Context and Learning To Change With ChangeOne of the hardest things for traders, or anyone for that matter, is to adapt to change. Mostly we get stuck when things change, which makes trading difficult since the very nature of markets is change. This is where the cliché 'going with the flow' originates, but simply understanding the cliché isn't enough; we must internalize and practice it and get it in our bones.

In this post, I will outline a trade plan for RNG. This is a part of our '30 Planned Trades' series, where we plan every aspect of the trade ahead of time and then execute what we have planned.

One aspect of a trade plan is the method or setup. Setups don’t happen in a vacuum, there is a context that determines the meaning of the content. I’m going to approach context very simply here as the thing that decides if the market is going up or down.

I often read things about how I should follow the trend or go with the flow or don’t fight the market, but exactly what trend or flow should I follow? It’s too abstract, so I’m going to fix a cycle to follow and learn to let go and change when it changes.

In the video, I show the basics of a simple practice you can try, using a rolling 100-bar cycle to determine if we are looking for long setups, short setups, or in a transitional or neutral phase. I not only want to be precise and consistent in my Trade Plans, I want to be consistent in my methods.

By adhering to a fixed cycle and adapting with changes, I avoid the need to guess or predict market directions, maintaining balance in my approach. Think about this: If you charge your mind with the impossible task of predicting a market when markets are unpredictable, you will end up a nervous wreck and then wonder why your trading is so emotional.

I encourage you to try this practice. Since it keeps you from constantly looking to the left of the chart or at higher time frames for more information, it will likely push you out of your comfort zone into the unknown, which is a good start.

Shane

Context

Morning Ideas December 30, 2021Good morning traders,

Same ol' stuff, different day. Still consolidating at the highs, likely to see some kind of push in the next two trading days to "clean up" this weak high.

You need to distance yourself as a trader from the result of the next trade, and think of the market in probabilities. The data shows that the probability of the market continuing higher is much higher than continuing lower.

Whatever happens in this particular trade, is irrelevant. Each trade is just 1 trade in a large sample.

Morning Ideas November 20, 2019A good lesson on unfinished profiles and what they mean.

I would expect to see 3110 area be a big level this morning. If we are able to sustain prices above it, 3122 is back on deck.

If we break below and pull back, I'd expect to see some sellers step in and try and move us down towards 3095

Morning Ideas November 14, 2019Market still clearly accepting prices higher.

Profile becoming very box-y meaning that the market is indifferent at any price between the highs and lows of value.

The line in the sand below is still 70, in my opinion, and you'd wouldn't be wrong staying long until that is broken.

Remember, the market is accepting higher and when that happens, the more likely scenario is that we will continue in that direction.

If you're going to be short from up here, you have a nice Reward for your risk as long as you keep the stops tighter.

You don't want to be holding on to positions against the grain that are moving against you.

Morning ideas October 17, 2019We are now hanging out at the top of balance.

Gun to the head, I'd still want to be short.

If I change my mind on the short, it's becuase the buyers will move the market abvoe this 3000 area and we will start to trade a lot of volume up there.

Until then, if you are long from here you are buying the breakout from value high and that's a losing proposition, long term, in this instrument.

Remember, whether this trade works or not is irrelevant, whats important is the body of trades.

Morning Ideas July 25 2019 E-Mini/E-Micro SP500Hey guys,

Morning ideas weren't downloading properly yesterday so I apologize for not having a video for the morning yesterday.

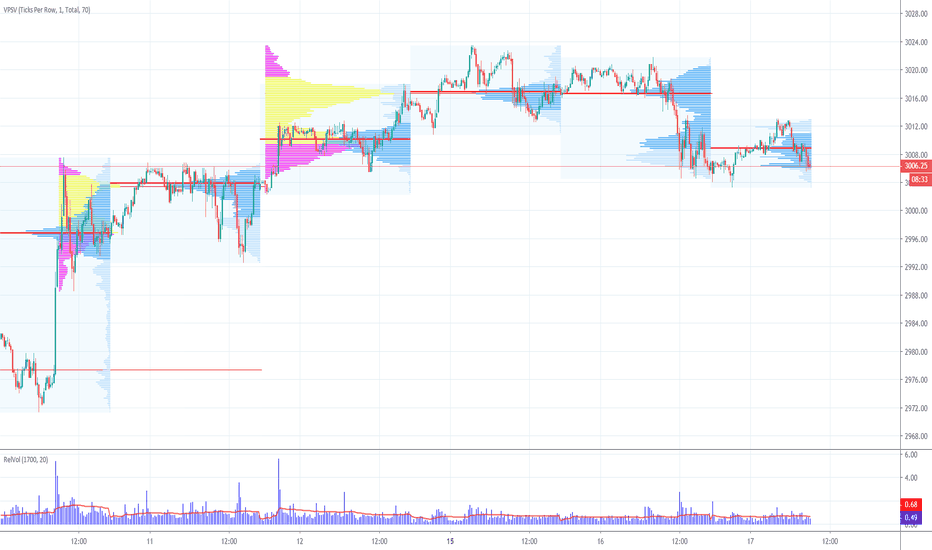

In class, we talked about it being a toss up on the open and it was best to take a wait and see approach, with an eye on 3010 as the breakout area.

Well, we ran right to that area on the open and sat there. Glorious opportunity and a great teaching lesson there.

In this product (SP500) we get these opportunities on breakout pullbacks very often and they are low risk plays.

They are low risk because if the breakout fails, you don't have to give it a lot of room before the idea is toast.

For today, I'm a bit concerned with the strong bar overnight because it could be sign of exhaustion.

Will monitor on the open to determind whether I will add, or start peeling some off.

Tough to see what the market will do here because we are at all-time-highs and there is no data up here.

I still have an eye on 3010 below, let that be your guide.

Morning Ideas July 15, 2019. Emini Sp500/E-Micro SP500Sounding like a broken record but we continue to accept value higher. That means I will continue to be long and continue to follow the value.

2992 is the line in the sand below where I think we pull back into the next distribution below, as shown on the video.

Morning Ideas July 5 2019 Emini SP500/EMicro SP500NFP number created some downward movement even though it was a good number. We reached 3000 and may have some temporary resistance because everyone is looking at that number, but I will continue to be long until the market starts accepting prices lower.

Are we stretched here? Sure

Is it possible that we have a down day? Sure

All of this is speculation though and I will continue to go where price is accepting value. It is still accepting value higher so I will continue to play the long side.

Areas of interested.

2980 area

2970 area

2960 area

Don't flip flop based on price action