Perfect automated detection of Crab pattern - ShortA Bearish-type Crab pattern occurred within the resistance zone of 137.0-137.6.

(In this resistance zone, there was a rebound in 28 Jul, 19 Jul,..)

Also on the daily chart, Bearish-type Gartley pattern is occurring.

Short after seeing the rebound. At that time, be careful of re-inversion in the support zone of 135.2-135.80.

*Harmonic patterns and support/resistance zones are automatically detected using the indicators below.

- Harmonic auto-detect PRO

- Support/Resistance Zone Auto PRO

Crabpatterns

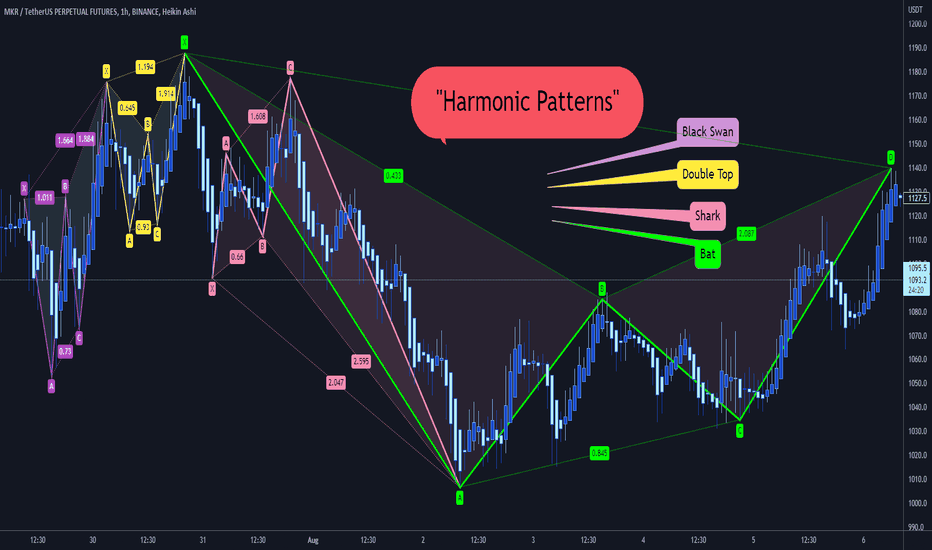

Harmonic PatternsHarmonic Patterns

we have so many kinds of “Harmonic Pattern”:

Black Swan

Bat

Crab

Butterfly

Gartly

White Swan

Shark

Zero_Five

Cypher

Double Top

Double Bottom

📚👌🏻 Each one of them has its unique Fibonacci levels.

⚡️ Do you want to know them?

😍 Happy to see what you find in the charts, please share yours with us

MEducation

Common features of all bullish harmonic patterns.www.tradingview.com

By combing all bullish harmonic patterns together, we can observe the following:

1. The Bat, Cypher , Gartley and Shark pattern point D is (0.786 - 0.886) XA without breaking the low.

2. The Butterfly, Nenstar , Crab and Deep Crab point D is (1.272 - 1.618) XA after breaking the low.

3. Point C band is common for all patterns (0.382 - 0.886) AB

4. Pint B band is common for three patterns ( 0.382 -0.618) : Bat (upto 0.5) , Gartley and Crab, with the Gartley pattern point B fixed at 0.618 XA

5. Patterns breaking out of Point A high have a band ( 1.13 - 1.61 )AB

U

EURUSD-Weekly Market Analysis-Jun22,Wk2A Potential Bearish Shark Pattern may form up at 1.0823. What I will be focusing on will be the candlestick pattern formation at PRZ. If the candle touches 1.0823 but didn't break and closes above 1.0805, I will expect a stronger bearish move, and that is because it completes at the Bearish Crab Pattern HOP level.

Crab Complete 🦀USOIL - Crab complete in strong HTF supply zone, break in momentum, have a confirmed entry on the LTF, SL is above the current daily high, i'm looking to trade the retracement after the BOS yesterday.

Let me know your thoughts!

* Disclaimer **

These ideas I never trade until the end target with my initial lots, I focused on high probable entries with higher lots and use a specific partial taking strategy giving me a very high win rate and take most of my profits very early, I only leave a small % of my capital to run the entire trade. On the flip side im constantly monitoring LTF momentum and will close early if things change, these analysis's are for research purposes only.

Bullisb Crab Pattern 15min BTCBullish crab coming up if breakdown on the 15 minute. For this harmonic pattern, the 1.618XD area should be expected to exceed that but no more than below the 2.0 for the stop zone area. As always, when the pattern completed it is still best to wait for a reversal signal before jumping in. You can try to find a great entry by going on the lower timeframe, in this case the 5 minute to see the trend change faster.

BTCUSDT micro double bottom AB=CDBTCUSDT micro double bottom - possible pullback. The price action has been made a wonderfull bear flag structure and the double bottom is in conjunction with an oversold condiction and increased interest in accumulation. My technical analysis is mainly based on Fibonacci ratios in a sequencial AB=CD pattern. Expecting a intraday swing upward in a potential micro bearish CRAB (updates incoming) pattern as a final leg up of this flag. Potential Reversal Zone predicted at 35K level - 14.6-0% Fibonacci Retracement.

AUDJPY ADVANCE HARMONICS PATTERN AUDJPY has formed an advance harmonics pattern on the daily chart.

The price is trading above the entry level EL 93.292 with a possible gartley bearish pattern on the hourly chart.

highly probably the price could reverse signaling a short entry at 94.369/94.776

TP1 88.278

TP2 86.255

TP3 83.669

NZDJPY ADVANCE HARMONICS PATTERN CRABNZDJPY has formed an advance harmonics pattern on its daily chart.

The price is trading below the entry level EL 85.435 with potential targets projection TP1 80.083/TP2 78.097

NZDJPY CRAB BEARISH PATTERN

PATTERNS ARE ONLY VALID, WHEN THE PRICE

BREAKS AND CLOSES ABOVE THE EL WITH A CONFIRMED TREND

💼EL 85.435

⚠️SL 85.719

🎯TP1 80.083

🎯TP2 78.097

EURJPY ADVANCE HARMONICS PATTERN EURJPY has formed an advance harmonics pattern on its hourly chart.

The price is trading below the entry level EL 138.981

EURJPY CRAB BEARISH PATTERN

PATTERNS ARE ONLY VALID WHEN

THE PRICE CLOSES ABOVE/BELOW THE ENTRY

LEVEL WITH A CONFIRMED TREND

💼EL 138.981

⚠️SL 140.135

🎯TP1 134.300 100% AD

🎯TP2 132.738 1272% AD

🎯TP3 130.780 1618% AD