GOLD MARKET – MARKET STRUCTURE in M30 GOLD MARKET – MARKET STRUCTURE (M30)

SELL Zone: 4510 – 4515

TP: 4480 – 4435

SL: 4525

• This is an HTF Supply zone – a supply area on the H1 timeframe where strong selling pressure has previously occurred.

• Suitable for selling based on larger timeframes, prioritizing tight volume management.

• Wait for a clear confirmation signal; avoid blind selling while the price is still rising sharply.

BUY Zone: 4435 – 4440

TP: 4470 – 4505

SL: 4425

• This is intraday demand within a M30 uptrend structure.

• Price is maintaining a higher high – higher low pattern; a pullback to demand is normal in a trend.

• Expect buying pressure to return to this area if a ChoCH/BOS pattern appears on M5–M15.

• Prioritize buy orders with confirmation; avoid entering trades when prices fall sharply and uncontrollably.

➤ Current Market Structure

On the M30 timeframe, the current structure continues to print higher highs and higher lows. However, price is now moving into a sensitive decision area with no clear breakout confirmation yet. The M30 bias remains bullish, but price is currently at a critical decision zone.

➤ HTF Supply (Higher-Timeframe Supply)

4,505 – 4,520

➤ Reaction Zone (Decision Zone)

4,455 – 4,485

This is the area where price is currently trading and acts as a balance zone between supply and demand. Multiple short-term reversals have occurred here, highlighting strong buyer–seller indecision.

• A clean hold and breakout above this zone increases the probability of continuation toward the HTF Supply.

• A clear rejection from this zone increases the likelihood of price rotating back to test lower demand.

➤ Intraday Demand (Short-Term Support)

4,435 – 4,450

This is a short-term demand area where price may pull back within the current bullish move. The zone is suitable for buy-on-pullback setups. If this area is broken, short-term bullish momentum will weaken.

➤ HTF Demand (Higher-Timeframe Support)

4,325 – 4,340

This is a higher-timeframe demand zone and the foundation of the current recovery move. If price returns to this area and buyers fail to defend it, the bullish M30 structure will be invalidated, and the market may shift back to a bearish phase.

➤ Market Scenarios

• Primary scenario: Price holds above Intraday Demand → continues consolidating within the Reaction Zone → breaks out toward HTF Supply.

• Alternative scenario: Price is rejected from the Reaction Zone → breaks below Intraday Demand → deeper correction toward HTF Demand.

Commodities

Crude to $75 Profit TargetYou all know I'm a 100% Chart driven trader.

But of course I also have my fundamental thoughts.

Here is my layman’s fundamental thesis:

I do not believe that Venezuelan oil will flood global markets, just because they grabed Maduro. On the contrary, the opposite is more likely. Venezuela’s production is dominated by heavy and extra-heavy crude, which is costly to extract and difficult to refine. As a result, an oversupplied market is unlikely from this point of view.

But with a U.S. military invasion of Iran could be very likely to drive oil prices higher, potentially sharply so. The effect would stem from supply risk, transportation chokepoints, and market psychology I think. Even if physical supply disruptions were initially limited. My experience is, that short-term crazy price moves are often driven by psychological factors.

So, in short:

1. Risk to the Strait of Hormuz (Primary Factor)

2. Potential loss or Threat of Iranian Oil Supply

3. Spillover Risk to Other Producers

4. Speculation and Financial Market Reaction

5. OPEC and Strategic Reserves Probably Very Limited

Sure, the magnitude would depend on duration, scope, and whether shipping through Hormuz remains uninterrupted, but upward price pressure would be immediate.

Timing is always the most difficult part. That’s why I would look at a trade with a horizon of at least three months, or longer (likely using ITM LEAP options).

The chart needs to confirm my thesis.

First, I want to see a break of the descending pressure line (red).

Next, the CIB line must be broken.

Finally, a sign of stabilization above the CIB line would serve as my entry signal.

That’s it. My stalker hat is on.

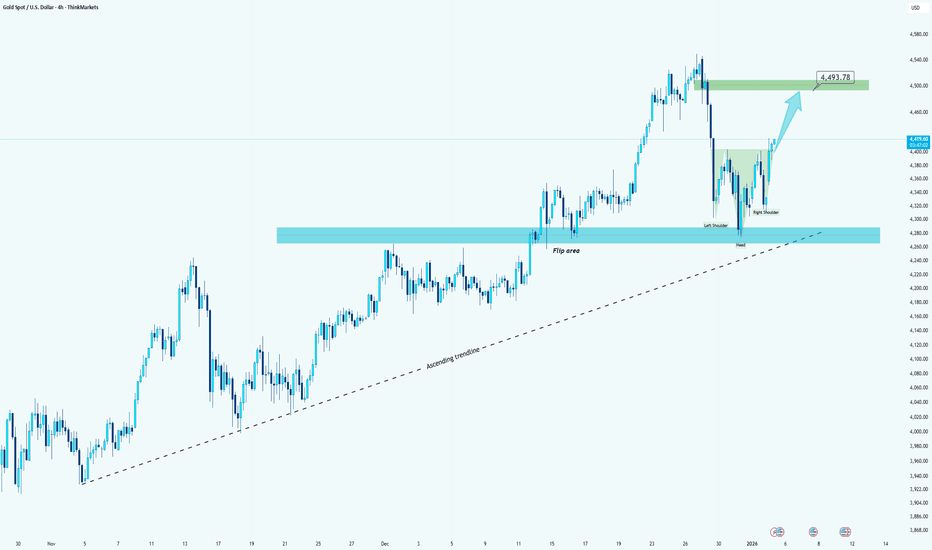

XAUUSD - Macro Tailwinds Align with a Technically Intact UptrendHello everyone, Camila here!

From a fundamental perspective, gold continues to receive clear support from macroeconomic factors. Expectations that the Fed will maintain a dovish stance throughout 2026 are keeping downward pressure on U.S. Treasury yields. As yields cool, the opportunity cost of holding gold declines, allowing capital to rotate back into the precious metal. In addition, ongoing geopolitical risks and unresolved global economic uncertainties mean that gold remains a preferred defensive asset.

From a technical standpoint, I see no signs of a trend reversal at this stage. On the H4 timeframe, the bullish structure remains firmly intact, with a clear sequence of higher lows. The ascending trendline extending from November to the present continues to be respected, indicating that buying pressure still dominates the medium-term market direction.

The 4.28x–4.30x price zone plays a critical role in the overall structure. This area previously acted as strong resistance and has now successfully flipped into support after being broken. Repeated price reactions and rebounds from this zone suggest that the market is accepting a higher price base, rather than entering a distribution phase.

Following the sharp correction from the recent peak, price behavior indicates that selling pressure has lost momentum. Instead of extending lower, price has begun to consolidate and form a structure resembling an inverse Head & Shoulders. The right shoulder remains relatively tight, signaling weakening bearish pressure and active supply absorption. This phase often represents a “pause” before the primary trend resumes.

My preferred short-term scenario is a modest break above the upper resistance, followed by a pullback to retest the newly broken area. If the underlying support continues to hold, this retracement should remain purely technical. In that case, gold would have a solid foundation to extend its advance toward the 4.49x region in the coming sessions.

Wishing you successful trading.

XAUUSD: Inverse Head & Shoulders from Flip Area Hi,

🧩 Pattern: Inverse Head & Shoulders

📍 Key Zone: Flip area (former resistance → support)

📈 Trend: Bullish (ascending trendline intact)

🔹 Gold pulled back into the flip area, respected it as support, and formed an Inverse Head & Shoulders

🔹 This structure suggests trend continuation, not a reversal

🔹 As long as price holds above the flip zone, buyers remain in control

🎯 Targets:

➡️ TP1: 4,480

➡️ TP2: 4,520

⚠️ A minor pullback is possible, but structure favors upside continuation

📌 Bullish continuation setup, momentum building 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

WDC: The "Vault" of the AI Era (Parabolic Channel Breakout)Everyone is obsessed with the "Brains" of AI ( NASDAQ:NVDA , NASDAQ:AMD ), but almost no one is talking about the "Memory." Where does all that data live? Western Digital ( NASDAQ:WDC ).

While the market chases hype, NASDAQ:WDC has quietly entered a Weekly Parabolic Channel. Here is the structural and fundamental breakdown of why this trend is far from over.

1️⃣ THE STRUCTURE:

Respect the Channel 📈 Look at the Weekly Chart (attached). This is textbook "Institutional Accumulation."

The Geometry: Price is strictly respecting a high-velocity Ascending Channel (Blue Zone). Every touch of the bottom trendline has been bought aggressively.

The Breakout: We are currently pressing against the $188 All-Time Highs (Green Line). A weekly close above this level puts us in "Blue Sky Territory" (Price Discovery), where there is zero overhead resistance.

2️⃣ THE FUNDAMENTALS:

The "Beat" Rhythm 📊 Price action is truth, but earnings are the fuel.

Consistency:

Looking at the last 3 quarters (Oct '25, Apr '25), WDC has consistently beaten EPS estimates (Standardized 3.069 vs Estimate 1.589 in Oct).

The Reality: Wall Street keeps underestimating the demand for High-Performance Storage in Data Centers. As long as they keep beating, this trend has a fundamental floor.

3️⃣ THE MACRO:

The "Digital Gold" Correlation 🥇 You asked about metals? Here is the connection. We are seeing Gold and Silver rally, signaling a "Hard Asset" cycle.

The Twist: In the digital economy, Data Storage IS the Hard Asset.

Input Costs:

While rising silver/gold prices increase manufacturing costs for hard drives (connectors/platters), WDC has massive pricing power right now because demand for storage exceeds supply. They pass those costs on. This isn't a bug; it's a feature.

🎯 THE VERDICT:

Trend is King We are seeing a convergence of Technical Strength (Channel Breakout) + Fundamental Growth (Earnings Beats).

Bull Case: A clean break of $188 opens the door to $200+. The trend remains your friend as long as we stay inside the Blue Channel.

Bear Risk: If we fail here, watch for a rotation back to the "Channel Median" line.

👇 Discussion:

Do you see WDC as a "Hardware Play" or an "AI Infrastructure Play"? Let me know below.

NZD/USD | Up and Down (READ THE CAPTION)In the 4H chart of NZDUSD we can see that after hitting the Bullish OB several times, it managed to make a bullish move and it reacted to the Volume Imbalance zone at 0.5791-93, and then it went to reach as high as 0.58105, and now it's being traded 0.5798, testing the IFVG as the whether it'll bounce back up and continue its movement or a further drop incoming.

Bullish Targets: 0.58030, 0.58100, 0.58170 and 0.58240.

Bearish Targets are: 0.57930, 0.57850 and 0.57770.

XAUUSD: Market Analysis and Strategy for January 6thGold Technical Analysis:

Daily Resistance: 4510, Support: 4305

4-Hour Resistance: 4481, Support: 4397

1-Hour Resistance: 4475, Support: 4436

From a technical perspective, the daily chart shows gold breaking strongly above the upper edge of its recent consolidation range, driven by fundamental factors and a return of bullish sentiment. The price is trading above the trendline support, the Bollinger Bands are widening upwards, and the MACD/KDJ indicators maintain a bullish trend. Today's support level is around 4420, with the 4405/4400 area acting as a potential turning point. In the short term, there is still room for further upward movement, and the historical high could be broken at any time.

On the 1-hour chart, the price broke through resistance but is still trading within an upward channel. The moving average system is providing support, and the Bollinger Bands are also widening upwards. The sustainability of the upward trend needs to be monitored, and the risk of a pullback should be noted. Support levels to watch are 4445, 4436, and 4420.

NY Time Period Strategy:

BUY: 4445near

BUY: 4436near

More Strategies →

XAUUSD | Market Structure & Key LevelsPrice is trading in a strong bullish ascending channel, with buyers defending the support zone at 4,280–4,310, which continues to act as a key demand area; as long as price holds above this support, the bullish structure remains intact and pullbacks can be considered healthy. With current price around 4,445, continuation is expected toward the target zone at 4,520–4,560, where major resistance and profit-taking may occur, while a strong close below 4,280 would invalidate this bullish outlook.

GOLD A Fall Expected! SELL!

My dear followers,

I analysed this chart on GOLD and concluded the following:

The market is trading on 4460.4 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 4450.7

Safe Stop Loss - 4465.7

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD BEARISH BIAS RIGHT NOW| SHORT

GOLD SIGNAL

Trade Direction: short

Entry Level: 4,460.42

Target Level: 4,408.00

Stop Loss: 4,495.06

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Cocoa Trend Continuation Scenario | Technical Market Outlook🍫📈 COCOA vs U.S. DOLLAR

Commodities Market Trade Opportunity Guide | Swing Trade

📊 MARKET OVERVIEW (BIG PICTURE)

Asset: COCOA / U.S. Dollar

Market Type: Soft Commodity

Trading Style: Swing Trade

Directional Bias: BULLISH

COCOA remains one of the most structurally volatile commodities, driven by supply concentration, climate sensitivity, and demand elasticity. After an extended impulse move, price is now digesting gains through a controlled pullback, which is technically healthy in an ongoing bullish environment.

This setup is not a breakout chase — it is a pullback-to-support continuation play, designed for smart positioning rather than emotional entries.

🧠 TECHNICAL STRUCTURE EXPLAINED (WHY BULLISH?)

📐 1️⃣ SIMPLE MOVING AVERAGE (SMA) PULLBACK

Price has retraced toward its key Simple Moving Average, which is acting as:

Dynamic support

Trend validation zone

Re-entry area for institutional buyers

In trending markets, SMA pullbacks often precede the next impulsive leg when the trend remains intact.

📈 2️⃣ MARKET BEHAVIOR (PRICE ACTION LOGIC)

What we are observing:

No aggressive bearish expansion

Controlled candles, overlapping ranges

Sellers failing to break below demand

This behavior signals accumulation, not distribution.

➡️ Smart money typically builds positions during pullbacks, not at tops.

🌀 3️⃣ MOMENTUM RESET

Indicators like RSI & momentum oscillators are cooling from overbought levels, which:

Reduces downside risk

Resets fuel for the next move

Improves risk-to-reward for long positions

This is exactly where layered entries outperform single entries.

🎯 ENTRY STRATEGY — LAYERED POSITIONING (THIEF METHOD)

🔑 WHY LAYERING?

Instead of predicting the exact bottom, this strategy:

Distributes risk

Improves average entry price

Reduces emotional decision-making

You are building a position, not gambling on one price.

BUY LIMIT ENTRY ZONES

Layered Buy Limits:

5900

6000

6100

6200

You may:

Add more layers

Reduce position size per layer

Adjust spacing based on volatility

➡️ Any price level entry is allowed as long as risk is controlled.

🛡️ STOP LOSS LOGIC (RISK FIRST)

Stop Loss: 5800

WHY THIS LEVEL?

Below the SMA structure

Below recent demand

Invalidates bullish pullback thesis

If price reaches this zone, it means:

❌ Buyers failed to defend structure

❌ Trend continuation is invalid

❌ Capital preservation becomes priority

⚠️ Always adjust SL based on your account size and risk rules.

Do not blindly follow any single SL.

💰 TARGET LOGIC — PROFIT ZONE EXPLAINED

🎯 PRIMARY TARGET: 6600

This zone represents:

🚓 Strong historical resistance

📊 Overbought reaction area

🧠 Profit-booking zone for large players

Expect:

Volatility spikes

False breakouts

Sharp pullbacks

➡️ Smart traders scale out profits instead of holding blindly.

⚠️ Take profits according to your own strategy.

🔗 RELATED MARKETS & CORRELATION (VERY IMPORTANT)

💵 US DOLLAR (DXY)

Strong USD = pressure on cocoa prices

Weak USD = tailwind for commodities

Always check USD strength before adding size.

🍬 SUGAR ($)

Same soft-commodity family

Moves on supply & weather narratives

Often confirms sentiment shifts

☕ COFFEE ($)

Highly speculative soft commodity

Volatility alignment helps timing entries/exits

📦 BROAD COMMODITY SENTIMENT

If:

Commodities are strong → cocoa strength more reliable

Commodities are weak → reduce position size

🌍 FUNDAMENTAL & ECONOMIC FACTORS (WHY COCOA MOVES HARD)

🌾 SUPPLY CONCENTRATION

Majority of global cocoa supply comes from West Africa

Any disruption = immediate price reaction

🌦 CLIMATE & WEATHER RISK

Rainfall irregularities

Crop disease

Climate stress

Even rumors can move prices aggressively.

🏭 DEMAND & COST PRESSURE

Chocolate manufacturers face rising costs

Grinding activity fluctuations affect demand expectations

Price adjustments often lag — causing volatility

💵 MACRO FACTORS

Interest rate expectations

USD liquidity

Global risk sentiment

Macro shifts can amplify technical moves.

📅 EVENTS TO MONITOR

👀 Crop condition updates

👀 Export data & supply commentary

👀 Central bank decisions affecting USD

🧠 FINAL TRADE LOGIC (SUMMARY)

✔️ Bullish trend intact

✔️ SMA pullback = high-probability zone

✔️ Layered entries reduce risk

✔️ Fundamentals support volatility

✔️ Risk management is mandatory

📈 If this analysis adds value:

👍 Like | 💬 Comment | ⭐ Follow

Trade with patience.

Trade with structure.

Protect capital first.

GOLD ANALYSIS 01/06/20261. Fundamental Analysis:

a) Economy:

• USD: Slight recovery mainly due to early-year technical factors; no strong data yet to confirm a long-term bullish trend.

• US Stocks: Stable; capital has not shifted strongly into safe-haven assets.

• FED: The market is waiting for more policy signals and early-year economic data → observation mode.

• TRUMP: Donald Trump is leaning toward a managerial/transition role regarding the Venezuela issue, with no new policy shock created for the market.

• Gold ETF: SPDR Gold Trust shows no buying or selling → major funds remain on the sidelines, confirming a wait-and-see sentiment.

b) Politics:

• US – Venezuela tensions have ended; short-term geopolitical risk has decreased, providing no strong catalyst for a sharp gold rally.

c) Market Sentiment:

• The market at the beginning of the year is neutral – cautious, waiting for confirmation and new information.

2. Technical Analysis:

• The overall trend remains a medium-term uptrend (higher highs compared to previous peaks).

• Price is currently in a technical correction after failing to hold higher levels, oscillating around the MA cluster.

• RSI has pulled back from high levels but has not entered oversold territory → a healthy correction, not a trend reversal.

👉 Overall: Sideways consolidation – correction within an uptrend, suitable for BUY on dips, not suitable for SELL against the trend.

RESISTANCE: 4,455 – 4,468 – 4,500

SUPPORT: 4,420 – 4,400 – 4,380

3. Previous Market Session (5/01/26):

• Gold rose 120 points, exactly as analyzed.

• No further breakout; price moved sideways in accumulation, with buying pressure weakening near resistance.

• No support from ETFs → slow price reaction, narrowing range.

• Slight USD recovery created short-term corrective pressure but not enough to break the bullish trend.

4. Today’s Strategy (6/01/26):

🪙 SELL XAUUSD | 4497 – 4495

• SL: 4501

• TP1: 4489

• TP2: 4483

🪙 BUY XAUUSD | 4443 – 4445

• SL: 4439

• TP1: 4451

• TP2: 4457

XAUUSD Rejection From Resistance | Bearish Continuation SetupGold is currently trading below a well-defined resistance zone around 4,470–4,485, where price has faced multiple rejections. The structure suggests lower highs and weakening bullish momentum on the 15-minute timeframe.

As long as price remains below this resistance, the bias stays bearish. A rejection from this area opens the door for a move back into the support zone near 4,430, with a deeper continuation toward the final target around 4,395–4,400.

This setup is based on range rejection + resistance hold, offering a clear risk-to-reward opportunity for intraday traders.

Trade Plan:

Sell Zone: 4,465 – 4,485

Stop Loss: Above 4,490

Targets: 4,430 → 4,400

⚠️ Wait for confirmation and always manage risk properly.

DeGRAM | GOLD is preparing to consolidate above the $4,400 level📊 Technical Analysis

● XAU/USD rebounded strongly from the 4,300–4,330 support area after a sharp sell-off, filling the downside gap and confirming buyer absorption at the ascending trendline. The breakout above the sloping resistance near 4,400 signals a bullish continuation after a corrective phase.

● The prior rising wedge breakdown was neutralized as price reclaimed structure, while higher lows now point toward a retest of 4,440–4,520 resistance zones.

💡 Fundamental Analysis

● Gold is supported by persistent geopolitical risks and expectations of softer US monetary policy, sustaining demand for safe-haven assets.

✨ Summary

● Bullish continuation confirmed. Support: 4,300–4,330. Targets: 4,440 and 4,520. Trend remains constructive above broken resistance.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

WTI Crude Oil – Inverse H&S Targeting Neckline BreakSummary:

WTI is attempting a bullish reversal after forming an inverse Head & Shoulders on the H1 chart, with price pushing back toward a key neckline zone around 57.00.

Technical Analysis:

Price previously respected a descending channel, but recent bearish momentum stalled near the lower range, leading to a clear inverse Head & Shoulders structure. The left shoulder and head were formed after a sharp sell-off, followed by a higher low forming the right shoulder — a classic reversal signal.

The neckline near 57.00–57.10 is the key level to watch. Current bullish candles show increasing buying pressure, suggesting an attempt to reclaim this level. A confirmed break and hold above the neckline would validate the pattern and open the door for continuation toward the upper channel area. Failure here would keep price range-bound and vulnerable to another pullback toward 56.20–55.80 support.

Fundamental Context:

Crude oil remains sensitive to OPEC+ production guidance, geopolitical risks, and near-term USD strength driven by Fed expectations. Any supportive headlines on supply tightening or softer dollar could help fuel the bullish breakout.

Key Levels:

Resistance / Neckline: 58.10 - 58.60

Bullish Targets: 60 → 62 (Making a HH in 4H timeframe)

Support: 56.20 → 55.80

Invalidation: Sustained move below 55.80

Takeaway:

Bullish if WTI breaks and holds above 57.10 — inverse H&S confirms and upside opens. Bearish if price rejects the neckline and loses 56.20, signaling continuation of the broader downtrend.

#WTI #Oil #CrudeOil #PriceAction #ChartPatterns #TradingView #Commodities

XAGUSD: $70 support breakdown setup🛠 Technical Analysis: On the 4-hour chart, silver (XAGUSD) is reversing from its recent peak and attempting to advance toward a key support zone near 70.0. The SMA50 is currently acting as support. The chart suggests a more reliable selling opportunity will only arise after a confirmed break below 70.0, which would signal a continuation of the bearish trend. In this case, the next bearish magnet would be the noted support at 64.515 (near the SMA200).

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on a confirmed breakdown below 70.0 (approx. 69.887 – 70.00)

🎯 Take Profit: 64.515

🔴 Stop Loss: 75.276

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

XAUUSD: Market Analysis and Strategy for January 8thGold Technical Analysis:

Daily Resistance: 4540, Support: 4350

4-Hour Resistance: 4500, Support: 4400

1-Hour Resistance: 4440, Support: 4415

The daily gold chart shows a pullback, but the overall magnitude is not large. The short-term structure still maintains a bullish outlook. Although there is a technical pullback, it cannot be ruled out that this is due to the anticipated negative impact of the non-farm payroll data. The deviation correction of the moving average indicators has basically ended. The price is repeatedly testing the support level of 4420. The price is trading above the upward trend line support. On the daily chart, the gold price is still in an upward channel. Pay attention to the upward rebound energy after the technical indicators stabilize. The short-term resistance level is around 4500. Once 4500 is recovered, the historical high could be broken at any time.

The 1-hour chart shows a downward trend with oscillations. It is in a downward channel, with the moving averages crossing downwards. The resistance level is moving down in a step-like manner. The Bollinger Bands are widening and have a continued downward trend. Pay attention to the short-term resistance level around 4440 and the support level around 4400.

Trading Strategy:

BUY: 4408~4400

More Analysis →

Huntsman Corp $HUN — The "Cheat" BreakoutHuntsman Corp: the company is a global leader in specialty chemicals, specifically dominating the MDI-based polyurethane market which accounts for roughly 75% of its operations and serves critical "future-proof" sectors like energy-saving insulation, automotive light-weighting, and EV battery encapsulation.

While the stock has weathered a difficult cyclical trough—marked by a significant 65% dividend reset in late 2025 to preserve cash—the bull case for 2026 rests on its aggressive $100 million cost-restructuring program and its strategic pivot away from volatile commodity chemicals toward high-margin "differentiated" products.

Huntsman’s high operating leverage is positioned to convert modest volume gains into an outsized earnings breakout.

USD/JPY | What's next? (READ THE CAPTION)As you can see in the hourly chart of USDJPY, in the early hours of today, it managed to break through the NWOG and the FVG, going as high as 156.955, before dropping to the low of the FVG at 156.460. Currently it's being traded at 156.680 and it's retesting the NWOG. I expect it to continue working the NWOG and FVG. Bullish targets are: 156.780, 156.860, 156.940 and 157.020.

GBP/JPY | Stuck to the same zone! (READ THE CAPTION)As you can see in the hourly chart of GBPJPY, it has been stuck to the same NWOG for the past couple weeks, going up and down of it. Currently, it is being traded at 210.650, I expect retesting the NWOG, the targets are: 210.740, 210.950, 211.16 and 211.370.

If it fails to go through the NWOG, the bearish targets are: 210.520, 210.310 and 210.100.

Gold Is Coiling in a Descending Triangle — Breakdown Risk Market Outlook (XAUUSD – H1)

Price is compressing inside a well-defined descending triangle, with lower highs pressing against a flat support around 4,420–4,430, signaling increasing sell-side pressure. Momentum remains capped below the descending trendline and the EMA, keeping the short-term bias bearish.

A minor bounce toward 4,450–4,460 is likely to act as a corrective retest of triangle resistance rather than a reversal.

A decisive break and close below 4,420 would confirm the pattern breakdown, exposing downside liquidity toward 4,380–4,350. Only a clean breakout above the descending trendline would invalidate the bearish setup and shift the bias back to bullish continuation.

Can the Venezuela Crisis Spark the Next Rally?Gold (XAUUSD) Price Outlook: Can the Venezuela Crisis Spark the Next Rally?

1. Market Context: Margin Hike Drives Forced Selling, Not Structural Weakness

Gold closed last week with a sharp downside move, but the decline was driven primarily by a technical and mechanical factor rather than a deterioration in fundamentals. The increase in futures margin requirements forced leveraged traders to liquidate positions, triggering a cascade of sell orders. This type of margin-driven selloff typically exaggerates price moves and does not, by itself, signal a change in the broader trend. Despite the magnitude of the drop, the long-term bullish structure remains intact.

2. Trader Behavior Shift: From Momentum Chasing to Selective Positioning

For several months, traders aggressively chased upside momentum, consistently lifting offers as price moved higher. The margin hike has altered that behavior. With higher capital requirements, participants are now more selective, focusing on value zones and confirmation rather than momentum alone. Until upside momentum re-emerges, gold is likely to trade with more caution and tactical positioning rather than impulsive trend extension.

3. Weekly Close Snapshot: Sharp Loss, Trend Still Preserved

XAUUSD settled last week at $4,332.06, down $201.14 (-4.44%). While the weekly decline was significant, it did not violate the core structure of the uptrend. From a professional trading perspective, this type of correction is consistent with position rebalancing rather than trend failure, especially after an extended rally.

4. Primary Technical Structure: Defining Bullish and Bearish Boundaries

From a technical standpoint, the main trend remains bullish. A sustained break above $4,550 would confirm trend continuation and signal renewed upside expansion. Conversely, the trend would only shift decisively bearish if price breaks below $3,886 on a weekly closing basis. Until one of these levels is resolved, gold remains structurally bullish within a corrective phase.

5. Key Decision Zone: $4,218–$4,139 Sets the Near-Term Tone

The most critical area in the current structure lies between $4,218 and $4,139, a key retracement zone. Price reaction here will determine the next directional move. Strong buying interest on the first test would suggest the formation of a secondary higher low, reinforcing bullish continuation toward the record high near $4,550. Failure to hold $4,139, however, would signal weakness and increase the probability of a deeper corrective leg toward $3,886.

6. Long-Term Value Area: Where Institutional Buyers May Step In

For longer-term positioning, the weekly chart highlights a high-confluence support cluster between $3,545 and $3,472. This zone aligns with the 50% retracement of the rally from the November 2024 low at $2,537, as well as the 52-week moving average near $3,472. As long as this moving average holds, the broader market regime remains firmly in “buy-the-dip” mode rather than a trend reversal environment.

7. Geopolitical Catalyst: Venezuela Crisis Adds Risk Premium

Fundamentally, gold has received a fresh tailwind from rising geopolitical uncertainty. Developments in Venezuela escalated after the U.S. launched a military strike and detained President Nicolás Maduro on criminal charges. President Donald Trump’s statement that the U.S. would oversee Venezuela during a transition period has added further uncertainty. Any escalation or instability tied to this situation has the potential to reintroduce a geopolitical risk premium into gold prices.

8. Macro Focus: U.S. Jobs Data and Fed Policy Expectations

Attention now turns to the upcoming December U.S. jobs report, which will be closely monitored by both traders and policymakers. Federal Reserve officials have emphasized that labor market conditions will play a key role in shaping the rate-cut path into 2026. Recent policy minutes revealed internal divisions, with labor data and inflation as the primary points of disagreement. A weaker employment print could strengthen expectations for additional rate cuts, indirectly supporting gold.

9. Week Ahead Outlook: Volatility Before Clarity

In the near term, gold is likely to experience heightened volatility as markets react to developments in Venezuela. Bias may remain cautiously to the upside as long as geopolitical uncertainty persists. However, the more decisive macro-driven move may not materialize until after the jobs data is fully absorbed. For now, gold sits at a critical junction—supported by long-term structure, constrained by near-term resistance, and highly sensitive to geopolitical and macroeconomic headlines.