BITCOIN - From the DISTRIBUTION phase to the CONSOLIDATION phaseBINANCE:BTCUSDT.P tested 60K during the current cycle and formed a fairly significant pullback to 70K. However, it is too early to talk about a bullish trend; this is just a reaction to liquidation. The cycle continues...

At the moment, the decline is 52%, which is historically within acceptable limits and is a relatively average indicator.

Fundamentally, there is no support for the crypto market, and Friday's pullback was supported by the recovery of the US stock market.

Global and local trends are bearish, and local spikes in volume and bullish impulses are possible in the hunt for liquidity, which should be viewed conservatively.

The price has entered the key trading channel of 53K - 73K and is likely to stop within the current cycle and form another trading range, which may subsequently reinforce the reversal momentum. Key liquidity zones have not yet been tested: 59650 - 53330.

Resistance levels: 71,900, 73,800, 82,200

Support levels: 65,000, 59,650, 53,330

How can we tell that the market is ready to reverse? Technically, the reversal phase does not come immediately after distribution, the cycle of which is still ongoing. The market must enter a consolidation phase with the gradual formation of sequentially rising lows/highs. The breakdown of local structures + the market holding above key resistance levels will hint at a positive market sentiment.

Thus, we are waiting for the formation of an intermediate bottom and a change in the market phase from distributive to consolidation...

Best regards, R. Linda!

Btc-e

BTC Friday Retrace Hits VWAP: Bullish Reversal or Bull Trap?Will Bitcoin hold this level, or are we looking at a deeper correction?

The Friday retrace played out exactly as anticipated, with price pulling back into the VWAP and establishing a reversal into the weekly close. We are now sitting at a major resistance level where the market must decide its next macro move. In this video, I break down the exact price action signals I'm watching to determine if we break bullish or if the bears take control for a deeper run into the lows. 📉🚀

As a trader, the most dangerous move is front-running a breakout before the market settles. I’ll walk you through my Step-by-Step Trade Plan for the beginning of the week, including the specific entry triggers and risk zones I’m using to navigate this volatility.

What we cover today:

The significance of the Friday VWAP retrace and weekly close 📊

Key support and resistance levels for the Monday open 🔑

Market structure shift vs. trend continuation scenarios

My personal bias

Stay Disciplined: We don't predict; we react. Let the market settle into the new week and provide the confirmation needed to execute.

⚠️ RISK DISCLAIMER: Trading involves significant risk. This video is for educational and entertainment purposes only and does not constitute financial advice. Always perform your own due diligence before risking capital.

EURUSD Bearish Continuation After Liquidity SweepEURUSD on the 2H timeframe shows a completed bullish channel followed by a liquidity sweep at the highs, which marked exhaustion of the uptrend. After the sweep, price broke down from the rising structure and moved below the Ichimoku cloud, signaling a shift to bearish momentum. The pair is now consolidating in a tight range, suggesting distribution before the next move. As long as price remains capped below the cloud and prior channel support, the bias favors a downside continuation toward the marked target zone.

ETHUSD Trend Shift: Bullish CHoCH from Demand ZoneETHUSD on the 2H timeframe is coming out of a strong descending channel after tapping a clear demand zone near the lows. The market printed a bullish CHoCH (change of character), signaling a potential short-term trend reversal. Price is now consolidating around the Ichimoku cloud, suggesting early accumulation, with upside room toward the first resistance/target area around the 2,400 zone. Overall bias shifts from strong bearish momentum to a cautious bullish recovery while price holds above the demand base.

Bitcoin $58,700 SupportBitcoin fell very close to final support in a dramatic sell off. That means there's a potential for it to move in this current uptrend range for a bit before it could eventually hit $58.7k. It's possible there simply aren't enough sellers to get us exactly to support either, but just keep in mind that's your optimal place to buy. This cream uptrend could also be the second best place to buy on the chance it doesn't make it to $58.7k (it's at least likely to be a good short term trade I currently have shorts at the close Friday targeting that trendline). I personally am waiting for it to hit 58.7k before buying. Ethereum still has a bit further to go to $1,530 for support, suggests to me that Bitcoin isn't done falling.

Good luck!

Bitcoin monthly —Support found at EMA55There are many things to consider. The market represents a natural force, a force of nature. It is a collective mind, human action. It represents one aspect of our collective mind. When we are thinking, being and feeling in a certain way, this is reflected in the market, that being neutral, bearish or bullish.

The market never stays the same, just as nothing stays the same in our bodies, minds and world. Everything is always in a constant flux. Everything is always changing.

The most basic part of this phenomena is the intrinsic duality of this world. It doesn't matter where you live, you can never miss the fact that the day changes between night and day. This basic reality is reflected as bearish and bullish in our market.

When the day comes, we know night is always lurking right around the corner. When the market is bearish, we know that bullish comes next.

Bitcoin found support on the monthly timeframe right at EMA55, trading five consecutive months red. A very strong bearish impulse. This is the night, now comes day.

EMA55 is a very strong support. So now we get some sort of reversal, some sort of relief, some sort of bullish action. The night makes way for the appearance of the sun. The morning has come. It is a bright day. We are going up.

Namaste.

Bitcoin: Wave 5 Toward New Highs!Following on from our last Bitcoin update, here’s how the structure is currently developing.

Structure

- Higher timeframe: Wave 5 in progress, forming an ending diagonal

- Current wave: Wave 4 correction (W-X-Y), currently in wave Y

- Pattern / formation: Corrective pullback within a larger wave-5 advance

Bias

- Directional bias: Bullish

- Invalidation level: Loss of structure / failure to hold the buy zone

Focus

- What we are waiting for: Price to move into the buy zone, where we’ll look for lower-timeframe reversal confirmation (trendline break, impulsive reclaim, or momentum shift) to position for wave-5 continuation

Targets

- Primary targets: 125k, 150k

- Extended target: Hold a runner toward 200k

btc sunday close on weekly candle📈 Bitcoin Weekly Candle Expectation

Based on the current lower timeframe structure, my expectation for the weekly Bitcoin candle (closing on Sunday night) is the following:

Before the weekly close, price is likely to print a higher high on the 1H timeframe

After that, we should see a lower low sweep, taking liquidity below the recent lows

This move is designed to trap both breakout longs and early shorts

🔻 Once liquidity is fully taken on both sides,

🔺 price is expected to move higher into Sunday night, closing the weekly candle as a bullish pin bar.

🕯️ Weekly Context

This type of weekly close:

Shows strong rejection from lower prices

Confirms absorption of sell pressure

Fits perfectly with a Wyckoff-style accumulation and liquidity grab

A bullish pin bar on the weekly timeframe would be a strong signal of buyers stepping in, especially after a clean lower low sweep.

🎯 Summary

Short-term volatility is expected

Liquidity will be taken both above and below

Weekly candle is likely to close bullish with a long lower wick

Patience until the weekly close is key

If this structure makes sense to you,

👉 make sure to follow me for more real-time Bitcoin and crypto market insights.

Smart money leaves clues — we just need to read them 🧠📈🔥

TradeCityPro | Bitcoin Daily Analysis #261👋 Welcome to TradeCity Pro!

Let’s move on to Bitcoin analysis. After the recent sharp drop, the market is now going through an upward corrective move.

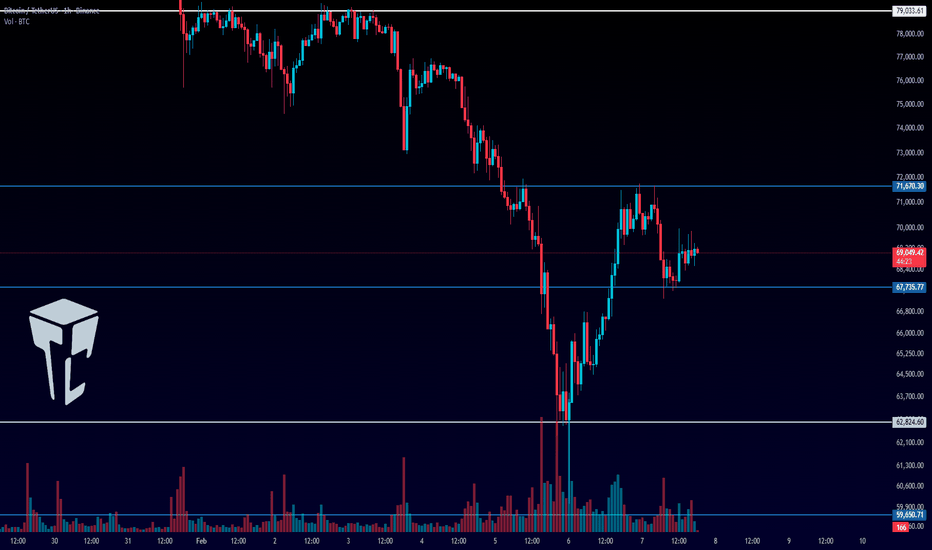

⏳ 1-Hour Timeframe

After Bitcoin’s bearish move down to the 62,824 support, it entered a corrective phase and has so far retraced up to 71,670.

✔️ During this correction, volume has decreased, which confirms the strength of the bearish trend. Now, as a new bearish leg appears to be starting, selling volume is increasing again, further supporting the continuation of the downtrend.

✨ At the moment, the short trigger we have on Bitcoin is 67,735. This trigger remains valid as long as price does not stabilize above 71,670, and we can open a short position on a clean break of this level.

💥 The main short trigger is still the break of 62,824. That said, in my view, if price continues lower, it will likely react to another low and form a new structure before moving further down—but for now, 62,824 remains our key trigger.

📊 For long positions, we have a very risky trigger at the break of 71,670. This setup is only worth considering if buying volume starts to increase, and even then, it should be taken with minimal risk.

🔔 The main long trigger will only be confirmed after a trend change on higher timeframes, such as the 4-hour and daily charts.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

BTCUSD — Defensive Structure Below Key MAs | Bottoming ProcessBitcoin remains in a defensive technical regime after a sharp 30–50% decline from the October 2025 peak, driven by macro tightening, leveraged long liquidations, and sustained fund outflows. Although institutional spot ETF accumulation continues to provide a longer-term structural tailwind, current price structure has not yet repaired, keeping the near-term outlook cautious.

Technical Structure

Price trades below all major trend references:

SMA200: 102,542

SMA50: 87,298

EMA20: 79,868

This alignment confirms a broken long-term structure and a still-bearish medium-term trend. Momentum signals are mixed: RSI near 53 indicates neutral internal momentum, while ADX around 44 shows a strong directional trend environment that still favors continuation risk to the downside. MACD histogram prints are marginally positive but remain insufficient to confirm a structural reversal. Volume and order-flow readings show no decisive accumulation phase yet.

Key Levels

Immediate resistance: 89,496

Critical structural support: 60,000

Mining-cost support zone: ~58,740

Scenario Outlook

Bullish structural repair: A sustained daily close above 89,496 followed by reclaiming EMA20 and SMA50 — and ultimately SMA200 — would shift bias toward a renewed bullish structure.

Bearish continuation risk: Failure to hold the 60,000 support zone would reopen downside tests toward the mining-cost area (~58,740) and potentially extend the prevailing downtrend.

Summarized

Current conditions suggest a neutral / defensive stance, as no high-probability entry structure is present until either structural resistance is reclaimed or a confirmed accumulation pattern forms near major support.

Bitcoin (BTC/USD) – Weekly Timeframe Bullish OutlookBitcoin remains structurally bullish on the weekly timeframe despite the recent ~10% dump, which appears more like a liquidity-driven flush and leverage reset than true distribution. Price has sold off impulsively into a major confluence support zone around 69k–73k, aligning with prior consolidation, high-volume acceptance, and the rising weekly trendline, which has been wicked below but not decisively lost on a closing basis. As long as BTC holds above this region and, critically, above the 52.8k cycle higher low, the broader bull market structure of higher highs and higher lows remains intact. A reclaim of 72.9k followed by 92.6k would signal momentum restoration and open the path back toward 108k+, while failure to hold current levels risks a deeper, but still bull-market, correction. Overall, this pullback fits historical bull-cycle behavior, with buyers favored on dips while key supports hold.

SOLANA CHoCH Signals Short-Term ReversalClean setup on SOLANA (30m) 👌 CHoCH after a strong bearish channel = potential short-term bullish continuation.

🎯 SOLANA Upside Targets

1️⃣ Target 1 (TP1):

👉 97.0 – 98.0

Prior structure resistance / supply zone

First liquidity pool above current price

2️⃣ Target 2 (TP2):

👉 105.0 – 107.0

Higher timeframe resistance

Major imbalance / premium zone

Good final target if momentum stays bullish

🔻 Invalidation (for bullish idea)

❌ Bullish bias weakens if price falls back below 82.0 – 80.0 (reclaim of bearish channel / cloud support lost).

One-liner description:

After breaking bearish structure, SOL shows CHoCH and aims for higher liquidity zones if buyers hold control.

BTCUSD Daily – Bearish Breakdown & Sell-the-Retests Setup

Here’s what the chart is saying, clean and to the point:

Market Structure

Clear distribution → breakdown sequence on the daily.

Price topped near the mid-90Ks, rolled over, and lost the 83–84K demand zone (former support marked in blue).

That loss flipped market structure firmly bearish.

Key Levels

Major breakdown level: ~83–84K (prior demand → resistance)

Supply / entry zone: ~72–74K (blue zone labeled “entry”)

Current support: ~67.4K (thin blue line)

Primary target: ~60–62K (grey demand zone)

Price Action Logic

The vertical sell-off into ~67K suggests impulsive bearish strength, not exhaustion.

The projected path shows a dead-cat bounce / consolidation into ~72–74K.

That zone aligns with:

Prior consolidation

Bearish retest logic

Likely supply from trapped longs

Trade Thesis (as illustrated)

Bias: Short

Entry idea: Sell a rejection in the 72–74K zone

Invalidation: Strong daily close back above ~75K

Target: 60–62K demand (first meaningful higher-timeframe support)

Big Picture

Unless BTC reclaims the 80K+ region quickly, this chart favors continuation lower, not a V-shaped recovery. The structure says rallies are for selling, not buying.

Bitcoin Bull Market RestartingMy updated primary count:

- RSI peaks ideally in wave 3's (orange circles)

- 200 weekly MA provides major cycle support + pitchfork level holding, which it appears to be respecting nicely

- Comparing altcoin charts, the vast majority topped in January 2025, supporting the idea that we've been in a corrective structure for a year now.

- Leads to question of what is more probable?

Bitcoin was the only crypto to be in a bull?

or

Bitcoin was also in a bear market?

BTCUSD: Potential Reversal at Major Support and Liquidity HuntMarket Context: Bitcoin (BTC/USD) is currently testing a significant support level near 65,000 following a sustained corrective move from recent highs.

Price Action: The chart shows a series of descending resistance zones (purple boxes) that have capped previous rallies. However, the price is now entering a high-interest demand zone where buyer exhaustion is turning into potential accumulation.

Trend Analysis: We are observing a potential "V-shaped" recovery or a double-bottom formation. The blue ascending trendline represents a key hurdle; a decisive breakout above this level would confirm a structural shift from bearish to bullish.

Upside Potential: If the support at 62,000 holds, the primary target is the liquidity gap near the 77,000 - 80.000 range.

BTC Turns at “Hunts”: A Multi-Timeframe Liquidity BlueprintWhy this idea matters

If you study BTC long enough, a pattern becomes difficult to ignore:

Major swing highs/lows are rarely “clean”.

Before Bitcoin forms a meaningful top or bottom, it usually collects liquidity first —then it reverses with force.

This is not a mystical claim. It is how auctions behave:

Obvious highs/lows attract clustered stop orders. When those stops trigger, they become market orders and inject liquidity (fuel). That fuel is often what enables the next expansion leg.

The repeating sequence (MTF)

Across Weekly → Daily → Intraday, the same structure appears:

1) Build a magnet : range boundaries, equal highs/lows, prior swing points, weekly/monthly extremes.

2) Run the stops : a sharp wick through the obvious level (liquidity sweep / stop run).

3) Show intent : displacement away from the wick (fast impulse, not slow grind).

4) Leave inefficiency : imbalance / FVG created by the displacement (auction skipped prices).

5) Confirm structure : BOS/CHOCH in the new direction, then mitigation/retest for execution.

What makes it tradable (and what makes it dangerous)

Most traders stop at “it wicked, so it must reverse”.

That is exactly where losses happen.

You need a strict filter:

Wick is not confirmation. Displacement + structure is confirmation.

My hard rule (invalidation logic)

After the liquidity-grab wick forms, price must NOT accept beyond the wick extreme.

Acceptance means: repeated closes / building structure beyond that extreme.

If acceptance happens, the “hunt” narrative is invalid and bias can flip.

Applying it to the current BTC location (based on the chart)

We are in a high-volatility selloff into a marked HTF pocket (low-60K area).

This is the type of zone where BTC historically either:

1) prints a final sweep and snaps back with displacement, or

2) breaks, accepts, and trends into the next HTF pocket.

The key takeaway

BTC turning points are often “manufactured”:

liquidity is collected first, then direction is revealed via displacement and structure.

Stop runs are the trigger. Confirmation is the edge.

How to use this as a clean system

Mark HTF magnets: weekly/monthly highs/lows, equal highs/lows, range edges.

Wait for the sweep (wick is the trigger, not the entry).

Demand displacement + FVG.

Execute on mitigation only after BOS/CHOCH confirms.

Risk is defined by the sweep wick extreme.

Risk note

This is a framework, not a signal.

Do not trade the wick. Trade the confirmation.

BTCSince my first forecast regarding the BINANCE:BTCUSDT.P decline 2 months ago, the asset has dropped by 27%.

As of today, my global outlook on the market remains bearish. The first significant target is 78,200.2. Once reached, it will be necessary to assess the character of the price movement there.

While we move toward this target, the entire market will also likely head down. This creates excellent opportunities to profit, as the market is moving rather than standing still.

Subscribe to not miss updates.

$BTC - Local Resistance at 72kBINANCE:BTCUSDT | 2h

Price held the 63.7k (VP-poc) and successfully rebalanced, clearing out the initial impulse imbalances above 70k. That acceptance helped stabilize structure after the move.

From here, if price can’t cleanly clear and accept above 72k, I’d want to see the 66–65k zone hold as support. As long as that area is defended, it keeps the door open for another rotation higher and a potential push back toward the 73–74k region.

BTC vs SaaS and Tech Software Sector CorrelationBitcoin is currently showing its strongest correlation with the SaaS and Tech-Software sector.

This signals a clear shift: BTC is behaving like a high beta tech asset, driven by liquidity, growth expectations, and valuation cycles within the software market.

This is how smart capital truly sees Bitcoin.

That also means the AI sector has direct points of conflict with Bitcoin, something very few are talking about.

Alphractal

$BTC bottom or dead cat bounce?BTC hit my long standing target of $60k yesterday . While I do think that's a great long-term entry, I'm also not sure if that's the final low.

Now the biggest level on the chart is $81k, if we can break above that resistance, the market will be back in a bull trend.

However, if we can't break above that level, there's a possibility of a final sweep of the lows which I think would potentially take us to that low $30k-40k range.

I didn't even entertain this idea before the price action today, but alts still look like they have one more leg down to go and I'm not sure if a retest of yesterdays lows would generate such a large move in alts, or if there's a larger move down to come for BTC.

BTC also still looks pretty heavy still after the bounce today. The bullish case would need to reclaim that $71k level and then $81k, but if we can't do that, there's risk of a final capitulation low.

Wanted to share this chart as a possibility. I'm being patient as I think any time we have a large move down like this, price takes a while to resolve higher, so there should be multiple chances to enter before we get a larger bull run beginning.

BTC USD - Bitcoin's Sharp DeclineBitcoin's Sharp Decline: A Deep Dive into Market Mechanics, Whale Behavior, and Structural Liquidity Pressures

Bitcoin recently underwent a severe and rapid price decline, briefly pushing its value toward the psychologically significant $60,000 level. This sell-off exhibited characteristics reminiscent of the cascading liquidations seen during the 2022 FTX collapse, driven not by a single, identifiable catalyst, but by a confluence of observable, mechanical pressures within the market's plumbing.

While the price has since recovered to approximately $69,800, the event underscored critical vulnerabilities and shifting dynamics. On-chain data from Glassnode highlighted the severity of the drop relative to key investor cost bases: the Short-Term Holder (STH) cost basis stood at $94,000, the Active Investors Mean at $86,800, and the True Market Mean at $80,100—all far above the spot price at the nadir. This dislocation indicates a broad swath of recent buyers were plunged into deep unrealized losses, creating fertile ground for panic and forced selling.

The Narrative Vacuum and the Search for a "Smoking Gun"

As prices fell, social media platforms, particularly X, became a breeding ground for speculative narratives attempting to explain the move. Traders floated theories ranging from a hidden Hong Kong hedge fund implosion and yen-carry trade unwinds to more exotic fears about quantum computing threats to cryptography. However, these narratives shared a common flaw: a lack of verifiable, real-time evidence. This pattern is typical in fast-moving digital asset markets; a sharp liquidation creates a vacuum that is quickly filled with speculation, often obscuring the more mundane, yet powerful, underlying drivers.

The Core Drivers: ETF Outflows, Leverage Unwind, and Whale Supply

A more durable and measurable explanation for the decline lies in three interconnected factors: persistent spot ETF outflows, a violent derivatives liquidation cascade, and on-chain signals of whale distribution.

The Erosion of the Steady Bid: Spot ETF Outflows

The landscape for U.S. spot Bitcoin ETFs has shifted dramatically from the relentless inflows seen after their launch. Data from firms like SoSo Value indicates these funds have experienced net outflows exceeding $6 billion over the past four months. This persistent selling pressure matters profoundly for market structure. Inflows provided a constant, price-insensitive source of demand that could absorb sell orders. Sustained outflows remove this "automatic dip buyer," leaving the market more susceptible to breakdowns when other forms of selling emerge. As noted by Bloomberg ETF analyst James Seyffart, ETF holders are facing their largest unrealized losses since the products launched, with the drawdown from peaks approaching 42%. This context of embedded losses can dampen the appetite for bargain-hunting among this investor cohort.

The Mechanical Cascade: Forced Leverage Liquidations

Once selling pressure pushed Bitcoin below key technical levels, it triggered a self-reinforcing cycle of forced liquidations in the derivatives market. Data from CoinGlass showed that over $1.2 billion in leveraged long and short positions were liquidated as the price descended. This process is mechanical and reflexive; when prices fall, exchanges automatically close overleveraged positions to prevent losses, which generates more selling pressure, leading to further liquidations. This dynamic can dominate price discovery in thin liquidity environments, creating the appearance of a coordinated dump when the reality is often a systemic flush of excess leverage.

On-Chain Evidence of Distribution and Capitulation

Blockchain analytics provided clear signals of distress and supply movement from large holders (whales):

Realized Losses Spike: Glassnode reported that Bitcoin's Entity-Adjusted Realized Loss hit $889 million per day on February 4th, the highest level since November 2022. This metric confirms that a significant volume of coins was being sold at a loss, indicative of capitulation.

Whale Exchange Deposits Surge: Data from CryptoQuant showed the Exchange Whale Ratio for Binance spiking to 0.447, its highest level since March 2025. This indicates that a disproportionately large share of exchange inflows came from whale-sized wallets. Furthermore, total Bitcoin inflows to Binance reached approximately 78,500 BTC in early February, with whale wallets contributing roughly 38,100 BTC (48.5%). While such deposits can be for hedging or collateral purposes, during a sell-off they are widely interpreted as preparatory moves for selling, adding to bearish sentiment.

Supply Redistribution: Santiment data revealed that wallets holding 10 to 10,000 BTC collectively reduced their holdings by 81,068 BTC over eight days, falling to a nine-month low of 68.04% of total supply. Concurrently, "shrimp" wallets (holding <0.01 BTC) accumulated to a 20-month high. This signals a distribution from large holders to smaller retail investors, a pattern often observed during corrective phases.

The Macro Context: A Broader Risk-Off Liquidity Squeeze

Bitcoin's decline did not occur in a vacuum. The move coincided with a broader risk-off sentiment across global markets. Reuters reported an unwind of leveraged positions across speculative assets, with commodities like gold and silver also selling off sharply. U.S. equities, particularly tech stocks, faced pressure as investors reassessed the timelines and profitability of massive AI investments. Additionally, concerning labor market data, including the highest January layoff announcements in 17 years, contributed to a macroeconomic environment of caution and deleveraging. As a liquidity-sensitive risk asset, Bitcoin is often one of the first to feel the impact of such broad-based portfolio rebalancing and margin calls.

Technical Framework: Key Support and Resistance Levels

For traders navigating this volatility, key technical levels provide a roadmap for potential price action:

Critical Support Zones:

Primary Support: $50,000 – A major psychological and technical level that has served as a foundational support in previous cycles.

Secondary Support: $40,000 – A deeper, stronger support zone that would represent a more severe correction but a potential long-term accumulation area.

Fibonacci Retracement Take-Profit Levels (from the recent high to the swing low):

Initial Resistance/Target: $75,587 – Corresponding to the 0.236 Fibonacci retracement.

Secondary Target: $85,273 – Aligning with the 0.382 Fibonacci level.

Major Resistance/Target: $93,101 – The 0.5 Fibonacci retracement, a key midline often watched for trend strength.

Full Trend Recovery Target: $100,929 – The 0.618 Fibonacci level, which would signal a robust recovery of the prior downtrend.

Conclusion: A Liquidity Event, Not a Fundamental Break

In summary, Bitcoin's steep decline is best understood as a complex liquidity event rather than the result of a single, hidden catastrophe. The interplay of persistent ETF outflows eroding structural support, a violent liquidation cascade in derivatives, observable whale distribution on-chain, and a broader macro risk-off mood created a perfect storm. This episode serves as a stark reminder of the market's current fragility when the steady institutional bid retreats and leverage is forcibly unwound. While the long-term thesis for Bitcoin may remain intact for many investors, the path forward is likely to be dictated by the re-establishment of a stable bid, the absorption of excess supply from large holders, and a calming of macro liquidity conditions. The identified support and resistance levels will be critical in gauging the market's healing process or vulnerability to further downside.