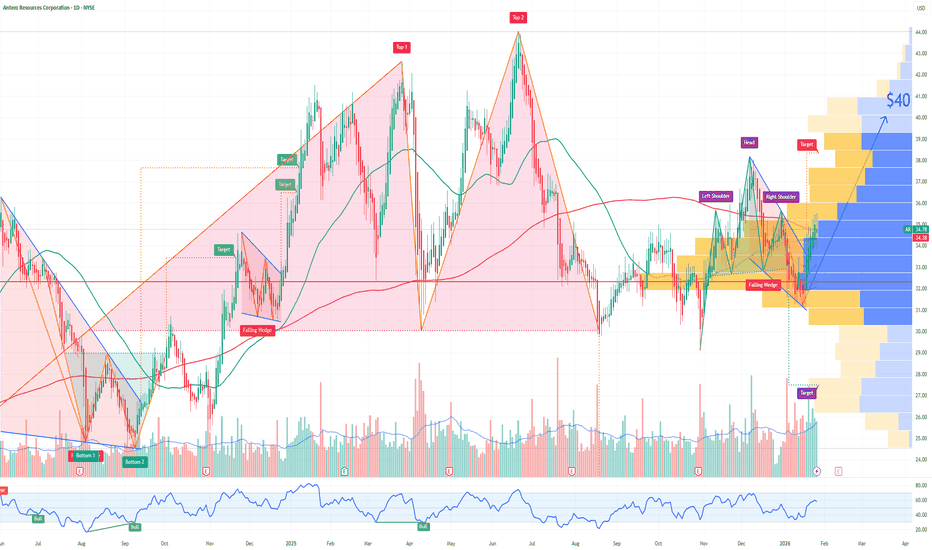

AR Antero Resources Bullish Bets in the Options Market! PT: $40Macro Catalyst: Winter Storm Fern:

The severe storm has disrupted U.S. gas supply, cutting production by 9–15% and boosting demand. For AR, focused on Appalachian gas, this spells direct upside as exports and heating needs spike.

Technicals:

AR held support above $34, with recent highs at $35.51. Volume topped 3.69M shares. A bullish pennant pattern suggests a breakout past $35.50–36 could target $37–38, accelerating to $40 post-earnings. EPS growth hit +472% Q/Q, limiting downside (support at $32–30).

Options Flow: Heavy Bullish Bets:

Sentiment screams bullish: $105M call premiums vs. minimal puts, volumes 6.8x daily average. Key unusual activity on long-dated calls:

Massive blocks on Feb 2026 $37 strikes (35k+ contracts, $2.6M–$8.6M premium)

Mar 2026 $38/$39 strikes with sweeps (40k/3k contracts)

Recent Mar $39 calls at $0.85

IV at 41–48%, high heat score signals aggressive upside plays. Dark pool blocks (e.g., 1.17M shares ~$40M) show smart money accumulating quietly.

Analyst Consensus: Strong Buy with Upside!

15 analysts rate Buy overall (9 Buy, 7 Hold, 2 Strong Buy), average target $44.33 (~29% upside). Wells Fargo at $46, Siebert at $48; optimists see $60. Stable BBB- ratings from Fitch/S&P. Expect ~$500M FCF boost from recent acquisitions like HG Energy.

Outlook: $40 Feasible!

Volatility in gas prices and post-storm corrections are risks, plus options decay without quick moves.

But with insider buying, earnings positioning, and flow momentum, $40 looks realistic post-report – a ~16% gain aligning with key strikes!

Course

MSFT Microsoft Corporation Options Ahead of EarningsIf you missed buying MSFT when they took a 49% stake in OpenAI:

Nor sold the recent double top:

Now analyzing the options chain and the chart patterns of MSFT Microsoft Corporation prior to the earnings report this week,

I would consider purchasing the 475usd strike price Calls with

an expiration date of 2026-2-20,

for a premium of approximately $14.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

STX Seagate Technology Holdings Options Ahead of EarningsAnalyzing the options chain and the chart patterns of STX Seagate Technology Holdings prior to the earnings report this week,

I would consider purchasing the 357.50usd strike price Puts with

an expiration date of 2026-1-30,

for a premium of approximately $17.90.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

NOW ServiceNow Options Ahead of EarningsIf you haven`t bought NOW before the rally:

Now analyzing the options chain and the chart patterns of NOW ServiceNow prior to the earnings report this week,

I would consider purchasing the 155usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $3.20.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

2026 Price Target for SPY: $790 – Why the S&P 500 Could Soar 15%If you haven`t bought the dip on SPY last year:

Why my Price Target is $790 for SPY? Key Drivers for 2026!

Earnings Growth Acceleration:

Analysts expect S&P 500 EPS to grow 12–15% in 2026 (Goldman Sachs: 12%; FactSet consensus: ~14.9%). This builds on the AI-driven productivity boom and resilient consumer spending. If AI adoption accelerates (as seen in Meta, Nvidia, and Microsoft earnings), we could see 15–18% EPS growth—pushing multiples higher in a low-rate environment.

Fed Policy Tailwinds:

With inflation cooling (core PCE at ~2.8% in November, in line with expectations) and the economy strong (Q3 2025 GDP revised to +4.4%), the Fed is likely to deliver 1–2 more rate cuts in 2026. Lower rates support valuations and boost corporate borrowing/profits—classic bull-market fuel.

Geopolitical & Policy Clarity:

Trump's recent backtrack on aggressive tariffs (U-turn on 10–25% threats to NATO allies and Greenland deal) has eased fears. Combined with potential fiscal stimulus and deregulation, this creates a pro-growth backdrop. Midterm elections could add volatility, but history shows markets often "pump" post-election.

Valuation Expansion Potential:

The forward P/E is ~22x—elevated but justified by AI productivity gains. If earnings beat expectations and rates fall, multiples could stretch to 24–25x (similar to past tech-led cycles), supporting my higher target.

Comparison to Wall Street ConsensusWall Street targets for the S&P 500 end-2026 range widely:

Conservative: Bank of America ~7,100 (3–4% upside)

Average: ~7,269–7,600 (6–11% upside)

Bullish: Oppenheimer 8,100; Deutsche Bank 8,000; Goldman Sachs ~12% total return

My $790 SPY target sits on the bullish side (~15% upside), assuming stronger-than-expected earnings and policy support. It's not moonshot territory (some outliers see 8,000+), but it requires the rally to broaden beyond Big Tech.

Risks to Watch:

Tariff resurgence or trade wars could cap gains.

Inflation reacceleration might delay Fed cuts.

AI spending disappointment → valuation compression.

Volatility spikes around elections or macro data.

Still, the base case remains bullish: resilient economy, AI tailwinds, and supportive policy. SPY at $790 would mark another strong year in this bull run.

LAES SEALSQ Corp Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LAES SEALSQ Corp prior to the earnings report next week,

I would consider purchasing the 5usd strike price Calls with

an expiration date of 2027-1-15,

for a premium of approximately $0.62.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

INTC Intel Corporation Options Ahead of EarningsIf you haven`t bought the dip on INTC:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 48usd strike price Calls with

an expiration date of 2026-3-20,

for a premium of approximately $2.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

MU Micron Technology Options Ahead of EarningsIf you haven`t bought MU before the rally:

Now analyzing the options chain and the chart patterns of MU Micron Technology prior to the earnings report next week,

I would consider purchasing the 247.5usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $8.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

FUBO: A Hidden Gem in 2026 – Disney Merger’s Overlooked ValueIf you haven`t bought FUBO before the merger:

As we enter 2026, FuboTV Inc. (FUBO) stands out as a high-conviction bullish pick in the streaming sector, trading at a deeply undervalued ~$2.67 per share with a market cap around $900 million.

Following its transformative merger with Disney's Hulu + Live TV assets, which closed in October 2025, FUBO is primed for significant synergies that could drive explosive growth this year.

With Disney holding a ~70% stake, the combined entity (NewCo) boasts ~6 million subscribers, positioning it as the sixth-largest pay-TV provider in the U.S. and setting the stage for a potential 4x+ upside if execution delivers.

The merger’s rationale is clear: FUBO’s sports-focused platform complements Hulu’s content library and Disney’s ecosystem (Disney+, ESPN+).

Key catalysts in 2026 include full integration by mid-year, which could slash content costs (currently 73% of revenue) through shared deals and boost average revenue per user (ARPU) from ~$76 to $90+ via targeted ads and bundling.

Adding to the bullish case, unusual options activity signals institutional confidence. In early January 2026, aggressive buying of $10 strike calls expiring January 2027 (over 1,500 contracts at ~$0.21) reflects bets on a breakout to $10+ – a ~270% jump from current levels.

This deeply out-of-the-money positioning screams lottery play, but it’s backed by real potential: if synergies materialize, FUBO could attract a full buyout from Disney to consolidate control, offering a premium of $8–12 per share, similar to ongoing media consolidations like Warner Bros. Discovery.

Risks exist – integration delays or subscriber churn could weigh on sentiment – but at this price, the asymmetry favors bulls.

If 2026 brings relaxed antitrust under Trump and a streaming boom, FUBO could triple or more. This is a speculative gem for patient investors eyeing the next big media winner.

JBL Jabil Options Ahead of EarningsIf you haven`t bought JBL before the rally:

Now analyzing the options chain and the chart patterns of JBL Jabil prior to the earnings report this week,

I would consider purchasing the 220usd strike price Puts with

an expiration date of 2025-12-19,

for a premium of approximately $8.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

PLCE The Children's Place Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PLCE The Children's Place prior to the earnings report this week,

I would consider purchasing the 8usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $0.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

DRI Darden Restaurants Options Ahead of EarningsIf you haven`t bought DRI before the rally:

Now analyzing the options chain and the chart patterns of DRI Darden Restaurants prior to the earnings report this week,

I would consider purchasing the 180usd strike price puts with

an expiration date of 2025-12-19,

for a premium of approximately $3.75.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Are You a Trader Seeking Clarity and Market Mastery?Are you a trader who wants clarity, accuracy, and real mastery over the markets?

Do you want to understand the deeper principles behind price movement — not just follow indicators?

If yes — Welcome. You’re exactly where you need to be.

I’m Niraj M Suratwala, a dedicated practitioner and mentor of W.D. Gann Theory.

For years, I’ve focused on studying, decoding, and practically applying:

✔ The Law of Vibration

✔ Time–Price Cycles

✔ Market Geometry

✔ Predictive price structures used by W.D. Gann

My mission is simple:

To help traders understand the market scientifically, logically, and precisely — exactly as Gann intended.

📚 What You’ll Get in My Upcoming TradingView Ideas

In this series, I will be sharing:

🔸 Simple and clear breakdowns of Gann concepts

🔸 Real chart examples

🔸 Practical implementation techniques

🔸 Time, price, angles & vibrations analysis

🔸 Actionable insights you can immediately start applying

This is not about shortcuts or magic indicators —

This is about understanding the natural laws that govern market movement.

🚀 Let’s Begin This Journey

This introduction is just the beginning.

If you truly want to strengthen your trading with Gann’s timeless principles —

don’t miss the upcoming ideas.

Markets follow natural laws.

Let’s decode them together.

BBAI BigBear ai Holdings Options Ahead of EarningsIf you haven`t bought BBAI before the massive rally:

Now analyzing the options chain and the chart patterns of BBAI BigBear ai Holdings prior to the earnings report this week,

I would consider purchasing the 3usd strike price Calls with

an expiration date of 2025-12-19,

for a premium of approximately $1.35.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

QURE uniQure Options Ahead of EarningsAnalyzing the options chain and the chart patterns of QURE uniQure prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $2.32.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

MRK Merck On the Verge of a Breakout? Unusual Calls !!Merck (MRK) is setting up for what could be a high-probability breakout. The stock has been in a falling wedge pattern for several months — a classic technical formation that often precedes sharp upside moves. Price action has now compressed to the end of the wedge, and we may be on the brink of a bullish resolution.

🔍 Technical Setup

Falling Wedge Pattern nearing completion

Price currently hovering near long-term support ($78.25)

Strong bullish divergence forming on momentum indicators (RSI/MACD)

The falling wedge is typically a reversal pattern, and given how deep MRK has pulled back from its highs ($134+), the risk/reward here looks compelling.

🔥 Options Flow

Today’s options market added fuel to the fire:

48,000 call contracts traded expiring this Friday

This sudden surge in short-dated call buying signals aggressive positioning for an imminent move

This kind of volume is not retail-driven — it points to potential institutional interest

💡 The Bullish Case

With the technical breakout structure in place and strong confirmation from options flow, the case for a bullish reversal is growing. If MRK can close above wedge resistance with volume, it opens the door to a quick move toward $85+, possibly even higher in the coming weeks.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bullish Thesis for INTC Intel Stock in 2025If you haven`t bought INTC before the previous earnings:

Now Intel INTC is positioned for a potential turnaround and upside by the end of 2025, driven by strategic leadership changes, foundry business expansion, AI innovation, and favorable geopolitical dynamics. Here’s why INTC could head higher this year:

1. Leadership Transformation and Strategic Vision

The appointment of Lip-Bu Tan as CEO in March 2025 has injected new optimism into Intel’s prospects. Tan is a respected semiconductor industry veteran, and his arrival was met with a 10% jump in INTC’s share price, reflecting renewed investor confidence in the company’s direction.

2. Foundry Business Expansion and Government Support

Intel’s pivot toward a foundry-centric model is gaining momentum. The company is leveraging its U.S.-based manufacturing footprint to attract domestic and international clients, especially as geopolitical tensions and trade restrictions make U.S. chip production more attractive.

There is speculation about strategic partnerships, such as TSMC potentially acquiring a stake in Intel’s foundry operations, which could accelerate technology transfers and client wins.

The U.S. government is likely to continue supporting domestic semiconductor manufacturing through incentives and tariffs, directly benefiting Intel’s foundry ambitions.

3. AI and Next-Gen Product Launches

Intel is aggressively targeting the AI and data center markets. The upcoming Jaguar Shores and Panther Lake CPUs, built on the advanced 18A process node, are set for release in the second half of 2025. These chips will be available not only for Intel’s own products but also for external clients like Amazon and Microsoft, expanding the addressable market.

Intel’s renewed focus on AI accelerators and competitive cost structures could help it regain share in high-growth segments.

4. Financial Resilience and Market Position

Despite recent setbacks, Intel remains a dominant player in the PC CPU market and continues to generate substantial revenue, outpacing some key competitors in the latest quarter.

Analysts have revised their short-term price targets upward, with some projecting INTC could reach as high as $62—a potential upside of over 170% from current levels.

Forecasts for 2025 suggest an average price target in the $40–$45 range, with bullish scenarios pointing even higher if execution on foundry and AI strategies meets expectations.

5. Technical and Sentiment Factors

While technical analysis currently signals caution, the $18.50–$20 zone has provided strong support, and any positive news on foundry contracts or AI wins could catalyze a breakout from current consolidation patterns.

Market sentiment has shifted more positively following the CEO change and strategic announcements, suggesting the potential for a sustained rebound if Intel delivers on its promises.

In conclusion:

Intel’s combination of visionary leadership, foundry expansion, AI innovation, and favorable geopolitical trends sets the stage for a potential stock price recovery by the end of 2025. With analyst targets and investor sentiment turning more bullish, INTC presents a compelling case for upside as it executes its turnaround strategy

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AAOI Applied Optoelectronics potential rally by EOYApplied Optoelectronics AAOI is well-positioned for a strong rally toward $24 per share by the end of 2025, supported by multiple operational and strategic catalysts. A key recent development—the warrant agreement with Amazon—adds a powerful endorsement and financial backing that enhances the bullish case.

1. Amazon’s Strategic Warrant Agreement: A Major Vote of Confidence

On March 13, 2025, AAOI issued a warrant to Amazon.com NV Investment Holdings LLC, granting Amazon the right to purchase up to approximately 7.95 million shares at an exercise price of $23.70 per share.

About 1.3 million shares vested immediately, with the remainder vesting based on Amazon’s discretionary purchases, potentially up to $4 billion in total purchases over time.

This agreement signals Amazon’s strong confidence in AAOI’s technology and its critical role as a supplier of high-speed optical transceivers for Amazon Web Services and AI data center infrastructure.

The warrant price near $24 effectively sets a floor and a valuation benchmark, supporting the thesis that AAOI’s stock could reach or exceed this level by year-end.

2. Major Data Center Wins and Hyperscale Customer Re-Engagement

AAOI recently resumed shipments to a major hyperscale customer, with volume shipments of high-speed data center transceivers expected to ramp significantly in the second half of 2025.

This re-engagement with a key customer aligns with the surging demand for AI-driven data center infrastructure, providing a strong revenue growth catalyst.

3. Robust Revenue Growth and Margin Expansion

Q1 2025 revenue doubled year-over-year to nearly $100 million, with gross margins expanding to over 30%, reflecting operational efficiencies and favorable product mix.

The company expects to sustain strong quarterly revenue ($100–$110 million) and ramp production capacity to over 100,000 units of 800G transceivers per month by year-end, with 40% manufactured in the U.S.

4. Manufacturing Expansion and Supply Chain Resilience

AAOI is scaling manufacturing in the U.S. and Taiwan, enhancing supply chain robustness and positioning itself to benefit from potential government incentives for domestic production.

Its automated, largely in-house manufacturing capabilities provide a competitive edge in meeting hyperscale and AI data center demand.

In conclusion:

Amazon’s warrant agreement at a $23.70 strike price not only provides a direct valuation anchor near $24 but also serves as a powerful strategic endorsement of AAOI’s technology and growth prospects. Combined with robust revenue growth, expanding manufacturing capacity, and key customer re-engagement, AAOI has a compelling case to reach or exceed $24 per share by the end of 2025.

RBLX Roblox Corporation Options Ahead of EarningsIf you haven`t bought RBLX before the rally:

Now analyzing the options chain and the chart patterns of RBLX Roblox Corporation prior to the earnings report this week,

I would consider purchasing the 130usd strike price Puts with

an expiration date of 2026-1-16,

for a premium of approximately $13.80.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ONDS Ondas Holdings Options Ahead of EarningsAnalyzing the options chain and the chart patterns of ONDS Ondas Holdings prior to the earnings report this week,

I would consider purchasing the 10usd strike price Calls with

an expiration date of 2028-1-21,

for a premium of approximately $3.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

VKTX Viking Therapeutics Potential Buyout Soon?!If you haven`t bought VKTX before the previous rally:

If GLP-1 obesity drugs are a multi-hundred-billion-dollar opportunity, a successful VK2735 (injectable + oral) could justify a valuation far north of where VKTX trades today—if it makes it to market.

My bullish thesis:

1. GLP-1 Momentum + “Mini Lilly / Novo” Narrative

VKTX is seen as a “pure play” on the global obesity and metabolic-disease boom.

Viking’s lead program, VK2735, is a dual GLP-1/GIP receptor agonist being developed in both injectable and oral form for obesity and related metabolic disorders.

Phase 1 and Phase 2 data for the injectable version have already shown meaningful weight loss with an encouraging safety/tolerability profile, which is why it advanced into large Phase 3 obesity trials.

An oral version of VK2735 is in Phase 2 obesity trials and, in the VENTURE oral study, delivered up to ~12.2% mean weight loss at 13 weeks, with a clear dose response.

2. Rapid Trial Execution = Strong Momentum & Upcoming Catalysts

Another big talking point is how fast Viking is executing on its trials, which bulls see as a leading indicator of future news flow:

Viking recently announced completion of enrollment in its Phase 3 VANQUISH-1 VK2735 obesity trial, with ~4,650 patients (above the original 4,500 target).

The company highlighted VK2735 data at ObesityWeek 2025 and continues to position both injectable and oral formulations as core programs.

Management has reiterated that VK2735 oral and injectable programs are moving forward on schedule, with more data expected as Phase 3 and longer-duration studies mature.

3. Short Interest + “Squeeze Fuel” Angle

VKTX has a high short interest, which Twitter traders love to highlight:

Recent data shows around 22–23% of the float short, with days to cover >5 based on average volume.

For many momentum and options traders, this is exactly the kind of setup they look for:

High short interest = a lot of investors betting against the stock.

Any positive surprise (trial data, partnership, M&A rumor, or a strong breakout on the chart) could force shorts to cover.

If that happens during a period of high retail interest, the price action can get violent to the upside.

4. Analyst Targets + Big Pharma Takeover Speculation

Analyst consensus is currently Strong Buy, with an average price target around $95+.

On top of that, there’s constant speculation that VKTX could become a takeover target:

The GLP-1 market is being dominated by Eli Lilly (Zepbound, Mounjaro) and Novo Nordisk (Wegovy, Ozempic).

Many large pharma companies without a strong obesity franchise might prefer buying a late-stage asset rather than starting from scratch.

VK2735, with Phase 3 obesity trials underway and promising oral data, is the kind of asset that fits that narrative.

EH EHang Holdings Limited Options Ahead of EarningsAnalyzing the options chain and the chart patterns of EH EHang Holdings Limited prior to the earnings report this week,

I would consider purchasing the 22usd strike price Calls with

an expiration date of 2026-4-17,

for a premium of approximately $0.48.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

BTC Bitcoin Bear Market If you haven`t bought BTC before the recent rally:

Historically, Bitcoin has shown a tendency to retrace in December before starting a recovery around March. This pattern could repeat this season, with BTC facing selling pressure as year-end portfolio rebalancing and macro uncertainties weigh on the market.

While a brief Santa Claus rally might provide temporary relief, the bearish trend is expected to dominate until March. By then, BTC could trade below $84K before regaining momentum, aligning with its historical recovery trend as market conditions stabilize in spring.