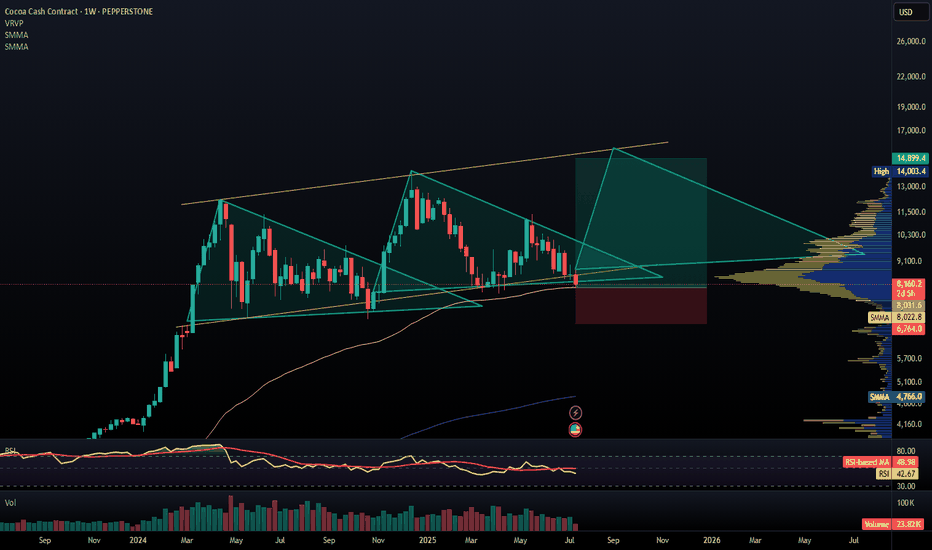

COCOAUSD — Trendline Breakout & Bearish Retest SetupCocoa price has reacted aggressively from the Strong Supply Zone, where repeated rejections clearly indicate heavy selling pressure and exhaustion of buyers. After the bullish expansion through the UTA phase, price failed to sustain higher levels and moved into a range, signaling distribution and loss of bullish strength at the top.

The key confirmation came with a clean trendline breakout, marking a shift in market structure from bullish to bearish. This breakout shows that buyers are no longer able to defend the trend, and control is gradually shifting to sellers. Price is now expected to retest the broken trendline and range high, which may act as a strong resistance zone.

If the retest is respected, a continuation move toward the Seller Zone becomes highly probable, with extended downside targets aligned toward the Demand Zone Area, where liquidity rests. Overall, the supply rejection, failed continuation, range distribution, and structure break together support a bearish continuation scenario unless price reclaims the supply zone with strong acceptance.

Cocoa

Cocoa CFD Technical Playbook | Downside Targets in Focus😎 Cocoa Crash Caper: Thief-Style Swing/Day Trade Setup 🍫📉

Asset: Cocoa Commodities CFD

Market Strategy: Wealth Thief Map (Swing/Day Trade)

Outlook: Bearish 🐻 — Sellers smashed through the Triangular Moving Average (TMA 1786), confirming the downtrend! 🚨

📜 The Grand Heist Plan

🎯 Entry: Deploy the Thief Layering Strategy with multiple sell limit orders to snatch profits like a pro!

Suggested layers:

💰 8000

💰 7800

💰 7600

💰 7500

Pro Tip: Feel free to add more layers based on your risk appetite — stack those orders like a master thief!

🕵️♂️ Alternatively, enter at any price level if you’re feeling bold!

🛑 Stop Loss: Set at 8200. Dear Thief OG’s 👑, this is my suggested SL, but it’s your heist — adjust it to your risk tolerance!

🎯 Target: Aim for 6800, where strong support, oversold conditions, and a potential trap await! 🕳️ Escape with your profits before the market pulls a fast one!

Note: This is my TP suggestion — take profits at your own discretion, you sly foxes! 🦊

🧠 Why This Setup?

The Cocoa market is screaming bearish vibes after sellers bulldozed the 1786 TMA . 📉 The trend is confirmed, and the momentum is on our side. With the Thief Layering Strategy, we’re setting up multiple sell limit orders to capitalize on this downward spiral while managing risk like seasoned bandits. 💸

🔗 Related Pairs to Watch ($ Correlated Assets)

Keep an eye on these correlated markets for extra clues:

Coffee ( PEPPERSTONE:COFFEE ): Often moves in tandem with Cocoa due to shared agricultural market dynamics. Watch for similar bearish signals! ☕

Sugar ( PEPPERSTONE:SUGAR ): Another soft commodity that can reflect broader agricultural trends. Check for parallel price action. 🍬

USD Index ( TVC:DXY ): A stronger USD can pressure commodity prices, including Cocoa. Monitor for correlation with Cocoa’s decline. 💵

Key Correlation Point: Cocoa prices often weaken when the USD strengthens, as commodities are priced in USD. A rising TVC:DXY could amplify this bearish setup, so keep tabs on it! 📊

⚠️ Disclaimer

This Thief-Style Trading Strategy is just for fun and educational purposes! Trading is risky, and you’re the master of your own heist. Always do your own research and manage your risk responsibly. No financial advice here — just a playful setup to spark your trading creativity! 😜

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#TradingView #Cocoa #ThiefStrategy #SwingTrading #DayTrading #Bearish #Commodities #TechnicalAnalysis

Over optimism with Cocoa harvest?Cocoa pods usually take 5–7 months to mature. Over the past six months, conditions have been relatively dry, yet some cocoa-related news seems to overlook this factor and overlook the recent weeks rain. I’m closely watching how this will affect the upcoming harvest. In my view, current price levels don’t reflect the impact of these conditions and due to thet, giving a bullish signal.

2024/2025 Mid-harvest estimates were too optimistic, as an example in Ivory Coast +9% compared to the actual. The key question is whether this pattern of over-optimism is repeating.

Cocoa Futures (ICE) – Long Trade Setup🍫 Cocoa Futures (ICE) – Long Trade Setup

Direction: Long Bias

Contract: Cocoa (NY / ICE)

Current Price: ~7,437

🔍 Technical Setup

Price has been consolidating after the sharp run-up and has now pulled back into a key long-term trendline (yellow support).

A downtrend channel breakout is forming – if price clears this, it opens the door to a relief rally.

I’m looking for price to push back toward the 8,500–9,000 zone as a first target (previous structure resistance).

EMA cross (9 vs 19) is flattening, signaling potential shift in momentum.

📊 COT & Sentiment

Speculators remain net long in cocoa, reflecting continued bullish sentiment.

Commercials (hedgers) are still short, but that’s typical for producers – nothing extreme.

Fundamentals remain tight:

Black pod disease in Cameroon hitting yields.

Stockpiles in London/NY at multi-year lows.

Consumer demand holding up despite high prices.

This alignment supports a bullish recovery if technicals confirm.

🎯 Trade Plan

Entry: Current levels around 7,400–7,500, scaling in on confirmation.

Target 1: 8,500 (previous resistance zone).

Target 2: 9,000+ if momentum extends.

Stop Loss: Below 7,000 to protect against breakdown.

Risk/Reward: ~1:2 setup.

⚠️ Risks

Stronger-than-expected supply recovery in Ivory Coast/Ghana.

Weak grind demand data (sign of demand destruction).

Speculators cutting long positions aggressively.

✅ Conclusion

Cocoa has pulled back into long-term support, with positioning and fundamentals still supportive of higher prices. If the descending trendline breaks, I’m positioning for a long swing toward 8,500–9,000.

This cocoa strategy has a profitability rate of 66% and average 9.4% gain on a long position.

Cocoa, Sugar, Coffee & Cotton Rotation📌 The Soft Commodities Super Guide: Cocoa, Sugar, Coffee & Cotton

Soft commodities — crops grown rather than mined — are among the oldest traded goods in human history. From cocoa beans once used as currency in Central America, to cotton powering textile revolutions, to sugar driving global trade and colonization, and coffee fueling productivity worldwide, these markets remain essential and volatile today.

On exchanges like ICE, CME, and NYMEX, traders can access futures and ETFs to speculate, hedge, or diversify portfolios. Soft commodities are especially attractive because of their strong seasonal patterns, geographic concentration of supply, and sensitivity to weather, politics, and demand shifts.

This guide will cover:

Seasonality of Cocoa, Sugar, Coffee & Cotton

Major Price Drivers

Trading Strategies & ETFs/Stocks

Yearly Rotation Playbook

🔹 1. Seasonality of Major Soft Commodities

Seasonality refers to recurring, predictable patterns of price strength or weakness tied to planting, harvest, and demand cycles.

📈 Cocoa (ICE: CC Futures)

Strongest: Summer (Jun–Sep) → Demand builds, weather risk in West Africa.

Weakest: Winter (Dec–Feb) → Fresh harvest supply hits markets.

📌 Example: June–Sep 2020 rally (+20%) from droughts + demand recovery.

📈 Sugar (ICE: SB Futures)

Best Months: Feb, Jun, Jul, Nov, Dec.

Strong seasonal window: May–Jan (fuel demand + holiday consumption).

Weakest: Mar–Apr (harvest pressure).

📌 Example: Nov–Dec 2020 sugar rally (+15%) as Brazil shifted cane to ethanol.

📈 Coffee (ICE: KC Futures)

Strongest: Late Winter to Summer (Feb–Jul).

Weakest: Fall harvest months (Sep–Oct) → new supply weighs on prices.

📌 Example: Frost in Brazil (Jul 2021) cut supply → Coffee futures spiked +60%.

📈 Cotton (ICE: CT Futures)

Strongest: Winter & Spring (Nov–May) → Textile demand, planting risk.

Weakest: Summer & Fall (Jun–Oct) → Harvest & oversupply pressures.

📌 Example: Nov 2020–May 2021 rally (+25%) from China demand + U.S. weather risks.

🔹 2. What Moves These Markets Most?

~ Cocoa

Weather in Ivory Coast & Ghana (70% of supply).

Labor disputes, political unrest, crop diseases.

Global chocolate consumption, health trends.

~ Sugar

Ethanol demand (linked to oil prices, Brazil cane allocation).

Government subsidies & tariffs (India, EU).

Brazil’s currency (BRL) & weather.

~ Coffee

Brazil & Vietnam crops (60% of global production).

Frosts, droughts, El Niño.

Consumer demand trends (premium coffee, emerging markets).

~ Cotton

U.S., India, China output (~65% global supply).

China’s stockpiling/import policy.

Substitute fabrics (polyester), energy prices.

Apparel demand cycles.

🔹 3. Trading Strategies & Investment Vehicles

Futures

Cocoa (CC), Sugar (SB), Coffee (KC), Cotton (CT) traded on ICE.

Provide direct, leveraged exposure.

ETFs & ETNs

Cocoa: NIB (iPath Cocoa ETN).

Sugar: CANE (Teucrium Sugar Fund), SGG (iPath Sugar).

Coffee: JO (iPath Coffee ETN).

Cotton: BAL (iPath Cotton ETF).

Stocks with Exposure

Cocoa: Hershey (HSY), Mondelez (MDLZ).

Sugar: Cosan (CZZ), ADM, Bunge (BG).

Coffee: Starbucks (SBUX), Nestlé, JM Smucker (SJM – owns Folgers).

Cotton: Levi’s (LEVI), VF Corp (VFC), Ralph Lauren (RL), Hanesbrands (HBI), Gildan (GIL).

🔹 4. Soft Commodities Yearly Rotation Playbook

Here’s how traders can rotate positions through the year for maximum seasonal edge:

📌 Example Rotation:

Start year in Sugar & Cotton (Jan–Feb).

Shift into Cocoa & Coffee (Jun–Aug).

Rotate back into Sugar & Cotton (Nov–Dec).

📌 Conclusion: The Soft Commodities Super Strategy

Soft commodities offer traders multiple edges:

✅ Seasonality: Cocoa (summer), Sugar (winter), Coffee (spring/summer), Cotton (winter/spring).

✅ Macro Drivers: Weather, politics, energy, government policies.

✅ Cross-Market Links: Oil prices → ethanol (sugar); apparel cycles → cotton; consumer demand → cocoa/coffee.

✅ Portfolio Benefits: Diversification vs. equities & metals.

The best strategy is to rotate across the year:

Long Sugar & Cotton (winter/spring),

Long Cocoa & Coffee (summer),

Rotate out during weak harvest windows.

Softs may be volatile, but for disciplined traders, they provide predictable, repeatable seasonal opportunities with both futures and equities exposure.

Long Chocolate📌 Cocoa Futures: Seasonality, Trading Strategies & Market Drivers

Cocoa is more than just the foundation of chocolate; it’s a soft commodity with centuries of economic significance. Once used as currency by ancient civilizations in Central and South America, cocoa became a global commodity after the Spanish conquest introduced it to Europe. Today, it underpins a multibillion-dollar industry that spans confectionery, beverages, cosmetics, and pharmaceuticals.

Cocoa futures, traded on the ICE (Intercontinental Exchange), give traders and institutions exposure to this volatile market. These contracts are a critical tool for producers, exporters, chocolate manufacturers, and speculative traders. Because cocoa is grown almost exclusively in tropical regions—with over 70% of global supply coming from West Africa—it is highly vulnerable to weather, political instability, and labor disruptions, making it one of the most volatile agricultural commodities.

For traders, this volatility is both a challenge and an opportunity. With the right combination of technical setups, seasonal awareness, and macro fundamentals, cocoa futures can be a powerful addition to a diversified trading strategy.

🔹 1. A Simple but Effective Cocoa Futures Strategy (RSI + EMA Model)

One robust short-term trading framework for cocoa is built on two components: momentum (measured by the Relative Strength Index) and trend direction (measured by the 100-day Exponential Moving Average).

📌 Trading Rules:

Buy Signal (enter next day open): When the 3-day RSI falls below 20 (oversold) and the close remains above the 100-day EMA.

Short Signal (enter next day open): When the 3-day RSI rises above 80 (overbought) and the close is below the 100-day EMA.

Risk/Reward (RR): Set at 2:1 for favorable risk exposure. I use Heikin-Ashi.

Historical Win Rate: Approximately 70%, meaning the system has shown consistent profitability in backtests.

📌 Why it works:

The RSI ensures entries are taken when the market is temporarily stretched.

The EMA filter avoids fighting against the broader trend, reducing false signals.

Cocoa, being highly mean-reverting, often corrects after extreme RSI conditions, especially when aligned with the prevailing long-term trend.

This makes the system simple enough for beginners yet effective for experienced futures traders looking for structured rules.

🔹 2. Seasonality in Cocoa Futures

In commodity trading, seasonality refers to recurring price tendencies tied to the calendar—harvests, weather cycles, or consumption trends. Cocoa has one of the clearest seasonal footprints in the soft commodity sector.

📈 Summer Months (June – September): Historically the strongest period for cocoa. Demand from chocolate manufacturers builds as companies secure supply ahead of year-end holidays. Weather risk in West Africa also coincides with the rainy season, which can create uncertainty about crop quality and yields.

📉 Winter Months (December – February): Often weaker as fresh harvest supplies enter the market. Prices may dip unless weather shocks disrupt output.

📌 Historical Example:

Between June and September 2020, cocoa futures rallied over 20% due to concerns about rainfall and labor issues in the Ivory Coast, even though global demand was still recovering from pandemic restrictions.

Thus, traders often rotate into cocoa longs during the summer months, much like how they rotate into corn or soybean trades during North American planting/harvest cycles.

🔹 3. Key Drivers of Cocoa Prices

Cocoa is especially sensitive to supply shocks because of its geographic concentration. A few core variables explain most of the large price swings:

1️⃣ Weather Conditions

Cocoa pods are delicate and require the right mix of rainfall and sunshine.

Too much rain → fungal outbreaks like Black Pod disease.

Too little rain → drought stress, smaller pods, and lower yields.

West Africa’s climate variability is the single largest driver of year-to-year volatility.

2️⃣ Labor Issues

Ivory Coast and Ghana rely heavily on manual labor for cocoa harvesting.

Strikes, disputes over wages, or child labor controversies can quickly cut output.

Supply disruptions ripple globally since these two countries account for over two-thirds of global cocoa exports.

3️⃣ Political Risk

Elections, coups, or civil unrest in cocoa-producing regions can paralyze exports.

Example: The 2010 Ivory Coast political crisis disrupted shipping, pushing cocoa futures to multi-decade highs.

4️⃣ Crop Diseases

Cocoa plants are vulnerable to pests and diseases.

The 2010 Black Pod outbreak alone wiped out 500,000 tonnes of cocoa.

The Cocoa Swollen Shoot Virus (CSSV) continues to be a structural threat.

5️⃣ Demand Shifts & Health Reports

Rising consumer demand for dark chocolate and functional foods (antioxidant-rich products) supports consumption growth.

Positive health studies on cocoa’s cardiovascular benefits can boost demand.

Conversely, economic downturns often weigh on chocolate consumption as it is seen as a semi-luxury item.

🔹 4. Seasonal Cocoa Trading Calendar

Month Key Events Typical Price Behavior Trade Implication

Jan–Feb Main crop exports Bearish pressure Avoid longs, look for shorts

Mar–Apr Mid-crop harvest Neutral to weak Cautious positioning

May–Jun Pre-summer build-up Bullish setup Early long entries

Jul–Sep Summer strength, weather risk Strongest seasonal rally Long futures, ETNs

Oct–Nov Rainy season risk Volatile Weather-driven trading

Dec Fresh harvest supply Often weak Take profits, rotate out

📌 Historical note: Cocoa’s June–September rally has persisted across multiple decades, making it one of the most reliable seasonal plays in the soft commodity space.

🔹 5. Vehicles for Trading Cocoa

Traders and investors can access cocoa in several ways:

Cocoa Futures (ICE: CC): Standardized contracts, physically delivered, high liquidity.

ETNs/ETFs:

NIB – iPath Bloomberg Cocoa Subindex ETN → easy exposure without futures account.

Chocolate & Confectionery Stocks:

Hershey (HSY), Mondelez (MDLZ), Nestlé (NESN.SW), Cheesecake (CAKE) → indirect exposure to cocoa demand.

Diversified Agricultural Funds: ETFs that include cocoa alongside coffee, sugar, and cotton.

📌 Conclusion: Best Cocoa Trading Strategy

Cocoa’s unique combination of ancient cultural roots, geographic concentration, and modern global demand makes it one of the most fascinating soft commodities to trade.

✅ Technical Edge: The RSI/EMA strategy offers a clear, rules-based approach with ~70% win rate.

✅ Seasonal Edge: Cocoa futures are strongest during summer (June–Sept).

✅ Macro Edge: Watch West African weather, labor strikes, and politics—they are the biggest price movers.

✅ Diversification Edge: Cocoa behaves differently than equities, metals, or energy, making it valuable for portfolio diversification.

While cocoa may not get the same attention as gold or crude oil, it remains a highly profitable niche market for traders who understand its seasonal flows and unique risks.

Cocoa futures near a key technical resistance areaMARKETSCOM:COCOA futures have been trending lower, while trading within a falling channel pattern since around mid-May of this year. But we are near the upper bound of that channel. Let's see if it holds.

Let us know what you think in the comments below.

Thank you.

75.2% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

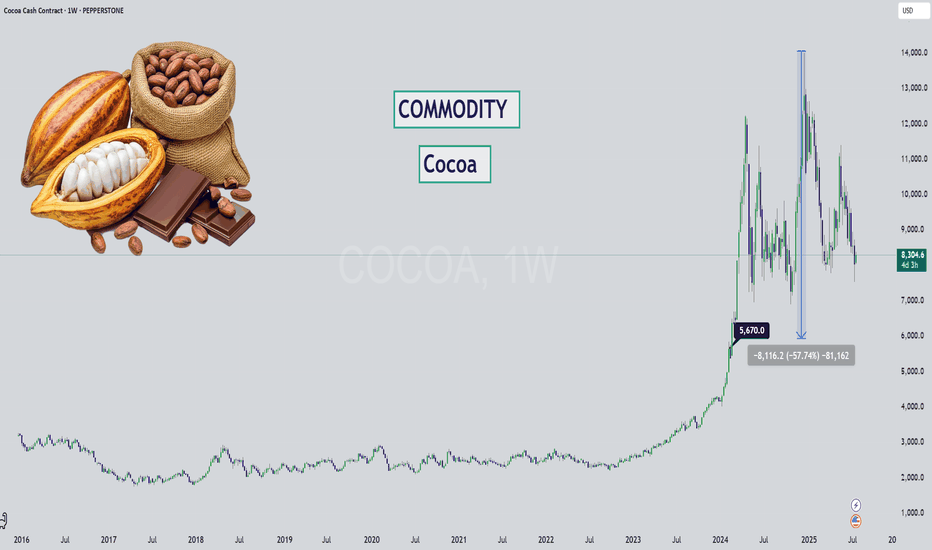

Cocoa - Chocolate is DIPPING (literally)Hello Market Watchers 👀

I bring today an update on your favorite commodity (mine actually)... 🍫

The weekly timeframe from a multi-year perspective is what's on the cover and one thing is clear - cocoa has never increased so much as it during May23' to Dec24'.

Sure inflation brought on by covid has a role to play. But even so, factoring in the amount of +509%? That is way out.

We could likely see this kind of stair step down movement on cocoa, since it has been following the logic of: " previous support = new resistance ".

Either way what this tells me is that cocoa has been running overly hot for too long... and it's time for a cooldown. Prices will likely never return to pre-covid levels, unless there is unfortunate weather or other supply chain issues.

Ultimately, a return back to the $5,600 zone would be a reasonable market correction for such a large increase.

Cocoa Futures: CC1! Potential Pullback at Familiar Supply ZoneCocoa futures (CC1) are approaching a key demand zone previously tested in March 2025. This area, highlighted on the chart, presents a potential for a pullback, fueled by likely buy orders from commercial traders, as indicated by bullish sentiment evident in the latest Commitment of Traders (COT) report. We're watching for a reversal pattern within these highlighted zones, signaling a shift from the current upward trend. This anticipated pullback, driven by commercial market participation, could offer a compelling entry point for traders looking to capitalize on a potential reversal in the agricultural commodity.

✅ Please share your thoughts about CC1! in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Rob the Cocoa Market Before the Trend Escapes🏴☠️Cocoa Vault Breach: Sweet Profit Heist in Progress!🍫💰

(Thief Trader’s Swing/Day Plan – Only Bulls Allowed)

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

We’ve cracked the code to the 🏉"COCOA"🏉 Commodities CFD market, and now it’s time to launch a high-stakes heist based on 🔥Thief Trading style technical + fundamental analysis🔥.

🎯 Mission Objective: Infiltrate the overbought zone, where traps are set, robbers are lurking, and the market’s about to turn. The plan? Ride the bullish wave, loot the Red Zone, and vanish with sweet profits. 🏆💸

🔓 Entry Point:

"The vault is wide open!"

Buy at will — loot that bullish treasure!

⏱️ Best tactic: Set buy limits on the 15M or 30M swing low/high zones. Set alerts and stay sharp.

🛑 Stop Loss:

SL = Nearest 4H Swing Low

🔐 Protect your stash. Use risk-adjusted SL based on trade size and number of entries.

🎯 Target:

11,300 or escape early if the pressure builds!

⚔️ Scalper’s Note:

Only steal on the long side.

💰 Big money = Go direct

💼 Small bags = Team up with swing traders

📉 Use trailing SLs to guard your gains.

🔥Cocoa Market is Bullish – Why?

☑️ Fundamentals

☑️ Macroeconomics

☑️ COT Report

☑️ Sentiment Signals

☑️ Intermarket Vibes

☑️ Seasonal Patterns

☑️ Trend Forecasts & Target Levels

👉 Dive into the data: 🔗🔗🔗

⚠️ Trading Alerts:

News releases = Danger zones!

❌ No new entries during news

✅ Trailing SL to protect ongoing raids

💥 Smash the Boost Button 💥

Support this Thief Plan and keep our crew winning daily.

💪 Rob with confidence. Win with consistency.

🎉 Thief Trading Style = Your daily cash machine.

💣Stay tuned for the next robbery blueprint!

— Your Friendly Market Criminal, 🐱👤

Cocoa Bounce From Demand – Can This Lead to a New 2025 High?On June 11th, price reacted sharply to a key demand block around the 8,880–9,000 zone, which aligns with:

Golden Pocket Fib (0.705–0.78) between 8,420 and 9,006

The midpoint of a previous consolidation range

A liquidity sweep followed by a strong bullish rejection

The RSI is showing a bullish divergence (lower lows on price vs rising RSI), which supports a possible technical rebound.

🟣 Immediate target: 10,400–10,600 (supply zone)

🔴 The bullish bias would be invalidated on a close below 8,850

📈 Commitments of Traders (COT) – as of June 3, 2025

Non-Commercials (speculators): still net long, but reduced their long exposure by -2,006 contracts, and trimmed shorts slightly as well

Commercials: remain heavily net short with over 61,000 contracts (61.4% of OI), indicating ongoing hedging by producers

Open Interest dropped by -1,257 → a sign of general position liquidation

➡️ The reduction in speculative longs likely reflects profit-taking after the May rally, but overall net positioning remains bullish on a medium-term view.

📅 Seasonality – June

On the 20, 15 and 10-year averages, June typically shows a moderately bullish rebound, often following weakness in May.

On the 5 and 2-year views, however, performance is more neutral to slightly negative.

Historically, June acts as a consolidation or pre-rally month, often preceding a stronger uptrend in July–August.

🧠 Operational Outlook

Bias: Moderately bullish in the short term, with potential recovery toward 10,400. Structure still shows signs of broader distribution, so caution remains in the medium term.

🎯 Trade idea:

Aggressive long initiated on the bounce from demand

First target: 10,400

Breakout extension: 11,200

Invalidation on daily close below 8,850

Cocoa Explosion Loading? Specs & Hedgers Agree🔍 Fundamental Analysis – Commitment of Traders (COT)

The latest COT report, dated May 13, 2025, reveals a strong bullish accumulation signal, with a significant increase in long positions across all major trader categories.

Specifically, Non-Commercials (speculative traders such as hedge funds and money managers) increased their long positions by +3,490 contracts while simultaneously reducing shorts by -467 contracts. This dynamic reflects renewed speculative confidence in the cocoa bullish trend.

Simultaneously, Commercials (typically producers and processors) added +5,187 long contracts and closed -661 short contracts. This is especially noteworthy, as commercials usually take the opposite side of speculators. Here, however, their alignment with speculators may indicate expectations of upcoming supply constraints or market stress.

Total open interest rose by more than +6,000 contracts, suggesting real capital inflow into the market rather than just rebalancing.

This alignment between speculators and institutional hedgers is rare and often precedes further price appreciation.

📈 Net Positions & Price Action

Looking at the “Net Positions & Prices” chart over the past year, it’s clear that Non-Commercial net positions are recovering after a notable drop in March and April. This reversal aligns with the technical bottom and the start of the current price rally.

Commercials, although still net short (in line with their historical bias), are reducing their bearish exposure, hinting at lower physical supply pressure or a need for hedging against further price increases.

Price action has reflected this narrative, surging higher following the April lows.

🕰️ Seasonal Analysis

Seasonality adds another layer to the analysis.

Historically, May tends to be flat or slightly bearish (10Y and 15Y averages), but the 2-Year seasonal line—which better reflects current market behavior—shows a strong bullish tendency starting mid-month. This supports the ongoing rebound and increases the likelihood of further upside in the short term.

Historical data also shows that June, while volatile, is often positive or neutral in shorter cycles.

📊 Technical Analysis

From a technical perspective, cocoa recently completed a strong bullish leg, rebounding from the 8,800–9,000 USD demand zone, identified as a clear area of institutional buying (evident through volume and impulsive candles).

The price then decisively broke through mid-range resistance levels and tested a key weekly supply zone between 11,200 and 11,500 USD, where it was initially rejected.

Currently, we are in a technical pullback, likely targeting the mitigation zone at 9,700–10,000 USD. This area represents a solid long entry opportunity if the market confirms a bullish structure on intraday charts (H1 or H4).

The RSI is near overbought, yet without divergence—suggesting the trend remains structurally bullish despite a natural correction.

🧭 Strategic Conclusion

Cocoa currently shows a rare convergence of bullish signals: supportive COT positioning, increasing net long interest, strong 2Y seasonality, and clear technical structure controlled by buyers.

However, after the recent sharp upside move, a correction to key support zones is likely before another bullish leg unfolds.

"COCOA" Commodities CFD Market Bullish Heist (Swing Trade Plan)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🏉"COCOA"🏉 Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the Dangerous Red Zone Level. It's a Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA line breakout (9700) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 2H timeframe (8900) Day/Swing trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 10700 (or) Escape Before the Target.

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸🏉"COCOA"🏉 Commodities CFD Market Heist (Swing Trade Plan) is currently experiencing a neutral trend there is high chance for bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro economics, COT Report, Geopolitical and News Analysis, Sentimental Outlook, Intermarket Analysis, Seasonal Factors, Positioning and future trend targets with Overall Score..... go ahead to check👉👉👉🔗🔗🌎🌏🗺

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COCOA" Commodity CFD Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑 💰

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COCOA" Commodity CFD market. Please adhere to the strategy I've outlined in the chart, which emphasizes long & Short entry. 👀 Be wealthy and safe trade 💪🏆🎉

Entry 📈 : You can enter a Bull or Bear trade at any point after the breakout.

Buy entry above 11,800

Sell Entry below 10,000

Stop Loss 🛑: Using the 2H period, the recent / nearest Pullbacks.

Goal 🎯: Bullish Robbers TP 13,600 (or) Escape Before the Target

Bearish Robbers TP 8,800 (or) Escape Before the Target

Fundamental Outlook 📰🗞️

The COCOA Market is expected to move in a Bullish direction, driven by the following key factors:

🔵Macro Factors:

Global Economic Growth: Rising global economic growth, particularly in emerging markets, is expected to increase demand for cocoa.

Inflation: Moderate inflation levels in major cocoa-consuming countries are expected to support cocoa prices.

Currency Fluctuations: A weaker US dollar is expected to support cocoa prices, as it makes cocoa more competitive in international markets.

🟡Fundamental Factors:

Supply and Demand Imbalance: The global cocoa market is expected to face a supply shortage in the 2022/23 crop year, supporting prices.

Weather Conditions: Favorable weather conditions in major cocoa-producing countries, such as Côte d'Ivoire and Ghana, are expected to support cocoa yields.

Certification and Sustainability: Growing demand for certified and sustainable cocoa is expected to support prices for high-quality cocoa beans.

🟠Sentimental Factors:

Investor Sentiment: Positive investor sentiment, driven by improving global economic growth and supply chain disruptions, is expected to support cocoa prices.

Market Positioning: The commitment of traders (CoT) report shows that hedge funds and other large speculators are net long cocoa, indicating a bullish sentiment.

Technical Analysis: Cocoa prices have broken out above a key resistance level, indicating a bullish trend.

- Bullish Sentiment: 83% of clients are long on COCOA, indicating a strong bullish trend.

- Bearish Sentiment: 17% of clients are short on COCOA, indicating a relatively weak bearish trend.

- Neutral Sentiment: No explicit data available, but we can infer it's relatively low given the strong bullish trend.

📌Please note that sentiment analysis can change rapidly and may not always reflect the actual market performance. These percentages are based on current market data and may not reflect future market movements.

That this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🫂

"COCOA" Commodities CFD Market Bearish Heist (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the 🏉COCOA🏉Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Yellow MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level for Pullback Entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 8H timeframe (8600) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 7000 (or) Escape Before the Target

🏉"COCOA"🏉 Commodities CFD Market Heist Plan (Swing/Day Trade) is currently experiencing a Neutral trend (there is a chance to move bearishness),., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COCOA" Commodities CFD Market Bearish Heist (Swing/Day Trade)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "🏉COCOA🏉" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Pink MA Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for Pullback entries.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 4H timeframe (8800) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 6800 (or) Escape Before the Target

🏉"COCOA"🏉 Commodities CFD Market Heist Plan (Swing/Day Trade) is currently experiencing to move bearishness.., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Seasonal Factors, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Cocoa's Future: Sweet Commodity or Bitter Harvest?The global cocoa market faces significant turbulence, driven by a complex interplay of environmental, political, and economic factors threatening price stability and future supply. Climate change presents a major challenge, with unpredictable weather patterns in West Africa increasing disease risk and directly impacting yields, as evidenced by farmer reports and scientific studies showing significant yield reductions due to higher temperatures. Farmers warn of potential crop destruction within the decade without substantial support and adaptation measures.

Geopolitical pressures add another layer of complexity, particularly regarding farmgate pricing in Ghana and Côte d'Ivoire. Political debate in Ghana centres on demands to double farmer payments to align with campaign promises and counter the incentive for cross-border smuggling created by higher prices in neighbouring Côte d'Ivoire. This disparity highlights the precarious economic situation for many farmers and the national security implications of unprofitable cocoa cultivation.

Supply chain vulnerabilities, including aging trees, disease prevalence like Swollen Shoot Virus, and historical underinvestment by farmers due to low prices, contribute to a significant gap between potential and actual yields. While recent projections suggest a potential surplus for 2024/25 after a record deficit, pollination limitations remain a key constraint, with studies confirming yields are often capped by insufficient natural pollination. Concurrently, high prices are dampening consumer demand and forcing manufacturers to consider reformulating products, reflected in declining cocoa grinding figures globally.

Addressing these challenges necessitates a multi-pronged approach focused on sustainability and resilience. Initiatives promoting fairer farmer compensation, longer-term contracts, agroforestry practices, and improved soil management are crucial. Enhanced collaboration across the value chain, alongside government support for sustainable practices and compliance with new environmental regulations, is essential to navigate the current volatility and secure a stable future for cocoa production and the millions who depend on it.

COCOA Nearing Major Support - Rebound Towards 9,000$?PEPPERSTONE:COCOA is approaching a significant support zone. This area has consistently acted as a key level where buyers have stepped in, leading to notable reversals in the past. The current move suggests the potential for a bullish reaction if price action confirms rejection through signals such as bullish engulfing candles, long lower wicks, or increased buying volume.

If the support holds, I anticipate a move upward toward the 9,000 level, aligning with the expectation of a short-term reversal. However, if the price breaches this zone and sustains below it, the bullish outlook may be invalidated, potentially opening the door for further downside.

Monitoring candlestick patterns and volume at this critical zone is essential for identifying buying opportunities. Proper risk management is advised to navigate potential volatility.

Just my take on support and resistance zones—not financial advice. Always confirm your setups and trade with solid risk management.

Best of luck!

COCOA; Heikin Ashi Trade ideaPEPPERSTONE:COCOA

In this video, I’ll be sharing my analysis of COCOA, using my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities. My goal is to help you enhance your trading skills and insights.

I’m always happy to receive any feedback.

Like, share and comment!