MARA, bottoming soon? Major support area...NASDAQ:MARA

🎯 Mara remains at the golden pocket support and channel lower boundary. It is below the weekly pivot and 200EMA, showing the bears are in control. Price appears to be in an Elliot wave 2, the lower trend line must hold here at the High Volume Node

📈 Weekly RSI is nearing oversold with no bullish divergence

👉 Analysis is invalidated if we close back below wave (II), $3.07

Safe trading

BTC

IREN, one more push lower still to come, $27 targetNASDAQ:IREN

🎯 Iren wave 4 hit the daily 200EMA and S1 pivot, just above 0.382 Fibonacci retracement. Wave C of 4 is underway with a downside target of tthe High Volume Node, $27

📈 Daily RSI has printed a bearish divergence without a higher high.

👉 Analysis is invalidated if we go above wave B

Safe trading

COIN, continues bearishly, reversal soon?NASDAQ:COIN

🎯 Price continued lower, ignoring all bullish divergences.. Price has filled the gap and sits in the High Volume Node. The bears are in control.

📈 Daily RSI went deep into oversold

👉 Analysis is invalidated below $40, wave 2 can extend deep, though i dont expect it to go much further down.

Safe trading

CIFR, triangle finished, , whats next?NASDAQ:CIFR

🎯 The bearish triangle from the last report played out. “ This is a penultimate pattern, we can expect price to thrust lower, test the daily 200EMA, end the correction, then makes its way to new highs.” So far so good.

📈 Daily RSI is back to neutral at the EQ

👉 Analysis is invalidated if price falls below wave 4, suggesting we have a complex correction lower

Safe trading

BTC | No Clear Structure Yet – Key Levels to WatchBTC – Market Structure Remains Unclear

Bitcoin’s direction remains uncertain. On the higher timeframe, price is still trading within the range formed below the previously lost $74,000 support. Even minor upside attempts continue to face immediate selling pressure.

In this environment, sharing aggressive trade setups doesn’t make much sense. The structure is technically unclear, so the focus should remain on monitoring key levels and avoiding unnecessary risk until price provides a more defined pattern.

On the lower timeframes, if we attempt to identify a workable structure, reclaiming the $68,385 level (the origin of the last local low) can be considered a short-term positive development.

From here, the expectation would be a push above $70,940 to maintain the internal bullish structure.

On the downside, the key level to hold during any pullback is $65,081. A 4H close below this zone could suggest that price may seek a new daily low.

For now, patience remains the most rational strategy.

BTCUSDT — Neutral OutlookMonday is traditionally a challenging trading day, yet the market is showing early signs of strength and opportunity.

Within the weekly and daily composite, I’m monitoring two scenarios:

1️⃣ Intraday Short (Priority)

The 69,000–69,600 zone acts as a strong resistance for a fast exit from the 11-day balance.

If short factors appear, I will consider a short position targeting 67,000.

Risk will remain minimal.

2️⃣ Resistance Break by Market Buyers

Following the large short liquidation phase, price showed weakness, but limit buyers remain заинтересed in holding positions.

Activation of market order flow could trigger an aggressive move above current prices.

XAUUSD is at strong support levelXAUUSD is currently reacting to a well-defined demand zone after a sharp corrective selloff, with price forming a higher low structure and showing early signs of bullish continuation on the intraday timeframe, which aligns with a classic pullback into support within a broader bullish trend. The rejection from the lower support area indicates strong institutional buying interest, and as long as price holds above this base, the upside bias remains valid toward the previous supply zone and liquidity highs. From a fundamentals perspective as of 16 Feb 2026, gold remains supported by persistent geopolitical uncertainty, sustained central bank gold purchases, and cautious market positioning ahead of key US macro data, while mixed US economic indicators and expectations of a slower pace of Federal Reserve tightening continue to pressure real yields and the US dollar, creating a favorable environment for gold strength. Volatility remains elevated, making gold attractive as a safe haven and inflation hedge, and technically a confirmed break and hold above the intraday equilibrium would likely attract momentum buyers targeting higher resistance levels, while any failure below demand would invalidate the bullish setup and shift focus back to range trading.

Bearish continuation?Bitcoin (BTC/USD) is rising towards the pivot and could reverse to the 1st support.

Pivot: 76,743.32

1st Support: 62,787.53

1st Resistance: 84,062.78

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party.

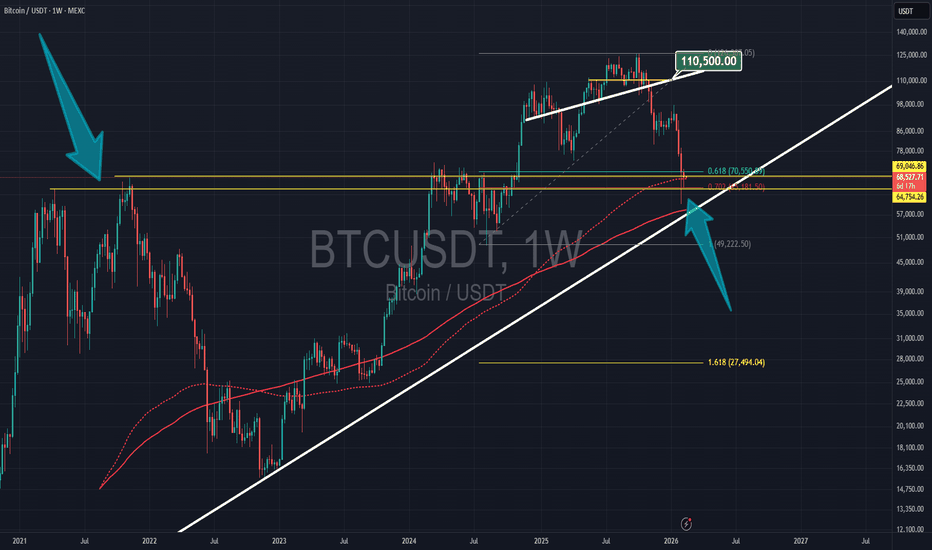

Macro Idea for BTC MovementAfter seeing this pullback (which was expected and we posted at 114k) BTC seems to be at a tipping point

After the bounce of monthly 82k and rejection at the weekly 98k the new target was 71k. They still have time to hold this monthly. Seeing as the previous ATH was 60k they bounced that again, no surprise.

If they lose 71k on this monthly, a new low unter 50k is expected (45k probably target). A move back to 82k is in play. They probably play another weekly again so maybe a bounce up to 76 or 78 to start the next leg down.

Will have to see how it plays after sub 50k. If they lose it on the monthly again then 30 is in play, if they hold it potential big move up in play.

There are downside and upside targets marked. Manually found.

The trend as I see it is marked in different colors, with the colors of the level corresponding to those legs.

This chart shows a general range of the most recent structure.

There are levels lower, if you scroll.

Downside levels are 13k. 11.6k and 6,900

There are also upside targets marked for the new highs.

If they turn it around anywhere near current price 60-70k. First target becomes 168k. After that they have 191k, 240k, 322k

If they go lower generally expect higher.

If they come down and bounce 17k, and get back above 30k that is the strongest case for new ath and targets become massive. 1.8m is the highest we can currently see.

Plenty of others marked depending what happens, this is a macro look using current structure to plan out BTC price between now and 2035.

The bigger the bear market, the higher the targets bcome in the next bull market.

#BITCOIN Halvings, length of tops and bottoms. $100K TOP?Due to the economic mass and increased liquidity

are we about to see the most disappointing #BTC bull run

Each Bull run has a remarkably similar ratio of diminishing returns.

Suggesting a high of around $90k,

Based on a Low $13k being achieved in the following few weeks!

If indeed the June low was to hold

it still only improves the amplitude of the next high by around $20k.

As the foundation for the crypto market, if the high is met with a BTC.d of 20%

That signals a 10 Trillion market cap

so picking Good products and platforms could still be a monumental place for price appreciation.

#ALTS #ALTCOINS

#HEX #NEAR #SOL #EGLD #MKR #AAVE #PULSECHAIN #ETH

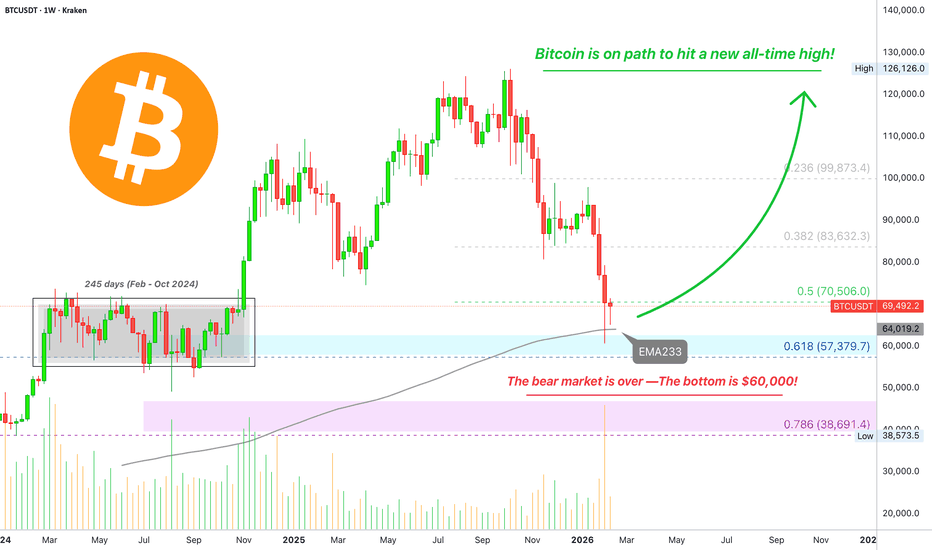

Changing markets —Bitcoin is headed towards a new all-time highAll the growth from late 2024 and 2025 has been deleted. Bitcoin performed a full correction and is now back trading within a consolidation range that was active for 245 days in 2024, 8 months.

This means back to zero. A correction cannot correct more than 100%, not on Bitcoin.

Bitcoin opened 2025 at $93,456 then peaked at $126,219, a total of 35% growth. Meager for Bitcoin. The bull market was in 2024. 2025 closed red. 2026 is starting red. Bitcoin has never closed more than one year red.

So far Bitcoin has four red years in its history: 2014, 2018, 2022 and 2025.

2026 is still very young. Market conditions changed. The year is young and started red, it is set to close green.

It is possible that Bitcoin will produce a new all-time high in 2026. Do you agree?

Maybe the all-time high shows up in 2027, that's ok. My point is that the bear market is over.

Remember, "bear markets will become shorter while bull markets will become longer." The Cryptocurrency market will continue to grow and evolve.

Bitcoin cannot behave in the same way when it is worth 2 trillion as when it was worth 200 billion, this doesn't make sense at all.

It is the first time Bitcoin produces a triple-top and it will also be the first time that a correction is really short.

A 50% correction is already a massive event. You want more? Remember, Bitcoin is hotter than hot bread. It is the most sought out investment in the whole world. Nobody will let it crash a second time, there is just too much demand; we are going up.

Get on board the bullish train; some altcoins have been rising for months.

Many altcoins are set to hit a new all-time high, will Bitcoin be left behind? Bitcoin cannot be left behind, what one does, the rest follows.

Namaste.

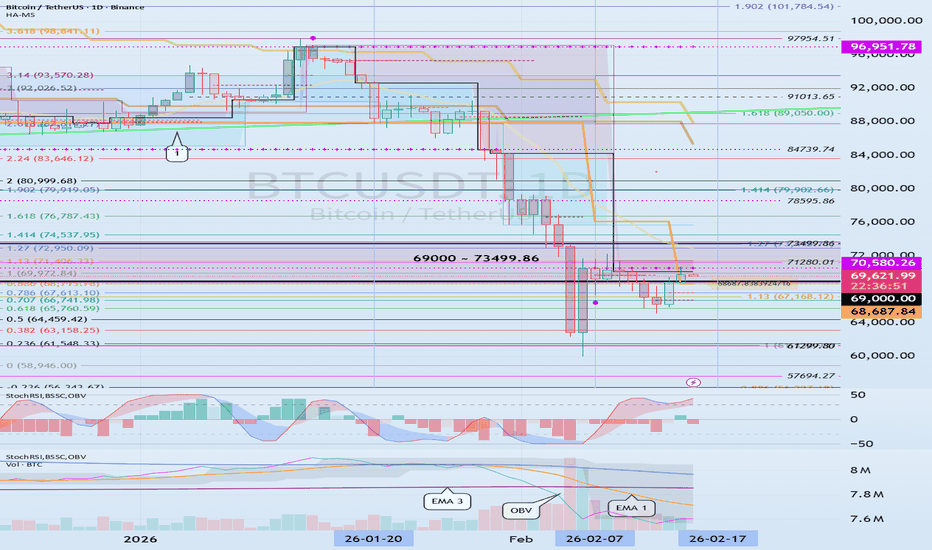

Bitcoin Sunday Analysis $BTC is trading inside the range,Bitcoin Sunday Analysis

CRYPTOCAP:BTC is trading inside the range, as mentioned in the last update. For any recovery, price must break and hold above 72k. If that happens, a move toward 80k–85k becomes possible. Below 100k, the market structure already confirms a bear market, so this price action is expected. The active accumulation range between 54k and 72k is now in play. Trading the range makes sense here, buying near the lows and selling near the highs. This is range trading, not long term accumulation.

Key levels remain clear. The buy zone is 54k–60k, which represents the local bottom of the range, not the macro bottom. The sell zone is 72k–85k. If price reaches the weekly 99 EMA near 85k, I may add additional short positions and will update if that setup develops. It is important to understand that 54k–60k is only a local bottom. The true bear market bottom is expected lower, around 45k–50k, where major long term positions will be built.

Regarding strategy, I am holding a short position that was opened near 97k, with the average entry around 104k. I closed 50% of the short at 72k and opened a long at that level, but BTC failed to hold and dropped toward 60k, where I added more to the long, bringing the average long entry to around 67k. After the recovery, I closed 50% of the long position. I am currently holding the remaining short and may add more shorts in the 80k–85k region. On the long side, I will look to add more exposure again in the 60k–54k zone.

How to interpret the current movement

Hello, fellow traders!

Follow us to get the latest information quickly.

Have a great day.

-------------------------------------

The key points to watch are the HA-Low indicator and the DOM (-60) indicator.

If the HA-Low and DOM (-60) indicators provide support, then that's a good time to buy.

Accordingly, the key question is whether the price can rise after finding support in the 68687.84 ~ 70580.26 range.

-

The StochRSI 20, 50, and 80 indicators are displayed on the chart because they provide useful information for detailed trading.

The StochRSI indicator can also be viewed as an indicator that reverts to its mean based on the 50 level.

Therefore, we need to carefully monitor the trend when the StochRSI crosses the 50 level.

While the StochRSI indicator is typically interpreted based on when it enters or exits overbought or oversold levels, this provides useful information when interpreting auxiliary indicators.

Currently, the order is StochRSI 20 > StochRSI 80 > StochRSI 50.

In other words, to break out of the low zone (oversold zone), the StochRSI must rise above the 20 level. Therefore, ultimately, we can see that the StochRSI must rise above the 20 level (75719.90).

However, the StochRSI 80 level is formed at 71453.53, indicating that a short-term peak has been formed.

This suggests that the current trend is likely a rebound from a downtrend.

Even if the StochRSI rises above the 80 level, if it fails to rise above the 20 level, it is highly likely that the price will eventually decline.

However, if the price remains above the StochRSI 50 level, the upward movement may trigger a change in the positions of the StochRSI 20 and StochRSI 80 indicators, potentially signaling a continued uptrend. Therefore, it's important to monitor whether the price can remain above the StochRSI 50 level (70130.00).

-

To break above a key point or range and continue the uptrend, the StochRSI, BSSC, and OBV indicators must show upward trends.

If possible,

1. The StochRSI indicator should not enter the overbought zone.

2. The BSSC indicator should remain above the 0 level.

3. The OBV indicator should remain above the High Line.

When the above conditions are met, the uptrend is likely to continue.

The current behavior of these auxiliary indicators indicates that the conditions for a sustained uptrend are not yet met.

Therefore, when support is found near the 68,687.84 ~ 70,580.26 range, we should examine whether the above conditions are met.

-

Summary of the above:

1. Support range: 68,687.84 ~ 70,580.26

2. Beginning of a full-blown short-term uptrend: 75,719.90

3. Volatility range: 71,453.53 ~ 75,719.90

Therefore, if support is found at the support range and the trend reverses while moving sideways in the volatility range, we can interpret this as indicating a potential continuation of the uptrend.

Since indicators change position over time, their interpretation may vary depending on the position at the time of the change.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

BTC/USDT 4H📊 BTCUSDT – 4H timeframe

The image shows:

• Price around 69,960 – 70,200

• Key resistance: 70,186

• Higher resistance: 72,792

• Support:

• 69,030

• 67,810

• 66,096

• Breakout from a declining wedge/upward feeding pattern

• RSI is rising but starting to flatten

⸻

🟢 What's bullish?

1. Higher low formed around 66k.

2. Dynamic losses from lower support.

3. RSI above 50 – bullish momentum.

4. Price is above 69k (local support).

If the 4H closes clearly above 70,200, you have a real chance for a move:

➡️ 71,000 – 72,800

⸻

🔴 What's bearish?

1. 70,000 is psychological resistance.

2. There was a strong consequence at this point.

3. RSI is entering the upper zone – correction.

4. No volume impulse available (from the image).

⸻

🎯 Scenario

🟢 Long scenario:

• Retest of 69,000 as support

• Defense and impulse candle

• Target: 71,000 → 72.8k

🔴 Short scenario:

• Rejection 70,200

• 4-hour close below 69,000

• Target: 67,800 → 66,100

Stock Market Forecast | BTC TSLA NVDA AAPL AMZN META MSFTWelcome to your essential weekly guide for navigating the dynamic stock market!

0:00 Weekly Stock Market Outlook (SPY, QQQ, Bitcoin, MAG 7) CME_MINI:ES1! CME_MINI:NQ1! CRYPTOCAP:BTC

0:18 Sector Rotation & Market Sentiment Breakdown

1:34 Semiconductor ETF PSI – Largest Dark Pool Since 2008

2:31 MAG 7 Dark Pools (Vanguard Growth ETF Breakdown)

3:24 PSQ Short ETF – Is Smart Money Positioning Bearish?

4:47 SPY Technical Analysis – Key Range & Breakout Levels

5:06 QQQ Technical Analysis – Lower Highs, 589 Support Watch

6:19 Bitcoin Technical Analysis – Bear Flag or Trend Reversal?

7:54 Tesla Stock Analysis – 388 Breakdown Risk?

9:39 Meta Stock Analysis – 620 Major Support Level

10:24 Amazon Stock Analysis – 200 Psychological Support

11:23 Microsoft Stock Analysis – 400 Key Breakdown Zone

13:40 Google NASDAQ:GOOGL Stock Analysis – Running Out of Momentum?

15:16 Apple Stock Analysis – 250 Support & Range Trade

17:01 Nvidia Stock Analysis – Critical Channel Break Watch

18:15 Market Outlook & What Could Trigger Volatility

You will ask "how did he know Btc would do that"?This is a continuation of yesterday's chart. I have added the current support and resistance targets that I am watching. I've included the history of how I derived these price targets below:

On Nov 18th 2025 I suggested that Btc was headed for a bottom at $84K (+/-2K).

I expressed concerns about a very bearish move if the price fell below $81K. On Nov 21st that low $80s target was hit. Only later to be violated to the downside.

On Nov 30th I suggested that Btc had bottomed at $80K & would bounce up to $98-99K and get rejected. On Jan 14th 2026 my target of $98K was hit with strange accuracy...and rejected as anticipated.

Once Btc was rejected at $98K, I suggested the recent lows at $80K would be swiped. I once again expressed concerns about a very bearish move if the price fell below this local low.

Once the $80K low was swiped (T1), I suggested (on Jan 31st) that the next bearish target would be hit at $60K (+/-2K).

On Feb 6th, my $60K target was hit, and the anticipated significant bounce to follow (20%)

On Feb 6th, I outlined the typical bottoming structures and targets based on my studies of historical price action and statistical analysis. This lead me to expect a bounce from $60K to $71K (+/-1K)...and then a minimum retrace to $62-$65K

On Feb 6th my bullish target at $71K was hit and I suggested that it had met resistance and would be rejected down to my next bearish target ($62K-$65K).

That target of $65K was hit yesterday, as seen in today's chart.

Those that follow me know that I was warning of this significant drop since I mentioned the "three red week down rule" since Sept 2025. I said not only would btc soon crash, but also top alts would follow (ie xrp). This chart called the top for Xrp:

This chart called the top for Btc:

TA works! It works on all assets, in all time frames, across all markets. The question is how? How can someone like me be so "strangely accurate"? After all, I don't have a crystal ball. Please know I'm not boasting, I've just been doing this a long time and I want to show you how predictable it can be. Hopefully this will encourage you to learn TA. Also, I post here to keep track of my calls and to share my trading ideas (I want us all to succeed). Hopefully this offers some insights as to how effective technical analysis can be. I encourage you all to become students of this trade. Technical analysis education is the only way we can gain any competitive edge in these fast moving markets. Everything else is just noise.

Congratulations to everyone that has taken these trades and are in significant profit.

May the trends be with you.

$BTC Back at 70k!CRYPTOCAP:BTC | 2h

Price is back at the key 70k resistance. Watching closely here — if we fail to break through again and start losing 68.5k, I’d expect a rotation back into the 66ks.

On the upside, there’s still room for a squeeze into 71.5k–72k. But if momentum stalls, we could see a rejection around 70.5k instead.

Since we’re pumping into the weekend, if this rolls over after, I’d want to see 65–66k hold on a pullback for a proper breakout and clean trendline retest.

TradeCityPro | Bitcoin Daily Analysis #268👋 Welcome to TradeCity Pro!

Let’s move on to Bitcoin analysis. Since we’re heading into the weekend, after Bitcoin faked the breakout of 68,365, the market has started to move upward.

⌛️ 1-Hour Timeframe

Bitcoin has returned to the range between 68,365 and 71,616, and price is currently moving back and forth inside this zone.

🧮 Even though the RSI has entered overbought, we still haven’t seen strong bullish momentum enter the market, and price hasn’t been able to break above 71,616 yet.

🔔 The reason for this is exactly what I mentioned in previous analyses: since the market is ranging and lacks momentum, using momentum oscillators like RSI isn’t very helpful right now and can actually give us misleading signals.

✔️ That’s why, for now, we’re not paying much attention to RSI and are instead taking confirmations and triggers directly from price action. A break above 71,616 would give us a long entry trigger. At the moment, the chart hasn’t formed any other valid trigger for us.

✨ If price reacts to 68,365, we can look for a position from the second touch onward, once that level breaks. The next triggers after that will be 65,402 and 62,824.

❌ Disclaimer ❌

Trading futures is highly risky and dangerous. If you're not an expert, these triggers may not be suitable for you. You should first learn risk and capital management. You can also use the educational content from this channel.

Finally, these triggers reflect my personal opinions on price action, and the market may move completely against this analysis. So, do your own research before opening any position.

$ETH - LTF Weekend OutlookBINANCE:ETHUSDT | 2h

Kinda dependent on Bitcoin here — if we get a push into 70–71k, Ethereum could squeeze into 2150-2190 for that triple tap. But it can also just reject around 2100 if momentum stalls.

We are pumping into the weekend, so if this rolls over after, I’d want to see 2000–1950 hold on a pullback to keep structure intact.

Bitcoin 10X Long with 689% profits potentialIt's been several days since Bitcoin hit bottom, six days now.

The drop that started 14-January 2026 was composed of strong bearish momentum; it was lower, followed by lower and then more lower. The longest stop was one or two days, never more than that. There was nothing weak about the drop.

Bitcoin isn't dropping anymore. The RSI oversold, the highest volume ever, etc. All those signals that I showed you multiple times are better now, stronger now—this is a great entry. The classic retrace is over, etc. There is so much supporting a bullish advance... You cannot miss this.

Ok. Bitcoin is bullish because it isn't bearish.

Bitcoin is set to rise because the altcoins are already rising.

›› The altcoins crashed first in 2025 then came Bitcoin.

›› The altcoins recover first in 2026 then comes Bitcoin.

Here you have the full trade-numbers with 10X.

___

LONG BTCUSDT

Leverage: 10X

Potential: 689%

Allocation: 3%

Entry zone: $60,000 - $67,000

Targets:

1) $69,800

2) $75,625

3) $85,300

4) $93,100

5) $100,911

6) $112,033

Stop: Close weekly below $57,000

____

Remember, it is possible that not only "the first leg down is over," but, the entire bear market. It is possible that the bear market is already over and we are set to experience long-term growth.

The bear market is over you say? Possible, I said.

Over or not over, we are going up.

Namaste.

Bitcoin —Last chance before $100,000 (Extreme buy opportunity!)While Bitcoin is no longer trading at $60,000, I am here to tell you that a strong opportunity is still present; a 2nd chance, the last chance.

Any trading below $70,000 is still a really good buy as Bitcoin is headed for a sure price between $90,000 to $100,000 first. This would be the first wave.

Not only below $70,000 but also below $75,000 and $80,000 are still good entry zones.

All support has been recovered but one, the 0.5 Fib. retracement level at $70,838. We have some interesting facts here related to Bitcoin's price.

After breaking above $70,000 in early November 2024, Bitcoin never looked back. Only recently this is happening and this happening we now know will be short-lived. Last week and this week only Bitcoin traded below $70,000 and this too soon will be history.

Within hours, Bitcoin is likely to trade back above $70,000 and then we are green long-term.

Remember, Bitcoin's supply is limited and production is cut in half every four years through the halving, a deflationary event.

With each successive halving event less Bitcoin's are created every ten minutes through mining and this puts pressure on prices to rise up.

Bitcoin is programmed to appreciate. Bitcoin's price will continue to grow.

All market conditions are now bullish. It is not too late, this is the last chance to buy Bitcoin while it trades below $70,000. This is an extreme buy opportunity. The same goes for most of the altcoins.

Thank you for reading.

Namaste.