#CHR/USDT READY TO NEW EXPLODE !#CHR

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.0298, and the price has bounced from this level several times. Another bounce is expected.

The RSI is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.0304

Target 1: 0.0312

Target 2: 0.0319

Target 3: 0.0328

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

Chrusdtlong

#CHR/USDT Buy Opportunity#CHR

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.0373, and the price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.0383

First Target: 0.0389

Second Target: 0.0400

Third Target: 0.0413

Stop Loss: Below the green support zone.

Remember this simple thing: Money management.

For any questions, please leave a comment.

Thank you.

CHR/USDT - Last Demand Zone Could Define the Next Big Move?On the weekly timeframe, CHR/USDT remains in a long-term bearish phase, clearly reflected by a consistent lower high and lower low structure since the all-time high around 1.50. Selling pressure continues to dominate, pushing price closer to a major historical demand zone formed during the early accumulation phase.

The yellow zone (0.0235 – 0.0180) is a critical area, as it previously triggered a strong bullish impulse and now acts as a key decision zone for long-term price direction.

---

Market Structure & Technical Pattern

Primary Trend: Bearish (long-term downtrend)

Market Structure: Lower High – Lower Low (no confirmed reversal yet)

Key Technical Patterns:

Descending Structure / Bearish Continuation

Potential early-stage Falling Wedge if bearish momentum weakens near demand

Key Levels:

Major Demand Zone (Weekly): 0.0235 – 0.0180 (yellow zone)

Minor Support: ~0.038

Nearest Resistance: 0.060 – 0.075

Major Resistance: 0.110 – 0.170

This demand zone represents a high-probability reaction area, especially for long-term positioning.

---

Bullish Scenario

The bullish scenario becomes valid if:

Price holds and reacts strongly within the 0.0235 – 0.0180 demand zone

Formation of strong weekly rejection or bullish engulfing candles

A minor market structure break above 0.060

Bullish upside targets:

Initial rebound toward 0.060 – 0.075

If breakout continuation occurs:

0.110

0.170

This scenario would signal the beginning of a long-term accumulation and reversal phase.

---

Bearish Scenario

The bearish continuation scenario remains valid if:

Price closes a weekly candle below 0.0180

The major demand zone fails to hold

Bearish implications:

Breakdown of long-term structure

Potential search for lower liquidity zones

Increased risk of market capitulation

No reversal confirmation exists unless a new structure is formed.

---

Conclusion

CHR/USDT is currently trading at a critical long-term decision zone. The 0.0235 – 0.0180 area acts as the last major demand, determining whether price will:

Enter a long-term accumulation and reversal phase, or

Continue a deeper bearish trend

Price reaction at this zone will be decisive for future market bias.

#CHR #CHRUSDT #Chromia #CryptoAnalysis #TechnicalAnalysis #WeeklyChart #DemandZone #SupportResistance #BearishTrend #PotentialReversal #AltcoinAnalysis

#CHR/USDT READY TO NEW EXPLODE !

#CHR

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.0387. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.0397

First target: 0.0405

Second target: 0.0416

Third target: 0.0429

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

#CHR/USDT Buy Opportunity#CHR

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.0564. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.0596

First target: 0.0613

Second target: 0.0630

Third target: 0.0652

Don't forget a simple principle: money management.

Place your stop-loss order below the support zone in green.

For any questions, please leave a comment.

Thank you.

#CHR/USDT Buy Opportunity#CHR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.0694, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.0706

First target: 0.0720

Second target: 0.0738

Third target: 0.0764

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

CHR/USDT — Sitting on Demand Zone, Rebound or Breakdown Ahead?CHR/USDT is currently trading around $0.0971, right inside the historical demand zone $0.07–0.12, which has been a strong accumulation area since 2021.

This zone has acted as a launchpad for multiple rallies, but at the same time, it holds a pool of equal lows liquidity that could be swept if buyers fail to defend it.

Key technical levels from the chart:

Major demand/support: 0.0700 – 0.0900

Step resistances: 0.1100 – 0.1332 – 0.1710 – 0.1919 – 0.2575 – 0.3455 – 0.4637 – 0.8752 – 1.2456 – 1.5000

Historical low: 0.0188

---

🔹 Market Structure & Pattern

Price is building a multi-year horizontal accumulation base between 0.07–0.12.

Each historical rally was triggered from this zone, making it a high-value demand block.

However, repeated tests without a strong breakout increase the risk of demand exhaustion and potential breakdown.

In other words, this area can either act as the foundation of the next bull rally or the last line before capitulation.

---

🟢 Bullish Scenario

Bias remains bullish as long as 0.0700 holds.

First trigger: A weekly close above 0.1100 → opens the path toward 0.1332.

Stronger confirmation: A break and close above 0.1332 → sets targets at 0.1710 → 0.1919.

Mid-term swing targets: 0.2575 → 0.3455.

In case of a full bullish cycle, reclaiming higher zones around 0.4–0.8 and even 1.2–1.5 remains possible.

---

🔴 Bearish Scenario

Warning sign: A weekly close below 0.0900 suggests fading buyer strength.

A breakdown below 0.0700 would unlock deeper downside: 0.0450 → 0.0310, with extreme risk toward the historical low at 0.0188.

This would mark a failed demand block and transition into a bearish market structure.

---

🎯 Conclusion & Strategy

CHR/USDT is at a critical crossroad:

Bullish case: Holding above 0.07–0.12 keeps the rebound potential alive.

Bearish case: Losing 0.07 would confirm structural weakness and open deeper downside.

💡 For aggressive traders: consider accumulation within the current zone with a tight stop below 0.0700.

💡 For conservative traders: wait for a weekly close >0.1332 as confirmation before entering long, targeting 0.1710–0.1919.

#CHRUSDT #Chromia #CryptoAnalysis #AltcoinTrading #PriceAction #SupportResistance #SwingTrading #CryptoTA #WeeklyChart

CHRUSDT UPDATE#CHR

UPDATE

CHR Technical Setup

Pattern: Bullish Wave Pattern

Current Price: $0.1043

Target Price: $0.16

Target % Gain: 52.95%

Technical Analysis: CHR is showing a bullish wave breakout on the 1D chart, reclaiming resistance around $0.10–$0.11 as new support. Strong bullish candles and momentum indicate a possible continuation move, with the next target set near $0.16.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

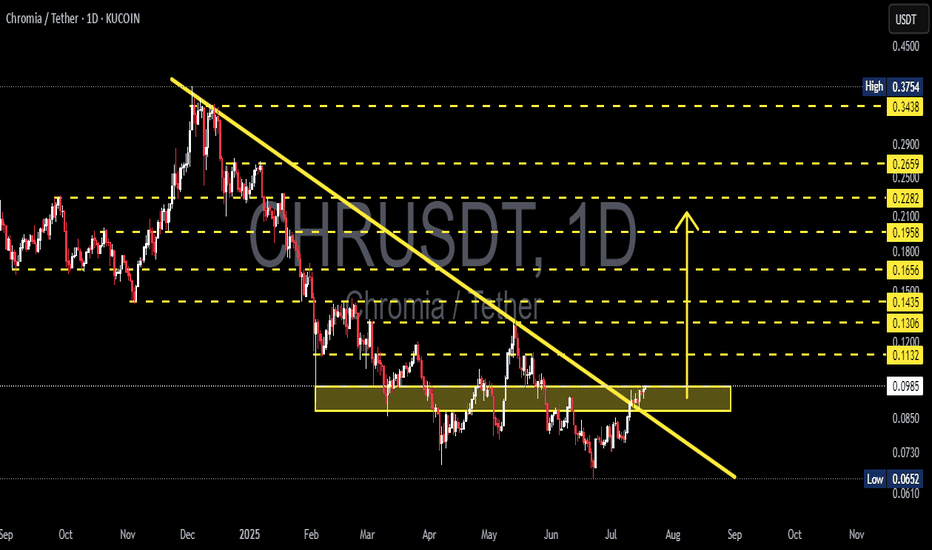

CHR/USDT Major Breakout! Bullish Momentum Ignites🧠 Complete Technical Analysis:

After months of being trapped in a prolonged downtrend since December 2024, Chromia (CHR) has finally shown signs of awakening. The price has successfully broken out of a major descending trendline, while also breaching a critical consolidation resistance zone between $0.093–$0.098 (highlighted in yellow).

This breakout not only indicates a potential trend reversal, but also opens the door for a medium-term bullish rally if sustained.

📊 Structure and Pattern Highlights:

Descending Trendline Breakout: CHR has decisively broken out of the long-standing bearish structure.

Validated Accumulation Zone: The $0.075–$0.098 range has proven to be a strong accumulation base after multiple tests.

Layered Horizontal Resistances: A clear ladder of resistance levels awaits as price pushes upward.

Potential Bullish Patterns: With a healthy pullback and higher low, CHR could form an Inverse Head and Shoulders or a Bullish Flag continuation pattern.

📈 Bullish Scenario:

If CHR can hold daily candle closes above the $0.098 breakout zone, the following targets come into play:

Target Level Description

$0.113 Breakout confirmation zone

$0.120 Psychological mini-resistance

$0.130 Historical horizontal resistance

$0.143 Previous local top

$0.165 Key breakdown level

$0.180 – $0.228 Medium-term target range with historical supply

$0.265 – $0.290 Strong resistance area from past distribution

$0.343 – $0.375 Long-term bullish target

💡 Note: If buying volume increases and BTC remains stable or bullish, these targets become increasingly realistic.

📉 Bearish Scenario:

However, if this breakout turns out to be a fakeout, CHR may fall back below the $0.093 zone and retest:

$0.085 (minor support)

$0.075 (base support)

As low as the demand zone around $0.065–$0.070

📌 Candle close and volume confirmation are critical. Avoid chasing price without solid validation!

📎 Conclusion & Strategy:

> CHR/USDT is currently at a pivotal moment. This breakout from a multi-month downtrend signals a potential trend reversal and a medium-term opportunity for swing traders and position holders.

📈 Trading Strategy Suggestion:

Entry: After a successful retest of the $0.095–$0.098 zone

Stop Loss: Below $0.085

Take Profit: Scale out at resistance levels listed above

#CHRUSDT #Chromia #CryptoBreakout #TrendReversal #AltcoinSeason #TechnicalAnalysis #CryptoTrading #BullishPattern #BreakoutSignal #ChartSetup

#CHR Is gearing up for an update ?#CHR

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0788.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0750, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0793

First target: 0.0820

Second target: 0.0843

Third target: 0.0861

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#CHR READY TO NEW EXPLODE !#CHR

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 0.0474, acting as strong support from which the price can rebound.

Entry price: 0.0756

First target: 0.0768

Second target: 0.0785

Third target: 0.0810

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

#CHR/USDT#CHR

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.0956.

Entry price: 0.1000

First target: 0.1036

Second target: 0.1067

Third target: 0.1100

#CHR/USDT Ready to go higher#CHR

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at 0.2390

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.2410

First target 0.2510

Second target 0.2628

Third target 0.2748

#CHR/USDT#CHR

The price is moving within a 12 hour descending channel pattern, which is a strong retracement pattern

We have a bounce from a major support area in the color EUR at 0.2000

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum and the price is based on it

Entry price is 0.2365

The first target is 0.2690

The second target is 0.3180

The third goal is 0.3744