MCD McDonald's Corporation Options Ahead of EarningsIf you haven`t bought MCD before the rally:

Now analyzing the options chain and the chart patterns of MCD McDonald's Corporation prior to the earnings report this week,

I would consider purchasing the 305usd strike price Puts with

an expiration date of 2026-5-15,

for a premium of approximately $5.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Buysellindicator

AI C3ai Imminent Takeover by Automation Anywhere? Rumors!C3 ai, once a darling of the enterprise AI space, has faced headwinds since its 2020 IPO. Founded by industry veteran Thomas Siebel, the company specializes in AI applications for industries like manufacturing, energy, and defense, offering tools for predictive maintenance, supply chain optimization, and more.

However, revenue growth has decelerated sharply—fiscal 2025 saw $389 million in sales (up 25% YoY), but early 2026 figures show a 20% drop in the first half, prompting the withdrawal of full-year guidance.

Siebel's departure in November 2025 fueled talks of strategic options, including a sale or private capital raise.

Enter Automation Anywhere, a leader in robotic process automation (RPA) valued at $6.8 billion in its 2019 funding round.

Backed by investors like Salesforce Ventures, the company generates hundreds of millions in revenue from tools that automate repetitive business processes.

The merger rumors, first reported by The Information on January 27, 2026, suggest Automation Anywhere would acquire C3 ai in a reverse merger, effectively listing publicly without a traditional IPO.

Neither company has confirmed the discussions, but sources indicate talks are advanced, with potential synergies in "agentic AI"—combining C3.ai's reasoning capabilities with Automation Anywhere's execution tools.

If talks are as advanced as reported, a pre-earnings reveal might preempt leaks and stabilize sentiment. Analysts speculate a deal could close in months, pending regulatory nods—especially given both firms' federal contracts.

The rally potential? Substantial. Historical AI mergers (e.g., similar reverse listings) have delivered 20-50% premiums, pushing shares toward $15-18 if terms favor C3 ai holders.

A combined entity would boast enhanced scale in enterprise AI and RPA, competing with giants like UiPath ( NYSE:PATH ) and Palantir ( NASDAQ:PLTR ).

Short squeeze dynamics, with a 6.85 short ratio and 31% float shorted, could amplify gains—imagine a 30-50% pop on confirmation, fueled by FOMO in the AI hype cycle.

Broader trends, like OpenAI's rumored Q4 2026 IPO, underscore AI's hot streak.

Bullish on AI!

LUMN Lumen Technologies Options Ahead of EarningsIf you haven`t bought LUMN before the previous rally:

Now analyzing the options chain and the chart patterns of LUMN Lumen Technologies prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2027-1-15,

for a premium of approximately $2.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

T AT&T Options Ahead of EarningsIf you haven`t bought T before the rally:

Now analyzing the options chain and the chart patterns of T AT&T prior to the earnings report this week,

I would consider purchasing the 23usd strike price Puts with

an expiration date of 2026-1-30,

for a premium of approximately $0.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AAPL Apple Options Ahead of EarningsIf you haven`t bought AAPL before the previous earnings:

Now analyzing the options chain and the chart patterns of AAPL Apple prior to the earnings report this week,

I would consider purchasing the 285usd strike price Calls with

an expiration date of 2026-5-15,

for a premium of approximately $5.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

2026 Price Target for SPY: $790 – Why the S&P 500 Could Soar 15%If you haven`t bought the dip on SPY last year:

Why my Price Target is $790 for SPY? Key Drivers for 2026!

Earnings Growth Acceleration:

Analysts expect S&P 500 EPS to grow 12–15% in 2026 (Goldman Sachs: 12%; FactSet consensus: ~14.9%). This builds on the AI-driven productivity boom and resilient consumer spending. If AI adoption accelerates (as seen in Meta, Nvidia, and Microsoft earnings), we could see 15–18% EPS growth—pushing multiples higher in a low-rate environment.

Fed Policy Tailwinds:

With inflation cooling (core PCE at ~2.8% in November, in line with expectations) and the economy strong (Q3 2025 GDP revised to +4.4%), the Fed is likely to deliver 1–2 more rate cuts in 2026. Lower rates support valuations and boost corporate borrowing/profits—classic bull-market fuel.

Geopolitical & Policy Clarity:

Trump's recent backtrack on aggressive tariffs (U-turn on 10–25% threats to NATO allies and Greenland deal) has eased fears. Combined with potential fiscal stimulus and deregulation, this creates a pro-growth backdrop. Midterm elections could add volatility, but history shows markets often "pump" post-election.

Valuation Expansion Potential:

The forward P/E is ~22x—elevated but justified by AI productivity gains. If earnings beat expectations and rates fall, multiples could stretch to 24–25x (similar to past tech-led cycles), supporting my higher target.

Comparison to Wall Street ConsensusWall Street targets for the S&P 500 end-2026 range widely:

Conservative: Bank of America ~7,100 (3–4% upside)

Average: ~7,269–7,600 (6–11% upside)

Bullish: Oppenheimer 8,100; Deutsche Bank 8,000; Goldman Sachs ~12% total return

My $790 SPY target sits on the bullish side (~15% upside), assuming stronger-than-expected earnings and policy support. It's not moonshot territory (some outliers see 8,000+), but it requires the rally to broaden beyond Big Tech.

Risks to Watch:

Tariff resurgence or trade wars could cap gains.

Inflation reacceleration might delay Fed cuts.

AI spending disappointment → valuation compression.

Volatility spikes around elections or macro data.

Still, the base case remains bullish: resilient economy, AI tailwinds, and supportive policy. SPY at $790 would mark another strong year in this bull run.

PPI - economic data against the backdrop of gold's ATH.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) rebounds toward the record high of $4,634.64 reached in the previous session, trading around $4,620.00 per troy ounce on Wednesday. Precious metals, including Gold, attract buyers amid growing bets on Federal Reserve (Fed) rate cuts following the softer inflation in the United States (US).

US inflation data for December signaled easing underlying US inflation, strengthening views that price pressures are gradually cooling. Rate futures showed investors divided between expectations of two or three Fed rate cuts this year, well above policymakers’ median projection of one.

⭐️Personal comments NOVA:

The bulls continue their uptrend - consolidating around the ATH price of 4630 and waiting for new highs to be established.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4684 - 4686 SL 4691

TP1: $4670

TP2: $4655

TP3: $4630

🔥BUY GOLD zone: 4565 - 4563 SL 4558

TP1: $4580

TP2: $4600

TP3: $4615

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price continues to reach a new all-time high - waiting for ⭐️GOLDEN INFORMATION:

The UK and Germany are reportedly considering boosting their military footprint in Greenland to underscore Europe’s commitment to Arctic security amid heightened geopolitical strains, following last week’s arrest of former Venezuelan President Nicolas Maduro by US forces. Rising global uncertainty continues to underpin demand for traditional safe-haven assets such as Gold.

Meanwhile, a mixed US employment report has reinforced expectations of further Federal Reserve rate cuts, lending additional support to the yellow metal. Lower interest rates reduce the opportunity cost of holding non-yielding assets, keeping Gold well supported.

⭐️Personal comments NOVA:

Gold prices continue to rise - officially reaching a new all-time high. Strong buying pressure continues.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4633 - 4635 SL 4640

TP1: $4620

TP2: $4605

TP3: $4590

🔥BUY GOLD zone: 4515 - 4513 SL 4508

TP1: $4530

TP2: $4545

TP3: $4560

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 3usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AAPL Poised for Continued GrowthIf you haven`t bought AAPL before the rally:

What to consider now:

1. AI-Driven iPhone Upgrade CycleApple’s integration of Apple Intelligence, its proprietary AI platform, is set to catalyze a significant iPhone replacement cycle. Posts on X highlight positive sentiment around AI-driven demand, with estimates suggesting a 40% year-over-year surge in iPhone shipments in China during May 2024, signaling strong consumer interest. New AI features, such as on-device processing for enhanced privacy and functionality, are expected to drive accelerated hardware upgrades. Analysts, including Bernstein, project these features could boost upgrade rates, with even a 1% increase in upgrades driving meaningful revenue growth. With the iPhone 15 and future iterations leveraging AI, Apple is likely to capture pent-up demand, as noted by industry observers who see long-term revenue growth from its 7% year-over-year increase in active installed base.

2. Strong Ecosystem and Services GrowthApple’s ecosystem—spanning iPhones, iPads, Macs, and wearables—continues to drive customer loyalty and recurring revenue. The company reported record services growth in Q2 2025, with revenue reaching $95.4 billion, up 5% year-over-year. Services like Apple Music, iCloud, and Apple TV+ benefit from the growing active device base, which ensures sticky, high-margin revenue streams. This ecosystem strength mitigates concerns about short-term iPhone sales fluctuations, as Apple captures upgrade revenue over time. The seamless integration of hardware and services creates a moat that competitors struggle to replicate, reinforcing AAPL’s long-term growth potential.

3. Technical Bullish MomentumFrom a technical perspective, AAPL exhibits strong bullish patterns across multiple timeframes. TradingView analyses point to a rising bullish channel, with higher highs and higher lows signaling sustained upward momentum. Key bullish patterns, such as an ascending wedge and triangle, are forming around current price levels, suggesting potential breakouts. For instance, if AAPL clears $203.21 with volume, it could target $204.98 or higher, with some analyses eyeing $240 as a near-term resistance. Technical indicators like a rising RSI and MACD convergence further support short-term bullish momentum. Despite recent consolidation, reduced volatility and a strong setup pattern indicate AAPL is primed for a breakout.

4. Analyst Optimism and Market SentimentAnalyst sentiment remains overwhelmingly positive, with a consensus “Buy” rating and a 12-month price target of $228.85, implying a 14.05% upside from the current price of $200.66 as of June 2025. Hedge funds like Third Point see “significant” upside, driven by AI features that could meaningfully boost earnings. Bernstein’s raised price target to $240 reflects confidence in Apple’s ability to monetize AI through hardware and services. Posts on X also highlight investor optimism, with AAPL’s $350 billion market cap increase in a single day underscoring strong market confidence in its AI-driven growth chapter.

5. Global Expansion and Emerging MarketsApple’s growth in emerging markets, particularly India and China, bolsters its bullish case. Improved guidance for December 2023, driven by iPhone 15 adoption and India’s market potential, signals untapped opportunities. Apple’s ability to penetrate these high-growth regions, combined with its premium brand appeal, positions it to capture a larger share of global smartphone and tech markets.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CLSK CleanSpark Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CLSK CleanSpark prior to the earnings report this week,

I would consider purchasing the 12.5usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.42.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

VKTX Viking Therapeutics Potential Buyout Soon?!If you haven`t bought VKTX before the previous rally:

If GLP-1 obesity drugs are a multi-hundred-billion-dollar opportunity, a successful VK2735 (injectable + oral) could justify a valuation far north of where VKTX trades today—if it makes it to market.

My bullish thesis:

1. GLP-1 Momentum + “Mini Lilly / Novo” Narrative

VKTX is seen as a “pure play” on the global obesity and metabolic-disease boom.

Viking’s lead program, VK2735, is a dual GLP-1/GIP receptor agonist being developed in both injectable and oral form for obesity and related metabolic disorders.

Phase 1 and Phase 2 data for the injectable version have already shown meaningful weight loss with an encouraging safety/tolerability profile, which is why it advanced into large Phase 3 obesity trials.

An oral version of VK2735 is in Phase 2 obesity trials and, in the VENTURE oral study, delivered up to ~12.2% mean weight loss at 13 weeks, with a clear dose response.

2. Rapid Trial Execution = Strong Momentum & Upcoming Catalysts

Another big talking point is how fast Viking is executing on its trials, which bulls see as a leading indicator of future news flow:

Viking recently announced completion of enrollment in its Phase 3 VANQUISH-1 VK2735 obesity trial, with ~4,650 patients (above the original 4,500 target).

The company highlighted VK2735 data at ObesityWeek 2025 and continues to position both injectable and oral formulations as core programs.

Management has reiterated that VK2735 oral and injectable programs are moving forward on schedule, with more data expected as Phase 3 and longer-duration studies mature.

3. Short Interest + “Squeeze Fuel” Angle

VKTX has a high short interest, which Twitter traders love to highlight:

Recent data shows around 22–23% of the float short, with days to cover >5 based on average volume.

For many momentum and options traders, this is exactly the kind of setup they look for:

High short interest = a lot of investors betting against the stock.

Any positive surprise (trial data, partnership, M&A rumor, or a strong breakout on the chart) could force shorts to cover.

If that happens during a period of high retail interest, the price action can get violent to the upside.

4. Analyst Targets + Big Pharma Takeover Speculation

Analyst consensus is currently Strong Buy, with an average price target around $95+.

On top of that, there’s constant speculation that VKTX could become a takeover target:

The GLP-1 market is being dominated by Eli Lilly (Zepbound, Mounjaro) and Novo Nordisk (Wegovy, Ozempic).

Many large pharma companies without a strong obesity franchise might prefer buying a late-stage asset rather than starting from scratch.

VK2735, with Phase 3 obesity trials underway and promising oral data, is the kind of asset that fits that narrative.

LAZR Luminar Technologies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LAZR Luminar Technologies prior to the earnings report this week,

I would consider purchasing the 1usd strike price Puts with

an expiration date of 2026-2-20,

for a premium of approximately $0.58.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

LShort

DLR Digital Realty Trust Options Ahead of EarningsAnalyzing the options chain and the chart patterns of DLR Digital Realty Trust prior to the earnings report this week,

I would consider purchasing the 190usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $7.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BB BlackBerry Limited Options Ahead of EarningsIf you haven`t bought BB before the prevous earnings:

Now analyzing the options chain and the chart patterns of BB BlackBerry Limited prior to the earnings report this week,

I would consider purchasing the 3.50usd strike price Calls with

an expiration date of 2025-10-24,

for a premium of approximately $0.53.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

INTC Intel Corporation Options Ahead of EarningsIf you haven`t bought INTC before the recent rally:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.83.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Why AI Could Rise Sharply Before Friday's Options ExpirationIn a market where enterprise AI spending is projected to hit $100B+ by 2026, C3.ai's 130+ turnkey apps (from supply chain optimization to ESG tracking) position it as a must-have for Fortune 500 digital transformations.

Trading at around $17.27 as of midday September 15, down a staggering 33% over the past month, the stock has been battered by leadership turmoil and disappointing quarterly results.

But for options traders eyeing the September 19 expiration, this could be the setup for a sharp rebound. Last month, we loaded up on those $25 strike calls, a tough grind to profitability amid the sell-off, but with fresh tailwinds emerging.

From a charting perspective on TradingView, the stock is testing support near its 200-day moving average around $16.50, with volume spiking on the downside but showing signs of capitulation.A bounce from here isn't just wishful thinking—it's backed by historical patterns. In similar drawdowns earlier this year, NYSE:AI rebounded 15-20% within a week on lighter selling pressure. With the broader Nasdaq futures pointing higher amid cooling inflation data, a risk-on rotation could propel NYSE:AI toward $20+ resistance by expiration, putting those $25 calls back in the money.

Smart money appears to be accumulating; recent options flow shows unusual call volume at the $20 and $22 strikes, hinting at bets on a quick snapback.

New CEO Stephen Ehikian: A Stabilizing Force with Proven PedigreeThe elephant in the room has been the abrupt CEO transition. Founder Thomas Siebel stepped aside for health reasons in late July, triggering a sales slowdown and the withdrawn full-year guidance that spooked investors.

Ehikian isn't just a placeholder; he's a serial innovator with deep ties to enterprise software giants. He built RelateIQ (acquired by Salesforce to form Einstein) and Airkit.ai (now core to Salesforce's Agentforce), and most recently served as Acting Administrator of the U.S. General Services Administration under President Trump.

His track record in scaling AI integrations could accelerate C3.ai's federal deals, which already made up a chunk of Q1 wins (e.g., expansions with the U.S. Air Force).

In his first comments, Ehikian emphasized capturing the "immense market opportunity in Enterprise AI," and whispers from the Street suggest he's fast-tracking partner integrations with Microsoft and AWS—key channels that drove 155% YoY growth in partner-sourced deals last quarter.

This leadership reset screams "buy the dip" for contrarians.3. Solid Q1 Fundamentals Amid AI TailwindsDon't let the headlines fool you—C3.ai's fiscal Q1 2026 results (ended July 31) weren't a disaster; they were a pause in an otherwise accelerating growth story. Revenue hit a record $87.2 million, up 21% YoY, with subscription revenue (86% of total) climbing to $60.3 million.

The company closed 71 deals—more than double last year's tally—and federal expansions highlight sticky demand for its Agentic AI platform.

Options Expiration Gamma Squeeze: The Friday Catalyst With September 19 OPEX looming, NYSE:AI 's options chain is primed for fireworks. Open interest is heavy on out-of-the-money calls around $20-$25, mirroring last month's setup where we rode the $25 strikes through volatility.

As delta hedging ramps up, a modest 5-10% pop in the underlying could trigger gamma squeezes, forcing market makers to buy shares and amplifying the move.

If NYSE:AI clears $18.50 early this week (a key pivot on the daily chart), momentum could carry it to $22+ by Friday.

UAL United Airlines Holdings Options Ahead of EarningsIf you haven`t exited UAL before the recent selloff:

Now analyzing the options chain and the chart patterns of UAL United Airlines Holdings prior to the earnings report this week,

I would consider purchasing the 92.5usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $5.12.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

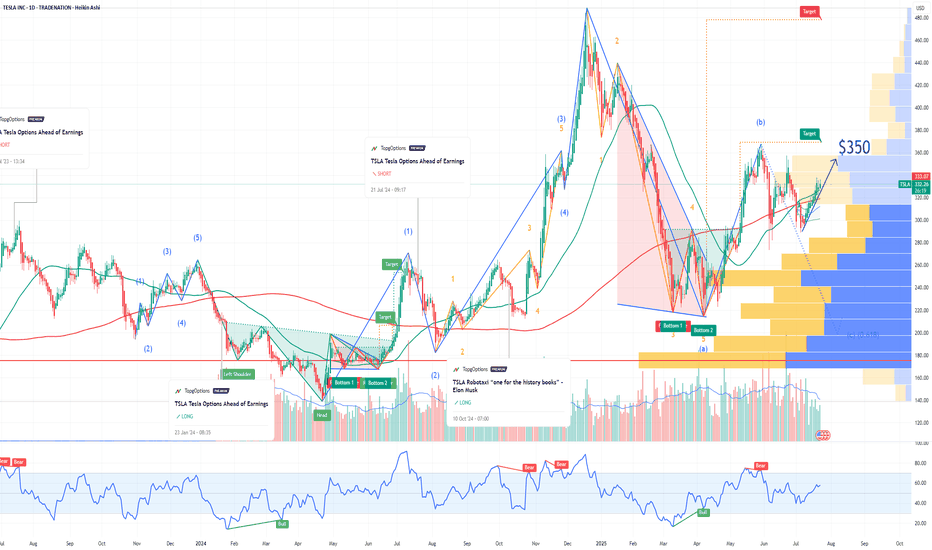

TSLA Tesla Options Ahead of EarningsIf you haven`t bought TSLA before the recent rally:

Now analyzing the options chain and the chart patterns of TSLA Tesla prior to the earnings report this week,

I would consider purchasing the 350usd strike price Calls with

an expiration date of 2025-8-15,

for a premium of approximately $14.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

RIOT: Lagging Behind Peers, Ready to Catch Up?RIOT Platforms is showing an interesting setup right now. While the broader crypto mining sector has already seen strong moves higher, RIOT is still trading at a relative discount compared to peers like Iris Energy (IREN).

Key Points:

Relative Valuation Gap: IREN and other Bitcoin miners have rallied strongly in recent weeks, yet RIOT has lagged behind. Historically, these names tend to move in cycles together, and RIOT often plays catch-up when the spread gets too wide.

Strong Fundamentals: RIOT continues to expand its hash rate and energy efficiency, positioning itself as one of the top U.S.-based miners. With Bitcoin consolidating above key levels, miners with scale like RIOT stand to benefit disproportionately.

Technical Setup: On the chart, RIOT is building a base with higher lows, showing accumulation. A breakout above recent resistance could trigger momentum buyers and fuel a sharp move higher.

Bullish Outlook:

If Bitcoin maintains its strength and the miner sector rotation continues, RIOT has plenty of room to the upside just to close the gap with peers. Traders looking for lagging plays in the sector may see RIOT as the next mover.

AI c3ai Bullish Reversal Ahead of EarningsAI C3.ai has been in the spotlight recently, following a series of notable developments that set the stage for a potential bullish reversal. The company recently announced that founder and CEO Thomas Siebel is stepping down due to health reasons. While this initially caused some market jitters, it coincides with a broader operational transformation that could act as a catalyst for a turnaround.

Earlier this month, C3ai reported preliminary fiscal first-quarter revenues below expectations, raising short-term concerns. However, the company continues to invest in AI-driven solutions and expand strategic partnerships, including a notable collaboration with Eletrobras in Brazil. These moves demonstrate that the firm is actively diversifying its offerings and positioning itself as a leading player in enterprise AI.

From an options market perspective, there is evidence of bullish sentiment building ahead of earnings. The $25 strike price out-of-the-money calls expiring on September 19 suggest that traders are betting on a near-term upside, signaling expectations of a possible recovery or positive surprise in the upcoming earnings report.

Leadership changes, while initially unsettling, often create opportunities for strategic shifts. A new CEO could accelerate operational efficiency, focus on high-growth initiatives, and highlight C3ai’s AI innovation, which has been a core strength of the company. Combined with ongoing product launches and partnership expansions, these factors could serve as a catalyst for a technical and fundamental reversal in the stock.

Traders may want to watch key support levels and the $25 strike options activity closely, as these indicators suggest that a bullish reversal could be on the horizon. With a renewed leadership team and continued AI innovation, C3.ai has the potential to regain momentum in the weeks leading up to earnings.

PLUG Plug Power Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PLUG Plug Power prior to the earnings report this week,

I would consider purchasing the 6usd strike price in the money Calls with

an expiration date of 2027-1-15,

for a premium of approximately $0.0.49.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

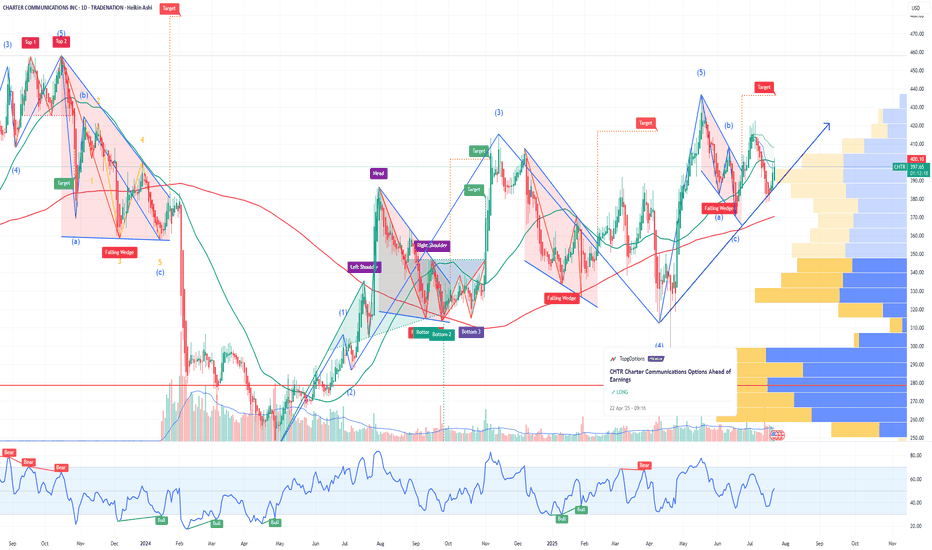

CHTR Charter Communications Options Ahead of EarningsIf you haven`t bought CHTR before the previous earnings:

Now analyzing the options chain and the chart patterns of CHTR Charter Communications prior to the earnings report this week,

I would consider purchasing the 387.5usd strike price Calls with

an expiration date of 2025-7-25,

for a premium of approximately $22.55.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.