Buy above $9If price drops back below $9, I'm going to be having a word with the charting gods. The technical setup here is very textbook.

White boxes on the chart may be fractals.

(Essentially, waves of momentum that ripple through like little mirror signatures after the initial wave.)

Tilray has a crazy awesome bullish setup over the next month or two, but oddly other markets I am seeing bearish signs. The only explanation I can think of is maybe Tilray is partly seen as a recessionary play due to their alcohol business and capital is switching sectors. One positive sign for Tilray is even though it is listed in the Nasdaq, even while the Nasdaq was red today (01/02/26), Tilray was UP +7%. Unexpected bullish divergence.

The other option is that this is all liquidity based and it's just the fact that rescheduling cannabis should lead to greater liquidity in the sector.

Who knows.

But!

IF the gods aren't completely screwing with us, Tilray should revisit $15 in the next few months. If Trump comes out and says, "Actually, I lied, and weed is bad." THEN the rally could end and we reverse the whole thing.

I love this stock long-term no matter what.

I think when the U.S. Treasury goes tits up, obviously everything will enter crisis, but they'll love cannabis once we peasants really get pissed and start banging on the doors. They'll legalize weed while we enter a lost decade and reshuffle the monetary system.

One day, cannabis will be a commodity again, like wheat, cotton, etc., but that's just my opinion and a bit of a historical cycle thing.

Cannabis

Buy the DipI am buying this dip. We've re-entered a good support area, but we need to watch the gap from Friday 12Dec2025. Gaps can be magnetic in that the market wants price discovery in those areas.

Entering the gap is fine, but if price starts to drag down to $9 then we are in caution mode. This December impulsive move up looks like a smaller fractal of the larger move up from July-October. IF that holds, it is mega-bullish.

For me, it all depends on what happens in that gap.

Best case, we hold above $10, build structure, and then launch up.

Worst case, we enter the gap, don't find buyers, and the smaller fractal fails when price closes below $9 and does not immediately gap back up on the next open.

Tilray: 80% gains!TLRY shares have made significant strides, boasting a gain of over 80%. Currently, the price continues to develop within orange wave iii, aiming to surpass the resistance at $23.20 in the next phase. A drop below the support at $3.51, however, would trigger our alternative scenario. In this case, it implies that the large beige wave alt.W is not yet complete (Probability: 33%).

Go TimeThis is the bounce we've been waiting for.

We have entered buy the dip mode on Tilray.

As long as we hold above $8.80, I'm bullish.

Biggest risk is that Trump 180's, but my longstanding theory has been and still is that the government is saving cannabis legalization for the next big downturn. Next depression? Legalize weed and then the working class won't revolt.

There are signs in the oil and debt markets that are saying this is beginning now. Just beginning.

Tilray Soars on Trump Policy Shift: Buy or Sell?Tilray (TLRY) shares jumped 30% following major political news. President Donald Trump announced plans to reclassify cannabis as a Schedule III drug. Additionally, a new pilot program may allow seniors to buy cannabis through Medicare. The stock has now doubled since its December lows. This analysis breaks down why this matters for your portfolio across key sectors.

Geopolitics and Strategy: The Policy Pivot

The U.S. government is changing its strategic stance on cannabis. President Trump’s potential executive order signals a massive shift in federal law. Moving cannabis to "Schedule III" lowers its legal severity. This aligns the U.S. with other progressive nations. For Tilray, this removes the constant fear of federal prosecution. It creates a safer environment for institutional investors to enter the market.

Economics: Tax and Banking Freedom

Reclassification solves two major economic problems for Tilray. Currently, cannabis companies pay extremely high taxes because of "Section 280E." This rule prevents them from deducting normal business expenses. Schedule III status removes this burden. It instantly improves cash flow and profitability. Furthermore, it opens access to traditional banking services, reducing the cost of doing business.

Business Models: The Senior Market

The proposed Medicare pilot program is a game-changer. It allows the government to subsidize cannabis for seniors. This creates a stable, guaranteed revenue stream for Tilray. Seniors often use these products for pain relief and health. This shifts the business model from recreational use to "medical necessity." A government-backed customer base is highly reliable and lucrative.

Science and Innovation: Research Growth

Strict laws previously blocked scientific research. Reclassification makes Research and Development (R&D) much easier. Tilray can now study cannabis compounds more freely. This accelerates the creation of new medical products. Patent analysis suggests this will lead to proprietary formulas. Owning exclusive medical patents creates a "moat" that protects Tilray from competitors.

Market Data: What Traders Are Betting

Options traders expect huge volatility. Data shows traders are pricing in a 50% move by March 2026. The target price in this bullish scenario is $21.22. This means investors are willing to bet money that the stock will rise significantly. Sentiment is aggressive and optimistic.

Technical Analysis: The Trend is Up

The stock chart confirms the positive news. Tilray is trading above its 50-day, 100-day, and 200-day moving averages. These are key lines that determine the trend direction. When the price is above them, the trend is "Bullish" (upward). The Relative Strength Index (RSI) is at 53, showing the rally has room to grow.

Conclusion: Wall Street’s Verdict

Analysts rate Tilray as a "Moderate Buy." Price targets reach as high as $25, suggesting a potential 75% gain. The combination of tax relief, new senior customers, and technical momentum makes a strong case. However, the move depends on the Executive Order becoming law. Investors should watch for official confirmation from the White House.

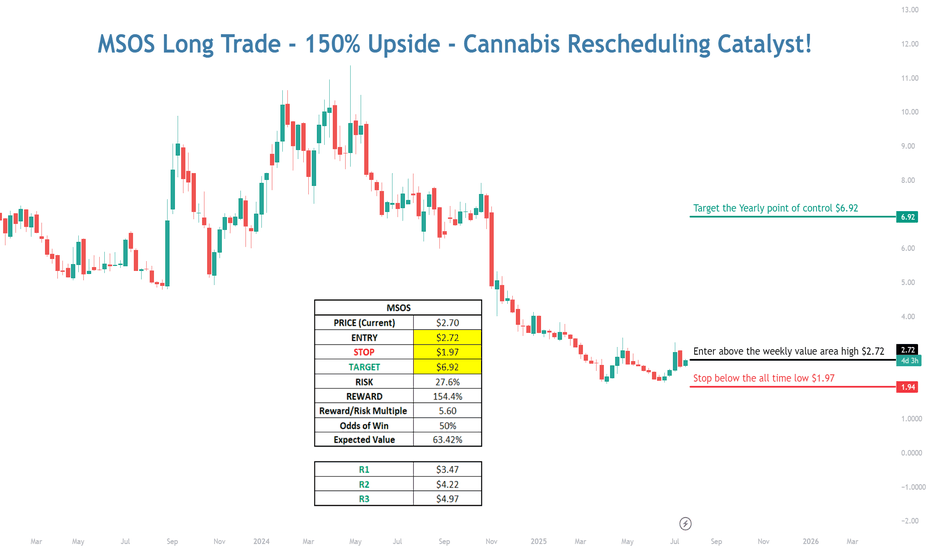

MSOS Long with 150% Upside - Cannabis Rescheduling Catalyst💠 Catalyst: Cannabis is currently classified as a schedule I drug alongside heroin, bath salts, and synthetic opioids that kill thousands every year — all while being safer than Tylenol and legal in over half the country. Cannabis is likely to be rescheduled to a schedule III drug soon after Terry Cole is confirmed as the head of the DEA. The vote to confirm him is expected to take place...TODAY

As a schedule I drug, cannabis companies can’t deduct regular business expenses for tax purposes, have limited access to banking, must transact with customers in all cash, and US multi-state operators are unable to list on the major US exchanges.

Terry Cole will be confirmed as the new head of the DEA, and when he is confirmed, the stalled process to reschedule cannabis from a schedule I to a schedule III drug should resume. If cannabis is rescheduled, that will pave the way for further research, destigmatize it, and open the door to banking and uplisting of US multi-state operators to the major exchanges in the near future.

This trade capitalizes on the fact that investors are not positioned for reform and further positive catalysts. The worst-case scenario is priced into the MSOS ETF, and when good news on rescheduling hits the tape, that should start a NEW Bull market in the MSOS cannabis stocks.

💠 Technical Setup:

Bear Market

• Multi-year bear market throughout the entire Biden administration on promises to reschedule that were never followed through on

• Capitulation when Trump won the election on the prospect of potentially another 4 years of no reform

Bearish to Bullish Technical Transition!

• LT Stage 1A Bottom Signal (Price > 50D SMA)

• ST Stage 2A Breakout (First day Price > 10D EMA and 20D SMA)

• Hourly Chart – Breaking out above Weekly Value Area

• Daily Chart – Trading above the Monthly Value Area

• Overlapping prior monthly value areas in sight!

• VPOC in sight!

• Weekly Chart – Targeting a retest of the Yearly POC

💠 Trade Plan

ENTRY: $2.72 (Break above weekly value area high)

STOP: $1.97 (Below the prior all-time-low)

TARGET: 6.92 (A retest of the yearly point of control from 2024)

RISK: 27.6%

REWARD: 154.4%

R/R Multiple: 5.6X

Probability of Win: 50%

Expected Value: 63.42%

Patience is KEYVery clear impulsive bullish price action from July-October.

We have pulled back currently 50%.

We're at a potentially good swing trade price, but I want to stack this stock for the long-term so I'm not buying yet. Before I buy, I want to see a shorter-term uptrend begin again and buy a pullback. Not looking to catch this falling knife.

***(Note: Since the bullish price action occurred around a news event where Trump talked about de-regulating cannabis, the bullish move may not last. This is why patience is key. This happened during Biden as well. Tilray 3-4x in weeks then bled back down to lower lows once people realized it was just talk.)

I am long-term bullish on this stock however.

I would love to buy sub-$1 on a little uptrend and hold for 5-10 years even.

Sundial Vs Wyckoff Accumulation Schematic, Ready For Lift Off!SNDL has clearly been under accumulation for a while and so I pulled up the Wyckoff schematic #1 for accumulation. It sure looks fitting to me. I have been in for a while but I will be adding more here.

SNDL Inc. is emerging as one of the leading vertically integrated cannabis companies in North America, showing strong signs of operational and financial turnaround in 2025. In Q2 2025, SNDL reported net revenue of $244.8 million, marking a solid 7.3% year-over-year increase, driven largely by a remarkable 17.4% growth in its cannabis business segment and a resurgence in its liquor retail division. Impressively, this quarter marked the first time SNDL achieved positive operating income and net earnings, highlighting the effectiveness of its strategic initiatives.

The company has demonstrated financial discipline by maintaining a robust cash reserve of over $208 million and exiting the period completely debt-free, positioning it well for future growth. SNDL is advancing its growth strategy through significant investments, including a $32.2 million acquisition of 32 new cannabis retail locations from 1CM Inc. and launching the Rise loyalty program to deepen customer engagement. Moreover, SNDL is expanding internationally with increased exports to the UK and European markets, diversifying its revenue streams beyond North America.

This combination of revenue growth, profitability milestone, strategic expansion, and financial strength solidifies SNDL's potential as a top cannabis stock in 2025. With a diversified portfolio of cannabis and liquor retail brands, SNDL is well positioned to capitalize on the growing legal cannabis market and maintain momentum in both domestic and international arenas.

This bullish case for SNDL emphasizes its operational execution, market expansion, and newfound profitability as drivers of long-term shareholder value. Not financial advice, DYOR.

Greenlane, perhaps a matter of time. But sooner than later...GNLN has been slammed yet we have decent fundamentals. The cannabis sector is ripe for pickings, one like this could be a gem yet to launch after being hammered down.

Here’s a positive, logically structured post you could use for GNLN (Greenlane Holdings):

Greenlane Holdings (GNLN) is one of those under-the-radar plays that the market has largely discounted, yet logic points to upside potential. The stock has been heavily beaten down, primarily due to sector pressure and dilution tied to past pivots, but the current setup leaves room for appreciation if you look beyond the negative headlines.

Market Position: GNLN is still a leading distributor of premium cannabis accessories, packaging, and vape technology. While many cannabis-touching companies face regulatory hurdles, GNLN operates on the ancillary side, meaning it doesn’t have the same legal exposure or cultivation costs. That’s a lower-risk niche with steady demand.

Industry Tailwinds: With increasing legalization momentum both at the state and federal level, accessory and packaging demand is a direct beneficiary. Every time new states open up, someone needs to sell the hardware, packaging, and storage solutions that GNLN specializes in. They’re positioned to ride the wave without production risks.

Operational Improvements: Management has been cutting costs, restructuring operations, and focusing on leaner growth. Smart capital preservation now means more runway to capture future sector upside.

Valuation Logic: After reverse splits and dilution, the float is still relatively low compared to many cannabis peers. This leaves room for big percentage swings when volume comes in. If you look at relative valuations in the cannabis accessory sector, GNLN trades at a steep discount.

Catalysts: Any progress in U.S. federal reform, SAFE banking, or industry expansion news could reignite interest in names like GNLN. Given how beaten down it is, even modest improvements in sentiment could translate to outsized percentage gains. Not financial advice, DYOR

Canaopy Growth looking to break outCannabis stocks are finally starting to wake up after rumours that Trump will finally legalize weed in the country.

A break above $1.99 should open $3.84 where the line linking the tops and the former lows should act as important resistances.

A break below $1.15 should invalidate this view.

Curaleaf: Target Zone in SightIn small steps, the CURA stock continues to move upward – however, we primarily interpret these movements as the internal structure of the downward wave v in orange. Therefore, the final low of this wave should soon be marked within the orange Long Target Zone between C$0.82 and C$0.37. Upon completion of wave v, the overarching wave II in beige should also end. Once this foundation is laid, a long-term upward movement should begin – initially driven by wave 1 in turquoise, which should carry the price above the resistance at C$4.93.

Innovative Industrial Properties: Low AheadThe stock of Innovative Industrial Properties managed to stabilize somewhat at the upper edge of our green Target Zone (coordinates: $53.48 – $16.80) but should soon initiate the next downward impulse. In the short term, we expect a final corrective movement deeper into our green Target Zone to establish the low of the overarching wave in green. Once the wave low is settled, the impulsive wave in green should take over and carry the stock beyond the resistance at $137.90.

Green Thumb, Cannabis Growth stock at good entry price multi year 25% earnings grower trading at 25 pe here.

double over sold with rsi and bollinger bands showing low readings.

peg ratio of 1.

tangible book value at 3.02.

buying calls and stock, will take profits on the calls to pay for the stock.

ride the stock for free for years.

TLRY Tilray Brands Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week,

I would consider purchasing the 2usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $0.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

$HITI - Rising with the tide, BIG MOVE INBOUND! High Tide - NASDAQ:HITI 🌊

Daily Chart Analysis:

-Green H5 Indicator

-Bullish Falling Wedge breakout inbound

-Volume Shelf Launch

-Price GAP filled before heading higher

-Weekly chart still intact and looking great

-Weekly Williams Consolidation Box thriving

🔜🎯$4.15

They know this is where the Liquidity Zone is I am bullish on Pot Stocks here but I believe a shakeout is in order before the next bullish impulse and the bear is dead. This clear "support" line if broken will provide ample liquidity for big fish to get in as there are likely many stops and much fears below this trend line. I think this will likely mean a broader pot stock dump before we can finally have a new bull market. Good luck.

$SNDL: A MASSIVE 1600% OPPORTUNITY FOR THIS CANNIBIS MICROCAP!NASDAQ:SNDL A MASSIVE 1600% OPPORTUNITY FOR THIS CANNIBIS MICROCAP STOCK! 🌿🤯

Are cannabis stocks back?!

3 Reasons Why in this Video: 📹

1⃣ My "High Five Trade Setup" strategy

2⃣ Catalyst: Decriminalization of MJ in Germany back in April and acquisition of NOVA.

3⃣ Symmetrical Triangle Breakout

Video analysis 2/5 dropping today. Stay tuned!🔔

Like ♥️ Follow 🤳 Share 🔂

Are cannabis stocks back?! Let me know in the comments below.

Not financial advice.

OTC:CRLBF OTC:TCNNF NASDAQ:TLRY TSX:ACB OTC:CURLF OTC:GTBIF AMEX:IWM NASDAQ:QQQ #TradingSignals #TradingTips #options #optiontrading #StockMarket #stocks #CannabisLegalisierung

CGC Canopy Growth Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CGC Canopy Growth Corporation prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $0.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TLRY cannabis stocksHexo turned out to be a bummer pick

but TLRY is still remaining

Which leads me to believe that the only thing that could cause a price to drop this much and then project this high upwards, has got to be due to federal legalization THC drinks and possibly more.

Lots of legal hoops to jump through for states and cannabis and more, but there is good that comes from legalization, meaning research money, meaning jobs, meaning genetics, meaning new ways of grow cannabis and using it that could ultimately be safer to consume vs now, maybe leads to dosages being figured out and effects to be specifically altered per user or use or effect or whatever you want to imagine.

Maybe not every state is ready to allow it but it seems across the board, it's a favorable issue for a lot of members of both parties. I've heard trump say, he doesn't need or want to use it but he has seen it do amazing things to help other, I've heard Kamala can help undo damage done during the course of a long a difficult career, and allow people who were simply selling to get by vs selling to commit crime and harm others, which ultimately means, she could probably do some good with the current fentanyl issue. As clearly she is now thinking about it from some views other than her own and how it can be used as a net good.

On top of that, it's clear the big companies or execs maybe even pharma companies need a look and a whole lot of questions asked about why cannabis caused the inability to fund through loans, borrow money, pay with credit and more.

So TLRY has overseas connections, favorable politics swinging their way through years of work, and drinks infused with THC, which as more research comes out, there might be ways to safely allow bars to serve drinks without someone being unable to get home within a reasonable amount of time. Would this ever occur, maybe, but the important key to take away is open research and money into science and then obviously trying to work with Mexico to literally end cartels (I have deep core ties to Columbia) and Escobar from stories I've heard personally and have no idea if they are true, really took care of the area he controlled, but yeah, he also probably was doing some awful stuff to others.

Lesson to learn here is that maybe some evil can be treated with a new direction, but some evil needs two major governments and police/technology and security that both keeps each place within their areas trying to solve a common goal and allowing each other to assist when a task is too difficult to handle on their own or ours. And clearly show the world that Mexico won't allow groups of evil to thrive and America can secure the border by doing it all in Mexico which could then theoretically lead to a an open border discussion, but say what you want. There is a major issue with cocaine usage and literally and knowingly killing other humans to profit, which is maybe evil, and something we could easily do which defense stocks getting obviously so much money pretty much all the time.

Again, why can't we help our vets to the point where it's not a issue? And they can seek help without losing status, rank, pay, benefits and more.

again, political views aside, America has a bad ass military that runs one hell of task, why aren't we using them to flush out corruption and evil and still find a way to maintain being an ideal view of how the military used to stand up to bad, and maybe we should have listened better should a former president suggest that money can cause an issue where oversight is gone, paraphrasing of course, as it's quite obvious this president have some serious foresight and tried to express that concern.

finally, cut anything out of this that you want to make it make sense in your world, but to make short a sweet, legalization allows the states more power, gives institutions power to direct lots of money towards meaningful research, gives avenues where we can actually start to work on the drugs that are laced with awful stuff coming into the country so frequently. And then you figure out who funds it and destroy whatever is left of that system, maybe dismantle is a better term, and start to setup some form of life that means someone in south america shouldn't feel the need to risk their life to leave their home, or why so many innocent people die for "drugs" which is probably a way better start a securing the border. A big wall can still have value in metal, and value can lead to an even better wall for cyber crimes, especially as we head to space. The space force is no joke, It was some well done prep work from former presidents and a realization of how much valuable stuff will be in a space making it targets for "evil"

Why do I say all of this, probably because a big first step is exactly the one I mention, legalization, and then locking up or whatever the leader decides is needed at that time. Ideally with a new lens of money being used to manipulate others at will. but my view is just one, I can't say my way is best, right or even possible, but again, legal leads to open freedom in safe environments. In fact, maybe the best person to handle an issue like that is someone who is potentially willing to legalize something that her decisions in the past have led to jail or worse.

TLRY Tilray Brands Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TLRY Tilray Brands prior to the earnings report this week,

I would consider purchasing the 1usd strike price in the money Calls with

an expiration date of 2024-10-11,

for a premium of approximately $0.70.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SNDL Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SNDL prior to the earnings report this week,

I would consider purchasing the 2usd strike price Calls with

an expiration date of 2024-10-18,

for a premium of approximately $0.48.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.