"Loonie-Yen Heist: CAD/JPY Bullish Blueprint in Motion"🕶️💼 “Operation Loonie-Yen: The CAD/JPY Clean Sweep Blueprint” 💼🕶️

(Scalp & Swing Strategy by the Thief Trader Guild)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Movers & Strategic Operators, 🤑💰✈️

This blueprint is part of our 🔥Thief Trading Style🔥 operation—a fusion of technical precision and fundamental edge designed to tactically exploit the CAD/JPY (Loonie-Yen) setup.

🎯 Mission Objective:

Infiltrate the Bullish Zone & secure profits before the authorities (sellers) regroup.

📌 Entry Point:

"The vault's wide open!"

🔓Buy into momentum at any key level OR set a buy limit on recent swing lows using the 15m–30m charts. Wait for a pullback? Perfect—join the crew on the next dip.

🛑 Stop-Loss (SL):

Place it just below the 4H swing low (105.900) candle body wick.

But remember, your SL should match your risk style, position size, and trade frequency. Risk management is part of every successful heist.

🎯 Target Zone:

Aim for 108.500 – but exit smart if market behavior changes. Lock profits and vanish before the trap closes!

⚔️ Scalpers' Game Plan:

Only long-side jobs here. Got deep pockets? Dive right in. If not, team up with swing robbers and ride the trend. Use trailing SLs to secure every coin.

🧠 Fundamentals & Sentiment:

CAD/JPY strength is supported by intermarket flow, macro shifts, and trader sentiment. Check reports and correlations to stay a step ahead.

📰 Trading Alerts:

Be cautious around news releases—volatile spikes could trigger alarms. Avoid new entries during major drops and always protect active trades with trailing SLs.

💖 Support the Heist:

Hit that Boost button to power up the crew. Every push fuels another successful strategy. Thief Trading Style isn’t just a tactic—it’s a movement. 🏆💪

Stay alert. More heist blueprints coming soon.

Till then, trade smart. Loot legally. Vanish profitably. 🐱👤📈💸

Cadjpylong

CAD/JPY Bank Heist: Bullish Breakout (or) Bearish Trap?🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Money Makers & Market Robbers, 🤑💰💸✈️

Based on the 🔥Thief Trading Style🔥, here’s our master plan to loot the CAD/JPY "Loonie-Yen" Forex Bank Heist! Follow the strategy on the chart—Long Entry is the play. Our escape? Near the high-risk Danger Resistance Zone. It’s a risky level—overbought, consolidating, potential reversal—where bearish robbers lurk. 🏆💸 Take profits fast, traders! You earned it! 💪🎉

📈 Entry: The Heist Begins!

Wait for the breakout above 105.700—then strike! Bullish profits await.

Buy Stop Orders above Moving Average OR

Buy Limit Orders (15-30min timeframe) near swing lows/highs for pullback entries.

📌 Set an ALERT! Don’t miss the breakout.

🛑 Stop Loss: Protect Your Loot!

🔊 Yo, listen up! 🗣️

Buy Stop Orders? Don’t set SL until after breakout.

Place SL at nearest/swing low (4H timeframe)—adjust based on your risk & lot size.

Rebels, set SL wherever… but don’t cry later! 🔥⚡

🎯 Target: 107.300

Scalpers: Only go LONG. Use trailing SL to lock in gains.

Swing Traders: Ride the wave or join late—robbery is teamwork! 🤝

💥 Why CAD/JPY? Bullish Momentum!

Fundamentals, COT Reports, Sentiment, Intermarket Trends—checkk our bio for full analysis. 🔗🔗🔗

⚠️ Trading Alert: News = Danger!

Avoid new trades during news.

Use trailing stops to protect profits.

💖 Support the Heist! Hit the BOOST Button!

More boosts = More robberies = More profits! 💰🚀

Stay tuned—next heist coming soon! �🤗🎉

CADJPY..BUY📈 On the daily timeframe, CADJPY is in a clear uptrend.

🔁 After a healthy correction, price has reached our key support level, and I’m ready to enter a long position here.

⚠️ As always, if this level breaks and the market moves against us,

I’ll open a risky short trade until we reach the next buy zone.

📉 The market does whatever it wants—nothing is guaranteed.

✅ We’re here to use smart risk management and make profit in every possible scenario.

For detailed entry points, trade management, and high-probability setups, follow the channel:

ForexCSP

#CADJPY:1700+ PIPS Swing Concept On The Way,Three Profit TargetsJPY initiated a bearish trend and anticipates a rapid reversal in all JPY pairs, such as CADJPY. We expect a significant swing move, potentially reaching 2000+ pips in the long term. Additionally, we have set three targets based on our analysis, which can aid in identifying potential trade opportunities. Good luck and trade safely.

Good luck and trade safely.

Thanks for your support! 😊

If you want to help us out, here are a few things you can do:

- Like our ideas

- Comment on our ideas

- Share our ideas

Team Setupsfx_

❤️🚀

CADJPY: Bullish Momentum vs. Overextension Risk!🚀 CADJPY Analysis 🚀

CADJPY is in a strong bullish trend on the 4H chart, with momentum still pushing higher. However, I’m noticing signs that the pair might be overextended 📈. While there could be a bit more upside, both the weekly and daily timeframes show price pushing into previous highs, which often leads to a retrace back to equilibrium ⚖️.

🔍 Key Levels:

I’m watching the Fibonacci 61.8% retracement for a potential pullback, with the 50% level also marked as a key equilibrium zone. I’m not looking to go long at these elevated prices—prefer to wait for a healthy retrace for a more optimal entry 🎯.

💡 Macro Consideration:

We also took a look at the NASDAQ 🧑💻, since tech stocks can impact the JPY as flows move between risk assets and safe havens. With a lower high forming on the NASDAQ, risk sentiment could shift, impacting CADJPY as well.

🗓️ It’s Monday—let’s trade cautiously and wait for the best setups! Patience pays.

Not financial advice.

CADJPY I Long Opportunity to Middle of the ChannelWelcome back! Let me know your thoughts in the comments!

** CADJPY Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

CADJPY Potential longsFX:CADJPY

🇨🇦/🇯🇵

📝 Price spiked by 300 pips after tapping into the strong support on 9 April but lost its momentum shortly after without breaking the daily trendline, suggesting sellers still in control. Price has now reached its daily trendline zone again, on the current price on the day of market close, we see a rejection candle on the 2H chart and slight push upwards.

📝 The buy structures have retraced to its demand zones on each key levels before continuing to push price upwards, forming a compression. If price breaks above the daily trendline and closes above with good momentum, I may expect price to go back and contest the 104.604 candle that gave the bears control for 2 weeks. Therefore, we can use lower timeframe confirmation to hop on buys when price breaks upward and retest.

CAD/JPY "Loonie-Yen" Forex Bank Heist Plan (Swing Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

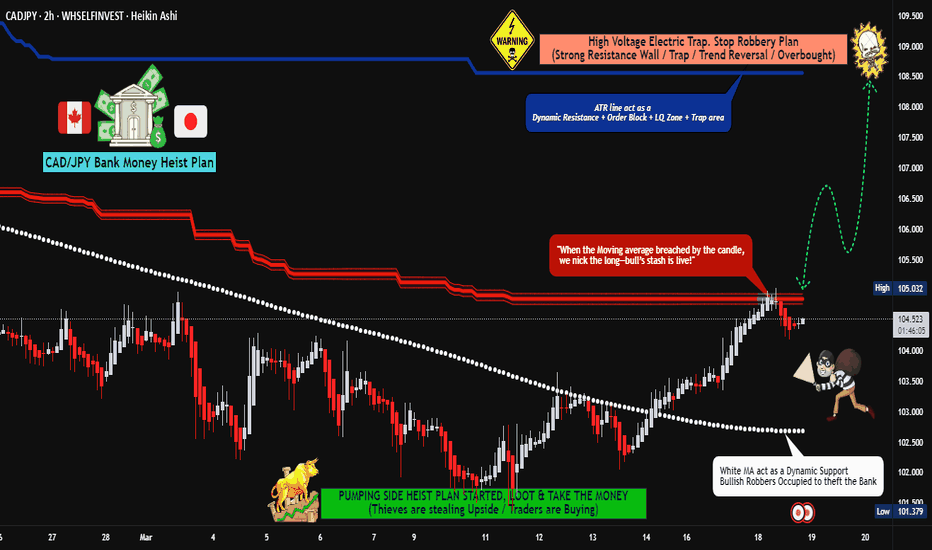

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the CAD/JPY "Loonie-Yen" Forex Bank. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (105.100) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 2H timeframe (103.300) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 108.500 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CAD/JPY "Loonie-Yen" Forex Bank Heist Plan (Swing Trade) is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental analysis, Macro Economics, COT Report, Quantitative Analysis, Intermarket Analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

CAD/JPY At Great Buying Area , 250 Pips Waiting For Us !Here is my CAD/JPY Long setup , we have a very good 4H Bullish P.A , The price at a very strong support which is we can buy from it , also we have a very good 4H Confirmation , so if the price go back to retest it we can enter a buy trade and targeting 250 pips .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

CADJPY: Bullish Setup Building — Fundamental AnalysisCADJPY is approaching a major support zone with a strong macro and seasonal backdrop favoring a bullish reversal.

Macro scores (LEI, endogenous) show consistent strength

Seasonality supports upside from late April into May

JPY is overbought per COT data

🔁 However, price structure remains bearish on 4H and Daily, so we are waiting for a confirmed CHoCH and HL before executing a swing long.

This idea is a "watch & prepare" setup — get ready to strike once structure flips.

CAD/JPY At Interesting Supp , Long Setup Valid To Get 200 Pips !Here is my Analysis On CAD/JPY , I See that the price starting giving a good bullish Price Action , So we can enter a buy trade if the price back again to my support and give us any good bullish P.A , And we can put our target at high of down trend line , and if we have a closure above we can continue .

This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

CAD JPY Trade Setup 1 hour timeframe CAD JPY Trade Setup 1 hour timeframe

Following last week's trade setup CAD JPY is moving in an uptrend making Higher Highs and Higher Lows, so we will keep looking for Buying opportunities.

CAD JPY is forming a bullish break and retest continuation pattern that also align with the 0.618-0.50 Fib Retracement level.

Lets wait for the price to pull back to the retest level then enter base off candlestick confirmation

CAD/JPY Triangle (BoJ Interest Rate- Today) 19.03.2025The CAD/JPY pair on the M30 timeframe presents a Potential Buying Opportunity due to a recent Formation of a Triangle Pattern. This suggests a shift in momentum towards the upside and a higher likelihood of further advances in the coming hours.

Possible Long Trade:

Entry: Consider Entering A Long Position around Trendline Of The Pattern.

Target Levels:

1st Resistance – 105.50

2nd Resistance – 106.06

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

CAD/JPY At Very Interesting Area To Buy , Don`t Miss 250 Pips !This Is An Educational + Analytic Content That Will Teach Why And How To Enter A Trade

Make Sure You Watch The Price Action Closely In Each Analysis As This Is A Very Important Part Of Our Method

Disclaimer : This Analysis Can Change At Anytime Without Notice And It Is Only For The Purpose Of Assisting Traders To Make Independent Investments Decisions.

CADJPY is in the Selling TrendHello Traders

In This Chart CADJPY HOURLY Forex Forecast By FOREX PLANET

today CADJPY analysis 👆

🟢This Chart includes_ (CADJPY market update)

🟢What is The Next Opportunity on CADJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts