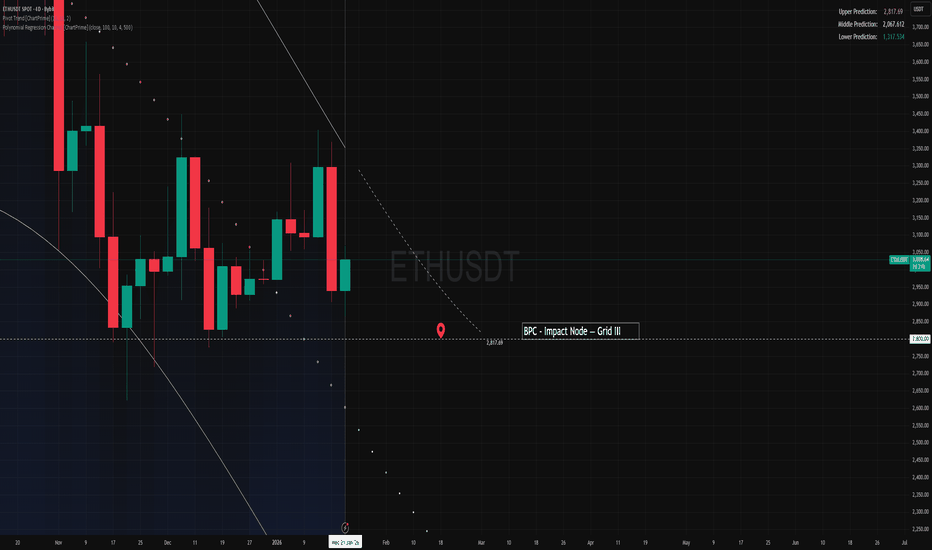

ETH — Price Slice. Capital Sector. 2798.20 BPC 5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 26.12.2025

🏷 2798.20 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2799.17 BPC 5© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.12.2025

🏷 2799.17 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 5

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

📎 Architect’s Commentary:

I express my gratitude to TradingView moderation for their constructive collaboration and for enabling the demonstration of analytical artifacts during their evolutionary phase. Publishing charts in prefactum mode is not merely a technique—it is a method of future verification through structure. This is quantum analytics under BPC — The Bolzen Price Covenant.

The permanent ETH and BTC Energy Grid Dashboard remains openly accessible and is intended for international institutional review.

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

BTC — Price Slice. Capital Sector. 86259.97 BPC 15© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 BTC — Price Slice. Capital Sector.

TradingView Publication Date: 10.01.2026

🏷 86259.97 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 15

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — BTC (numerical equivalent):

🏷 In development — coming soon

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2800 BPC Impact Node© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 22.01.2026

🏷 2800 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Impact Node — Grid III

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2800.85 BPC 8.1© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 21.01.2026

🏷 2800.85 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 8.1

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2807.81 BPC 7.2© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 28.12.2025

🏷 2807.81 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Tape 1: price published in the order of energy block production.

🏷 The price energy block is already ordered—not chronologically, but by block execution priority. Crucially, do not confuse: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution sequence records their market manifestation. Every price in the dynamic tape is tied to proprietary energy production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

🏷 The Bolzen Price Covenant — Strength Index: 7.2

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The Architect

BPC — The Bolzen Price Covenant

BRIEFING Week #4 : Look for the Dollar SignalHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

Bitcoin Price AnalysisBitcoin is declining within a descending channel that I charted just over a day ago. The price action is following the projected path as anticipated.

Key Levels to Watch:

Primary Target Zone: $80,700 - $79,000

This is where I’m expecting the next potential bounce. Specifically, I’m watching for a sweep of the lows around $79,500 as a likely scenario.

Alternative Scenarios:

If we fail to find support in the $80,700-$79,000 range, the technical picture deteriorates significantly, with $55,000 becoming a realistic downside target.

There’s also the possibility of a shorter-term bounce occurring at the current local lows around $84,600-$84,800, though this seems less probable given the lack of buying pressure we’re seeing at these levels.

Timeline:

We have considerable time for this price action to develop and resolve, so there’s no immediate rush to判断 the final direction.

Base Case:

My primary expectation remains a move down to sweep the $80,000 level, with $79,500 as the most likely area where we see a meaningful reaction.

Bitcoin is still under the control of the bears (4H)This analysis is an updated follow-up to the previous analysis, which you can find in the Related Ideas section.

This Bitcoin move is still valid and intact.

Although price has experienced a drop, it has not yet reached the main supply zone, where large sellers and institutional orders are expected to be positioned.

At this stage, price is expected to enter a corrective and neutral pullback phase, slowly moving toward our planned entry areas. This type of behavior is typical market conditioning it creates uncertainty, draws in late buyers, and weakens conviction before the next directional move.

Once price reaches the zone between the two red lines, which represent our primary entry levels, a rejection to the downside is expected.

The upper green box represents our first target (TP1)

The lower green box represents our second target (TP2)

A daily candle close above the invalidation level will completely invalidate this analysis.

As always, let price come to you, respect your levels, and avoid emotional decision-making. The market rewards patience far more than prediction.

If you have a coin or altcoin you want analyzed, first hit the like button and then comment its name so I can review it for you.

This is not a trade setup, as it has no precise stop-loss, stop, or target. I do not publish my trade setups here.

Stress-Testing Bollinger Bands Across Major Crypto AssetsBollinger Bands are one of the most widely used volatility-based strategies in crypto. Rather than evaluating a single configuration, I ran a large-scale parameter sweep to observe how the same breakout logic behaves across different assumptions.

For this test, I backtested 2,700+ Bollinger Bands Breakout configurations across BTC, ETH, SOL, and AVAX, varying timeframe, band length, standard deviation, and trade direction (long + short) within realistic, non-extreme ranges.

The results showed a wide dispersion of outcomes. Many configurations appeared profitable in isolation, but most exhibited unfavorable drawdown characteristics or were highly sensitive to small parameter changes. Timeframe selection had a larger impact on risk profile than individual band settings, and configurations that performed well on one asset often failed to generalize across others.

A smaller subset of parameter clusters demonstrated comparatively better balance between return and drawdown, but even these were not broadly stable across the full test space.

The takeaway is not about identifying a “best” Bollinger Bands setup. It’s about robustness. Single backtests can be misleading. Examining distributions across symbols, timeframes, and parameters provides a clearer view of where performance is coming from — and where risk is hiding.

ETH — Price Slice. Capital Sector. 2841.70 BPC 9.1© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.01.2026

🏷 2841.70 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 9.1

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2847.11 BPC 2.8© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 11.01.2026

🏷 2847.11 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 2.8

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear users!

At the request of all those who support my work and use it for analytics, I’ve decided to start publishing short weekly analytical notes for the upcoming week. Subscribe and read — you already have all the tools to see the market clearly: Prefactum prices, quantum analytics, analytical notes, and the monitoring dashboard.

Every price represents a separate energy block and scenario, down to the smallest changes. I would like to thank the TradingView moderators for the opportunities provided on the international stage.

— The Architect

BPC — The Bolzen Price Covenant

ETH — Price Slice. Capital Sector. 2857.16 BPC 6.6© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 22.01.2026

🏷 2857.16 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 6.6

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant

RSI SMA Cross – BTC & ETH Multi-Timeframe TestThe RSI SMA crossover is a simple and widely used TradingView strategy, often assumed to behave consistently once “good” parameters are selected. Rather than evaluating it on a single symbol or timeframe, I tested how the same logic performs across different market environments.

For this test, I ran a parameter sweep across multiple symbols and timeframes, keeping the strategy logic fixed while varying only RSI length and SMA length within reasonable ranges. The test covered BTCUSDT and ETHUSDT across 4H, 1D, 3D, and 1W timeframes, resulting in 160 total combinations.

The goal was not to find a single optimal configuration, but to observe whether performance is driven more by indicator parameters or by the trading environment itself.

Representative Results (Risk-Adjusted)

Below are four configurations that best illustrate the results and support the overall conclusions. These were selected for balance between profitability, drawdown, and trade frequency rather than headline return alone.

1) BTCUSDT — 1D (Most Stable Overall)

RSI Length: 28

SMA Length: 50

Profit Factor: ~1.77

Trades: ~109

This configuration showed the most consistent risk-adjusted behavior across nearby parameter sets and was less sensitive to small changes than others.

2) BTCUSDT — 1D (Lower Drawdown Variant)

RSI Length: 21

SMA Length: 50

Profit Factor: ~1.70

Trades: ~121

Slightly lower profitability than the first configuration, but meaningfully lower drawdown, highlighting a trade-off between responsiveness and stability.

3) ETHUSDT — 1D (Best ETH Environment)

RSI Length: 28

SMA Length: 40

Profit Factor: ~1.55–1.60

Trades: ~110–120

ETH showed acceptable performance on the daily timeframe, but drawdowns were consistently higher than BTC under similar settings.

4) BTCUSDT — 4H (Higher Activity, Lower Stability)

RSI Length: 28

SMA Length: 40

Profit Factor: ~1.55–1.60

Trades: 400+

Lower timeframes increased trade frequency substantially but introduced significantly more drawdown and instability.

Takeaway

Across all tests, performance varied far more by symbol and timeframe than by RSI or SMA length. Small parameter changes often mattered less than the environment the strategy was applied to. Some symbol/timeframe combinations remained relatively stable, while others deteriorated quickly despite using identical logic.

The broader takeaway is that strategy performance is often environment-dependent rather than parameter-dependent. Evaluating a strategy on a single symbol or timeframe can give a misleading sense of robustness. Testing across multiple environments provides a clearer view of where a strategy holds up and where it breaks down.

I’m documenting these tests to better understand robustness, sensitivity, and how commonly used TradingView strategies behave under different market conditions.

THE MARKET CYCLE IS NOT A PRICE CHART, IT IS AN EMOTION CHARTRemember the famous quote by legendary investor John Templeton summarizing market cycles:

"Bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria."

Look at this chart. It's the same story in every cycle, only the players change:

Depression (Bottom): The moment everyone says "Bitcoin is dead" and the black-hooded "Doomer" takes the stage. (2015, 2019, 2022).

Skepticism (Growth): Price rises, but no one believes it. They say, "It's a trap."

Optimism (Maturity): The moment people start saying, "Maybe it is turning."

Euphoria (Top): The moment the wide-mouthed Wojaks appear, and everyone thinks they are a genius.

Where are we now? According to the chart, the market is currently preparing to transition from the "Skepticism" phase to the "Optimism" phase. People are still afraid; they are still expecting a crash. This is the healthiest fuel for a bull run. Because Euphoria has not arrived yet.

bitcoin / BTC / CYCLE

BTC vs HYPE - or we will grow from here like hypeWhy the setups are actually similar (BTC ↔ HYPE)

Common characteristics:

Upward impulse → pullback

The pullback does NOT break the impulse low

Price is holding:

either the 0.382–0.5 Fibonacci zone

or an ascending local trendline

Structure = bullish pullback, but without confirmation

So this is not “weakness” — it’s a test.

2️⃣ Key moment — where we are now

Right now we are:

below the local high

at the edge of a Fibonacci zone, where:

either real buyers step in

or the market says: “Okay, let’s go deeper.”

And this is where it becomes critical:

how the Sunday candle opens

3️⃣ Two scenarios (and they are clean)

🟢 SCENARIO 1 — MOVE UP FROM HERE

Valid if:

Sunday opens without a gap down

The candle holds 0.382 / the trendline

We see:

a long lower wick

or an impulsive reaction to the upside

👉 Then this is:

liquidity collection

trend continuation

targets: a return to the local high + extension

This is a healthy, clean bullish continuation.

🔴 SCENARIO 2 — DROP ON THE OPEN

Triggered if:

Sunday opens below 0.382

The candle closes below the trendline

There is no fast buyback

👉 Then:

the pullback is invalidated

this becomes distribution → continuation down

logical targets:

0.618

or a full retest of the impulse

And this part is critical:

don’t try to catch the knife

because this would no longer be a “correction,” but a phase shift.

BTC DOMINANCE – MARKET STRUCTURE UPDATE. BTC DOMINANCE – MARKET STRUCTURE UPDATE

Current: ~59.8%

BTC Dominance is compressing inside a rising wedge, right below a major resistance zone.

Resistance: 60.5% – 60.8%

Support: 59.2% – 58.8%

Major Breakdown Zone: 57.5%

If BTC.D fails near 60.5–60.8%,

Expect Dominance drop toward 58%–57.5%

ALTCOINS likely to outperform (Altseason push) 🚀

Price is near the wedge apex → volatility incoming

Cloud + trendline rejection favors a fake breakout/rejection

$BTC Weekend LTF OutlookCRYPTOCAP:BTC wicked into the 91ks, then trading back below 90k.

I’d only look for long if we get a deviation into 86.8k–86.4k, targeting 91.8k–92.6k. I’ll be looking to short there if the move pans out with a clean rejection.

What we’ll be keeping an eye on is if it starts ranging again below 90k, there’s a risk we break down into 74k–72ks.

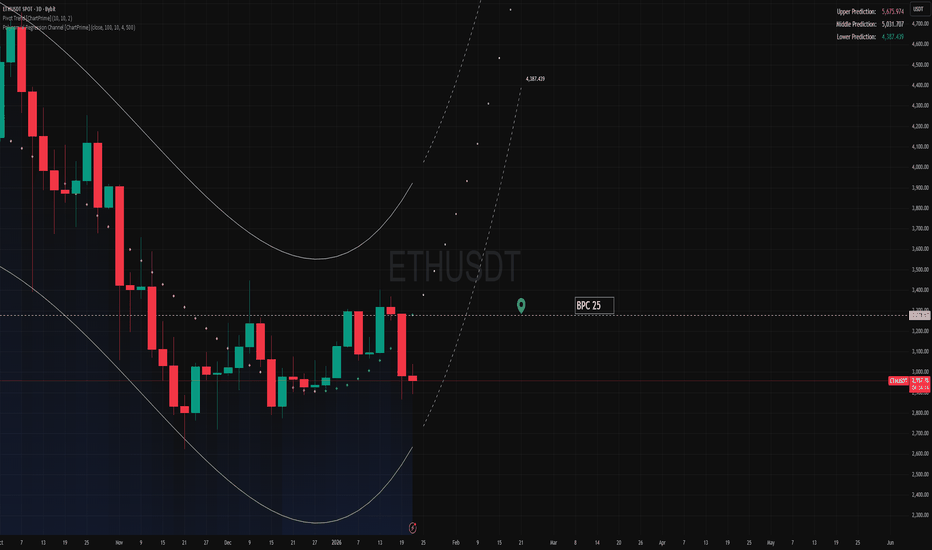

ETH — Price Slice. Capital Sector. 3278.67 BPC 25© Bolzen | The Architect | BPC Framework

Bolzen Market Institute

🏷 ETH — Price Slice. Capital Sector.

TradingView Publication Date: 24.01.2026

🏷 3278.67 — price not yet reached at time of publication.

🏷 BPC — The Bolzen Price Covenant — Strength Index: 25

Quantum structure of obligations and capital flow in price formation via energy blocks.

🏷 Vertical chart — Energy Grid Dashboard.

🏷 Static Stream 1: price published in energy-block production sequence.

🏷 The price energy block is already ordered—not by time, but by execution priority. Crucially: block priority dynamically reconfigures in response to hidden energetic impulses, whereas price execution order records their market manifestation. Every price in the dynamic stream is tied to proprietary energy-production metrics inaccessible to the general public. Those who perceive structure before its manifestation do not follow price—they anticipate it.

EΞ2Φ8Ψ45Θ·ζ⁻¹·106Λ732·Ω²

📎 Screenshot:

🏷 When trading from levels, use liquidity zones from BPC 10 and above.

🏷 Bolzen Liquidity Map — ETH (numerical equivalent):

🏷 I. Interactive Reference Guide: BPC — The Bolzen Price Covenant

🏷 P.S. English is not my native language — I offer no apologies for stylistic imperfections. What you see here is not a post. It is a demonstration of another level of preparation: the symbiosis of human intuition and algorithmic precision. Mathematics and aggressive market analysis — against the machine of liquidations.

The persistent ETH and BTC Energy Grid Dashboard remains publicly accessible and is intended for international institutional review.

Dear international community,

I extend my gratitude to the TradingView moderation team for their impartiality and support of analytical work at the global level, as well as to all who follow my research. This platform serves as a space to demonstrate contributions to the advancement of market analytics.

Attention and time are your most valuable resources. ATH is emotion; timeframes are your truest allies. Thank you.

— The Architect

BPC — The Bolzen Price Covenant