Coca-Cola: Approaching a Resistance LevelCoca-Cola has recently experienced a dynamic upward impulse, moving noticeably closer to our resistance level at $74.38. In the next step, price should surpass this mark, aiming to reach the red Short Target Zone between $77.63 and $82.89. In this range, we pinpoint the peak of the larger impulse wave III. Subsequently, the stock should move to the downside, which makes the red zone suitable for establishing short positions. Alternatively, an immediate reversal is also possible: If the stock falls directly below the support at $65.35, that could suggest the top of the beige wave alt.III has already been reached (probability: 30%).

Cocacola

Coca-Cola - Slowly Moving HigherWe are analyzing the move from March 2020 to the present.

We assume this is the fifth wave of the larger move, and we are currently forming the fifth sub-wave within the fifth wave.

One of the key targets is at the 85 level.

Estimated upside potential from current levels:

Approximately 17%

---

Please subscribe and leave a comment!

You’ll get new information faster than anyone else.

---

Coca-Cola (KO) Pullback Trade Aligns With Trend Strength!🔥 KO Playbook: Bullish Pullback Trap or Clean Rebound? 🥤📈

📌 Asset

NYSE:KO — The Coca-Cola Company

NYSE | Stock Market Profit Playbook

Style: Swing Trade / Day Trade

🧠 Market Structure & Technical Thesis

KO is currently showing a Bullish Pullback Setup after a healthy retracement into a Triangular Moving Average (TMA) zone, indicating potential mean-reversion and continuation strength.

Key technical factors supporting the bullish bias:

📐 Price pulling back into TMA dynamic support

📉 Controlled retracement (no breakdown structure)

🧲 Liquidity resting below current price (ideal for layered entries)

📊 Context supports a buy-the-dip strategy, not a chase

🎯 Trade Plan — Thief Style (Layered Entry Method) 🕵️♂️

🟢 Entry Strategy (Layering Method)

This plan uses a multiple buy-limit layering strategy, also known as scale-in entries, to reduce average cost and manage volatility.

Buy Limit Layers (Example):

🟢 70.00

🟢 69.50

🟢 69.00

👉 You may increase or adjust the number of limit layers based on your own risk management and execution style.

👉 Aggressive traders may also choose any price level entry, depending on confirmation.

🛑 Stop Loss (Risk Control)

Thief SL Reference: 68.00

⚠️ Note:

Dear Ladies & Gentleman (Thief OG’s),

I am not recommending you to use only my Stop Loss. Risk management is a personal choice — protect capital and trade responsibly.

🎯 Target / Exit Zone

Primary Target: 73.00

🚨 Why this level matters:

🚓 “Police force” zone = Strong resistance area

📈 Price likely to be overbought near this zone

Potential bull trap or profit-taking zone

👉 Kindly escape with profits if price reaches this level.

⚠️ Note:

Dear Ladies & Gentleman (Thief OG’s),

I am not recommending you to use only my Take Profit. Secure gains based on your own plan and comfort level.

🔍 Related Stocks to Watch (Correlation Insight)

NASDAQ:PEP (PepsiCo Inc.) 🥤

👉 Strong sector correlation with KO. Bullish continuation in PEP often supports upside momentum in KO.

AMEX:SPY (S&P 500 ETF) 📊

👉 Overall market strength matters. A bullish SPY environment increases follow-through probability for defensive stocks like KO.

AMEX:XLP (Consumer Staples ETF) 🛒

👉 If XLP holds support or trends higher, KO usually benefits as a sector leader.

💡 FINAL THOUGHTS FROM YOUR TRADER

This isn't a "set and forget" trade—it's an active, discipline-required play. The setup is clean, the technicals are aligned, but markets always have surprises.

The margin of safety exists at these levels. But margin of safety ≠ guaranteed profit. Ever.

Trade with conviction but manage risk like a pro. 🚀

📲 COMMUNITY APPRECIATION

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

Happy Trading, Legends! 🚀💰 Chart your own path. The market rewards the prepared mind. 📊

Coca Cola - $78 Target for New Highs Imminent 🥤The Coca-Cola Company (KO) suggests the stock has definitively finished a long period of price correction and is now ready for a significant upward trend. This pullback, which had been complex, officially concluded when the price hit its low at $65.36. Critically, the strong bounce that followed has broken the stock out of its long-term downward trading range, confirming that the selling phase is fully over.

Following this successful breakout, the chart indicates that a major new five-wave rally is starting, with the stock currently engaging the powerful middle part of this upswing (Wave 3). The analysis projects that after completing this rally, the price will ultimately reach a target around $78.00. This suggests that the stock is now in a strong phase of growth, making it a key focus for traders looking for the next major increase in value.

Stay Tuned!

@Money_Dictators

Coca-Cola: Approaching Key Resistance LevelCoca-Cola shares continue their upward trajectory, marked by minor pullbacks and brief periods of sideways movement. Overall, the stock maintains a bullish trend and is currently trading just below resistance at $74.38, which is likely to be tested next. We anticipate that the blue wave (y) will push the stock into our red short Target Zone between $76.58 and $81.51. Within this range, we expect the beige impulse wave III to complete. Once this high is reached, a significant correction is likely. As such, we view this zone as an opportunity to establish short positions. If a new high fails to materialize, it could indicate that the beige wave alt.III has already concluded. In that scenario, a direct drop below $65.35 would be expected (probability: 30%).

Coca-Cola: Fresh Upside MomentumAfter some recent setbacks, Coca-Cola shares have regained upward momentum. Blue wave (y) is expected to first break through resistance at $74.38, potentially pushing price into our beige Target Zone, which ranges from $76.58 to $81.51. In this area, we anticipate the completion of the same-colored impulse wave III. Once this wave is complete, a significant correction is likely to follow. For this reason, we view this range as an opportunity to establish short positions. If beige wave alt.III has already concluded, price could drop directly below $60.62 (probability: 32%).

Pour Yourself A "Cup" of Cola, Grab A Share of KONYSE:KO has made a 61.8% Fibonacci Retracement of the Low @ $60.62 to the High @ $74.38 and begun to form what looks to be a Cup and Handle Pattern!!

On Wednesday, Price on NYSE:KO managed to Confirm the Pattern by reaching the Equal High of $71.61, completing the "Cup".

Now based on the Cup and Handle Pattern, we want to see Price make a Retracement to form the "Handle" of the Pattern and currently Price on NYSE:KO is falling. We can expect Price will Close the Gap from Last Week and find Support at the 50% Fibonacci Level @ $68.48.

Once the Retracement is successful, we should see Price move up to Complete the "Handle" and Pattern altogether!

Fundamentally, NYSE:KO CFO, John Murphy, plans to make changes to products with affordability in todays economy in mind for both High and Low income earners.

www.tradingview.com

NYSE:KO also posted greater than forecasted Earnings for Q3 this year!

www.tradingview.com

If Technicals and Fundamentals can align, NYSE:KO may be a great company to get stock in soon!

Coca-cola is losing its fizzCoca-cola just delivered another earnings beat. Margins up, earnings strong, cash flow better than expected if you look closely enough. But something deeper is shifting. Global unit case volume is falling.

That is the true heartbeat of the business. You can only raise prices for so long before consumers push back. The company has masked demand weakness with pricing and product mix tricks. But tricks don’t scale forever.

Free cash flow tells the story. Reported numbers look bad, down over two billion this quarter. Management points to a one off fairlife payment. Strip that out and sure, the adjusted figure is better. But the bigger trend is flat. Cash generation has stalled. Margins can only expand so much.

Marketing cuts are not a growth strategy. Eventually the lack of volume growth will catch up.

The stock is trading below its 200-day moving average. In a bull market, that is a warning. Not a crash, just a quiet shift in sentiment. The kind that happens before everyone else notices.

And then there is sugar. The core product is facing a structural threat. In the age of LLMs and algorithmic health advice, the message is clear and consistent. Cut sugar . Drink water.

Stay away from soft drinks. No amount of marketing will change that. Coke’s global reach is now its biggest risk. If AI changes consumer habits, the decline will be slow and wide.

This is not a collapse. But the model is cracking. Quietly and steadily.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

Coca-Cola: Support BreachedAfter nearly two weeks of indecision, Coca-Cola shares have now slipped below the $66.05 support level. In the near term, we expect further declines as part of the final wave (c) of the blue three-wave pattern, which should complete the broader corrective wave X in turquoise, just above the $60.62 support. After this, we anticipate a trend reversal, with the stock advancing in the final upward leg of the large beige wave III, targeting the beige short zone between $76.58 and $81.51. The peak of this third wave is likely to be established within this range before a significant correction sets in. Alternatively, it’s possible that beige wave alt.III has already concluded (probability: 39%). This scenario would be confirmed by a break below the $60.62 level.

Coca-Cola: Uphill Battle Toward Key ResistanceThe climb toward our resistance level at $74.38—and ultimately into our beige Target Zone between $76.58 and $81.51—remains challenging for now. Coca-Cola shares have made little headway over the past two weeks. With the stock swinging both up and down, there’s still no clear direction. We’re maintaining our primary outlook, expecting the stock to move higher and establish the wave III top before a more significant pullback sets in. However, there’s a 38% chance that wave alt.III has already peaked, which could lead to an immediate drop below the $66.05 support level.

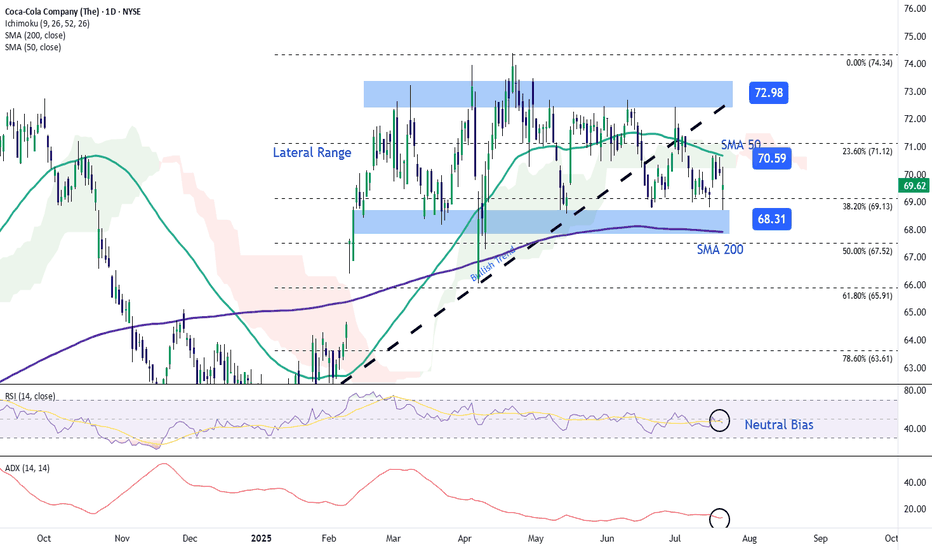

Coca-Cola Stock Falls Despite Strong EarningsDuring the latest trading session, Coca-Cola stock maintained a clear neutral bias after a nearly 1% decline, falling below the $70 per share level. This movement came despite the company reporting better-than-expected results, with earnings per share (EPS) of $0.87, above the $0.83 expected, and total revenue of $12.62 billion, exceeding market estimates of $12.54 billion.

Despite these solid results, the company noted that it expects a possible decline in sales volume over the coming months and also anticipates higher costs due to a new commercial strategy. Additionally, there is growing uncertainty around demand for sugary beverages, which could be impacted by the current economic backdrop. These factors have limited short-term upside potential, leaving the stock in a state of technical neutrality.

Sideways Range Holds

Since late February, the stock has been trading within a steady sideways range, with a ceiling at $73 and a floor at $68. The current price remains near the midpoint of that range, reflecting a lack of clear long-term direction. As long as this indecision continues, range-bound behavior is likely to dominate in the sessions ahead.

Technical Indicators

RSI: The Relative Strength Index remains close to the neutral level of 50, indicating a balance between buying and selling pressures. Without a clear directional shift, the sideways range may continue in the short term.

ADX: The ADX line has been fluctuating below the 20 level, indicating low average volatility and a persistent consolidation phase. Unless this indicator sees a meaningful uptick, the current range is likely to remain in play.

Key Levels to Watch:

$73 – Major Resistance: Marks the upper boundary of the range. A strong move toward this level could initiate a new bullish trend.

$70 – Immediate Resistance: Aligns with the 50-period simple moving average and the 23.6% Fibonacci retracement level. A breakout here could signal a short-term bullish bias.

$68 – Key Support: Aligned with the 200-period simple moving average, this level represents a critical technical floor. A break below it could activate a relevant bearish bias and potentially lead to a longer-term downtrend.

Written by Julian Pineda, CFA – Market Analyst

Coca-Cola: Nearing Final Wave III HighDespite recent sell-offs, we still expect Coca-Cola to reach a final high of magenta wave within our beige Target Zone between $76.58 and $81.51, which should also mark the completion of the broader beige wave III. However, an alternative scenario—with a 38% probability—remains in play: in this case, the top of beige alt.III would have already occurred, and a direct decline below $60.62 would likely follow. In either scenario, once the high of beige wave III is established, we anticipate a significant correction.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do.

Coca-Cola: IndecisiveCoca-Cola continues to trade sideways, still failing to confirm either of our scenarios definitively. The primary scenario envisions that wave III in beige will post another high within the beige Target Zone ($76.58–$81.51), which offers a potential setup for short positions. Following that, wave IV in beige should begin a substantial correction. However, if the stock fails to overcome resistance at $74.38, it could indicate that the top of wave alt.III in beige is already in. A decline below the $66.05 support level would activate the alternative scenario (35% probability), implying a drop below $60.62.

KO 1D — A Diamond Not Yet Broken, But Already CrackingOn the daily chart of Coca-Cola, a classic diamond top structure is forming — not yet completed, but clearly visible. The market expanded its range in the initial stage, then began to compress into a tighter zone, creating the typical shape of a diamond. This isn’t a continuation pattern — it’s the setup phase for redistribution.

The key level sits at $68.50 — the base of the diamond. As long as this line holds, the pattern remains inactive. But current price behavior says more than enough: weakening momentum, falling volume, and a lack of aggressive follow-through on recent highs. This isn’t accumulation — it’s preparation.

Price is currently trading between the MA50 and MA200, signaling a neutral phase with downside risk. The moving averages are narrowing, but no crossover has occurred yet. That’s critical — the trend isn’t broken, but it’s clearly losing energy. If $68.50 gives way, the measured move from the pattern projects a decline toward $61.82.

From a fundamental standpoint, Coca-Cola remains stable — but uninspiring. Earnings met expectations, revenue was steady, and no major catalysts are visible. In this type of environment, technical structure often becomes the tool for institutional rotation — not because the story collapsed, but because the setup makes sense.

The edges of the diamond are in place. All that’s missing is the break. If the neckline fails, the downside scenario is already built — structurally and logically.

COCA-COLA: This is a +43% wave, aiming at $82.Coca-Cola is about to turn bullish on its 1D technical outlook (RSI = 53.500, MACD = -0.130, ADX = 31.368), trading on a flat 1M candle, coming off another flat candle before it (April). This neutrality has historically been a re accumulation period for the stock. Given that its most recent low was on the 0.382 of its multi year Channel Up and the rebound took place on the 1M MA50, we expect at least a +43.22% rise from there. On this pattern, all rallies that started on the 1M MA50, grew by at least +43.22% and touched the 0.786 Fibonacci level of the Channel. Our TP = 82.00 and we expect to get there by the end of the year.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Shares of Coca-cola Set For Breakout Amid Golden Cross Pattern The Coca-Cola Company (NYSE: NYSE:KO ) on Tuesday reported first-quarter sales below analysts' estimates but profit that topped expectations, as the beverage giant navigates tariff uncertainty.

Earnings Overview

The company said its "comparable," or adjusted, earnings per share came in at $0.73 on revenue that declined 2% YoY to $11.1 billion. Analysts expected $0.72 and $11.22 billion, respectively.

CEO James Quincey said:

"Despite some pressure in key developed markets, the power of our global footprint allowed us to successfully navigate a complex external environment."

Coca-Cola Says Operations 'Subject to Global Trade Dynamics'

In an update to its full-year outlook, Coca-Cola said that its "operations are primarily local, however, it is subject to global trade dynamics which may impact certain components of the company’s cost structure across its markets. At this time, the company expects the impact to be manageable."

Technical Outlook

Shares of Coca-Cola ( NYSE:KO ) were down about 1% shortly after the market opened Tuesday. They entered the day up about 15% since the start of the year. As of the time of writing, the stock is up 0.49%.

Albeit earnings missed estimate, the 4 hour price of Coca-Cola shares (NYSE: NYSE:KO ) depicts a golden cross pattern- this is a metric that is generally seen as a bullish reversal with its counterpart known as "Death cross". With the RSI at 51 and the Golden cross pattern, NYSE:KO might be on the cusp of a bullish campaign.

Coca-Cola Company (KO) Shares Trade Near All-Time HighCoca-Cola Company (KO) Shares Trade Near All-Time High

Stock market charts indicate that from the start of last week’s trading through to its close:

→ The S&P 500 Index (US SPX 500 mini on FXOpen) declined by approximately 3%;

→ Pepsico (PEP) shares dropped by more than 1%;

→ Coca-Cola Company (KO) shares rose by around 2.4%.

Why Aren’t Coca-Cola Shares Falling?

The relatively strong performance of Coca-Cola (KO) shares compared to the broader market and its main competitor may be attributed to the fact that Coca-Cola operates a concentrate production facility in Atlanta, USA. In contrast, Pepsico’s equivalent production is based in Ireland. This gives Coca-Cola a potential advantage under the tariff policies pursued by the Trump administration.

Incidentally, according to media reports, Diet Coke is the favourite drink of the US President.

Technical Analysis of KO Stock Chart

In 2025, KO stock has been forming an upward channel, though the current price is approaching key resistance levels:

→ the upper boundary of this ascending channel;

→ the $73 level, above which several successive all-time highs have been formed. However, price action suggests that bulls have so far struggled to establish a foothold above this mark.

It is possible that the upcoming quarterly earnings report, scheduled for 29 April, could provide a positive catalyst for KO’s share price.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coca-Cola: As PlannedAs primarily anticipated, Coca-Cola has recently established the peak of wave in magenta just below the resistance at $73.53. The stock then dropped by approximately 5%. We now expect the low of wave in magenta to occur soon, and afterward, wave should bring significant gains, thus completing the large wave III in beige. Our Target Zone for this wave III top lies between $75.42 and $78.88. It provides opportunities to either close existing long positions or to open new short trades.

Coca-Cola: High in Sight?!Coca-Cola has gained around 9% over the past two weeks and should now be approaching the high of the turquoise wave 4. As soon as this top is established (below the resistance at $70.74), we expect sell-offs down to the forecast low of wave (A) in magenta below the support at $60.62. However, if the stock breaks above the resistances at $70.74 and $73.53 during its current upward move, we will consider wave alt.(A) in magenta as complete. In this scenario, the subsequent wave alt.(B) would already be underway, aiming for a high within our beige Target Zone between $75.32 and $80.36 (probability: 39%).

Coca-Cola (KO) Stock Surges Nearly 5% in a DayCoca-Cola (KO) Stock Surges Nearly 5% in a Day

Yesterday, shares of The Coca-Cola Company (KO) saw a significant rally, climbing nearly 5% and reaching a yearly high above $67. The last time KO stock traded at this level was in late October 2024. Investor optimism was fueled by the release of the company’s Q4 financial report, which exceeded expectations:

→ Reported earnings per share: $0.55 vs. expected $0.52

→ Gross revenue: $11.5 billion vs. forecasted $10.7 billion

Additionally, Coca-Cola announced:

→ A substantial market share increase in the non-alcoholic beverage sector and $10.8 billion in free cash flow.

→ Projections for 5–6% organic revenue growth in 2025, highlighting the company’s resilience amid economic uncertainty.

Technical Analysis of Coca-Cola (KO) Stock

At yesterday’s market open, KO formed a large bullish gap, which may act as future support. Meanwhile, price extremes outline an ascending channel pattern.

If optimism persists:

→ The price may move towards the channel median, where supply and demand tend to balance (similar to early 2025).

→ Bears might become active around $69.25, a level that has previously influenced price movements (indicated by arrows).

Analysts' Price Forecast for Coca-Cola (KO) Stock

Following the earnings report, analysts from leading investment firms have acknowledged Coca-Cola’s strong performance, either reaffirming or raising their price targets for KO stock:

→ Citi maintained a "Buy" rating with a $85 price target.

→ Jefferies reiterated its "Buy" rating with a target of $75.

→ UBS kept its "Buy" rating, setting a $72 target.

According to TipRanks:

→ 12 out of 13 surveyed analysts recommend buying KO stock.

→ The 12-month average price target for KO is $72.4.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Coca-Cola To Report Q4 Earnings Today Ahead of Market OpenCan the Beverage Giant Sustain Its Momentum?

Coca-Cola (NYSE: KO) is set to report its fourth-quarter earnings results on Tuesday, February 11,2025 ahead of the market open. Investors and traders are closely watching the stock, which has already shown premarket strength, rising 0.20% early Tuesday morning. With the Relative Strength Index (RSI) at 60.84, market participants are anticipating a potential bullish continuation, provided earnings results meet or exceed expectations.

Strong Performance in 2023

Coca-Cola, a global leader in the beverage industry, has continued to demonstrate resilience despite economic uncertainties. In 2023, the company reported $45.75 billion in revenue, marking a 6.39% increase from the previous year’s $43 billion. Earnings also saw an impressive 12.28% growth, reaching $10.71 billion. This performance underscores Coca-Cola’s ability to maintain steady growth through product diversification and strategic market positioning.

Analysts remain optimistic about the stock, with 17 analysts giving KO a consensus rating of "Strong Buy." The 12-month price target of $72.18 suggests a potential 11.82% upside from its latest price, reinforcing bullish sentiment ahead of the earnings report.

Technical Analysis

As of Tuesday’s premarket session, NYSE:KO is trending upwards, with its price hovering near $65, a key pivot and resistance level. Breaking this barrier could trigger a bullish rally, potentially pushing KO toward higher price targets in the coming weeks.

However, if earnings disappoint, a retracement may be in play, with immediate support aligning with the 38.2% Fibonacci retracement level at $63. This level could serve as a critical point for a potential rebound, should selling pressure emerge following the earnings announcement.

What to Expect Post-Earnings

A strong earnings beat could propel KO further into bullish territory, confirming its upward trajectory and attracting more institutional interest. On the flip side, weaker-than-expected results may lead to a temporary pullback, offering a potential buying opportunity at key support levels.

COCA-COLA: bottomed and started the 2025 rally to $82.The Coca-Cola company just turned bullish on its 1D technical outlook (RSI = 56.409, MACD = 0.210, ADX = 24.907) as it crossed over the 1D MA50 following a clean HL at the bottom of the long term Channel Up. The 1D RSI is already on a bullish divergence and this validates technically the start of the new bullish wave. The previous one increased by +42.18% so a target significantly below it (TP = 82.00) is more than justified long term.

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##