CHR/USDT - Last Demand Zone Could Define the Next Big Move?On the weekly timeframe, CHR/USDT remains in a long-term bearish phase, clearly reflected by a consistent lower high and lower low structure since the all-time high around 1.50. Selling pressure continues to dominate, pushing price closer to a major historical demand zone formed during the early accumulation phase.

The yellow zone (0.0235 – 0.0180) is a critical area, as it previously triggered a strong bullish impulse and now acts as a key decision zone for long-term price direction.

---

Market Structure & Technical Pattern

Primary Trend: Bearish (long-term downtrend)

Market Structure: Lower High – Lower Low (no confirmed reversal yet)

Key Technical Patterns:

Descending Structure / Bearish Continuation

Potential early-stage Falling Wedge if bearish momentum weakens near demand

Key Levels:

Major Demand Zone (Weekly): 0.0235 – 0.0180 (yellow zone)

Minor Support: ~0.038

Nearest Resistance: 0.060 – 0.075

Major Resistance: 0.110 – 0.170

This demand zone represents a high-probability reaction area, especially for long-term positioning.

---

Bullish Scenario

The bullish scenario becomes valid if:

Price holds and reacts strongly within the 0.0235 – 0.0180 demand zone

Formation of strong weekly rejection or bullish engulfing candles

A minor market structure break above 0.060

Bullish upside targets:

Initial rebound toward 0.060 – 0.075

If breakout continuation occurs:

0.110

0.170

This scenario would signal the beginning of a long-term accumulation and reversal phase.

---

Bearish Scenario

The bearish continuation scenario remains valid if:

Price closes a weekly candle below 0.0180

The major demand zone fails to hold

Bearish implications:

Breakdown of long-term structure

Potential search for lower liquidity zones

Increased risk of market capitulation

No reversal confirmation exists unless a new structure is formed.

---

Conclusion

CHR/USDT is currently trading at a critical long-term decision zone. The 0.0235 – 0.0180 area acts as the last major demand, determining whether price will:

Enter a long-term accumulation and reversal phase, or

Continue a deeper bearish trend

Price reaction at this zone will be decisive for future market bias.

#CHR #CHRUSDT #Chromia #CryptoAnalysis #TechnicalAnalysis #WeeklyChart #DemandZone #SupportResistance #BearishTrend #PotentialReversal #AltcoinAnalysis

Chrusdtanalysis

CHR/USDT — Sitting on Demand Zone, Rebound or Breakdown Ahead?CHR/USDT is currently trading around $0.0971, right inside the historical demand zone $0.07–0.12, which has been a strong accumulation area since 2021.

This zone has acted as a launchpad for multiple rallies, but at the same time, it holds a pool of equal lows liquidity that could be swept if buyers fail to defend it.

Key technical levels from the chart:

Major demand/support: 0.0700 – 0.0900

Step resistances: 0.1100 – 0.1332 – 0.1710 – 0.1919 – 0.2575 – 0.3455 – 0.4637 – 0.8752 – 1.2456 – 1.5000

Historical low: 0.0188

---

🔹 Market Structure & Pattern

Price is building a multi-year horizontal accumulation base between 0.07–0.12.

Each historical rally was triggered from this zone, making it a high-value demand block.

However, repeated tests without a strong breakout increase the risk of demand exhaustion and potential breakdown.

In other words, this area can either act as the foundation of the next bull rally or the last line before capitulation.

---

🟢 Bullish Scenario

Bias remains bullish as long as 0.0700 holds.

First trigger: A weekly close above 0.1100 → opens the path toward 0.1332.

Stronger confirmation: A break and close above 0.1332 → sets targets at 0.1710 → 0.1919.

Mid-term swing targets: 0.2575 → 0.3455.

In case of a full bullish cycle, reclaiming higher zones around 0.4–0.8 and even 1.2–1.5 remains possible.

---

🔴 Bearish Scenario

Warning sign: A weekly close below 0.0900 suggests fading buyer strength.

A breakdown below 0.0700 would unlock deeper downside: 0.0450 → 0.0310, with extreme risk toward the historical low at 0.0188.

This would mark a failed demand block and transition into a bearish market structure.

---

🎯 Conclusion & Strategy

CHR/USDT is at a critical crossroad:

Bullish case: Holding above 0.07–0.12 keeps the rebound potential alive.

Bearish case: Losing 0.07 would confirm structural weakness and open deeper downside.

💡 For aggressive traders: consider accumulation within the current zone with a tight stop below 0.0700.

💡 For conservative traders: wait for a weekly close >0.1332 as confirmation before entering long, targeting 0.1710–0.1919.

#CHRUSDT #Chromia #CryptoAnalysis #AltcoinTrading #PriceAction #SupportResistance #SwingTrading #CryptoTA #WeeklyChart

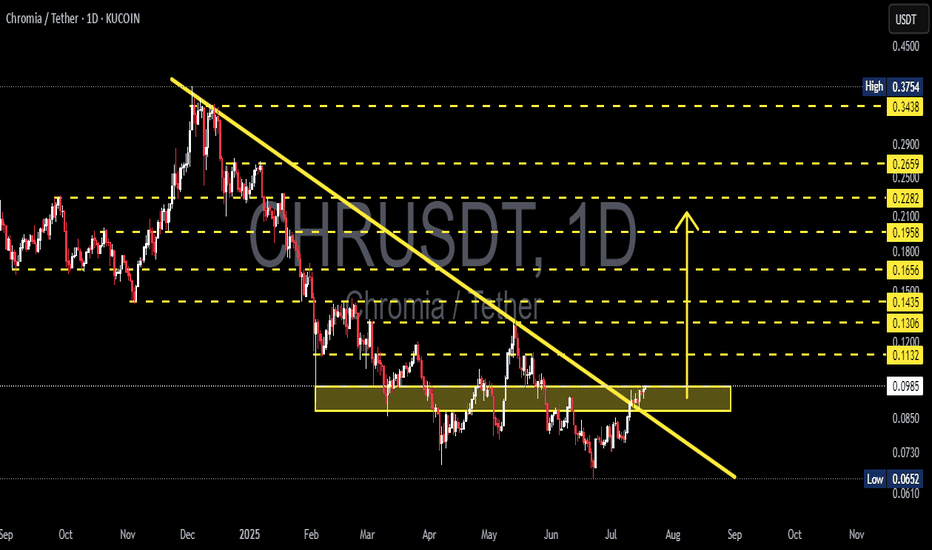

CHR/USDT Major Breakout! Bullish Momentum Ignites🧠 Complete Technical Analysis:

After months of being trapped in a prolonged downtrend since December 2024, Chromia (CHR) has finally shown signs of awakening. The price has successfully broken out of a major descending trendline, while also breaching a critical consolidation resistance zone between $0.093–$0.098 (highlighted in yellow).

This breakout not only indicates a potential trend reversal, but also opens the door for a medium-term bullish rally if sustained.

📊 Structure and Pattern Highlights:

Descending Trendline Breakout: CHR has decisively broken out of the long-standing bearish structure.

Validated Accumulation Zone: The $0.075–$0.098 range has proven to be a strong accumulation base after multiple tests.

Layered Horizontal Resistances: A clear ladder of resistance levels awaits as price pushes upward.

Potential Bullish Patterns: With a healthy pullback and higher low, CHR could form an Inverse Head and Shoulders or a Bullish Flag continuation pattern.

📈 Bullish Scenario:

If CHR can hold daily candle closes above the $0.098 breakout zone, the following targets come into play:

Target Level Description

$0.113 Breakout confirmation zone

$0.120 Psychological mini-resistance

$0.130 Historical horizontal resistance

$0.143 Previous local top

$0.165 Key breakdown level

$0.180 – $0.228 Medium-term target range with historical supply

$0.265 – $0.290 Strong resistance area from past distribution

$0.343 – $0.375 Long-term bullish target

💡 Note: If buying volume increases and BTC remains stable or bullish, these targets become increasingly realistic.

📉 Bearish Scenario:

However, if this breakout turns out to be a fakeout, CHR may fall back below the $0.093 zone and retest:

$0.085 (minor support)

$0.075 (base support)

As low as the demand zone around $0.065–$0.070

📌 Candle close and volume confirmation are critical. Avoid chasing price without solid validation!

📎 Conclusion & Strategy:

> CHR/USDT is currently at a pivotal moment. This breakout from a multi-month downtrend signals a potential trend reversal and a medium-term opportunity for swing traders and position holders.

📈 Trading Strategy Suggestion:

Entry: After a successful retest of the $0.095–$0.098 zone

Stop Loss: Below $0.085

Take Profit: Scale out at resistance levels listed above

#CHRUSDT #Chromia #CryptoBreakout #TrendReversal #AltcoinSeason #TechnicalAnalysis #CryptoTrading #BullishPattern #BreakoutSignal #ChartSetup