#COOKIE/USDT BROKEN OUT OF DESCENDING TRAINGLE#COOKIE

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We have a bearish trend on the RSI indicator that is about to be broken and retested, which supports the upward breakout.

There is a major support area in green at 0.0920, representing a strong support point.

We are heading for consolidation above the 100 moving average.

Entry price: 0.0950

First target: 0.0974

Second target: 0.1006

Third target: 0.1040

Don't forget a simple matter: capital management.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

Cookie

COOKIE / USDT — Final Support Test: Breakout or Breakdown?📊 Overview

COOKIE price is currently sitting at a critical decision point: resting right on the major support zone (yellow box) that has held multiple times, while also being pressed down by a long-term descending trendline from January 2025. This forms a classic descending triangle pattern — historically a bearish continuation, but in crypto it can also act as an accumulation base before a strong breakout.

In short, the market is in a make-or-break phase.

---

🔎 Pattern & Price Structure

1. Descending Triangle

Clear lower highs from the 0.825 peak.

Horizontal support zone (yellow box) repeatedly absorbing selling pressure.

Price now squeezed into the apex → signaling that a strong move is imminent.

2. Support Zone (Demand Area)

The 0.12 – 0.13 region is the last line of defense for bulls.

A breakdown below this would validate the bearish structure.

3. Key Resistance Levels

0.1658 → first breakout target.

0.2195 → key resistance above the breakout zone.

0.3074 → major resistance, ideal swing target.

0.5806 → long-term bullish extension if momentum sustains.

---

🚀 Bullish Scenario

Catalyst: confirmed breakout above descending trendline with strong 2D candle close + increased volume.

Additional validation: successful retest of the breakout line showing buyers’ dominance.

Upside targets:

Target 1: 0.1658 (≈ +27%)

Target 2: 0.2195 (≈ +69%)

Target 3: 0.3074 (≈ +137%)

Extended target: 0.5806 (multi-month rally potential).

Bullish strategy: enter on confirmation, take profits gradually, and move stop-loss to breakeven after first target is hit.

---

🐻 Bearish Scenario

Catalyst: breakdown below the yellow support zone (close 2D < 0.12).

Downside targets:

0.09 (≈ -30% from current price).

0.065 (≈ -50%).

Extreme case: retest historical low at 0.0192 (≈ -85%).

Bearish strategy: beware of false breakdowns (long wicks below support quickly reclaimed). Always wait for confirmation.

---

📌 Trading Strategy & Risk Management

Conservative traders: wait for a clear breakout/breakdown confirmation on the 2D timeframe.

Aggressive traders: may play the bounce off support, but must use strict stop-loss just below the yellow zone.

Position sizing: limit risk per trade (1–2% of capital) given the potential volatility once the pattern resolves.

---

📝 Conclusion

COOKIE is at a critical junction. The descending triangle often favors the bears, but in crypto, patterns are frequently invalidated by short squeezes or hidden accumulation. A confirmed breakout could spark a strong rally toward 0.1658 – 0.3074, while a breakdown may drag price below 0.09 and even to 0.065.

Bottom line: COOKIE is in an energy build-up phase. The next breakout or breakdown will likely define the medium-term trend — whether COOKIE becomes a “big winner rally” or continues deeper correction.

---

#COOKIE #CookieDAO #CryptoAnalysis #Altcoins #DescendingTriangle #SupportResistance #TradingStrategy #CryptoTrading #PriceAction

Cookie DAO · The Bullish Wave · Resistance & SupportWe need just one signal here and the market works based on resistance and support. When trading is happening above support, the bulls have the upper-hand, the advantage. When trading is happening below support, the bears have the advantage.

Here we are looking at COOKIEUSDT. The main support is the 3-February low for us. When the action moved below this level, we look for a bottom and reversal pattern. The bottom showed up and the pattern resulted in a cup or inverted triangle. When the action moves back above the 3-February support line the bullish bias is now confirmed.

Now fast forward to present day. COOKIEUSDT produced a retrace after peaking in May and the same support zone was tested. It was challenged for a few days and after suffering briefly, it seems to hold.

Now COOKIE has been green five days moving up. The fact that the action today is happening at the top of the session moving above EMA21 is another positive signal. The day started red and prices actually moved much lower. All the selling was bought and now COOKIE is back green, this signal is double-strong (bullish).

We will see a bullish wave next. Market my words.

Namaste.

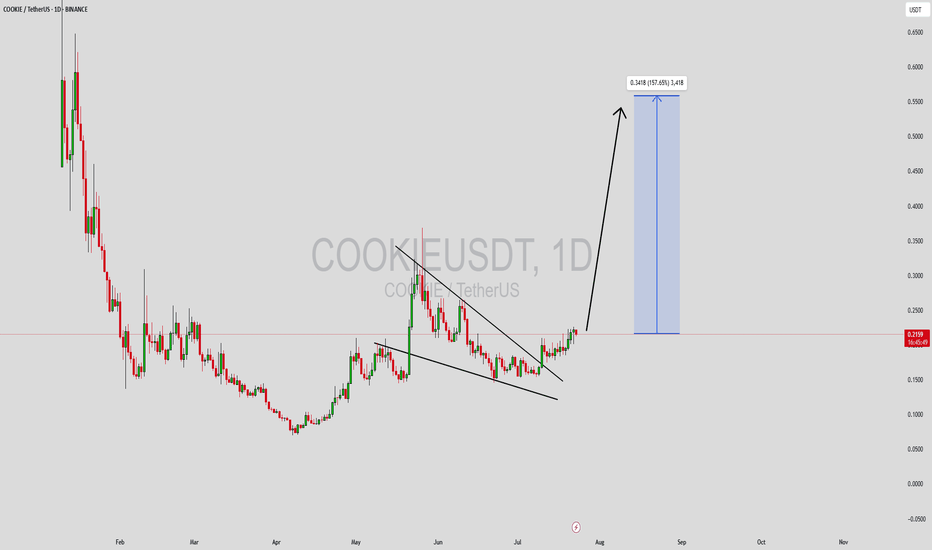

COOKIEUSDT Forming Falling WedgeCOOKIEUSDT has recently broken out from a bullish falling wedge pattern on the daily chart, a formation that typically signals a trend reversal and strong upward momentum. The wedge formed after a long consolidation and price compression, which usually results in a breakout supported by increased volume—and that’s exactly what we’re seeing. This breakout now opens the path for a potential move toward a 140% to 150% gain in the near-to-mid term.

The falling wedge breakout is accompanied by rising buying volume, which validates the pattern and confirms growing market interest in COOKIE. Price action has flipped from lower lows to forming higher highs, a technical shift that’s often the early phase of a parabolic move. COOKIEUSDT has established a solid support base, making this breakout structure more reliable for bullish continuation.

Investor sentiment around COOKIE has also been turning positive. With increased attention across crypto communities and favorable positioning on Binance, COOKIE is beginning to draw speculative momentum. The risk-reward ratio remains attractive at current levels, especially considering the technical setup and expected target levels projected around the $0.55–$0.60 zone.

Traders should keep an eye on short-term resistance zones for potential pullbacks and re-entry opportunities. As long as the breakout holds and volume remains strong, COOKIEUSDT could become one of the top-performing mid-cap altcoins in this cycle.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

COOKIE/USDT on the Verge of a Breakout? Descending Triangle

📊 Complete Technical Analysis

COOKIE/USDT has been forming a classic Descending Triangle since February 2025, indicating prolonged market consolidation. Sellers have been pushing the price down gradually (lower highs), but buyers have strongly defended the horizontal support around $0.16–$0.18.

Now, the price is testing the upper boundary of this structure, signaling a potential explosive breakout.

🔍 Pattern Breakdown

Pattern Name: Descending Triangle

Key Traits:

Lower highs compressing price action

Strong horizontal support zone holding steady

Typically a continuation pattern, but in this case, it can act as a reversal signal if breakout occurs to the upside

Formation Duration: ±6 months

Breakout Confirmation: A daily candle close above ~$0.22 with strong bullish volume

🚀 Bullish Scenario (Upside Breakout)

If COOKIE/USDT successfully breaks above the triangle resistance, here are the potential bullish targets:

Target Price Reason

🎯 Target 1 $0.259 Local resistance zone

🎯 Target 2 $0.299 Key breakout confirmation

🎯 Target 3 $0.407 Measured move from triangle height

🎯 Target 4 $0.626 – $0.700 Historical resistance range

🏁 Final Target $0.842 (ATH Zone) If bullish sentiment fuels momentum

✅ Volume confirmation is crucial. A breakout without strong volume might signal a fakeout.

🛑 Bearish Scenario (Rejection or Breakdown)

On the flip side:

❌ If the price fails to break the triangle resistance (~$0.22) and gets rejected again, we could see a retest of:

Support zone around $0.18

A breakdown below this level could drive the price toward:

$0.140

$0.120

Possibly as low as $0.095 – $0.075 if sentiment worsens

❗ Be cautious of fake breakouts or bear traps near key levels.

📚 Summary & Insights

> The current descending triangle is a textbook setup of “compression under pressure.” If the structure breaks upward with conviction, COOKIE/USDT may enter a powerful bullish trend after months of consolidation.

This setup is ideal for swing traders, breakout traders, or early trend investors seeking solid entries before momentum accelerates.

#COOKIEUSDT #CryptoBreakout #DescendingTriangle #AltcoinAnalysis #BullishReversal #TechnicalAnalysis #TradingView #CryptoTA #AltcoinSetup #ChartPattern

Cookie DAO price analysis😠 Those who like high-risk trading can take a closer look at #Cookie

📈 If buyers manage to keep the price of OKX:COOKIEUSDT.P above $0.25, then the chance for another powerful upward momentum will be very, very high.

📉 If the #CookieDAO price is fixed below $0.25, it may indicate that a corrective movement is starting, which, according to the red scenario, could be quite deep.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

COOKIE Looks Bullish (1D)We have a good setup on the chart. A bullish CH has formed, the trigger line has been broken, and the price is currently sitting on a support level.

The green zone has been tested twice and rejected, which has strengthened the bullish outlook for this asset.

The main supply zone is marked in red. It is expected that, with price fluctuations, the asset will reach the red zone in the coming days or weeks.

A daily candle closing below the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

BNB is in an interesting zoneBNB is going to test its ATH at previous cycle (around $700) and at the next step, its total ATH (around $800). If it break these levels, BNB parabola is inevitable. At this situation, BSC tokens like NASDAQ:FORM , $Cookie, NASDAQ:CAKE and ... will have potential to explode.

COOKIE Buy/Long Setup (4H)Looking at the chart, we can identify bullish signs for COOKIE.

On the CH chart, we see a bullish structure along with the clearing of resistance zones. There’s also a liquidity pool above the chart which is expected to be swept soon.

The only remaining resistance order block on the chart is the marked supply zone, which could potentially also be taken out.

As long as the demand zone holds, we expect a move toward the targets.

A daily candle close below the invalidation level would invalidate this analysis.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

$COOKIEIn terms of charting, for the corrective movement to be complete, it is necessary for the price to correct to the range of $0.0832. After the price reaches this range, it is expected that the corrective movement will be complete, and the chart will form a base there from which the price will reverse. If the overall market condition is good, one can expect it to rise to the price range of $0.542. For now, this section of the analysis focuses on the continuation of the downtrend. If this occurs and the price movement progresses according to the presented analysis, further supplementary analyses will be provided based on the overall market situation.

COOKIE Long Swing OpportunityMarket Context:

COOKIE is nearing a key support zone, offering an ideal entry for a potential bounce and continuation of its trend.

Trade Details:

Entry Zone: Around $0.15

Take Profit Targets:

$0.25

$0.36

Stop Loss: Daily close below $0.11

This trade provides a favorable risk-to-reward ratio if COOKIE holds at support and reverses upward. 📈

COOKIE is Bearish (2H)First of all, note that this symbol is highly volatile and risky.

From the point where I placed the red arrow on the chart, it seems that the COOKIE correction has begun.

Currently, it appears that COOKIE is in wave B of an ABC pattern or possibly a more complex structure.

As long as the red zone is maintained, it is expected to move toward the specified targets.

Closing a 4-hour candle above the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Cookie Chart Projecting Cup and Handle and Bullish Flag Pattern.Cookie Chart Projecting Cup and Handle and Bullish Flag Pattern in 1 HTF And 4 HTF.

Entry Stop Loss and Target Profits are mentioned. Trade With Care. After Reaching Tp 1 Break Even Your Position .

Manage Risk According To Your Portfolio.

SPY Stock Analysis - Day Short Term Bullish Pull Back Feb 15thTraderMan PennyPorkChop looks out for opportunity to survey and examine the latest value activity in the market in a way that makes it helpful to you.

Utilizing Technical Analysis, I play out an insiders view of the activity in the financial exchanges today and gives you my Day Trading of 6 years of Trading Volatile current market , examining market patterns , and interpreting of where the market is going.

TraderMan PennyPorkChop Focus incorporates - Specialized Analysis - Exchange and market Education - Pattern and Pattern Analysis - Market Psychology - and Trading Mental Health.

Day Trading , The Unified Theory that works when nothing else will , Unperilled Strategy. Beginning the Journey.

👉 If you enjoy this video, Please like and share it.

👉 Don't forget to subscribe to this channel and press the bell 🔔 for more updates.

SPY Stock Analysis - S&P 500 SPDR ETF Stock Price Prediction for Tomorrow.

February

We go over the SPY stock - S&P 500 SPDR ETF stock, and give our stock price prediction on the SPY stock, our SPY stock price analysis, and stock price forecast on SPY for tomorrow TUESday February .

SPY STOCK: THIS IS A Bitcoin STOCK PRICE PREDICTION, SPY STOCK PRICE ANALYSIS, AND A SPY STOCK PRICE FORECAST VIDEO.

. My Ideal Views are looking for new ways to think about Trading.

. No BS Technical Analysis that works, period.

. Day Trading and Swing Trading.

. New Traders Welcome.

. Swing Traders Welcome.

. You get Daily SPY STOCK pre and Post Market and the Price Spy ETF price predictions Weekend editions.

. TESLA stock along with TESLA share Price including Tesla After Hours.

. Bitcoin

DISCLAIMER: No financial advice, the information on this channel is provided for education and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The information contained in or provided from or through this channel is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The information on this channel and provided from or through this channel is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investment, trading or otherwise, based on any of the information presented on this channel without undertaking independent due diligence and consultation with a professional broker or financial advisory.