Contains IO script

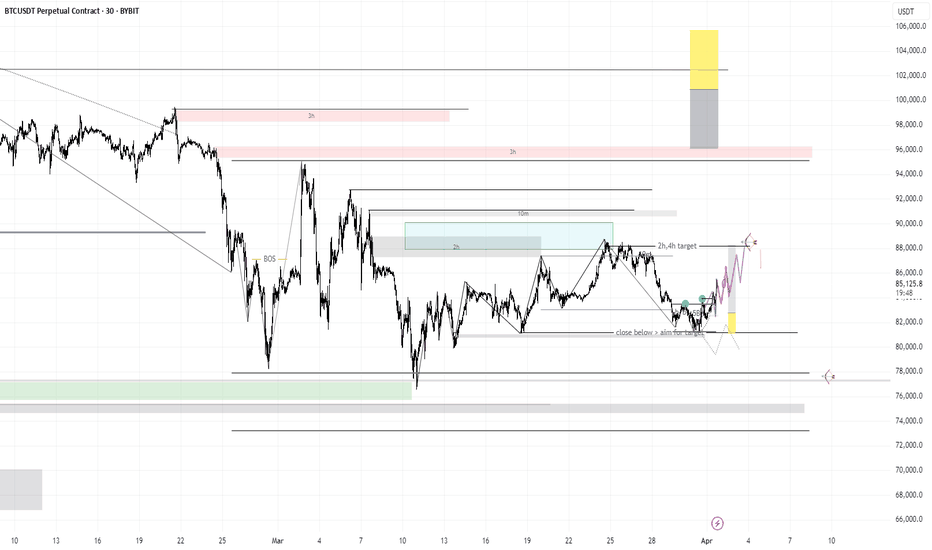

Trade of the day! Exclusive video recap🚨 I know I haven’t been posting our usual videos lately, but along with the daily morning update, here’s a trade breakdown of what’s been happening in the world of Bitcoin! 🟠📉📈

At this point, we should be 2 for 2—both setups came to fruition. However, in my honest opinion, neither gave us that clear-as-day confirmation. If you went for the riskier approach and jumped in without confirmation, congrats! 🎉💰 But let’s be real—that’s a dangerous game. 😅

👀 Keep your eyes peeled for tomorrow morning’s Wednesday update! We all know BTC loves Tuesdays, Wednesdays, and Sundays—so let’s see if we’re in for a treat this Wednesday! 🍿🔥

FXAN & Heikin Ashi TradeBINANCE:XRPUSD

In this video, I’ll be sharing my analysis of XRPUSD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Sunday Viper Upcoming week overview. On Sunday's i break down the DXY and the rest of the market giving a forward look and expectation of what we can expect or look for upcoming. I breakdown US30, Nas100, Gold, Oil, BTC and some forex pairs. Possibly a big week ahead with Tariffs coming out April 2nd and NFP on Friday. Looking forward to an exciting volatile week.

Check out my Week 14 Trade Analysis for 2025!Hello fellow traders , my regular and new friends!

How was your trading this week?

For me i did a couple of trades, namely on the EurNzd, Usdjpy and snp500.

Took a lost on snp500.

Usdjpy was so so

Eurnzd was not bad :)

Which are the pairs you have traded?

NFP for this week, do take note. What should we keep an eye on?

Do check out my recorded video for more insights!

Do Like and Boost if you have learnt something and enjoyed the content, thank you!

-- Get the right tools and an experienced Guide, you WILL navigate your way out of this "Dangerous Jungle"! --

*********************************************************************

Disclaimers:

The analysis shared through this channel are purely for educational and entertainment purposes only. They are by no means professional advice for individual/s to enter trades for investment or trading purposes.

*********************************************************************

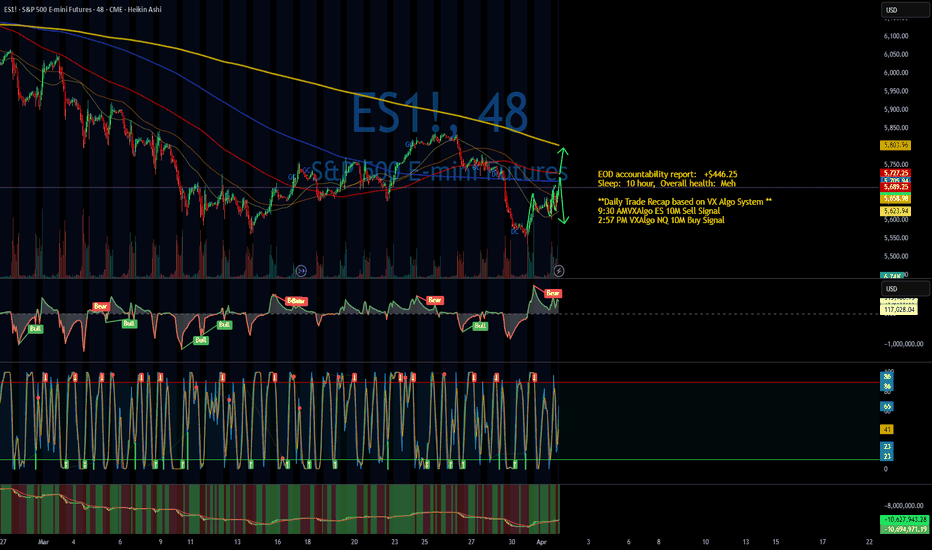

Daily Trade Recap based on VX Algo SystemEOD accountability report: +$537.50

Sleep: 8 hour, Overall health: Energized

As mentioned in our trade recap video yesterday, today was suppose to be really bearish and go down more,

However, the inflation report ended up being really bad and that just crashed the market all day.

I was expecting to see some bounces here and there along the way but it was just straight drill with no buyers in sight.

Daily Trade Recap based on VX Algo System

8:24 AM Market Structure flipped bearish on VX Algo X3! Look to STR at 1 min MOB or resistance.

11:10 AM VXAlgo NQ 10M Buy Signal

3:36 PM VXAlgo NQ 48M Buy Signal

Daily Trade Recap based on VX Algo SystemEOD accountability report: +$786.25

Sleep: :ok: Overall health: Day 1 of fasting, edgy as f

I finally got to test Caffeine and lions mane on an empty stomach and it was crazy, really sharp focus but jumpy as well.

We started the day off pretty scary, Huge drop to 5720 and instant recovery to the top. Traded a bit on one of my APEX evals that renewed today but

Didn't really touch the funded account until 11:20 when we hit the 48m resistance and got a 10m signal.

Overall day was pretty decent, 10m and 5 m chart worked really well.

Daily Trade Recap based on VX Algo System

9:50 AM VXAlgo ES 10M Buy signal 2x

11:10 AM VXAlgo ES 10M Sell Signal 2x

12:24 PM Market Structure flipped bearish on VX Algo X3!

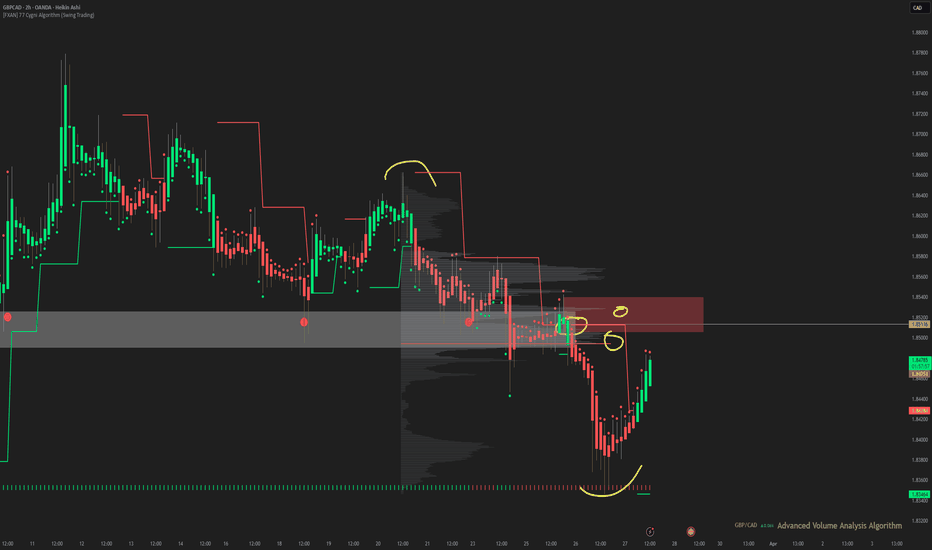

FXAN & Heikin Ashi Trade IdeaOANDA:GBPCAD

In this video, I’ll be sharing my analysis of GBPCAD, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Daily Trade Recap based on VX Algo SystemEOD accountability report: +$790

Sleep: Great Overall health: :check:

Overall pretty decent trading day, spotted long term sell signals on market across the board this morning pre market so I was expecting thing to be bearish and drop. It played out as expected and helped with the trades today as thing went according to plan most of the time.

I did expect a V shape recovery at some point but that didnt happen.

Daily Trade Recap based on VX Algo System

10:36 AM VXAlgo NQ 10M Buy Signal,( didn't work that well)

1:30PM 10min MOB bounce :check:

2:09 PM VXAlgo ES 10M Buy signal + 10min MOB (Double Signal) :check:

3:36 PM VXAlgo NQ 48M Buy Signal :check:

FXAN & Heikin Ashi Trade IdeaOANDA:USDCHF

In this video, I’ll be sharing my analysis of USDCHF, using FXAN's proprietary algo indicators with my unique Heikin Ashi strategy. I’ll walk you through the reasoning behind my trade setup and highlight key areas where I’m anticipating potential opportunities.

I’m always happy to receive any feedback.

Like, share and comment! ❤️

Thank you for watching my videos! 🙏

Daily Trade Recap based on VX Algo SystemEOD accountability report: +$760

Sleep: Bad Overall health: drained

Daily Trade Recap based on VX Algo System

9:50 AM VXAlgo ES 48M Sell Signal ( didn't work that well)

10:10 AM VXAlgo ES 10M Buy signal (Double Signal) :check:

12:47 PM VXAlgo ES 10M Buy signal (Double Signal) :check:

3:30PM doji trade + expecting 48m to flip up

Market stalled a it today as expected because we ran up a lot yesterday,

We did go a bit higher but not much up from yesterday's high.

Overall decent range day if you trade the 1 min MOB.

Daily Trade Recap based on VX Algo SystemEOD accountability report: +$650

Sleep: 🆗 Overall health: feeling drained today.

Health wise, Feeling really tired today, might need to really add red light therapy to my morning process.

Daily Trade Recap based on VX Algo System

11:39 AM VXAlgo NQ 48M Sell Signal (took mes but got stopped out)

12:26 PM VXAlgo ES 48M Sell Signal +NQ 48 sell (made money)

1:30 PM VXAlgo ES 10M Buy signal (avg down at support & made money)

In regards to the market today, we broke over the 48 min resistance yesterday night when market opened and it pushed us into bullish zone,

naturally when market is in bullish zones, it can push hard so you just have to sit back and watch if you missed the entry.

Which was what I did and just waited until we get a sell signal.

Daily Trade Recap based on VX Algo SystemEOD accountability report: +$503.75

Sleep: :check: Overall health: did not feel so well today.

C+ & B+ set up trades today

Today at 9:30 AM VXAlgo NQ 10M Buy Signal + major support from 🎯┃𝐅𝐮𝐭𝐮𝐫𝐞𝐬-𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬…

10:11am Buying at major support from 🎯┃𝐅𝐮𝐭𝐮𝐫𝐞𝐬-𝐀𝐧𝐚𝐥𝐲𝐬𝐢𝐬…

Today at 12:12 PM Market Structure flipped bullish on VX Algo X3!

Today at 1:11 PM VXAlgo ES 10M Sell Signal,

Started the day somewhat bearish because we had a daily sell signal,, but all time frames were pretty close to bottoming out and a lot of the move happened overnight already so by the time we opened, it was already at 50% off the expected move for the day and -1% on the index.

So since i had a major support there, i just started buying everytime we hit 5653ish area.

When it failed to break support 3x today, I realize that sellers were weak and had no strength so my bias started to flip bullish.

Explanation of Wyckoff VSA Trigger Bar and Future ReactionIn this short video, Author of "Trading in the Shadow of the Smart Money" explains the importance of identifying "Trigger Numbers and Bars" in multiple timeframes.

Markets and price action move because three universal laws:

Supply and Demand

Cause and Effect

Effort Vs Reasult

This example in the Nasdaq futures shows it perfectly.

Wishing You all goodtrading and constant profits,

Gavin D Holmes

Author and Trader

Hidden Forces: Decoding Buyer & Seller Activity on ChartsTotal Volume vs. Volume Delta: The total volume on the chart includes both buys and sells, making it less useful for analysis. Volume Delta, however, shows whether buyers or sellers dominated within a candle.

A green Delta candle means more aggressive retail buying; a red one means more retail selling. This helps analyze market sentiment beyond price movement.

Price & Delta Relationships:

1. Price and Delta move together → Organic movement, likely driven by retail.

2. Delta moves, but price doesn’t → Retail is heavily biased in one direction, absorbing limit orders. Possible smart money trap.

3. Price moves, but Delta doesn’t → Retail didn’t participate in the move. Lack of belief or failed market-making attempt.

4. Price moves against Delta → Strong indication of market manipulation. Large players using aggressive strategies against retail.

Market Manipulation & Smart Money:

* Whales leverage retail psychology and order flow to position themselves.

* Retail often gets caught in fake moves, unknowingly providing liquidity to big players.

Final Thought: By analyzing Delta and price movement together, we can spot hidden large buyers and sellers and understand market dynamics beyond surface-level price action.