#CRV/USDT breakout alert!#CRV

The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected.

We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected.

There is a key support zone in green at 0.3800. The price has bounced from this level multiple times and is expected to bounce again.

We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement.

Entry price: 0.3880

First target: 0.3941

Second target: 0.4014

Third target: 0.4100

Don't forget a simple principle: money management.

Place your stop-loss below the support zone in green.

For any questions, please leave a comment.

Thank you.

Crvusdtlong

#CRV/USDT breakout alert!#CRV

The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel.

We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move.

There is a key support zone in green at 0.4100, representing a strong support point.

We have a trend of consolidation above the 100-period moving average.

Entry price: 0.4290

First target: 0.4400

Second target: 0.4515

Third target: 0.4674

Don't forget a simple money management rule:

Place your stop-loss order below the green support zone.

Once you reach the first target, save some money and then change your stop-loss order to an entry order.

For any questions, please leave a comment.

Thank you.

#CRV/USDT#CRV

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.6600.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.6614

First target: 0.6840

Second target: 0.7120

Third target: 0.7420

CRV/USDT — Major Reversal Incoming or the Next Breakdown?CRV is now sitting at one of its most critical price levels of the entire year.

Price has returned to the 0.42–0.37 support zone, an area that has acted as a last major defense for buyers throughout multiple months.

At the same time, the chart shows a clear downward trendline pressing the price from above — creating a powerful structure:

👉 Consistent lower highs (seller pressure)

👉 Strong, repeated support at the same zone (buyer defense)

This combination forms a large Descending Triangle, a classic pattern that often precedes a large volatility burst — either a strong reversal or a deep continuation breakdown.

The market is quiet, but tense. Volume is thinning.

Everyone is waiting for the next explosive move.

---

Bullish Scenario — A Potential Reversal Born from the Golden Support Zone

For a strong bullish shift, CRV must:

✔️ Hold above the 0.42–0.37 support zone

✔️ Break above the descending trendline with a confirmed 2D/weekly close

✔️ Show clear volume expansion

If these conditions align, this zone transforms into:

🔥 A mid-term launchpad for a larger trend reversal

Bullish targets:

0.56 → first key resistance

0.63 → psychological mid-level

0.82 → broader range resistance

1.04 – 1.165 → mid-term targets on strong bullish continuation

> A successful breakout would officially neutralize the downtrend and shift momentum toward the buyers.

---

Bearish Scenario — If 0.37 Fails, Structure Breaks Down Hard

If CRV loses the 0.37 support:

❌ Historical support collapses

❌ Descending Triangle confirms as a bearish continuation pattern

❌ The existing downtrend accelerates

Bearish targets:

0.30 → first liquidity pocket

0.22–0.20 → full breakdown target

0.12 → extreme scenario if crypto enters a risk-off phase

> Breakdown + failed retest is the strongest bearish confirmation.

---

Pattern Breakdown

1. Major Descending Triangle

Lower highs + horizontal support = compression of energy.

The longer this structure holds, the more powerful the eventual breakout or breakdown.

2. The Golden Demand Zone (0.42–0.37)

Not just any support.

This is a battlefield zone — where smart money often accumulates positions.

3. Lower-High Structure Still Intact

No real bullish trend reversal unless the trendline breaks decisively.

---

Message for Traders

CRV is in a perfect “calm before the storm” setup.

The next major move out of this structure is likely to define CRV’s direction for the coming weeks.

For swing traders and trend-followers, this is one of the most interesting zones on the chart.

---

#CRV #CRVUSDT #Crypto #CryptoAnalysis #TechnicalAnalysis #PriceAction #AltcoinAnalysis #DescendingTriangle #Breakout #Breakdown #CryptoReversal #SupportZone

CRV/USDT — Descending Channel: Reversal or Another Rejection?📊 Market Overview

Curve DAO Token (CRV) is currently standing at a critical juncture after spending several months moving inside a well-defined descending channel since early August.

This channel has consistently reflected sustained selling pressure — yet recent momentum shows buyers pushing back, testing the upper boundary of the channel, and signaling a potential shift in short-term trend dynamics.

At the moment, CRV is retesting the key resistance zone between 0.79 and 0.82 USDT, aligning with the upper boundary of the descending channel — a classic decision zone that will likely define whether the next move is a breakout or another rejection.

📈 Technical Structure & Pattern Explanation

Main pattern: Descending Channel

The structure reflects a sequence of lower highs and lower lows, contained within parallel boundaries, forming a clear bearish trend channel.

Technical validation:

Multiple touches on both upper and lower boundaries confirm strong technical respect for the pattern — making it a reliable setup.

Key horizontal levels (based on the chart):

Immediate support: 0.7970

Major resistance zones: 0.8233 → 0.9369 → 1.0000 → 1.0404 → 1.0951

High level: 1.1626

Mid-channel support: 0.64–0.70

Lower boundary: 0.55–0.60

Major structural low: 0.4893

🔥 Bullish Scenario – Breakout and Early Reversal Setup

Bullish narrative:

If CRV successfully breaks and closes a daily candle above 0.8233, it would signal a clear breakout from the descending channel — potentially marking the early stage of a trend reversal after months of downside pressure.

Confirmation checklist:

Rising volume during breakout.

RSI breaking above 50 and trending toward 60–70.

MACD showing a bullish crossover with positive histogram growth.

Upside targets after breakout:

First target: 0.9369 – minor resistance & initial breakout confirmation zone.

Second target: 1.0404 – key psychological and historical resistance.

Extended target: 1.0951 → 1.1626 – if momentum remains strong.

Trading plan & risk management:

Aggressive entry: on daily close above 0.82.

Conservative entry: wait for a retest of the upper channel as support (~0.80).

Stop loss: below 0.74–0.75 (failed breakout zone).

Take profit gradually at the levels mentioned above.

Bullish conclusion:

A confirmed breakout with strong volume could signal the transition from a medium-term downtrend to a neutral or bullish recovery phase.

⚠️ Bearish Scenario – Rejection and Continuation of the Downtrend

Bearish narrative:

If CRV fails to close above the upper trendline and faces rejection near 0.80–0.82, the descending channel remains intact — confirming that sellers still dominate the market structure.

Confirmation checklist:

Bearish candlestick formations (e.g., bearish engulfing, shooting star) near upper trendline.

Weak volume on approach to resistance.

RSI fails to cross 50 and turns downward again.

Downside targets:

First target: mid-channel area ~0.66–0.70.

Second target: lower boundary 0.55–0.60.

Final support: 0.4893 – major structural low.

Trading plan & risk management:

Entry short after confirmed rejection candle.

Stop loss above 0.85–0.90 (outside the channel).

Take profit at mid- and lower-channel zones.

Bearish conclusion:

As long as CRV remains below 0.82 and continues to respect the descending channel, the bearish structure of lower highs and lower lows remains valid.

🔍 Overall Technical Summary

The descending channel defines CRV’s structure clearly — it’s now testing the most crucial point of that formation.

A daily close above 0.8233 could trigger a trend reversal, while a rejection would extend the downtrend.

Momentum and volume confirmation will be key in determining which path unfolds next.

#CRV #CRVUSDT #CurveDAO #TechnicalAnalysis #CryptoAnalysis #DescendingChannel #BreakoutTrading #ChartPattern #CryptoTrading #PriceAction #CryptoMarket

CRVUSDT UPDATE#CRV

UPDATE

CRV Technical Setup

Pattern: Bullish falling wedge breakout

Current Price: $0.7729

Target Price: $1.07

Target % Gain: 40.20%

CRYPTOCAP:CRV is breaking out of a falling wedge pattern on the 1D timeframe. The breakout signals renewed bullish strength with potential upside toward $1.07, offering around 40% gains. The structure supports a continuation move higher. Always use proper risk management.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

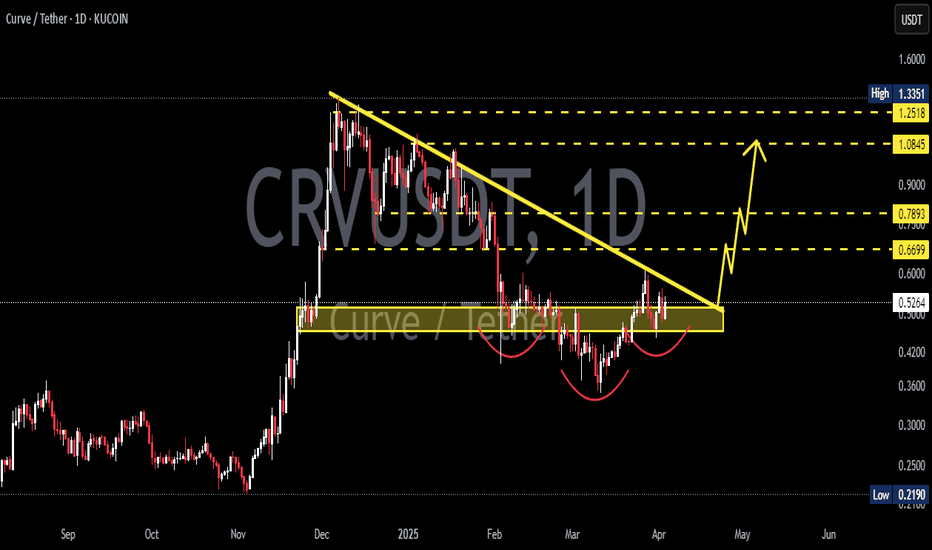

$CRVUSDT Ready to Breakout: 70% Rally Potential Ahead.CRYPTOCAP:CRV is currently testing the top of a descending channel at 0.774.

If it breaks through this level, we could see a 70% rally towards 1.312.

The MACD is showing signs of momentum, so there's a good chance for a bullish move ahead.

DYOR, NFA

CRV : Will suffering be broken?Hello friends

Well, after reaching a resistance and hitting a higher ceiling, the price has fallen in the two movement logs that we have specified for you.

Now the price has been compressed in a support area and we have to wait for it to move to the specified targets if this range is broken.

*Trade safely with us*

CVR – Ready to Run, Monthly Confirmation In

Tons of strength showing on $CVRUSDT—expecting continuation from here and even more once the trendline breaks.

The monthly candle is confirming the move, pointing to a potential 6-month uptrend. Looks like this one is finally ready for the run we’ve been waiting for.

Buying here and stacking more around 90c if given the chance.

First target: above $2.

BINANCE:ENAUSDT may have gotten away—but this one won’t.

Bullish on CRVUSDTCRV has gained massive volume in the last days and therefore now sits on a high volume node. Trading volume and accumulation both went up big. We trade above major EMAs. Everything bullish so far. This bullishness will lead to further growth in the next weeks with very ambitious targets in the very near future. You wont be disappointed!

For more trade ideas check and insights check our profile.

Disclamer: only entertaining purpose, no financial advice - trading is risky.

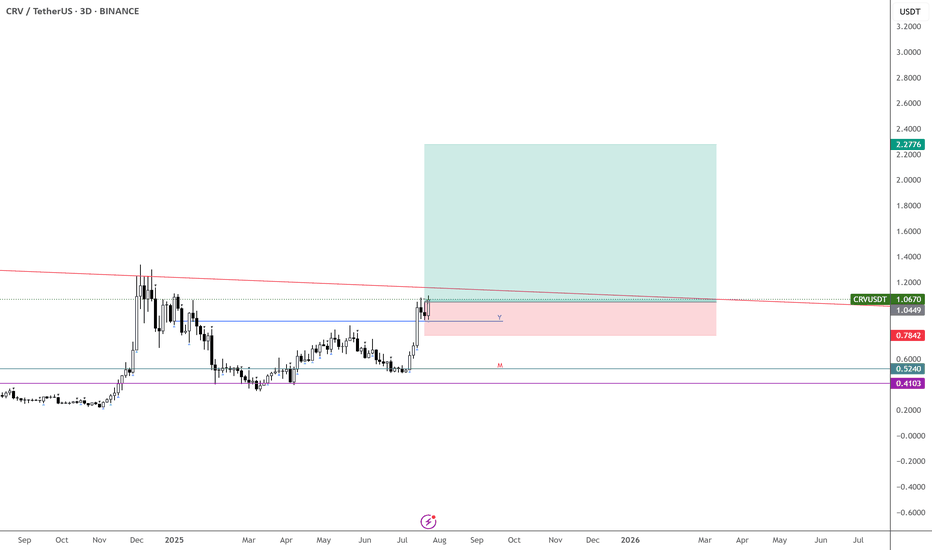

CRVUSDT 3D CURVE DAO TOKENDecided to update the idea. As always, key support and resistance levels are marked on the chart — along with price reactions at those zones.

Currently, we’re observing a potential breakout from a bull flag formation. The mid-term target lies in the $2.3 – $3.4 range, with a possible extension up to $4.8 as a maximum target.

⚠️ Don’t forget: there’s still a chance we get a retest of the bull flag — around the $0.64 level — before any major move to the upside. Manage your entries accordingly

CRV/USD on Coinbase Daily Chart Shows Strong Turn UpCRV/USD on Coinbase. This is a daily chart. The grey MA is the 200. The green is the 314 MA.

Looking at a 3d chart it is easy to see CRV is making a turn around after long downtrend.

The Daily chart here show a move up after ranging roughly between the 200 and 314ma's.

I have an alert set for a cross about the 200ma on the daily chart. If all looks good on lower time frames (1 and 4 hour) will be a LONG for me.

This is a really nice setup that could run and run. No prediction of take profit area. Just go with it and wait for a turn around. Could also be like the previous spike.

CRVUSDT Weekly Analysis – Major Trend Shift Unfolding!!Curve DAO Token (CRV):

Market Structure Overview

Uptrend Phase (2021 – mid-2022):

CRV was in a healthy bullish structure, printing consecutive Higher Highs (HH) and Higher Lows (HL). Momentum was strong and sentiment bullish.

Downtrend Phase (mid-2022 – end of 2024):

Price flipped structure and entered a long correction. We saw a series of Lower Highs (LH) and Lower Lows (LL) confirming the downtrend, following a firm rejection from the resistance zone (~$2.1).

Potential Reversal & New Uptrend (Post Dec 2024):

December 2024 marked a major structural shift. We printed a new Higher High and followed it with a Higher Low — a textbook uptrend confirmation.

Support Zone: $0.22 - $0.33

This area acted as a strong historical base — price respected this zone during accumulation and reversal attempts multiple times over the last 2 years.

Recent price action shows a bounce with volume, confirming demand interest.

Resistance Zone: $1.90 - $2.10

A heavy supply zone where price got rejected in past rallies.

A breakout and weekly close above this zone could signal the start of a strong continuation rally toward higher targets ($3.5+ range).

Break of Downtrend Line

The long-term diagonal resistance trendline has been broken decisively.

Price is consolidating above the trendline with structure favoring bulls — a strong signal of trend reversal.

Bullish Roadmap (if trend sustains)

The current rally could head toward $1.24 (mid-level key resistance).

If price holds and creates a Higher Low (HL), next upside extension could target the $2+ resistance zone.

Sustained break and hold above $2.10 will open room for a macro shift back toward bullish price discovery phases.

The macro chart of CRV is showing a clear transition from a multi-year downtrend into a potential uptrend. Confirmation through structure (HH & HL), breakout of long-term resistance, and a strong support base sets a solid technical foundation.

Keep CRV on your radar.

Patience is key. Let price confirm through weekly closes.

If you find this analysis helpful, please hit the like button to support my content! Share your thoughts in the comments, and feel free to request any specific chart analysis you’d like to see.

Happy Trading!!

CRV/USD "Curve Dao Token vs U.S Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the XRP/USD "Ripple vs U.S Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits, Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (0.4600) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 3H timeframe (0.3800) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 0.5800 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

CRV/USD "Curve Dao Token vs U.S Dollar" Crypto Market Heist Plan is currently experiencing a bullishness,., driven by several key factors.

📰🗞️Get & Read the Fundamental, Macro Economics, On Chain analysis, Sentimental Outlook, Positioning and future trend...

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩