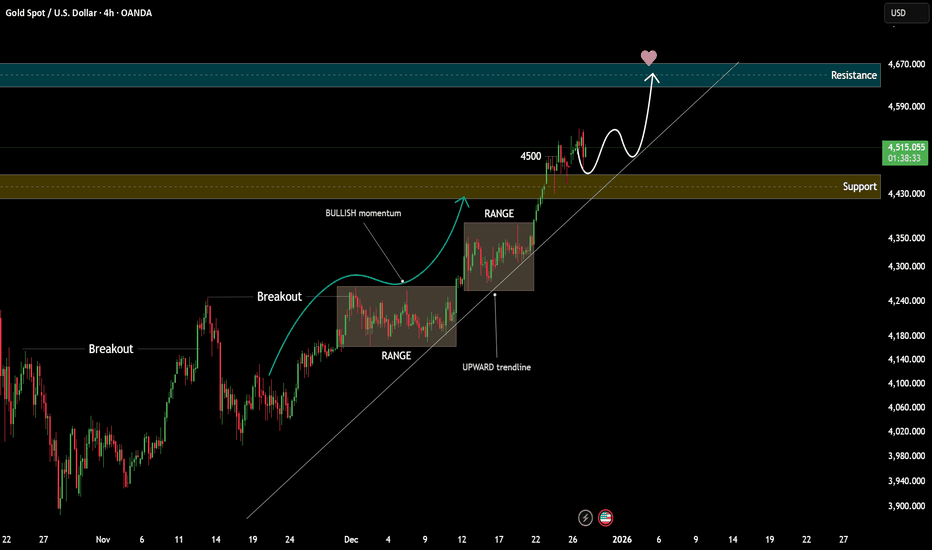

XAUUSD – Retesting Support Before the Next Upside MoveHello, I'm Camila.

Observing the H4 chart, I can see that gold has proactively pulled back to rete afterhow the market is reacting at lower prices. Instead of continued selling pressure, the current candles show a clear loss of bearish momentum, while buying interest is beginning to re-emerge. This is typical behavior in a healthy uptrend, where the market reassesses its foundation before committing to the next move.

From a structural perspective, the bullish trend remains intact. Price is still trading above the ascending trendline, and there are no confirmed signals of a structural breakdown. The recent volatility appears to be more about rebalancing supply and demand than distribution. In momentum-driven uptrends, pullbacks to test support are not signs of weakness; they are often necessary steps to determine whether buyers are still committed to defending higher prices.

On the fundamental side, the broader backdrop continues to favor gold. Ongoing global economic and geopolitical risks remain unresolved, sustaining demand for safe-haven assets. At the same time, expectations that the Federal Reserve will maintain a relatively accommodative policy stance help limit upside pressure on the U.S. dollar and Treasury yields. However, with a busy U.S. economic calendar ahead, upcoming data releases could generate uneven intraday volatility, making it unlikely for gold to move in a straight line and more likely to continue its familiar “advance-and-pause” rhythm.

The area I am watching most closely is the current support zone, where price is now reacting. If gold continues to hold this area and shows clearer buying responses, the bullish structure will be further reinforced. In such scenarios, the market often completes its base-building process before resuming the broader trend that has already been established.

Wishing you disciplined and successful trading.

Commodities

Gold - Today marks the official bullrun top!💣Gold ( OANDA:XAUUSD ) is creating its top formation:

🔎Analysis summary:

Over the course of the past couple of months, we witnessed an incredible rally of +140% on Gold. But this rally ended today, with Gold retesting a massive resistance trendline. And since Gold is totally overextended, it is now time for a healthy correction of -45%.

📝Levels to watch:

$4,500

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

Drawing in on the last day of the year what a move on Gold! Yesterday we said we're not going to long due to our indicators venturing into the extreme territory and usually when we get those double dots it's a clean move, and what a move it was. We managed to stay below the bias level and complete all the targets in one day again!

We then identified a couple of levels for bounce and managed to get in on the RIPs for a couple of decent long trades for those who missed the short.

Now, we have support below at the 4310 level and an undercut low at red box defence which if targeted over the Asia session can give us the retracement needed, otherwise, 4335 is the key level of resistance and above that 4390ish is the level we would want.

RED BOXES:

Break above 4540 for 4555, 4565, 4570 and 4583 in extension of the move

Break below 4520 for 4510✅, 4504✅, 4490✅, 4479✅ and 4465✅ in extension of the move

As always, trade safe.

KOG

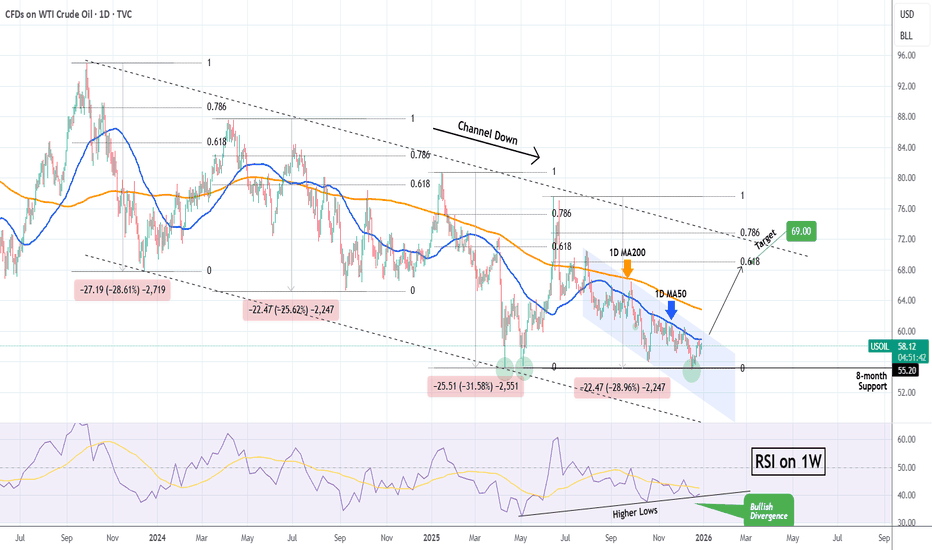

Hellena | Oil (4H): SHORT to support area of 55.74 (Wave 5).Colleagues, wave “4” of the minor order is ending or has already ended. As part of a major downward movement in wave ‘5’ of the major movement, I expect a downward movement in wave “5” of the minor order.

This wave should update the low of wave “3”, but I believe it is worth looking at the nearest target in the support area of 55.746.

I also allow for the possibility of reaching the 59.00 area before the price begins a downward movement.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

Hellena | GOLD (4H): SHORT to support area of 4360 (Correction).Colleagues, the price has shown fairly steady growth, reaching a new historic high, and I believe that a correction is not far off.

So, at the moment, wave “1” of the higher order is coming to an end, and I expect this to happen around the 4545 level, followed by the start of corrective movement “2” towards the 4360 level — this is the minimum target. Of course, I expect a deeper correction, but I prefer to take more likely targets.

I would also like to point out that the price may already begin its correction, which would mean that wave “1” is already complete.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

WTI OIL Strong case for a 2-month rally.WTI Oil (USOIL) has been trading within a Channel Down since the September 28 2023 High. Since then, it as had four Bearish Legs (including the current one), which declined on a range of -25.62% to -31.58%. All subsequent rebounds (Bullish Legs) that followed, hit at least their 0.681 Fibonacci retracement levels.

Given that the price rebounded 2 weeks ago on the 8-month Support (55.20) and the 1W RSI has been on Higher Lows (i.e. Bullish Divergence) since May, we may see a new Bullish Leg emerging now.

The one condition that will confirm that will be the price breaking above the blue Channel Down. If that takes place, we will turn bullish for the next two months, targeting $69.00 (Fib 0.618).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold crashes 5%! Dead cat bounce or buy-the-dip opportunity?Gold has taken a brutal hit, plunging over 5% from the $4,550 highs down to $4,300 as profit-taking slams the market in thin holiday trade. We are now seeing a bounce toward $4,400, but the big question is: is this just a dead cat bounce before a drop to $4,150?

In this video, we analyse the sharp reversal driven by year-end profit-taking and thin liquidity after an extraordinary ~70% rally in 2025. We then map out the critical Fibonacci retracement zones that will determine whether we see a V-shaped recovery or another leg lower.

Key drivers

Profit-taking & thin liquidity : The 5% drop was fuelled by a lack of buyers to absorb heavy selling in a thin, pre-New Year market. This is classic risk-off behaviour after an extended run.

Dead-cat-bounce risk : Bounces to the 38.2% ($4,400) or 50% ($4,430) Fibonacci levels are typical after violent drops. If price rejects here, the technical structure favours another leg down.

Downside targets : A measured move extension from a rejection at $4,400 points to a target around $4,150, which aligns with the 100% Fibonacci extension and previous support zones.

RSI reset : The 4-hour RSI has swung from overbought to oversold in one go. A bounce to the 50-60 level on the RSI would likely reset momentum for the next wave of selling.

Trade plan Bearish continuation : Sell the rally into $4,400–$4,430, targeting $4,170–$4,180 with a stop above $4,500.

Bullish reversal : Watch for hidden bullish divergence on the RSI or a break above the 61.8% retracement ($4,460) to invalidate the immediate bearish bias.

Are you selling this bounce or waiting for the bottom? Share your plan in the comments, and happy New Year to all traders! See you in 2026.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Is Smart Money Reloading Gold After the Latest Liquidity Sweep?🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (30/12)

📈 Market Context

Gold remains structurally supported on higher timeframes, but current price action reflects controlled volatility and liquidity engineering rather than trend continuation.

With markets reacting to fresh U.S. data expectations, USD yield fluctuations, and ongoing geopolitical uncertainty, Gold continues to attract safe-haven interest — yet extended intraday ranges suggest Smart Money is actively positioning rather than chasing price.

Recent headlines around Fed rate path uncertainty and mixed U.S. macro signals keep Gold bid on pullbacks, while thinning liquidity into the year-end session increases the likelihood of stop hunts and engineered traps on both sides of the range.

Smart Money behavior favors drawing liquidity first, confirming structure later — not clean breakouts.

🔎 Technical Framework – Smart Money Structure (1H)

Current Phase:

HTF bullish structure with short-term corrective compression

Key Idea:

Expect liquidity interaction at discount (4320–4318) or reaction from internal supply (4465–4467) before any sustained displacement.

Structural Notes:

HTF bullish BOS remains valid

Prior CHoCH triggered a corrective leg

Price is compressing under bearish trendline

Discount zone aligns with potential accumulation

Buy-side liquidity rests above internal highs

Sell-side liquidity recently probed and absorbed

💧 Liquidity Zones & Triggers

• 🟢 BUY GOLD 4320 – 4318 | SL 4310

• 🔴 SELL GOLD 4465 – 4467 | SL 4475

🧠 Institutional Flow Expectation

Liquidity sweep → MSS / CHoCH → BOS → displacement → FVG / OB retest → expansion

🎯 Execution Rules

🟢 BUY GOLD 4320 – 4318 | SL 4310

Rules:

✔ Liquidity grab into discount zone

✔ Bullish MSS / CHoCH on M5–M15

✔ Clear upside BOS with impulsive displacement

✔ Entry via bullish FVG fill or refined demand OB

Targets:

4360

4400

4465 – extension if USD weakens and risk sentiment deteriorates

🔴 SELL GOLD 4465 – 4467 | SL 4475

Rules:

✔ Reaction into internal supply / premium imbalance

✔ Bearish MSS / CHoCH on LTF

✔ Downside BOS with momentum shift

✔ Entry via bearish FVG refill or supply OB

Targets:

4430

4385

4320 – extension if USD strengthens or yields rise

⚠️ Risk Notes

Compression favors false breakouts

No execution without MSS + BOS confirmation

Expect volatility during U.S. session

Reduce risk around USD yield spikes or Fed-related headlines

Thin liquidity amplifies stop hunts

📍 Summary

Gold remains bullish by structure, but today’s edge lies in patience, not prediction.

Smart Money is likely to engineer liquidity before committing:

• A sweep into 4320–4318 may reload longs toward 4400–4465, or

• A reaction near 4465–4467 could fade price back into discount.

Let liquidity move first. Let structure confirm.

Smart Money waits — retail reacts. ⚡️

📌 Follow @Ryan_TitanTrader for daily Smart Money gold breakdowns.

BTCUSD (1H) chart pattern...BTCUSD (1H) chart pattern.

📈 BTCUSD – Bullish Targets

Current Bias: Bullish continuation

🎯 Target 1: 90,500 – 91,000

🎯 Target 2: 93,500 – 94,000

📌 Price is holding above the support zone (around 88,000 – 88,500) and showing higher highs, indicating buyers are in control.

🔑 Key Support:

88,000

87,500 (strong support)

⚠️ Invalidation:

If price breaks and closes below 87,500, bullish setup may fail.

If my want, I can also give:

📉 Sell scenario

🛑 Proper SL (Stop Loss)

DeGRAM | GOLD will fall from $4,400📊 Technical Analysis

● XAU/USD broke down sharply from the rising channel, confirming a bearish reversal after repeated failures near the upper boundary around 4,540–4,560. The impulsive sell-off invalidated prior bullish structure and pushed price below key intraday supports.

● Current rebound looks corrective, with price retesting the former support-turned-resistance near 4,390–4,420. As long as this zone caps upside, the bias favors continuation toward lower supports at 4,310 and 4,270.

💡 Fundamental Analysis

● Gold faces pressure from firmer USD and cautious market positioning ahead of upcoming US macro data, limiting demand for non-yielding assets in the short term.

✨ Summary

● Short-term bearish setup. Resistance: 4,390–4,420. Targets: 4,310 and 4,270. Bearish bias holds below broken channel resistance.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

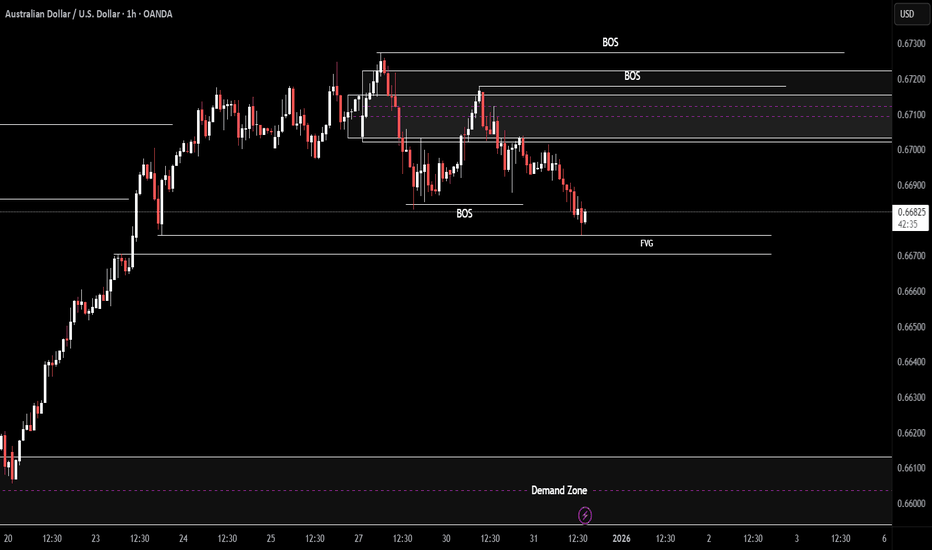

AUD/USD | Going back up? (READ THE CAPTION)As you can see in the 4H chart of AUDUSD, it has reacted to the high of the FVG at 0.66758 and has rebounced and now is being traded at 0.66826. Should it go higher, I expect a reaction to the low of the Bearish OB at 0.67022.

Current Bullish targets for AUDUSD: 0.66960, 0.67120 and 0.67270.

Bearish Targets: 0.66640, 0.66490 and 0.66330.

XAUUSD – Structure Holding at the Blue BoxHi fellow traders,

On the 1H XAUUSD chart, I am applying Elliott Wave principles to outline a potential continuation scenario. After a sharp corrective move, price is reacting from the blue box and holding above the key structural level, suggesting the correction may be complete and continuation to the upside remains possible.

I am entering at the current price, with a Stop Loss at 4270.00. My Take Profit is set at 4574.60, targeting continuation within the larger impulsive structure.

If price breaks below the stop level, this trade is no longer valid.

Structure first. Noise second.

Good luck and trade safe!

Absolute Insanity in SILVER right Now $4 billion in silver longs get vaporized in 70 minutes.

$83.75 to $75.15. Fastest wipeout ever, With current price sitting at $71

American traders panic-dumped at $75, Chinese buyers were paying $90. Ninety. For the same metal. The premium didn’t shrink during the crash—it widened.

Let that sink in.

This wasn’t a top. This was a heist.

China locks silver exports in 72 hours. January 1st. Export licenses only. They control 70% of global supply. COMEX is down 70% on inventory. London’s vaults are bleeding. And Elon Musk just tweeted “this is not good” about the shortage.

The gold-silver ratio is 60:1. Historical average is 30. That’s $150 silver just to normalize.

Everyone’s calling this 1980. It’s not. The Hunts were speculators playing paper games. This is industrial demand crashing into empty vaults. Solar panels don’t negotiate. AI chips don’t wait.

Retail just handed their silver to sovereign wealth funds at a 15% discount.

The rumor says a major bank collapsed on a silver margin call at 2:47 AM December 28.

I cannot verify that.

What I can verify is more interesting.

JPMorgan filed an 8K on December 27 disclosing 4.875 billion dollars in unrealized silver losses. They flipped from 200 million ounces short to 750 million ounces long physical. The largest position reversal in the history of the silver market happened in the last 30 days and nobody on financial television said a word.

The rumor claims 34 billion in emergency Fed repos. Official data shows routine operations under 7 billion. Either the data is lagged or the rumor is wrong.

Why did JPMorgan suddenly need to own three quarters of a billion ounces of physical silver after spending 15 years on the short side. What did they see coming that made them eat a 5 billion dollar loss just to get positioned the other way.

The collapse story might be fiction.

The position flip is filed with the SEC.

One of those facts will matter more in 90 days than the other.

Stop chasing the rumor. Start asking why the smartest bank in commodities just switched sides at the worst possible price and seems fine with it.

XAUUSD H4 Buy Limit | Trend Continuation Setup📊 XAUUSD Technical Analysis (H4)

Price is moving within an ascending structure and continues to respect the bullish trendline.

After a healthy pullback into the demand zone, a continuation to the upside is expected.

🔹 Entry Zone: Buy Limit at 4258 – 4216

❌ Stop Loss: Two H4 candle closes below 4196

✅ Target: 4353

📌 Once the buy limit is activated, partial risk management will be applied.

After price reaches 4290, the position will be secured by moving to break-even (risk-free).

⚠️ Always manage your risk properly.

Wishing you success and victory,🧿❤️✌️

FXG Team Management” 🏅

SILVER'S PRICE WITHIN BUYERS' LEVELSilver has declined to the buyers' level...

N.B!

- XAGUSD price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#silver

#xagusd

XAUUSD Intraday OutlookXAUUSD Intraday Outlook (1H): Range Reclaim After the Dump, Eyes on 4,365 Then 4,485

Gold (XAUUSD) is trading back inside a large 1H range after a sharp selloff from the 4,52x supply. The key intraday read from the chart is simple: price is attempting to rebuild a base inside the green demand/range zone, and the next directional move will likely be defined by whether bulls can reclaim and hold above the 4,365 range ceiling.

With year-end liquidity often thinner, expect sharper wicks around the edges of the range. Trade the levels, not the noise.

Market Structure and Price Behavior (1H)

A strong impulsive drop broke the previous bullish sequence, creating a new short-term bearish leg.

Price then returned into the prior range/demand (large green box), showing acceptance rather than immediate continuation lower.

The recent low printed near the bottom of the range and snapped back quickly, suggesting buy-side defense is active.

Current bias is “range-to-reclaim”: bullish intraday as long as price holds above the lower band, but still capped until 4,365 is reclaimed.

Key Support and Resistance Levels (High Priority)

Support Zones

4,318–4,300: intraday decision area (current acceptance zone).

4,295: first support shelf; repeated reaction level.

4,270–4,265: range floor and main invalidation for longs (break and hold below shifts bias back to sell continuation).

4,240–4,216: deeper support if the floor fails (only relevant if 4,265 breaks clean).

Resistance Zones

4,355–4,365: range ceiling and the most important intraday trigger level.

4,405: mid resistance on the way up (often a pause/partial TP zone).

4,445: pre-supply reaction level.

4,475–4,485: major supply zone (green band above); primary upside target if 4,365 breaks and holds.

4,525–4,560: higher-timeframe supply zone (top green band); only in play if momentum is strong.

Fibonacci Map (Using the Selloff Swing High to Swing Low)

From the visible drop (high around 4,52x to low around 4,27x), the most useful retracement cluster for intraday is:

Fib 0.382: around 4,36x (lines up with range ceiling 4,365)

Fib 0.50: around 4,39x–4,40x (lines up with 4,405 region)

Fib 0.618: around 4,42x–4,43x (reaction zone before the 4,445–4,485 supply)

This confluence is why 4,365 is the key “go/no-go” level for bullish continuation.

EMA and RSI Read (How to Use Them Today)

EMA (Practical Use Intraday)

If price is below EMA50/EMA200 on 1H, rallies into 4,355–4,405 can still be sold unless price shows strong closes above the EMAs.

The clean bullish confirmation is: reclaim 4,365 + hold above EMA50, then use EMA20 as a dynamic support on pullbacks.

If price keeps closing back under EMA20 after touching 4,355–4,365, that is a sign the range top is still rejecting.

RSI (Confirmation, Not a Signal Alone)

RSI recovering back toward 50 supports the “base-build” idea.

Bullish continuation is favored if RSI holds above 50 during pullbacks after a 4,365 breakout.

Rejection setups are higher probability if RSI fails under 50 at the range top and prints bearish divergence near 4,365.

Intraday Trade Plans (Clear Conditions, Clean Invalidation)

Plan A: Buy the Dip Inside Demand (Best RR if You Get the Pullback)

Entry idea: 4,318–4,300 (or deeper 4,295 if a sweep happens)

Stop-loss: below 4,265 (range floor break)

Targets:

TP1: 4,355–4,365

TP2: 4,405

TP3: 4,445

Management: reduce risk into 4,355–4,365 because it is the major decision ceiling.

Plan B: Breakout Buy Above 4,365 (Momentum Confirmation)

Trigger: 1H close above 4,365 with follow-through, then a retest that holds (no immediate reclaim failure)

Stop-loss: below the retest swing low (or below 4,345 for tighter structure-based risk)

Targets:

TP1: 4,405

TP2: 4,445

TP3: 4,475–4,485 supply zone

Note: A breakout without a hold usually turns into a bull trap. Wait for acceptance.

Plan C: Sell Rejection at Range Top (If 4,365 Keeps Failing)

Trigger: rejection wicks + weak closes under 4,355, ideally with RSI failing under 50

Stop-loss: above rejection high (above 4,380 is a clean buffer)

Targets:

TP1: 4,318

TP2: 4,295

TP3: 4,270–4,265

Plan D: Sell at 4,485 Supply (If Price Reaches the Green Band)

Trigger: first touch reaction is common; confirm with 1H failure to close above supply

Stop-loss: above 4,505 (or above the supply high)

Targets:

TP1: 4,445

TP2: 4,405

TP3: 4,365

What to Watch During the Session

If price holds above 4,295 and keeps building higher lows, the market is preparing for a 4,365 break.

A clean reclaim and hold above 4,365 increases the probability of a push into 4,405 then 4,445.

The first major upside objective remains 4,475–4,485 supply; expect reaction there.

A breakdown and acceptance below 4,265 invalidates the bullish reclaim thesis and opens the door to 4,240–4,216.

Risk Note

This is a technical analysis view for trading and education, not financial advice. Intraday volatility can spike, especially around range edges and thin liquidity periods. Keep risk fixed per trade and avoid overtrading the middle of the range.

If you found these levels and trade plans useful, follow and save this idea to get more session-based XAUUSD strategies.

Gold Is Not Collapsing — It’s Completing a Pullback at H1 DemandHello everyone,

On the H1 timeframe, the key focus right now is not the sharp sell-off, but how gold is behaving after breaking below a descending trendline and reacting into a clearly defined support zone. The market has already delivered the impulsive leg down; what matters next is whether sellers can extend or whether price shifts into a corrective rebound.

From the chart, gold completed a lower-high sequence beneath a descending resistance line, confirming sustained selling pressure throughout the session. Each attempt to recover was capped by the trendline, keeping price compressed and vulnerable. That structure finally resolved with a strong impulsive breakdown, sending price directly into the 4,270–4,290 demand zone.

This support area is critical. It aligns with prior reaction lows and has already triggered a sharp intraday response, indicating that sell-side momentum is slowing as liquidity is absorbed. The long downside candle into support followed by reduced follow-through suggests this move is exhaustive, not the start of a fresh acceleration lower.

Structurally, price is now in a post-breakdown rebalancing phase. A brief consolidation or marginal sweep below support is possible to complete the downside sequence. However, as long as the market holds this demand area, a corrective rebound becomes the higher-probability scenario rather than immediate continuation lower.

The projected path on the chart reflects this logic:

Short-term stabilization inside the 4,270–4,290 zone

A corrective push back toward the descending trendline

Potential extension higher toward the 4,390–4,400 resistance, which marks the next major supply level

Only a clean breakdown and acceptance below the support zone would reopen the door for deeper downside. Conversely, a decisive reclaim above the descending trendline would signal that bearish pressure has reset and that gold is ready to challenge higher resistance levels again.

Until that confirmation appears, gold is not trending aggressively lower. It is working through a technical pullback after a completed bearish impulse, where patience and level awareness remain key.

Wishing you all effective and disciplined trading.

Welcome 2026 — A New Year for Better TradesHappy New Year 2026, Traders.

2025 has been a year that truly tested every trader strong volatility, constant macro shifts, and markets that rewarded discipline while punishing emotional decisions. This year reminded us that profitability does not come from being right once, but from managing risk correctly over hundreds of trades. There were winning trades that built confidence, and losing trades that reinforced an essential truth: the market is always right, and our job is to adapt.

As we step into 2026, I wish every trader a strong and stable mindset. Trade with a plan, respect your stop-loss without hesitation, and never let emotions override structure. May you stay calm during sudden spikes, remain disciplined during winning streaks, and trust your system during drawdowns. Consistent profits are the result of patience and execution not speed or prediction.

May 2026 be a year of clean trading: fewer impulsive trades, less FOMO, more high-quality setups, and a steadily rising equity curve over time. Wishing you good health, mental clarity, and continuous growth as a trader. Happy New Year 2026.

Gold at a Crossroad: Correction Phase Still in ControlHello Traders,

OANDA:XAUUSD is currently trading in a critical transition zone following a sharp rejection from the all-time high (ATH) near 4,550. The sell-off from this level was impulsive and decisive, indicating strong profit-taking and distribution at premium prices. However, the subsequent price action shows stabilization rather than continuation, suggesting the market has entered a rebalancing phase after extreme volatility.

From a market structure perspective, the breakdown below the former support zone around 4,430–4,450 marked a short-term structural shift. This zone now acts as a key resistance, where prior demand has turned into supply. Price is currently trading below this level, confirming that the market has not yet regained bullish control. At the same time, sellers have failed to extend price significantly lower after the initial breakdown, which limits immediate downside momentum.

The rebound from the 4,300–4,320 support zone is technically significant. This area aligns with a higher-timeframe demand zone where buying interest has previously emerged. The reaction here shows that buyers are still active at discounted prices, but the recovery remains corrective in nature, characterized by overlapping candles and measured upside moves rather than impulsive expansion.

Dynamic indicators support this neutral view. Price remains below the 34 EMA and 89 EMA, both of which are flattening after a prior bullish slope. This behavior typically reflects a loss of directional momentum and the development of a range. A sustained move above these moving averages would be required to shift momentum back to the upside, while rejection below them would reinforce resistance.

From a macro standpoint, gold is currently influenced by mixed drivers. U.S. Treasury yields have stabilized after recent volatility, while the U.S. dollar is holding firm but not accelerating. This macro balance reduces the probability of an immediate directional breakout and instead supports range-bound price behavior, especially as markets approach year-end liquidity conditions.

In conclusion, gold is not confirming a bullish continuation, nor signaling a bearish expansion at this stage. The market is trading between defined support at 4,300–4,320 and resistance at 4,430–4,450, with ATH supply overhead near 4,550. Until price either reclaims resistance with strong acceptance or breaks support with follow-through, gold remains in a neutral, level-driven environment, where discipline, confirmation, and risk management are more important than directional bias.

OKLO: watching for top formation NYSE:OKLO : as long as price remains below the 175–183 local resistance zone, I’m watching for at least a mid-term top formation, with selling pressure likely to start dominating. The first support levels to watch are 135–125.

A confirmed break above 183 would shift the odds toward one more upside leg into the 210 macro-resistance area.

Chart:

Macro view:

Previously:

On macro-bottom potential (May 1): www.tradingview.com

Back in the game baby!I think we are nearly in the clear and back in the game. There will most likely be a pullback, I’m thinking as low as 3.75 in the next 2 days but we may be shifting fully into bull control. With such a huge discrepancy between contracts it is impossible that the next one won’t at least hit $4.2. Winter is here stay warm. Buy all dips from hear until Feb, good luck all.