CAD/JPY at Key Weighted Support – Is the Next Wave Up?💹 CAD/JPY – Bullish Layer Trap Setup | Weighted Power Play! 💥

Asset: CAD/JPY (Canadian Dollar vs Japanese Yen)

Market Type: Forex Market Profit Pathway Setup (Swing / Day Trade)

🎯 Plan: The Bullish Thief’s Weighted Move

The bullish plan is confirmed after a Weighted Moving Average (WMA) pullback — a classic thief-style momentum catch! 😎

We’re stalking the zone where price respects the WMA curve and bounces higher, hinting a continuation to the upside.

💡 Why Weighted MA?

Because it gives sharper precision and reacts faster to price volatility, giving us the edge in timing our entries before the crowd jumps in.

💰 Entry Zone (Layer Strategy Style)

The Thief Strategy uses a layered limit order entry method — stacking multiple buys to average a prime position during pullbacks:

Buy Limit Layers: 108.000 | 108.200 | 108.400 | 108.600

(You can adjust or add more layers based on your risk appetite)

🛡️ Stop-Loss: @ 107.700 (Thief SL Zone)

📈 Target Zone: @ 110.200 – 110.500

🧠 Trade Logic & Insight

🔹 Why Bullish?

The recent momentum shows buyers defending key structural lows near 108.000.

Weighted MA crossover supports bullish momentum continuation, backed by strong CAD fundamentals and stable oil prices (CAD often correlates positively with crude).

🌐 Correlated Pairs to Watch

💵 USD/JPY: Similar JPY-side weakness can confirm CAD/JPY upside.

💰 CAD/CHF: Often mirrors CAD strength in risk-on sentiment.

🛢️ XTI/USD (WTI Crude Oil): Rising oil prices can fuel CAD gains, providing extra confirmation for bullish CAD/JPY bias.

⚠️ Notes from the Thief OG’s Desk

Dear Ladies & Gentlemen (Thief OGs) — this setup is my personal style of entry planning.

Not a recommendation. You’re the driver — your profit, your risk, your rulebook! 📜

Police barricade near 110.500 is a trap zone — act smart, escape with profits before the correction hits.

Always manage risk wisely and use your judgment — that’s the real thief’s code! 🕶️

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

⚖️ Disclaimer

This is a Thief-style trading strategy shared just for fun and educational purposes.

Not financial advice — trade responsibly and always do your own analysis.

🔖 #CADJPY #Forex #SwingTrade #DayTrade #ThiefStrategy #TechnicalAnalysis #FX #WMA #WeightedMovingAverage #CAD #JPY #ForexSetup #RiskManagement #TradingCommunity #TrendTrader

Cadjpylong

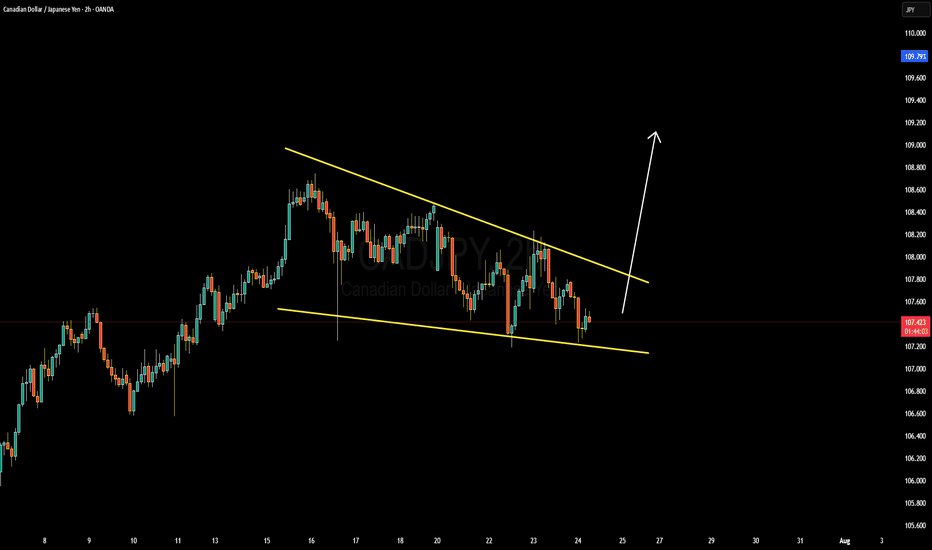

#CADJPY +2300 Pips Swing Buy With Three Major Targets| Possible?The CADJPY has nicely formed a swing bullish pattern that is confirmed. One strong entry zone lies between these prices, 109 and 106, which remain a critical level. As described in the chart, there are three targets to focus on. We strongly recommend thoroughly examining the charts and reading them carefully, as this description is brief due to the detailed chart.

Here’s what to look for:

- Look for a continued or repeated pattern to better understand the next possible move.

- Look for volume when it emerges; enter with the trend momentum.

- Don’t forget to like and comment on the chart!

Team Setupsfx_

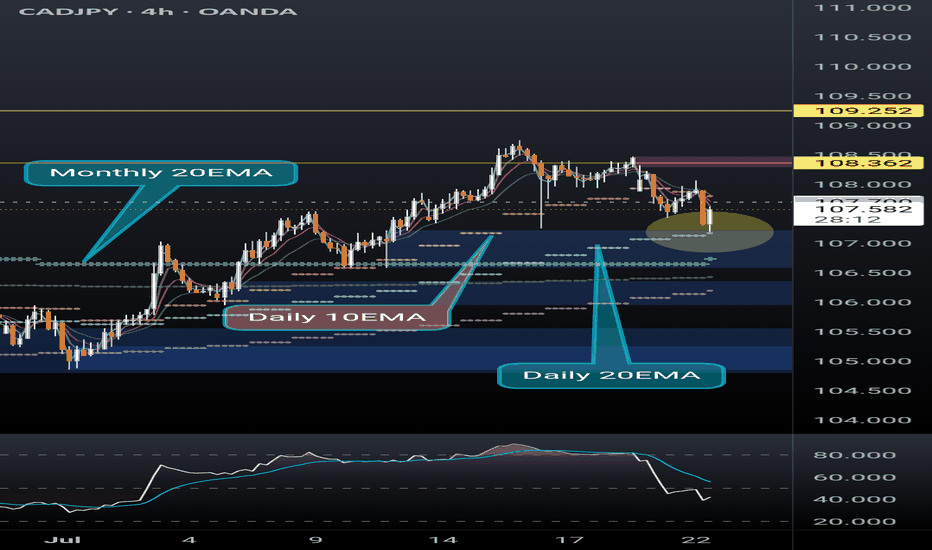

CADJPY Forming Bullish MomentumCADJPY on the 4H timeframe is showing a clear transition from bullish momentum into a corrective bearish phase. After an extended rally, price formed a lower high and broke structure to the downside, confirming short-term selling pressure. The current retracement appears corrective, and as long as price remains below recent lower-high levels, I’ll be watching for the next impulsive leg toward 105.00 and potentially deeper.

From a fundamental perspective, the yen is gaining strength as risk sentiment cools ahead of key central bank events and rising geopolitical uncertainty supports safe-haven flows. Meanwhile, the Canadian dollar is facing headwinds due to softening oil prices and growing expectations that the Bank of Canada may lean toward easing in upcoming meetings if economic slowdown persists. This divergence between a potentially weaker CAD and a recovering JPY adds confluence to the bearish technical setup.

I anticipate price to retest the previous broken structure zone before continuing downward. Any rejection from that supply area will act as confirmation for continuation targets toward mid-105s. I’ll be patient and let price action align with fundamentals for a clean entry with maximum reward-to-risk potential.

CADJPY Forming Ascending ChannelCADJPY is currently trading within a clear ascending channel, and price is pulling back after rejecting the upper boundary near the 110.00 psychological level. The recent bearish momentum suggests that buyers are taking profit, allowing sellers to regain short-term control. I’m watching for price to continue drifting toward the channel’s lower support near 105.50–106.00. If this support breaks with strong volume, it opens the door for a deeper drop into the major demand zone around 101.50–102.50, which aligns with previous liquidity sweeps and institutional footprints.

From a fundamental perspective, CAD has been under slight pressure due to softer crude oil demand and growing expectations that the Bank of Canada may shift to a more accommodative stance if economic slowdown deepens. Meanwhile, the Japanese yen remains broadly weak as the Bank of Japan maintains negative interest rates, but risk-off sentiment and rising geopolitical tensions could temporarily strengthen JPY through safe-haven flows. That makes this pair vulnerable to corrective downside despite the broader bullish structure.

I’ll be monitoring price action closely once price reaches the lower boundary of the channel. A clean rejection from that zone will provide a high-probability buy setup to ride the continuation of the long-term trend. But a confirmed breakdown will flip this structure into a bearish reversal, making the 102.00 liquidity pool a prime target. Patience and precision are key — this setup has profit written all over it once confirmation aligns with fundamentals.

CAD/JPY GOING LONG! BUT FOR HOW LONG? I want to document this possible direction because from what I am seeing this looks very probable.

When it comes to this pair we have seen a great push to the upside that looked very steady until the disaster of 10/10 but I believe we will bounce long! but for how long is the good question, I would pay attention to this pair due to the fact that there is no real impactful news this week for either pair! Meaning some good foundational trades should be possible but again we follow price action and then move a long side! My theory is-

Price will push down to .786 or .619 level and then bounce back up for a pullback or correction! (for my ICC) this is where I will be looking to do longs if I see HH N HL on smaller time frames up until critical prices like 108.497 and 108.962 and above! one of these key levels will either hold and push down even further or it will be broken and price will continue!

tell me your feed back and thoughts on this trading idea.

CAD/JPY: Thief’s Playbook or Trap Zone? A Full Technical + Macro🚨 CAD/JPY – “Loonie vs Yen” Bank Heist Plan 🏦💸 (Swing/Day Trade)

📊 Market Overview (02 Sept 2025, Real-Time Data)

Daily Change: +0.26% ⬆️

52-Week Range: 101.24 – 111.57

📈 Technical Snapshot

RSI (14-Day): 47.9 (Neutral zone)

Moving Averages: Price trading below 50 & 200 SMA → bearish bias on higher TF

Volatility: Low (0.35%) = Possible breakout setup

Technical Signal: Mixed, leaning SELL from MA cluster

🧠 Sentiment & Positioning

Retail Traders: Split views (mixed long/short positions)

Institutions: Increasing net-long JPY exposure for 3rd consecutive week

Fear & Greed Index: 61/100 (Greed mode)

🏦 Fundamental & Macro Heist Briefing:

Like every great “operation,” CAD/JPY’s moves depend on central banks, commodities, and macro flows:

🇯🇵 Bank of Japan (BoJ)

Gradually exiting ultra-loose policy, supported by stronger wage growth & sticky inflation.

A hawkish BoJ = stronger yen = tighter barricades for our heist 🚔.

🇨🇦 Bank of Canada (BoC)

Balancing rate cuts with sticky inflation & housing concerns.

CAD remains highly correlated with oil prices → if crude rallies, it reloads the Loonie’s ammo 🛢️💥.

🇺🇸 Federal Reserve Impact

Markets pricing a 91% chance of September rate cut.

A softer USD can spill into CAD pairs, but safe-haven flows may still favor JPY.

Commodities & Oil Connection

CAD has high sensitivity to oil. WTI stability above $75 supports the Canadian dollar.

Falling crude = weak CAD = smoother entry route for JPY “detectives.”

Risk Appetite / Global Macro

Equities in greed mode (S&P 500 holding above 125-day MA).

Low VIX (14.2) → calm environment, but lurking volatility traps ahead.

Junk bond demand signaling investors willing to take risk → CAD benefits in risk-on.

Macro Score → Neutral to slightly bearish for CAD/JPY, as JPY strength from BoJ policy may outpace CAD support from oil.

Macro:

BoJ staying hawkish ⚔️ (inflation + wage growth)

Fed tilting dovish 🕊️ (rate cut odds ~91% in Sept)

CAD/JPY Macro Score → Neutral to Slightly Bearish

🎯 Thief’s Playbook (Educational Trading Blueprint)

This is a “layering / DCA style” plan 🧩 – using multiple limit orders like setting up escape routes in a heist:

Layer Entries (Example levels):

💰 106.000

💰 106.500

💰 106.800

💰 107.000

(you can adjust & add more “layers” based on risk appetite)

Risk Management:

🛑 “Thief Stop” suggested around 105.500 (always adjust to your own risk model)

Profit Objective:

🎯 Potential upside checkpoint near 109.000 (take the bag & escape before the police barricade 🚔)

🌍 Macro & Outlook

Short-Term → Bearish tilt (JPY strength risk)

Medium-Term → Neutral range (106 – 111)

Long-Term → Potential pressure from broader JPY cycles

🐂🐻 Final Take

CAD/JPY sits in a cautious zone – sentiment is mixed, with short-term JPY strength possible. But with layered entries, disciplined SL, and planned exits, traders can map their “heist strategy” like a pro.

📌 Related Pairs to Watch

FX:USDJPY

OANDA:EURJPY

OANDA:GBPJPY

OANDA:AUDJPY

OANDA:CADCHF

#CADJPY #Forex #SwingTrading #DayTrading #PriceAction #Yen #Loonie #TechnicalAnalysis #TradingCommunity #MarketOutlook

CADJPY Fading the Rally Bears Target 105.40 After Sharp ReversalCADJPY surged to fresh highs near 109.70 but quickly lost momentum, with sellers stepping in and pushing the pair lower. This sharp rejection hints at a possible top formation, especially as oil prices soften and Canadian data highlight labor market slack. With the Bank of Japan still dovish but domestic politics increasing uncertainty, CADJPY now looks vulnerable to deeper retracements, bringing key support zones into focus.

Current Bias

Bearish – Recent rejection at resistance strengthens the case for a corrective move lower toward 107.30 and potentially 105.40.

Key Fundamental Drivers

Canada: September labor force survey showed employment gains (+60k) but unemployment steady at 7.1%, signaling economic slack despite wage growth cooling to ~3.3% y/y.

Japan: BOJ policy remains accommodative, but political uncertainty and wage negotiations add a backdrop of yen volatility.

Commodities: Oil, Canada’s key export, has softened from recent highs, weighing on CAD support.

Macro Context

Interest Rates: BoC seen as patient, with markets pricing slower easing despite elevated unemployment. BOJ stays dovish, but political pressures could gradually shift expectations.

Economic Growth: Canada is slowing, while Japan’s growth remains modest but wage-driven improvements keep the yen in play.

Geopolitics & Trade: Trump tariffs and global trade risks weigh more heavily on CAD than JPY, as Japan benefits from safe-haven flows.

Primary Risk to the Trend

A sharp rebound in oil or a dovish shift in BoJ communication could limit JPY gains and re-strengthen CADJPY.

Most Critical Upcoming News/Event

Canada CPI – inflation readings will determine how patient the BoC can remain.

BOJ commentary – any shift in tone on policy normalization could lift JPY across the board.

Leader/Lagger Dynamics

CADJPY tends to be a lagger, following moves in oil and USDJPY. It often amplifies volatility seen in broader JPY crosses like EURJPY and GBPJPY.

Key Levels

Support Levels:

107.30

105.40

Resistance Levels:

109.20

110.10

Stop Loss (SL): 110.10

Take Profit (TP): 105.40

Summary: Bias and Watchpoints

CADJPY has shifted into bearish territory after rejecting 109.70, with momentum now pointing to downside targets at 107.30 and 105.40. The fundamental backdrop favors JPY resilience amid global risk caution and CAD softness tied to weaker oil and labor slack. A protective stop sits at 110.10, while take profit aligns with the 105.40 zone. Keep an eye on Canada CPI and BOJ rhetoric, as either could trigger sharp swings.

CADJPY - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

CADJPY Forming Ascending TrendlineCADJPY is currently trading around 105.50 after breaking below its long-term ascending trendline on the daily chart. This bearish breakdown signals potential continuation toward lower levels, with sellers gaining momentum after several failed attempts to sustain above 107.00. The rejection at higher levels indicates exhaustion from buyers, leaving room for the pair to retrace deeper toward the 102.00–101.00 support zone in the coming weeks.

From a fundamental angle, the Canadian dollar is under pressure as oil prices face renewed volatility due to uncertain global demand and fluctuating supply dynamics. At the same time, the Japanese yen is drawing safe-haven demand, especially as global investors remain cautious ahead of central bank guidance. With the Bank of Japan signaling a gradual shift from ultra-loose policy and the Bank of Canada holding a cautious stance due to softer economic data, the yen has an edge in the current risk environment.

Technically, the clean break of the ascending trendline confirms a potential trend reversal, and the bearish momentum is expected to strengthen if the pair stays below 106.00. Sellers will be eyeing the 103.50 and 101.00 zones as profit targets, while any pullback toward 106.80–107.30 is likely to attract fresh supply.

Traders should remain alert to upcoming Canadian employment and inflation data, as well as BOJ policy remarks, which could bring sharp volatility. For now, downside setups remain favorable while price action holds below the broken trendline, offering solid profit opportunities toward key support levels.

CAD/JPY – potential bullish reversal The pair is trading within an ascending channel. After testing the upper boundary, price corrected downward and broke through the median, but now buyers are showing signs of activity near the lower boundary.

📈 Idea: Long from current levels with the median line as the potential reversal magnet.

Target: 106.47 (resistance)

💡 Rationale: Price is approaching the channel support area.

A reversal toward the median line offers a favorable risk/reward setup.

The channel has already been respected multiple times, reinforcing its structure.

Risk: A sustained breakdown below the channel could trigger further bearish momentum.

CADJPY Momentum Stalls, Sellers Look for ControlCADJPY has tested the 107.40 zone but failed to sustain a breakout, suggesting fading bullish momentum. With oil prices struggling to find direction and the yen attempting to stabilize after weeks of weakness, sellers are circling. The chart structure points to a potential corrective leg lower if the pair breaks under near-term support.

Current Bias

Bearish – the pair shows signs of exhaustion near resistance, with downside levels now in focus.

Key Fundamental Drivers

Bank of Japan: Still accommodative, but the risk of verbal intervention increases as yen weakness deepens.

Bank of Canada: Expected to lean dovish after weak GDP and labor data, leaving CAD vulnerable.

Oil Prices: CAD remains tied to energy performance; lower oil tends to weaken CAD.

Macro Context

Interest Rates: BoC rate cut bets have increased, while BoJ policy remains ultra-loose, although rising JGB yields may offer some yen support.

Growth Trends: Canadian economy shows signs of stagflation risk (weak growth, sticky inflation), reducing CAD’s appeal.

Commodity Flows: Oil volatility directly impacts CADJPY, with recent weakness adding to pressure.

Geopolitics: Energy trade flows and Middle East tensions could ripple into oil and CAD sentiment.

Primary Risk to the Trend

A sharp rebound in oil prices or BoJ hesitation to tolerate further yen strength could invalidate the bearish case.

Most Critical Upcoming News/Event

Canada GDP and inflation reports

BoJ commentary/intervention signals

OPEC-related oil output headlines

Leader/Lagger Dynamics

CADJPY often acts as a lagger, following moves in oil and broader yen crosses like USDJPY and EURJPY. Watch USDJPY for early signals on yen direction and oil prices for CAD momentum.

Key Levels

Support Levels: 106.45, 105.95, 104.98

Resistance Levels: 107.44, 108.05

Stop Loss (SL): 108.05 (above recent highs)

Take Profit (TP): 106.45 (first target), 105.95 (secondary target), 104.98 (extended target)

Summary: Bias and Watchpoints

CADJPY carries a bearish bias as resistance holds at 107.40–108.00 and sellers push for a move toward 106.45 and below. Stop loss sits just above 108.05 to protect against false breakouts, while take profit levels extend toward 105.95 and 104.98. The pair remains heavily influenced by oil and yen sentiment, making it more of a lagger than a leader. Watch oil headlines and BoJ remarks closely, as they could shift momentum quickly.

SMC Concept: Defining the Trading Range (Step 1) On CADJPYCAD/JPY, 4H Timeframe (as demonstrated)

This post outlines the first step in a methodology focused on identifying key market structure levels. The goal is to objectively define a trading range, using CAD/JPY as the example.

The Process: Of a bullish Structure

Identify the range Low: Locate the last retracement from the previous high, the low is deepest price level retraced to.

Find the Inducement: Mark the low of the most recent pullback (retracement) before the price made a new high.

Wait for Confirmation: The high is only confirmed once price returns to hit this inducement level. This validates the high as an official range boundary.

A break of the confirmed high is a break of structure (BOS). A break of the confirmed low suggests a change of character (CHoCH), shifting sentiment.

This is the foundational step for identifying future points of interest. The next step involves plotting POIs based on this confirmed range.

This methodology is based on one that I learned from someone else on Youtube, but I have changed many details to suit my style. As a thank you note, I have referred to this person on other paltforms, but unfortunately, I don't think I can do this here as I might be violating this platform's rules.

I will be posting the next steps that would lead to deciding on a trading position on step by step basis.

I am already making videos but I might be using this platforms video option for later posts.

CADJPY Sellers Target Key Support as Momentum FadesCADJPY has slipped after failing to sustain momentum above the 107 handle, and the price action now leans toward renewed downside pressure. The chart structure shows repeated rejections and lower highs forming, which opens the door for a deeper pullback. With oil prices struggling to hold gains and JPY catching periodic safe-haven bids, this cross looks vulnerable to further declines.

Current Bias

Bearish – CADJPY is showing weakness with sellers eyeing lower support levels.

Key Fundamental Drivers

CAD: Weak Canadian labor market data and rising BoC rate cut expectations pressure CAD. Oil prices remain soft, removing an important support pillar.

JPY: The yen continues to benefit from safe-haven demand, especially during global risk-off waves and BoJ’s gradual steps toward yield control adjustments.

Yield spreads: Narrowing spreads between CAD and JPY rates reduce CADJPY’s carry appeal.

Macro Context

Interest rates: The BoC is leaning dovish after weak jobs and growth numbers, while the BoJ’s cautious shift away from ultra-loose policy provides structural support to the yen.

Growth trends: Canada faces slowing growth amid weaker domestic demand, while Japan’s growth remains modest but steady.

Commodities: Oil weakness weighs on CAD.

Geopolitical: Risk-off events (tariff disputes, Middle East tensions) tend to favor JPY strength, amplifying CADJPY downside.

Primary Risk to the Trend

A sharp recovery in oil prices or a stronger-than-expected Canadian economic release could lift CAD and cap downside momentum in this pair.

Most Critical Upcoming News/Event

Canada CPI and retail sales for confirmation of BoC’s dovish outlook.

BoJ policy commentary for clarity on yield control and inflation stance.

Leader/Lagger Dynamics

CADJPY tends to act as a lagger, often following broader risk sentiment and oil price movements. It also reacts to USDJPY moves, meaning JPY flows largely set the pace.

Key Levels

Support Levels: 105.95, 104.98

Resistance Levels: 106.93, 107.54

Stop Loss (SL): 107.54 (above resistance zone)

Take Profit (TP): 104.98 (major support)

Summary: Bias and Watchpoints

CADJPY bias is bearish, with SL set at 107.54 and TP aimed at 104.98. Oil weakness, dovish BoC expectations, and resilient JPY flows all lean in favor of further downside. The key watchpoints are Canada’s CPI/retail sales and BoJ commentary. Unless oil rebounds strongly, sellers are likely to stay in control, with price action favoring a test of 105.95 and potentially 104.98.

CADJPY - Expecting Bullish Continuation In The Short TermH1 - Strong bullish momentum.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

CADJPY Sellers Defend Resistance, Bears Eye Deeper CorrectionCADJPY is stalling once again at the 107.10–107.50 resistance zone, where sellers have stepped in multiple times over the past sessions. Price is forming a clear rejection pattern after retesting supply, suggesting that momentum is shifting in favor of the bears. With crude oil volatility weighing on CAD and safe-haven demand supporting JPY, this setup looks poised for a potential downside leg.

Current Bias

Bearish — short-term rejections at resistance open the door for a move lower toward 106.30 and 105.20.

Key Fundamental Drivers

Crude oil dynamics: CAD’s correlation with oil remains strong; lower oil prices weaken CAD and reinforce downside risk in CADJPY.

BoJ normalization risks: Any hint of a shift in Japanese monetary policy or discussions around yield control tends to boost JPY.

Risk sentiment: Risk-off flows typically drive JPY higher, while CAD suffers under global growth concerns.

Macro Context

Interest rate expectations: BoC is seen as close to its peak rate, with limited room for further hikes, while the BoJ is slowly signaling normalization steps.

Economic growth: Canada’s growth is vulnerable to commodity fluctuations, while Japan’s economy, though modest, is gaining traction from external demand and JPY’s relative undervaluation.

Commodity flows: Oil weakness puts pressure on CAD, while defensive flows boost JPY.

Geopolitical themes: Tariffs, trade disruptions, or Middle East tensions could amplify demand for JPY as a safe haven.

Primary Risk to the Trend

A strong rebound in crude oil or dovish BoJ messaging could support CADJPY and push the pair back above 107.50 resistance, invalidating the bearish setup.

Most Critical Upcoming News/Event

Canada CPI / Retail Sales (key for BoC policy outlook)

BoJ statements on monetary policy or FX stability

Leader/Lagger Dynamics

CADJPY often trades as a lagger, following oil and USDJPY trends.

It tends to be influenced by WTI crude prices and USDJPY moves, which dictate directional bias.

Key Levels

Support Levels: 106.35, 105.95, 105.20

Resistance Levels: 107.10, 107.50

Stop Loss (SL): 107.55

Take Profit (TP): 106.35 (first target), 105.20 (extended target)

Summary: Bias and Watchpoints

CADJPY is showing rejection at a major resistance zone, with sellers stepping in to cap upside momentum. The bearish bias remains valid as long as the pair stays below 107.50, with downside targets set at 106.35 and 105.20. A stop loss above 107.55 protects against a breakout reversal, while oil price fluctuations and BoJ rhetoric remain the most important watchpoints. Unless crude oil rallies sharply or Japan signals dovish backpedaling, the path of least resistance appears to favor the bears.

CAD/JPY Entry Uncapped – Loonie Robbery in Motion🔐CAD/JPY Heist Activated: Thief Breaks Into the Bullish Vault📈💰💥

📌 Asset: CAD/JPY "Loonie-Yen" Forex Bank

📌 Plan: Bullish

📌 Entry: Any price level

📌 Stop Loss: 106.600

📌 Target: 109.200

📌 Method: Multi-limit orders using Layering / DCA Strategy

👋🏼 Hello Money Movers & Market Robbers!

Welcome back to the battlefield — this time we’re breaching the vault of the CAD/JPY Loonie-Yen Forex Bank with a bullish masterplan. This isn't just a trade, it’s a planned heist using Thief Trader Strategy. Precision entries, layered orders, and sharp exits — that’s how we roll! 🏦💣

🔓 ENTRY — The Vault Is Open!

💸 Swipe the loot at any price — but the real pros place Buy Limits near recent swing lows (15min/30min TF) to catch price pullbacks.

⚠️ Only Long — Short is off-limits unless you’re surrendering your loot.

🛑 STOP LOSS — Lock Before They Catch You!

📍 Place SL at 106.600, or below your last entry layer if you stack orders.

Let your lot size, risk %, and DCA levels guide the SL placement. Safety first, profit always.

🎯 TARGET — The Exit Door: 109.200

📈 That’s where the loot gets stashed! Trail it smart if the price gets hot. Escape early if market mood shifts.

🧠 STRATEGY BREAKDOWN:

☑️ Style: Layered Grid / DCA Method

☑️ Trade Type: Scalping 🔹 Day Trade 🔹 Swing

☑️ Market Condition: Bullish momentum pushing through resistance — fundamental & sentiment align.

📚 MARKET INTEL:

📰 Stay ahead — read the COT reports, scan the macros, dive into quant flows & sentiment indexes.

Want the full picture? Click the 🔗 in proo file for the research vault.

⚠️ Avoid entries during high-volatility news. Set trailing SLs to protect your robbery bag. 🎒

🚨 THIEF TIPS:

🔹 Don’t panic — layer in, scale smart.

🔹 Use M15/H1 TF to plan sniper entries.

🔹 Let profits run, but never let them bleed.

💥 BOOST THIS IDEA if you support the Thief’s mission 💥

Every like powers up the next robbery!

Your support lets me share more free trade ideas with real planning & real money in mind.

🔐 Catch you on the next break-in… Stay funded, stay dangerous. 🤑🚁💼

CADJPY Forming Descending ChannelCADJPY is currently trading within a clean descending channel on the 4H chart, offering a classic technical setup for a potential bullish breakout. The pair has been consolidating for several sessions within this structure, making higher lows off key support. The channel is acting as a controlled retracement in a broader uptrend, and price is now reacting from the lower boundary—indicating a strong possibility of a bullish reversal toward the upper zone near 202.70.

Fundamentally, the British pound remains supported by strong wage growth and persistent inflation, which keeps the Bank of England on alert for further rate action. Traders are pricing in the potential for policy tightening to continue or remain elevated longer than expected. In contrast, the Japanese yen stays under pressure due to the Bank of Japan’s ultra-loose stance and its reluctance to normalize interest rates, especially after the latest BOJ meeting reaffirmed dovish policy despite a weakening yen.

The technical setup aligns perfectly with the fundamental landscape. CADJPY is positioned to benefit from yield differentials and risk-on sentiment in the market. A clean breakout above the channel resistance around 199.50 could trigger a wave of bullish momentum, targeting the 202.70 zone and potentially higher if bullish fundamentals persist. The current support zone around 197.40 serves as a tight invalidation level, providing a favorable risk-to-reward for swing buyers.

With this descending channel structure and macro tailwinds favoring strength and CADJPY weakness, I'm anticipating a breakout soon. This setup is one to watch closely, as it blends technical precision with fundamental divergence—a high-probability scenario that aligns with my trading plan.