The price range remains sideways around 5000.Related Information:!!! ( XAU / USD )

Gold (XAU/USD) continues to trade under pressure during the early European session on Monday, although it has recovered from its intraday low and is holding above the $5,000 psychological threshold. A confluence of supportive factors, however, suggests that caution is warranted before positioning for a deeper bearish extension.

A modest rebound in the US Dollar, together with a broadly constructive risk environment, has weighed on demand for the safe-haven metal. That said, geopolitical risks remain elevated ahead of the second round of US–Iran nuclear negotiations scheduled for later this week. The United States has reportedly deployed a second aircraft carrier to the region and is preparing contingency plans for a prolonged military engagement should talks fail. In response, Iran’s Revolutionary Guards have warned of retaliatory measures against US military installations in the event of an attack. These developments continue to underpin geopolitical risk premia and may provide underlying support for gold prices.

personal opinion:!!!

With no significant economic news at the start of the week, gold prices mostly traded sideways within a range around 5000.

Important price zone to consider : !!!

Resistance zone point: 5031, 5045, 5115 zone

Support zone point : 4964 zone

technical analysis : !!!

3 EMA moving averages, price trading above --> supports an uptrend.

Trading volume is stable and accumulating.

Follow us for the most accurate gold price trends.

Buytrade

Bullish recovery - gold rose 5136Related Information:!!! ( XAU / USD )

Bullion initially advanced toward the $5,000 threshold before reversing direction, as early profit-taking emerged. However, buying interest resurfaced near the $4,950 area, where dip-buyers stepped in and propelled the yellow metal back toward its intraday highs.

Meanwhile, the broader set of US macroeconomic indicators released over the week painted a resilient picture of economic activity. In particular, a robust Nonfarm Payrolls report showed job gains exceeding 130,000 in January, alongside a decline in the unemployment rate to 4.3%. These data points have alleviated pressure on the Federal Reserve by reinforcing the strength of the labor market.

personal opinion:!!!

Gold prices recovered above $5000 after negative CPI data for the USD, allowing buyers to continue their current accumulation trend. The long-term trend remains upward due to ongoing global instability.

Important price zone to consider : !!!

Resistance zone point: 5089, 5250 zone

Support zone point : 4658 , 4404 zone

technical analysis : !!!

3 EMA moving averages, price trading above --> supports an uptrend.

Trading volume is stable and accumulating.

Follow us for the most accurate gold price trends.

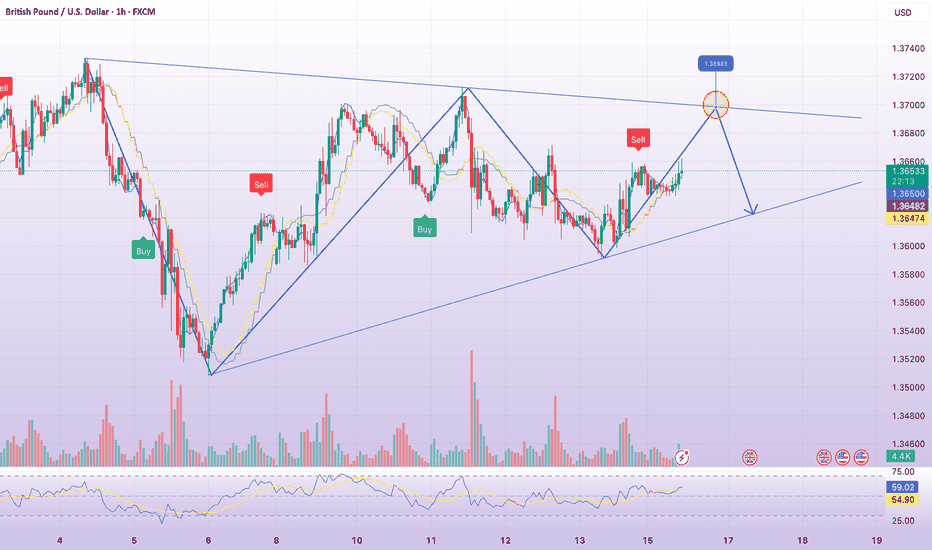

sell point - supply zone 1.36950 trendlineRelated Information:!!! (gbp/usd )

ING strategist Francesco Pesole points to an event-heavy UK data docket, with upcoming employment and inflation releases expected to reinforce evidence of a cooling labour market and persistently muted core services inflation. Should these dynamics carry through into the March readings, expectations for a policy easing by the Bank of England would strengthen materially.

Against this backdrop, heightened political fragility surrounding Prime Minister Keir Starmer further compounds downside risks for Sterling. ING therefore maintains a constructive stance on EUR/GBP, projecting a move toward the 0.88 area as the Pound remains vulnerable to episodic depreciation pressures.

Looking ahead, the January labour market report due Tuesday is anticipated to show further slackening in employment conditions alongside a moderation in annual wage growth. A continuation of these trends would significantly increase the likelihood of a BoE rate cut as early as next month.

personal opinion:!!!

Moving within two trend lines, touching the upper trendline and correcting, the market is stabilizing.

Important price zone to consider : !!!

Resistance zone point: 1.36950 zone

Support zone point : 1.36250 zone

technical analysis : !!!

3 EMA moving averages, price trading above --> supports an uptrend.

Trading volume is stable and accumulating.

Follow us for the most accurate gold price trends.

EURUSD sideways, breakout and price increase.Related Information:!!! ( EUR / USD )

The Euro (EUR) is trading broadly unchanged against the US Dollar (USD) on Tuesday, hovering near 1.1917 at the time of writing and consolidating at one-week highs following a two-session advance. The greenback remains under pressure ahead of a series of key US macroeconomic releases, while a moderately positive risk backdrop continues to weigh on the currency.

The USD is still struggling to recover from last week’s disappointing labor market data. Adding to the soft tone, White House economic adviser Kevin Hassett cautioned on Monday that job creation is likely to slow in the coming months, citing the impact of US President Donald Trump’s immigration policies and rising productivity. These remarks, delivered ahead of Wednesday’s release of the January Nonfarm Payrolls (NFP) report, have done little to shore up demand for the US Dollar.

personal opinion:!!!

The accumulation is continuing, awaiting a breakout from the uptrend, while the DXY index remains weak.

Important price zone to consider : !!!

Resistance zone point: 1.19300, 1.19500 zone

Support zone :1.18850 zone

Follow us for the most accurate gold price trends.

Major volatility is coming with NFP.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) attracts some dip-buyers following the previous day's modest slide and climbs back above the $5,050 level during the Asian session on Wednesday. Prospects for lower US interest rates keep the US Dollar (USD) depressed near its lowest level in over a week and act as a tailwind for the non-yielding yellow metal. However, the underlying bullish sentiment might cap the upside for the safe-haven commodity. Traders might also opt to wait for the release of the US Nonfarm Payrolls (NFP) report before placing fresh directional bets

⭐️Personal comments NOVA:

Gold prices are consolidating and compressing strongly around 5000-5090. There will be significant volatility awaiting the NFP news results.

⭐️SET UP GOLD PRICE

🔥SELL GOLD zone: 5236 - 5238 SL 5243

TP1: $5220

TP2: $5200

TP3: $5178

🔥BUY GOLD zone: 4897- 4895 SL 4890

TP1: $4918

TP2: $4940

TP3: $4965

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Resistance 5141 - Fibo 0.618 , GOLD today Related Information:!!! ( XAU / USD )

Indirect negotiations between the United States and Iran over the future of Tehran’s nuclear program concluded on Friday with a broad consensus to pursue a diplomatic track. The outcome has helped to alleviate fears of a potential military escalation in the Middle East, lifting investor confidence and reinforcing risk-on sentiment. As a result, capital has rotated away from traditional safe-haven assets, including gold, during the Asian session on Tuesday.

Commenting on the talks, Iranian Foreign Minister Abbas Araghchi characterized the eight-hour discussions as a constructive first step conducted in a positive atmosphere. US President Donald Trump also described the negotiations as “very good,” adding that a follow-up meeting is expected to take place early this week.

personal opinion:!!!

Gold prices are primarily awaiting NF news this week, with accumulation and a potential rebound back to the 5141 resistance level according to the 0.618 Fibonacci retracement.

Important price zone to consider : !!!

Resistance zone point: 5086, 5141 zone

Support zone : 4967 , 5000 zone

Follow us for the most accurate gold price trends.

Continued consolidation next week below 5250✍️ NOVA hello everyone, Let's comment on gold price next week from 02/09/2026 - 02/13/2026

⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) rallies more than 3% on Friday, poised for a decent weekly gain as dip buyers emerged, following a session that pushed the yellow metal below the $4,800 mark. Worth noting that Friday has been a volatile session, with the non-yielding metal falling to a three-day low of $4,655 before erasing those previous losses. At the time of writing, XAU/USD trades at $4,963.

XAU/USD stages a sharp rebound toward $4,950 as soft US labor data revives Fed easing bets

The non-yielding metal is enjoying a healthy recovery from Thursday. Greenback’s initial weakness on Friday reflected worse-than-expected US labor market data on Thursday, which fueled speculation for further easing by the Federal Reserve (Fed). This prompted traders to buy bullion’s dip even though US Treasury yields began to show signs of life.

⭐️Personal comments NOVA:

Gold prices broke the trendline and showed signs of recovery next week, continuing to consolidate below 5250.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $5100, $5242

Support: $4655, $4402

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Correction - Accumulation below 5000⭐️GOLDEN INFORMATION:

Gold (XAU/USD) retreats more than 4% on Monday after the US President Donald Trump announced his pick to lead the Federal Reserve (Fed) in succession to the Fed Chair Jerome Powell. Economic data in the US paint an optimistic outlook as manufacturing activity improves. At the time of writing,XAU/USD trades at $4,681.

XAU/USD sinks below $4,700 as markets reprice a firmer Fed outlook and US manufacturing hits multi-year highs

Since last Friday, Gold price tumbled by over 14%. Although the nomination of Kevin Warsh was seen as one of the catalysts behind the precious metals rout. Economic activity in the manufacturing sector improved the most, reaching levels last seen in 2022, according to the Institute for Supply Management (ISM).

⭐️Personal comments NOVA:

Gold prices continue to consolidate below 5000 - selling pressure cools down the market, leading to greater stability.

⭐️SET UP GOLD PRICE

🔥SELL GOLD zone: 4996 - 4998 SL 5003

TP1: $4980

TP2: $4965

TP3: $4950

🔥BUY GOLD zone: 4400 - 4398 SL 4393

TP1: $4415

TP2: $4444

TP3: $4470

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Correction - Gold begins to fall✍️ NOVA hello everyone, Let's comment on gold price next week from 02/02/2026 - 02/06/2026

⭐️GOLDEN INFORMATION:

Since the announcement, Gold prices have reaccelerated their losses, while the Greenback recovered, despite being poised to sustain losses of over 1.42% in January, based on the US Dollar Index (DXY).

The DXY, which measures the US currency performance versus six peers, surges 0.74% to 96.87, a headwind for Bullion prices.

Long-dated US Treasury yields are rising in a sign that speculators see fewer odds that Warsh could cut rates “indiscriminately” to please the White House. The US 10-year Treasury note yield is up one-and-a-half basis points at 4.247% as of writing.

⭐️Personal comments NOVA:

Gold prices have begun a major downward correction, falling below 5000 due to profit-taking pressure.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $4995, $5164, $5453

Support: $4675, $4532

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

The upward trend is above 5300, gold is rising sharply.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) prolongs its record-setting rally for the eighth consecutive day and surges past the $5,200 mark during the Asian session on Wednesday. Economic and geopolitical uncertainties on the back of US President Donald Trump's decision turn out to be a key factor that continues to drive flows towards the safe-haven commodity. Apart from this, renewed worries about the US Federal Reserve's (Fed) independence and prospects for lower interest rates in the US provide an additional boost to the non-yielding yellow metal.

⭐️Personal comments NOVA:

Gold surged in early 2026, tariffs and territorial issues destabilized global finance, continuing its trajectory towards 5314.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5314 - 5316 SL 5321

TP1: $5300

TP2: $5280

TP3: $5260

🔥BUY GOLD zone: 5182 - 5180 SL 5175

TP1: $5200

TP2: $5220

TP3: $5240

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Prices continue to rise - significant growth⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) rises to a fresh record high near $5,090 during the early Asian session on Monday. The precious metal extends its upside amid geopolitical risks and concerns over the US Federal Reserve (Fed).

The first three-way peace talks between Russia, Ukraine, and the US have concluded in Abu Dhabi with no apparent breakthrough, as fighting continues, according to the BBC. Ukrainian President Volodymyr Zelensky proposed a second meeting as early as next week, while a US official said that a fresh round will begin on February 1.

⭐️Personal comments NOVA:

The buying pressure in the gold market is too strong - investors are focusing on safe-haven assets, causing gold prices to rise almost continuously.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5135 - 5137 SL 5142

TP1: $5120

TP2: $5100

TP3: $5085

🔥BUY GOLD zone: 4990 - 4988 SL 4983

TP1: $5008

TP2: $5025

TP3: $5040

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

ATH above 5000 - gold price increases✍️ NOVA hello everyone, Let's comment on gold price next week from 01/26/2026 - 01/30/2026

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) surges during the North American session on Friday, up by over 1% as the US Dollar (USD) gets smashed on intervention rumors to propel the Japanese Yen (JPY) in the FX markets, amid an improvement in risk appetite that pushed the yellow metal to fresh all-time highs at $4,988.

Bullion hits fresh record highs as sharp Dollar losses outweigh improving risk sentiment and steady yields

Market mood remains upbeat, yet Bullion prices continue to run up as the US Dollar tumbles to its lowest level since October 2025. The US Dollar Index (DXY), which tracks the buck’s performance against a basket of six currencies, drops close to 0.50% at 97.79, after reaching a daily low of 97.70.

⭐️Personal comments NOVA:

Unstoppable buying pressure - maintaining the price increase next week, surpassing 5000 for the first time.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $5006, $5031, $5113

Support: $4903, $4768

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Continued growth - gold rises sharply⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) extends the rally to around $4,950 during the early Asian session on Friday. The precious metal gains momentum as geopolitical risk and threats to the US Federal Reserve’s (Fed) independence boost the safe-haven demand.

The yellow metal is set to reach a fresh all-time high and is on track for a weekly gain of more than 7%. Traders flock to traditional safe-haven assets such as Gold after tensions in Venezuela, Iran and Greenland.

⭐️Personal comments NOVA:

Political tensions and tariffs have led to gold's breakthrough, approaching $5000. Strong buying pressure is expected.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 5000 - 5002 SL 5007

TP1: $4980

TP2: $4965

TP3: $4950

🔥BUY GOLD zone: 4890 - 4888 SL 4883

TP1: $4902

TP2: $4920

TP3: $4935

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Selling pressure - gold corrects to 4713⭐️GOLDEN INFORMATION:

Gold (XAU/USD) is seen extending the previous day's modest pullback from the vicinity of the $4,900 mark, or a fresh all-time peak, and drifting lower through the Asian session on Thursday. This marks the first day of a negative move in the previous four and is sponsored by a combination of negative factors. US President Donald Trump pulled back from his threat to slap additional tariffs on eight European nations and ruled out seizing Greenland by force, triggering a fresh wave of the global risk-on trade and undermining the safe-haven precious metal.

⭐️Personal comments NOVA:

Gold prices correct downwards - accumulating liquidity around 4713 to continue the upward trend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4852 - 4854 SL 4859

TP1: $4840

TP2: $4825

TP3: $4810

🔥BUY GOLD zone: 4714 - 4712 SL 4707

TP1: $4732

TP2: $4745

TP3: $4760

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

The current buying pressure on gold is unstoppable.⭐️GOLDEN INFORMATION:

Gold price ( XAU/USD) climbs to near $4,775 during the early Asian trading hours on Wednesday. The precious metal extends the rally and is poised for another record high amid a time of political and economic uncertainty. The speech by US President Donald Trump at the World Economic Forum in Davos, Switzerland, will be in the spotlight later on Wednesday.

Traders continue to pile into safe-haven assets amid tensions between the US and Europe over Greenland. US President Donald Trump over the weekend threatened to impose tariffs on eight European nations that oppose his plans to take control of Greenland.

⭐️Personal comments NOVA:

Incredible growth, gold price reaches 4850. Strong buying pressure in the market. Expect 4900 soon.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4905 - 4907 SL 4912

TP1: $4885

TP2: $4870

TP3: $4865

🔥BUY GOLD zone: 4748 - 4746 SL 4741

TP1: $4760

TP2: $4780

TP3: $4803

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Sideways movement and waiting for a new ATH of 4724.⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) edges higher to near $4,670 during the early Asian session on Tuesday. The precious metal is set to hit a fresh record high as traders flock to safe-haven assets amid a persistent geopolitical and economic outlook.

US President Donald Trump said on Saturday that he would impose new tariffs on goods from eight European countries that reject his plan to acquire Greenland. The countries affected include Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland and the United Kingdom (UK).

⭐️Personal comments NOVA:

Gold prices are trading sideways, consolidating and recovering around 4680 in the Asian session, awaiting a breakout and further highs.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4724 - 4726 SL 4731

TP1: $4710

TP2: $4690

TP3: $4675

🔥BUY GOLD zone: 4617 - 4615 SL 4610

TP1: $4630

TP2: $4645

TP3: $4660

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

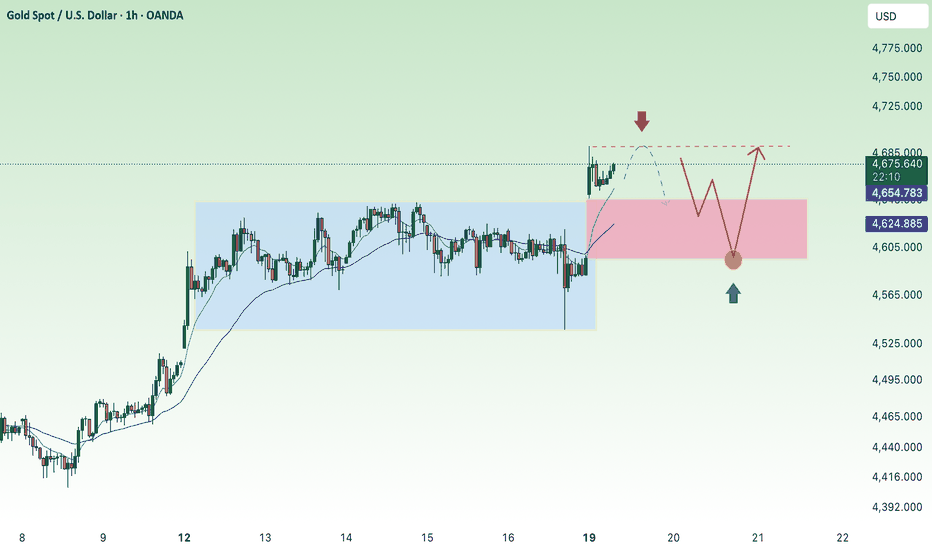

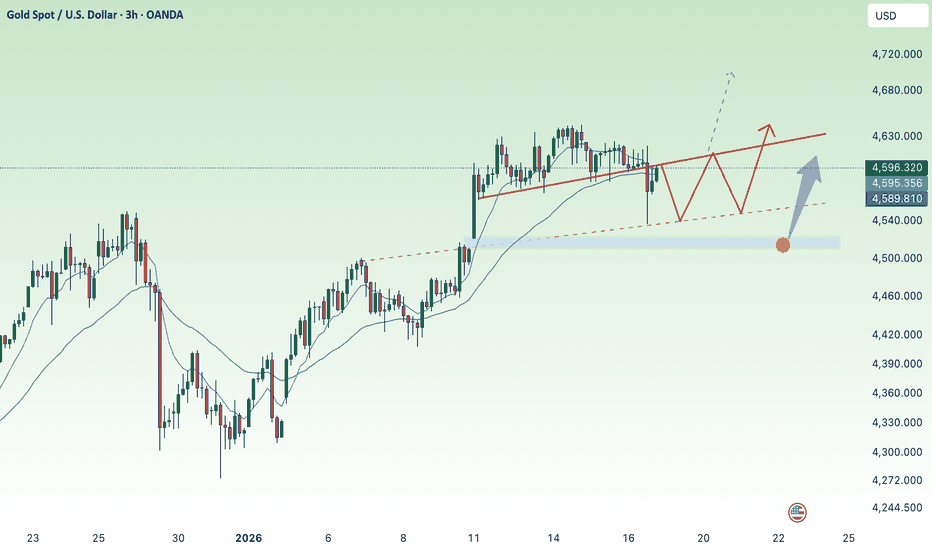

Tariff impact - gold breaks record high at 4690⭐️GOLDEN INFORMATION:

Gold (XAU/USD) catches aggressive bids at the start of a new week and jumps to the $4,700 neighborhood, or a fresh all-time peak, during the Asian session amid the global flight to safety. US President Donald Trump threatened to impose new tariffs on eight European countries that opposed his plan to acquire Greenland. The announcement drew criticism from European officials and raised concerns about a broader transatlantic trade dispute. This comes on top of heightened geopolitical risk and triggers a fresh wave of the global risk-aversion trade, prompting investors to seek refuge in the traditional safe-haven commodity.

⭐️Personal comments NOVA:

US and European tariff pressures were the main factor driving the sharp rise in gold prices, reaching 4690.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4690 - 4692 SL 4697

TP1: $4675

TP2: $4660

TP3: $4645

🔥BUY GOLD zone: 4597 - 4595 SL 4590

TP1: $4610

TP2: $4625

TP3: $4640

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Correction - Gold prices decline and consolidate.✍️ NOVA hello everyone, Let's comment on gold price next week from 01/19/2026 - 01/23/2026

⭐️GOLDEN INFORMATION:

Gold (XAU/USD) registers losses of over 0.70% on Friday as traders take profits, as in the last two weeks, data in the US has shown the labor market is not as weaker as expected. Therefore, traders are turning skeptical that the Federal Reserve (Fed) might go for two cuts, as reflected by the swaps markets. XAU/USD trades at $4,580 at the time of writing.

Bullion retreats as resilient US data, easing geopolitical risks push traders to cut aggressive Fed easing bets

Market mood is turning negative as US President Donald Trump shook the markets, as he seems reluctant to nominate the National Economic Council Director Kevin Hassett for the Fed Chair post. “I actually want to keep you where you are, if you want to know the truth,” Trump told Hassett during a White House event.

⭐️Personal comments NOVA:

Pay attention to the 4515 gap, liquidity is supporting it. Gold prices are correcting downwards. Tariffs are returning, still a major driver for the upward trend.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $4618, $4640, $4700

Support: $4536, $4515, $4477

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Continued expectations for a new all-time high (ATH) for gold.⭐️GOLDEN INFORMATION:

Gold Price (XAU/USD) jumps to near $4,600 during the early Asian session on Tuesday. The precious metal extends the rally after retreating from a fresh record high of $4,630 in the previous session amid uncertainty and geopolitical risks. The US Consumer Price Index (CPI) inflation data for December will take center stage later on Tuesday.

Federal Reserve (Fed) Chair Jerome Powell said on Sunday that he’s under criminal investigation, sparking an independence crisis and triggering a flight to safety across global markets. Powell stated that the US Department of Justice had issued subpoenas to the central bank and threatened a criminal indictment related to his testimony before the Senate Banking Committee in June 2025 concerning a $2.5 billion renovation of the Fed's Washington, D.C., headquarters. Powell called the threats a "pretext" aimed at putting pressure on the Fed to cut interest rates.

⭐️Personal comments NOVA:

Gold prices continue to fluctuate upwards, consolidating around 4600 and awaiting the formation of a new all-time high (ATH): a potential 4679.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4678 - 4680 SL 4685

TP1: $4660

TP2: $4645

TP3: $4630

🔥BUY GOLD zone: 4547 - 4545 SL 4540

TP1: $4560

TP2: $4575

TP3: $4595

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price continues to reach a new all-time high - waiting for ⭐️GOLDEN INFORMATION:

The UK and Germany are reportedly considering boosting their military footprint in Greenland to underscore Europe’s commitment to Arctic security amid heightened geopolitical strains, following last week’s arrest of former Venezuelan President Nicolas Maduro by US forces. Rising global uncertainty continues to underpin demand for traditional safe-haven assets such as Gold.

Meanwhile, a mixed US employment report has reinforced expectations of further Federal Reserve rate cuts, lending additional support to the yellow metal. Lower interest rates reduce the opportunity cost of holding non-yielding assets, keeping Gold well supported.

⭐️Personal comments NOVA:

Gold prices continue to rise - officially reaching a new all-time high. Strong buying pressure continues.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4633 - 4635 SL 4640

TP1: $4620

TP2: $4605

TP3: $4590

🔥BUY GOLD zone: 4515 - 4513 SL 4508

TP1: $4530

TP2: $4545

TP3: $4560

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold price returns to all-time high - above 4550.✍️ NOVA hello everyone, Let's comment on gold price next week from 01/12/2026 - 01/16/2026

⭐️GOLDEN INFORMATION:

December Nonfarm Payrolls undershot both forecasts and the prior reading, though the Unemployment Rate declined and Average Hourly Earnings met expectations. Housing indicators signaled continued cooling, with Building Permits and Housing Starts easing. Meanwhile, the preliminary January University of Michigan Consumer Sentiment beat estimates, despite households remaining concerned about medium-term inflation.

⭐️Personal comments NOVA:

Gold prices return above 4500 - continuing the uptrend with a new all-time high expected next week.

🔥 Technically:

Based on the resistance and support areas of the gold price according to the H4 frame, NOVA identifies the important key areas as follows:

Resistance: $4550, $4630

Support: $4483, $4410

🔥 NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

- The winner is the one who sticks with the market the longest

Gold prices recover - awaiting NFP breakout.⭐️GOLDEN INFORMATION:

Gold prices stabilize ahead of the US Nonfarm Payrolls release as firmer labor market data and a stronger US Dollar weigh on the metal. The Greenback is rebounding after employment figures showed a sharp slowdown in job losses in December, while Initial Jobless Claims beat expectations despite a weekly increase. A narrower US trade deficit has further bolstered USD sentiment.

⭐️Personal comments NOVA:

Gold recovered and maintained buying pressure above 4400, awaiting the NFP results today.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4518 - 4520 SL 4525

TP1: $4505

TP2: $4490

TP3: $4475

🔥BUY GOLD zone: 4400 - 4398 SL 4393

TP1: $4416

TP2: $4430

TP3: $4445

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable SELL order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Gold prices continue to rise - heading above 4500.⭐️GOLDEN INFORMATION:

Dovish Federal Reserve expectations continue to underpin Gold, as the latest FOMC Minutes signaled that most policymakers favor further rate cuts if inflation keeps easing, lowering the opportunity cost of holding the non-yielding metal. Markets now focus on Friday’s US December jobs report, with payrolls seen rising by 55,000 and the jobless rate edging down to 4.5%; any upside surprise could lift the USD and cap near-term gains in Gold.

⭐️Personal comments NOVA:

Gold prices continue their upward trend - forming a bullish Dow pattern on the H1 chart, heading above 4500.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4545 - 4547 SL 4552

TP1: $4530

TP2: $4515

TP3: $4500

🔥BUY GOLD zone: 4400 - 4398 SL 4393

TP1: $4415

TP2: $4430

TP3: $4445

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account