A truncation is in the correction flat waveBased on the chart, I realized a truncation wave what is completed at 0.71728.

CAPITALCOM:AUDUSD is retracing to around 0.77834 (wave B), why?

Because, wave A is truncation that proved seller's weakness and wave B can retrace to 0.236 Fib to complete a flat wave.

Time will tell....

Capital

What Is Capital Partitioning ? How will it help you as a trader?Hi everyone:

Let's talk about capital partitioning, which is a risk management approach for consistent traders to utilize to allow them to leverage their capital.

You may ask what exactly is capital partitioning ? well to simply put it in words, it is basically divide up your trading $ in the current trading account into 2 or more sub accounts.

So what's the point of doing that you may ask ?

Well, with leverage, a consistent trader does not require to have their entire money deposit into one trading account.

They can allocate the asset into different trading accounts to reduce risk as well as trading different markets available

Let's take a look here:

Say I have a $100,000 trading capital. I understand risk management, trading psychology, and will not over trade, over risk and revenge trade.

Hence, it's in my best interest to divide the $ in this account into a different accounts, or simply in a liquid-able account such as a savings account, stocks, bond..etc

Here are a few scenarios that you can implement into your trading accounts.

Understand that the % to allocate, what other trading accounts to deposit $ into, and how to move around the $ is totally up to you as a trader.

The most important is to make sure you are a consistent trader before you approach this type of method.

As more accounts you divide your capital into, the more % you will need to risk per account as you need to open bigger position sizes now.

Any questions, comments, or feedback welcome to let me know.

Thank you

I will share other risk management educational videos that can be helpful for you.

Risk Management: When/How to move SL to BE and to profit in a running trade ?

Risk Management: How to filter trading opportunities if multiple setups are presenting entries:

Risk Management: 3 different entries on how to enter the impulsive phrase of price action

Risk Management 101

Risk Management: How to set a Take Profit (TP) for your trades

Risk Management: How to Enter and set SL and TP for an impulse move in the market

Risk Management: How to scale in the impulsive phrase of the market condition?

Risk Management: Combine everything you learn to prevent blowing a trading account

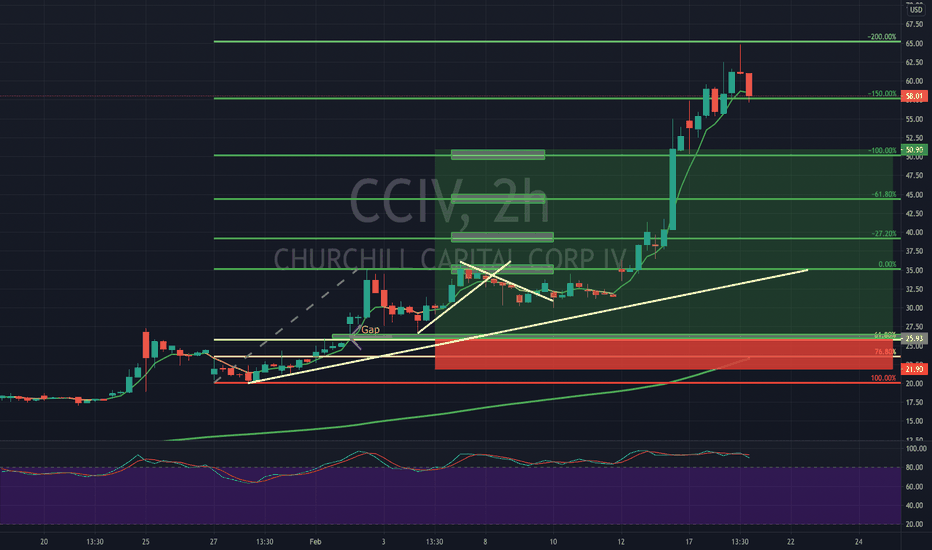

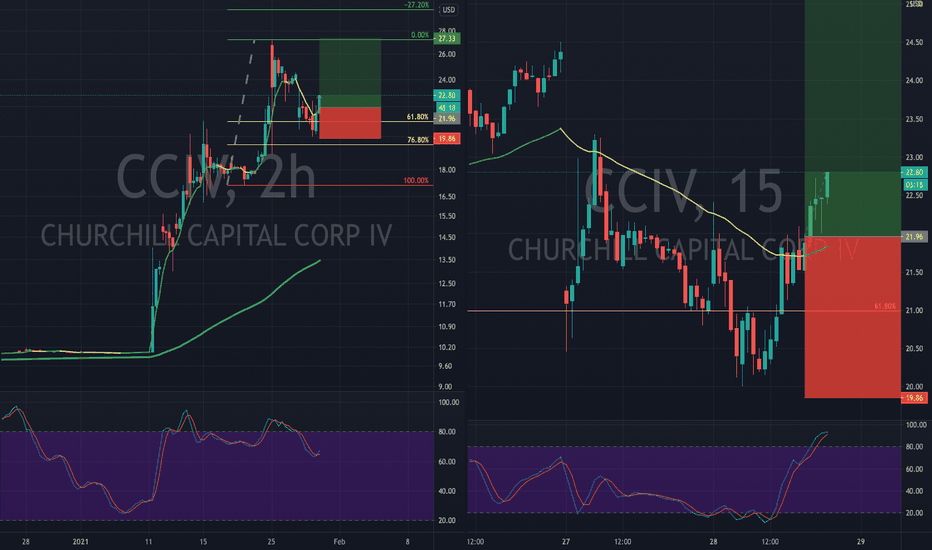

Lucid Motors - CCIV - Recalculating - Technicals vs FundamentalsLucid Motors - CCIV - Recalculating - Technicals vs Fundamentals - From a technical standpoint, CCIV should return to close the gap around $50 after bouncing off the golden zone support. This is taking a long time for a company that is expected to increase in value with momentum. From a fundamental standpoint, Is the initial merger even complete? When will the symbol change from CCIV? There is no concrete delivery date for the first car deliveries. Each time they demo the car, they mention more improvements that need to be made. Then there's the elephant in the room. If the Lucid developers are from Tesla, will there be patent issues with the design and technology? Or is Tesla completely open source? Finally, from a speculative standpoint, if Apple is interested in Lucid, why wouldn't they purchase the entire company and cut out CCIV (is the CCIV merger final?)? We know Apple was interested in buying Tesla at one point. Basically Lucid needs some FIRM announcements to launch this stock to the next level. This is not financial advice.

CCIV - Lucid Motors - Patiently waiting for the gap fill at $50CCIV - Lucid Motors - Patiently waiting for the gap fill at $50. CCIV has started trending upwards. Patience Patience. Not Financial Advice.

Lucid Motors - CCIV - Ready to break out?Lucid Motors - CCIV - Ready to break out? After a small inverted head and shoulder pattern, is Lucid Motors (CCIV) finally ready to breakout? We will see? Not Financial advice.

Churchill Capital - CCIV - LUCID Motors - The Gap is filled!Churchill Capital - CCIV - LUCID Motors - The Gap is filled! From a technical point, price is free to go up and fill the larger gap above? We are now expecting some fundamental catalyst to spark the turnaround? What will the catalyst be? Any thoughts? We will see? Not financial advice.

Churchill Capital - CCIV - Hitting the Buy Zone?Churchill Capital - CCIV - Hitting the Buy Zone? CCIV is closer to the value entry price? Keep in mind that there are a lot of obstacles still ahead for LUCID Motors. If they do not have solid plans, the other existing car manufacturers will start to reveal their electric cars. Yes, people will go for a luxury EV from a proven brand like Mercedes, Audi or BMW at the LUCID Dream price point. Also, The first EV company to reveal a sizable car priced between $20K to $30K may dominate sales(Tesla may be closer to delivering on this)? So time is of the essence for LUCID to establish its brand and truly become a car manufacturer and not just designers. As far as the stock and the price, we are closer to a better entry at this point? Not financial advice.

Churchill Capital CCIV - Lucid Motor vs Tesla near buy target?Churchill Capital CCIV - Lucid Motor vs Tesla. CCIV near buy target? Then looking for 100% short term gain? Patients pays off? Not financial advice.

Churchill Capital CCIV - Merger - Lucid - Tesla rival but Price Churchill Capital CCIV - Merger - Lucid - Tesla rival but Price may be too high for CCIV in merger. We will see? If it goes to $25 then it may be a buy? get your popcorn and watch what happens. Not financial advice.

CCIV - Churchill Capital- What is a fair price?CCIV - Churchill Capital- What is a fair pre-merger price? As investors pile into CCIV, we have to consider that there has not been an official Lucid Motors merger announcement. We also have to consider that other Tesla competitors that are already listed are at this same pre-merger price. NIO is at $54. Xpeng XPEV is at $41. GM is at $52. Meanwhile, CCIV, a company that is not in the automotive industry yet is priced at $58 already. Of course, market cap matters, but does CCIV have an edge on these other companies? All of this makes you think of whether some news or dilution of shares will happen. It is hard to think that CCIV will go above $100 before a merger is even announced. In todays world, anything can happen. I think we would all feel better if the merger is officially announced. Not Financial Advice.

CCIV Churchill Capital has gone Parabolic? Merger with LUCID?CCIV Churchill Capital has gone Parabolic? Merger with LUCID Motors? Break out was sooner than expected. Watch for pullbacks? 100% move?

IPOE - Buy zone $20-$22 then 50% gain?IPOE - Buy zone $20-$22 then 50% gain? Patience usually pays off. There is a gap around the $20-$22ish range. Fib golden zone also. We will see if price drops to these levels?

CCIV - Churchill Capital - Needs to fill the GAP before LaunchCCIV - Churchill Capital - Needs to fill the GAP before launch. Look for this pull back to the $24 - $26ish range before the price shoots up. Short term dip for a longterm pop. This is not financial advice.

CCIV Churchill Capital - Stock to watch!CCIV Churchill Capital - Stock to watch! If Lucid Motor merger is announce this stock may run. This is just a rumor. Do your research.

CCIV Churchill Capital - 100% Gain potential?CCIV Churchill Capital - 100% Gain potential? Double your Money? Rumor has it CCIV will merge with Lucid Motors to take it public. Rumors can be wrong. Lucid is the first EV based competitor who will deliver cars in the US later this year. Other EV makers such as NIO and XPENG XPEV are trading at 57.98 and 47.52 but have no immediate plans to deliver cars in the US. IF IF IF CCIV/Lucid performs the same as these companies, then a $50 stock price is reasonable. If CCIV goes to $25-$26ish level then a double up play to $50ish will activate. This is not advice. Just food for thought.

Not Financial Advice!

Manifest your Success

Some people are in too much of a hurry to get rich.

It is more reasonable to take a year or 2 to grow an account to $1,000,000 by compounding.

The Secret of Compounding:

Double your money 10-15 times to get to $1million dollars over time

Plan:

Starting with capital you don't mind losing

Choose your trades carefully and execute with patients

Only risk 50% of your capital on each trade idea, if you hit your stop loss you only step back to the previous step

Starting with $1000

Step 1: $1000 X 2 = $2000

Step 2: $2000 X 2 = $4000

Step 3: $4000 X 2 = $8000

Step 4: $8000 X 2 = $16,000

Step 5: $16,000 X 2 = $32,000

Step 6: $32,000 X 2 = $64,000

Step 7: $64,000 X 2 = $128,000

Step 8: $128,000 X 2 = $256000

Step 9: $256,000 X 2 = $512,000

Step 10: $512,000 X 2 = $1,024,000

Starting with $100

Step 1: $100 X 2 = $200

Step 2: $200 X 2 = $400

Step 3: $400 X 2 = $800

Step 4: $800 X 2 = $1,600

Step 5: $1,600 X 2 = $3,200

Step 6: $3,200 X 2 = $6,400

Step 7: $6,400 X 2 = $12,800

Step 8: $12,800 X 2 = $25,600

Step 9: $25,600 X 2 = $51,200

Step 10: $51,200 X 2 = $102,800

Step 11: $102,400 X 2 = $204,800

Step 12: $204,800 X 2 = $409,600

Step 13: $409,600 X 2 = $819,200

Step 15: $819,200 X 2 = $1,638,400

CCIV - May Merge with LUCID to rival Tesla?CCIV - May Merge with LUCID to rival Tesla? Fib play taking off like a SpaceX rocket. Ex-TELSA engineers a part of LUCID. Should you buy the Rumor or buy the Fib Play? Who knows? It's just a rumor.

CCIV - Time to buy? Will the merge with Tesla rival Lucid?CCIV - Buy the Rumor, Sell the News! SPAC rumors can still be traded with caution. We just need a stock to be motivated to move. Hit 61.8 fib level and moving up so time to buy? Churchill Capital.

Bitcoin is making new highs, but some ALTs haven't (yet)Hello, today I want to share my current trading strategy.

First, I will look at Bitcoin against USDT.

The market is bullish and shows no sign of ending anytime soon, at least for now.

From this information, I know I can trade the BTC/USDT chart, but not only. Because with all this capital flowing into crypto, usually (that's what used to happen everytime), a great part of this capital will turn into Altcoins.

Indeed, if we look at the ETH/BTC pair for example, we can see that it is starting to over-pace bitcoin, put it simply: it can beat bitcoin.

What I mean is: while bitcoin beat his previous all time high by 80%, a lot of coins haven't done the same yet.

Looking at ETH/USDT, which previous high is 1438 USDT, hasn't made a new high yet.

Litecoin as well is starting to gain strength against bitcoin, its volume is increasing lately.

His all time high, around 368 USDT, remains to be beaten.

ADA (Cardano) is in the same scenario, and I'm sure we could find other ALTs like such.

To sum up, my current stratgy is to find Altcoins who perform better than bitcoin, to maximise the potential gains.

Then I will setup a swing trade indicator on each.

One last thing, very important, is to keep an eye on the Bitcoin dominance and Altcoins marketcap.

Right now, Bitcoin is getting 67% of the total capital put into crypto. It has a lot of room to go down.

Meanwhile the altcoins (bottom chart), are following a strong ascending trendline, with a lot of space to go up.

This only confirms the strategy to get into Alts right now.

/!\ This is not a financial advice, I am a developer, not a trader (yet).