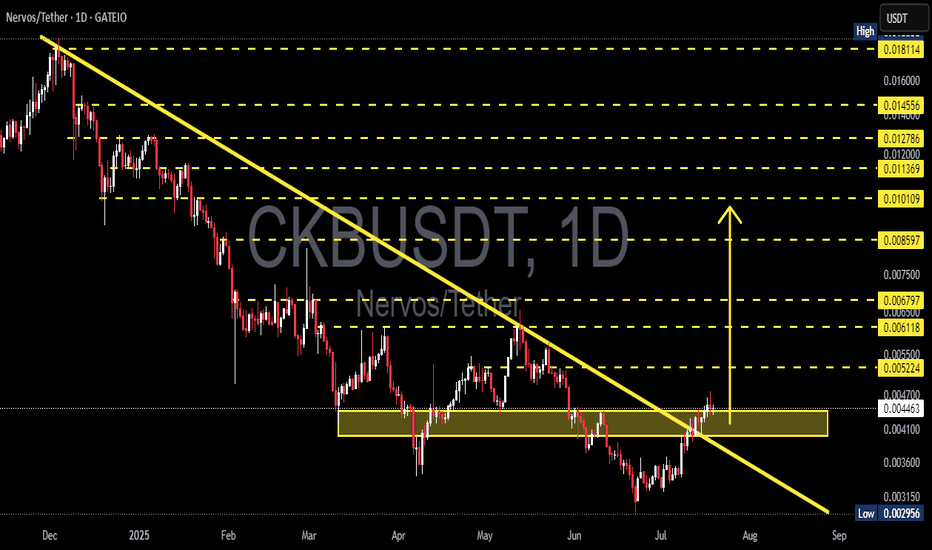

CKBUSDT — Test Demand Zone: Reversal or Deeper Breakdown?📝 Full Analysis

The Nervos (CKB/USDT) pair is now trading right inside a critical demand zone at 0.0038 – 0.0046. This area has repeatedly acted as a last line of defense against deeper declines. At this stage, the market is at a decision point: will this zone trigger another accumulation bounce, or will it finally give way to a stronger bearish continuation?

---

🔎 Price Structure & Pattern

1. Macro Trend

Since early 2025, CKB has remained in a major downtrend, printing consecutive lower highs and lower lows.

Every bullish attempt has been capped around key resistance clusters (yellow dashed lines).

2. Demand Zone (Yellow Box)

The 0.0038 – 0.0046 range has served as a strong base support.

Historically, buyers have stepped in whenever price dipped into this zone.

3. Key Resistance Levels (Upside Targets)

0.005224 → first minor resistance, key for early confirmation.

0.006118 → short-term target.

0.006797 → stronger psychological barrier.

0.008597 – 0.010109 → mid-term supply zone.

0.011369 – 0.018114 → long-term bullish targets if a major reversal takes place.

4. Key Support Levels (Downside Risks)

0.0038 → bottom of the demand zone.

0.002956 → previous major low.

A breakdown below this low could trigger a deeper bearish phase, exposing historical supports seen only on higher timeframes.

---

🚀 Bullish Scenario

Scenario A: Initial Bounce

If price holds above 0.0040–0.0044 and forms bullish reversal patterns (engulfing, hammer, or long-tail pinbar) with high volume, buyers may attempt a rebound.

Scenario B: Breakout Confirmation

A daily close above 0.005224 would shift the short-term structure bullish, paving the way toward 0.006118 – 0.006797.

Scenario C: Extended Rally

With strong momentum and volume, mid-term targets at 0.008597 – 0.0101 could be tested, which will act as a major test for a long-term reversal.

---

⚠️ Bearish Scenario

Scenario A: Breakdown of Demand

A daily close below 0.0038 invalidates the demand zone, signaling strong bearish continuation.

Scenario B: Downside Targets

The first target would be 0.002956 (previous low). A breakdown there could expose deeper historical supports below 0.0025.

Scenario C: Bull Trap / False Bounce

If price bounces off 0.0044 but fails to break above 0.005224 and reverses downward, it signals distribution and usually leads to an aggressive sell-off.

---

📊 Trading Plan (Example, Not Financial Advice)

Aggressive Strategy (Buy the Dip):

Entry near 0.0044, stop-loss below 0.0038.

Risk: ~14%

Target 1: 0.005224 (+17%)

Target 2: 0.006118 (+37%)

RR Ratio to Target 2 ≈ 2.6

Conservative Strategy (Wait for Breakout):

Entry after a daily close >0.005224 with valid retest.

Lower risk of false signal.

Targets extend toward 0.0068 and 0.0085.

Invalidation: All bullish bias is canceled if daily closes <0.0038.

---

🎯 Conclusion

At this stage, the 0.0038 – 0.0046 demand zone is the last stronghold for CKB.

If it holds, a rebound toward 0.0061–0.0068 is likely.

If it breaks, the market could quickly revisit 0.002956 or even lower.

In short, the price action in this zone will determine CKB’s mid-to-long term direction. Traders should closely watch volume and candlestick formations in the coming days to gauge whether buyers or sellers take control.

---

#CKB #CKBUSDT #Nervos #CryptoAnalysis #PriceAction #CryptoTA #SupportResistance #Altcoin #Breakout

Ckbusdsignals

CKB/USDT Massive Breakout Confirmed! Is This the Beginning?🧠 Technical Analysis Overview (1D Chart - Gate.io)

CKB/USDT has officially broken out of a long-term descending trendline that has capped price action since late 2024. This breakout marks a potential trend reversal from a prolonged bearish market into a bullish phase. The breakout occurs alongside a key horizontal accumulation zone (highlighted in yellow), indicating both volume absorption and buyer interest at this level.

📐 Pattern Breakdown:

Main Structure: Descending Trendline Breakout

Supporting Pattern: Horizontal Accumulation / Reaccumulation Box

Confluence Area: The breakout aligns with the top of the accumulation zone, indicating a structural shift.

Psychological Confirmation: The trendline that acted as resistance is now broken, flipping sentiment.

This setup represents a classical technical reversal signal, strengthened by the fact that CKB has consolidated sideways for weeks before breaking upward — a sign of strong base-building.

📊 Bullish Scenario (Primary Outlook):

If the price continues to close above the breakout zone around $0.0044–$0.0047, a multi-level rally could be triggered:

Target Level Zone Type

$0.00522 Minor resistance

$0.00611 – $0.00679 Mid-range liquidity zone

$0.00859 Key supply zone

$0.01010 – $0.01200 Bullish target zone

$0.01455 – $0.01811 Extended rally target

📈 These levels also align with previous support/resistance flips and Fibonacci-based projections.

✅ A successful retest of the breakout zone will add confidence to the bull case.

🐻 Bearish Scenario (Alternative Risk View):

If price fails to hold above the $0.0044–$0.0047 zone and closes back below with increasing sell volume, it may be a false breakout or bull trap. In this case:

Immediate support lies at $0.00360

Major demand and psychological level at $0.00295

Falling back into the downtrend channel would invalidate the bullish thesis

⚠️ Traders should watch for rejection candles, high selling volume, or breakdown retests that fail to recover quickly.

🔎 Key Takeaways:

Trendline Breakout: First time in 8+ months

Accumulation Zone Break: Validated with bullish momentum

Risk Management: Place stop-losses slightly below $0.0044

R/R Potential: Very attractive reward-to-risk toward $0.0085–$0.012 zones

📌 Summary:

CKB is flashing one of its most promising technical signals in recent months. The breakout from a long-term downtrend, combined with a strong horizontal base, makes this setup highly attractive for both swing and position traders.

All eyes are on whether this momentum can be sustained through key resistance levels. If so, CKB may be on its way to reclaiming lost ground with a potential 100%+ upside from current levels.

#CKBUSDT #CryptoBreakout #BullishReversal #AltcoinSeason #TrendlineBreak #TechnicalAnalysis #CryptoTrading #CKBAnalysis #NervosNetwork #CryptoSetup

CKBUSDT Enters Critical Accumulation Zone – Multi-X Rebound🧠 Overview:

After a prolonged downtrend throughout early 2025, CKB/USDT has now returned to a major macro support zone between $0.0026 – $0.0035 — a historically strong accumulation range seen during 2022–2023. This area has previously triggered powerful rallies, and once again, the market is flashing early signs of a potential trend reversal.

📈 Bullish Scenario (Potential Rebound):

1. Well-Tested Demand Zone:

The area between $0.0026 – $0.0035 has acted as a long-term floor multiple times over the past 2 years.

This suggests strong institutional accumulation or smart money positioning.

2. Rising Volume Could Confirm Trend Reversal:

A surge in volume from this range could validate a transition into a markup phase (Wyckoff Theory).

3. Stair-Step Rally Potential:

Immediate resistance: $0.0050 – $0.0058

Mid-term target: $0.0076 – $0.0090

Major breakout zone: $0.0127 – $0.0180

4. Technical Projection:

Formation of a Double Bottom or Inverse Head & Shoulders could signal a strong macro reversal.

If confirmed, price could aim for $0.027 – $0.038+ in the longer term.

5. Market Sentiment & Timing:

Historically, altcoins like CKB rally after Bitcoin dominance cools off or when BTC moves sideways.

📉 Bearish Scenario (Breakdown Risk):

1. Losing Macro Support:

If price breaks below $0.0026, further downside may accelerate toward sub-$0.0020 levels.

2. Fakeouts Without Volume:

A weak bounce from support without volume could indicate a bull trap or short-term relief rally only.

3. Sideways Risk:

Extended consolidation or ranging may continue for weeks if there’s no strong catalyst or market-wide recovery.

📐 Structure & Pattern Insights:

Long-Term Accumulation Range: The current price action mirrors the accumulation phase from 2022–2023, possibly forming a Wyckoff Re-accumulation structure.

Reversal Patterns Forming: With a potential higher low next week, we may see an Inverse Head & Shoulders begin to take shape.

📝 Conclusion:

CKB is currently in a "high-reward, low-risk" zone from a swing trader’s perspective. Price is near macro bottom levels, and any breakout from here could result in multi-fold returns in the medium to long term.

However, confirmation through volume and structure breakout is essential. Without that, the risk of prolonged ranging or deeper correction remains.

#CKBUSDT #CKB #AltcoinSeason #CryptoBreakout #TechnicalAnalysis #InverseHeadAndShoulders #WyckoffAccumulation #BullishReversal #CryptoGems #CryptoSetup

CKBUSD Major bullish break-out. Expect more upside ahead.Nervos Network (CKBUSD) broke this week above the 1D MA200 (orange trend-line) for the first time since June 17. This is a major bullish break-out signal as every time this happened historically after a Lower Highs trend-line break-out, the price in 3 cases made a new High and in 2 reached at least the 0.85 Fibonacci retracement level.

As a result, we expect a strong bounce on the 1D MA200 to target at least 0.02900.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇