DeGRAM | GOLD is forming an ascending wedge📊 Technical Analysis

● XAU/USD is testing a key support area at $4,840.00 after a series of lower highs.

● The price is forming a triangle pattern, suggesting a potential breakout to the downside if support is broken.

💡 Fundamental Analysis

● A stronger USD and uncertainty in global markets have pressured gold, pushing it lower in the short-term.

✨ Summary

● Watch the support at $4,840.00 for potential breakdown; resistance lies near $4,900.00. Expect downside momentum if support fails.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

Commodities

Silver bullish continuation supported at 9050The Silver remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 9050 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 9050 would confirm ongoing upside momentum, with potential targets at:

10160 – initial resistance

10550 – psychological and structural level

10940 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 9050 would weaken the bullish outlook and suggest deeper downside risk toward:

8780 – minor support

8470 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Silver holds above 9050. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Gold breakout supported at 4790The Gold remains in a bullish trend, with recent price action showing signs of a breakout within the broader uptrend.

Support Zone: 4790 – a key level from the previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 4790 would confirm ongoing upside momentum, with potential targets at:

5000 – initial resistance

5050 – psychological and structural level

5100 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 4790 would weaken the bullish outlook and suggest deeper downside risk toward:

4754 – minor support

4717 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the Gold holds above 4790. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

GOLD: Long Signal with Entry/SL/TP

GOLD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GOLD

Entry - 4936.8

Sl - 4926.3

Tp - 4654.5

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

XAUUSD Pre NY SELLS we are now having a 1 Hour candle rejection to down side

for next hour we might see a down side move

the volume is getting low so to go more further up needs to take out buyers Stoplosses

so i will be going with the hunters to take out the stoploss of early buyers

then after that once the early buyers are out we will further push the market

trade gets invalid once the Higher high is broken again

The Christmas Silver Finally Breaks FreeFor decades, Silver has celebrated the holidays the same way 🎄

Strong rallies.

Rising excitement.

And a familiar ceiling.

🎄 Christmas 1980

Silver climbed like a Christmas tree, fast, vertical, and emotional.

The star was reached at the $50 level.

And just like that, the lights went out ✨

The market peaked and collapsed back into its long-term range.

🎄 Christmas 2010

Different era. Same story.

Once again, Silver rallied into Christmas, lit up the chart, and tested the same $50 level.

The tree was tall.

The star was bright.

But price could not hold above it.

⭐️Why the Star at $50 Always Mattered

That star was not decorative .

It was structural .

The $50 level represented:

• decades of trapped supply

• historical excess from prior cycles

• a psychological round number the market respected

Every Christmas rally stopped at the same place.

Until this one❗️

💫Christmas 2025: The Star Breaks Free

This time, Silver did not just touch the star.

It broke above it and held.

The Christmas tree is no longer capped.

The star has turned into a shooting star ☄️

That is what price discovery looks like.

When a market escapes a level it failed to conquer for decades, it stops trading inside a box and starts trading into open space.

🌌Discovery Mode: The Sky Is the Limit

With the ceiling gone, Silver enters a new phase.

The blue zone ahead is not a prediction .

It is a projection .

A natural expansion toward the next psychological magnet near 100.

Not because history says so.

But because history no longer applies the same way once a multi-decade barrier breaks.

Above the star, there is only sky.

💡The Takeaway

Silver spent decades decorating the same tree.

This Christmas, it finally stepped outside the room 🎄➡️🌌

And once a market reaches open skies,

it does not ask for permission.

It explores .

🧐So here’s the real question:

Where do you see Silver next Christmas?🎄

And where do you think it will be ten Christmases from now?

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~ Richard Nasr

Silver & the $100 MagnetFrom a long-term perspective, Silver remains clearly bullish, holding well above the blue rising trendline.

Zooming in, the short-term structure is just as clean. XAGUSD is trading inside a rising red channel, respecting both its upper and lower bounds with precision.

As long as this red channel continues to hold, my focus stays on trend-following long setups. The natural target remains the upper bound of the channel, which aligns perfectly with the $100 level, a round number that has been acting like a magnet for price.

What do you think? Does Silver tap $100 again before any deeper correction? 🤔

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GOLD | Consolidation Before the Next $5K PushGold Hits Fresh Record, Nearing $5,000

Gold prices surged to a new all-time high, moving closer to the $5,000 per ounce milestone, supported by heightened geopolitical risks, economic uncertainty, and a weaker U.S. dollar.

According to Saxo Bank analysts, gold continues to benefit from hard-asset supportive drivers, even as U.S.–EU tensions have eased slightly.

They note that central-bank demand remains strong, the U.S. dollar continues to weaken, and governments are issuing debt with limited clarity on long-term repayment.

Meanwhile, PCE inflation data, the Fed’s preferred inflation gauge, came largely in line with expectations, reinforcing market views that the Federal Reserve will hold rates steady at the upcoming meeting—further supporting gold prices.

Technical Outlook (GOLD)

Gold is currently consolidating between 4905 and 4931, awaiting a directional breakout.

Corrective / Bearish Risk

While trading below 4931, price may remain in a corrective phase

A confirmed 1H candle close below 4884, or a noticeable easing in geopolitical tensions, would activate a bearish move

Bullish Continuation

As long as price holds above 4884, the bullish structure remains intact

A breakout above 4931 would support upside continuation toward:

4965 - 4990 - 5000 (major psychological level)

Key Levels

Pivot Line: 4931

Resistance: 4965 – 4990 – 5000

Support: 4905 – 4884 – 4850

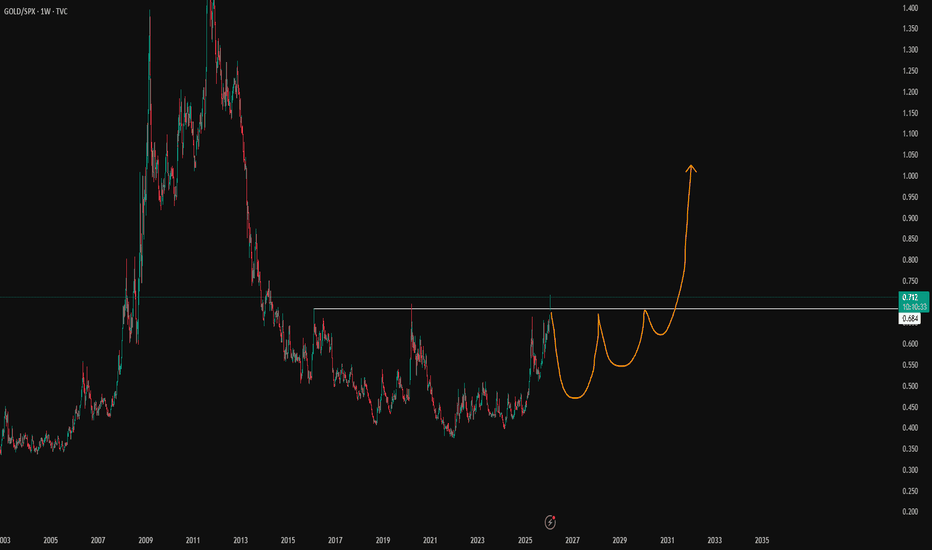

The Gold/SPX Breakout Narrative Is a TrapSaw the GOLD / SP:SPX chart with people calling a breakout.

Not buying it.

Until this W candle actually confirms, there is no breakout.

For me, this is the top in gold or at least very close. We’re talking days, not weeks.

The real trap?

People trying to time the perfect short on $XAU.

That won’t work either.

Gold won’t just roll over and die. It’ll chop, frustrate, and punish anyone trying to front-run the move. Longs get tired. Shorts get squeezed. Everyone loses patience.

And while that’s happening, something bigger is unfolding.

The rotation from GOLD into CRYPTOCAP:BTC and risk assets is already in motion.

It’s one of those transitions that’ll be studied in history books.

No indicators. No opinions. Nothing can stop it.

XAUUSD (Gold) – 30M Support Break & ContinuationPrice has strongly impulsed from the support zone and is holding above the EMA, signaling bullish continuation toward the higher supply target.

Key Levels:

Support: 4880 – 4890

Resistance: 4950 – 4960

Target Zone: 4980 – 5000

Bullish bias remains valid above support. Look for pullbacks or consolidation for continuation entries. Manage risk accordingly.

XAUUSD: Market Analysis and Strategy for January 23Gold Technical Analysis:

Daily Resistance: 5000, Support: 4690

4-Hour Resistance: 5000, Support: 4882

1-Hour Resistance: 4967, Support: 4900

Gold rose strongly in the Asian session, targeting the 5000 level. Moving average support gradually moved upwards, with the price reaching a high of around 4967 before a slight pullback. Whether the NY market can hold 4900 is key to whether the trend continues or whether short-term profit-taking has ended. The daily chart shows consecutive gains, strengthening the bullish technical outlook. The price is moving within an upward channel. The current market is reacting to both news and technical factors. Note that it is currently in overbought territory, but no top formation has yet appeared. Don't speculate on where the top is. Short-term pullbacks are nothing to panic about; watch for a return to the upward trend after the price stabilizes.

The 1-hour chart shows a pullback, but the overall magnitude is relatively limited. Bollinger Bands are narrowing. Friday's market faces complex sentiment influences; pay attention to intraday directional changes. Moving averages are crossing downwards. The short-term upside target price still needs to be monitored around the psychological price level of $5000, while the key support level to watch on a pullback is $4880.

Trading Strategy:

BUY: 4900near

BUY: 4880near

More Analysis →

XAUUSD: Holds $4,770 Support With Upside Potential Toward $4,890Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold is trading within a well-defined bullish structure, supported by a clear ascending channel that reflects sustained buyer control. Earlier in the move, price respected the lower boundary of the channel and formed a sequence of higher highs and higher lows, confirming strong bullish momentum. During the advance, XAUUSD entered a consolidation range, signaling a temporary pause and accumulation before continuation. This range eventually resolved to the upside, reinforcing the prevailing bullish trend. After the breakout, price experienced a brief corrective move, including a fake breakout to the downside, which was quickly absorbed by buyers. This false break further validated underlying demand and led to a strong impulsive move higher back into the channel. Most recently, Gold broke above a key intraday resistance and successfully retested the former resistance as support near the 4,770 Support Zone, confirming acceptance above this level.

Currently, XAUUSD is trading above support and pushing toward the upper boundary of the ascending channel. Price is approaching a major Resistance Zone around 4,880–4,890, which aligns with the channel high and represents a critical reaction area where profit-taking or short-term selling pressure may appear.

My Scenario & Strategy

My primary scenario remains bullish as long as XAUUSD holds above the 4,770 support zone and continues to respect the ascending channel structure. A sustained move and acceptance above the 4,890 resistance would confirm continuation toward higher levels within the channel.

However, rejection from the resistance zone could lead to a short-term consolidation or a corrective pullback toward the 4,770 support area before the next attempt higher. A clear breakdown and acceptance below support would weaken the bullish bias and signal a deeper correction. For now, market structure and momentum favor buyers while price remains supported above key levels.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

XAUUSD Ascending Channel Holds, Upside Toward $4,950Hello traders! Here’s my technical outlook on XAUUSD (1H) based on the current chart structure. Gold is trading within a well-defined bullish structure, supported by a rising price channel formed after a clear shift in market control from sellers to buyers. Earlier on the chart, price respected the ascending support line, creating higher lows and confirming sustained buying pressure. This gradual advance led to a consolidation phase, where price formed a clear range, reflecting temporary balance before continuation. Following the range, XAUUSD broke out to the upside, confirming trend continuation. This breakout was supported by a clean impulse move and acceptance above the former range high. After the breakout, price successfully retested the Buyer Zone around 4,820, which aligns with the prior resistance turned support and the lower boundary of the bullish channel. This area is acting as a strong demand zone, where buyers are actively defending the structure. Currently, price is moving higher within the ascending channel and approaching a key Resistance Level and Seller Zone near 4,950. This zone represents a major upside objective and a potential area for profit-taking or seller reaction. The bullish momentum remains intact as long as price holds above the Buyer Zone and respects the rising support line. My scenario: as long as XAUUSD stays above the 4,820 Buyer Zone, the bullish structure remains valid. Continued strength could drive price toward the 4,950 resistance level (TP1). A clean breakout and acceptance above this seller zone would open the door for further upside continuation. However, a decisive rejection from resistance could lead to a corrective pullback toward the Buyer Zone. A breakdown below support would weaken the bullish bias and signal a deeper correction. For now, the market structure favors buyers while price remains supported within the ascending channel. Please share this idea with your friends and click Boost 🚀

USOIL at Final Supporting Region? holds or not??#USOIL market perfectly dropped and placed near to our supporting region low as we discussed in our last idea regarding USOIL.

now that region is our final supporting region of the day n week as well.

so keep close and sustain above means we can expect a bounce from above here otherwise not.

NOTE: we will go for cut n reverse below mentioned region bottom line on confirmation.

good luck

trade wisely

XAUUSD 1H Intraday Outlook – Trendline Bullish StructureXAUUSD 1H Intraday Outlook – Trendline Bullish Structure, Fibonacci Levels, EMA/RSI Trade Setups

Gold (XAUUSD) on the 1H chart remains in a strong bullish structure supported by a clean rising trendline. Price is currently pulling back after printing an equal-high / weak-high cluster near the recent top, which typically signals liquidity sitting above that high. This creates two high-probability intraday scenarios: a continuation breakout or a pullback into demand before the next push.

Current price area on chart: 4919

1H Market Structure: What Price Is Telling Us

The market has been trending up with a consistent series of higher highs and higher lows.

The recent top formed an EQH (equal highs), often a liquidity magnet.

The pullback into the 4900 region looks like a healthy retracement within the uptrend, not a confirmed reversal yet.

As long as price respects the rising trendline and holds above key demand blocks, bulls keep the advantage.

Key Resistance Levels (Sell-Reaction Zones)

1) 4960 – 4975 (EQH / Weak High)

The most important intraday resistance. Expect stop-sweeps and wick rejections here.

2) 5000 (Psychological level)

If price breaks 4975 and holds, 5000 becomes the next magnet.

3) 5030 – 5050 (Extension zone)

Upside expansion target if momentum accelerates above 5000.

Key Support Levels (Buy-Defense Zones)

1) 4900 – 4885 (Trendline retest area / immediate support)

First area to watch for buyers stepping back in.

2) 4820 – 4835 (Major demand block)

Clearly marked on your chart as a strong zone; ideal for deeper pullback buys.

3) 4670 – 4660 (Higher-timeframe support / deeper retracement base)

If 4820 fails, this becomes the next “must-hold” for bullish structure.

4) 4580 – 4600 (Strong low base)

A break below this area would invalidate the broader bullish bias on the swing.

Fibonacci Map (Swing Low → Swing High)

Using the visible swing 4580 → 4965, Fibonacci retracement levels:

0.236: 4874

0.382: 4818

0.500: 4772

0.618: 4727

0.786: 4662

How to use it today:

If price holds above 4874, the pullback is shallow and continuation is favored.

The 4818 (0.382) aligns closely with your 4820 demand block, making it a high-confluence buy zone.

A move into 4727–4662 is a deeper reset and typically requires stronger confirmation (EMA/RSI + structure reclaim).

EMA + RSI Confirmation Rules (Simple, Repeatable)

EMA Filter (20/50/200 on 1H)

Bull trend confirmation: price holds above EMA200, and EMA20 stays above EMA50.

Pullback buy timing: price dips into support while EMA20 flattens, then candles reclaim EMA20 with strength.

Warning sign: 1H closes below EMA50 and fails to reclaim it on retest.

RSI Filter (14)

Bull continuation: RSI holds above 50 on dips and turns up.

Bearish trap warning near highs: RSI prints a lower high while price re-tests 4960–4975 (bearish divergence), then RSI breaks below 50.

Best Intraday Trading Strategies for XAUUSD

Strategy A: Buy the Dip at Trendline (Primary Plan)

Bias: continuation within the uptrend.

Entry trigger: bullish reaction at 4900–4885 (engulfing candle or 15M break of pullback structure), ideally with RSI reclaiming 50.

Stop loss: below the reaction low or below the trendline swing (keep it technical, not emotional).

Take profit targets:

TP1: 4960 – 4975

TP2: 5000

TP3: 5030 – 5050

This setup fits the cleanest structure: trendline support + bullish market context.

Strategy B: Deep Pullback Buy at 4820 (High-Confluence Zone)

Bias: re-entry after liquidity grab / deeper retracement.

Entry trigger: price taps 4820–4835 and forms a clear reversal pattern (strong bullish close + reclaim micro-structure), with RSI stabilizing above 40 then pushing back toward 50.

Stop loss: below the demand block low (invalidates the zone).

Targets:

TP1: 4874

TP2: 4919

TP3: 4960 – 4975

This is the “patience trade” with stronger risk-to-reward if the pullback extends.

Strategy C: Breakout Long Above 4975 (Only With Acceptance)

Bias: momentum expansion.

Entry trigger: 1H close above 4975, then a retest that holds (old resistance becomes support).

Stop loss: back below 4960 (failed breakout signal).

Targets: 5000, then 5030 – 5050

Avoid chasing inside the range; wait for close + retest to reduce fakeout risk.

Optional Counter-Setup: Liquidity Sweep Short at 4975 (Scalp Only)

This is not the main bias because the structure is bullish, but it can work intraday.

Entry trigger: sweep above 4960–4975 then strong rejection back below (wick + follow-through).

Stop loss: above the sweep high.

Targets: 4919, then 4874

Treat it as a quick reaction play, not a swing reversal call.

Today’s Decision Levels (What Confirms Each Scenario)

Hold above 4874: bullish continuation remains dominant.

Rejection at 4960–4975: likely rotation back toward trendline support.

Acceptance below 4820: opens room toward 4727–4662 (deeper reset).

Why Did Natural Gas Explode by 88% ? - AnalysisWhy it spiked so hard

1) Forecasts flipped colder → demand repriced immediately. The biggest mechanical driver was a rapid shift to much colder weather forecasts across key consuming regions, which instantly implies:

-higher residential/commercial heating demand, and higher power-sector gas burn (especially when wind/renewables are weak).

2) Short covering / squeeze dynamics amplified the move

When a market is positioned short and fundamentals suddenly tighten, price doesn’t just rise, it jumps as shorts rush to buy back contracts. Multiple market writeups for that week explicitly point to short covering as fuel for the outsized daily gains.

3) “Freeze-offs” risk (supply disruption from extreme cold)

Extreme cold can reduce production and disrupt operations (“freeze-offs”), especially if it pushes into producing regions and infrastructure bottlenecks. That risk premium is exactly the kind that gets priced fast because it can change balances overnight.

4) Europe: low storage + cold + geopolitics added an extra premium

In Europe, TTF/UK hubs were also reacting to: colder forecasts and storage draw concerns, and added supply-security/geopolitical anxiety (some coverage linked this to fears around U.S.–EU tensions and LNG leverage). Those helped push European benchmarks to their highest levels in months during the same window.

Disclaimer:

This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Asset prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not a licensed financial advisor or professional trader. I am not personally liable for your own losses; this is not financial advice.

Bullish Structure Intact, Pullback Seen as OpportunityOn the H4 timeframe, Gold remains in a strong bullish continuation structure after breaking and holding above the previous all-time high (ATH) around 4,960–4,970. The breakout was impulsive and decisive, confirming aggressive buyer control and validating the prior accumulation-to-expansion phase. Importantly, price has not collapsed back below ATH, which keeps the broader trend firmly bullish.

The current price action reflects healthy post-breakout behavior, not weakness. After tagging ATH, Gold is consolidating and showing signs of a potential pullback into the demand zone around $4,780–$4,820, where previous structure support and unfilled orders sit. This zone aligns with the classic breakout–retest dynamic and would allow the market to rebalance before the next expansion leg. Deeper downside toward the gap area near 4,650–4,700 remains a secondary scenario, but only likely if momentum sharply deteriorates.

As long as price continues to hold above the ATH support, any retracement should be viewed as corrective within a dominant uptrend, not the start of a reversal. A clean rejection from demand followed by higher lows would strengthen the bullish continuation case. On the upside, acceptance above ATH opens the path toward $5,000–$5,100, which stands as the next logical expansion target based on momentum projection and clean overhead liquidity.

In summary, Gold is consolidating above record highs, signaling strength rather than distribution. The structure favors buy-the-dip scenarios into demand, while a sustained break below the ATH level would be the first warning sign of a deeper correction. Until that happens, the bias remains decisively bullish, with pullbacks seen as opportunities, not threats.

USOIL H4 | Bearish Drop OffBased on the H4 chart analysis, we could see the price rise to our sell entry level at 60.68, which is an overlap resistance that lines up with the 50% Fibonacci retracement.

Our stop loss is set at 61.99, which acts as a swing high resistance.

Our take profit is set at 58.39, which is a pullback support that aligns with the 61.85 Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com