BITCOIN MONDAY ANALYSIS (the next move is incoming) Yello Paradisers! Enjoy the video!

And Paradisers! Keep in mind to trade only with a proper professional trading strategy. Wait for confirmations. Play with tactics. This is the only way you can be long-term profitable.

Remember, don’t trade without confirmations. Wait for them before creating a trade. Be disciplined, patient, and emotionally controlled. Only trade the highest probability setups with the greatest risk to reward ratio. This will ensure that you become a long-term profitable professional trader.

Don't be a gambler. Don't try to get rich quick. Make sure that your trading is professionally based on proper strategies and trade tactics.

Btc-e

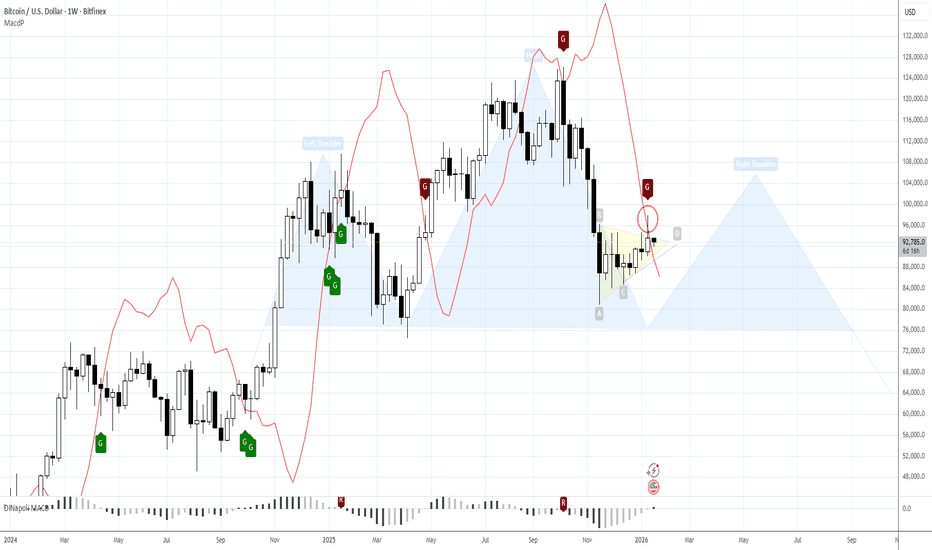

BTC – The Perfect Intersection!I called this area the "perfect intersection" for a reason.

BTC is now reacting around a level where everything lines up:

- the lower blue trendline

- the 90,000 round number

- a clear demand zone

- and prior structure acting as support

When multiple factors meet at one place, I pay attention.

As long as BTC respects this zone, the path remains open for another push higher.

If buyers step in here and defend it, I’ll be looking for continuation rather than guessing tops.

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Solana| Bounce From Key Support – Long Spot SetupSolana (SOL) has retraced into a key support zone between $127–$133, an area that has previously acted as a solid base for bullish reversals. Price action is consolidating with declining sell volume, hinting at a potential bounce.

🔹 Entry Zone: $127 – $133

🔹 Take Profit Targets:

• TP1: $148 – $154

• TP2: $170 – $180

🔹 Stop Loss: Just below $125

BTC/USDT – 4H Chart Update. BTC/USDT – 4H Chart Update

Price is pulling back into a major demand zone (92,000–93,500)

Price remains above the 4H moving average, which is acting as dynamic support

The long-term rising trendline remains unbroken, keeping the macro bias bullish

Immediate Support: 92,000 – 93,000

Support: 90,200

Strong Support: 84,400 (HTF Demand)

Resistance: 95,500 → 97,800 → 99,000

If BTC holds above 92K and reclaims 93.5K, further upside is likely

Targets:

95,500

97,800

99,000+

A break below 92K with high volume could lead to a larger pullback towards the 90K MA support

The structure only weakens below 90,200

BTC is in a healthy pullback within an overall uptrend. As long as the price remains above the moving average and the rising trendline, dips remain buying opportunities rather than trend reversal signals.

⚠️ This is not financial advice. Trade with proper risk management.

BITCOIN | $90K Defense as Macro Volatility BuildsBitcoin Bulls Defend $90K as U.S. Macro Events Loom

Bitcoin bulls continue to defend the $90,000 psychological level despite heightened geopolitical volatility. With Fed rate-cut expectations shifting, traders are closely watching a packed U.S. economic calendar, which could drive sharp moves across BTC and the broader crypto market.

Key U.S. Economic Events to Watch

1️⃣ President Trump Speaks – Jan 21, 1:30 PM ET

President Donald Trump’s speech at the World Economic Forum in Davos is expected to be a potential market mover. Given his history of unscripted comments on tariffs, trade, and geopolitics, markets will be sensitive to any remarks affecting USD strength and global risk appetite.

2️⃣ Initial Jobless Claims

Economists forecast 203K, up from 198K previously.

Recent data surprised to the downside, signaling a resilient labor market, which continues to support the USD and may weigh on risk assets, including crypto.

3️⃣ Core PCE Price Index – Jan 22, 1:30 PM ET

The Fed’s preferred inflation gauge is expected at 0.2% m/m, up from 0.1%.

A hotter print could delay rate cuts, boost yields, and pressure Bitcoin and altcoins, as capital rotates toward interest-bearing assets.

4️⃣ Consumer Sentiment – Jan 23, 3:00 PM ET

The revised University of Michigan Consumer Sentiment Index is expected to hold at 54.0, a historically depressed level. Weak sentiment may increase volatility and reinforce macro uncertainty across markets.

Technical Outlook (BTC)

Bitcoin’s structure remains constructive, but momentum depends on key support levels.

Bullish Scenario:

Holding above 92.5K and 88.16K supports upside continuation toward:

100.8K - 106.2K

Bearish Scenario:

A confirmed break below 88.16K would shift momentum bearish, targeting:

83.5K -76.68K

Key Levels

Pivot Line: 88.16K

Resistance: 100.8K – 106.2K

Support: 83.5K – 76.6K

$BTC 1D Update: Middle of the RangeBitcoin update.

BTC is still trading in the middle of its higher timeframe range here, so this is not a breakout zone, but I lean bullish overall. Price is holding above the key mid-range support around the low-90s and continues to put in higher lows since the last flush, which suggests buyers are defending value rather than stepping away.

As long as BTC holds this range and doesn’t lose reclaimed support, the path of least resistance remains higher. A clean push back toward the upper range near 108k would be the next meaningful test. Until then, expect chop, but I favor dips over tops while this structure holds.

BTC bearish divergence negated, 200EMA not yet testedCRYPTOCAP:BTC

🎯The bottom appears to be in as Bitcoin climbs the wall of worry once more. BTC showed strength this week, rejecting just below the daily 200EMA. This isn’t a great sign, I would like to have seen it tested to show strength. Still a possibility from here as price tests resistance, flipped support. Wave (3) appears to be underway; we should expect a strong move in the coming days/weeks. The first resistance will be the daily 200EMA; overcoming this will be bullish. Price is above the daily pivot, showing a bullish trend emerging.

📈 Daily RSI is creeping to overbought, bearish divergence was negated.

👉 Analysis is invalidated below wave (2), bringing up the downside target $76600

Safe trading

BITCOIN 1W Ichimoku just turned red. Massive Bear Cycle signal.Bitcoin (BTCUSD) has turned its 1W Ichimoku Cloud red following an impressive run of more than 2 straight years of green. Historically, every time this development took place, the market was already on a Bear Cycle.

Technically this is the latest signal to confirm the 2026 Bear Cycle and the last times it took place, BTC bottomed at -68% (on all cases) from the following High rejection on the 1D MA200 (black trend-line). Based on the current position of the 1D MA200 a -68% decline would have the market test $35k.

Since however BTC bottomed on its 1W MA350 (red trend-line) during its last Bear Cycle, we should be expecting to hit it again. Based on its current trajectory, that should take place on $55000 at least. And given the fact that since 2018, every Bear Cycle bottom is a +150 MA lower on 1W (2018 bottom on 1W MA200, 2022 bottom on 1W MA350), we can assume that the 1W MA500 (grey trend-line) could get hit. That creates a potential fair bottom zone within $55000 - $40000, for use of optimistic - pessimistic scenarios.

So do you think the 1W Ichimoku Cloud turning red has confirmed the Bear Cycle? Feel free to let us know in the comments section below!

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Riot Announces Fee Simple Acquisition of Land with AMDRiot Platforms, Inc. (NASDAQ: RIOT) is pleased to announce a series of transformative transactions that firmly establish the Company’s rapidly scaling data center business, including:

The fee simple acquisition of 200 acres of land at Rockdale currently occupied by Riot (the “Rockdale Site”) for total consideration of $96.0 million funded entirely by the sale of approximately 1,080 bitcoin from Riot’s balance sheet, adding the Rockdale Site to Riot’s portfolio of data center development opportunities.

The signing of a Data Center Lease and Services Agreement (“Data Center Lease”) with Advanced Micro Devices, Inc. (“AMD”), a leading innovator in high-performance computing, graphics and visualization technologies, at the Rockdale Site, which includes an initial deployment of 25 MW of critical IT load capacity to be delivered in phases beginning in January 2026 and completing in May 2026, with the potential for additional expansion of up to a total of 200 MW of critical IT load capacity.

Technically, NASDAQ:RIOT shares broke out of a bullish falling wedge spiking 16% in Fridays market session.... in todays premarket session the asset is doing well- up by 0.32% as momentum builds.

Analyst Summary

According to 12 analysts, the average rating for RIOT stock is "Strong Buy." The 12-month stock price target is $26.13, which is an increase of 35.81% from the latest price

About RIOT

Riot Platforms, Inc., together with its subsidiaries, operates as a Bitcoin mining company in the United States. The company operates in two segments, Bitcoin Mining and Engineering.

19/01/26 Weekly OutlookLast weeks high: $97,925.71

Last weeks low: $90,140.82

Midpoint: $94,033.27

So close, yet so far!

After a strong start to the week BTC pushed through the all important $94,000 level with strength and purpose reaching a high of ~$98,000, shy of the bullish target at $100,000. However the resistance approaching that level is clearly strong as price was quickly rejected and pushed towards retesting the $94,000 level.

This coincided with last weeks outlook as the weekly high, after two clear retests price consolidated above the level, price compression takes place and from there the probability of a breakdown increases dramatically. Which is how we have started this week with an aggressive move lower within the opening hour of the week. In essence the bulls are back to square one, trying to flip the $94,000 level.

The bears are still in control on the larger time frame, the Midpoint is the key battleground area once again with whoever controls that line looking to push towards either the weekly high for the bulls or the weekly low for the bears.

BTC Is Stalling at Resistance — Distribution Before the Next Dro1. Current Market Structure

Bitcoin remains in a broader bullish context, but the short-term structure on H1 is showing clear signs of exhaustion. After a strong impulsive rally from the 91K–92K region, price expanded aggressively into the 97.5K–98K resistance zone. Since then, momentum has faded and the market has shifted into sideways-to-lower consolidation, suggesting buyers are no longer in full control. This is not a reversal yet, but it is no longer a clean continuation either.

2. Key Zones & Market Positioning

Major Resistance Zone: 97,600 – 98,000 → Multiple rejections and long upper wicks indicate heavy sell pressure

Immediate Support: 95,700 → Breakdown here would confirm short-term weakness

Dynamic Support (EMA 89): ~94,100

Deeper Support Targets:

- 93,100

- 91,800 (major demand / prior base)

As long as price trades below the resistance zone, upside potential remains capped.

3. Liquidity & Price Behavior

The rally into 98K appears to have swept buy-side liquidity, followed by rejection a classic sign of distribution at the highs. The current choppy price action reflects order absorption, not accumulation. Buyers are defending locally, but without strong follow-through, increasing the probability of a downside rotation.

4. Short-Term Market Scenari os

🔽 Primary Scenario – Bearish Pullback (Higher Probability)

Price fails to reclaim 97.6K–98K

Breakdown below 95.7K confirms distribution

Price rotates toward EMA 89 (~94.1K)

Extension targets: 93.1K → 91.8K

🔼 Alternative Scenario – Bullish Continuation (Lower Probability)

Clean breakout and acceptance above 98K

Strong volume expansion

Opens the path toward higher highs above 100K

Without a confirmed breakout, this scenario remains secondary.

5. Trading Perspective

Bias: Sell rallies into resistance, not chase longs

Best approach: Patience wait for confirmation below support

This is not accumulation at the highs; it is a pause after expansion

Summary

Bitcoin is no longer trending impulsively.

It is stalling at resistance, distributing liquidity, and preparing for a corrective leg.

As long as the 97.6K–98K zone holds, the roadmap remains clear:

Rejection → Breakdown → Pullback to key demand zones.

Bitcoin Enters Greed at Major Resistance—Bull Trap or Breakout!?Bitcoin ( BINANCE:BTCUSDT ) is currently trading near a key resistance zone($102,000-$97,900), overlapping with a Potential Reversal Zone (PRZ) and the 100_SMA(Daily), which makes this area technically sensitive.

The Bitcoin Fear & Greed Index has finally entered the Greed zone after several weeks, suggesting improving sentiment—but also raising caution from a contrarian perspective.

Bitcoin appears to be attempting a breakout above the $95,000 level, which is a major psychological and technical trading zone. However, this breakout has not been supported by strong volume, which weakens its reliability.

From an Elliott Wave perspective, Bitcoin seems to be in the final stages of completing the main Wave C. The internal structure of this Wave C resembles an Expanding Ending Diagonal, a pattern that often appears near the end of corrective or terminal moves.

One of the main external risks for Bitcoin and other risk-on assets is the potential escalation of geopolitical tensions in the Middle East, which could intensify in the coming days and increase market volatility.

As long as Bitcoin fails to stabilize and hold above the $102,000 level, there is still a strong possibility that the recent rally over the past few weeks is corrective in nature, rather than the start of a new impulsive uptrend. In that case, Bitcoin could resume a deeper pullback.

First Target: $94,023

Second Target: Cumulative Long Liquidation Leverage: $93,520-$92,580

Stop Loss(SL): $100,823/$102,143(Worst)

CME gap: $94,790-$94,415

CME gap: $88,720-$88,120

Cumulative Long Liquidation Leverage: $87,125-$86,000

What’s your view on Bitcoin?

Has Bitcoin already started a new bullish trend, or should we still expect another corrective move?

💡 Please respect each other's opinions and express agreement or disagreement politely.

📌Bitcoin Analysis (BTCUSDT), Daily time frame.

🛑 Always set a Stop Loss(SL) for every position you open.

✅ This is just my idea; I’d love to see your thoughts too!

🔥 If you find it helpful, please BOOST this post and share it with your friends.

Bitcoin Completes an Impulsive CycleHello traders! Here’s a clear technical breakdown of BTCUSD (1H) based on the current chart structure. Bitcoin has completed a full impulsive Elliott Wave sequence (1–5), with wave (5) marking the local top and momentum exhaustion point. The advance into wave (5) was strong, but notably lacked continuation follow-through afterward, which is a classic early warning of a trend transition.

Following the completion of wave (5), price has shifted into a corrective market phase, forming an ABC structure. The price action is now characterized by overlapping candles, lower highs, and weaker rebounds, confirming that bullish momentum has faded and the market is no longer in impulse mode. This transition signals a cycle shift from expansion to correction, not just a random pullback.

SUPPLY & DEMAND – KEY ZONES

Major Distribution / Wave (5) Supply Zone:

The region around the wave (5) high represents distribution at premium, where smart money typically exits long exposure. The sharp rejection from this zone confirms strong seller presence.

Corrective Structure Levels (ABC):

Wave (A): Initial impulsive sell-off, breaking bullish momentum

Wave (B): Weak corrective bounce, failing to reclaim prior highs

Wave (C): Ongoing decline, currently developing with expanding downside risk

Macro Support / Cycle Low:

The 90,000–90,300 zone stands out as a critical higher-timeframe support, aligned with the base of the prior accumulation range and the projected completion zone of wave (C).

🎯 CURRENT MARKET POSITION

Currently, BTC is trading inside the corrective phase, with price action suggesting wave (C) is still unfolding. The inability to reclaim prior structure highs confirms that bounces are corrective, not impulsive.

Momentum structure now favors continuation lower, unless the market invalidates the corrective count by reclaiming key resistance levels with strength.

🧠 MY SCENARIO

As long as Bitcoin remains below the wave (B) high and fails to re-enter the impulsive structure, the probability favors continued downside toward the 90,000 support zone, where wave (C) may complete.

That area is critical:

- A strong reaction there could mark cycle reset and re-accumulation

- A clean breakdown would signal deeper corrective extension and broader trend weakness

Only a decisive reclaim above the corrective highs would invalidate the ABC scenario and reopen the path for bullish continuation.

For now, Bitcoin is in correction after impulse, not in trend continuation.

⚠️ RISK NOTE

Corrective phases are volatile and deceptive. Trade reactions, not predictions, respect key invalidation levels, and always manage your risk.

Bitcoin Compressing at Demand Bitcoin on the 45-minute timeframe is currently holding above a well-defined demand zone around 95,180–94,700, while price continues to respect a descending trendline acting as dynamic resistance. This structure reflects compression, not weakness.

Price has already completed a corrective pullback from the prior impulse and is now stabilizing above demand, with downside attempts failing to gain follow-through. The yellow EMA is flattening and aligning closely with current price, signaling loss of bearish momentum and a transition into balance.

As long as Bitcoin defends the demand zone, the market is positioned for a bullish resolution. A clean break and acceptance above the descending trendline would confirm a shift in short-term structure, opening the path toward 96,800 → 97,600 → 98,600 as upside objectives.

However, a decisive breakdown below 94,700 would invalidate the bullish setup and expose deeper downside liquidity.

➡️ Support: 95,180–94,700

➡️ Key trigger: Break & close above descending trendline

➡️ Bias: Neutral → Bullish on breakout

➡️ Invalidation: Acceptance below demand zone

Bitcoin is not trending yet it’s loading liquidity.

ETH Trapped Between Supply & Demand On the H1 timeframe, Ethereum is clearly transitioning from impulsive strength into a balanced range environment. After a sharp bullish breakout, price stalled inside a well-defined resistance zone around 3,380–3,420, where repeated attempts to push higher have been rejected. This behavior confirms that sell-side liquidity is actively defending the highs, preventing continuation for now.

Structurally, ETH is printing overlapping swings with equal highs and shallow pullbacks, a textbook sign of consolidation rather than trend continuation. On the downside, the support zone around 3,260–3,280 continues to attract buyers, aligning closely with the rising EMA structure. As long as this zone holds, downside pressure remains corrective, not impulsive.

However, momentum has noticeably weakened. Each push into resistance lacks follow-through, while bounces from support are becoming less aggressive. This suggests buyers are absorbing supply, but not yet strong enough to force a breakout. The market is effectively coiling, compressing volatility between supply and demand.

From a trading perspective, ETH is currently in a high-risk middle-range zone. The higher-probability opportunities will come from reactions at the extremes:

A clean rejection from resistance keeps the bias short-term bearish, opening room for a deeper pullback toward 3,200–3,150.

A strong breakout and acceptance above 3,420 would invalidate the range and signal trend continuation toward higher expansion targets.

➡️ Market state: Range / consolidation

➡️ Key resistance: 3,380–3,420

➡️ Key support: 3,260–3,280

➡️ Bias: Neutral-to-bearish below resistance, bullish only on confirmed breakout

Until the range resolves, ETH is best treated as a reaction-based market, not a directional one.

Bitcoin Is Losing Momentum at Range Mid1. Higher-Timeframe Context & Trend Quality

Bitcoin remains structurally bullish on the higher timeframe, but the current H1 structure is no longer impulsive. After a strong vertical expansion from the 91k area, price failed to hold above the prior highs and has now transitioned into overlapping, corrective price action. This signals that momentum has slowed and the market is digesting liquidity, not trending cleanly.

The EMA 98 is still rising and located well below price, meaning the broader trend is intact however, short-term control has shifted away from buyers.

2. Key Supply & Demand Zones

Major Resistance Zone: 96,700 – 97,800 → Clear supply absorption, repeated rejections, failure to hold highs

Mid-Range Resistance (Now Acting as Cap): ~96,000 → Price repeatedly stalls here, showing weak follow-through

Key Support Zone: 94,600 – 94,800 → First meaningful demand aligned with EMA 98 trajectory

Deeper Demand / Liquidity Pool: 92,300 – 92,500 → Likely downside magnet if support breaks

Price is currently trapped between resistance overhead and weakening demand below, which is a classic environment for stop-hunting and fake recoveries.

3. Price Action & Liquidity Behavior

The recent bounce attempts are corrective in nature shallow, overlapping candles with no impulsive bullish continuation. This suggests buyers are reactive, not proactive.

The curved downside projection on the chart reflects a typical distribution → breakdown → expansion sequence:

First, price holds sideways to trap late buyers

Then, liquidity is taken below local lows

Finally, price accelerates toward deeper demand zones

Importantly, no higher high has been formed since the rejection from the upper resistance zone, confirming loss of bullish control on H1.

4. Scenario Outlook

🔽 Primary Scenario – Corrective Breakdown (Higher Probability)

Failure to reclaim and hold above ~96,000

Loss of 94,600 support

Acceleration toward 92,300 – 92,500 liquidity zone

This would still be a pullback within a broader uptrend, not a trend reversal.

🔼 Alternative Scenario – Bullish Reclaim (Lower Probability)

Strong impulsive reclaim above 96,800

Acceptance above the prior range highs

Opens path back toward 97,800+

Without volume and momentum, this scenario remains secondary.

5. Trading Perspective

Bias: Neutral → Bearish (short-term)

Avoid longs in the middle of the range

Shorts only make sense on rejection from resistance or confirmed breakdown

Best longs are patience-based, waiting at deeper demand zones

Summary

Bitcoin is not breaking down yet but it is clearly distributing momentum after a strong rally.

As long as price remains below key resistance and momentum stays corrective, downside liquidity remains the more attractive target.

This is a cooling phase, not a continuation leg and the market is preparing for its next decisive move.

BTC WEEKLY BEARISH GRABBER IS SETMorning folks,

Today a short update, as last time we explained our position in details. So, the clarity has come, we've got our bearish grabber on weekly chart. This pattern suggests drop back to 76-80$ K lows within a few weeks.

Now we consider no longs. From fundamental point of view, appearing of this pattern is quite logical now. Geopolitical tensions are raising and demand for high risk assets is dropping. BTC is one of the most risky assets with questionable potential return. So, it is not a surprise that it is under pressure. Clarity Act has not passed the Senate and postponed...

So, right now we rather watch for chances to sell, at least until this pattern holds.

Bitcoin Keeps Printing Higher Highs — Trend Continuation On the H1 timeframe, Bitcoin is maintaining a textbook bullish market structure, clearly defined by a consistent sequence of higher highs (HH) and higher lows (HL). After reclaiming and holding above the key moving averages, price transitioned into a strong impulsive phase, with each pullback remaining shallow and corrective rather than aggressive. The most recent retracement respected the prior higher-low zone and the rising MA, confirming that buyers are still firmly in control and that selling pressure remains limited to profit-taking, not distribution.

From a structural perspective, the current pullback is forming a healthy higher low, which is a critical condition for trend continuation. Momentum has already re-engaged after the pullback, signaling that demand is stepping in earlier rather than waiting for deeper discounts. This behavior typically appears in strong trending markets, where price does not allow extended corrections. As long as Bitcoin holds above the recent HL area and above the moving averages, the bullish structure remains fully intact.

Looking ahead, the market roadmap remains straightforward: continuation toward the next upside liquidity zone. A sustained push above the recent HH opens the path toward the 98,700 region, with a further extension toward the psychological 99,500–100,000 zone if momentum accelerates. Any short-term dips into the higher-low region should be viewed as continuation opportunities, not weakness. The bullish scenario would only be invalidated if price breaks decisively below the last higher low, which would signal a deeper corrective phase. Until then, Bitcoin is not topping — it is trending, reloading, and preparing for the next expansion leg.

ETHEREUM - Bullish market behavior pattern. Confirmation?BINANCE:ETHUSDT is forming a consolidation in the $3300 zone in a “descending wedge” pattern, which is a relatively bullish market behavior model.

The market is reacting to the improvement in the fundamental background, inflows of funds are increasing, and buyers are showing interest. Local trends are beginning to change for the better. After the rally, Bitcoin is trying to consolidate above 94-95K, and if it succeeds, we will have a green signal.

Ethereum is consolidating and fighting for the 3300 zone after implementing a U-formation pattern. Overall, there are signs of bulls in the market, and if buyers keep the price above 3300, the market will have an opportunity for growth.

The price is forming a descending wedge against the backdrop of a local bull market. A close above 3315 will be a confirming signal for growth.

Resistance levels: 3315, 3383, 3450

Support levels: 3300, 3281

The price has consolidated above 3300 and above 3315, as well as broken the resistance of the descending wedge. If the bulls keep the price above these key areas, another bull run may form...

Best regards, R. Linda!

Could we see a bullish reversal from here?Bitcoin (BTC/USD) is reacting off the pivot, and a bounce could lead the price to rise to the 1st resistance.

Pivot: 92,972.95

1st Support: 84,280.72

1st Resistance: 106,899.10

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

$BTC - Possible Second Test into 95-96kBINANCE:BTCUSDT | 2h

Price got capped and stalled under 96k and broke down into 92k (local demand zone).

I think if we can hold 92-90k, we might get a secondary upthrust back into 95–96k

If you’re short, I’d consider de-risking or just closing it out here — especially if we end up holding this current low / the 90k zone.

BRIEFING Week #3 : ETH and OilHere's your weekly update ! Brought to you each weekend with years of track-record history..

Don't forget to hit the like/follow button if you feel like this post deserves it ;)

That's the best way to support me and help pushing this content to other users.

Kindly,

Phil

BTC Bearish cycleAs I see it BTC we are going into a long term retracement below the 50% of the previous bullish range.

The price target is at OTE level (Optimal Target Entry)around 45.000$ .

BTC revolve in cycles ,bearish and bullish and it often ,almost always repeat the same price delivery at the same time.

The bearish cycle :

-365 day

The bullish cycle :

-around 1060 days

But how do I calculate?

Placing a Fib projection from the lower low to the higher high of the BEARISH range, once the leg(range) is broken(the higher have been taken , we can approximate our target as you can see in the image are pretty precise.

To find the bearish target ,always below 50% of the Bullish (explanation on image).

I do so expect to go into a big buy by this year October .

This is a fully technical and only analysis ,but long term calculations do not lie.

Let me know in the comments what you think about it.